Fresh and Value-Added Products for Fiscal 2024:

Net Sales 5% Higher, Gross Margin 9.3% versus 6.8% in the Prior

Year

Long-Term Debt Reduced by $156 Million or 39%

to $244 Million at the End of Fiscal Year 2024

Company Increased Quarterly Dividend for the

Third Consecutive Year

Fresh Del Monte Produce Inc. (NYSE: FDP), ("Fresh Del Monte" or

the "Company") today reported financial results for the fourth

quarter and the full fiscal year ended December 27, 2024.

"Our full-year 2024 results reflect the effectiveness of our

strategic focus and operational improvements. This success,

achieved despite facing several challenges in 2024, was primarily

driven by the exceptional performance of our fresh and value-added

products segment, particularly pineapples, avocados, and fresh-cut

fruit, which continue to fuel our growth and deliver strong gross

margins for the Company,” said Mohammad Abu-Ghazaleh, Fresh Del

Monte’s Chairman and Chief Executive Officer. "Other notable 2024

performance highlights include a reduction in long-term debt,

driven by strong cash flow, and a quarterly dividend increase for

the third consecutive year. Building on this momentum and focusing

on our core strengths, we remain committed to expanding key

segments and delivering sustainable value for our

shareholders."

Financial highlights for the fourth quarter 2024:

Net sales for the fourth quarter of 2024 were $1,013.2 million

compared with $1,008.6 million in the prior-year period. The

increase in net sales was driven by higher net sales in the

Company's fresh and value-added products segment, primarily due to

higher per unit selling prices. The increase was partially offset

by a decrease in net sales in the banana segment due to lower per

unit selling prices and reduced sales volume, as well as lower net

sales in the Company's other products and services segment.

Gross profit for the fourth quarter of 2024 was $68.7 million

compared with $62.5 million in the prior-year period. The increase

in gross profit was principally driven by higher net sales in the

Company's fresh and value-added products segment, partially offset

by lower per unit selling prices and reduced sales volume in the

banana segment, along with higher per unit production and

procurement costs.

Adjusted gross profit(1) for the fourth quarter of 2024 was

$68.9 million compared with $56.2 million in the prior-year period.

Adjusted gross profit for the fourth quarter excludes $0.2 million

of other product-related charges, primarily related to inventory

write-offs incurred due to flood damage at the Company's melon

farms in Costa Rica. In the prior-year period, Adjusted gross

profit excluded other product-related charges (credits), which

primarily consisted of $6.9 million of insurance recoveries related

to severe flooding in the Company's Greece production facility in

2023, partially offset by inventory write-offs of $0.6 million due

to rerouting of shipments as a result of the conflict in the Red

Sea.

Operating income for the fourth quarter of 2024 was $30.3

million compared with an operating loss of $113.4 million in the

prior-year period. The notable change in operating income is

primarily attributable to a $133.8 million non-cash asset

impairment charge in the prior-year period, primarily pertaining to

long-lived assets in the Company's Mann Packing operations and

goodwill in its prepared foods reporting unit. The one-time

accounting adjustment significantly impacted the prior year’s

results.

Adjusted operating income(1) for the fourth quarter of 2024 was

$17.1 million compared with $12.0 million in the prior-year

period.

(1) Non-GAAP financial measure. Reconciliations and other

information required by Regulation G can be found below under

"Non-GAAP Measures."

Adjusted operating income excludes the above-mentioned $0.2

million other product-related charges, $2.9 million in asset

impairment and other charges, net, primarily due to impairments

related to damaged and unused housing at farms in Costa Rica and

goodwill associated with the Company's vegetable reporting unit,

and a gain on asset sales of $16.3 million, primarily related to

the sale of a Canadian distribution center and certain assets of

Fresh Leaf Farms in the Company's North America operations. In the

prior-year period, Adjusted operating income excluded the

above-mentioned non-cash impairment of $133.8 million, a $6.3

million other product-related credit, and a gain on an asset sale

of $2.1 million related to the sale of vehicles in the Middle

East.

FDP net income(2) for the fourth quarter of 2024 was $20.4

million compared with FDP net loss of $106.4 million in the

prior-year period and Adjusted FDP net income(1) was $12.3 million

compared with $11.8 million in the prior-year period. Adjusted FDP

net income for the fourth quarter of 2024, and prior-year period,

excludes the above-mentioned other product-related charges, asset

impairment and other charges, net, and gain on sale of assets, net

of tax effect.

Financial highlights for the full fiscal year 2024:

For full fiscal year 2024, net sales were $4,280.2 million

compared with $4,320.7 million in the prior-year period. The

decrease in net sales was primarily due to lower sales volume and

per unit selling prices in the Company's banana segment, as well as

the negative impact of exchange rate fluctuations, primarily versus

the Japanese yen and Korean won, compared with the prior-year

period. The decrease was partially offset by higher per unit

selling prices and sales volume in the Company's fresh and

value-added products segment.

For full fiscal year 2024, gross profit was $357.9 million

compared with $350.7 million in the prior-year period. The increase

in gross profit was primarily driven by higher net sales in the

Company's fresh and value-added products segment, along with lower

ocean freight costs, partially offset by lower net sales in the

Company's banana segment, higher production and procurement costs,

and the negative impact of fluctuations in exchange rates,

primarily related to the Costa Rican colon and Japanese yen.

For full fiscal year 2024, Adjusted gross profit was $358.9

million compared with $354.5 million in the prior-year period.

Adjusted gross profit for full fiscal year 2024 excludes $1.0

million of other product-related charges, primarily related to $1.2

million of severance charges from the outsourcing of certain

functions in the Company's fresh and value-added operations, and

$1.0 million of additional logistic costs and inventory write-offs

incurred as a result of Hurricane Beryl during July 2024. These

were partially offset by a $1.7 million insurance recovery

associated with severe flooding in the Company's Greece production

facility in 2023. Adjusted gross profit in the prior-year period

excluded other product-related charges of $3.8 million, primarily

related to $1.5 million of inventory write-offs due to the sale of

two distribution centers in Saudi Arabia, $1.4 million of inventory

write-offs and clean-up costs, net of insurance recoveries, tied to

the flooding in Greece, and $0.6 million of inventory write-offs

due to rerouting of shipments as a result of the conflict in the

Red Sea.

For the full fiscal year 2024, operating income was $196.3

million compared with $58.5 million in the prior-year period. The

increase in operating income was primarily driven by lower asset

impairment charges and higher gross profit, partially offset by

higher selling, general and administrative expenses compared to the

prior-year period.

For the full fiscal year 2024, Adjusted operating income was

$158.6 million compared with $165.3 million in the prior-year

period. The comparison excludes the above-mentioned other

product-related charges, asset impairment charges, and gains on

asset sales. The year-over-year decrease in Adjusted operating

income was primarily driven by higher selling, general and

administrative expenses.

For the full fiscal year 2024, FDP net income was $142.2 million

compared with a net loss of $11.4 million in the prior-year period

and Adjusted FDP net income was $116.2 million compared with $101.7

million in the prior-year period. Adjusted FDP net income for the

full fiscal year 2024, and prior-year period, excludes the

above-mentioned other product-related charges, asset impairment and

other charges and gain on sale of assets, net of tax effect.

(2) "FDP net income/loss" as referenced throughout this release

is defined as Net income/loss attributable to Fresh Del Monte

Produce Inc.

Fourth Quarter and Full Fiscal Year

2024 Business Segment Performance and Selected Financial

Data

(As reported in business segment data)

Fresh Del Monte Produce Inc.

and Subsidiaries

Business Segment Data

(U.S. dollars in millions,

except for Gross Margin) - (Unaudited)

Quarters ended

December 27, 2024

December 29, 2023

Segment Data:

Net Sales

Gross Profit

Gross Margin

Net Sales

Gross Profit

Gross Margin

Fresh and value-added products

$

612.3

61

%

$

46.1

67

%

7.5

%

$

582.8

57

%

$

22.0

35

%

3.8

%

Banana

356.8

35

%

14.0

20

%

3.9

%

379.6

38

%

37.6

60

%

9.9

%

Other products and services

44.1

4

%

8.6

13

%

19.5

%

46.2

5

%

2.9

5

%

6.3

%

$

1,013.2

100

%

$

68.7

100

%

6.8

%

$

1,008.6

100

%

$

62.5

100

%

6.2

%

Years ended

December 27, 2024

December 29, 2023

Segment Data:

Net Sales

Gross Profit

Gross Margin

Net Sales

Gross Profit

Gross Margin

Fresh and value-added products

$

2,606.9

61

%

$

243.3

68

%

9.3

%

$

2,477.8

57

%

$

167.3

48

%

6.8

%

Banana

1,475.9

34

%

86.8

24

%

5.9

%

1,638.2

38

%

163.3

47

%

10.0

%

Other products and services

197.4

5

%

27.8

8

%

14.1

%

204.7

5

%

20.1

5

%

9.8

%

$

4,280.2

100

%

$

357.9

100

%

8.4

%

$

4,320.7

100

%

$

350.7

100

%

8.1

%

Fourth Quarter 2024 Business Segment Performance

Fresh and Value-Added

Products

Net sales for the fourth quarter of 2024 increased $29.5

million, or 5%, to $612.3 million compared with $582.8 million in

the prior-year period. The increase in net sales was primarily

driven by higher per unit selling prices and sales volume in the

Company's avocado product line, as well as higher per unit selling

prices in its pineapple product line due to increased demand of the

specialty pineapples, Honeyglow® and Pinkglow®. Additionally, there

was higher sales volume and higher per unit selling prices in the

Company's fresh-cut fruit product line. The increase was partially

offset by lower net sales in its prepared food and vegetable

product lines due to lower sales volume, as well as lower per unit

selling prices in the Company's fresh-cut vegetable product

line.

Gross profit for the fourth quarter of 2024 was $46.1

million compared with $22.0 million in the prior-year period. The

increase in gross profit was primarily driven by higher net sales

and lower per unit production costs in the Company's pineapple and

fresh-cut product lines, partially offset by higher distribution

and ocean freight costs. Gross margin increased to 7.5% compared

with 3.8% in the prior-year period.

Banana

Net sales for the fourth quarter of 2024 were $356.8

million compared with $379.6 million in the prior-year period. The

decrease in net sales was primarily driven by lower sales volume in

North America, partially offset by higher sales volume in the

Middle East.

Gross profit for the fourth quarter of 2024 was $14.0

million compared with $37.6 million in the prior-year period. The

decrease in gross profit was primarily due to lower net sales and

higher per unit production and procurement costs, offset by lower

distribution and ocean freight costs. Gross margin decreased to

3.9% compared with 9.9% in the prior-year period.

Other Products and

Services

Net sales for the fourth quarter of 2024 were $44.1

million compared with $46.2 million in the prior-year period. The

decrease in net sales was primarily due to lower net sales in the

Company's third-party ocean freight services business.

Gross profit for the fourth quarter of 2024 was $8.6

million compared with $2.9 million in the prior-year period. The

increase in gross profit was primarily due to lower per unit

production costs in the Company's poultry and meats business. Gross

margin increased to 19.5% compared with 6.3% in the prior-year

period.

Full Fiscal Year 2024 Business Segment Performance and

Selected Financial Data (continued)

(As reported in business segment data)

Fresh and Value-Added

Products

Net sales for full fiscal year 2024 were $2,606.9 million

compared with $2,477.8 million in the prior-year period. The

increase in net sales was primarily a result of higher per unit

selling prices and sales volume in the Company's avocado and

pineapple product lines due to stronger demand, as well as higher

sales volume in the Company's melon product line. The increase was

partially offset by lower net sales in the Company's vegetable and

fresh-cut fruit product lines due to lower sales volume, and the

unfavorable impact of fluctuations in exchange rates, primarily due

to a weaker Japanese yen and Korean won.

Gross profit for full fiscal year 2024 was $243.3 million

compared with $167.3 million in the prior-year period. The increase

in gross profit was primarily driven by higher net sales and lower

per unit production costs in the Company's pineapple, fresh-cut

fruit and fresh-cut vegetables product lines, partially offset by

the negative impact of fluctuations in exchange rates, primarily

due to a stronger Costa Rican colon. Gross margin increased to 9.3%

compared with 6.8% in the prior-year period.

Banana

Net sales for full fiscal year 2024 were $1,475.9 million

compared with $1,638.2 million in the prior-year period. The

decrease in net sales was primarily due to lower sales volume in

North America, driven by competitive market pressures, lower sales

volume in Asia due to decreased supply from the Philippines as a

result of weather-related events, and the negative impact of

exchange rate fluctuations, primarily due to a weaker Japanese yen

and Korean won.

Gross profit for full fiscal year 2024 was $86.8 million

compared with $163.3 million in the prior-year period. The decrease

in gross profit was primarily due to lower net sales, higher per

unit production and procurement costs, and the negative impact of

fluctuations in exchange rates due to a stronger Costa Rican colon,

partially offset by lower per unit ocean freight and distribution

costs. Gross margin decreased to 5.9% compared with 10.0% in the

prior-year period.

Other Products and

Services

Net sales for full fiscal year 2024 were $197.4 million

compared with $204.7 million in the prior-year period. The decrease

in net sales was primarily due to the sale of the Company's

plastics subsidiary during the prior-year period, partially offset

by higher net sales in the poultry and meats business, driven by an

increase in per unit selling prices.

Gross profit for full fiscal year 2024 was $27.8 million

compared with $20.1 million in the prior-year period. The increase

in gross profit was primarily due to higher net sales and lower per

unit production costs in the Company's poultry and meats business,

partially offset by lower net sales in its third-party ocean

freight services business. Gross margin increased to 14.1% compared

with 9.8% in the prior-year period.

Cash Flows

Net cash provided by operating activities for full fiscal year

2024 was $182.5 million, compared with $177.9 million in the

prior-year period. The increase in net cash provided by operating

activities was principally attributable to current year working

capital fluctuations, primarily from higher levels of accounts

payable and accrued expenses compared to the prior year, due to the

timing of period-end payments to suppliers.

Long Term Debt

Long term debt as of the end of 2024 decreased to $244.1 million

from $400.0 million as of the prior-year end.

Quarterly Cash Dividend

On February 21, 2025, the Company's Board of Directors declared

an increase to the quarterly cash dividend to $0.30 per share,

payable on March 28, 2025, to shareholders of record on March 10,

2025.

Fresh Del Monte Produce Inc.

and Subsidiaries

Consolidated Statements of

Operations

(U.S. dollars in millions,

except share and per share data) - (Unaudited)

Quarter ended

Year ended

Statement of Operations:

December 27, 2024

December 29, 2023

December 27, 2024

December 29, 2023

Net sales

$

1,013.2

$

1,008.6

$

4,280.2

$

4,320.7

Cost of products sold

944.3

952.4

3,921.3

3,966.2

Other product-related charges

(credits)

0.2

(6.3

)

1.0

3.8

Gross profit

68.7

62.5

357.9

350.7

Selling, general and administrative

expenses

48.4

44.2

196.9

186.7

Gain on disposal of property, plant and

equipment, net

12.9

2.1

39.5

37.9

Asset impairment and other charges,

net

2.9

133.8

4.2

143.4

Operating income (loss)

30.3

(113.4

)

196.3

58.5

Interest expense

3.6

3.7

18.4

24.1

Interest income

0.5

0.3

1.2

1.4

Other expense (income), net

3.2

(3.5

)

8.4

19.3

Income (loss) before income taxes

24.0

(113.3

)

170.7

16.5

Income tax provision (benefit)

3.6

(6.8

)

29.1

18.1

Net income (loss)

$

20.4

$

(106.5

)

$

141.6

$

(1.6

)

Less: Net income (loss) attributable to

redeemable and noncontrolling interests

—

(0.1

)

(0.6

)

9.8

Net income (loss) attributable to Fresh

Del Monte Produce Inc.

$

20.4

$

(106.4

)

$

142.2

$

(11.4

)

Earnings (loss) per share(1):

Basic

$

0.43

$

(2.22

)

$

2.97

$

(0.24

)

Diluted

$

0.42

$

(2.22

)

$

2.96

$

(0.24

)

Dividends declared per ordinary share

$

0.25

$

0.20

$

1.00

$

0.75

Weighted average number of ordinary

shares:

Basic

47,939,455

47,868,948

47,876,129

47,979,143

Diluted

48,257,648

47,868,948

48,040,005

47,979,143

(1) Earnings per share ("EPS") is

calculated based on Net income (loss) attributable to Fresh Del

Monte Produce Inc.

Fresh Del Monte Produce Inc.

and Subsidiaries

Consolidated Balance

Sheets

(U.S. dollars in millions) -

(Unaudited)

December 27, 2024

December 29, 2023

Assets

Current assets:

Cash and cash equivalents

$

32.6

$

33.8

Trade accounts receivable, net

393.2

387.0

Other accounts receivable, net

78.0

95.1

Inventories, net

595.3

599.9

Assets held for sale

9.5

4.5

Prepaid expenses and other current

assets

24.3

24.0

Total current assets

1,132.9

1,144.3

Investment in and advances to

unconsolidated companies

39.9

22.2

Property, plant and equipment, net

1,191.6

1,256.4

Operating lease right-of-use assets

186.1

213.8

Goodwill

396.3

401.9

Intangible assets, net

33.2

33.3

Deferred income taxes

47.5

51.5

Other noncurrent assets

68.7

60.7

Total assets

$

3,096.2

$

3,184.1

Liabilities and shareholders'

equity

Current liabilities:

Accounts payable and accrued expenses

$

476.0

$

479.0

Current maturities of debt and finance

leases

1.5

1.4

Current maturities of operating leases

38.6

48.6

Income taxes and other taxes payable

17.0

11.6

Total current liabilities

533.1

540.6

Long-term debt and finance leases

248.9

406.1

Operating leases, less current

maturities

122.3

142.1

Retirement benefits

83.1

82.3

Other noncurrent liabilities

26.8

27.6

Deferred income taxes

75.2

72.7

Total liabilities

1,089.4

1,271.4

Commitments and contingencies

Shareholders' equity:

Preferred shares

—

—

Ordinary shares

0.5

0.5

Paid-in capital

605.0

597.7

Retained earnings

1,435.4

1,341.4

Accumulated other comprehensive loss

(50.4

)

(43.3

)

Total Fresh Del Monte Produce Inc.

shareholders' equity

1,990.5

1,896.3

Noncontrolling interests

16.3

16.4

Total shareholders' equity

2,006.8

1,912.7

Total liabilities and shareholders'

equity

$

3,096.2

$

3,184.1

Fresh Del Monte Produce Inc.

and Subsidiaries

Consolidated Statements of

Cash Flows

(U.S. dollars in millions) -

(Unaudited)

Year ended

December 27, 2024

December 29, 2023

Operating activities:

Net income (loss)

$

141.6

$

(1.6

)

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation and amortization

78.5

84.8

Amortization of debt issuance costs

0.5

0.5

Share-based compensation expense

6.9

9.9

Asset impairments

3.7

141.3

Change in uncertain tax positions

(1.0

)

1.5

Gain on disposal of property, plant and

equipment, net and subsidiary

(39.5

)

(37.9

)

Deferred income taxes

3.6

(3.8

)

Gain on release of cumulative translation

adjustment

—

(2.4

)

Other, net

(6.6

)

(1.3

)

Changes in operating assets and

liabilities:

Receivables

(9.8

)

(19.3

)

Inventories

(1.5

)

64.7

Prepaid expenses and other current

assets

(2.4

)

1.7

Accounts payable and accrued expenses

11.2

(64.1

)

Other noncurrent assets and

liabilities

(2.7

)

3.9

Net cash provided by operating

activities

182.5

177.9

Investing activities:

Capital expenditures

(51.7

)

(57.7

)

Proceeds from sales of property, plant and

equipment and subsidiary

74.4

119.9

Insurance proceeds received for damage to

property, plant and equipment, net

5.7

—

Investments in and advances to

unconsolidated companies

(8.0

)

(5.3

)

Other investing activities

—

(0.5

)

Net cash provided by investing

activities

20.4

56.4

Financing activities:

Proceeds from debt

620.4

590.5

Payments on debt

(776.3

)

(730.3

)

Distributions to noncontrolling

interests

—

(17.9

)

Purchase of redeemable noncontrolling

interest

—

(5.2

)

Share-based awards settled in cash for

taxes

(0.9

)

(0.8

)

Dividends paid

(47.8

)

(35.9

)

Payment of deferred financing costs

(2.2

)

—

Repurchase and retirement of ordinary

shares

—

(11.8

)

Other financing activities

(3.1

)

(2.1

)

Net cash used in financing

activities

(209.9

)

(213.5

)

Effect of exchange rate changes on

cash

5.8

(4.2

)

Net (decrease) increase in cash and cash

equivalents

(1.2

)

16.6

Cash and cash equivalents, beginning

33.8

17.2

Cash and cash equivalents, ending

$

32.6

$

33.8

Non-GAAP Measures

The Company's results are determined in accordance with U.S.

generally accepted accounting principles (GAAP). Certain

information presented in this press release reflects adjustments to

GAAP measures such as amounts related to asset impairment and other

charges, net, gain on disposal of property, plant and equipment,

net, and subsidiary, and other product-related charges. These

adjustments result in non-GAAP financial measures and are referred

to in this press release as Adjusted gross profit, Adjusted gross

margin, Adjusted operating income, Adjusted FDP net income (loss),

and Adjusted diluted EPS. Management believes these adjustments

provide a more comparable analysis of the underlying operating

performance of the business.

This press release also includes non-GAAP measures such as

EBITDA, Adjusted EBITDA, EBITDA margin, and Adjusted EBITDA margin.

EBITDA is defined as net income (loss) attributable to Fresh Del

Monte Produce Inc. excluding interest expense, interest income,

provision (benefit) for income taxes, depreciation and

amortization, and share-based compensation expense. Adjusted EBITDA

represents EBITDA with additional adjustments for non-recurring

items, including asset impairment and other charges (credits), net,

gain on disposal of property, subsidiary and other product-related

charges. EBITDA margin represents EBITDA as a percentage of net

sales, and Adjusted EBITDA margin represents Adjusted EBITDA as a

percentage of net sales.

Adjusted gross profit, Adjusted operating income, Adjusted FDP

net income (loss), and Adjusted EBITDA provide the Company with an

understanding of the results from the primary operations of its

business. The Company uses these metrics because management

believes they provide more comparable measures to evaluate

period-over-period operating performance since they exclude special

items that are not indicative of the Company's core business or

operations. These measures may be useful to an investor in

evaluating the underlying operating performance of the Company's

business because these measures:

- Are used by investors to measure a company's comparable

operating performance;

- Are financial measurements that are used by lenders and other

parties to evaluate creditworthiness; and

- Are used by the Company's management for various purposes,

including as measures of performance of its operating entities, as

a basis of strategic planning and forecasting, and in certain cases

as a basis for incentive compensation.

Because all companies do not use identical calculations, the

Company's presentation of these non-GAAP financial measures may not

be comparable to similarly titled measures used by other companies.

Reconciliations of non-GAAP financial measures to the most directly

comparable GAAP financial measures are provided in the financial

tables that accompany this release.

Fresh Del Monte Produce Inc.

and Subsidiaries

Non-GAAP

Reconciliation

(U.S. dollars in millions,

except per-share amounts) - (Unaudited)

Quarter ended

December 27, 2024

December 29, 2023

Gross profit

Operating income

Net income (loss) attributable to

Fresh Del Monte Produce Inc.

Diluted EPS

Gross profit

Operating (loss) income

Net income (loss) attributable to

Fresh Del Monte Produce Inc.

Diluted EPS

As reported

$

68.7

$

30.3

$

20.4

$

0.42

$

62.5

$

(113.4

)

$

(106.4

)

$

(2.22

)

Adjustments:

Other product-related charges (credits)

(1)

0.2

0.2

0.2

—

(6.3

)

(6.3

)

(6.3

)

(0.13

)

Asset impairment and other charges, net

(2)

—

2.9

2.9

0.06

—

133.8

133.8

2.79

(Gain) on disposal of property, plant and

equipment, net and subsidiary (3)

—

(16.3

)

(16.3

)

(0.33

)

—

(2.1

)

(2.1

)

(0.04

)

Other adjustments (4)

—

—

—

—

—

—

—

—

Tax effects of all adjustments and other

tax-related items (5)

—

—

5.1

0.11

—

—

(7.2

)

(0.15

)

As adjusted

$

68.9

$

17.1

$

12.3

$

0.26

$

56.2

$

12.0

$

11.8

$

0.25

Year ended

December 27, 2024

December 29, 2023

Gross profit

Operating (loss) income

Net income (loss) attributable to

Fresh Del Monte Produce Inc.

Diluted EPS

Gross profit

Operating (loss) income

Net income (loss) attributable to

Fresh Del Monte Produce Inc.

Diluted EPS

As reported

$

357.9

$

196.3

$

142.2

$

2.96

$

350.7

$

58.5

$

(11.4

)

$

(0.24

)

Adjustments:

Other product-related charges (credits)

(1)

1.0

1.0

1.0

0.02

3.8

3.8

3.8

0.08

Asset impairment and other charges, net

(2)

—

4.2

4.2

0.09

—

143.4

143.4

2.99

(Gain) on disposal of property, plant and

equipment, net and subsidiary (3)

—

(42.9

)

(42.9

)

(0.89

)

—

(40.4

)

(40.4

)

(0.84

)

Other adjustments (4)

—

—

—

—

—

—

7.6

0.16

Tax effects of all adjustments and other

tax-related items (5)

—

—

11.7

0.24

—

—

(1.3

)

(0.03

)

As adjusted

$

358.9

$

158.6

$

116.2

$

2.42

$

354.5

$

165.3

$

101.7

$

2.12

Fresh Del Monte Produce Inc.

and Subsidiaries

Segment Gross Profit Non-GAAP

Reconciliation

(U.S. dollars in millions) -

(Unaudited)

Quarter ended

December 27, 2024

December 29, 2023

Fresh and value-added

products

Banana

Other products and services

Fresh and value-added

products

Banana

Other products and services

Gross profit (as reported)

$

46.1

$

14.0

$

8.6

$

22.0

$

37.6

$

2.9

Adjustments:

Other product-related charges (credits)

(1)

0.2

—

—

(6.3

)

—

—

Adjusted gross profit

$

46.3

$

14.0

$

8.6

$

15.7

$

37.6

$

2.9

Net Sales

$

612.3

$

356.8

$

44.1

$

582.8

$

379.6

$

46.2

Gross margin(a)

7.5

%

3.9

%

19.5

%

3.8

%

9.9

%

6.3

%

Adjusted gross margin(b)

7.6

%

3.9

%

19.5

%

2.7

%

9.9

%

6.3

%

Year ended

December 27, 2024

December 29, 2023

Fresh and value-added

products

Banana

Other products and services

Fresh and value-added

products

Banana

Other products and services

Gross profit (as reported)

$

243.3

$

86.8

$

27.8

$

167.3

$

163.3

$

20.1

Adjustments:

Other product-related charges (1)

0.6

0.4

—

3.7

0.1

—

Adjusted gross profit

$

243.9

$

87.2

$

27.8

$

171.0

$

163.4

$

20.1

Net Sales

$

2,606.9

$

1,475.9

$

197.4

$

2,477.8

$

1,638.2

$

204.7

Gross margin(a)

9.3

%

5.9

%

14.1

%

6.8

%

10.0

%

9.8

%

Adjusted gross margin(b)

9.4

%

5.9

%

14.1

%

6.9

%

10.0

%

9.8

%

(a) Calculated as Gross profit as a

percentage of net sales.

(b) Calculated as Adjusted gross profit as

a percentage of net sales.

Fresh Del Monte Produce Inc.

and Subsidiaries

Reconciliation of EBITDA and

Adjusted EBITDA

(U.S. dollars in millions) -

(Unaudited)

Quarter ended

Year ended

December 27, 2024

December 29, 2023

December 27, 2024

December 29, 2023

Net income (loss) attributable to Fresh

Del Monte Produce Inc.

$

20.4

$

(106.4

)

$

142.2

$

(11.4

)

Interest expense, net

3.1

3.4

17.2

22.7

Income tax provision (benefit)

3.6

(6.8

)

29.1

18.1

Depreciation & amortization

19.3

19.9

78.5

84.8

Share-based compensation expense

2.0

2.3

6.9

9.9

EBITDA

$

48.4

$

(87.6

)

$

273.9

$

124.1

Adjustments:

Other product-related charges (credits)

(1)

0.2

(6.3

)

1.0

3.8

Asset impairment and other charges, net

(2)

2.9

133.8

4.2

143.4

(Gain) on disposal of property, plant and

equipment, net (3)

(16.3

)

(2.1

)

(42.9

)

(40.4

)

Other adjustments (4)

—

—

—

7.6

Adjusted EBITDA

$

35.2

$

37.8

$

236.2

$

238.5

Net sales

$

1,013.2

$

1,008.6

$

4,280.2

$

4,320.7

Net income margin(a)

2.0

%

(10.5

)%

3.3

%

(0.3

)%

(a) Calculated as Net income (loss)

attributable to Fresh Del Monte Produce Inc. as a percentage of net

sales.

EBITDA margin(b)

4.8

%

(8.7

)%

6.4

%

2.9

%

(b) Calculated as EBITDA as a percentage

of net sales.

Adjusted EBITDA margin(c)

3.5

%

3.7

%

5.5

%

5.5

%

(c) Calculated as Adjusted EBITDA as a

percentage of net sales.

(1)

Other product-related charges

(credits) for the quarter ended December 27, 2024, primarily

consisted of $0.2 million of inventory write-offs related to

flooding damage at melon farms in Costa Rica. Other product-related

charges (credits) for the year ended December 27, 2024, also

included $1.2 million of severance charges from the outsourcing of

certain functions within our fresh and value-added operations and

$1.0 million of additional logistic and inventory write-off

expenses incurred as a result of Hurricane Beryl during July 2024,

partially offset by $1.7 million of insurance recoveries, net of

expenses, associated with the flooding of a production facility in

Greece. Other product-related charges (credits) for the quarter

ended December 29, 2023, primarily consisted of $6.9 million of

insurance recoveries and recovery of inventory written-off due to

severe flooding caused by heavy rainstorms in Greece during the

third quarter of 2023, partially offset by inventory write-offs of

$0.6 million as a result of reroutes of shipments impacted by

conflict in the Red Sea. Other product-related charges (credits)

for the year ended December 29, 2023, also included inventory

write-off and clean-up costs of $8.4 million due to Greece flooding

and $1.8 million of inventory write-offs primarily related to the

sale of two distribution centers in Saudi Arabia.

(2)

Asset impairment and other

charges, net for the quarter ended December 27, 2024, primarily

consisted of $1.5 million of impairment charges related to damaged

and unused housing at farms in Costa Rica and a $1.4 million

impairment charge related to goodwill in our vegetable reporting

unit. Asset impairment and other charges, net for year ended

December 27, 2024 also included $1.8 million of legal settlement

charges, $0.5 million of reserves related to a potential liability

arising from our third-party logistics operations (refer to Form

10-K for the year ended December 27, 2024 for further information

on this matter), partially offset by $2.0 million of insurance

recoveries associated with fire damage to a warehouse facility in

South America during the fourth quarter of 2023. Asset impairment

and other charges, net for the quarter ended December 29, 2023,

primarily consisted of impairment charges of $109.6 million related

to customer list and trade name intangible assets and building,

land, and land improvements assets in North America, a $21.6

million impairment charge related to goodwill in our prepared foods

reporting unit and $2.6 million of impairment charges related to

low-yielding non-tropical fruit farms in Chile. Asset impairment

and other charges, net for the year ended December 29, 2023, also

consisted of $3.7 million of impairment charges related to

low-yielding banana farms in the Philippines, $1.8 million of

impairment charges due to low productivity grape vines in South

America, $1.3 million of expenses, net of insurance reimbursements,

incurred in connection with a cybersecurity incident which occurred

during early 2023 and $1.1 million of impairment charges related to

idle land in South America. The cybersecurity incident temporarily

impacted certain of the Company's operational and information

technology systems and resulted in incremental costs primarily

related to the engagement of specialized legal counsel and other

incident response advisors. The Company's critical operational data

and business systems were promptly recovered and accordingly, the

incident did not have a material impact on the Company's financial

results for the year ended December 29, 2023.

(3)

Gain on disposal of property,

plant and equipment, net and subsidiary for the quarter ended

December 27, 2024 primarily related to a $11.3 million gain on the

sale of a Canadian distribution center, $4.3 million related to the

sale of the operating assets of Fresh Leaf Farms, a North American

subsidiary of Mann Packing in our fresh and value-added operations,

and $0.5 million related to the sale of an administrative office in

Central America. Gain on disposal of property, plant and equipment,

net and subsidiary for the year ended December 27, 2024 also

included a $14.7 million gain from the sale of two idle facilities

in South America, a $7.7 million gain from the sale of a warehouse

in South America and a $3.4 million gain from the sale of a

warehouse in Europe. Gain on disposal of property, plant and

equipment, net and subsidiary for the quarter ended December 29,

2023, mainly related to the sale of a carrier vessel. For the year

ended December 29, 2023, gain on disposal of property, plant and

equipment, net and subsidiary also included a $20.5 million gain on

the sale of two distribution centers and related assets in Saudi

Arabia, a $7.0 million gain on the sale of an idle facility in

North America, a $3.8 million gain on the sale of the Company's

plastics business subsidiary in South America, a $2.4 million gain

on the sale of an additional carrier vessel and gains on the sales

of land assets in South and Central America.

(4)

Other adjustments for the year

ended December 29, 2023, primarily related to portions of the gain

on disposal of property, plant, and equipment, net and subsidiary

which were attributable to a minority interest partner, reflected

in net income (loss) attributable to redeemable and noncontrolling

interests.

(5)

Tax effects are calculated in

accordance with ASC 740, Income Taxes, using the same methodology

as the GAAP provision of income taxes. Income tax effects of

non-GAAP adjustments are calculated based on the applicable

statutory tax rate for each jurisdiction in which such adjustments

were incurred, except for those items which are non-taxable for

which the tax provision was calculated at 0%. Certain non-GAAP

adjustments were subject to valuation allowances and therefore were

calculated at 0%.

Conference Call and Webcast Data

Fresh Del Monte will host a conference call and simultaneous

webcast at 11:00 a.m. Eastern Time today to discuss the fourth

quarter and full fiscal year 2024 financial results and to review

the Company’s progress and outlook. The webcast can be accessed on

the Company’s Investor Relations home page at

https://investorrelations.freshdelmonte.com. The call will be

available for re-broadcast on the Company’s website approximately

two hours after the conclusion of the call for a period of one

year.

About Fresh Del Monte Produce Inc.

Fresh Del Monte Produce Inc. is one of the world’s leading

vertically integrated producers, marketers, and distributors of

high-quality fresh and fresh-cut fruit and vegetables, as well as a

leading producer and distributor of prepared food in Europe,

Africa, and the Middle East. Fresh Del Monte Produce Inc. markets

its products worldwide under the DEL MONTE® brand (under license

from Del Monte Foods Corporation II Inc.), a symbol of product

innovation, quality, freshness, and reliability for over 135 years.

The company also markets its products under the MANN® brand and

other related trademarks. Fresh Del Monte Produce Inc. is not

affiliated with certain other Del Monte companies around the world,

including Del Monte Foods, Inc., the U.S. subsidiary of Del Monte

Pacific Limited, Del Monte Canada, or Del Monte Asia Pte. Ltd.

Fresh Del Monte Produce Inc. is the first global marketer of fruits

and vegetables to commit to the “Science Based Targets” initiative.

In 2022, 2023, and 2024 Fresh Del Monte Produce was ranked as one

of "American's Most Trusted Companies" by Newsweek based on an

independent survey rating companies on three different touchpoints,

including customer trust, investor trust, and employee trust. The

company was also named a Humankind 100 Company for two consecutive

years by Humankind Investments, which recognizes companies that

substantially impact areas such as access to food and clean water,

healthcare, and digital services. Fresh Del Monte Produce Inc. is

traded on the NYSE under the symbol FDP.

Forward-looking Information

This press release and the related earnings call contain certain

forward-looking statements regarding the intent, beliefs or current

expectations of the Company. These statements include statements

that are preceded by, followed by or include the words “believes”,

“expects”, “anticipates”, “may” or similar expressions with respect

to various matters. Specifically, this presentation and the

earnings call contain forward-looking statements regarding the

Company’s: focus on high-margin products that align with market

demands and the Company’s business model; ability to solidify its

position as a global leader of pineapples, including with respect

to its pineapple varieties and related innovations; five-year

growth strategy, as well as the Company’s strategy to build its

fresh-cut program into a key profit center; ability to expand and

diversify global sourcing through various partnerships;

expectations regarding the banana segment, as well as the Company’s

ability to penetrate the market; expectations regarding its ability

as well as its timing to achieve compliance with FSMA 204; ongoing

commitment to maximize the full utilization of its biomass, as well

as the intended use and timing of such biofertilizers and the

impact on the Company’s sustainability efforts; the impact of any

potential international business on the business, as well as the

Company’s ability to mitigate potential disruptions; ability to

streamline operations and the impact that may have on its

profitability and future growth; ability to generate value for

shareholders; expectations regarding the Mann Packing business, and

any impact on its profitability and financial condition; ongoing

commitment to future growth, operational excellence and meeting

evolving customer and consumer demands; future weather-related

events on the Company’s business, and its ability to recover

insurance proceeds, if any, to cover any damage or expenses;

expectations for the tax rate; expected SG&A expenses, debt

management, capital expenditures and cash flow in 2025 and expected

segment results for the first six months of 2025. It is important

to note that these forward-looking statements are not guarantees of

future performance and involve risks and uncertainties. The

Company’s actual plans and performance may differ materially from

those in the forward-looking statements as a result of various

factors, including (i) ongoing elevated commodity and supply chain

costs, (ii) the cost and other implications of changes in

regulations applicable to the Company’s business, including

potential domestic and international legislative or regulatory

initiatives; (iii) ability to successfully execute on its strategic

growth plans, including the use of biofertilizers and other

technology, (iv) the impact of foreign currency fluctuations, (v)

the impact of asset impairment or other charges, including those

associated with exit activities, crop or facility damage or

otherwise, (vi) the impact of any disruptions in the Company's

supply chain, (vii) trends and other factors affecting consumer

preferences, including customers’ reception of new product

offerings and innovation, (viii) the impact of severe weather

conditions and natural disasters, such as flooding, hurricanes,

earthquakes, (ix) competitive pressures and ability to realize the

full benefits of the inflation driven price increases implemented,

(x) the impact of claims and adjustments proposed by the IRS or

other foreign taxing authorities in connection with any tax audits

and the Company’s ability to successfully contest such tax claims

and pursue necessary remedies, (xi) damage to the Company’s

reputation or brand names or negative publicity about the Company’s

products, (xii) the Company’s ability to successfully manage the

risks associated with international operations and (xiii) the

adequacy of insurance coverage. In addition, these forward-looking

statements and the information in this presentation and the

earnings call are qualified in their entirety by cautionary

statements and risk factor disclosures contained in the Company’s

Securities and Exchange Commission filings, including the Company’s

most recently filed Annual Report on Form 10-K. All forward-looking

statements in this presentation are based on information available

to us on the date hereof, and we assume no obligation to update

such statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250224960898/en/

Investors: Christine

Cannella Vice President, Investor Relations

305-520-8433 Investors@freshdelmonte.com

Media: Claudia Pou

Vice President, Global Head of Corporate Communications

Communications@freshdelmonte.com

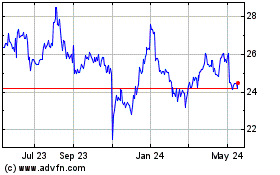

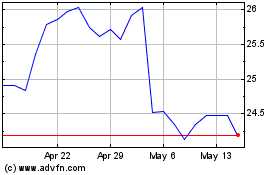

Fresh Del Monte Produce (NYSE:FDP)

Historical Stock Chart

From Jan 2025 to Feb 2025

Fresh Del Monte Produce (NYSE:FDP)

Historical Stock Chart

From Feb 2024 to Feb 2025