0000814547false00008145472024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported) November 6, 2024

FAIR ISAAC CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Delaware

| 1-11689

| 94-1499887 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer

Identification Number) |

| | | |

| 5 West Mendenhall, Suite 105 | | |

| Bozeman, | Montana | | 59715 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code 406-982-7276

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | FICO | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b‑2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

TABLE OF CONTENTS

| | | | | |

| Item 2.02. Results of Operations and Financial Condition. | |

| Item 9.01. Financial Statements and Exhibits. | |

| Exhibit 99.1 | |

| Signature | |

Item 2.02. Results of Operations and Financial Condition.

On November 6, 2024, Fair Isaac Corporation (the “Company”) reported its financial results for the quarter ended September 30, 2024. See the Company’s press release dated November 6, 2024, which is furnished as Exhibit 99.1 hereto and incorporated by reference in this Item 2.02.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit | | Description |

| 99.1 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | FAIR ISAAC CORPORATION |

| | By: | /s/ STEVEN P. WEBER |

| | | Steven P. Weber |

| | | Executive Vice President and Chief Financial Officer |

| | | |

| Date: | November 6, 2024 | | |

Exhibit 99.1

FICO Announces Earnings of $5.44 per Share

for Fourth Quarter Fiscal 2024

Revenue of $454 million vs. $390 million in prior year

BOZEMAN, Mont.--(BUSINESS WIRE)--November 6, 2024--FICO (NYSE:FICO), a global analytics software leader, today announced results for its fourth fiscal quarter ended September 30, 2024.

Fourth Quarter Fiscal 2024 GAAP Results

Net income for the quarter totaled $135.7 million, or $5.44 per share, versus $101.4 million, or $4.01 per share, in the prior year period.

Net cash provided by operating activities for the quarter was $226.5 million versus $164.0 million in the prior year period.

Fourth Quarter Fiscal 2024 Non-GAAP Results

Non-GAAP Net Income for the quarter was $163.2 million versus $126.7 million in the prior year period. Non-GAAP EPS for the quarter was $6.54 versus $5.01 in the prior year period. Free cash flow was $219.4 million for the current quarter versus $163.0 million in the prior year period. The Non-GAAP financial measures are described in the financial table captioned “Non-GAAP Results” and are reconciled to the corresponding GAAP results in the financial tables at the end of this release.

Fourth Quarter Fiscal 2024 GAAP Revenue

The company reported revenues of $453.8 million for the quarter as compared to $389.7 million reported in the prior year period, an increase of 16%.

“I am very proud of our performance in FY24, another record year for FICO financially,” said Will Lansing, chief executive officer. “I am also pleased to provide our FY 2025 guidance, which includes double-digit percentage growth for all our metrics.”

Revenues for the fourth quarter of fiscal 2024 for the company’s two operating segments were as follows:

•Scores revenues, which include the company’s business-to-business (B2B) scoring solutions, and business-to-consumer (B2C) solutions, were $249.2 million in the fourth quarter, compared to $195.6 million in the prior year period, an increase of 27%. B2B revenue increased 38%, driven largely by higher unit prices. B2C revenue decreased 1% from the prior year period due to lower volumes on myFICO.com business.

•Software revenues, which include the company’s analytics and digital decisioning technology, were $204.6 million in the fourth quarter, compared to $194.2 million in the prior year period, an increase of 5%, mainly due to increased recurring revenue, partially offset by a decrease in professional services. Software Annual Recurring Revenue was up 8% year-over-year, consisting of 31% platform ARR growth and no growth in non-platform. Software Dollar-Based Net Retention Rate was 106% on September 30, 2024, with platform software at 123% and non-platform software at 99%.

Outlook

The company is providing the following guidance for fiscal 2025:

| | | | | |

| Fiscal 2025 Guidance |

| Revenues | $1.98 billion |

| GAAP Net Income | $624 million |

| GAAP EPS | $25.05 |

| Non-GAAP Net Income | $712 million |

| Non-GAAP EPS | $28.58 |

The Non-GAAP financial measures are described in the financial table captioned “Reconciliation of Non-GAAP Guidance.”

Company to Host Conference Call

The company will host a webcast on November 6, 2024, at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time) to report its fourth quarter fiscal 2024 results and provide various strategic and operational updates. The call can be accessed at FICO's web site at www.fico.com/investors. A replay of the webcast will be available on our Past Events page through November 6, 2025.

About FICO

FICO (NYSE: FICO) powers decisions that help people and businesses around the world prosper. Founded in 1956, the company is a pioneer in the use of predictive analytics and data science to improve operational decisions. FICO holds more than 200 U.S. and foreign patents on technologies that increase profitability, customer satisfaction and growth for businesses in financial services, insurance, telecommunications, health care, retail and many other industries. Using FICO solutions, businesses in more than 80 countries do everything from protecting four billion payment cards from fraud, to improving financial inclusion, to increasing supply chain resiliency. The FICO® Score, used by 90% of top U.S. lenders, is the standard measure of consumer credit risk in the U.S. and has been made available in over 40 other countries, improving risk management, credit access and transparency.

Learn more at https://www.fico.com/en

Join the conversation at https://x.com/FICO_corp & https://www.fico.com/blogs/

For FICO news and media resources, visit https://www.fico.com/en/newsroom

FICO is a registered trademark of Fair Isaac Corporation in the U.S. and other countries.

Statement Concerning Forward-Looking Information

Except for historical information contained herein, the statements contained in this news release that relate to FICO or its business are forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially, including the impact of macroeconomic conditions on FICO’s business, operations and personnel, the success of the Company’s Decision Management strategy and reengineering initiative, the maintenance of its existing relationships and ability to create new relationships with customers and key alliance partners, its ability to continue to develop new and enhanced products and services, its ability to recruit and retain key technical and managerial personnel, competition, regulatory changes applicable to the use of consumer credit and other data, the failure to protect such data, the failure to realize the anticipated benefits of any acquisitions, or divestitures, and material adverse developments in global economic conditions or in the markets we serve. Additional information on these risks and uncertainties and other factors that could affect FICO’s future results are described from time to time in FICO’s SEC reports, including its Annual Report on Form 10-K for the year ended September 30, 2024 and its

subsequent filings with the SEC. If any of these risks or uncertainties materializes, FICO’s results could differ materially from its expectations. Investors are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date they are made. FICO disclaims any intent or obligation to update these forward-looking statements, whether as a result of new information, future events or otherwise.

FAIR ISAAC CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | |

| September 30, 2024 | | September 30, 2023 |

| (In thousands) |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 150,667 | | | $ | 136,778 | |

| Accounts receivable, net | 426,642 | | | 387,947 | |

| Prepaid expenses and other current assets | 40,104 | | | 31,723 |

| Total current assets | 617,413 | | | 556,448 |

| Marketable securities | 45,289 | | | 33,014 | |

| Property and equipment, net | 38,465 | | | 10,966 | |

| Operating lease right-of-use assets | 29,580 | | | 25,703 | |

| Goodwill and intangible assets, net | 782,752 | | | 774,244 | |

| Other assets | 204,385 | | | 174,906 | |

| Total assets | $ | 1,717,884 | | | $ | 1,575,281 | |

| Liabilities and Stockholders’ Deficit | | | |

| Current liabilities: | | | |

| Accounts payable and other accrued liabilities | $ | 102,285 | | | $ | 78,487 | |

| Accrued compensation and employee benefits | 106,103 | | | 102,471 | |

| Deferred revenue | 156,897 | | | 136,730 | |

| Current maturities on debt | 15,000 | | | 50,000 | |

| Total current liabilities | 380,285 | | | 367,688 | |

| Long-term debt | 2,194,021 | | | 1,811,658 | |

| Operating lease liabilities | 21,963 | | | 23,903 | |

| Other liabilities | 84,294 | | | 60,022 | |

| Total liabilities | 2,680,563 | | | 2,263,271 | |

| | | |

| Stockholders’ deficit | (962,679) | | | (687,990) | |

| Total liabilities and stockholders’ deficit | $ | 1,717,884 | | | $ | 1,575,281 | |

FAIR ISAAC CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended September 30, | | Year Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (In thousands, except per share data) |

| Revenues: | | | | | | | |

| On-premises and SaaS software | $ | 181,707 | | | $ | 168,979 | | | $ | 711,340 | | | $ | 640,182 | |

| Professional services | 22,899 | | | 25,199 | | | 86,536 | | | 99,547 | |

| Scores | 249,203 | | | 195,555 | | | 919,650 | | | 773,828 | |

| Total revenues | 453,809 | | | 389,733 | | | 1,717,526 | | | 1,513,557 | |

| Operating expenses: | | | | | | | |

| Cost of revenues | 89,574 | | | 82,832 | | | 348,206 | | | 311,053 | |

| Research and development | 44,208 | | | 41,596 | | | 171,940 | | | 159,950 | |

| Selling, general and administrative | 122,757 | | | 99,331 | | | 462,834 | | | 400,565 | |

| Amortization of intangible assets | 92 | | | 275 | | | 917 | | | 1,100 | |

| | | | | | | |

| Gain on product line asset sale | — | | | — | | | — | | | (1,941) | |

| Total operating expenses | 256,631 | | | 224,034 | | | 983,897 | | | 870,727 | |

| Operating income | 197,178 | | | 165,699 | | | 733,629 | | | 642,830 | |

| Other expense, net | (25,795) | | | (25,234) | | | (91,604) | | | (89,206) | |

| Income before income taxes | 171,383 | | | 140,465 | | | 642,025 | | | 553,624 | |

| Provision for income taxes | 35,692 | | | 39,041 | | | 129,214 | | | 124,249 | |

| Net income | $ | 135,691 | | | $ | 101,424 | | | $ | 512,811 | | | $ | 429,375 | |

| Earnings per share: | | | | | | | |

| Basic | $ | 5.54 | | | $ | 4.09 | | | $ | 20.78 | | | $ | 17.18 | |

| Diluted | $ | 5.44 | | | $ | 4.01 | | | $ | 20.45 | | | $ | 16.93 | |

| Shares used in computing earnings per share: | | | | | | | |

| Basic | 24,501 | | | 24,826 | | | 24,676 | | | 24,986 | |

| Diluted | 24,950 | | | 25,273 | | | 25,079 | | | 25,367 | |

FAIR ISAAC CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | |

| | Year Ended September 30, |

| | 2024 | | 2023 |

| | (In thousands) |

| Cash flows from operating activities: | | | |

| Net income | $ | 512,811 | | | $ | 429,375 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 13,827 | | | 14,638 | |

| Share-based compensation | 149,439 | | | 123,847 | |

| Changes in operating assets and liabilities | (20,485) | | | (63,448) | |

| Gain on product line asset sale | — | | | (1,941) | |

| Other, net | (22,628) | | | (33,556) | |

| Net cash provided by operating activities | 632,964 | | | 468,915 | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (8,884) | | | (4,237) | |

| Capitalized internal-use software costs | (16,667) | | | — | |

| Net activity from marketable securities | (2,442) | | | (5,591) | |

| Cash transferred, net of proceeds, from product line asset sale | — | | | (6,126) | |

| | | |

| Net cash used in investing activities | (27,993) | | | (15,954) | |

| Cash flows from financing activities: | | | |

| Proceeds from revolving line of credit and term loans | 947,000 | | | 407,000 | |

| Payments on revolving line of credit and term loans | (602,000) | | | (402,000) | |

| | | |

| | | |

| Proceeds from issuance of treasury stock under employee stock plans | 25,006 | | | 22,198 | |

| Taxes paid related to net share settlement of equity awards | (139,188) | | | (76,673) | |

| Repurchases of common stock | (821,702) | | | (405,526) | |

| Other, net | (2,039) | | | — | |

| Net cash used in financing activities | (592,923) | | | (455,001) | |

| Effect of exchange rate changes on cash | 1,841 | | | 5,616 | |

| Increase in cash and cash equivalents | 13,889 | | | 3,576 | |

| Cash and cash equivalents, beginning of year | 136,778 | | | 133,202 | |

| Cash and cash equivalents, end of year | $ | 150,667 | | | $ | 136,778 | |

FAIR ISAAC CORPORATION

NON-GAAP RESULTS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended September 30, | | Year Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (In thousands, except per share data) |

| GAAP net income | $ | 135,691 | | | $ | 101,424 | | | $ | 512,811 | | | $ | 429,375 | |

| Amortization of intangible assets | 92 | | | 275 | | | 917 | | | 1,100 | |

| Gain on product line asset sale | — | | | — | | | — | | | (1,941) | |

| Share-based compensation expense | 39,982 | | | 34,097 | | | 149,439 | | | 123,847 | |

| Income tax adjustments | (10,134) | | | (8,760) | | | (38,083) | | | (30,806) | |

| Excess tax benefit | (2,429) | | | (852) | | | (29,774) | | | (12,586) | |

| Adjustment to tax reserves and valuation allowance | — | | | 560 | | | — | | | (8,940) | |

| Non-GAAP net income | $ | 163,202 | | | $ | 126,744 | | | $ | 595,310 | | | $ | 500,049 | |

| | | | | | | |

| GAAP diluted earnings per share | $ | 5.44 | | | $ | 4.01 | | | $ | 20.45 | | | $ | 16.93 | |

| Amortization of intangible assets | — | | | 0.01 | | | 0.04 | | | 0.04 | |

| Gain on product line asset sale | — | | | — | | | — | | | (0.08) | |

| Share-based compensation expense | 1.60 | | | 1.35 | | | 5.96 | | | 4.88 | |

| Income tax adjustments | (0.41) | | | (0.35) | | | (1.52) | | | (1.21) | |

| Excess tax benefit | (0.10) | | | (0.03) | | | (1.19) | | | (0.50) | |

| Adjustment to tax reserves and valuation allowance | — | | | 0.02 | | | — | | | (0.35) | |

| Non-GAAP diluted earnings per share | $ | 6.54 | | | $ | 5.01 | | | $ | 23.74 | | | $ | 19.71 | |

| | | | | | | |

| Free cash flow | | | | | | | |

| Net cash provided by operating activities | $ | 226,478 | | | $ | 164,049 | | | $ | 632,964 | | | $ | 468,915 | |

| Capital expenditures | (7,123) | | | (1,068) | | | (25,551) | | | (4,237) | |

| Free cash flow | $ | 219,355 | | | $ | 162,981 | | | $ | 607,413 | | | $ | 464,678 | |

Note: The numbers may not sum to total due to rounding.

About Non-GAAP Financial Measures

To supplement the consolidated GAAP financial statements, the company uses the following non-GAAP financial measures: non-GAAP net income, non-GAAP EPS, and free cash flow. Non-GAAP net income and non-GAAP EPS exclude, to the extent applicable, such items as the impact of amortization expense, share-based compensation expense, restructuring and acquisition-related, excess tax benefit, and adjustment to tax valuation allowance items. Free cash flow excludes capital expenditures. The presentation of these financial measures is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

Management uses these non-GAAP financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons. Our management believes these non-GAAP financial measures provide meaningful supplemental information regarding our performance and liquidity by excluding certain items that may not be indicative of recurring business results including significant non-cash expenses. We believe management and investors benefit from referring to these non-GAAP financial measures in assessing our performance when planning, forecasting and analyzing future periods. These non-GAAP financial measures also facilitate management’s internal comparisons to historical performance and liquidity as well as comparisons to our competitors’ operating results. We believe these non-GAAP financial measures are useful to investors because they allow for greater transparency with respect to key measures used by management in its financial and operating decision-making.

FAIR ISAAC CORPORATION

RECONCILIATION OF NON-GAAP GUIDANCE

(Unaudited)

| | | | | | | | | | |

| | | | | Fiscal 2025 Guidance |

| | | | | (In millions, except per share data) |

| | | | | |

| GAAP net income | | | | $ | 624 | |

| Share-based compensation expense | | | | 157 | |

| Income tax adjustments | | | | (39) | |

| Excess tax benefit | | | | (30) | |

| Non-GAAP net income | | | | $ | 712 | |

| | | | |

| GAAP diluted earnings per share | | | | $ | 25.05 | |

| Share-based compensation expense | | | | 6.31 | |

| Income tax adjustments | | | | (1.58) | |

| Excess tax benefit | | | | (1.20) | |

| Non-GAAP diluted earnings per share | | | | $ | 28.58 | |

Note: The numbers may not sum to total due to rounding.

About Non-GAAP Financial Measures

To supplement the consolidated GAAP financial statements, the company uses the following non-GAAP financial measures: non-GAAP net income, non-GAAP EPS, and free cash flow. Non-GAAP net income and non-GAAP EPS exclude, to the extent applicable, such items as the impact of amortization expense, share-based compensation expense, restructuring and acquisition-related, excess tax benefit, and adjustment to tax valuation allowance items. Free cash flow excludes capital expenditures. The presentation of these financial measures is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

Management uses these non-GAAP financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons. Our management believes these non-GAAP financial measures provide meaningful supplemental information regarding our performance and liquidity by excluding certain items that may not be indicative of recurring business results including significant non-cash expenses. We believe management and investors benefit from referring to these non-GAAP financial measures in assessing our performance when planning, forecasting and analyzing future periods. These non-GAAP financial measures also facilitate management’s internal comparisons to historical performance and liquidity as well as comparisons to our competitors’ operating results. We believe these non-GAAP financial measures are useful to investors because they allow for greater transparency with respect to key measures used by management in its financial and operating decision-making.

Contacts

Investors/Analysts:

Dave Singleton

Fair Isaac Corporation

(800) 459-7125

investor@fico.com

v3.24.3

Cover

|

Nov. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 06, 2024

|

| Entity Registrant Name |

FAIR ISAAC CORP

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-11689

|

| Entity Tax Identification Number |

94-1499887

|

| Entity Address, Address Line One |

5 West Mendenhall, Suite 105

|

| Entity Address, City or Town |

Bozeman,

|

| Entity Address, State or Province |

MT

|

| Entity Address, Postal Zip Code |

59715

|

| City Area Code |

406

|

| Local Phone Number |

982-7276

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

FICO

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000814547

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

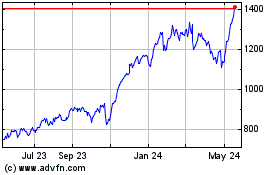

Fair Isaac (NYSE:FICO)

Historical Stock Chart

From Oct 2024 to Nov 2024

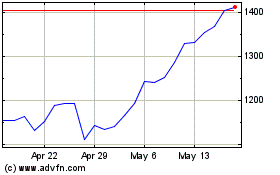

Fair Isaac (NYSE:FICO)

Historical Stock Chart

From Nov 2023 to Nov 2024