UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2023

Commision File Number 005-81586

FOMENTO ECONÓMICO MEXICANO, S.A.B. DE

C.V.

(Exact name of Registrant as specified in its charter)

Mexican Economic Development, Inc.

(Translation of Registrant’s name into English)

General Anaya No. 601 Pte.

Colonia Bella Vista

Monterrey, Nuevo León 64410

México

(Address of principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

CONTENTS

Exhibit 99.1. Press release from Fomento Económico Mexicano, S.A.B. de C.V. (FEMSA), dated October 31, 2023, regarding commencement of tender offer.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the

registrant has duly caused this report to be signed

on its behalf of the

undersigned, thereunto duly authorized.

| |

FOMENTO ECONÓMICO MEXICANO, S.A.B. DE C.V. |

| |

|

| |

|

By: |

/s/ Eugenio Garza y Garza |

| |

Eugenio Garza y Garza |

| |

Director of Finance and Corporate Development |

Date: October 31, 2023

Exhibit 99.1

FEMSA ANNOUNCEs

commencement of CASH TENDER OFFER

FOR its outstanding NOTES due 2043

OCTOBER 31,

2023

MONTERREY, MEXICO – FOMENTO ECONÓMICO

MEXICANO, S.A.B. DE C.V. (“FEMSA”) (NYSE: FMX; BMV: FEMSAUBD, FEMSAUB) announces that it has commenced an offer (the

“Tender Offer”) to purchase for cash any and all of its outstanding US$552,830,000 principal amount of 4.375% Senior

Notes due 2043 (CUSIP/ISIN: 344419 AB2 / US344419AB20) (the “Securities”) on the terms and subject to the conditions

set forth in the offer to purchase, dated October 31, 2023 (the “Offer to Purchase”) and the related notice of guaranteed

delivery (the “Notice of Guaranteed Delivery” and, together with the Offer to Purchase, the “Offer Documents”).

The following table sets forth the Securities subject

to the Tender Offer:

| Securities | |

CUSIP / ISIN | |

Principal

Amount

Outstanding | | |

Reference

Security | |

Bloomberg

Reference

Page | |

Fixed Spread

(basis

points)(1) | |

Hypothetical

Offer

Consideration(2) | |

| 4.375% Senior Notes due 2043 | |

344419 AB2 / US344419AB20 | |

US$ | 552,830,000 | | |

4.375% U.S. Treasury Note due 2043 | |

PX1 | |

+20 | |

US$ | 871.32 | |

| (1) | The consideration payable per each US$1,000 principal amount of Securities validly tendered (and not validly withdrawn) and accepted

for purchase will be calculated in accordance with the formula set forth in Schedule I to the Offer to Purchase, based on

the fixed spread specified in the table above (the “Fixed Spread”), plus the yield of the reference security

set forth in the table above in the column under the heading “Reference Security” (the “Reference Security”)

as determined from the Bloomberg Reference Page specified in the table above as of 11:00 a.m. (New York City time), on November 6, 2023,

unless extended (such date and time, as the same may be extended, the “Price Determination Date”). |

| (2) | Per US$1,000 principal amount of Securities validly tendered (and not validly withdrawn) and accepted for purchase. The hypothetical

offer consideration provided in the above table is for illustrative purposes only and was calculated based on the yield of the Securities

through their maturity date and has been determined as of 11:00 a.m. (New York City time), on October 30, 2023, in accordance with the

formula set forth in Schedule I to the Offer to Purchase. FEMSA makes no representation with respect to the actual Offer Consideration

(as defined below) payable in connection with the Tender Offer, and such amounts may be greater or less than those shown in the above

table depending on the yield of the Reference Security on the Price Determination Date. |

The Tender Offer will expire at 5:00 p.m. (New York City time) on November

6, 2023, unless extended (such date and time, as the same may be extended, the “Expiration Date”). Securities validly

tendered may be withdrawn at any time at or prior to 5:00 p.m. (New York City time) on November 6, 2023, unless extended, but not thereafter.

The settlement date of the Tender Offer will be promptly following the Expiration Date, expected to be no later than three business days

following the Expiration Date, or November 9, 2023, unless extended (such date, as the same may be extended, the “Settlement

Date”).

Holders of Securities who (i) validly tender and do not validly withdraw

their Securities, in each case, on or prior to the Expiration Date or (ii) deliver a properly completed and duly executed Notice of Guaranteed

Delivery on or prior to the Expiration Date and follow the guaranteed delivery procedures described in the Offer to Purchase and tender

their Securities at or prior to 5:00 p.m. (New York City time) on the second business day after the Expiration Date, which is expected

to be November 8, 2023, will be eligible to receive, per US$1,000 principle amount of Securities validly tendered (and not validly withdrawn)

and accepted for purchase, the price (calculated as described in Schedule I to the Offer to Purchase) (the “Offer Consideration”)

that would reflect:

(1)

the present value on the Settlement Date of (x) US$1,000, representing the principal amount payable on the scheduled maturity date

of the Securities and (y) all scheduled interest payments from the Settlement Date up to and including the scheduled maturity date of

the Securities, in each case, discounted on the basis of a yield equal to the sum of (a) the reference yield to maturity of the Reference

Security, as calculated by the Dealer Manager (as defined below) in accordance with standard market practice, determined by reference

to the bid-side price of the Reference Security at 11:00 a.m. (New York City time), on the Price Determination Date, as displayed on the

Bloomberg Reference Page specified in the table above in the column under the heading “Bloomberg Reference Page” or any recognized

quotation source selected by the Dealer Manager in its sole discretion if such Bloomberg Reference Page is not available or is manifestly

erroneous, plus (b) the Fixed Spread, minus

(2)

Accrued Interest (as defined below) from and including the last interest payment date to, but not including, the Settlement Date,

such price being rounded to the nearest US$0.01 per US$1,000 principal

amount of the Securities.

In addition to the Offer Consideration, holders whose Securities are

validly tendered (and not validly withdrawn) and accepted for purchase in the Tender Offer, will receive accrued and unpaid interest in

respect of such purchased Securities (the “Accrued Interest”) from and including the last interest payment date to,

but not including, the Settlement Date. The Offer Consideration and the Accrued Interest will be payable in cash in US Dollars, on the

Settlement Date. Interest will cease to accrue on the Settlement Date for all Securities purchased in the Tender Offer, including those

tendered through the guaranteed delivery procedures described in the Offer to Purchase.

FEMSA’s obligation to accept Securities tendered in the Tender

Offer is subject to the satisfaction of certain customary conditions, including that FEMSA will not be obligated to consummate the Tender

Offer upon the occurrence of an event or events or the likely occurrence of an event or events that would or might reasonably be expected

to prohibit, restrict or delay the consummation of the Tender Offer. These conditions may be waived by FEMSA, in whole or in part, at

any time and from time to time, in its sole discretion, subject to applicable law. The Tender Offer is not contingent upon the tender

of any minimum principal amount of Securities.

Subject to applicable law, the Tender Offer may be amended, extended

or, upon failure of a condition to be satisfied or waived prior to the Expiration Date, terminated. If FEMSA terminates the Tender Offer,

it will give prompt notice to the tender agent for the Tender Offer and all Securities tendered will be returned promptly to the tendering

holders thereof. With effect from such termination, any Securities blocked in DTC will be released.

Holders are advised to check with any bank, securities broker or other

intermediary through which they hold Securities as to when such intermediary would need to receive instructions from such holder in order

for that holder to be able to participate in, or withdraw their instruction to participate in, a Tender Offer, before the deadlines specified

herein and in the Offer Documents. The deadlines set by any such intermediary and DTC for the submission and withdrawal of tender instructions

will also be earlier than the relevant deadlines specified herein and in the Offer Documents.

FEMSA has retained BofA Securities, Inc. to act as dealer manager in

connection with the Tender Offer (the “Dealer Manager”). Global Bondholder Services Corporation will act as the tender

agent and information agent for the Tender Offer.

Any questions or requests for assistance regarding the Tender Offer

may be directed to BofA Securities, Inc. at (888) 292-0070 (toll-free) or (646) 855-8988 (collect). Requests for additional copies of

the Offer Documents may be directed to Global Bondholder Services Corporation at +1 (855) 654-2014 (toll-free) or +1 (212) 430-3774 (collect).

The Offer Documents can be accessed at the following link: https://www.gbsc-usa.com/femsa/.

* * *

This press release is for informational purposes only. This press release

shall not constitute an offer to purchase or the solicitation of an offer to sell any securities, nor shall there be any offer, solicitation

or sale of any securities in any state or other jurisdiction in which such an offer, solicitation or sale would be unlawful.

The Tender Offer is being made solely pursuant to the Offer Documents.

The Offer Documents have not been filed with, and have not been approved or reviewed by any federal or state securities commission or

regulatory authority of any country. No authority has passed upon the accuracy or adequacy of the Offer Documents or any other documents

related to the Tender Offer, and it is unlawful and may be a criminal offense to make any representation to the contrary. The Tender Offer

is not being made to holders of Securities in any jurisdiction in which the making or acceptance thereof would not be in compliance with

the securities, blue sky or other laws of such jurisdiction. In any jurisdiction in which the securities laws or blue sky laws require

the Tender Offer to be made by a licensed broker or dealer, the Tender Offer will be deemed to be made on behalf of FEMSA by the Dealer

Manager or one or more registered brokers or dealers that are licensed under the laws of such jurisdiction.

FEMSA Forward Announcement

The Tender Offer described above forms an integral part of the series

of strategic initiatives announced by FEMSA on February 15, 2023, as a result of a thorough strategic review of its business platform,

including the bottom-up definition of long-range plans for each business unit, as well as the top-down analysis of FEMSA’s corporate

and capital structure. That announcement is available at: https://www.globenewswire.com/news release/2023/02/15/2609255/0/en/FEMSA-Forward-Announcing-results-of-strategic-review.html.

That announcement does not form part of this communication.

About FEMSA

FEMSA is a company that creates economic and social

value through companies and institutions and strives to be the best employer and neighbor to the communities in which it operates. It

participates in the retail industry through a Proximity Americas Division operating, among others, OXXO, a small-format store chain, and

other related retail formats, and Proximity Europe which includes Valora, its European retail unit which operates convenience and foodvenience

formats. In the retail industry, it also participates through a Health Division, which includes drugstores and related activities and

Digital@FEMSA, which includes Spin by OXXO and Spin Premia, among other digital financial services initiatives. In the beverage industry,

it participates through Coca-Cola FEMSA, the largest franchise bottler of Coca-Cola products in the world by volume. FEMSA also participates

in the logistics and distribution industry through its Strategic Business Unit, which additionally provides point-of-sale refrigeration

and plastic solutions to its business units and third-party clients. Across its business units, FEMSA has more than 350,000 employees

in 18 countries. FEMSA is a member of the Dow Jones Sustainability MILA Pacific Alliance, the FTSE4Good Emerging Index and the Mexican

Stock Exchange Sustainability Index: S&P/BMV Total México ESG, among other indexes that evaluate its sustainability performance.

Forward-Looking Statements

This press release contains forward-looking statements. Forward-looking

statements are information of a non-historical nature or which relate to future events and are subject to risks and uncertainties. No

assurance can be given that the transactions described herein will be consummated or as to the ultimate terms of any such transactions.

FEMSA undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or

future events or for any other reason.

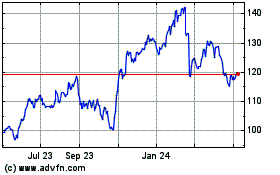

Fomento Economico Mexica... (NYSE:FMX)

Historical Stock Chart

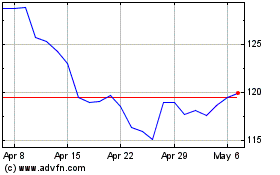

From Oct 2024 to Nov 2024

Fomento Economico Mexica... (NYSE:FMX)

Historical Stock Chart

From Nov 2023 to Nov 2024