0000928054FALSE00009280542025-03-102025-03-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

March 10, 2025

Date of Report (Date of earliest event reported)

Flotek Industries, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-13270 | 90-0023731 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

5775 N. Sam Houston Parkway W., Suite 400 Houston, TX, 77086

(Address of principal executive office and zip code)

(713) 849-9911

(Registrant’s telephone number, including area code)

(Not applicable)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of Exchange on which registered |

| Common Stock, $0.0001 par value | FTK | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

Item 2.02 | Results of Operations and Financial Condition |

On March 10, 2025, Flotek Industries, Inc. (the "Company") issued a press release providing its financial results for the quarter and year-ended December 31, 2024 and announcing that it will hold a conference call to discuss its financial and operating results. The press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished pursuant to Item 2.02 of this Current Report on Form 8-K and in Exhibit 99.1 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is not subject to the liabilities of that section and is not deemed incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except as otherwise expressly stated in such filing.

| | | | | |

Item 7.01 | Regulation FD Disclosure |

On March 10, 2025, the Company provided on its website a presentation containing information relating to its current operations and financial results. A copy of the presentation is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

The information furnished pursuant to Item 7.01 of this Current Report on 8-K and in Exhibit 99.2 shall not be deemed to be “filed” for the purposes of the Exchange Act, is not subject to the liabilities of that section and is not deemed incorporated by reference into any filing of the Company under the Securities Act, or the Exchange Act, except as otherwise expressly stated in such filing.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

d) Exhibits.

| | | | | | | | |

| | |

Exhibit Number | | Description |

| |

| 99.1 | | |

| |

| 99.2 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| FLOTEK INDUSTRIES, INC. |

Date: March 10, 2025 | /s/ Bond Clement |

| Name: | Bond Clement |

| Title: | Chief Financial Officer |

Exhibit 99.1

Flotek Surpasses 2024 Annual Guidance with Strong Fourth Quarter and Full-Year Results

HOUSTON, March 10, 2025 - Flotek Industries, Inc. (“Flotek” or the “Company”) (NYSE: FTK) today announced operational and financial results for the fourth quarter and full-year ended December 31, 2024. Fourth quarter 2024 results were the strongest quarterly results of 2024 in terms of revenue, gross profit, net income and adjusted EBITDA (1).

Financial Summary (in thousands, except ‘per share’ amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Total Revenues | $ | 50,758 | | | $ | 42,188 | | | $ | 187,025 | | | $ | 188,058 | |

| Gross Profit | $ | 12,277 | | | $ | 9,430 | | | $ | 39,386 | | | $ | 24,263 | |

| Net Income | $ | 4,429 | | | $ | 2,104 | | | $ | 10,498 | | | $ | 24,713 | |

| Diluted Income (Loss) Per Share | $ | 0.14 | | | $ | 0.07 | | | $ | 0.34 | | | $ | (0.10) | |

Adjusted EBITDA (1) | $ | 7,023 | | | $ | 3,952 | | | $ | 20,327 | | | $ | 1,488 | |

Full-Year and Fourth Quarter 2024 Highlights

•Q4 2024 total revenue rose 20% vs. Q4 2023, led by a 21% jump in external customer revenue—the highest in 5 years.

•Data analytics service revenue grew 124% vs. Q4 2023 and 44% vs. full year 2023.

•Gross profit climbed 30% vs. Q4 2023 and 62% vs. full year 2023, with Q4 2024 gross margin rising to 24%.

•Q4 2024 net income was $4.4 million and adjusted EBITDA(1) $7.0 million, up 111% and 78% respectively vs Q4 2023.

•2024 net income hit $10.5 million or $0.34/share, vs. a loss of $(0.10)/share in 2023.

•2024 adjusted EBITDA(1) reached $20.3 million, up $18.8 million from 2023—the highest since 2017—exceeding guidance of $18.5 million by 10%.

Management Commentary

Chief Executive Officer Dr. Ryan Ezell commented, “2024 marks a significant step in the execution of our corporate strategy towards the convergence between innovative Data and Chemistry solutions that deliver outstanding value to our customers and external stakeholders. This year, we not only achieved the highest profitability metrics in nearly a decade but did so through superior operational efficiency and service quality execution. Additionally, our commitment to safety has shone through, with no lost-time incidents recorded in the past three years.

We’ve expanded our technology portfolio with the introduction of three cutting-edge Data Analytics solutions: VeraCal, JP3 Raman, and XSPCT, systems specifically designed to address the unique challenges of the energy and infrastructure sector while driving high-margin growth into 2025 and beyond. In the fourth quarter, we observed a significant

transformation in our Data Analytics revenue resulting in a 67% sequential increase in service revenue furthering the shift from products to services.

Looking ahead, we expect that the integration of Data and Chemistry at Flotek will provide exciting new innovations in the energy and infrastructure market. These advancements are set to empower our customers' assets to maximize returns, reduce costs, automate processes, and leverage data in ways previously unimaginable. We believe that our relentless pursuit to leverage chemistry as the common value creation platform will position Flotek as a leader in differentiated technologies and foster our future growth.”

Fourth Quarter and Full-Year 2024 Financial Results

•Revenue: Flotek reported total revenues of $50.8 million for fourth quarter 2024, an increase of $8.6 million, or 20%, compared to total revenues of $42.2 million for fourth quarter 2023. Full-year 2024 total revenues totaled $187.0 million, as compared to total revenues of $188.1 million during 2023. Fourth quarter and full year 2024 revenues include $8.6 million and $32.4 million, respectively, related to the minimum purchase requirements under the Company’s long-term supply agreement with ProFrac Services, LLC.

Segment Revenue Summary (in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, | |

| | 2024 | | 2023 | | 2024 | | 2023 | | | |

| | | | | | | | | | |

| Chemistry Technologies: | | | | | | | | | | |

| External Revenues | $ | 21,071 | | | $ | 17,996 | | | $ | 63,214 | | | $ | 59,016 | | | | |

| Related Party Revenues | 27,215 | | | 22,769 | | | 114,947 | | | 120,903 | | | | |

| Total | $ | 48,286 | | | $ | 40,765 | | | $ | 178,161 | | | $ | 179,919 | | | | |

| | | | | | | | | | |

| Data Analytics: | | | | | | | | | | |

| Product Revenues | $ | 826 | | | $ | 688 | | | $ | 4,745 | | | $ | 5,277 | | | | |

| Service Revenues | 1,646 | | | 735 | | | 4,119 | | | 2,862 | | | | |

| Total | $ | 2,472 | | | $ | 1,423 | | | $ | 8,864 | | | $ | 8,139 | | | | |

•Gross Profit: The Company generated gross profit of $12.3 million during fourth quarter 2024 compared to a gross profit of $9.4 million during fourth quarter 2023. The improvement in fourth quarter 2024 gross profit was primarily the result of successful initiatives throughout 2024 to drive cost reductions with respect to freight, logistics and materials combined with an 18% increase in chemistry revenue and a 74% increase in data analytics revenue, as compared to fourth quarter 2023.

The Company generated gross profit of $39.4 million for full-year 2024 compared to gross profit of $24.3 million for full-year 2023.

•Selling, General and Administrative (“SG&A”) Expense: SG&A expense totaled $6.6 million for the fourth quarters of 2024 and 2023. SG&A expense totaled $24.7 million for full-year 2024 compared to $27.8 million for full-year 2023, an 11% reduction year-over-year. Excluding non-cash stock compensation expense, 2024 SG&A expense is 17% lower than 2023.

•Net Income (Loss) and EPS: Flotek reported net income of $4.4 million, or $0.14 per diluted share, for the fourth quarter 2024. This compares to net income of $2.1 million, or $0.07 per diluted share, for the fourth quarter 2023. Net income for full-year 2024 was $10.5 million, or $0.34 per diluted share, compared to net income (loss) of $24.7 million, or ($0.10) per diluted share, for the comparable period of 2023. Net income for full-year 2023 included non-cash gains related to the fair value measurement of convertible notes payable and a PPP loan forgiveness totaling $34.5 million.

•Adjusted EBITDA (Non-GAAP)(1): Adjusted EBITDA(1) was $7.0 million in fourth quarter 2024 as compared to $4.0 million in fourth quarter 2023. Adjusted EBITDA(1) was $20.3 million for full-year 2024 compared to $1.5 million for full-year 2023.

(1)See the “Unaudited Reconciliation of Non-GAAP Items and Non-Cash Items Impacting Earnings” section in this release for more information, including reconciliations to the most comparable GAAP measures.

2025 Guidance

Consistent with 2024 and 2023, Flotek plans to issue 2025 guidance in conjunction with the release of its first quarter 2025 financial and operating results.

Upcoming Investor Event

Flotek will participate in the 37th Annual Roth Conference to be held at the Marriott in Laguna Dana Point, California, March 17-18, 2025. Flotek Chief Executive Officer, Ryan Ezell, will participate in an industry panel discussion on March 17 at 10:00 a.m. PT and will be joined by Chief Financial Officer, Bond Clement, in hosting one-on-one meetings during the event. An updated corporate presentation to be used in discussions at the conference will be posted to the Investor Relations section of Flotek’s corporate website at www.flotekind.com prior to the start of the conference.

Conference Call Details

Flotek will host a conference call on March 11, 2025, at 9:00 a.m. CT (10:00 a.m. ET) to discuss its fourth quarter and full-year 2024 results. Participants may access the call through Flotek’s website at www.flotekind.com under “News” within the Investor Relations section, by telephone toll free at 1-800-836-8184 (international toll: 1-646-357-8785), or by using the following link to access the audience view of the webcast at https://app.webinar.net/qDjWg9qga1Y approximately five minutes prior to the start of the call. Following the conclusion of the conference call, a recording of the call will be available on the Company’s website.

An updated corporate presentation that will be referenced on the call will be posted to the Investor Relations section of Flotek’s website at www.flotekind.com prior to the start of the earnings conference call.

About Flotek Industries, Inc.

Flotek Industries, Inc. is a leading chemistry and data technology company focused on servicing the Energy industry. The Company’s top tier technologies leverage near real-time data to deliver innovative solutions to maximize customer returns. Flotek has an intellectual property portfolio of over 130 patents, 20+ years of field and laboratory data, and a global presence in more than 59 countries.

Flotek has established collaborative partnerships focused on sustainable and optimized chemistry and data solutions, aiming to reduce the environmental impact of energy on land, air, water and people.

Flotek is based in Houston, Texas and its common shares are traded on the New York Stock Exchange under the ticker symbol “FTK.” For additional information, please visit www.flotekind.com.

Forward-Looking Statements

Certain statements set forth in this press release constitute forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934) regarding Flotek Industries, Inc.’s business, financial condition, results of operations and prospects. Words such as will, continue, expects, anticipates, intends, plans, believes, seeks, estimates and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this press release. Although forward-looking statements in this press release reflect the good faith judgment of management, such statements can only be based on facts and factors currently known to management. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. Further information about the risks and uncertainties that may impact the Company are set forth in the Company’s most recent filing with the Securities and Exchange Commission on Form 10-K (including, without limitation, in the “Risk Factors” section thereof), and in the Company’s other SEC filings and publicly available documents. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company undertakes no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this press release.

Investor contact:

Mike Critelli

Director of Finance & Investor Relations

E: ir@flotekind.com

FLOTEK INDUSTRIES, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

| | | | | | | | | | | |

| December 31, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 4,404 | | | $ | 5,851 | |

| Restricted cash | 102 | | | 102 | |

Accounts receivable, net of allowance for credit losses of $447 and $745 at December 31, 2024 and December 31, 2023, respectively | 17,386 | | | 13,687 | |

Accounts receivable, related party, net of allowance for credit losses of $0 at each of December 31, 2024 and December 31, 2023, respectively | 52,370 | | | 34,569 | |

| Inventories, net | 13,303 | | | 12,838 | |

| | | |

| | | |

| Other current assets | 2,952 | | | 3,564 | |

| Current contract asset | 5,939 | | | 5,836 | |

| Total current assets | 96,456 | | | 76,447 | |

| Long-term contract asset | 63,105 | | | 68,820 | |

| Property and equipment, net | 6,178 | | | 5,129 | |

| Operating lease right-of-use assets | 3,326 | | | 5,030 | |

| Deferred tax assets, net | 51 | | | 300 | |

| Other long-term assets | 1,680 | | | 1,787 | |

| TOTAL ASSETS | $ | 170,796 | | | $ | 157,513 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 38,073 | | | $ | 31,705 | |

| Accrued liabilities | 5,912 | | | 5,890 | |

| Income taxes payable | 48 | | | 45 | |

| | | |

| Current portion of operating lease liabilities | 1,486 | | | 2,449 | |

| Current portion of finance lease liabilities | — | | | 22 | |

| Asset-based loan | 4,789 | | | 7,492 | |

| Current portion of long-term debt | 60 | | | 179 | |

| | | |

| | | |

| Total current liabilities | 50,368 | | | 47,782 | |

| Deferred revenue, long-term | 14 | | | 35 | |

| Long-term operating lease liabilities | 6,514 | | | 7,676 | |

| | | |

| Long-term debt | — | | | 60 | |

| | | |

| TOTAL LIABILITIES | 56,896 | | | 55,553 | |

| Commitments and contingencies | | | |

| Stockholders’ equity: | | | |

| Preferred stock, $0.0001 par value, 100,000 shares authorized; no shares issued and outstanding | — | | | — | |

Common stock, $0.0001 par value, 240,000,000 shares authorized; 30,938,073 shares issued and 29,826,508 shares outstanding at December 31, 2024; 30,772,837 shares issued and 29,664,130 shares outstanding at December 31, 2023 | 3 | | | 3 | |

| Additional paid-in capital | 464,620 | | | 463,140 | |

| Accumulated other comprehensive income | 251 | | | 127 | |

| Accumulated deficit | (316,308) | | | (326,806) | |

Treasury stock, at cost; 1,111,565 and 1,108,707 shares at December 31, 2024 and December 31, 2023, respectively | (34,666) | | | (34,504) | |

| Total stockholders’ equity | 113,900 | | | 101,960 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 170,796 | | | $ | 157,513 | |

FLOTEK INDUSTRIES, INC.

Unaudited Condensed Consolidated Statements of Operations

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, | | |

| | 2024 | | 2023 | | 2024 | | 2023 | | | | |

| Revenue: | | | | | | | | | | | |

| Revenue from external customers | $ | 23,328 | | | $ | 19,239 | | | $ | 71,263 | | | $ | 66,518 | | | | | |

| Revenue from related party | 27,430 | | | 22,949 | | | 115,762 | | | 121,540 | | | | | |

| Total revenues | 50,758 | | | 42,188 | | | 187,025 | | | 188,058 | | | | | |

| Cost of goods sold | 38,481 | | | 32,758 | | | 147,639 | | | 163,795 | | | | | |

| Gross profit | 12,277 | | | 9,430 | | | 39,386 | | | 24,263 | | | | | |

| Operating costs and expenses: | | | | | | | | | | | |

| Selling, general, and administrative | 6,630 | | | 6,552 | | | 24,709 | | | 27,827 | | | | | |

| Depreciation | 229 | | | 204 | | | 891 | | | 734 | | | | | |

| Research and development | 365 | | | 255 | | | 1,714 | | | 2,486 | | | | | |

| Gain on sale of property and equipment | (90) | | | — | | | (124) | | | (38) | | | | | |

| | | | | | | | | | | |

| Gain in fair value of Contract Consideration Convertible Notes Payable | — | | | — | | | — | | | (29,969) | | | | | |

| | | | | | | | | | | |

| Total operating costs and expenses | 7,134 | | | 7,011 | | | 27,190 | | | 1,040 | | | | | |

| Income from operations | 5,143 | | | 2,419 | | | 12,196 | | | 23,223 | | | | | |

| Other income (expense): | | | | | | | | | | | |

| Paycheck protection plan loan forgiveness | — | | | — | | | — | | | 4,522 | | | | | |

| Interest expense | (253) | | | (320) | | | (1,095) | | | (2,857) | | | | | |

| Other income (expense), net | (105) | | | 56 | | | 46 | | | (26) | | | | | |

| Total other (expense) income | (358) | | | (264) | | | (1,049) | | | 1,639 | | | | | |

| Income before income taxes | 4,785 | | | 2,155 | | | 11,147 | | | 24,862 | | | | | |

| Income tax expense | (356) | | | (51) | | | (649) | | | (149) | | | | | |

| Net income | $ | 4,429 | | | $ | 2,104 | | | $ | 10,498 | | | $ | 24,713 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Income (loss) per common share: | | | | | | | | | | |

| Basic | $ | 0.15 | | | $ | 0.07 | | | $ | 0.36 | | | $ | 1.00 | | | | | |

| Diluted | $ | 0.14 | | | $ | 0.07 | | | $ | 0.34 | | | $ | (0.10) | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Weighted average common shares: | | | | | | | | | | | |

| Weighted average common shares used in computing basic income (loss) per common share | 29,642 | | | 29,396 | | | 29,534 | | | 24,830 | | | | | |

| Weighted average common shares used in computing diluted income (loss) per common share | 31,436 | | | 30,496 | | | 30,889 | | | 28,377 | | | | | |

FLOTEK INDUSTRIES, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

| | | | | | | | | | | |

| | Twelve Months Ended

December 31, |

| | 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 10,498 | | | $ | 24,713 | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | | | |

| Change in fair value of contingent consideration | 71 | | | (527) | |

| Change in fair value of Contract Consideration Convertible Notes Payable | — | | | (29,969) | |

| Amortization of convertible note issuance costs | — | | | 83 | |

| Payment-in-kind interest expense | — | | | 2,284 | |

| Amortization of contract asset | 5,612 | | | 5,033 | |

| Depreciation | 891 | | | 734 | |

| Amortization of asset-based loan origination costs | 314 | | | 121 | |

| Provision for credit losses, net of recoveries | 181 | | | 138 | |

| Provision for excess and obsolete inventory | 645 | | | 959 | |

| Gain on sale of property and equipment | (124) | | | (38) | |

| | | |

| Non-cash lease expense | 2,094 | | | 3,014 | |

| Stock compensation expense | 1,366 | | | (254) | |

| Deferred income tax expense | 249 | | | 104 | |

| Paycheck protection plan loan forgiveness | — | | | (4,522) | |

| Changes in current assets and liabilities: | | | |

| Accounts receivable | (3,880) | | | 5,311 | |

| Accounts receivable, related party | (17,801) | | | (11,886) | |

| Inventories | (1,110) | | | 1,938 | |

| Income taxes receivable | 8 | | | — | |

| Other assets | 561 | | | (836) | |

| | | |

| Accounts payable | 6,368 | | | (1,670) | |

| Accrued liabilities | (70) | | | (2,575) | |

| Operating lease liabilities | (2,515) | | | (3,391) | |

| Income taxes payable | 3 | | | (53) | |

| Interest payable | — | | | (8) | |

| Net cash provided by (used in) operating activities | 3,361 | | | (11,297) | |

FLOTEK INDUSTRIES, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(continued)

| | | | | | | | | | | |

| Twelve Months Ended

December 31, |

| 2024 | | 2023 |

| Cash flows from investing activities: | | | |

| Capital expenditures | (1,940) | | | (1,081) | |

| Proceeds from sale of assets | 124 | | | 67 | |

| Net cash used in investing activities | (1,816) | | | (1,014) | |

| Cash flows from financing activities: | | | |

| Payment for forfeited stock options | — | | | (617) | |

| Payments on long term debt | (179) | | | (149) | |

| Proceeds from asset-based loan | 166,950 | | | 68,716 | |

| Payments on asset-based loan | (169,653) | | | (61,224) | |

| Payment of asset-based loan origination costs | (164) | | | (574) | |

| Payments to tax authorities for shares withheld from employees | (162) | | | (268) | |

| Proceeds from issuance of stock under Employee Stock Purchase Plan | 114 | | | 77 | |

| Payments for finance leases | (22) | | | (33) | |

| Net cash (used in) provided by financing activities | (3,116) | | | 5,928 | |

| Effect of changes in exchange rates on cash and cash equivalents | 124 | | | (54) | |

| Net change in cash and cash equivalents and restricted cash | (1,447) | | | (6,437) | |

| Cash and cash equivalents at the beginning of period | 5,851 | | | 12,290 | |

| Restricted cash at the beginning of period | 102 | | | 100 | |

| Cash and cash equivalents and restricted cash at beginning of period | 5,953 | | | 12,390 | |

| Cash and cash equivalents at end of period | 4,404 | | | 5,851 | |

| Restricted cash at the end of period | 102 | | | 102 | |

| Cash and cash equivalents and restricted cash at end of period | $ | 4,506 | | | $ | 5,953 | |

FLOTEK INDUSTRIES, INC.

Unaudited Reconciliation of Non-GAAP Items and Non-Cash Items Impacting Earnings

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, | |

| | 2024 | | 2023 | | 2024 | | 2023 | | | |

| | | | | | | | | | |

| Gross profit | $ | 12,277 | | | $ | 9,430 | | | $ | 39,386 | | | $ | 24,263 | | | | |

| Stock compensation expense | 15 | | | 3 | | | 24 | | | (132) | | | | |

| Severance and retirement | 2 | | | 3 | | | 11 | | | 29 | | | | |

| Contingent liability revaluation | 117 | | | (143) | | | 71 | | | (527) | | | | |

| Amortization of contract asset | 1,271 | | | 1,368 | | | 5,612 | | | 5,033 | | | | |

Adjusted Gross profit (Non-GAAP) (1) | $ | 13,682 | | | $ | 10,661 | | | $ | 45,104 | | | $ | 28,666 | | | | |

| | | | | | | | | | |

| Net income | $ | 4,429 | | | $ | 2,104 | | | $ | 10,498 | | | $ | 24,713 | | | | |

| Interest expense | 253 | | | 320 | | | 1,095 | | | 2,857 | | | | |

| Income tax expense | 356 | | | 51 | | | 649 | | | 149 | | | | |

| Depreciation and amortization | 229 | | | 204 | | | 891 | | | 734 | | | | |

EBITDA (Non-GAAP) (1) | $ | 5,267 | | | $ | 2,679 | | | $ | 13,133 | | | $ | 28,453 | | | | |

| Stock compensation expense | 451 | | | 307 | | | 1,366 | | | (268) | | | | |

| Severance and retirement | 7 | | | 10 | | | 39 | | | (17) | | | | |

| Contingent liability revaluation | 117 | | | (143) | | | 71 | | | (527) | | | | |

| Gain on disposal of assets | (90) | | | — | | | (124) | | | (38) | | | | |

| PPP loan forgiveness | — | | | — | | | — | | | (4,522) | | | | |

| Contract Consideration Convertible Notes Payable revaluation adjustment | — | | | — | | | — | | | (29,969) | | | | |

| Amortization of contract asset | 1,271 | | | 1,368 | | | 5,612 | | | 5,033 | | | | |

| Non-Recurring professional fees | — | | | (269) | | | 230 | | | 3,343 | | | | |

Adjusted EBITDA (Non-GAAP) (1) | $ | 7,023 | | | $ | 3,952 | | | $ | 20,327 | | | $ | 1,488 | | | | |

(1) Management believes that adjusted gross profit, EBITDA and adjusted EBITDA for the three and twelve months ended December 31, 2024 and 2023, are useful to investors to assess and understand operating performance, especially when comparing those results with previous and subsequent periods. Management views the income and expenses noted above to be outside of the Company’s normal operating results. Management analyzes operating results without the impact of the above items as an indicator of performance, to identify underlying trends in the business and cash flow from continuing operations, and to establish financial and operational goals, excluding certain non-cash or non-recurring items.

FY 2024 Earnings Presentation

Forward-Looking Statements Certain statements set forth in this presentation constitute forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934) regarding Flotek Industries, Inc.’s business, financial condition, results of operations and prospects. Words such as will, continue, expects, anticipates, intends, plans, believes, seeks, estimates and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this presentation. Although forward-looking statements in this presentation reflect the good faith judgment of management, such statements can only be based on facts and factors currently known to management. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. Further information about the risks and uncertainties that may impact the Company are set forth in the Company’s most recent filing with the Securities and Exchange Commission on Form 10-K (including, without limitation, in the "Risk Factors" section thereof), and in the Company’s other SEC filings and publicly available documents. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. The Company undertakes no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this presentation. This presentation includes certain non-GAAP measures. Please refer to the reconciliations provided in the earnings press release and the appendix in this presentation for the most comparable GAAP measure. // 2

// 3 9 Consecutive Quarters of Improved Adj. EBITDA* Strong Balance Sheet with Low Debt Data Analytics Technology with High ROI Long-term ‘Take or Pay’ Contract Insulates Risk Tangible Environmental, Health, &, Safety Impacts Flotek Industries CHEMISTRY AS A COMMON VALUE CREATION PLATFORM Value Creation through Chemistry & Data * Adjusted EBITDA is a non-GAAP measure. See the Appendix in this presentation for a reconciliation to the most comparable GAAP measure

Complementary Segments Drive Growth // 4 Sustainable chemistry solutions to maximize customer’s value chain while minimizing their environmental impact Transforming business through real-time data, monitoring and visualization across the energy value chain utilizing proprietary technologies Chemistry Technologies Data Analytics CHEMISTRY AS A COMMON VALUE CREATION PLATFORM Founded: 1985 Employees: 146 Headquarters: Houston Patents: >130 Results: 2024 2023 – Gross Profit Margin: 21% 13% – Net Income * ($MM): $10.5 ($9.8) – Adj. EBITDA** ($MM): $20.3 $1.5 – Adj. EBITDA Margin: 11% 1% – Debt to Adj. EBITDA** 0.2x 5.0x – Diluted Income (Loss) Per Share $0.34 $(0.10) * Net income for 2023 excludes non-cash gains related to the fair value measurement of convertible notes payable and a PPP loan forgiveness totaling $34.5 million ** Adjusted EBITDA is a non-GAAP measure. See the Appendix in this presentation for a reconciliation to the most comparable GAAP measure

• Increased Revenue, Net Income, and Adj. EBITDA every quarter • The Fourth Quarter hit a 5-year peak with $23.3M in external customer revenue • Data analytics service revenue accounted for 67% of total 4Q24 DA revenue • Developed 3 new products within Data Analytics in 2H2024 with a future TAM >$500MM (XSPCT,RAMAN,VERACAL) • Highest annual adj. EBITDA*, $20.3 million, reported since 2017 (exceeded guidance by 10%) • Top 3 Oil Field Service stock performer in 2024 1Q24 2Q24 3Q24 4Q24 FY2024 Revenue $ 40.4 $ 46.2 $ 49.7 $ 50.8 $ 187.0 Gross Profit $ 8.8 $ 9.2 $ 9.1 $ 12.3 $ 39.4 SG&A $ 6.1 $ 6.3 $ 5.7 $ 6.6 $ 24.7 Net Income $ 1.6 $ 2.0 $ 2.5 $ 4.4 $ 10.5 Adj. EBITDA* $ 4.0 $ 4.4 $ 4.8 $ 7.0 $ 20.3 Diluted EPS $ 0.05 $ 0.06 $ 0.08 $ 0.14 $ 0.34 Flotek 2024 Highlights // 5 DELIVERED CONSISTENT GROWTH THROUGHOUT 2024 * Adjusted EBITDA is a non-GAAP measure. See the Appendix in this presentation for a reconciliation to the most comparable GAAP measure Quarterly Performance ($MM) Year-Over-Year Highlights DA Service Revenue: 58% Ext. Chem. Revenue: 7% SG&A: 11% Adj. EBITDA*: 1,253% Diluted EPS: $ 0.44 Stock Price (as of 12/31): 143%

Financial Momentum Continues // 6 Quarterly Adjusted EBITDA** Growth *Net income for full-year 2023 excludes non-cash gains related to the fair value measurement of convertible notes payable and a PPP loan forgiveness totaling $34.5 million **Adjusted EBITDA is a non-GAAP measure. See the Appendix in this presentation for a reconciliation to the most comparable GAAP measure $(5.1) $(3.9) $(2.0) $3.4 $4.0 $4.0 $4.4 $4.8 $7.0 -$6.5 -$4.5 -$2.5 -$0.5 $1.5 $3.5 $5.5 $7.5 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 Ad j. EB IT DA ($ M M ’s ) 9 CONSECUTIVE QUARTERS OF PROFITABILITY IMPROVEMENT 2023 2024 Growth Gross Profit: $ 24.3 MM $ 39.4 MM $ 15.1 MM SG&A: $ 27.8 MM $ 24.7 MM ($ 3.1 MM) Net Income*: ($ 9.8 MM) $ 10.5 MM $ 20.3 MM Adj. EBITDA**: $ 1.5 MM $ 20.3 MM $ 18.8 MM

Chemistry Growth in a Contracting Market // 7 • 50% growth in 4Q24 external chemistry compared to 3Q24 • 4Q24 represented the strongest quarter of external chemistry revenue in 5 years • 4Q24 International chemistry revenue of $4.5MM, up 275% from 3Q24 • Chemistry Market consolidation boosts Flotek’s unique product portfolio CHEMISTRY SEGMENT CONTINUES TO GAIN MARKET SHARE -All Frac Fleet data is derived from AOGR Primary Vision Averages. $27.0 $27.7 $33.0 $27.2 $11.7 $16.4 $14.1 $21.1 255 253 233 226 200 210 220 230 240 250 260 $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 $45.0 $50.0 1Q24 2Q24 3Q24 4Q24 N or th A m er ic a Fr ac F le et C ou nt s Re ve nu e Related Party and External Chemistry Revenue Related Party External Avg. Fleet Count

// 8 • Prescriptive Chemistry Management (PCM)TM • Proprietary energy chemistry solutions • Experienced chemistry energy team • Customized solutions to each well’s geology • AI Driven Analytics from >20,000 wells • Real-Time Field Data to Enhance Performance • Field Correlated Diagnostics • +130 Patents * Data derived from 2019-2023 Enverus Prism Platform (1,878 Permian wells) DELIVERING THE BEST WELL PERFORMANCE IN INDUSTRY 26% INCREASE IN PRODUCTION* PERFORMANCE VERSUS COMPETITION Chemistry Technologies: Competitive Advantage

Unlocking Value Through Chemistry & Data Data Analytics/Physics Based Modeling on >20k Wells • +10 years Field Completion Data • Reservoir Similarities and Physicochemical Properties • Production Uplift Curve Analysis • Basin Water and Frac Water Properties A Decade of Data with Predictive Models • Polymer Viscosity & Friction Reduction Predictions • Clay Stabilization Analytics • Scale Inhibitor Database • Formation Damage Mechanism Identification Aligning Support with Vendors and Customers • Leverage vendor data where applicable • Utilize databases to streamline analytical procedures DATA SUPPORTED GEOCENTRIC CHEMISTRY MODELING // 9

Data Analytics Revenue Growth // 10 • Service revenue accounted for 67% of Q4 2024 DA revenue and 46% of FY 2024 • Flare revenue totaled $1.3MM in 2H24 ($0 in 1H24) – 13 Active VeraCal Carts in Q4 2024 • XSPCT Analyzer fully commissioned Dec. 2024 – 14 XSPCT committed to pilot locations • Q4 2024 saw 15 power generation units deployed, with 9 more committed for 2025 delivery UPSTREAM APPLICATIONS CONTINUE TO IMPROVE SERVICE REVENUE GROWTH $3.6 $3.9 $5.5 $4.8 $0.7 $1.6 $2.6 $4.1 $0 $1 $2 $3 $4 $5 $6 $7 $8 $9 2021 2022 2023 2024 Re ve nu e ($ M M ) Data Analytics Revenue CapEx Revenue Service/DAAS Revenue 32 % 46 % 29 % 16 %

Data Analytics: “Measure More Strategy” Upstream • Flare monitoring: comply with EPA regulations • Custody Transfer: improves accuracy of payments to royalty owners and operators • Power Generation: facilitate field gas utilization in powering rigs and frac fleets Midstream • Gas processing plant control and optimization • Pipeline batch detection to optimize pipeline transmix processes • Vapor pressure controls to achieve product specifications • Emerging market in carbon capture Downstream • Process Controls: real-time measurement to optimize distillation tower efficiency • Chemicals: quality measurement in pipelines and terminals UTILIZING TECHNOLOGIES FOR EXPANSION INTO NEW MARKETS // 11 Growth

Data Analytics Product Offerings JP3 Raman • Raman Laser • C1-C6+, H2, N2, CO2 • C1/D2 Area Classification • Real Time Data VERAX • Near InfraRed (NIR) • Real-Time Data • Up to 8 Measurement Points • C1/D2 Area Classification XSPCT • Near InfraRed (NIR) • Modular System • No Fiber Connections • C1/D1 Area Classification • Auto-Validation VeraCaL • Near InfraRed (NIR) • EPA Approved (ALT-157) • Two Channels • C1/D2 Area Classification • Auto-Validation CORE Applications (RVP, Transmix, Other) Upstream Applications (Flare, Power Gen, Custody Transfer) (80/20 Product/Service Revenue) (80/20 Service/Product Revenue) DRIVING TOWARDS SERVICE REVENUE WITH NEW PRODUCT OFFERINGS // 12 (Commissioned Dec 2024)(Commissioned Dec 2024) (EPA Approved July 2024)

Investor Contact: Mike Critelli Director of Finance & Investor Relations ir@flotekind.com // 13 Come Join Us: March 17 – 18th 2025 at The 37th Annual ROTH Conference On 3/17 at 10am PT Panelist Speaker: Ryan Ezell The Marriott Laguna Cliffs Dana Point, CA May 27-29th 2025 at The Louisiana Energy Conference The Four Seasons New Orleans, LA

Appendix

Data Analytics: VeraCal Flare Solution // 15 INITIAL PENETRATION INTO SIGNIFICANT UPSTREAM APPLICATIONS Pictured above: The proprietary VeraCal mobile flaring cart on location EPA Approval on Flaring Measurement Application • VeraCal was the first EPA approved alt. measurement solution • EPA Amendment in December 2024 delayed market demand Our Flare Measurement System is Differentiated • Continuous and autonomous monitoring • No consumable calibration gas • No manual sampling errors • Fast install and extreme durability Customer Emission Savings via EPA Subpart-W • 4-6% additional savings in emission penalties • Gain 3-4% in production before Super Emitter Status

We tested against Traditional Gas Chromatography (GC) • Zero GC Samples matched the 60-day Average Gas BTU Value • 20-25% swings in “Associated Gas” BTU value • 16% Variances within manual sampling processes Data Analytics: XSPCT Custody Transfer Solution // 16 INITIAL PENETRATION INTO SIGNIFICANT UPSTREAM APPLICATIONS No Shelter, No Calibration Gas, Remotely/Continuously Monitored San Antonio Houston Example: 60 days of real-time BTU Values; demonstrates extreme variability. GC Spot Sample Lab Test +/- $4.4MM* ANNUAL PROCEEDS IMPACT *$2.50 $/mmBTU @ 15mmscf/D

Liquids In “Dry Associated Gas” // 17 $1.4MM* IN POTENTIAL ASSOCIATED GAS PROCEEDS High-Value Liquids Found in “Dry Gas” Typical Spectral Response for Associated Gas During Trial Water • Associated gas is “assumed” to be dry gas • GCs remove any liquids prior to measurement • Operators and mineral owners are not being compensated for “carry-over” products Liquids In “Dry Associated Gas” Line *$2.50 $/mmBTU @ 15mmscf/D

• JP3 field gas monitoring system allows any dual-fuel engine to safely run on field gas displacing more expensive and higher carbon footprint diesel • Provides meaningful cost savings compared to gas chromatography and/or asset failures • Provides clarity on BTU value for resource owner payment • A three-pad customer case study July - August 2023: • Achieved >70% field gas substitution rate • Eliminated 1.2 mm gallons of diesel usage • Realized 100% uptime Data Analytics: Upstream Field Gas Usage // 18 Delivered >70% Reduction in Diesel and CNG usage Frac Trailer Mounted System

Recent Financials Unaudited Condensed Consolidated Statement of Operations (in thousands) // 19

// 20 Recent Financials Unaudited Condensed Consolidated Balance Sheets (in thousands, except share data)

// 21 Recent Financials Unaudited Condensed Consolidated Statements of Cash Flows (in thousands)

// 22 (1) Management believes that adjusted gross profit, EBITDA and adjusted EBITDA for the periods presented above, are useful to investors to assess and understand operating performance, especially when comparing those results with previous and subsequent periods. Management views the income and expenses noted above to be outside of the Company’s normal operating results. Management analyzes operating results without the impact of the above items as an indicator of performance, to identify underlying trends in the business and cash flow from continuing operations, and to establish financial and operational goals, excluding certain non-cash or non-recurring items. Recent Financials Unaudited Reconciliation of Non-GAAP Items & Non-Cash Items Impacting Earnings (in thousands)(1)

v3.25.0.1

Cover

|

Mar. 10, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 10, 2025

|

| Entity Registrant Name |

Flotek Industries, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-13270

|

| Entity Tax Identification Number |

90-0023731

|

| Entity Address, Address Line One |

5775 N. Sam Houston Parkway W., Suite 400

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77086

|

| City Area Code |

(713)

|

| Local Phone Number |

849-9911

|

| Soliciting Material |

false

|

| Written Communications |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value

|

| Trading Symbol |

FTK

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000928054

|

| Amendment Flag |

false

|

| Entity Addresses [Line Items] |

|

| City Area Code |

(713)

|

| Local Phone Number |

849-9911

|

| Document Period End Date |

Mar. 10, 2025

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

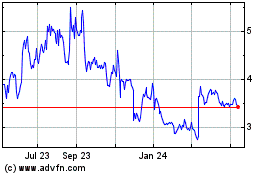

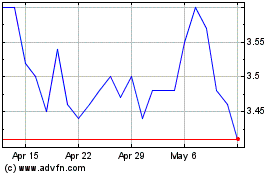

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Feb 2025 to Mar 2025

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Mar 2024 to Mar 2025