- Delivered robust margin expansion and record cash flow in

2024

- Strong execution and FBS-driven innovation enabled

better-than-expected Q4 operating performance, including record

margins and cash flow

- Q4 GAAP diluted EPS of $0.60, adjusted diluted EPS of $1.17,

up 19% year-over-year

- Q4 reported operating cash flow of $502 million and free

cash flow of $465 million, up 13% year-over-year

- Introducing 2025 outlook; GAAP diluted EPS of $2.38 to

$2.50, year-over-year increase of 1% to 6%; adjusted diluted EPS of

$4.00 to $4.12, year-over-year increase of 3% to 6%

- Separation of PT segment progressing well, expect to close

early Q3’25

Fortive Corporation (“Fortive”) (NYSE: FTV) today announced

financial results for the fourth quarter and full year 2024.

For the fourth quarter, net earnings were $209 million. For the

same period, adjusted net earnings were $406 million. Diluted net

earnings per share for the fourth quarter were $0.60. For the same

period, adjusted diluted net earnings per share were $1.17.

For the fourth quarter, revenues increased 2% year-over-year to

$1.62 billion, which included 2% core revenue growth.

For the full year, net earnings were $833 million. For the same

period, adjusted net earnings were $1.37 billion. Diluted net

earnings per share for the full year were $2.36. For the same

period, adjusted diluted net earnings per share were $3.89.

For the full year, revenues increased 3% year-over-year to $6.23

billion, which included 1% core revenue growth.

James A. Lico, President and Chief Executive Officer, stated,

“Our fourth quarter results once again demonstrated strong

execution despite the mixed macro environment, leading to

better-than-expected core growth, earnings, and free cash flow.

Continued growth in our Intelligent Operating Solutions (IOS) and

Advanced Healthcare Solutions (AHS) segments was driven by steady

demand for our safety and productivity solutions and increased

contributions from FBS-driven product innovations. We saw strong

order growth across all of our segments, including the second

consecutive quarter of double-digit orders growth for our Precision

Technologies (PT) segment. This momentum drove sequential

improvement in PT core growth and supports our view of a gradual

recovery as we move through 2025. As we look ahead, Fortive is

poised for improving core sales growth and continued strong

operating performance again in 2025.”

For the first quarter of 2025, Fortive anticipates revenue of

$1.48 billion to $1.51 billion, diluted net earnings per share of

$0.39 to $0.42, and adjusted diluted net earnings per share of

$0.83 to $0.86.

For the full year 2025, Fortive anticipates revenue of

approximately $6.23 billion to $6.35 billion, diluted net earnings

per share of $2.38 to $2.50, and adjusted diluted net earnings per

share of $4.00 to $4.12. The foregoing guidance for the full year

2025 does not give effect to the pending separation of the

Precision Technologies segment.

Mr. Lico continued, “We have a proven track record of evolving

Fortive to ensure sustained performance. Our enhanced portfolio of

leading brands and dedication to the Fortive Business System have

enabled us to deliver consistent, compounding results over the past

five years. As we move through the separation, we are well-prepared

to continue this success in 2025 and beyond. I am incredibly

excited for the future. Both companies are strategically positioned

to build on our performance history and thrive with focused growth

and capital allocation strategies that reflect our unwavering

commitment to creating sustained value for all stakeholders.”

Update on Pending Separation Into Two Independent, Publicly

Traded Companies

On September 4, 2024, Fortive announced its intention to

separate its Precision Technologies business into an independent

publicly traded company, which will be named Ralliant. The

Separation will create (i) a technology solutions company,

retaining the Fortive name, with a portfolio of the brands

currently operating under Fortive’s Intelligent Operating Solutions

and Advanced Healthcare Solutions business segments, focused on

resilient, high-quality recurring growth by delivering productivity

and safety to customers, and (ii) a global technology company

consisting of the brands currently operating under the Precision

Technologies segment with a focus on precision instruments and

highly engineered products essential for breakthrough innovation

and aligned to powerful secular trends. The Separation is intended

to qualify as a tax-free spin-off to Fortive shareholders for U.S.

federal income tax purposes. Fortive is currently targeting

completion of the Separation early in the third quarter of 2025,

subject to the satisfaction of certain conditions, including, among

others, final approval of Fortive’s Board of Directors,

satisfactory completion of financing, receipt of a favorable

opinion of legal counsel and/or a private letter ruling from the

U.S. Internal Revenue Service with respect to the tax treatment of

the transaction for U.S. federal income tax purposes, the

effectiveness of a Form 10 registration statement filed with the

SEC, and other regulatory approvals.

CONFERENCE CALL DETAILS

Fortive will discuss results and outlook during its quarterly

investor conference call today starting at 12:00 p.m. ET. The call

and an accompanying slide presentation will be webcast on the

“Investors” section of Fortive’s website, www.fortive.com, under

“Events/Presentations.” A replay of the webcast will be available

at the same location shortly after the conclusion of the

presentation.

The conference call can be accessed by dialing 877-407-3110

within the U.S. or by dialing 215-268-9915 outside the U.S. a few

minutes before 12:00 p.m. ET and notifying the operator that you

are dialing in for Fortive’s earnings conference call. A digital

recording of the conference call will be available two hours after

the completion of the call until Friday, February 21, 2025. You can

access the conference call replay on the “Investors” section of

Fortive’s website, www.fortive.com, under “Events/Presentations,”

or by dialing 877-660-6853 within the U.S. or 201-612-7415 outside

the U.S (Access ID: 13750805).

ABOUT FORTIVE

Fortive is a provider of essential technologies for connected

workflow solutions across a range of attractive end-markets.

Fortive’s strategic segments – Intelligent Operating Solutions,

Precision Technologies, and Advanced Healthcare Solutions – include

well-known brands with leading positions in their markets. The

company’s businesses design, develop, service, manufacture, and

market professional and engineered products, software, and

services, building upon leading brand names, innovative

technologies, and significant market positions. Fortive is

headquartered in Everett, Washington and employs a team of more

than 18,000 research and development, manufacturing, sales,

distribution, service and administrative employees in more than 50

countries around the world. With a culture rooted in continuous

improvement, the core of our company’s operating model is the

Fortive Business System. For more information please visit:

www.fortive.com.

NON-GAAP FINANCIAL MEASURES

In addition to the financial measures prepared in accordance

with generally accepted accounting principles (GAAP), this earnings

release also references “adjusted net earnings,” “adjusted diluted

net earnings per share,” “adjusted operating profit margin,” “free

cash flow,” and “core revenue growth,” which are non-GAAP financial

measures. The reasons why we believe these measures, when used in

conjunction with the GAAP financial measures, provide useful

information to investors, how management uses such non-GAAP

financial measures, a reconciliation of these measures to the most

directly comparable GAAP measures and other information relating to

these measures are included in the supplemental reconciliation

schedule attached. The non-GAAP financial measures should not be

considered in isolation or as a substitute for the GAAP financial

measures, but should instead be read in conjunction with the GAAP

financial measures. The non-GAAP financial measures used by Fortive

in this release may be different from similarly-titled non-GAAP

measures used by other companies.

FORWARD-LOOKING STATEMENTS

Statements in this presentation that are not strictly

historical, including statements regarding anticipated financial

results, global and regional economic conditions, industry trends,

geopolitical events, our plans to separate into two independent,

publicly-traded companies, including the timing and cost related to

the planned separation, interest rate and current exchange rate

impact, future prospects, shareholder value, and any other

statements identified by their use of words like “anticipate,”

“expect,” “believe,” “outlook,” “guidance,” "target", or “will” or

other words of similar meaning, are “forward-looking statements”

within the meaning of the United States federal securities laws.

Factors that could cause actual results to differ materially from

those in the forward-looking statements include, among other

things: deterioration of or instability in the economy, the markets

we serve, geopolitical conditions and conflicts, international

trade policies and the financial markets, security breaches or

other disruptions of our information technology systems, supply

chain constraints, our ability to adjust purchases and

manufacturing capacity to reflect market conditions, reliance on

sole sources of supply, changes in trade relations with other

countries, contractions or lower growth rates and cyclicality of

markets we serve, competition, changes in industry standards and

governmental regulations, our ability to recruit and retain key

employees, our ability to successfully identify, consummate,

integrate and realize the anticipated value of appropriate

acquisitions and successfully complete divestitures and other

dispositions, our ability to develop and successfully market new

products, software, and services and expand into new markets, the

potential for improper conduct by our employees, agents or business

partners, contingent liabilities relating to acquisitions and

divestitures, impact of changes to tax laws, our compliance with

applicable laws and regulations and changes in applicable laws and

regulations, risks relating to international economic,

geopolitical, including war and sanctions, legal, compliance and

business factors, risks relating to potential impairment of

goodwill and other intangible assets, currency exchange rates, tax

audits and changes in our tax rate and income tax liabilities, the

impact of our debt obligations on our operations, litigation and

other contingent liabilities including intellectual property and

environmental, health and safety matters, our ability to adequately

protect our intellectual property rights, risks relating to

product, service or software defects, product liability and

recalls, risks relating to product manufacturing, our relationships

with and the performance of our channel partners, commodity costs

and surcharges, adverse effects of restructuring activities, our

plans to separate into two independent, publicly-traded companies,

risk related to tax treatment of our prior or pending separation,

impact of our indemnification obligation to Vontier, impact of

changes to U.S. GAAP, labor matters, and disruptions relating to

man-made and natural disasters and climate change. Additional

information regarding the factors that may cause actual results to

differ materially from these forward-looking statements is

available in our SEC filings, including our Annual Report on Form

10-K for the year ended December 31, 2023 and Quarterly Report on

Form 10-Q for the quarter ended September 27, 2024. These

forward-looking statements speak only as of the date of this

presentation, and Fortive does not assume any obligation to update

or revise any forward-looking statement, whether as a result of new

information, future events and developments or otherwise.

FORTIVE CORPORATION AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

EARNINGS

($ and shares in millions,

except per share amounts)

Three Months Ended

Year Ended

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

(unaudited)

(unaudited)

(unaudited)

Sales

$

1,620.3

$

1,583.7

$

6,231.8

$

6,065.3

Cost of sales

(643.1

)

(636.2

)

(2,500.8

)

(2,471.2

)

Gross profit

977.2

947.5

3,731.0

3,594.1

Operating costs:

Selling, general and administrative

expenses

(563.0

)

(537.4

)

(2,173.5

)

(2,062.6

)

Research and development expenses

(107.1

)

(99.2

)

(414.0

)

(397.8

)

Gain on sale of property

—

—

63.1

—

Operating profit

307.1

310.9

1,206.6

1,133.7

Non-operating income (expense), net:

Interest expense, net

(33.1

)

(28.5

)

(152.8

)

(123.5

)

Loss from divestiture

—

—

(25.6

)

—

Other non-operating expense, net

0.7

(4.9

)

(58.6

)

(19.4

)

Earnings before income taxes

274.7

277.5

969.6

990.8

Income taxes

(65.9

)

(12.3

)

(136.7

)

(125.0

)

Net earnings

$

208.8

$

265.2

$

832.9

$

865.8

Net earnings per share:

Basic

$

0.61

$

0.75

$

2.39

$

2.46

Diluted

$

0.60

$

0.75

$

2.36

$

2.43

Average common stock and common equivalent

shares outstanding:

Basic

344.5

351.3

349.2

352.5

Diluted

348.0

354.5

352.8

355.6

This information is presented for reference only. Final audited

statements will include footnotes, which should be referenced when

available, to more fully understand the contents of this

information.

FORTIVE CORPORATION AND

SUBSIDIARIES

SEGMENT INFORMATION

($ in millions)

Three Months Ended

Year Ended

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

(unaudited)

(unaudited)

(unaudited)

Sales:

Intelligent Operating Solutions

$

710.8

$

682.7

$

2,714.7

$

2,612.2

Precision Technologies

567.7

569.8

2,229.4

2,223.7

Advanced Healthcare Solutions

341.8

331.2

1,287.7

1,229.4

Total

$

1,620.3

$

1,583.7

$

6,231.8

$

6,065.3

Operating Profit:

Intelligent Operating Solutions

$

199.6

$

176.8

$

704.6

$

628.8

Precision Technologies

113.6

142.9

500.0

544.2

Advanced Healthcare Solutions

46.9

35.8

155.6

101.6

Other (a)

(53.0

)

(44.6

)

(153.6

)

(140.9

)

Total

$

307.1

$

310.9

$

1,206.6

$

1,133.7

Operating Margins:

Intelligent Operating Solutions

28.1

%

25.9

%

26.0

%

24.1

%

Precision Technologies

20.0

%

25.1

%

22.4

%

24.5

%

Advanced Healthcare Solutions

13.7

%

10.8

%

12.1

%

8.3

%

Total

19.0

%

19.6

%

19.4

%

18.7

%

(a) Operating profit amounts in the Other

category consist of unallocated corporate costs and other costs not

considered part of our evaluation of reportable segment operating

performance.

This information is presented for reference only. Final audited

statements will include footnotes, which should be referenced when

available, to more fully understand the contents of this

information.

FORTIVE CORPORATION AND

SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

($ and shares in millions,

except per share amounts)

As of December 31,

2024

2023

(unaudited)

ASSETS

Current assets:

Cash and equivalents

$

813.3

$

1,888.8

Accounts receivable less allowance for

doubtful accounts of $30.7 and $39.2, respectively

945.4

960.8

Inventories:

Finished goods

220.1

214.1

Work in process

105.4

108.9

Raw materials

219.3

213.9

Inventories

544.8

536.9

Prepaid expenses and other current

assets

288.8

285.1

Total current assets

2,592.3

3,671.6

Property, plant and equipment, net

433.1

439.8

Other assets

494.7

518.9

Goodwill

10,156.0

9,121.7

Other intangible assets, net

3,340.0

3,159.8

Total assets

$

17,016.1

$

16,911.8

LIABILITIES AND EQUITY

Current liabilities:

Current portion of long-term debt

$

376.2

$

—

Trade accounts payable

677.4

608.6

Accrued expenses and other current

liabilities

1,184.8

1,182.7

Total current liabilities

2,238.4

1,791.3

Other long-term liabilities

1,251.0

1,149.0

Long-term debt

3,331.1

3,646.2

Commitments and Contingencies (Note

13)

Equity:

Common stock: $0.01 par value, 2.0 billion

shares authorized; 366.6 and 363.7 issued; 341.2 and 350.7

outstanding; respectively

3.7

3.6

Additional paid-in capital

4,035.0

3,851.3

Treasury shares, at cost

(1,612.3

)

(715.8

)

Retained earnings

8,227.6

7,505.9

Accumulated other comprehensive loss

(465.4

)

(326.1

)

Total Fortive stockholders’ equity

10,188.6

10,318.9

Noncontrolling interests

7.0

6.4

Total stockholders’ equity

10,195.6

10,325.3

Total liabilities and equity

$

17,016.1

$

16,911.8

This information is presented for reference only. Final audited

statements will include footnotes, which should be referenced when

available, to more fully understand the contents of this

information.

FORTIVE CORPORATION AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

CASH FLOWS

($ in millions)

Year Ended December 31

2024

2023

(unaudited)

Cash flows from operating activities:

Net earnings from continuing

operations

$

832.9

$

865.8

Adjustments to reconcile net earnings to

net cash provided by operating activities:

Amortization

453.3

370.4

Depreciation

90.6

86.4

Stock-based compensation

109.2

113.3

Gain on sale of property

(63.1

)

—

Loss from divestiture

25.6

—

Loss from equity investments

39.4

17.3

Change in certain assets and

liabilities:

Change in deferred income taxes

(65.0

)

(104.1

)

Change in accounts receivable, net

(4.5

)

9.8

Change in inventories

8.8

(1.7

)

Change in trade accounts payable

74.3

(16.8

)

Change in prepaid expenses and other

assets

8.5

(86.3

)

Change in accrued expenses and other

liabilities

16.8

99.5

Net cash provided by operating

activities

1,526.8

1,353.6

Cash flows from investing activities:

Cash paid for acquisitions, net of cash

received

(1,721.8

)

(95.8

)

Purchases of property, plant and

equipment

(120.4

)

(107.8

)

Proceeds from sale of property

61.2

7.4

Cash infusion into divestiture

(14.0

)

—

All other investing activities

(1.0

)

0.8

Net cash used in investing

activities

(1,796.0

)

(195.4

)

Cash flows from financing activities:

Net proceeds from (repayments of)

commercial paper borrowings

(596.5

)

839.9

Proceeds from borrowings (maturities

greater than 90 days), net of issuance costs

1,733.5

549.3

Repayment of borrowings (maturities

greater than 90 days)

(1,000.0

)

(1,000.0

)

Repurchase of common shares

(889.6

)

(272.9

)

Payment of common stock cash dividend to

shareholders

(111.2

)

(102.0

)

All other financing activities

71.1

18.0

Net cash provided by (used in)

financing activities

(792.7

)

32.3

Effect of exchange rate changes on cash

and equivalents

(13.6

)

(10.9

)

Net change in cash and equivalents

(1,075.5

)

1,179.6

Beginning balance of cash and

equivalents

1,888.8

709.2

Ending balance of cash and equivalents

$

813.3

$

1,888.8

This information is presented for reference only. Final audited

statements will include footnotes, which should be referenced when

available, to more fully understand the contents of this

information.

FORTIVE CORPORATION AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES AND

OTHER INFORMATION

Management believes that each of the non-GAAP financial measures

described below provide useful information to investors by

reflecting additional ways of viewing aspects of our operations

that, when reconciled to the corresponding GAAP measure, help our

investors to understand the long-term profitability trends of our

business, and facilitate comparisons of our operational performance

and profitability to prior and future periods and to our peers.

These non-GAAP measures should be considered in addition to, and

not as a replacement for or superior to, the comparable GAAP

measures, and may not be comparable to similarly titled measures

reported by other companies.

Adjusted Net Earnings, Adjusted Diluted Net

Earnings per Share, and Adjusted Operating Profit Margin

We disclose the non-GAAP measures of historical adjusted net

earnings, historical and forecasted adjusted diluted net earnings

per share and historical adjusted operating profit margin, which to

the extent applicable, make the following adjustments to GAAP net

earnings, GAAP diluted net earnings per share, and GAAP operating

profit margin:

- Excluding on a pretax basis amortization of acquisition related

intangible assets and non-cash impairments;

- Excluding on a pretax basis acquisition, divestiture, and

separation related items;

- Excluding on a pretax basis the gain on sale of property;

and

- Excluding on a pretax basis the costs incurred pursuant to

discrete restructuring plans that are fundamentally different from

ongoing productivity improvements in terms of the size, strategic

nature, planning requirements and the inconsistent frequency of

such plans as well as the associated macroeconomic drivers which

underlie such plans (the “Discrete Restructuring Charges”).

In addition, with respect to the non-GAAP measures of historical

adjusted net earnings and historical and forecasted adjusted

diluted net earnings per share, we make the following adjustments

to GAAP net earnings and GAAP diluted net earnings per share:

- Excluding on a pretax basis the effect of gains and losses from

our equity investments;

- Excluding the loss from divestiture;

- Excluding on a pretax basis the charitable contribution

expense;

- Excluding the tax effect (to the extent tax deductible) of the

pretax adjustments noted above. The tax effect of such adjustments

was calculated by applying our overall estimated effective tax rate

to the pretax amount of each adjustment (unless the nature of the

item and/or the tax jurisdiction in which the item has been

recorded requires application of a specific tax rate or tax

treatment, in which case the tax effect of such item is estimated

by applying such specific tax rate or tax treatment). We expect to

apply our overall estimated effective tax rate to each adjustment

going forward;

- Excluding the discrete tax expense resulting from the

Separation of NewCo; and

- Excluding discrete non-cash tax benefits.

Amortization of Acquisition Related Intangible Assets and

Non-cash Impairments

As a result of our acquisition activity, we have significant

amortization expense associated with definite-lived intangible

assets. We adjust for amortization expense of acquisition related

intangible assets incurred in each period, and impairment charges

incurred, if any. During the three and twelve month periods ended

December 31, 2023, we recognized $2.3 million and $5.2 million,

respectively, related to impairment charges. We believe that this

adjustment provides our investors with additional insight into our

operational performance and profitability as such impacts are not

related to our core business performance.

Acquisition, Divestiture, and Separation Related Items

While we have a history of acquisition and divestiture activity,

we do not acquire and divest businesses or assets on a predictable

cycle. The amount of an acquisition’s purchase price allocated to

inventory fair value adjustments are unique to each acquisition and

can vary significantly from acquisition to acquisition. In

addition, transaction costs, which include acquisition,

divestiture, integration, restructuring, and separation costs

related to completed or announced transactions, and the

non-recurring gains on divestitures of businesses or assets are

unique to each transaction and are impacted from period to period

depending on the number of acquisitions or divestitures evaluated,

pending, or completed during such period, and the complexity of

such transactions. As a result of the Separation, we also incurred

costs primarily related to professional fees for legal, tax,

accounting and finance, information technology services, and other

general and administrative costs as well as costs to stand up the

new company to operate as a stand alone entity . We adjust for

transaction costs, costs related to the Separation, acquisition

related fair value adjustments to inventory, integration costs and

corresponding restructuring charges related to acquisitions, in

each case, incurred in a given period.

Gains and Losses from Equity Investments

We adjust for the effect of earnings and losses from our equity

method investments over which we do not exercise control over the

operations or the resulting earnings or losses. We believe that

this adjustment provides our investors with additional insight into

our operational performance. However, it should be noted that

earnings and losses from our equity method investments will recur

in future periods while we maintain such investments.

In addition, we adjust for remeasurement gains and losses,

including impairment loss, on equity investments. We believe such

adjustments facilitate comparison of our performance with prior and

future periods and provides our investors with additional insight

into our operational performance.

Loss from Divestiture

In June 2024, we divested and transferred ownership of Invetech,

excluding the Motion Solution Business, to its management team (the

“Invetech Divestiture”). We adjust for the loss from the Invetech

Divestiture because we believe the adjustment facilitates

comparison of our performance with prior and future periods and

provides our investors with additional insight into our operational

performance.

Gain on Sale of Property and Charitable Contribution Expense

On March 14, 2024, we completed a transaction to sell land and

certain office buildings in our Precision Technologies segment for

$90 million, for which we received $20 million cash proceeds and a

$70 million promissory note secured by a letter of credit. We

received $10 million of principal in August and the remaining in

November 2024. During the year ended December 31, 2024, we recorded

a gain on sale of property of $63.1 million in the Consolidated

Statements of Earnings.

Concurrently, during the first quarter of 2024, we pledged to

make a charitable donation of $20 million to the Fortive Foundation

(“the Foundation”), a related party, without any donor imposed

conditions or restrictions. In the third quarter of 2024, $20

million of the promissory note due in November 2024 was reassigned

to the Foundation. We recorded a charitable contribution expense of

$20 million within the “Other non-operating expense, net” line in

the Consolidated Statements of Earnings.

We adjust for the gain on sale of property and charitable

donation expense because we believe the adjustment facilitates

comparison of our performance with prior and future periods and

provides our investors with additional insight into our operational

performance.

Discrete Restructuring Costs

We will exclude costs incurred pursuant to discrete

restructuring plans that are fundamentally different in terms of

the size, strategic nature and planning requirements, as well as

the inconsistent frequency, of such plans originating from

significant macroeconomic trends or material disruptions to

operations, economy or capital markets from the ongoing

productivity improvements that result from application of the

Fortive Business System or from execution of general cost saving

strategies. Because these restructuring plans will be incremental

to the fundamental activities that arise in the ordinary course of

our business and we believe are not indicative of our ongoing

operating costs in a given period, we exclude these costs to

facilitate a more consistent comparison of operating results over

time. Restructuring costs related primarily to an acquisition are

not included in this adjustment but are instead included in

acquisition and divestiture related items. In the fourth quarter of

2024, we initiated a discrete restructuring plan related to the

Separation that is expected to be completed by December 31, 2025,

we adjusted for the related discrete restructuring charges in the

fourth quarter of 2024. Discrete restructuring charges adjusted for

in the quarter and the year-to-date period in 2023 are related to

our 2023 discrete plan.

Discrete Tax Expense Resulting from the Separation of NewCo

We adjust for discrete tax expense items that resulted from the

Separation of NewCo. These discrete items are non-recurring

expenses that resulted from the US GAAP calculation of income taxes

from continuing operations and do not reflect our current or future

cash tax obligations.

Discrete Non-cash Tax Benefit

As a result of revaluation of deferred tax assets required due

to changes in tax rates in Switzerland, we recognized a non-cash

tax benefit during the three and twelve month period ended December

31, 2023. We adjust for this non-cash tax benefit because we

believe such benefit occurs with inconsistent frequency and for

reasons that are unrelated to our commercial performance. We

believe such adjustment facilitates comparison with prior and

future periods and provides our investors with additional insight

into our ongoing tax expenses.

Management believes that each of the non-GAAP financial measures

noted above provide useful information to investors by reflecting

additional ways of viewing aspects of our operations that, when

reconciled to the corresponding GAAP measure, help our investors to

understand the long-term profitability trends of our business, and

facilitate comparisons of our operational performance and

profitability to prior and future periods and to our peers.

These non-GAAP measures should be considered in addition to, and

not as a replacement for or superior to, the comparable GAAP

measures, and may not be comparable to similarly titled measures

reported by other companies.

Core Revenue Growth

We use the term “core revenue growth” when referring to a

corresponding year-over-year GAAP revenue measure, excluding (1)

the impact from acquired or divested businesses and (2) the impact

of foreign currency translation. References to sales attributable

to acquisitions or acquired businesses refer to GAAP sales from

acquired businesses recorded prior to the first anniversary of the

acquisition less the amount of sales attributable to certain

divested businesses or product lines that have been divested or, at

the time of reporting, are pending divestiture but are not, and

will not be, considered discontinued operations prior to the first

anniversary of the divestiture. The portion of sales attributable

to the impact of currency translation is calculated as the

difference between (a) the period-to-period change in sales

(excluding sales impact from acquired businesses) and (b) the

period-to-period change in sales (excluding sales impact from

acquired businesses) after applying the current period foreign

exchange rates to the prior year period. This non-GAAP measure

should be considered in addition to, and not as a replacement for

or superior to, the comparable GAAP measure, and may not be

comparable to similarly titled measures reported by other

companies.

Management believes that this non-GAAP measure provides useful

information to investors by helping identify underlying growth

trends in our business and facilitating comparisons of our revenue

performance with prior and future periods and to our peers. We

exclude the effect of acquisition and divestiture-related items

because the nature, size and number of such transactions can vary

dramatically from period to period and between us and our peers. We

exclude the effect of currency translation from sales measures

because currency translation is not under management’s control and

is subject to volatility. We believe that such exclusions, when

presented with the corresponding GAAP measures, may assist in

assessing the business trends and making comparisons of long-term

performance.

Free Cash Flow

We use the term “free cash flow” when referring to net cash

provided by operating activities calculated according to GAAP less

payments for capital expenditures.

Management believes that such non-GAAP measure provides useful

information to investors in assessing our ability to generate cash

without external financing, fund acquisitions and other investments

and, in the absence of refinancing, repay our debt obligations.

However, it should be noted that free cash flow as a liquidity

measure has material limitations because it excludes certain

expenditures that are required or that we have committed to, such

as debt service requirements and other non-discretionary

expenditures. Such non-GAAP measure should be considered in

addition to, and not as a replacement for or superior to, the

comparable GAAP measure, and may not be comparable to similarly

titled measures reported by other companies.

Adjusted Operating Profit and Adjusted

Operating Profit Margin (unaudited)

Three Months Ended

Year Ended

($ in millions)

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Revenue (GAAP)

$

1,620.3

$

1,583.7

$

6,231.8

$

6,065.3

Operating Profit (GAAP)

$

307.1

$

310.9

$

1,206.6

$

1,133.7

Amortization of acquisition-related

intangible assets and non-cash impairments

112.9

95.5

453.3

375.6

Acquisition, divestiture, and separation

related Items

24.7

2.7

59.6

4.4

Gain on sale of property

—

—

(63.1

)

—

Discrete restructuring charges

19.7

29.4

19.7

58.6

Adjusted Operating Profit

(Non-GAAP)

$

464.4

$

438.5

$

1,676.1

$

1,572.3

Operating Profit Margin (GAAP)

19.0

%

19.6

%

19.4

%

18.7

%

Adjusted Operating Profit Margin

(Non-GAAP)

28.7

%

27.7

%

26.9

%

25.9

%

The sum of the components of adjusted

operating profit may not equal due to rounding.

Adjusted Net Earnings and Adjusted

Diluted Net Earnings Per Share (unaudited)

Three Months Ended

Year Ended

($ in millions, except per share

amounts)

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Per share values

Per share values

Per share values

Per share values

Net Earnings and Net Earnings Per Share

(GAAP)

$

208.8

$

0.60

$

265.2

$

0.75

$

832.9

$

2.36

$

865.8

$

2.43

Pretax amortization of acquisition related

intangible assets and non-cash impairments

112.9

0.32

95.5

0.27

453.3

1.28

375.6

1.06

Pretax acquisition, divestiture, and

separation related items

24.7

0.07

2.7

0.01

59.6

0.17

4.4

0.01

Pretax losses from equity investments

—

—

4.4

0.01

39.4

0.11

17.3

0.05

Loss from divestiture

—

—

—

—

25.6

0.07

—

—

Pretax gain on sale of property and

charitable contribution expense

—

—

—

—

(43.1

)

(0.12

)

—

—

Pretax discrete restructuring charges

19.7

0.06

29.4

0.08

19.7

0.06

58.6

0.16

Tax effect of the adjustments reflected

above (a)

(25.4

)

(0.07

)

(23.0

)

(0.07

)

(80.7

)

(0.23

)

(76.1

)

(0.21

)

Discrete tax expense resulting from the

Separation of NewCo

65.6

0.19

—

—

65.6

0.19

—

—

Discrete non-cash tax benefit

—

—

(25.5

)

(0.07

)

—

—

(25.5

)

(0.07

)

Adjusted Net Earnings and Adjusted Net

Earnings Per Share (Non-GAAP)

$

406.3

$

1.17

$

348.7

$

0.98

$

1,372.3

$

3.89

$

1,220.1

$

3.43

Average Common Diluted Stock

Outstanding (shares in millions)

348.0

354.5

352.8

355.6

(a) The loss from divestiture had no tax

impact. The tax effect of the adjustments includes all other line

items above.

The sum of the components of adjusted

diluted net earnings per share may not equal due to rounding.

Core Revenue Growth (unaudited)

% Change Three Months

Ended

December 31, 2024 vs.

Comparable 2023 Period

% Change Year Ended

December 31, 2024

vs.

Comparable 2023 Period

Total Revenue Growth (GAAP)

2.3

%

2.7

%

Impact of:

Acquisitions and divestitures

(Non-GAAP)

(1.1

)%

(2.0

)%

Impact of currency translation

(Non-GAAP)

0.6

%

0.6

%

Core Revenue Growth (Non-GAAP)

1.8

%

1.3

%

Free Cash Flow (unaudited)

($ in millions)

Three Months Ended

Year Ended

December 31,

2024

December 31,

2023

% Change

December 31,

2024

December 31,

2023

% Change

Operating Cash Flows (GAAP)

$

502.2

$

446.8

12.4

%

$

1,526.8

$

1,353.6

12.8

%

Less: purchases of property, plant &

equipment (capital expenditures) (GAAP)

(37.0

)

(34.1

)

(120.4

)

(107.8

)

Free Cash Flow (Non-GAAP)

$

465.2

$

412.7

12.7

%

$

1,406.4

$

1,245.8

12.9

%

Forecasted Adjusted Diluted Net

Earnings Per Share (unaudited)

Three Months Ending

March 28, 2025

Twelve Months Ending

December 31,

2025

Low

High

Low

High

Forecasted Diluted Net Earnings Per

Share (GAAP)

$

0.39

$

0.42

$

2.38

$

2.50

Anticipated pretax amortization of

acquisition related intangible assets

0.33

0.33

1.33

1.33

Anticipated pretax acquisition,

divestiture, and separation related items

0.11

0.11

0.40

0.40

Anticipated pretax discrete restructuring

charges

0.02

0.02

0.04

0.04

Tax effect of the adjustments reflected

above

(0.07

)

(0.07

)

(0.27

)

(0.27

)

Discrete tax expense resulting from the

Separation of NewCo

0.05

0.05

0.12

0.12

Forecasted Adjusted Diluted Net

Earnings Per Share (Non-GAAP)

$

0.83

$

0.86

$

4.00

$

4.12

The sum of the components of forecasted

adjusted diluted net earnings per share may not equal due to

rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250207412002/en/

Elena Rosman Investor Relations Fortive Corporation 6920 Seaway

Boulevard Everett, WA 98203 Telephone: (425) 446-5000

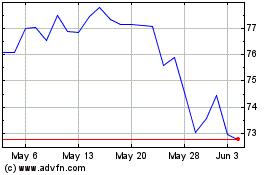

Fortive (NYSE:FTV)

Historical Stock Chart

From Jan 2025 to Feb 2025

Fortive (NYSE:FTV)

Historical Stock Chart

From Feb 2024 to Feb 2025