falseQ10000018498--02-012025http://fasb.org/us-gaap/2023#OtherAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherAccruedLiabilitiesCurrent0000018498us-gaap:SubsequentEventMember2024-05-052024-06-120000018498us-gaap:IntersegmentEliminationMember2024-02-042024-05-040000018498gco:WholesaleCostsOfDistributionMember2023-01-292023-04-290000018498us-gaap:AdditionalPaidInCapitalMember2023-04-290000018498gco:JourneysGroupSegmentMemberus-gaap:IntersegmentEliminationMember2024-02-042024-05-040000018498us-gaap:OperatingSegmentsMembergco:SchuhGroupSegmentMember2023-01-292023-04-290000018498country:GB2023-04-290000018498us-gaap:OperatingSegmentsMembergco:SchuhGroupSegmentMember2023-04-290000018498us-gaap:CommonStockMember2024-02-030000018498us-gaap:TrademarksMember2024-05-040000018498us-gaap:OperatingSegmentsMember2023-01-292023-04-290000018498country:GBus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-02-042024-05-040000018498srt:NorthAmericaMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-292023-04-290000018498us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-05-040000018498us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-290000018498us-gaap:RetainedEarningsMember2023-01-292023-04-290000018498gco:GenescoBrandsSegmentMemberus-gaap:IntersegmentEliminationMember2023-01-292023-04-290000018498us-gaap:PreferredStockMember2024-02-042024-05-040000018498us-gaap:CustomerListsMember2024-02-030000018498gco:RetailOccupancyCostsMember2023-01-292023-04-290000018498us-gaap:OperatingSegmentsMembergco:JohnstonAndMurphyGroupSegmentMember2023-04-290000018498us-gaap:AdditionalPaidInCapitalMember2024-02-030000018498us-gaap:TreasuryStockCommonMember2024-05-040000018498gco:JohnstonAndMurphyGroupSegmentMemberus-gaap:IntersegmentEliminationMember2024-02-042024-05-040000018498us-gaap:OperatingSegmentsMembergco:SchuhGroupSegmentMember2024-02-042024-05-040000018498us-gaap:PreferredStockMember2023-04-290000018498us-gaap:CommonStockMember2024-02-042024-05-040000018498us-gaap:OperatingSegmentsMembergco:JohnstonAndMurphyGroupSegmentMember2024-02-042024-05-040000018498us-gaap:AdditionalPaidInCapitalMember2024-02-042024-05-0400000184982024-05-310000018498gco:GenescoBrandsSegmentMember2023-01-292023-04-290000018498us-gaap:TrademarksMember2024-02-0300000184982024-02-030000018498us-gaap:OperatingSegmentsMembergco:SchuhGroupSegmentMember2024-05-040000018498us-gaap:OperatingSegmentsMembergco:GenescoBrandsSegmentMember2023-01-292023-04-290000018498us-gaap:RetainedEarningsMember2023-01-280000018498us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-280000018498gco:JohnstonAndMurphyGroupSegmentMemberus-gaap:IntersegmentEliminationMember2023-01-292023-04-290000018498gco:WholesaleCostsOfDistributionMember2024-02-042024-05-040000018498gco:JourneysGroupSegmentMembergco:RetailStoreAssetImpairmentsMember2023-01-292023-04-290000018498us-gaap:RevolvingCreditFacilityMembergco:USRevolverBorrowingsMember2024-05-040000018498us-gaap:PreferredStockMember2023-01-280000018498gco:JohnstonAndMurphyGroupSegmentMember2024-02-042024-05-040000018498us-gaap:CustomerListsMember2024-05-040000018498gco:JourneysGroupSegmentMember2023-01-292023-04-290000018498gco:SchuhGroupSegmentMember2023-01-292023-04-290000018498us-gaap:IntersegmentEliminationMembergco:SchuhGroupSegmentMember2023-01-292023-04-290000018498us-gaap:AdditionalPaidInCapitalMember2023-01-280000018498us-gaap:CorporateNonSegmentMember2024-02-042024-05-040000018498country:GBus-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2023-01-292023-04-290000018498gco:USRevolverBorrowingsMember2024-05-040000018498us-gaap:AdditionalPaidInCapitalMember2024-05-040000018498gco:JourneysGroupSegmentMemberus-gaap:IntersegmentEliminationMember2023-01-292023-04-290000018498us-gaap:CommonStockMember2024-05-0400000184982023-01-292023-04-290000018498us-gaap:CorporateNonSegmentMember2023-01-292023-04-290000018498country:CA2023-04-290000018498us-gaap:OperatingSegmentsMembergco:JourneysGroupSegmentMember2024-05-040000018498gco:GenescoBrandsSegmentMember2024-02-042024-05-040000018498country:GB2024-05-040000018498us-gaap:OperatingSegmentsMembergco:GenescoBrandsSegmentMember2024-05-040000018498us-gaap:IntersegmentEliminationMembergco:GenescoBrandsSegmentMember2024-02-042024-05-040000018498us-gaap:IntersegmentEliminationMember2023-01-292023-04-290000018498us-gaap:RetainedEarningsMember2024-05-040000018498us-gaap:EmployeeSeveranceMember2024-02-042024-05-040000018498gco:USRevolverBorrowingsMember2024-02-030000018498us-gaap:OperatingSegmentsMembergco:GenescoBrandsSegmentMember2024-02-042024-05-040000018498us-gaap:OtherIntangibleAssetsMember2024-02-030000018498us-gaap:RetainedEarningsMember2024-02-042024-05-040000018498us-gaap:RevolvingCreditFacilityMembergco:GenescoCanadaUlcMember2024-05-0400000184982024-02-042024-05-040000018498us-gaap:CommonStockMember2023-01-292023-04-2900000184982023-04-290000018498us-gaap:TreasuryStockCommonMember2024-02-030000018498us-gaap:OperatingSegmentsMembergco:JohnstonAndMurphyGroupSegmentMember2023-01-292023-04-290000018498us-gaap:OperatingSegmentsMembergco:JourneysGroupSegmentMember2024-02-042024-05-040000018498us-gaap:PreferredStockMember2023-01-292023-04-290000018498us-gaap:IntersegmentEliminationMembergco:SchuhGroupSegmentMember2024-02-042024-05-040000018498us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-292023-04-290000018498srt:NorthAmericaMemberus-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2024-02-042024-05-040000018498us-gaap:RetainedEarningsMember2023-04-290000018498us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-02-030000018498us-gaap:OperatingSegmentsMembergco:JourneysGroupSegmentMember2023-04-290000018498us-gaap:PreferredStockMember2024-05-040000018498us-gaap:TreasuryStockCommonMember2023-04-290000018498us-gaap:OperatingSegmentsMembergco:JohnstonAndMurphyGroupSegmentMember2024-05-040000018498us-gaap:OperatingSegmentsMembergco:JourneysGroupSegmentMember2023-01-292023-04-290000018498us-gaap:CommonStockMember2023-01-280000018498gco:JourneysGroupSegmentMembergco:RetailStoreAssetImpairmentsMember2024-02-042024-05-040000018498us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-02-042024-05-040000018498country:CA2024-05-040000018498gco:RetailOccupancyCostsMember2024-02-042024-05-040000018498us-gaap:OperatingSegmentsMembergco:GenescoBrandsSegmentMember2023-04-290000018498us-gaap:CorporateNonSegmentMember2023-04-290000018498us-gaap:OperatingSegmentsMember2024-02-042024-05-040000018498gco:JohnstonAndMurphyGroupSegmentMember2023-01-292023-04-290000018498us-gaap:FairValueInputsLevel3Member2024-05-040000018498us-gaap:OtherIntangibleAssetsMember2024-05-040000018498us-gaap:AdditionalPaidInCapitalMember2023-01-292023-04-290000018498gco:JourneysGroupSegmentMember2024-02-042024-05-040000018498us-gaap:CorporateNonSegmentMember2024-05-040000018498gco:SchuhGroupSegmentMember2024-02-042024-05-0400000184982024-05-0400000184982023-01-280000018498us-gaap:RetainedEarningsMember2024-02-030000018498us-gaap:CommonStockMember2023-04-290000018498gco:SamsungCTAmericaIncorporationMember2024-05-040000018498us-gaap:RevolvingCreditFacilityMember2024-05-040000018498us-gaap:FairValueInputsLevel1Member2024-05-040000018498us-gaap:TreasuryStockCommonMember2023-01-280000018498us-gaap:PreferredStockMember2024-02-03xbrli:purexbrli:sharesiso4217:CADgco:Segmentgco:Storeiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Quarter Ended May 4, 2024 |

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the transition period from to |

Commission File No. 1-3083

Genesco Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

Tennessee |

|

62-0211340 |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

535 Marriott Drive |

|

37214 |

Nashville, |

Tennessee |

|

(Zip Code) |

(Address of principal executive offices) |

|

|

Registrant's telephone number, including area code: (615) 367-7000

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $1.00 par value |

GCO |

New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such report), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer; an accelerated filer; a non-accelerated filer; a smaller reporting company; or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

☒ |

|

|

|

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

☐ |

|

|

|

|

Emerging growth company |

|

☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ☐ No ☒

As of May 31, 2024, there were 11,626,195 shares of the registrant's common stock outstanding.

INDEX

|

|

|

|

Part I. Financial Information |

|

Item 1. Financial Statements: |

|

Condensed Consolidated Balance Sheets - May 4, 2024, February 3, 2024 and April 29, 2023 |

4 |

Condensed Consolidated Statements of Operations - Three Months ended May 4, 2024 and April 29, 2023 |

5 |

Condensed Consolidated Statements of Comprehensive Loss - Three Months ended May 4, 2024 and April 29, 2023 |

6 |

Condensed Consolidated Statements of Cash Flows - Three Months ended May 4, 2024 and April 29, 2023 |

7 |

Condensed Consolidated Statements of Equity - Three Months ended May 4, 2024 and April 29, 2023 |

8 |

Notes to Condensed Consolidated Financial Statements |

9 |

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations |

14 |

Item 3. Quantitative and Qualitative Disclosures about Market Risk |

19 |

Item 4. Controls and Procedures |

19 |

Part II. Other Information |

20 |

Item 1. Legal Proceedings |

20 |

Item 1A. Risk Factors |

20 |

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds |

20 |

Item 5. Other Information |

20 |

Item 6. Exhibits |

21 |

Signature |

22 |

|

|

cautionary notice regarding forward-looking statements

Statements in this Quarterly Report on Form 10-Q include certain forward-looking statements, which include statements regarding our intent, belief or expectations and all statements other than those made solely with respect to historical fact. Actual results could differ materially from those reflected by the forward-looking statements in this Quarterly Report on Form 10-Q and a number of factors may adversely affect the forward-looking statements and our future results, liquidity, capital resources or prospects. These include, but are not limited to, adjustments to projections reflected in forward-looking statements, including those resulting from weakness in store and shopping mall traffic, restrictions on operations imposed by government entities and/or landlords, changes in public safety and health requirements and limitations on our ability to adequately staff and operate stores. Differences from expectations could also result from our ability to obtain from suppliers products that are in-demand on a timely basis and effectively manage disruptions in product supply or distribution, including disruptions as a result of pandemics or geopolitical events, including shipping disruptions in the Red Sea; the level of consumer spending on our merchandise and interest in our brands and in general; the level and timing of promotional activity necessary to maintain inventories at appropriate levels; our ability to pass on price increases to our customers; the timing and amount of any share repurchases by us; the imposition of tariffs on products imported by us or our vendors as well as the ability and costs to move production of products in response to tariffs; unfavorable trends in fuel costs, foreign exchange rates, foreign labor and material costs; a disruption in shipping or increase in cost of our imported products, and other factors affecting the cost of products; our dependence on third-party vendors and licensors for the products we sell; our ability to renew our license agreements; impacts of the Russia-Ukraine war, and other sources of market weakness in the U.K. and the Republic of Ireland; the effectiveness of our omni-channel initiatives; costs associated with changes in minimum wage and overtime requirements; wage pressure in the U.S. and the U.K.; labor shortages; the effects of inflation; the evolving regulatory landscape related to our use of social media; the establishment and protection of our intellectual property; weakness in the consumer economy and retail industry; competition and fashion trends in our markets, including trends with respect to the popularity of casual and dress footwear; any failure to increase sales at our existing stores, given our high fixed expense cost structure, and in our e-commerce businesses; risks related to the potential for terrorist events; store closures and effects on the business as a result of civil disturbances; changes in buying patterns by significant wholesale customers; changes in consumer preferences; our ability to continue to complete and integrate acquisitions; our ability to expand our business and diversify our product base; impairment of goodwill in connection with acquisitions; payment related risks that could increase our operating cost, expose us to fraud or theft, subject us to potential liability and disrupt our business; retained liabilities associated with divestitures of businesses including potential liabilities under leases as the prior tenant or as a guarantor of certain leases; and changes in the timing of holidays or in the onset of seasonal weather affecting period-to-period sales comparisons. Additional factors that could cause differences from expectations include the ability to secure allocations to refine product assortments to address consumer demand; the ability to renew leases in existing stores and control or lower occupancy costs, to open or close stores in the number and on the planned schedule, and to conduct required remodeling or refurbishment on schedule and at expected expense levels; our ability to realize anticipated cost savings, including rent savings; our ability to make our occupancy costs more variable, realize any anticipated tax benefits in both the amount and timeframe anticipated, and achieve expected digital gains and gain market share; deterioration in the performance of individual businesses or of our market value relative to our book value, resulting in impairments of fixed assets, operating lease right of use assets or intangible assets or other adverse financial consequences and the timing and amount of such impairments or other consequences; unexpected changes to the market for our shares or for the retail sector in general; our ability to meet our sustainability, stewardship, emission and diversity, equity and inclusion related ESG projections, goals and commitments; costs and reputational harm as a result of disruptions in our business or information technology systems either by security breaches and incidents or by potential problems associated with the implementation of new or upgraded systems, and the cost and outcome of litigation, investigations, disputes and environmental matters that involve us. For a full discussion of risk factors, see Item 1A, "Risk Factors".

Readers are cautioned not to place undue reliance on forward-looking statements as such statements speak only as of the date they were made and involve risks and uncertainties that could cause actual events or results to differ materially from the events or results described in the forward-looking statements. The most important factors which could cause our actual results to differ from our forward-looking statements are set forth in our description of risk factors in Item 1A contained in our Annual Report on Form 10-K for the fiscal year ended February 3, 2024 which should be read in conjunction with the forward-looking statements in this Quarterly Report on Form 10-Q. Forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update any forward-looking statement.

The events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. As a result, our actual results may differ materially from the results contemplated by these forward-looking statements.

We maintain a website at www.genesco.com where investors and other interested parties may obtain, free of charge, press releases and other information as well as gain access to our periodic filings with the Securities and Exchange Commission (“SEC”). The information contained on this website should not be considered to be a part of this or any other report filed with or furnished to the SEC.

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements (unaudited)

Genesco Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(In thousands, except share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets |

|

May 4, 2024 |

|

|

February 3, 2024 |

|

|

April 29, 2023 |

|

Current Assets: |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

19,247 |

|

|

$ |

35,155 |

|

|

$ |

31,786 |

|

Accounts receivable, net of allowances of $2,545 at May 4, 2024, |

|

|

|

|

|

|

|

|

|

$4,266 at February 3, 2024 and $4,051 at April 29, 2023 |

|

|

50,119 |

|

|

|

53,618 |

|

|

|

54,068 |

|

Inventories |

|

|

392,671 |

|

|

|

378,967 |

|

|

|

470,763 |

|

Prepaids and other current assets |

|

|

46,003 |

|

|

|

39,611 |

|

|

|

42,325 |

|

Total current assets |

|

|

508,040 |

|

|

|

507,351 |

|

|

|

598,942 |

|

Property and equipment, net |

|

|

233,601 |

|

|

|

240,266 |

|

|

|

239,120 |

|

Operating lease right of use assets |

|

|

420,133 |

|

|

|

436,896 |

|

|

|

477,962 |

|

Non-current prepaid income taxes |

|

|

57,441 |

|

|

|

56,839 |

|

|

|

54,567 |

|

Goodwill |

|

|

9,417 |

|

|

|

9,565 |

|

|

|

37,928 |

|

Other intangibles |

|

|

26,914 |

|

|

|

27,250 |

|

|

|

27,538 |

|

Deferred income taxes |

|

|

26,119 |

|

|

|

26,230 |

|

|

|

28,729 |

|

Other noncurrent assets |

|

|

25,752 |

|

|

|

25,493 |

|

|

|

30,526 |

|

Total Assets |

|

|

1,307,417 |

|

|

|

1,329,890 |

|

|

|

1,495,312 |

|

Liabilities and Equity |

|

|

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

|

108,847 |

|

|

|

114,621 |

|

|

|

143,814 |

|

Current portion - operating lease liabilities |

|

|

125,450 |

|

|

|

129,189 |

|

|

|

131,830 |

|

Other accrued liabilities |

|

|

73,888 |

|

|

|

75,727 |

|

|

|

75,992 |

|

Total current liabilities |

|

|

308,185 |

|

|

|

319,537 |

|

|

|

351,636 |

|

Long-term debt |

|

|

59,444 |

|

|

|

34,682 |

|

|

|

118,151 |

|

Long-term operating lease liabilities |

|

|

345,670 |

|

|

|

359,073 |

|

|

|

399,374 |

|

Other long-term liabilities |

|

|

45,665 |

|

|

|

45,396 |

|

|

|

43,526 |

|

Total liabilities |

|

|

758,964 |

|

|

|

758,688 |

|

|

|

912,687 |

|

Commitments and contingent liabilities |

|

|

— |

|

|

|

— |

|

|

|

— |

|

Equity |

|

|

|

|

|

|

|

|

|

Non-redeemable preferred stock |

|

|

812 |

|

|

|

813 |

|

|

|

812 |

|

Common equity: |

|

|

|

|

|

|

|

|

|

Common stock, $1 par value: |

|

|

|

|

|

|

|

|

|

Authorized: 80,000,000 shares |

|

|

|

|

|

|

|

|

|

Issued common stock |

|

|

12,122 |

|

|

|

11,961 |

|

|

|

13,052 |

|

Additional paid-in capital |

|

|

322,288 |

|

|

|

319,143 |

|

|

|

308,817 |

|

Retained earnings |

|

|

271,647 |

|

|

|

296,766 |

|

|

|

318,538 |

|

Accumulated other comprehensive loss |

|

|

(40,559 |

) |

|

|

(39,624 |

) |

|

|

(40,737 |

) |

Treasury shares, at cost (488,464 shares) |

|

|

(17,857 |

) |

|

|

(17,857 |

) |

|

|

(17,857 |

) |

Total equity |

|

|

548,453 |

|

|

|

571,202 |

|

|

|

582,625 |

|

Total Liabilities and Equity |

|

$ |

1,307,417 |

|

|

$ |

1,329,890 |

|

|

$ |

1,495,312 |

|

The accompanying Notes are an integral part of these Condensed Consolidated Financial Statements.

Genesco Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

(In thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

May 4, 2024 |

|

|

April 29, 2023 |

|

Net sales |

|

|

$ |

457,597 |

|

|

$ |

483,332 |

|

Cost of sales |

|

|

|

241,316 |

|

|

|

254,524 |

|

Gross margin |

|

|

|

216,281 |

|

|

|

228,808 |

|

Selling and administrative expenses |

|

|

|

247,831 |

|

|

|

251,497 |

|

Asset impairments and other, net |

|

|

|

578 |

|

|

|

308 |

|

Operating loss |

|

|

|

(32,128 |

) |

|

|

(22,997 |

) |

Other components of net periodic benefit cost |

|

|

|

109 |

|

|

|

92 |

|

Interest expense, net |

|

|

|

890 |

|

|

|

1,651 |

|

Loss from continuing operations before income taxes |

|

|

|

(33,127 |

) |

|

|

(24,740 |

) |

Income tax benefit |

|

|

|

(8,839 |

) |

|

|

(5,865 |

) |

Loss from continuing operations |

|

|

|

(24,288 |

) |

|

|

(18,875 |

) |

Loss from discontinued operations, net of tax |

|

|

|

(59 |

) |

|

|

(15 |

) |

Net Loss |

|

|

$ |

(24,347 |

) |

|

$ |

(18,890 |

) |

|

|

|

|

|

|

|

|

Basic loss per common share: |

|

|

|

|

|

|

|

Continuing operations |

|

|

$ |

(2.22 |

) |

|

$ |

(1.60 |

) |

Discontinued operations |

|

|

|

(0.01 |

) |

|

|

0.00 |

|

Net loss |

|

|

$ |

(2.23 |

) |

|

$ |

(1.60 |

) |

|

|

|

|

|

|

|

|

Diluted loss per common share: |

|

|

|

|

|

|

|

Continuing operations |

|

|

$ |

(2.22 |

) |

|

$ |

(1.60 |

) |

Discontinued operations |

|

|

|

(0.01 |

) |

|

|

0.00 |

|

Net loss |

|

|

$ |

(2.23 |

) |

|

$ |

(1.60 |

) |

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

Basic |

|

|

|

10,930 |

|

|

|

11,818 |

|

Diluted |

|

|

|

10,930 |

|

|

|

11,818 |

|

The accompanying Notes are an integral part of these Condensed Consolidated Financial Statements.

Genesco Inc. and Subsidiaries

Condensed Consolidated Statements of Comprehensive Loss

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

May 4, 2024 |

|

|

April 29, 2023 |

|

Net loss |

|

$ |

(24,347 |

) |

|

$ |

(18,890 |

) |

Other comprehensive income (loss): |

|

|

|

|

|

|

Postretirement liability adjustments, net of tax |

|

|

38 |

|

|

|

29 |

|

Foreign currency translation adjustments |

|

|

(973 |

) |

|

|

445 |

|

Total other comprehensive income (loss) |

|

|

(935 |

) |

|

|

474 |

|

Comprehensive Loss |

|

$ |

(25,282 |

) |

|

$ |

(18,416 |

) |

The accompanying Notes are an integral part of these Condensed Consolidated Financial Statements.

Genesco Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

May 4, 2024 |

|

|

April 29, 2023 |

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

Net loss |

|

$ |

(24,347 |

) |

|

$ |

(18,890 |

) |

Adjustments to reconcile net loss to net cash used in |

|

|

|

|

|

|

operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

13,237 |

|

|

|

11,286 |

|

Deferred income taxes |

|

|

399 |

|

|

|

16 |

|

Impairment of long-lived assets |

|

|

244 |

|

|

|

308 |

|

Share-based compensation expense |

|

|

3,307 |

|

|

|

3,772 |

|

Other |

|

|

72 |

|

|

|

315 |

|

Changes in working capital and other assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

3,573 |

|

|

|

(13,367 |

) |

Inventories |

|

|

(14,466 |

) |

|

|

(11,789 |

) |

Prepaids and other current assets |

|

|

(6,415 |

) |

|

|

(16,364 |

) |

Accounts payable |

|

|

(5,816 |

) |

|

|

359 |

|

Other accrued liabilities |

|

|

(2,158 |

) |

|

|

(4,843 |

) |

Other assets and liabilities |

|

|

(1,374 |

) |

|

|

(11,248 |

) |

Net cash used in operating activities |

|

|

(33,744 |

) |

|

|

(60,445 |

) |

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

Capital expenditures |

|

|

(6,377 |

) |

|

|

(17,235 |

) |

Proceeds from asset sales |

|

|

— |

|

|

|

87 |

|

Net cash used in investing activities |

|

|

(6,377 |

) |

|

|

(17,148 |

) |

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

Borrowings under revolving credit facility |

|

|

83,374 |

|

|

|

152,569 |

|

Payments on revolving credit facility |

|

|

(58,573 |

) |

|

|

(79,469 |

) |

Shares repurchased related to share repurchase plan |

|

|

— |

|

|

|

(9,170 |

) |

Shares repurchased related to taxes for share-based awards |

|

|

(773 |

) |

|

|

(449 |

) |

Change in overdraft balances |

|

|

214 |

|

|

|

(1,698 |

) |

Net cash provided by financing activities |

|

|

24,242 |

|

|

|

61,783 |

|

Effect of foreign exchange rate fluctuations on cash |

|

|

(29 |

) |

|

|

(394 |

) |

Net decrease in cash |

|

|

(15,908 |

) |

|

|

(16,204 |

) |

Cash at beginning of period |

|

|

35,155 |

|

|

|

47,990 |

|

Cash at end of period |

|

$ |

19,247 |

|

|

$ |

31,786 |

|

Supplemental information: |

|

|

|

|

|

|

Interest paid |

|

$ |

761 |

|

|

$ |

1,147 |

|

Income taxes paid |

|

|

1,116 |

|

|

|

626 |

|

The accompanying Notes are an integral part of these Condensed Consolidated Financial Statements.

Genesco Inc. and Subsidiaries

Condensed Consolidated Statements of Equity

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-

Redeemable

Preferred

Stock |

|

Common

Stock |

|

Additional

Paid-In

Capital |

|

Retained

Earnings |

|

Accumulated

Other

Comprehensive

Loss |

|

Treasury

Shares |

|

Total

Equity |

|

Balance January 28, 2023 |

$ |

815 |

|

$ |

13,089 |

|

$ |

305,260 |

|

$ |

346,870 |

|

$ |

(41,211 |

) |

$ |

(17,857 |

) |

$ |

606,966 |

|

Net loss |

|

— |

|

|

— |

|

|

— |

|

|

(18,890 |

) |

|

— |

|

|

— |

|

|

(18,890 |

) |

Other comprehensive income |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

474 |

|

|

— |

|

|

474 |

|

Share-based compensation expense |

|

— |

|

|

— |

|

|

3,772 |

|

|

— |

|

|

— |

|

|

— |

|

|

3,772 |

|

Restricted stock issuance |

|

— |

|

|

234 |

|

|

(234 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Restricted shares withheld for taxes |

|

— |

|

|

(13 |

) |

|

13 |

|

|

(449 |

) |

|

— |

|

|

— |

|

|

(449 |

) |

Shares repurchased |

|

— |

|

|

(255 |

) |

|

— |

|

|

(8,915 |

) |

|

— |

|

|

— |

|

|

(9,170 |

) |

Other |

|

(3 |

) |

|

(3 |

) |

|

6 |

|

|

(78 |

) |

|

— |

|

|

— |

|

|

(78 |

) |

Balance April 29, 2023 |

$ |

812 |

|

$ |

13,052 |

|

$ |

308,817 |

|

$ |

318,538 |

|

$ |

(40,737 |

) |

$ |

(17,857 |

) |

$ |

582,625 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-

Redeemable

Preferred

Stock |

|

Common

Stock |

|

Additional

Paid-In

Capital |

|

Retained

Earnings |

|

Accumulated

Other

Comprehensive

Loss |

|

Treasury

Shares |

|

Total

Equity |

|

Balance February 3, 2024 |

$ |

813 |

|

$ |

11,961 |

|

$ |

319,143 |

|

$ |

296,766 |

|

$ |

(39,624 |

) |

$ |

(17,857 |

) |

$ |

571,202 |

|

Net loss |

|

— |

|

|

— |

|

|

— |

|

|

(24,347 |

) |

|

— |

|

|

— |

|

|

(24,347 |

) |

Other comprehensive loss |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(935 |

) |

|

— |

|

|

(935 |

) |

Share-based compensation expense |

|

— |

|

|

— |

|

|

3,307 |

|

|

— |

|

|

— |

|

|

— |

|

|

3,307 |

|

Restricted stock issuance |

|

— |

|

|

198 |

|

|

(198 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Restricted shares withheld for taxes |

|

— |

|

|

(29 |

) |

|

29 |

|

|

(773 |

) |

|

— |

|

|

— |

|

|

(773 |

) |

Other |

|

(1 |

) |

|

(8 |

) |

|

7 |

|

|

1 |

|

|

— |

|

|

— |

|

|

(1 |

) |

Balance May 4, 2024 |

$ |

812 |

|

$ |

12,122 |

|

$ |

322,288 |

|

$ |

271,647 |

|

$ |

(40,559 |

) |

$ |

(17,857 |

) |

$ |

548,453 |

|

The accompanying Notes are an integral part of these Condensed Consolidated Financial Statements.

Genesco Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements (unaudited)

Note 1

Summary of Significant Accounting Policies

Basis of Presentation

These Condensed Consolidated Financial Statements should be read in conjunction with our Consolidated Financial Statements and Notes for Fiscal 2024, which are contained in our Annual Report on Form 10-K as filed with the SEC on March 27, 2024. The Condensed Consolidated Financial Statements and Notes contained in this report are unaudited but reflect all adjustments, including normal recurring adjustments, necessary for a fair presentation of the results for the interim periods of the fiscal year ending February 1, 2025 ("Fiscal 2025"), which is a 52-week year, and of the fiscal year ended February 3, 2024 ("Fiscal 2024"), which was a 53-week year. All subsidiaries are consolidated in the Condensed Consolidated Financial Statements. All significant intercompany transactions and accounts have been eliminated. The results of operations for any interim period are not necessarily indicative of results for the full year. The Condensed Consolidated Financial Statements and the related Notes have been prepared in accordance with the instructions to Form 10-Q and do not include all of the information and notes required by U.S. Generally Accepted Accounting Principles (“GAAP”) for complete financial statements. The Condensed Consolidated Balance Sheet as of February 3, 2024 has been derived from the audited financial statements at that date.

Nature of Operations

Genesco Inc. and its subsidiaries (collectively the "Company", "Genesco," "we", "our", or "us") business includes the sourcing and design, marketing and distribution of footwear and accessories through retail stores in the U.S., Puerto Rico and Canada primarily under the Journeys®, Journeys Kidz®, Little Burgundy® and Johnston & Murphy® banners and under the Schuh® banner in the United Kingdom (“U.K.”) and the Republic of Ireland (“ROI”); through e-commerce websites including the following: journeys.com, journeyskidz.com, journeys.ca, littleburgundyshoes.com, schuh.co.uk, schuh.ie, schuh.eu, johnstonmurphy.com, johnstonmurphy.ca, nashvilleshoewarehouse.com and dockersshoes.com as well as catalogs. We also source, design, market and distribute footwear and accessories at wholesale, primarily under our Johnston & Murphy brand, the licensed Levi's® brand, the licensed Dockers® brand, the licensed G.H. Bass® brand and other brands that we license for footwear. At May 4, 2024, we operated 1,321 retail stores in the U.S., Puerto Rico, Canada, the U.K. and the ROI.

During the three months ended May 4, 2024 and April 29, 2023, we operated four reportable business segments (not including corporate): (i) Journeys Group, comprised of the Journeys, Journeys Kidz and Little Burgundy retail footwear chains and e-commerce operations; (ii) Schuh Group, comprised of the Schuh retail footwear chain and e-commerce operations; (iii) Johnston & Murphy Group, comprised of Johnston & Murphy retail operations, e-commerce operations and wholesale distribution of products under the Johnston & Murphy brand; and (iv) Genesco Brands Group, comprised of the licensed Dockers, Levi's, and G.H. Bass brands, as well as other brands we license for footwear.

Selling and Administrative Expenses

Wholesale costs of distribution are included in selling and administrative expenses on the Condensed Consolidated Statements of Operations in the amount of $2.4 million and $3.5 million for the first quarters of Fiscal 2025 and Fiscal 2024, respectively.

Retail occupancy costs recorded in selling and administrative expenses were $75.5 million and $76.4 million for the first quarters of Fiscal 2025 and Fiscal 2024, respectively.

Advertising Costs

Advertising costs were $23.7 million and $23.6 million for the first quarters of Fiscal 2025 and Fiscal 2024, respectively.

Vendor Allowances

Vendor reimbursements of cooperative advertising costs recognized as a reduction of selling and administrative expenses were $1.9 million and $4.7 million for the first quarters of Fiscal 2025 and Fiscal 2024, respectively. During the first three months of each of Fiscal 2025 and Fiscal 2024, our cooperative advertising reimbursements received were not in excess of the costs incurred.

Genesco Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements (unaudited)

Note 1

Summary of Significant Accounting Policies, Continued

New Accounting Pronouncements

We continuously monitor and review all current accounting pronouncements and standards from the FASB of U.S. GAAP for applicability to our operations and financial reporting. As of May 4, 2024, there were no other new pronouncements or interpretations, other than those disclosed in the Annual Report on Form 10-K for the fiscal year ended February 3, 2024, that had or were expected to have a significant impact on our financial reporting.

Note 2

Goodwill and Other Intangible Assets

The changes in the carrying amount of goodwill for the Journeys Group segment were as follows:

|

|

|

|

(In thousands) |

Total

Goodwill |

|

Balance, February 3, 2024 |

$ |

9,565 |

|

Effect of foreign currency exchange rates |

|

(148 |

) |

Balance, May 4, 2024 |

$ |

9,417 |

|

Other intangibles by major classes were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trademarks |

|

Customer Lists |

|

|

Other |

|

|

Total |

|

(In thousands) |

|

May 4, 2024 |

|

|

Feb. 3, 2024 |

|

May 4, 2024 |

|

|

Feb. 3, 2024 |

|

|

May 4, 2024 |

|

|

Feb. 3, 2024 |

|

|

May 4, 2024 |

|

|

Feb. 3, 2024 |

|

Gross other intangibles |

|

$ |

24,270 |

|

|

$ |

24,464 |

|

$ |

6,490 |

|

|

$ |

6,501 |

|

|

$ |

400 |

|

|

$ |

400 |

|

|

$ |

31,160 |

|

|

$ |

31,365 |

|

Accumulated amortization |

|

|

— |

|

|

|

— |

|

|

(3,846 |

) |

|

|

(3,715 |

) |

|

|

(400 |

) |

|

|

(400 |

) |

|

|

(4,246 |

) |

|

|

(4,115 |

) |

Net Other Intangibles |

|

$ |

24,270 |

|

|

$ |

24,464 |

|

$ |

2,644 |

|

|

$ |

2,786 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

26,914 |

|

|

$ |

27,250 |

|

Note 3

Inventories

|

|

|

|

|

|

|

|

|

(In thousands) |

|

May 4, 2024 |

|

|

February 3, 2024 |

|

Wholesale finished goods |

|

$ |

44,268 |

|

|

$ |

57,678 |

|

Retail merchandise |

|

|

348,403 |

|

|

|

321,289 |

|

Total Inventories |

|

$ |

392,671 |

|

|

$ |

378,967 |

|

Genesco Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements (unaudited)

Note 4

Fair Value

Fair Value of Financial Instruments

The carrying amounts and fair values of our financial instruments at May 4, 2024 and February 3, 2024 are:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In thousands) |

May 4, 2024 |

|

February 3, 2024 |

|

|

Carrying

Amount |

|

Fair

Value |

|

Carrying

Amount |

|

Fair

Value |

|

U.S. Revolver Borrowings |

$ |

59,444 |

|

$ |

59,595 |

|

$ |

34,682 |

|

$ |

34,638 |

|

Total Long-Term Debt |

$ |

59,444 |

|

$ |

59,595 |

|

$ |

34,682 |

|

$ |

34,638 |

|

Debt fair values were determined using a discounted cash flow analysis based on current market interest rates for similar types of financial instruments and would be classified in Level 2 within the fair value hierarchy. We did not have any debt classified as current portion as of May 4, 2024 or February 3, 2024.

As of May 4, 2024, we have $0.7 million of long-lived assets held and used which were measured using Level 3 inputs within the fair value hierarchy. As of May 4, 2024, we have $6.5 million of investments held and used which were measured using Level 1 inputs within the fair value hierarchy.

Note 5

Long-Term Debt

The revolver borrowings outstanding under the Credit Facility as of May 4, 2024 included $56.3 million U.S. revolver borrowings and $3.1 million (C$4.3 million) related to GCO Canada ULC. We were in compliance with all the relevant terms and conditions of the Credit Facility and Facility Agreement as of May 4, 2024. Excess availability under the Credit Facility was $200.1 million at May 4, 2024.

Note 6

Earnings Per Share

Weighted-average number of shares used to calculate earnings per share are as follows:

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

(Shares in thousands) |

|

May 4, 2024 |

|

|

April 29, 2023 |

|

Weighted-average number of shares - basic |

|

|

10,930 |

|

|

|

11,818 |

|

Common stock equivalents |

|

|

- |

|

|

|

- |

|

Weighted-average number of shares - diluted |

|

|

10,930 |

|

|

|

11,818 |

|

Common stock equivalents of 0.2 million shares are excluded for each of the three months ended May 4, 2024 and April 29, 2023 due to the loss from continuing operations because to do so would be anti-dilutive.

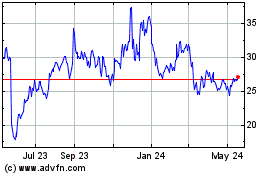

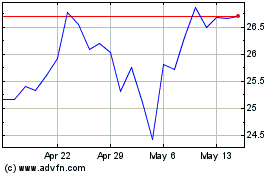

We did not repurchase any shares during the first quarter of Fiscal 2025. We have $52.1 million remaining as of May 4, 2024 under our expanded share repurchase authorization announced in June 2023. We repurchased 255,000 shares during the first quarter of Fiscal 2024 at a cost of $9.2 million, or $35.96 per share.

During the second quarter of Fiscal 2025, through June 12, 2024, we have repurchased 7,700 shares at a cost of $0.2 million, or $24.90 per share.

Genesco Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements (unaudited)

Note 7

Legal Proceedings

Environmental Matters

The Company has legacy obligations including environmental monitoring and reporting costs related to: (i) a 2016 Consent Judgment entered into with the United States Environmental Protection Agency involving the site of a knitting mill operated by a former subsidiary from 1965 to 1969 in Garden City, New York; and (ii) a 2010 Consent Decree with the Michigan Department of Natural Resources and Environment relating to our former Volunteer Leather Company facility in Whitehall, Michigan. We do not expect that future obligations related to either of these sites will have a material effect on our consolidated financial condition or results of operations.

Accrual for Environmental Contingencies

Related to all outstanding environmental contingencies, we had accrued $2.0 million as of May 4, 2024, $2.0 million as of February 3, 2024 and $1.7 million as of April 29, 2023. All such provisions reflect our estimates of the most likely cost (undiscounted, including both current and noncurrent portions) of resolving the contingencies, based on facts and circumstances as of the time they were made. There is no assurance that relevant facts and circumstances will not change, necessitating future changes to the provisions. Such contingent liabilities for discontinued operations are included in other accrued liabilities and other long-term liabilities on the accompanying Condensed Consolidated Balance Sheets because they relate to former facilities operated by us. We have made pretax accruals for certain of these contingencies which were not material for the first quarter of Fiscal 2025 or Fiscal 2024. These charges are included in loss from discontinued operations, net of tax in the Condensed Consolidated Statements of Operations and represent changes in estimates.

In addition to the matters specifically described in this Note, we are a party to other legal and regulatory proceedings and claims arising in the ordinary course of our business. While management does not believe that our liability with respect to any of these other matters is likely to have a material effect on our condensed consolidated financial statements, legal proceedings are subject to inherent uncertainties, and unfavorable rulings could have a material adverse impact on our condensed consolidated financial statements.

As part of our Genesco Brands Group business, we have a commitment to Samsung C&T America, Inc. (“Samsung”) related to the ultimate sale and valuation of any inventories owned by Samsung. If product is sold below Samsung’s cost, we are required to pay to Samsung the difference between the sales price and its cost. At May 4, 2024, the inventory owned by Samsung had a historical cost of $7.8 million. As of May 4, 2024, we believe that we have appropriately accounted for any differences between the fair value of the Samsung inventory and Samsung's historical cost.

Genesco Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements (unaudited)

Note 9

Business Segment Information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended May 4, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

(In thousands) |

Journeys

Group |

|

Schuh

Group |

|

Johnston

& Murphy

Group |

|

Genesco Brands Group |

|

Corporate

& Other |

|

Consolidated |

|

Sales |

$ |

259,445 |

|

$ |

92,349 |

|

$ |

79,207 |

|

$ |

28,593 |

|

$ |

— |

|

$ |

459,594 |

|

Intercompany sales |

|

— |

|

|

— |

|

|

— |

|

|

(1,997 |

) |

|

— |

|

|

(1,997 |

) |

Net sales to external customers(1) |

|

259,445 |

|

|

92,349 |

|

|

79,207 |

|

|

26,596 |

|

|

— |

|

|

457,597 |

|

Segment operating income (loss) |

|

(18,822 |

) |

|

(5,896 |

) |

|

2,355 |

|

|

(986 |

) |

|

(8,201 |

) |

|

(31,550 |

) |

Asset impairments and other(2) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

578 |

|

|

578 |

|

Operating income (loss) |

|

(18,822 |

) |

|

(5,896 |

) |

|

2,355 |

|

|

(986 |

) |

|

(8,779 |

) |

|

(32,128 |

) |

Other components of net periodic benefit cost |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

109 |

|

|

109 |

|

Interest expense, net |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

890 |

|

|

890 |

|

Earnings (loss) from continuing operations before income taxes |

$ |

(18,822 |

) |

$ |

(5,896 |

) |

$ |

2,355 |

|

$ |

(986 |

) |

$ |

(9,778 |

) |

$ |

(33,127 |

) |

Total assets (3) |

$ |

653,489 |

|

$ |

209,372 |

|

$ |

153,890 |

|

$ |

54,716 |

|

$ |

235,950 |

|

$ |

1,307,417 |

|

Depreciation and amortization |

|

8,612 |

|

|

1,869 |

|

|

1,382 |

|

|

314 |

|

|

1,060 |

|

|

13,237 |

|

Capital expenditures |

|

3,491 |

|

|

733 |

|

|

1,715 |

|

|

231 |

|

|

207 |

|

|

6,377 |

|

(1) Net sales in North America and in the U.K., which includes the ROI, accounted for 80% and 20%, respectively, of our net sales in the first quarter of Fiscal 2025.

(2) Asset impairments and other includes a $0.3 million charge for asset impairments in Journeys Group and $0.3 million for severance.

(3) Of our $653.7 million of long-lived assets, $90.0 million and $11.9 million relate to long-lived assets in the U.K. and Canada, respectively.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended April 29, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

(In thousands) |

Journeys

Group |

|

Schuh

Group |

|

Johnston

& Murphy

Group |

|

Genesco Brands Group |

|

Corporate

& Other |

|

Consolidated |

|

Sales |

$ |

272,190 |

|

$ |

93,105 |

|

$ |

82,630 |

|

$ |

35,864 |

|

$ |

— |

|

$ |

483,789 |

|

Intercompany sales |

|

— |

|

|

— |

|

|

(3 |

) |

|

(454 |

) |

|

— |

|

|

(457 |

) |

Net sales to external customers(1) |

|

272,190 |

|

|

93,105 |

|

|

82,627 |

|

|

35,410 |

|

|

— |

|

|

483,332 |

|

Segment operating income (loss) |

|

(18,362 |

) |

|

(1,790 |

) |

|

4,806 |

|

|

(32 |

) |

|

(7,311 |

) |

|

(22,689 |

) |

Asset impairments and other (2) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

308 |

|

|

308 |

|

Operating income (loss) |

|

(18,362 |

) |

|

(1,790 |

) |

|

4,806 |

|

|

(32 |

) |

|

(7,619 |

) |

|

(22,997 |

) |

Other components of net periodic benefit cost |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

92 |

|

|

92 |

|

Interest expense, net |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,651 |

|

|

1,651 |

|

Earnings (loss) from continuing operations before income taxes |

$ |

(18,362 |

) |

$ |

(1,790 |

) |

$ |

4,806 |

|

$ |

(32 |

) |

$ |

(9,362 |

) |

$ |

(24,740 |

) |

Total assets (3) |

$ |

765,064 |

|

$ |

212,579 |

|

$ |

187,247 |

|

$ |

78,313 |

|

$ |

252,109 |

|

$ |

1,495,312 |

|

Depreciation and amortization |

|

7,347 |

|

|

1,561 |

|

|

1,120 |

|

|

203 |

|

|

1,055 |

|

|

11,286 |

|

Capital expenditures |

|

13,019 |

|

|

2,151 |

|

|

1,205 |

|

|

455 |

|

|

405 |

|

|

17,235 |

|

(1) Net sales in North America and in the U.K., which includes the ROI, accounted for 81% and 19%, respectively, of our net sales for the first quarter of Fiscal 2024.

(2) Asset impairments and other includes a $0.3 million charge for asset impairments in Journeys Group.

(3) Of our $717.1 million of long-lived assets, $91.2 million and $15.4 million relate to long-lived assets in the U.K. and Canada, respectively.

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

This section discusses management’s view of the financial condition, results of operations and cash flows of the Company. This section should be read in conjunction with the information contained in our Annual Report on Form 10-K for the fiscal year ended February 3, 2024, including the Risk Factors section, and information contained elsewhere in this Quarterly Report on Form 10-Q, including the Condensed Consolidated Financial Statements and notes to those financial statements. The results of operations for any interim period may not necessarily be indicative of the results that may be expected for any future interim period or the entire fiscal year.

Summary of Results of Operations

Our net sales decreased 5.3% to $457.6 million in the first quarter of Fiscal 2025 compared to $483.3 million in the first quarter of Fiscal 2024. The sales decrease compared to last year's first quarter was driven by a decline in store sales in all of our retail businesses, decreased wholesale sales primarily reflecting the repositioning of the Genesco Brands Group business to a more refined portfolio of licenses and the impact of net store closings, partially offset by a 3% increase in comparable e-commerce sales for the total Company and a $2.5 million favorable impact in sales due to changes in foreign exchange rates. Our sales for the first quarter of Fiscal 2025 included approximately $9.2 million due to moving a week of sales from the second quarter last year to the first quarter this year related to last year's 53-week calendar shift. The consumer environment remains choppy with consumers continuing to show a willingness to shop when there's a reason and shopping almost exclusively for key footwear items and brands. In addition, ongoing inflationary pressures continue to impact discretionary spending behavior. Journeys Group sales decreased 5%, Schuh Group sales decreased 1%, Johnston & Murphy Group sales decreased 4% and Genesco Brands Group sales decreased 25%, or an aggregate of $8.8 million for the first quarter of Fiscal 2025 compared to the first quarter of Fiscal 2024. Schuh's sales decreased 4% on a local currency basis for the first quarter of Fiscal 2025. Total comparable sales decreased 5% for the first quarter of Fiscal 2025, with same store sales down 7% and comparable e-commerce sales up 3%.

Gross margin decreased 5.5% to $216.3 million in the first quarter of Fiscal 2025 from $228.8 million in the first quarter of Fiscal 2024 and was flat as a percentage of net sales at 47.3% reflecting increased gross margin as a percentage of net sales in Journeys Group and Johnston & Murphy Group, partially offset by decreased gross margin as a percentage of net sales in Schuh Group and Genesco Brands Group. The flat gross margin as a percentage of net sales reflects lower markdowns at Journeys as a result of disciplined inventory management and a greater mix of direct-to-consumer sales, offset by decreased gross margin at Schuh reflecting product mix pressure and decreased gross margin at Genesco Brands reflecting a $1.6 million inventory provision for a distribution model transition.

Selling and administrative expenses in the first quarter of Fiscal 2025 decreased 1.5% to $247.8 million from $251.5 million compared to the first quarter of Fiscal 2024, reflecting the impact of our cost savings initiatives, including net store closures. Selling and administrative expenses increased as a percentage of net sales in the first quarter of Fiscal 2025 compared to the first quarter of Fiscal 2024 from 52.0% to 54.2%, reflecting increased expenses as a percentage of net sales in all of our operating business units except Genesco Brands Group. The overall increase in expenses as a percentage of net sales reflects the deleverage of expenses, especially occupancy expense, selling salaries, professional fees and depreciation expense, primarily as a result of decreased revenue in the first quarter of Fiscal 2025.

Operating margin was a loss of 7.0% in the first quarter of Fiscal 2025 compared to a loss of 4.8% in the first quarter of Fiscal 2024 reflecting decreased operating margin in all of our operating business units. The decrease in operating margin for the first quarter this year compared to the first quarter last year was impacted by decreased net sales and increased expenses as a percentage of net sales, while gross margin as a percentage of net sales remained flat.

The loss from continuing operations before income taxes (“pretax loss”) for the first quarter of Fiscal 2025 was $33.1 million compared to a pretax loss of $24.7 million for the first quarter of Fiscal 2024. The pretax loss for the first quarter of Fiscal 2025 included a $1.6 million charge for a distribution model transition in the Genesco Brands Group and asset impairment and other charges of $0.6 million for severance and asset impairments. The pretax loss for the first quarter of Fiscal 2024 included asset impairment and other charges of $0.3 million for asset impairments.

We had an effective income tax rate of 26.7% and 23.7% in the first quarter of Fiscal 2025 and Fiscal 2024, respectively. The higher tax rate for the first quarter this year compared to the first quarter last year reflects an increase in the applicable statutory tax rate in our U.K. jurisdiction from 24% to 25% and an increase in the amount of foreign losses for which we are unable to recognize a tax benefit.

The net loss in the first quarter of Fiscal 2025 was $24.3 million, or $2.23 diluted loss per share, compared to a net loss of $18.9 million, or $1.60 diluted loss per share, in the first quarter of Fiscal 2024.

Critical Accounting Estimates

We discuss our critical accounting estimates in Item 7, "Management’s Discussion and Analysis of Financial Condition and Results of Operations", in our Annual Report on Form 10-K for the fiscal year ended February 3, 2024. We describe our significant accounting policies in Note 1, "Summary of Significant Accounting Policies", of the Notes to Consolidated Financial Statements included in our Annual Report on

Form 10-K for the fiscal year ended February 3, 2024. There have been no other significant changes in our definition of significant accounting policies or critical accounting estimates since the end of Fiscal 2024.

Key Performance Indicators

In assessing the performance of our business, we consider a variety of performance and financial measures. The key performance indicators we use to evaluate the financial condition and operating performance of our business are comparable sales, net sales, gross margin, operating income and operating margin. These key performance indicators should not be considered superior to, as a substitute for or as an alternative to, and should be considered in conjunction with, the U.S. GAAP financial measures presented herein. These measures may not be comparable to similarly titled performance indicators used by other companies.

Comparable Sales

We consider comparable sales to be an important indicator of our current performance, and investors may find it useful as such. Comparable sales results are important to achieve leveraging of our costs, including occupancy, selling salaries, depreciation, etc. Comparable sales also have a direct impact on our total net revenue, cash and working capital. We define "comparable sales" as sales from stores open longer than one year, beginning with the first day a store has comparable sales (which we refer to as "same store sales"), and sales from websites operated longer than one year and direct mail catalog sales (which we refer to in this report as "comparable e-commerce sales"). Temporarily closed stores are excluded from the comparable sales calculation if closed for more than seven days. Expanded stores are excluded from the comparable sales calculation until the first day an expanded store has comparable prior year sales. Current year foreign exchange rates are applied to both current year and prior year comparable sales to achieve a consistent basis for comparison.

Results of Operations – First Quarter of Fiscal 2025 Compared to First Quarter of Fiscal 2024

Journeys Group

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

|

May 4, 2024 |

|

|

April 29, 2023 |

|

|

%

Change |

|

|

|

(dollars in thousands) |

|

|

|

|

Net sales |

|

$ |

259,445 |

|

|

$ |

272,190 |

|

|

|

(4.7 |

)% |

Operating loss |

|

$ |

(18,822 |

) |

|

$ |

(18,362 |

) |

|

|

(2.5 |

)% |

Operating margin |

|

|

(7.3 |

)% |

|

|

(6.7 |

)% |

|

|

|

Net sales from Journeys Group decreased 4.7% to $259.4 million in the first quarter of Fiscal 2025, compared to $272.2 million in the first quarter of Fiscal 2024, primarily due to a total comparable sales decrease of 5% driven by decreased store sales, partially offset by increased e-commerce sales, and a 6% decrease in the average number of stores in the first quarter this year. We've experienced pressure on Journeys' core product assortment including boots and vulcanized product. We believe the Journeys consumer continues to be pressured by inflation and has chosen to conserve discretionary spending and primarily shop for key footwear items and brands. We closed 17 Journeys Group stores in the first quarter of Fiscal 2025 and continue to evaluate up to 50 Journeys store closures in Fiscal 2025. Journeys Group operated 1,047 stores at the end of the first quarter of Fiscal 2025, including 221 Journeys Kidz stores, 39 Journeys stores in Canada and 31 Little Burgundy stores in Canada, compared to 1,115 stores at the end of the first quarter of last year, including 232 Journeys Kidz stores, 42 Journeys stores in Canada and 34 Little Burgundy stores in Canada.

Journeys Group had an operating loss of $18.8 million in the first quarter of Fiscal 2025 compared to an operating loss of $18.4 million in the first quarter of Fiscal 2024. The increase in the operating loss for Journeys Group was due to (i) decreased net sales and (ii) increased selling and administrative expenses as a percentage of net sales reflecting the deleverage of expenses, especially occupancy expense, depreciation expense and selling salaries as a result of the decreased revenue in the first quarter of Fiscal 2025. In absolute dollars, selling and administrative expenses decreased 3.1%, which demonstrates the impact of our cost savings initiatives and closing underperforming stores. Gross margin as a percentage of net sales increased for the first quarter of Fiscal 2025, reflecting lower markdowns as a result of disciplined inventory management, partially offset by decreased initial mark-ons driven by a shift in brand mix.

Schuh Group

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

|

May 4, 2024 |

|

|

April 29, 2023 |

|

|

%

Change |

|

|

|

(dollars in thousands) |

|

|

|

|

Net sales |

|

$ |

92,349 |

|

|

$ |

93,105 |

|

|

|

(0.8 |

)% |

Operating loss |

|

$ |

(5,896 |

) |

|

$ |

(1,790 |

) |

|

|

(229.4 |

)% |

Operating margin |

|

|

(6.4 |

)% |

|

|

(1.9 |

)% |

|

|

|

Net sales from Schuh Group decreased 0.8% to $92.3 million in the first quarter of Fiscal 2025 compared to $93.1 million in the first quarter of Fiscal 2024, primarily due to decreased total comparable sales of 7% driven by decreased store sales and e-commerce sales, partially offset by a favorable impact of $2.5 million due to changes in foreign exchange rates. Schuh continued to contend with a challenging U.K. macro environment in the first quarter this year and unseasonable weather to start the spring selling season. In addition, Schuh Group sales in the first quarter of Fiscal 2025 compares against strong sales growth in the first quarters of Fiscal 2024 and Fiscal 2023. Just like the Journeys consumer, the U.K. consumer is more discriminating and key-item focused in their purchases. Schuh's e-commerce business remains a key channel for consumer engagement, accounting for approximately 40% of its sales in the first quarter of Fiscal 2025. Schuh's sales decreased 4% on a local currency basis for the first quarter of Fiscal 2025. Schuh Group operated 122 stores at the end of the first quarter of Fiscal 2025, compared to 123 stores at the end of the first quarter of Fiscal 2024.

Schuh Group had an operating loss of $5.9 million in the first quarter of Fiscal 2025 compared to an operating loss of $1.8 million in the first quarter of Fiscal 2024. The $4.1 million increase in operating loss compared to last year reflects (i) decreased net sales, (ii) decreased gross margin as a percentage of net sales reflecting a brand mix shift and (iii) increased selling and administrative expenses as a percentage of net sales, reflecting increased marketing, depreciation and compensation expenses. In addition, the operating loss included an unfavorable impact of $0.2 million due to changes in foreign exchange rates compared to last year.

Johnston & Murphy Group

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

|

May 4, 2024 |

|

|

April 29, 2023 |

|

|

%

Change |

|

|

|

(dollars in thousands) |

|

|

|

|

Net sales |

|

$ |

79,207 |

|

|

$ |

82,627 |

|

|

|

(4.1 |

)% |

Operating income |

|

$ |

2,355 |

|

|

$ |

4,806 |

|

|

|

(51.0 |

)% |

Operating margin |

|

|

3.0 |

% |

|

|

5.8 |

% |

|

|

|

Johnston & Murphy Group net sales decreased 4.1% to $79.2 million for the first quarter of Fiscal 2025 from $82.6 million for the first quarter of Fiscal 2024, primarily due to a 3% decrease in comparable sales, reflecting decreased store sales and e-commerce sales with the slower start to spring selling, and decreased wholesale sales as well as a 3% decrease in the average number of stores in the first quarter this year. In addition, Johnston & Murphy Group sales in the first quarter of Fiscal 2025 compares against strong sales growth in the first quarters of Fiscal 2024 and Fiscal 2023. Johnston & Murphy just launched its new marketing campaign, "Not Your Dad's Shoe Company" which continues to showcase the repositioning of the business to a more casual, modern lifestyle brand. The brand's apparel and accessories continued to resonate well with its consumers in the first quarter this year. Retail operations accounted for 74.0% of Johnston & Murphy Group's sales in the first quarter of Fiscal 2025, up from 72.9% in the first quarter of Fiscal 2024. The store count for Johnston & Murphy retail operations at the end of the first quarter of Fiscal 2025 was 152 stores, including five stores in Canada, compared to 158 stores, including six stores in Canada, at the end of the first quarter of Fiscal 2024.

Johnston & Murphy Group had operating income of $2.4 million for the first quarter of Fiscal 2025 compared to $4.8 million in the first quarter of Fiscal 2024. The decrease in operating income compared to last year reflects (i) decreased net sales and (ii) increased selling and administrative expenses as a percentage of net sales for the first quarter of Fiscal 2025, reflecting the deleverage of expenses, especially marketing expense, occupancy expense and selling salaries as a result of decreased revenue in the first quarter of Fiscal 2025, partially offset by decreased performance-based compensation. Gross margin as a percentage of net sales increased for the first quarter of Fiscal 2025, reflecting lower warehouse costs.

Genesco Brands Group

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

|

May 4, 2024 |

|

|

April 29, 2023 |

|

|

%