0001467858FALSE00014678582025-02-262025-02-26

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM 8-K

___________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 26, 2025

___________________

GENERAL MOTORS COMPANY

(Exact name of registrant as specified in its charter)

__________________

| | | | | | | | | | | |

Delaware | 001-34960 | 27-0756180 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 300 Renaissance Center, | Detroit, | Michigan | | | 48265 | -3000 |

| (Address of principal executive offices) | (Zip Code) |

(313) 667-1500

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

__________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | GM | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 7.01 Regulation FD Disclosure

A copy of the press release issued by General Motors Company (the “Company”) relating to the matters described in Item 8.01 of this Current Report on Form 8-K is attached as Exhibit 99.1 hereto and incorporated by reference into this Item 7.01.

The information furnished pursuant to this Item 7.01 of Current Report on Form 8-K shall not be considered “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and such information shall not be deemed incorporated by reference in any filing by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

ITEM 8.01 Other Events

On February 24, 2025, the Board of Directors (the “Board”) of the Company authorized an increase under the Company’s share repurchase program to an aggregate of $6.3 billion, of which $0.3 billion of capacity was remaining under the Company’s previously authorized program. Following the completion of the transactions contemplated in the ASR Agreements (as defined below), the Company expects to have $4.3 billion in share repurchase capacity for additional, opportunistic share repurchases. The Company also announced that it expects to increase its quarterly common stock dividend by $0.03 per share, beginning with the Company’s next quarterly dividend which is expected to be declared in April 2025.

ASR Agreements

On February 26, 2025, the Company entered into a master confirmation (each a “Master Confirmation”) and supplemental confirmation (together with the related Master Confirmation, collectively, the “ASR Agreements”), with each of Barclays Bank PLC (“Barclays”) and J.P. Morgan Chase Bank, National Association (“JPM” and, collectively with Barclays, the “Counterparties”). Under the ASR Agreements, the Company will repurchase an aggregate of $2.0 billion of the Company’s common stock (such transaction, the “ASR”) as part of the share repurchase program approved by the Company’s Board on February 24, 2025. Pursuant to the ASR Agreements, the Company will advance an aggregate amount of $2.0 billion to the Counterparties on February 27, 2025 and will immediately receive and retire an initial delivery of shares of the Company’s common stock with a value of $1.6 billion. The final number of shares to ultimately be repurchased under the ASR Agreements will be based on the average of the daily volume-weighted average prices of the Company’s common stock during the term of the ASR Agreements, less a discount and subject to adjustments pursuant to the terms and conditions of the ASR Agreements. Upon final settlement of the ASR, under certain circumstances, each of the Counterparties may be required to deliver additional shares of common stock, or the Company may be required to deliver shares of common stock or to make a cash payment, at its election, to the Counterparties. The final settlement of the transactions contemplated under the ASR Agreements is scheduled to occur no later than June 30, 2025, which, in each case, may be accelerated at the option of the applicable Counterparty under certain limited circumstances.

Each of the ASR Agreements contains customary terms for these types of transactions, including, among others, the mechanisms to determine the number of shares or the amount of cash that will be delivered at settlement, the required timing of delivery upon settlement, the specific circumstances under which adjustments may be made to the transactions, the specific circumstances under which the transactions may be cancelled prior to the scheduled maturity, and various acknowledgments, representations, and warranties made by the Company and the Counterparties, as applicable, to one another.

Cautionary Note on Forward-Looking Statements:

This Current Report on Form 8-K and the document incorporated herein by reference include “forward-looking statements” within the meaning of the U.S. federal securities laws. Future declarations of quarterly dividends and the establishment of future record and payment dates, as well as repurchases of shares, are at the discretion of our Board of Directors and will be based on a number of factors, including our future financial performance and other investment priorities. Forward-looking statements are any statements other than statements of historical fact. Forward-looking statements represent our current judgment about possible future events and are often identified by words like “aim,” “anticipate,” “appears,” “approximately,” “believe,” “continue,” “could,” “designed,” “effect,” “estimate,” “evaluate,” “expect,” “forecast,” “goal,” “initiative,” “intend,” “may,” “objective,” “outlook,” “plan,” “potential,” “priorities,” “project,” “pursue,” “seek,” “should,” “target,” “when,” “will,” “would,” or the negative of any of those words or similar expressions. In making these statements, we rely on assumptions and analysis based on our experience and perception of historical trends, current conditions and expected future developments as well as other factors we consider appropriate under the circumstances. We believe these judgments are reasonable, but these statements are not guarantees of any future events or financial results, and our actual results may differ materially due to a variety of important factors, many of which are beyond our control. These factors, which may be revised or supplemented in subsequent reports we file with the SEC, include, among others, the following: (1) our ability to deliver new products, services, technologies and customer experiences in response to increased competition and changing consumer needs and preferences; (2) our ability to attract and retain talented and highly skilled employees; (3) our ability to timely fund and introduce new and

improved vehicle models, including electric vehicles (“EVs”), that are able to attract a sufficient number of consumers; (4) our ability to profitably deliver a strategic portfolio of EVs; (5) our long-term strategy is dependent on consumer adoptions of EVs; (6) the success of our current line of internal combustion engine vehicles, particularly our full-size SUVs and full-size pickup trucks; (7) our highly competitive industry, which has been historically characterized by excess manufacturing capacity and the use of incentives, and the introduction of new and improved vehicle models by our competitors; (8) the unique technological, operational, regulatory and competitive risks related to our recently announced plans to refocus our autonomous vehicle (“AV”) strategy on personal vehicles; (9) risks associated with climate change, including increased regulation of greenhouse gas emissions, our transition to EVs and the potential increased impacts of severe weather events; (10) global automobile market sales volume, which can be volatile; (11) inflationary pressures and persistently high prices and uncertain availability of raw materials and commodities used by us and our suppliers, and instability in logistics and related costs; (12) our business in China, which is subject to unique operational, competitive, regulatory and economic risks; (13) the success of our ongoing strategic business relationships, particularly with respect to facilitating access to raw materials necessary for the production of EVs, and of our joint ventures, which we cannot operate solely for our benefit and over which we may have limited control; (14) the international scale and footprint of our operations, which expose us to a variety of unique political, economic, competitive and regulatory risks, including the risk of changes in government leadership and laws (including labor, trade, tax and other laws), political uncertainty or instability and economic tensions between governments and changes in international trade policies, new barriers to entry and changes to or withdrawals from free trade agreements, changes in foreign exchange rates and interest rates, economic downturns in the countries in which we operate, differing local product preferences and product requirements, changes to and compliance with U.S. and foreign countries' export controls and economic sanctions, differing labor regulations, requirements and union relationships, differing dealer and franchise regulations and relationships, difficulties in obtaining financing in foreign countries, and public health crises, including the occurrence of a contagious disease or illness; (15) any significant disruption, including any work stoppages, at any of our manufacturing facilities; (16) the ability of our suppliers to deliver parts, systems and components without disruption and at such times to allow us to meet production schedules; (17) pandemics, epidemics, disease outbreaks and other public health crises; (18) the possibility that competitors may independently develop products and services similar to ours, or that our intellectual property rights are not sufficient to prevent competitors from developing or selling those products or services; (19) our ability to manage risks related to security breaches, cyberattacks and other disruptions to our information technology systems and networked products, including connected vehicles; (20) our ability to manage security breaches and other disruptions to our in-vehicle systems; (21) our ability to comply with increasingly complex, restrictive and punitive regulations relating to our enterprise data practices, including the collection, use, sharing and security of the personal information of our customers, employees or suppliers; (22) our ability to comply with extensive laws, regulations and policies applicable to our operations and products, including those relating to fuel economy, emissions and AVs; (23) costs and risks associated with litigation and government investigations; (24) the costs and effect on our reputation of product safety recalls and alleged defects in products and services; (25) any additional tax expense or exposure or failure to fully realize available tax incentives; (26) our continued ability to develop captive financing capability through GM Financial; and (27) any significant increase in our pension funding requirements. A further list and description of these risks, uncertainties and other factors can be found in our most recent Annual Report on Form 10-K and our subsequent filings with the SEC.

We caution readers not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information, future events or other factors, except where we are expressly required to do so by law.

ITEM 9.01 Financial Statements and Exhibits

EXHIBIT

| | | | | |

| Exhibit | Description |

| |

| Exhibit 99.1 | |

| Exhibit 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | GENERAL MOTORS COMPANY (Registrant)

|

| By: | /s/ JOHN S. KIM |

| Date: February 26, 2025 | | John S. Kim

Assistant Corporate Secretary |

Exhibit 99.1 News For Release: Wednesday, February 26, 2025, 6:30 a.m. ET GM board approves new share repurchase plan, including $2 billion ASR, and higher rate for future dividends DETROIT, February 26, 2025 – General Motors (NYSE: GM) today announced that its Board of Directors has approved a $0.03 per share increase in the quarterly common stock dividend rate beginning with the next planned dividend, as well as a new $6 billion share repurchase authorization. The company has entered into an accelerated share repurchase (ASR) program to execute $2 billion of the share repurchase authorization. “The GM team’s execution continues to be strong across all three pillars of our capital allocation strategy, which are to reinvest in the business for profitable growth, maintain a strong investment grade balance sheet, and return capital to our shareholders,” said Mary Barra, chair and CEO. “We are growing our business thanks to our broad, deep, and compelling portfolio of ICE vehicles and EVs. At the same time, we are investing our capital in a disciplined and consistent way to continue generating strong margins and cash flows.” As the company shared last month, capital spending in 2025 is expected to be in the range of $10 billion - $11 billion, inclusive of investments in the company's battery cell manufacturing joint ventures. Spending on research and product development is expected to be more than $8 billion. The new quarterly dividend rate of $0.15 per share represents a $0.03 per share increase from the previous quarterly dividend of $0.12 per share. It will take effect with the company’s next planned dividend, which is expected to be declared in April 2025. “We feel confident in our business plan, our balance sheet remains strong, and we will be agile if we need to respond to changes in public policy,” said Paul Jacobson, executive vice president and CFO. “The repurchase authorization our board approved continues a commitment to our capital allocation policy.”

The share repurchase program, which has no expiration date, will be executed in accordance with applicable securities laws and regulations and may be suspended or discontinued at any time at the company's discretion. Through the ASR program, GM will advance an aggregate of $2 billion to the executing banks to receive and retire GM common stock. The total number of shares ultimately repurchased under the ASR program will be determined upon final settlement and will be based on the average of the daily volume-weighted average prices of GM’s common stock during the term of the program. The ASR program is expected to conclude in the second quarter of 2025. The ASR program will be executed by Barclays and J.P. Morgan. Outside of the ASR program, GM will have $4.3 billion of capacity remaining under its share repurchase authorizations for additional, opportunistic share repurchases. In 2024, GM’s weighted average common shares outstanding was 1.055 billion, and as of Dec. 31, 2024, the company had less than 1 billion total shares outstanding. General Motors (NYSE:GM) is driving the future of transportation, leveraging advanced technology to build safer, smarter, and lower emission cars, trucks, and SUVs. GM’s Buick, Cadillac, Chevrolet, and GMC brands offer a broad portfolio of innovative gasoline-powered vehicles and the industry’s widest range of EVs, as we move to an all-electric future. Learn more at GM.com. ### CONTACTS: Jim Cain Ashish Kohli GM Communications GM Investor Relations 313.407.2843 847.964.3459 james.cain@gm.com ashish.kohli@gm.com Cautionary Note on Forward-Looking Statements: This press release and related comments by management, may include “forward-looking statements” within the meaning of the U.S. federal securities laws. Future declarations of quarterly dividends and the establishment of future record and payment dates, as well as repurchases of shares, are at the discretion of our Board of Directors and will be based on a number of factors, including our future financial performance and other investment priorities. Forward-looking statements are any statements other than

statements of historical fact. Forward-looking statements represent our current judgment about possible future events and are often identified by words like “aim,” “anticipate,” “appears,” “approximately,” “believe,” “continue,” “could,” “designed,” “effect,” “estimate,” “evaluate,” “expect,” “forecast,” “goal,” “initiative,” “intend,” “may,” “objective,” “outlook,” “plan,” “potential,” “priorities,” “project,” “pursue,” “seek,” “should,” “target,” “when,” “will,” “would,” or the negative of any of those words or similar expressions. In making these statements, we rely on assumptions and analysis based on our experience and perception of historical trends, current conditions and expected future developments as well as other factors we consider appropriate under the circumstances. We believe these judgments are reasonable, but these statements are not guarantees of any future events or financial results, and our actual results may differ materially due to a variety of important factors, many of which are beyond our control. These factors, which may be revised or supplemented in subsequent reports we file with the SEC, include, among others, the following: (1) our ability to deliver new products, services, technologies and customer experiences; (2) our ability to attract and retain talented and highly skilled employees; (3) our ability to timely fund and introduce new and improved vehicle models, including electric vehicles (EVs); (4) our ability to profitably deliver a strategic portfolio of EVs; (5) our long-term strategy is dependent on consumer adoptions of EVs; (6) the success of our current line of internal combustion engine vehicles; (7) our highly competitive industry; (8) the unique technological, operational, regulatory and competitive risks related to our announced plans to refocus our AV strategy on personal vehicles; (9) risks associated with climate change, including increased regulation of GHG emissions, our transition to EVs; (10) global automobile market sales volume; (11) inflationary pressures, persistently high prices, uncertain availability of raw materials and commodities, and instability in logistics and related costs; (12) our business in China, which is subject to unique operational, competitive, regulatory and economic risks; (13) the success of our ongoing strategic business relationships and of our joint ventures; (14) the international scale and footprint of our operations, which exposes us to a variety of unique political, economic, competitive and regulatory risks, including the risk of changes in government leadership and laws, political uncertainty or instability and economic tensions between governments and changes in international trade policies; (15) any significant disruption at any of our manufacturing facilities; (16) the ability of our suppliers to deliver parts, systems and components without disruption and at such times to allow us to meet production schedules; (17) pandemics, epidemics, disease outbreaks and other public health crises; (18) the possibility that competitors may independently develop products and services similar to ours, or that our intellectual property rights are not sufficient to prevent competitors from developing or selling those products or services; (19) our ability to manage risks related to security breaches and other disruptions to our information technology systems and networked products, including connected vehicles; (20) our ability to manage security breaches and other disruptions to our in-vehicle systems; (21) our ability to comply with increasingly complex, restrictive and punitive regulations relating to our enterprise data practices; (22) our ability to comply with extensive laws, regulations and policies applicable to our operations and products, including those relating to fuel economy, emissions and AVs; (23) costs and risks associated with litigation and government investigations; (24) the costs and effect on our reputation of product safety recalls and alleged defects

in products and services; (25) any additional tax expense or exposure or failure to fully realize available tax incentives; (26) our continued ability to develop captive financing capability through General Motors Financial Company, Inc.; and (27) any significant increase in our pension funding requirements. A further list and description of these risks, uncertainties and other factors can be found in our most recent Annual Report on Form 10-K and our subsequent filings with the SEC. We caution readers not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information, future events or other factors, except where we are expressly required to do so by law.

v3.25.0.1

Cover

|

Feb. 26, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 26, 2025

|

| Entity Registrant Name |

GENERAL MOTORS COMPANY

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-34960

|

| Entity Tax Identification Number |

27-0756180

|

| Entity Address, Address Line One |

300 Renaissance Center,

|

| Entity Address, City or Town |

Detroit,

|

| Entity Address, State or Province |

MI

|

| Entity Address, Postal Zip Code |

48265

|

| City Area Code |

313

|

| Local Phone Number |

667-1500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

GM

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001467858

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

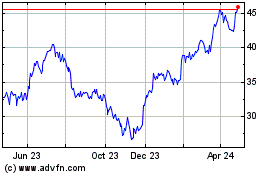

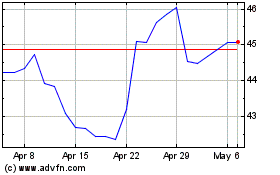

General Motors (NYSE:GM)

Historical Stock Chart

From Feb 2025 to Mar 2025

General Motors (NYSE:GM)

Historical Stock Chart

From Mar 2024 to Mar 2025