Gorman-Rupp Announces Increase in Quarterly Cash Dividend

October 25 2024 - 5:40AM

Business Wire

The Board of Directors of The Gorman-Rupp Company (NYSE: GRC)

has declared a quarterly cash dividend of $0.185 per share on the

common shares of the Company, payable December 10, 2024, to

shareholders of record November 15, 2024. The cash dividend will

represent a 2.8% increase over the $0.18 dividend per share paid in

the previous quarter.

This action will mark the 299th consecutive quarterly dividend

paid by The Gorman-Rupp Company and the 52nd consecutive year of

increased dividends to its shareholders, which positions

Gorman-Rupp in the top 50 of all U.S. public companies with respect

to number of years of increased dividend payments.

About The Gorman-Rupp Company

Founded in 1933, The Gorman-Rupp Company is a leading designer,

manufacturer and international marketer of pumps and pump systems

for use in diverse water, wastewater, construction, dewatering,

industrial, petroleum, original equipment, agriculture, fire

suppression, heating, ventilating and air conditioning (HVAC),

military and other liquid-handling applications.

Forward-Looking Statements

In connection with the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, The Gorman-Rupp Company

provides the following cautionary statement: This news release

contains various forward-looking statements based on assumptions

concerning The Gorman-Rupp Company’s operations, future results and

prospects. These forward-looking statements are based on current

expectations about important economic, political, and technological

factors, among others, and are subject to risks and uncertainties,

which could cause the actual results or events to differ materially

from those set forth in or implied by the forward-looking

statements and related assumptions. Such uncertainties include, but

are not limited to, our estimates of future earnings and cash

flows, general economic conditions and supply chain conditions and

any related impact on costs and availability of materials,

integration of the Fill-Rite business in a timely and cost

effective manner, retention of supplier and customer relationships

and key employees, the ability to achieve synergies and cost

savings in the amounts and within the time frames currently

anticipated and the ability to service and repay indebtedness

incurred in connection with the transaction. Other factors include,

but are not limited to: company specific risk factors including (1)

loss of key personnel; (2) intellectual property security; (3)

acquisition performance and integration; (4) the Company’s

indebtedness and how it may impact the Company’s financial

condition and the way it operates its business; (5) general risks

associated with acquisitions; (6) the anticipated benefits from the

Fill-Rite transaction may not be realized; (7) impairment in the

value of intangible assets, including goodwill; (8) defined benefit

pension plan settlement expense; (9) risk of reserve and expense

increases resulting from the LIFO inventory method, and (10) family

ownership of common equity; and general risk factors including (11)

continuation of the current and projected future business

environment; (12) highly competitive markets; (13) availability and

costs of raw materials and labor; (14) cybersecurity threats; (15)

compliance with, and costs related to, a variety of import and

export laws and regulations; (16) environmental compliance costs

and liabilities; (17) exposure to fluctuations in foreign currency

exchange rates; (18) conditions in foreign countries in which The

Gorman-Rupp Company conducts business; (19) changes in our tax

rates and exposure to additional income tax liabilities; and (20)

risks described from time to time in our reports filed with the

Securities and Exchange Commission. Except to the extent required

by law, we do not undertake and specifically decline any obligation

to review or update any forward-looking statements or to publicly

announce the results of any revisions to any of such statements to

reflect future events or developments or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241025501456/en/

Brigette A. Burnell Corporate Secretary The Gorman-Rupp Company

Telephone (419) 755-1246

For additional information, contact James C. Kerr, Chief

Financial Officer, Telephone (419) 755-1548.

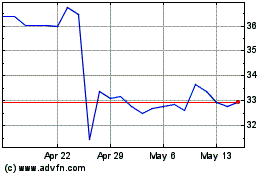

Gorman Rupp (NYSE:GRC)

Historical Stock Chart

From Dec 2024 to Jan 2025

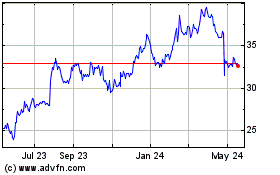

Gorman Rupp (NYSE:GRC)

Historical Stock Chart

From Jan 2024 to Jan 2025