FALSE000183462200018346222025-02-272025-02-27

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2025

Hayward Holdings, Inc.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-40208 | | 82-2060643 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

1415 Vantage Park Drive

Suite 400 Charlotte, NC 28203

(Address of principal executive offices, including zip code)

(704) 837-8002

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.001 per share | | HAYW | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| | | | | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On February 27, 2025, Hayward Holdings, Inc. (the “Company”) issued a press release announcing the Company’s financial results for the quarter and fiscal year ended December 31, 2024. A copy of this press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Form 8-K (including Exhibit 99.1 attached hereto) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing by the Company, under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

| | | | | | | | |

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| |

| | Press Release of the Company, dated February 27, 2025 |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| HAYWARD HOLDINGS, INC. |

| | |

Date: February 27, 2025 | By: | /s/ Eifion Jones |

| | Eifion Jones |

| | Senior Vice President and Chief Financial Officer |

February 27, 2025

Hayward Holdings Reports Fourth Quarter and Full Year 2024 Financial Results

and Introduces 2025 Guidance

FOURTH QUARTER FISCAL 2024 SUMMARY

•Net Sales increased 17% year-over-year to $327.1 million

•Net Income increased 76% year-over-year to $54.7 million

•Adjusted EBITDA* increased 30% year-over-year to $98.7 million

•Diluted EPS increased 79% year-over-year to $0.25

•Adjusted diluted EPS* increased 35% year-over-year to $0.27

FULL FISCAL YEAR 2024 HIGHLIGHTS

•Net Sales increased 6% year-over-year to $1,051.6 million

•Net Income increased 47% year-over-year to $118.7 million

•Adjusted EBITDA* increased 12% year-over-year to $277.4 million

•Diluted EPS and adjusted diluted EPS* of $0.54 and $0.67, increased 47% and 20%, respectively

•Strong cash flow from operations of $212.1 million

CHARLOTTE, N.C. -- (BUSINESS WIRE) -- Hayward Holdings, Inc. (NYSE: HAYW) (“Hayward” or the “Company”), a global designer, manufacturer, and marketer of a broad portfolio of pool and outdoor living technology, today announced financial results for the fourth quarter and full fiscal year ended December 31, 2024.

CEO COMMENTS

“I am pleased to report strong fourth quarter results ahead of expectations,” said Kevin Holleran, Hayward’s President and Chief Executive Officer. “We finished the year on a high note with increased shipments for in-quarter demand and robust early buy orders for the upcoming 2025 pool season, resulting in solid sales and earnings growth, margin expansion and increased cash flow generation. As I reflect on 2024, it was a successful year for Hayward despite the macroeconomic challenges faced by the pool industry, and I am proud of the performance of our team. In addition to returning to sales growth, we further strengthened the senior leadership team and executed our strategic plans to position the Company for continued growth. This included expanding our customer relationships, advancing our technology leadership position with the introduction of several innovative new products, and further demonstrating our operational excellence capabilities. Solid profitability and cash flow enabled us to reduce net leverage into our targeted range while completing accretive capital deployments for early debt repayment and a strategic acquisition. Looking forward, as we celebrate the 100th anniversary of Hayward’s founding in 1925, I am encouraged by the Company’s solid foundation and excited about the many opportunities to build on our momentum and deliver exceptional value to our customers and shareholders.”

FOURTH QUARTER FISCAL 2024 CONSOLIDATED RESULTS

Net sales increased by 17% to $327.1 million for the fourth quarter of fiscal 2024. The increase in net sales during the quarter was the result of higher volumes, an increase in net price and the favorable impact from acquisitions. The growth in volume was driven by increased in-quarter demand and a strong Early Buy program. The increase in net price was due to price increases enacted to offset inflationary pressure.

Gross profit increased by 23% to $168.0 million for the fourth quarter of fiscal 2024. Gross profit margin increased 220 basis points to 51.4%. The increase in gross margin was principally due to the management of our manufacturing costs, partially offset by an increase to cost of goods sold resulting from the fair value inventory step-up adjustment recognized as part of the purchase accounting for the acquisition of ChlorKing HoldCo, LLC and related entities (“ChlorKing”) and discrete inventory adjustments in Europe.

Selling, general, and administrative (“SG&A”) expenses increased by 19% to $73.3 million for the fourth quarter of fiscal 2024 compared to $61.6 million for the fourth quarter of fiscal 2023. The increase was largely driven by normalized annual incentive compensation, higher salary costs driven by wage inflation, targeted investments for growth and professional expenses. As a percentage of net sales, SG&A remained relatively flat at 22%. Research, development, and engineering expenses were $6.9

million for the fourth quarter of fiscal 2024, or 2% of net sales, as compared to $5.5 million for the prior-year period, or 2% of net sales.

Operating income increased by 38% to $76.5 million for the fourth quarter of fiscal 2024. The increase in operating income was driven by higher sales. Operating income as a percentage of net sales (“operating margin”) was 23.4% for the fourth quarter of fiscal 2024, a 350 basis point increase from the 19.9% operating margin in the fourth quarter of fiscal 2023.

Interest expense, net, decreased by 23% to $13.6 million for the fourth quarter of fiscal 2024 primarily due to the repayment of the Incremental Term Loan B principal balance in April 2024.

Income tax expense for the fourth quarter of fiscal 2024 was $8.7 million for an effective tax rate of 13.7%, compared to $8.1 million at an effective tax rate of 20.6% for the prior-year period. The increase in income tax expense was primarily due to the increase in income from operations. The decrease in the effective tax rate was driven by return-to-provision adjustments.

Net income increased by 76% to $54.7 million for the fourth quarter of fiscal 2024. Net income margin expanded 560 basis points to 16.7%.

Adjusted EBITDA* increased by 30% to $98.7 million for the fourth quarter of fiscal 2024. Adjusted EBITDA margin* expanded 300 basis points to 30.2%.

Diluted EPS increased by 79% to $0.25 for the fourth quarter of fiscal 2024. Adjusted diluted EPS* increased by 35% to $0.27 for the fourth quarter of fiscal 2024.

FOURTH QUARTER FISCAL 2024 SEGMENT RESULTS

North America

Net sales increased by 20% to $286.0 million for the fourth quarter of fiscal 2024. The increase was primarily the result of an increase in volume and the favorable impact of net price and acquisitions. The growth in volume was driven by increased in-quarter demand and a strong Early Buy program. The increase in net price was due to price increases enacted to offset inflationary pressure.

Segment income increased by 34% to $95.1 million for the fourth quarter of fiscal 2024. Adjusted segment income* increased by 39% to $104.9 million.

Europe & Rest of World

Net sales increased by 2% to $41.1 million for the fourth quarter of fiscal 2024. The increase was primarily due to modest volume growth driven by a strong Early Buy program and the favorable impact of net price, partially offset by the unfavorable impact of foreign currency translation.

Segment income decreased by 39% to $4.8 million for the fourth quarter of fiscal 2024. Adjusted segment income* decreased by 35% to $5.3 million.

FULL FISCAL YEAR 2024 CONSOLIDATED RESULTS

Net sales increased by 6% to $1,051.6 million for the full fiscal year 2024. The increase in net sales was primarily driven by an increase in net price, as well as by an increase in volume and the favorable impact from acquisitions. The increase in net price was due to price increases enacted to offset inflationary pressures. The increase in volume was primarily the result of normalized channel inventory movements, partially offset by market declines in the Middle East and Asia and lower new construction and remodel activity in the United States.

Gross profit increased by 11% to $530.8 million for the full fiscal year 2024. Gross profit margin increased to 50.5% for the fiscal year 2024, an increase of 240 basis points compared to the prior full year, primarily due to operational efficiencies, net price increases and management of our manufacturing costs, partially offset by an increase to cost of goods sold resulting from the fair value inventory step-up adjustment recognized as part of the purchase accounting for the acquisition of ChlorKing and discrete inventory adjustments in Europe.

Operating income increased by 19% to $208.8 million for the full fiscal year 2024. The increase in operating income was driven by the net sales growth. Operating margin was 19.9% in the full fiscal year 2024, a 220 basis point increase from the 17.7% operating margin in the prior full year.

Net income increased by 47% to $118.7 million for the full fiscal year 2024. Adjusted net income* increased by 20% to $147.9 million compared to the prior fiscal year. Net income margin expanded 320 basis points to 11.3%.

Adjusted EBITDA* increased by 12% to $277.4 million for the full fiscal year 2024 driven primarily by an increase in net sales, partially offset by an increase in SG&A expenses due to normalized annual incentive compensation. Adjusted EBITDA margin* increased by 150 basis points to 26.4% for the full fiscal year 2024 compared to the prior fiscal year.

Diluted EPS increased by 47% to $0.54 for the full fiscal year 2024. Adjusted diluted EPS* increased by 20% to $0.67 for the fiscal year 2024.

BALANCE SHEET AND CASH FLOW

As of December 31, 2024, Hayward had cash and cash equivalents of $196.6 million and $163.9 million available for borrowing under its credit facilities. Cash flow from operations for fiscal 2024 of $212.1 million was an increase of $27.6 million from the prior year primarily as a result of an increase in net income.

OUTLOOK

Hayward is introducing 2025 guidance reflecting sales and earnings growth driven by solid execution across the organization, positive price realization and continued technology adoption. For fiscal year 2025, Hayward expects net sales of approximately $1.060 billion to $1.100 billion and Adjusted EBITDA* of $280 million to $290 million.

Hayward is excited about the long-term dynamics of the pool industry. The installed base of pools increases every year, providing continued growth opportunities, and the Company benefits from favorable secular demand trends in outdoor living, sunbelt migration, and technology adoption. Hayward continues to leverage its competitive advantages and drive increasing adoption of its leading SmartPad™ pool equipment products both in new construction and the aftermarket, which has historically represented approximately 80% of net sales. Hayward is confident in its long-term outlook for profitable growth and robust cash flow generation, driven by its technology leadership, operational excellence, strong brand and installed base, and multi-channel capabilities.

Please see the Forward-Looking Statements section of this release for a discussion of certain risks relevant to Hayward’s outlook.

CONFERENCE CALL INFORMATION

Hayward will hold a conference call to discuss the results today, February 27, 2025 at 9:00 a.m. (ET).

Interested investors and other parties can also listen to a webcast of the live conference call by logging onto the Investor Relations section of the company's website at https://investor.hayward.com/events-and-presentations/default.aspx. An earnings presentation will be posted to the Investor Relations section of the Company’s website prior to the conference call. The conference call may also be accessed by dialing (877) 423-9813 or (201) 689-8573.

For those unable to listen to the live conference call, a replay will be available approximately three hours after the call through the archived webcast on the Hayward website or by dialing (844) 512-2921, or (412) 317-6671. The access code for the replay is 13750901. The replay will be available until 11:59 p.m. Eastern Time on March 13, 2025.

ABOUT HAYWARD HOLDINGS, INC.

Hayward Holdings, Inc. (NYSE: HAYW) is a leading global designer and manufacturer of pool and outdoor living technology. With a mission to deliver exceptional products, outstanding service and innovative solutions to transform the experience of water, Hayward offers a full line of energy-efficient and sustainable residential and commercial pool equipment including pumps, filters, heaters, cleaners, sanitizers, LED lighting, and water features all digitally connected through Hayward’s intuitive IoT-enabled SmartPad™.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains certain “forward-looking statements” as that term is defined under the Private Securities Litigation Reform Act of 1995 (the “Act”) and releases issued by the Securities and Exchange Commission (the “SEC”). Such forward-looking statements relating to Hayward are based on the beliefs of Hayward’s management as well as assumptions made by, and information currently available to it. These forward-looking statements include, but are not limited to, statements about Hayward’s strategies, plans, objectives, expectations, intentions, expenditures and assumptions and other statements contained in or incorporated by reference in this earnings release that are not historical facts. When used in this document, words such as “guidance,” “may,” “will,” “should,” “could,” “intend,” “potential,” “continue,” “anticipate,” “believe,” “estimate,” “expect,” “plan,” “target,” “predict,” “project,” “seek” and similar expressions as they relate to Hayward are intended to identify forward-looking statements. Hayward believes that it is important to communicate its future expectations to its stockholders, and it therefore makes forward-looking statements in reliance upon the safe harbor provisions of the Act. However, there may be events in the future that Hayward is not able to accurately predict or control, and actual results may differ materially from the expectations it describes in its forward-looking statements.

Examples of forward-looking statements include, among others, statements Hayward makes regarding: Hayward’s 2025 guidance; business plans and objectives; general economic and industry trends; business prospects; future product development and acquisition strategies; future channel stocking levels; growth and expansion opportunities; operating results; and working capital and liquidity. The forward-looking statements in this earnings release are only predictions. Hayward may not achieve the plans, intentions or expectations disclosed in Hayward’s forward-looking statements, and you should not place significant

reliance on its forward-looking statements. Hayward has based these forward-looking statements largely on its current expectations and projections about future events and financial trends that it believes may affect its business, financial condition and results of operations. Moreover, neither Hayward nor any other person assumes responsibility for the accuracy and completeness of forward-looking statements taken from third-party industry and market reports.

Important factors that could affect Hayward’s future results and could cause those results or other outcomes to differ materially from those indicated in its forward-looking statements include the following: its relationships with and the performance of distributors, builders, buying groups, retailers and servicers who sell Hayward’s products to pool owners; impacts on Hayward’s business from the sensitivity of its business to seasonality and unfavorable economic business conditions; competition from national and global companies, as well as lower-cost manufacturers; Hayward’s ability to develop, manufacture and effectively and profitably market and sell its new planned and future products; its ability to execute on its growth strategies and expansion opportunities; Hayward's exposure to credit risk on its accounts receivable; impacts on Hayward’s business from political, regulatory, economic, trade, and other risks associated with operating foreign businesses, including risks associated with geopolitical conflict; its ability to maintain favorable relationships with suppliers and manage disruptions to its global supply chain and the availability of raw materials; Hayward’s ability to identify emerging technological and other trends in its target end markets; failure of markets to accept new product introductions and enhancements; the ability to successfully identify, finance, complete and integrate acquisitions; its reliance on information technology systems and susceptibility to threats to those systems, including cybersecurity threats, and risks arising from its collection and use of personal information data; misuse of its technology-enabled products could lead to reduced sales, liability claims or harm to its reputation; the impact of product manufacturing disruptions, including as a result of catastrophic and other events beyond Hayward’s control; the potential adverse impact of tariffs and other trade restrictions on its business; regulatory changes and developments affecting Hayward’s current and future products; volatility in currency exchange rates and interest rates; Hayward’s ability to service its existing indebtedness and obtain additional capital to finance operations and its growth opportunities; Hayward’s ability to establish, maintain and effectively enforce intellectual property protection for its products, as well as its ability to operate its business without infringing, misappropriating or otherwise violating the intellectual property rights of others; the impact of material cost and other inflation; Hayward’s ability to attract and retain senior management and other qualified personnel; the impact of changes in laws, regulations and administrative policy, including those that limit U.S. tax benefits, impact trade agreements, or address the impacts of climate change; the outcome of litigation and governmental proceedings; uncertainties related to distribution channel inventory practices and its impact on sales volumes; Hayward’s ability to realize cost savings from restructuring activities and other factors set forth in “Risk Factors” in Hayward’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q.

Many of these factors are macroeconomic in nature and are, therefore, beyond Hayward’s control. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, Hayward’s actual results, performance or achievements may vary materially from those described in this earnings release as anticipated, believed, estimated, expected, intended, planned or projected. The forward-looking statements included in this earnings release are made only as of the date of this earnings release. Unless required by United States federal securities laws, Hayward neither intends nor assumes any obligation to update these forward-looking statements for any reason after the date of this earnings release to conform these statements to actual results or to changes in Hayward’s expectations.

*NON-GAAP FINANCIAL MEASURES

This earnings release includes certain financial measures not presented in accordance with the generally accepted accounting principles in the United States (“GAAP”) including adjusted net income, adjusted basic EPS, adjusted diluted EPS, EBITDA, adjusted EBITDA, adjusted EBITDA margin, adjusted segment income and adjusted segment income margin. These financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing the Company’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income (loss), operating income or other measures of profitability or performance under GAAP. You should be aware that the Company’s presentation of these measures may not be comparable to similarly titled measures used by other companies, which may be defined and calculated differently. See the appendix for a reconciliation of historical non-GAAP measures to the most directly comparable GAAP measures.

Reconciliation of fiscal 2025 adjusted EBITDA guidance (which is presented on a basis similar to the presentation of historical adjusted EBITDA) is not being provided, as Hayward does not currently have sufficient data to accurately estimate the variables and individual adjustments for such reconciliation.

Hayward Holdings, Inc.

Unaudited Consolidated Balance Sheets

(Dollars in thousands, except per share data) | | | | | | | | | | | | | | |

| | December 31, 2024 | | December 31, 2023 |

| Assets | | | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 196,589 | | | $ | 178,097 | |

Short-term investments | | — | | | 25,000 | |

Accounts receivable, net of allowances of $2,701 and $2,870, respectively | | 278,582 | | | 270,875 | |

| Inventories, net | | 216,472 | | | 215,180 | |

| Prepaid expenses | | 20,203 | | | 14,331 | |

| Income tax receivable | | 6,426 | | | 9,994 | |

| Other current assets | | 48,697 | | | 11,264 | |

| Total current assets | | 766,969 | | | 724,741 | |

Property, plant, and equipment, net of accumulated depreciation of $112,099 and $95,917, respectively | | 160,377 | | | 158,979 | |

| Goodwill | | 943,645 | | | 935,013 | |

| Trademark | | 736,000 | | | 736,000 | |

| Customer relationships, net | | 198,333 | | | 206,308 | |

| Other intangibles, net | | 96,095 | | | 94,082 | |

| Other non-current assets | | 89,205 | | | 91,161 | |

| Total assets | | $ | 2,990,624 | | | $ | 2,946,284 | |

| | | | |

Liabilities and Stockholders’ Equity | | | | |

| Current liabilities | | | | |

| Current portion of long-term debt | | $ | 13,991 | | | $ | 15,088 | |

| Accounts payable | | 81,476 | | | 68,943 | |

| Accrued expenses and other liabilities | | 217,242 | | | 155,543 | |

| Income taxes payable | | 273 | | | 109 | |

| Total current liabilities | | 312,982 | | | 239,683 | |

| Long-term debt, net | | 950,562 | | | 1,079,280 | |

| Deferred tax liabilities, net | | 239,111 | | | 248,967 | |

| Other non-current liabilities | | 64,322 | | | 66,896 | |

| Total liabilities | | 1,566,977 | | | 1,634,826 | |

| | | | |

| | | | |

Stockholders’ equity | | | | |

Preferred stock, $0.001 par value, 100,000,000 authorized, no shares issued or outstanding as of December 31, 2024 and December 31, 2023 | | — | | | — | |

Common stock $0.001 par value, 750,000,000 authorized; 244,444,889 issued and 215,778,520 outstanding at December 31, 2024; 242,832,045 issued and 214,165,676 outstanding at December 31, 2023 | | 245 | | | 243 | |

| Additional paid-in capital | | 1,093,468 | | | 1,080,894 | |

Common stock in treasury; 28,666,369 and 28,666,369 at December 31, 2024 and December 31, 2023, respectively | | (358,133) | | | (357,755) | |

| Retained earnings | | 699,564 | | | 580,909 | |

| Accumulated other comprehensive income (loss) | | (11,497) | | | 7,167 | |

Total stockholders’ equity | | 1,423,647 | | | 1,311,458 | |

Total liabilities, redeemable stock, and stockholders’ equity | | $ | 2,990,624 | | | $ | 2,946,284 | |

Hayward Holdings, Inc.

Unaudited Consolidated Statements of Operations

(Dollars in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31, 2024 | | December 31, 2023 | | December 31, 2024 | | December 31, 2023 |

| Net sales | | $ | 327,075 | | | $ | 278,469 | | | $ | 1,051,606 | | | $ | 992,452 | |

| Cost of sales | | 159,079 | | | 141,331 | | | 520,849 | | | 515,502 | |

| Gross profit | | 167,996 | | | 137,138 | | | 530,757 | | | 476,950 | |

| Selling, general and administrative expense | | 73,250 | | | 61,550 | | | 260,928 | | | 233,607 | |

| Research, development and engineering expense | | 6,908 | | | 5,520 | | | 25,778 | | | 24,547 | |

| Acquisition and restructuring related expense | | 3,976 | | | 6,993 | | | 6,464 | | | 13,213 | |

| Amortization of intangible assets | | 7,375 | | | 7,584 | | | 28,800 | | | 30,361 | |

| Operating income | | 76,487 | | | 55,491 | | | 208,787 | | | 175,222 | |

| Interest expense, net | | 13,563 | | | 17,645 | | | 62,163 | | | 73,584 | |

| Loss on debt extinguishment | | — | | | — | | | 4,926 | | | — | |

| Other (income) expense, net | | (495) | | | (1,247) | | | (2,484) | | | 551 | |

| Total other expense | | 13,068 | | | 16,398 | | | 64,605 | | | 74,135 | |

| Income from operations before income taxes | | 63,419 | | | 39,093 | | | 144,182 | | | 101,087 | |

| Provision for income taxes | | 8,686 | | | 8,057 | | | 25,527 | | | 20,400 | |

| Net income | | $ | 54,733 | | | $ | 31,036 | | | $ | 118,655 | | | $ | 80,687 | |

| | | | | | | | |

| Earnings per share | | | | | | | | |

| Basic | | $ | 0.25 | | | $ | 0.15 | | | $ | 0.55 | | | $ | 0.38 | |

| Diluted | | $ | 0.25 | | | $ | 0.14 | | | $ | 0.54 | | | $ | 0.37 | |

| | | | | | | | |

| Weighted average common shares outstanding | | | | | | | | |

| Basic | | 215,584,373 | | 213,768,108 | | | 215,028,683 | | | 213,144,063 | |

| Diluted | | 221,872,482 | | 220,848,098 | | | 221,370,188 | | | 220,688,616 | |

| | | | | | | | | | | | | | | | |

Hayward Holdings, Inc. Unaudited Consolidated Statements of Cash Flows (In thousands) | | Year Ended | | |

| December 31, 2024 | | December 31, 2023 | | |

| Cash flows from operating activities | | | | | | |

| Net income | | $ | 118,655 | | | $ | 80,687 | | | |

| Adjustments to reconcile net income to net cash provided by operating activities | | | | | | |

| Depreciation | | 20,078 | | | 15,983 | | | |

| Amortization of intangible assets | | 35,783 | | | 37,079 | | | |

| Amortization of deferred debt issuance fees | | 4,203 | | | 4,696 | | | |

| Stock-based compensation | | 10,595 | | | 9,165 | | | |

| Deferred income taxes | | (10,514) | | | (12,786) | | | |

| Allowance for bad debts | | (169) | | | (1,067) | | | |

| Loss on debt extinguishment | | 4,926 | | | — | | | |

| Loss on impairment | | — | | | 6,720 | | | |

| (Gain) loss on sale of property, plant and equipment | | (428) | | | 1,000 | | | |

| Changes in operating assets and liabilities | | | | | | |

| Accounts receivable | | (7,260) | | | (58,700) | | | |

| Inventories | | 4,330 | | | 67,824 | | | |

| Other current and non-current assets | | (41,167) | | | 24,820 | | | |

| Accounts payable | | 11,794 | | | 14,551 | | | |

| Accrued expenses and other liabilities | | 61,242 | | | (5,432) | | | |

| Net cash provided by operating activities | | 212,068 | | | 184,540 | | | |

| | | | | | |

| Cash flows from investing activities | | | | | | |

| Purchases of property, plant, and equipment | | (24,289) | | | (30,994) | | | |

Purchases of short-term investments | | — | | | (25,000) | | | |

| | | | | | |

| Acquisitions, net of cash acquired | | (55,153) | | | — | | | |

| Proceeds from sale of property, plant, and equipment | | 311 | | | 613 | | | |

| Proceeds from short-term investments | | 25,000 | | | — | | | |

| Net cash used in investing activities | | (54,131) | | | (55,381) | | | |

| | | | | | |

| Cash flows from financing activities | | | | | | |

| | | | | | |

| | | | | | |

| Purchases of common stock for treasury | | (378) | | | — | | | |

| Proceeds from issuance of long-term debt | | 2,886 | | | 5,448 | | | |

| | | | | | |

| Payments of long-term debt | | (138,638) | | | (12,518) | | | |

| Proceeds from revolving credit facility | | — | | | 144,100 | | | |

| Payments on revolving credit facility | | — | | | (144,100) | | | |

| Proceeds from issuance of short term debt | | 6,340 | | | 6,130 | | | |

| Payments of short term debt | | (6,463) | | | (6,894) | | | |

| | | | | | |

| Other, net | | (537) | | | 222 | | | |

| Net cash used in financing activities | | (136,790) | | | (7,612) | | | |

| | | | | | |

Effect of exchange rate changes on cash and cash equivalents | | (2,655) | | | 373 | | | |

Change in cash and cash equivalents | | 18,492 | | | 121,920 | | | |

Cash and cash equivalents, beginning of year | | 178,097 | | | 56,177 | | | |

Cash and cash equivalents, end of year | | $ | 196,589 | | | $ | 178,097 | | | |

| | | | | | |

| Supplemental disclosures of cash flow information: | | | | | | |

| Cash paid-interest | | $ | 68,476 | | | $ | 75,658 | | | |

| Cash paid-income taxes | | 35,938 | | | 16,420 | | | |

| | | | | | |

Non-cash investing and financing activities: | | | | | | |

Accrued and unpaid purchases of property, plant, and equipment | | $ | 4,567 | | | $ | 1,150 | | | |

| Equipment financed under finance leases | | 1,046 | | | (21) | | | |

Reconciliations

Consolidated Reconciliations

Adjusted EBITDA and Adjusted EBITDA Margin Reconciliations (Non-GAAP)

Following is a reconciliation from net income to adjusted EBITDA: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | | Three Months Ended | | Twelve Months Ended |

| | December 31, 2024 | | December 31, 2023 | | December 31, 2024 | | December 31, 2023 |

| Net income | | $ | 54,733 | | | $ | 31,036 | | | $ | 118,655 | | | $ | 80,687 | |

| Depreciation | | 6,149 | | | 2,965 | | | 20,078 | | | 15,983 | |

| Amortization | | 9,484 | | | 9,276 | | | 35,783 | | | 37,079 | |

| Interest expense | | 13,563 | | | 17,645 | | | 62,163 | | | 73,584 | |

| Income taxes | | 8,686 | | | 8,057 | | | 25,527 | | | 20,400 | |

| Loss on extinguishment of debt | | — | | | — | | | 4,926 | | | — | |

| EBITDA | | 92,615 | | | 68,979 | | | 267,132 | | | 227,733 | |

Stock-based compensation(a) | | 52 | | | 269 | | | 608 | | | 1,270 | |

| | | | | | | | |

Currency exchange items(b) | | (366) | | | (490) | | | (836) | | | 786 | |

Acquisition and restructuring related expense, net(c) | | 3,976 | | | 6,993 | | | 6,464 | | | 13,213 | |

Other(d) | | 2,422 | | | (96) | | | 4,079 | | | 4,271 | |

| Total Adjustments | | 6,084 | | | 6,676 | | | 10,315 | | | 19,540 | |

| Adjusted EBITDA | | $ | 98,699 | | | $ | 75,655 | | | $ | 277,447 | | | $ | 247,273 | |

| | | | | | | | |

| Net income margin | | 16.7 | % | | 11.1 | % | | 11.3 | % | | 8.1 | % |

| Adjusted EBITDA margin | | 30.2 | % | | 27.2 | % | | 26.4 | % | | 24.9 | % |

| | | | | | | | |

| (a) | | Represents non-cash stock-based compensation expense related to equity awards issued to management, employees, and directors. The adjustment includes only expense related to awards issued under the 2017 Equity Incentive Plan, which were awards granted prior to the effective date of Hayward’s initial public offering (the “IPO”). |

| (b) | | Represents unrealized non-cash (gains) losses on foreign denominated monetary assets and liabilities and foreign currency contracts. |

| (c) | | Adjustments in the fiscal quarter ended December 31, 2024 are primarily driven by $2.9 million of compensation expenses for the retention of key employees acquired in the ChlorKing acquisition. Pursuant to the ChlorKing acquisition agreement, this $3.2 million was part of a total $6.3 million employee retention payment that was deposited into an escrow account on the date of acquisition. The full amount held in escrow will be released to the specified key employees if such employees are employed by Hayward on the one-year anniversary of the acquisition. These payments are contingent on continued employment and are not dependent on the achievement of any metric or performance measure. The retention costs will be recognized over the twelve-month period from the date of acquisition. Also included in adjustments for the fiscal quarter ended December 31, 2024 is $0.9 million of termination benefits related to a reduction-in-force within E&RW and $0.1 million of transaction and integration costs associated with the acquisition of the ChlorKing business. Adjustments in the fiscal quarter ended December 31, 2023 are primarily driven by $6.7 million of costs related to the discontinuation of a product line leading to an impairment of the associated fixed assets, inventory and intangible assets. |

| | Adjustments in the year ended December 31, 2024 are primarily driven by $3.2 million of compensation expenses for the retention of key employees acquired in the ChlorKing acquisition. Pursuant to the ChlorKing acquisition agreement, this $3.2 million was part of a total $6.3 million employee retention payment that was deposited into an escrow account on the date of acquisition. The full amount held in escrow will be released to the specified key employees if such employees are employed by Hayward on the one-year anniversary of the acquisition. These payments are contingent on continued employment and are not dependent on the achievement of any metric or performance measure. The retention costs will be recognized over the twelve-month period from the date of acquisition. Further, other adjustments for the year ended December 31, 2024 include $1.1 million of transaction and integration costs associated with the acquisition of the ChlorKing business, $0.9 million of termination benefits related to a reduction-in-force within E&RW, $0.8 million of separation and other costs associated with the centralization and consolidation of operations in Europe and $0.4 million of costs to finalize restructuring actions initiated in prior years.

Adjustments in the year ended December 31, 2023 primarily include $6.7 million of costs related to the discontinuation of a product line leading to an impairment of the associated fixed assets, inventory and intangible assets, $2.4 million related to programs to centralize and consolidate manufacturing operations and professional services in Europe, $1.9 million of costs associated with the relocation of the corporate headquarters to Charlotte, North Carolina, $1.2 million separation costs associated with the 2022 cost reduction program and $0.8 million of costs associated with integration costs from prior acquisitions. |

| (d) | | Adjustments in the fiscal quarter ended December 31, 2024 are primarily driven by a $1.6 million increase in cost of goods sold resulting from the fair value inventory step-up adjustment recognized as part of the purchase accounting for the acquisition of the ChlorKing business and $0.7 million of costs sustained from flood damage associated with a hurricane at a contract manufacturing facility. Adjustments in the fiscal quarter ended December 31, 2023 are primarily related to programs to centralize and consolidate operations and professional services in Europe. |

| | Adjustments in the year ended December 31, 2024 are primarily driven by a $3.3 million increase in cost of goods sold resulting from the fair value inventory step-up adjustment recognized as part of the purchase accounting for the acquisition of the ChlorKing business, $0.7 million of costs sustained from flood damage associated with a hurricane at a contract manufacturing facility and $0.5 million of costs incurred related to litigation, partially offset by $0.5 million of gains on the sale of assets.

Adjustments in the year ended December 31, 2023 primarily include $1.8 million related to inventory and fixed asset write-offs in Europe and $1.5 million of costs incurred related to the selling stockholder offerings of shares in March, May and August 2023, which are reported in SG&A in our consolidated statements of operations. |

Adjusted Net Income and Adjusted EPS Reconciliation (Non-GAAP)

Following is a reconciliation of net income to adjusted net income and earnings per share to adjusted earnings per share:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands, except per share data) | | Three Months Ended | | Twelve Months Ended |

| | December 31, 2024 | | December 31, 2023 | | December 31, 2024 | | December 31, 2023 |

| Net income | | $ | 54,733 | | | $ | 31,036 | | | $ | 118,655 | | | $ | 80,687 | |

Tax adjustments (a) | | (7,167) | | | 974 | | | (9,389) | | | (1,930) | |

| Other adjustments and amortization: | | | | | | | | |

Stock-based compensation (b) | | 52 | | | 269 | | | 608 | | | 1,270 | |

Currency exchange items (c) | | (366) | | | (490) | | | (836) | | | 786 | |

Acquisition and restructuring related expense, net (d) | | 3,976 | | | 6,993 | | | 6,464 | | | 13,213 | |

Other (e) | | 2,422 | | | (96) | | | 4,079 | | | 4,271 | |

| Total other adjustments | | 6,084 | | | 6,676 | | | 10,315 | | 19,540 | |

| Loss on extinguishment of debt | | — | | | — | | | 4,926 | | | — | |

| Amortization | | 9,484 | | | 9,276 | | | 35,783 | | | 37,079 | |

Tax effect (f) | | (3,892) | | | (2,890) | | | (12,356) | | | (12,507) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Adjusted net income | | $ | 59,242 | | | $ | 45,072 | | | $ | 147,934 | | | $ | 122,869 | |

| | | | | | | | |

| Weighted average number of common shares outstanding, basic | | 215,584,373 | | | 213,768,108 | | | 215,028,683 | | | 213,144,063 | |

| Weighted average number of common shares outstanding, diluted | | 221,872,482 | | | 220,848,098 | | | 221,370,188 | | | 220,688,616 | |

| | | | | | | | |

| Basic EPS | | $ | 0.25 | | | $ | 0.15 | | | $ | 0.55 | | | $ | 0.38 | |

| Diluted EPS | | $ | 0.25 | | | $ | 0.14 | | | $ | 0.54 | | | $ | 0.37 | |

| | | | | | | | |

| Adjusted basic EPS | | $ | 0.27 | | | $ | 0.21 | | | 0.69 | | 0.58 |

| Adjusted diluted EPS | | $ | 0.27 | | | $ | 0.20 | | | 0.67 | | 0.56 |

| | | | | | | | |

| (a) | | Tax adjustments for the three and twelve months ended December 31, 2024 reflect a normalized tax rate of 25% and 24.2% compared to our effective tax rate of 13.7% and 17.7%, respectively. Our effective tax rate for the three and twelve months ended December 31, 2024 primarily includes the tax benefits resulting from prior period return-to-provision adjustments, revaluation of deferred tax liabilities as a result of state tax changes, and the exercise of stock options along with other miscellaneous items. Tax adjustments for the three and twelve months ended December 31, 2023 reflect a normalized tax rate of 18.1% and 22.1% compared to our effective tax rate of 20.6% and 20.2%, respectively. Our effective tax rate for the three months ended December 31, 2023 includes discrete tax expenses related to state tax audit settlements and stock options exercises, partially offset by the tax benefits from a state franchise tax adjustment and other miscellaneous items. Our effective tax rate for the twelve months ended December 31, 2023 includes the tax benefits resulting from the exercise of stock options and prior period return-to-provision adjustments, partially offset by the impact of a discrete tax expense related to a change in the indefinite reinvestment assertion for one jurisdiction and other miscellaneous items. |

| (b) | | Represents non-cash stock-based compensation expense related to equity awards issued to management, employees, and directors. The adjustment includes only expense related to awards issued under the 2017 Equity Incentive Plan, which were awards granted prior to the effective date of Hayward’s IPO. |

| (c) | | Represents unrealized non-cash (gains) losses on foreign denominated monetary assets and liabilities and foreign currency contracts. |

| (d) | | Adjustments in the fiscal quarter ended December 31, 2024 are primarily driven by $2.9 million of compensation expenses for the retention of key employees acquired in the ChlorKing acquisition. Pursuant to the ChlorKing acquisition agreement, this $3.2 million was part of a total $6.3 million employee retention payment that was deposited into an escrow account on the date of acquisition. The full amount held in escrow will be released to the specified key employees if such employees are employed by Hayward on the one-year anniversary of the acquisition. These payments are contingent on continued employment and are not dependent on the achievement of any metric or performance measure. The retention costs will be recognized over the twelve-month period from the date of acquisition. Also included in adjustments for the fiscal quarter ended December 31, 2024 is $0.9 million of termination benefits related to a reduction-in-force within E&RW and $0.1 million of transaction and integration costs associated with the acquisition of the ChlorKing business.

Adjustments in the fiscal quarter ended December 31, 2023 are primarily driven by $6.7 million of costs related to the discontinuation of a product line leading to an impairment of the associated fixed assets, inventory and intangible assets. |

| | Adjustments in the year ended December 31, 2024 are primarily driven by $3.2 million of compensation expenses for the retention of key employees acquired in the ChlorKing acquisition. Pursuant to the ChlorKing acquisition agreement, this $3.2 million was part of a total $6.3 million employee retention payment that was deposited into an escrow account on the date of acquisition. The full amount held in escrow will be released to the specified key employees if such employees are employed by Hayward on the one-year anniversary of the acquisition. These payments are contingent on continued employment and are not dependent on the achievement of any metric or performance measure. The retention costs will be recognized over the twelve-month period from the date of acquisition. Further, other adjustments for the year ended December 31, 2024 include $1.1 million of transaction and integration costs associated with the acquisition of the ChlorKing business, $0.9 million of termination benefits related to a reduction-in-force within E&RW, $0.8 million of separation and other costs associated with the centralization and consolidation of operations in Europe and $0.4 million of costs to finalize restructuring actions initiated in prior years.

Adjustments in the year ended December 31, 2023 primarily include $6.7 million of costs related to the discontinuation of a product line leading to an impairment of the associated fixed assets, inventory and intangible assets, $2.4 million related to programs to centralize and consolidate manufacturing operations and professional services in Europe, $1.9 million of costs associated with the relocation of the corporate headquarters to Charlotte, North Carolina, $1.2 million separation costs associated with the 2022 cost reduction program and $0.8 million of costs associated with integration costs from prior acquisitions. |

| (e) | | Adjustments in the fiscal quarter ended December 31, 2024 are primarily driven by a $1.6 million increase in cost of goods sold resulting from the fair value inventory step-up adjustment recognized as part of the purchase accounting for the acquisition of the ChlorKing business and $0.7 million of costs sustained from flood damage associated with a hurricane at a contract manufacturing facility. Adjustments in the fiscal quarter ended December 31, 2023 are primarily related to programs to centralize and consolidate operations and professional services in Europe. |

| | Adjustments in the year ended December 31, 2024 are primarily driven by a $3.3 million increase in cost of goods sold resulting from the fair value inventory step-up adjustment recognized as part of the purchase accounting for the acquisition of the ChlorKing business, $0.7 million of costs sustained from flood damage associated with a hurricane at a contract manufacturing facility and $0.5 million of costs incurred related to litigation, partially offset by $0.5 million of gains on the sale of assets.

Adjustments in the year ended December 31, 2023 primarily include $1.8 million related to inventory and fixed asset write-offs in Europe and $1.5 million of costs incurred related to the selling stockholder offerings of shares in March, May and August 2023, which are reported in SG&A in our consolidated statements of operations. |

| (f) | | The tax effect represents the immediately preceding adjustments at the normalized tax rates as discussed in footnote (a) above. |

| | |

Segment Reconciliations

Following is a reconciliation from segment income to adjusted segment income for the North America (“NAM”) and Europe & Rest of World (“E&RW”) segments: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | | | | Three Months Ended | | | | Three Months Ended |

| | | | December 31, 2024 | | | | December 31, 2023 |

| | | | NAM | | E&RW | | | | NAM | | E&RW |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Segment income | | | | $ | 95,089 | | $ | 4,832 | | | | $ | 71,079 | | $ | 7,871 |

| Depreciation | | | | $ | 5,370 | | | $ | 424 | | | | | $ | 2,658 | | | $ | 246 | |

| Amortization | | | | 2,111 | | | — | | | | | 1,692 | | | — | |

| Stock-based compensation | | | | — | | | — | | | | | 20 | | | 11 | |

Other (a) | | | | 2,356 | | | — | | | | | — | | | — | |

| Total adjustments | | | | 9,837 | | | 424 | | | | | 4,370 | | | 257 | |

| Adjusted segment income | | | | $ | 104,926 | | $ | 5,256 | | | | $ | 75,449 | | $ | 8,128 |

| | | | | | | | | | | | |

| Segment income margin % | | | | 33.2 | % | | 11.8 | % | | | | 29.8 | % | | 19.5 | % |

| Adjusted segment income margin % | | | | 36.7 | % | | 12.8 | % | | | | 31.7 | % | | 20.2 | % |

| | | | | | | | |

| | |

| (a) | | Adjustments in the fiscal quarter ended December 31, 2024 for NAM are primarily driven by a $1.6 million increase in cost of goods sold resulting from the fair value inventory step-up adjustment recognized as part of the purchase accounting for the acquisition of the ChlorKing business and $0.7 million of costs sustained from flood damage associated with a hurricane at a contract manufacturing facility. |

| | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | | | | Twelve Months Ended | | | | Twelve Months Ended |

| | | | December 31, 2024 | | | | December 31, 2023 |

| | | | NAM | | E&RW | | | | NAM | | E&RW |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Segment income | | | | $ | 261,735 | | $ | 21,632 | | | | $ | 215,425 | | $ | 33,518 |

| Depreciation | | | | $ | 17,989 | | | $ | 1,215 | | | | | $ | 14,610 | | | $ | 940 | |

| Amortization | | | | 6,985 | | | — | | | | | 6,718 | | | — | |

| Stock-based compensation | | | | 176 | | | 10 | | | | | 437 | | | 45 | |

Other (a) | | | | 4,079 | | | — | | | | | 503 | | | — | |

| Total adjustments | | | | 29,229 | | | 1,225 | | | | | 22,268 | | | 985 | |

Adjusted segment income | | | | $ | 290,964 | | $ | 22,857 | | | | $ | 237,693 | | $ | 34,503 |

| | | | | | | | | | | | |

| Segment income margin % | | | | 29.2 | % | | 13.9 | % | | | | 26.2 | % | | 19.8 | % |

Adjusted segment income margin % | | | | 32.5 | % | | 14.6 | % | | | | 28.9 | % | | 20.4 | % |

| | | | | | | | |

| | |

(a) | | Adjustments in the year ended December 31, 2024 for NAM include a $3.3 million increase in cost of goods sold resulting from the fair value inventory step-up adjustment recognized as part of the purchase accounting for the acquisition of the ChlorKing business and $0.7 million of costs related to a flood sustained at a contract manufacturer.

Adjustments in the year ended December 31, 2023 for NAM include miscellaneous items we believe are not representative of our ongoing business operations. |

| | |

CONTACTS

Investor Relations:

Kevin Maczka

investor.relations@hayward.com

Media Relations:

Misty Zelent

mzelent@hayward.com

Source: Hayward Holdings, Inc.

v3.25.0.1

Cover

|

Feb. 27, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 27, 2025

|

| Entity Registrant Name |

Hayward Holdings, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40208

|

| Entity Tax Identification Number |

82-2060643

|

| Entity Address, Address Line One |

1415 Vantage Park Drive

|

| Entity Address, Address Line Two |

Suite

|

| Entity Address, City or Town |

Charlotte

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

28203

|

| City Area Code |

704

|

| Local Phone Number |

837-8002

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.001 per share

|

| Trading Symbol |

HAYW

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001834622

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

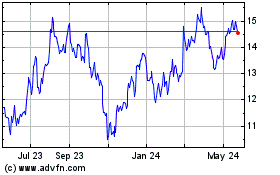

Hayward (NYSE:HAYW)

Historical Stock Chart

From Feb 2025 to Mar 2025

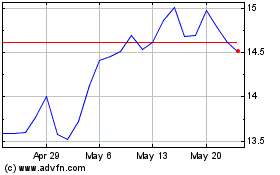

Hayward (NYSE:HAYW)

Historical Stock Chart

From Mar 2024 to Mar 2025