- Reports better-than-expected fourth-quarter and full-year 2024

results.

- Announced agreement to exit Champion Japan license and moved

business to discontinued operations in fourth-quarter 2024. Results

not directly comparable to prior guidance--see earnings handout for

additional information.

- Net sales for the quarter of $888 million increased 4.5% over

prior year, or 3.8% on an organic constant currency basis.

- GAAP and Adjusted operating margins for the quarter were 13.5%

and 14.2%, respectively, an increase of 240 and 300 basis points,

respectively, compared to prior year.

- GAAP earnings per share (EPS) of $0.13 and Adjusted EPS of

$0.17.

- Generated full-year cash flow from operations of $264 million

and paid down more than $1 billion of debt. Year-end leverage of

3.4 times net debt-to-adjusted EBITDA decreased nearly 2 turns as

compared to prior year.

- Provides first-quarter and full-year 2025 guidance, including

net sales growth, continued margin expansion, strong EPS growth,

and further debt reduction. Company expects to refinance all of its

2026 maturities in first-quarter 2025, subject to market

conditions.

HanesBrands Inc. (NYSE: HBI), a global leader in iconic apparel

brands, today announced results for fourth-quarter and full-year

2024.

“We delivered a strong quarter and full-year with results across

all key metrics exceeding our expectations as the benefits of our

transformation strategy are clearly working,” said Steve Bratspies,

CEO. “We enter 2025 as a new Company. We are a more simplified,

focused business with a powerful asset base and significant

competitive advantages. We believe we are well positioned to build

on fourth quarter’s momentum and deliver positive sales growth,

additional margin expansion, strong cash generation and continued

debt reduction, providing us multiple levers to create additional

shareholder value in 2025 and beyond.”

Fourth-Quarter 2024

Results

Net Sales from continuing operations were $888

million.

- Net sales increased 4.5% compared to the prior year.

- On an organic constant currency basis, net sales increased 3.8%

over prior year (Table 2-B).

Gross Profit and Gross Margin increased year-over-year

driven by the benefits from accelerated cost savings initiatives

and lower input costs.

- The Company continued its consolidation and other optimization

actions in its supply chain to lower fixed cost, increase

efficiencies, and further improve customer service and in-stocks

with lower levels of inventory. The Company expects these actions

to drive continued benefits in 2025.

- Gross Profit and Adjusted Gross Profit were $390 million and

$392 million, respectively, an increase over prior year of 14% and

15%, respectively.

- Gross Margin and Adjusted Gross Margin increased 380 and 400

basis points, respectively, to 43.9% and 44.1%, respectively.

- Adjusted Gross Profit and Adjusted Gross Margin exclude certain

costs related to restructuring and other action-related charges

(Table 6-A).

Selling, General and Administrative (SG&A) Expenses,

as a percentage of net sales, increased over prior year as planned,

strategic increased brand investments drove a 125 basis point

increase in SG&A, which was partially offset by benefits from

cost savings initiatives and disciplined expense management.

- The Company continued its strategic actions to improve its

processes and lower fixed cost and expects the savings from these

actions to continue to build over the next several quarters.

- SG&A Expenses were $271 million, or 30.5% of net sales,

which represents an increase over prior year of 9% and 140 basis

points, respectively.

- Adjusted SG&A Expenses were $266 million, or 29.9% of net

sales, which represents an increase of 8% and 100 basis points,

respectively.

- Adjusted SG&A Expenses exclude certain costs related to

restructuring and other action-related charges (Table 6-A).

Operating Profit and Operating Margin increased over

prior year driven by gross margin improvement and SG&A savings

initiatives, which supported a 125 basis point increase in brand

investments.

- Operating Profit increased 27% to $120 million and Operating

Margin increased 240 basis points to 13.5% as compared to prior

year.

- Adjusted Operating Profit increased 33% to $126 million and

Adjusted Operating Margin increased 300 basis points to 14.2% as

compared to prior year.

- Adjusted Operating Profit and Adjusted Operating Margin exclude

certain costs related to restructuring and other action-related

charges (Table 6-A).

Interest Expense and Other Expenses

- Interest expense of $46 million decreased 13% compared to prior

year driven by lower debt balances.

- Other expenses of $18 million included $9 million of an

expected write-off of debt issuance costs related to debt pay down

in the quarter. Adjusted Other expenses of $9 million increased $2

million over prior year (Table 6-A).

Tax Expense

- Tax expense was $9 million as compared to a tax benefit of

$(65) million in the prior year. Effective Tax Rate for

fourth-quarter 2024 was 16.6%.

- Adjusted Tax Expense was $9 million as compared to $16 million

in fourth-quarter 2023. Adjusted Tax Rate was 12.9% as compared to

46.3% last year (Table 6-A).

- The Company's effective tax rate for 2024 and 2023 is not

reflective of the U.S. statutory rate due to valuation allowances

against certain net deferred tax assets.

Earnings Per Share

- Income from continuing operations totaled $46 million, or $0.13

per diluted share, in fourth-quarter 2024. This compares to income

from continuing operations of $99 million, or $0.28 per diluted

share, in fourth-quarter 2023.

- Adjusted Income from continuing operations totaled $61 million,

or $0.17 per diluted share. This compares to adjusted income from

continuing operations of $18 million, or $0.05 per diluted share,

last year (Table 6-A).

See the Note on Adjusted Measures and Reconciliation to GAAP

Measures later in this news release for additional discussion and

details of actions, which include restructuring and other

action-related charges.

Fourth-Quarter 2024 Business Segment

Summary

- U.S. net sales increased 3% over prior year driven

primarily by innerwear innovation, including Hanes Absolute Socks,

Hanes Moves, Hanes Supersoft and Bali Breathe, as well as

incremental holiday programming, and new category growth. Operating

margin of 23.1% increased approximately 525 basis points over prior

year. The increase was driven primarily by the benefits from cost

savings initiatives and lower input costs, which helped fund a 30%

increase in brand investments to drive consumer demand behind new

product innovation in both Men’s and Women’s.

- International net sales increased 2% on a reported

basis, which included a $9 million headwind from unfavorable

foreign exchange rates. International sales increased 6% on a

constant currency basis compared to prior year as sales grew in

Australia, the Americas, and Asia. Operating margin of 12.6%

decreased approximately 550 basis points compared to prior year

driven primarily by transactional foreign exchange headwinds,

business mix, and brand investments, which was partially offset by

lower input costs and the benefits from cost savings

initiatives.

Cash Flow, Balance Sheet and

Liquidity

- Total liquidity position at the end of fourth-quarter

2024 was more than $1.2 billion, consisting of $215 million of cash

and equivalents and approximately $1.0 billion of available

capacity under the Company’s credit facilities.

- Based on the calculation as defined in the Company’s senior

secured credit facility, the Leverage Ratio at the end of

fourth-quarter 2024 was 3.4 times on a net debt-to-adjusted EBITDA

basis, which was below its fourth-quarter 2024 covenant of 6.38

times and below prior year’s 5.2 times (See Table 6-B). The Company

paid down more than $1.0 billion of debt in 2024.

- Inventory at the end of fourth-quarter 2024 of $871

million decreased 9%, or $85 million, year-over-year. The

year-over-year decrease was driven predominantly by the benefits of

the Company’s inventory management capabilities, including SKU

discipline and lifecycle management, lower input costs as the

Company continued to anniversary the impact from peak inflation,

and improving sales trends.

- Cash Flow from Operations for the full-year was $264

million as compared to $562 million last year. Free Cash

Flow for the full-year was $226 million as compared to $518

million last year.

Announces Exit of Champion Japan

License

At the time of closing for the sale of its global Champion

business on September 30, 2024, the Company indicated it would

continue to operate the Champion Japan business as a licensee for a

temporary period of time until it was ultimately transitioned to

Authentic Brands Group, in accordance with the terms of the

definitive agreement. In the fourth-quarter 2024, the Company

notified Authentic Brands Group of its plan to exit the license by

the end of 2025 and transition the business ahead of schedule. As a

result, the Champion Japan business was reclassified to

discontinued operations in the fourth-quarter 2024. For the

full-year 2024, the Champion Japan business generated approximately

$124 million of net sales and an adjusted operating profit of

approximately $12 million.

First-Quarter and Full-Year 2025

Financial Outlook

The Company is providing guidance on tax expense due to the

expected fluctuation of its quarterly tax rate, stemming from the

deferred tax reserve matter previously disclosed in the fourth

quarter of 2022. Importantly, the reserve does not impact cash

taxes. Some portion of the reserve may reverse in future

periods.

The Company defines organic constant currency net sales as net

sales excluding the ‘other’ segment and the year-over-year impact

from foreign exchange rates.

For fiscal year 2025, which ends on January 3, 2026 and includes

a 53rd week, the Company currently expects:

- Net sales from continuing operations of approximately $3.47

billion to $3.52 billion, which includes projected headwinds of

approximately $60 million from changes in foreign currency exchange

rates. At the midpoint, net sales are expected to be relatively

consistent with prior year on a reported basis and increase

approximately 1% on an organic constant currency basis.

- GAAP operating profit from continuing operations of

approximately $420 million to $440 million.

- Adjusted operating profit from continuing operations of

approximately $450 million to $465 million, which excludes pretax

charges for restructuring and other action-related charges of

approximately $25 million to $30 million. The operating profit

outlook includes a projected headwind of approximately $8 million

from changes in foreign currency exchange rates.

- GAAP and Adjusted Interest expense of approximately $190

million.

- GAAP Other expenses of approximately $49 million. Adjusted

Other expenses of approximately $36 million, which excludes

approximately $13 million of estimated pretax refinancing

charges.

- GAAP and Adjusted Tax expense of approximately $40

million.

- GAAP earnings per share from continuing operations of

approximately $0.39 to $0.45.

- Adjusted earnings per share from continuing operations of

approximately $0.51 to $0.55.

- Cash flow from operations of approximately $350 million.

- Capital investments of approximately $65 million, consisting of

approximately $50 million of capital expenditures and approximately

$15 million of cloud computing arrangements.

- Free cash flow of approximately $300 million.

- Fully diluted shares outstanding of approximately 361

million.

For first-quarter 2025, which ends on March 29, 2025, the

Company currently expects:

- Net sales from continuing operations of approximately $750

million, which includes projected headwinds of approximately $15

million from changes in foreign currency exchange rates. This

represents an approximate 1% increase as compared to prior year on

a reported basis and on an organic constant currency basis net

sales are expected to be consistent with prior year.

- GAAP operating profit from continuing operations of

approximately $55 million.

- Adjusted operating profit from continuing operations of

approximately $65 million, which excludes pretax charges for

restructuring and other action-related charges of approximately $10

million. The operating profit outlook includes a projected headwind

of approximately $1 million from changes in foreign currency

exchange rates.

- GAAP and Adjusted Interest expense of approximately $47

million.

- GAAP Other expenses of approximately $21 million. Adjusted

Other expenses of approximately $8 million, which excludes

approximately $13 million of estimated pretax refinancing

charges.

- GAAP and Adjusted Tax expense of approximately $3 million.

- GAAP loss per share from continuing operations of approximately

$(0.05) based on 354 million diluted shares outstanding, as

calculated under GAAP (no dilution due to GAAP loss from continuing

operations)

- Adjusted earnings per share from continuing operations of

approximately $0.02 based on fully diluted shares outstanding of

approximately 360 million.

HanesBrands has updated its quarterly frequently-asked-questions

document, which is available at www.Hanes.com/FAQ.

HanesBrands Announces Leadership

Succession

In a separate press release issued today, HanesBrands announced

that Steve Bratspies will depart as Chief Executive Officer of the

Company at the end of 2025, or upon the appointment of his

successor. Bratspies will also step down from the Board of

Directors concurrent with the end of his tenure as CEO. The

HanesBrands Board has begun a comprehensive search to identify the

Company’s next CEO as part of the Company’s leadership succession

planning process and has retained Spencer Stuart, a leading

executive search firm, to support its work. Bratspies will stay on

in an advisory role once a new CEO is named to support a smooth

transition.

Note on Adjusted Measures and

Reconciliation to GAAP Measures

To supplement financial results prepared in accordance with

generally accepted accounting principles, the Company provides

quarterly and full-year results concerning certain non‐GAAP

financial measures, including adjusted EPS from continuing

operations, adjusted income (loss) from continuing operations,

adjusted income tax expense, adjusted income (loss) from continuing

operations before income taxes, adjusted operating profit (and

margin), adjusted SG&A, adjusted gross profit (and margin),

EBITDA, adjusted EBITDA, organic constant currency net sales,

adjusted effective tax rate, adjusted interest expense, adjusted

other expenses, net debt, leverage ratio and free cash flow.

Adjusted EPS from continuing operations is defined as diluted

EPS from continuing operations excluding actions and the tax effect

on actions. Adjusted income (loss) from continuing operations is

defined as income (loss) from continuing operations excluding

actions and the tax effect on actions. Adjusted income tax expense

is defined as income tax expense excluding actions. Adjusted income

(loss) from continuing operations before income taxes is defined as

income (loss) from continuing operations before income tax

excluding actions. Adjusted operating profit is defined as

operating profit excluding actions. Adjusted SG&A is defined as

selling, general and administrative expenses excluding actions.

Adjusted gross profit is defined as gross profit excluding actions.

Adjusted interest expense is defined as interest expense excluding

actions. Adjusted other expenses is defined as other expenses

excluding actions and adjusted effective tax rate is defined as

adjusted tax expense divided by adjusted income (loss) from

continuing operations before income tax.

Charges for actions taken in 2024 and 2023, as applicable,

include supply chain restructuring and consolidation, corporate

asset impairment, headcount actions and related severance charges,

professional services, technology charges, gain/loss on sale of

business and classification of assets held for sale, loss on

extinguishment of debt, gain on final settlement of cross currency

swap contracts and the tax effects thereof.

While these costs are not expected to continue for any singular

transaction on an ongoing basis, similar types of costs, expenses

and charges have occurred in prior periods and may recur in future

periods depending upon future business plans and circumstances.

HanesBrands has chosen to present these non‐GAAP measures to

investors to enable additional analyses of past, present and future

operating performance and as a supplemental means of evaluating

operations absent the effect of our supply chain restructuring and

consolidation and other actions that are deemed to be material

stand-alone initiatives apart from the Company’s core operations.

HanesBrands believes these non-GAAP measures provide management and

investors with valuable supplemental information for analyzing the

operating performance of the Company’s ongoing business during each

period presented without giving effect to costs associated with the

execution of any of the aforementioned actions taken.

The Company has also chosen to present EBITDA and adjusted

EBITDA to investors because it considers these measures to be an

important supplemental means of evaluating operating performance.

EBITDA is defined as net income (loss) before the impacts of

discontinued operations, interest, taxes, depreciation and

amortization. Adjusted EBITDA is defined as EBITDA excluding (x)

restructuring charges related to our supply chain restructuring and

consolidation, and other action-related charges described in more

detail in Table 6-A and (y) certain other losses, charges and

expenses as defined in the Consolidated Net Total Leverage Ratio

under its Fifth Amended and Restated Credit Agreement, dated

November 19, 2021, as amended (the “Credit Agreement”) described in

more detail in Table 6-B. HanesBrands believes that EBITDA and

adjusted EBITDA are frequently used by securities analysts,

investors and other interested parties in the evaluation of

companies in the industry, and management uses EBITDA and adjusted

EBITDA for planning purposes in connection with setting its capital

allocation strategy. EBITDA and adjusted EBITDA should not,

however, be considered as measures of discretionary cash available

to invest in the growth of the business.

Net debt is defined as the total of current debt, long-term

debt, and borrowings under the accounts receivable securitization

facility (excluding long-term debt issuance costs and debt discount

and borrowings of unrestricted subsidiaries under the accounts

receivable securitization facility) less (x) other debt and cash

adjustments and (y) cash and cash equivalents. Leverage ratio is

the ratio of net debt to adjusted EBITDA as it is defined in our

Credit Agreement.

The Company defines free cash flow as net cash from operating

activities less capital expenditures. Management believes that free

cash flow, which measures our ability to generate additional cash

from our business operations, is an important financial measure for

use in evaluating the Company's financial performance. The Company

defines organic net sales as net sales excluding the ‘other’

segment and excluding those derived from businesses acquired or

divested within the previous 12 months of the reporting date.

HanesBrands is a global company that reports financial

information in U.S. dollars in accordance with GAAP. As a

supplement to the Company’s reported operating results, HanesBrands

also presents constant currency financial information, which is a

non-GAAP financial measure that excludes the impact of translating

foreign currencies into U.S. dollars. The Company uses constant

currency information to provide a framework to assess how the

business performed excluding the effects of changes in the rates

used to calculate foreign currency translation.

To calculate foreign currency translation on a constant currency

basis, operating results for the current-year period for entities

reporting in currencies other than the U.S. dollar are translated

into U.S. dollars at the average exchange rates in effect during

the comparable period of the prior year (rather than the actual

exchange rates in effect during the current year period).

HanesBrands believes constant currency information is useful to

management and investors to facilitate comparison of operating

results and better identify trends in the Company’s businesses. The

Company defines organic constant currency sales as net sales

excluding the ‘other’ segment and also excluding the impact of

translating foreign currencies into U.S. dollars as discussed

above.

Non‐GAAP financial measures have limitations as analytical tools

and should not be considered in isolation or as an alternative to,

or substitute for, financial results prepared in accordance with

GAAP. Further, the non-GAAP measures presented may be different

from non-GAAP measures with similar or identical names presented by

other companies.

Reconciliations of these non-GAAP measures to the most directly

comparable GAAP financial measures are presented in the

supplemental financial information included with this news

release.

Cautionary Statement Concerning Forward-Looking

Statements

This news release contains information that may constitute

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. Forward-looking statements include all

statements that do not relate solely to historical or current

facts, and can generally be identified by the use of words such as

“may,” “believe,” “could,” “will,” “expect,” “outlook,”

“potential,” “project,” “estimate,” “future,” “intend,”

“anticipate,” “plan,” “continue” or similar expressions. However,

the absence of these words or similar expressions does not mean

that a statement is not forward-looking. All statements regarding

our intent, belief and current expectations about our strategic

direction, prospects and future results are forward-looking

statements and are subject to risks and uncertainties that could

cause actual results to differ materially from those implied or

expressed by such statements. These risks and uncertainties

include, but are not limited to, trends associated with our

business; our ability to successfully implement our strategic

plans, including our supply chain restructuring and consolidation

and other cost savings initiatives; trends associated with our

business; the rapidly changing retail environment and the level of

consumer demand; the effects of any geopolitical conflicts

(including the ongoing Russia-Ukraine conflict and Middle East

conflicts) or public health emergencies or severe global health

crises, including effects on consumer spending, global supply

chains, critical supply routes and the financial markets; our

ability to deleverage on the anticipated time frame or at all; any

inadequacy, interruption, integration failure or security failure

with respect to our information technology; future intangible

assets or goodwill impairment due to changes in our business,

market condition or other factors, significant fluctuations in

foreign exchange rates; legal, regulatory, political and economic

risks related to our international operations; our ability to

effectively manage our complex international tax structure; our

future financial performance; and other risks identified from time

to time in our most recent Securities and Exchange Commission

reports, including our annual report on Form 10-K and quarterly

reports on Form 10-Q. Because it is not possible to predict or

identify all of the risks, uncertainties and other factors that may

affect future results, the above list should not be considered a

complete list. Any forward-looking statement speaks only as of the

date on which such statement is made, and HanesBrands undertakes no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise, except as required by law.

HanesBrands

HanesBrands (NYSE: HBI) is a global leader in manufacturing

basics and Innerwear brands that are synonymous with comfort,

quality, and value, and have been trusted by consumers around the

world for generations. Among the Company’s iconic brands are Hanes,

the leading basic apparel brand in the U.S.; Bonds, an Australian

staple since 1915 that is setting new standards for design and

innovation; Maidenform, America’s number one shapewear brand; and

Bali, Americas number one national bra brand in the U.S.

HanesBrands owns the majority of its worldwide manufacturing

facilities and has built a strong reputation for workplace quality

and ethical business practices.

TABLE 1

HANESBRANDS INC.

Consolidated Statements of

Operations

(in thousands, except per

share data)

(Unaudited)

Quarters Ended

Years Ended

December 28,

2024

December 30,

2023

% Change

December 28,

2024

December 30,

2023

% Change

Net sales

$

888,469

$

850,283

4.5

%

$

3,507,438

$

3,639,386

(3.6

)%

Cost of sales

498,198

508,690

2,147,914

2,347,496

Gross profit

390,271

341,593

14.3

%

1,359,524

1,291,890

5.2

%

As a % of net sales

43.9

%

40.2

%

38.8

%

35.5

%

Selling, general and administrative

expenses

270,571

247,154

9.5

%

1,173,576

1,025,612

14.4

%

As a % of net sales

30.5

%

29.1

%

33.5

%

28.2

%

Operating profit

119,700

94,439

26.7

%

185,948

266,278

(30.2

)%

As a % of net sales

13.5

%

11.1

%

5.3

%

7.3

%

Other expenses

18,420

7,095

47,441

37,761

Interest expense, net

46,497

53,685

195,901

214,187

Income (loss) from continuing operations

before income taxes

54,783

33,659

(57,394

)

14,330

Income tax expense (benefit)

9,115

(65,104

)

40,601

(14,818

)

Income (loss) from continuing

operations

45,668

98,763

(53.8

)%

(97,995

)

29,148

(436.2

)%

Loss from discontinued operations, net of

tax

(58,548

)

(20,822

)

(222,436

)

(46,874

)

Net income (loss)

$

(12,880

)

$

77,941

$

(320,431

)

$

(17,726

)

Earnings (loss) per share - basic:

Continuing operations

$

0.13

$

0.28

$

(0.28

)

$

0.08

Discontinued operations

(0.17

)

(0.06

)

(0.63

)

(0.13

)

Net income (loss)

$

(0.04

)

$

0.22

$

(0.91

)

$

(0.05

)

Earnings (loss) per share - diluted:

Continuing operations

$

0.13

$

0.28

$

(0.28

)

$

0.08

Discontinued operations

(0.16

)

(0.06

)

(0.63

)

(0.13

)

Net income (loss)

$

(0.04

)

$

0.22

$

(0.91

)

$

(0.05

)

Weighted average shares outstanding:

Basic

352,881

350,765

352,139

350,592

Diluted

356,851

351,566

352,139

351,057

TABLE 2-A

HANESBRANDS INC.

Supplemental Financial

Information

Impact of Foreign

Currency

(in thousands, except per

share data)

(Unaudited)

The following tables present a

reconciliation of reported results on a constant currency basis for

the quarter and year ended December 28, 2024 and a comparison to

prior year:

Quarter Ended December 28,

2024

As Reported

Impact from Foreign

Currency1

Constant Currency

Quarter Ended December 30,

2023

% Change, As

Reported

% Change, Constant

Currency

As reported under GAAP:

Net sales

$

888,469

$

(9,241

)

$

897,710

$

850,283

4.5

%

5.6

%

Gross profit

390,271

(3,078

)

393,349

341,593

14.3

15.2

Operating profit

119,700

(558

)

120,258

94,439

26.7

27.3

Diluted earnings (loss) per share from

continuing operations3

$

0.13

$

0.00

$

0.13

$

(0.28

)

146.4

%

146.4

%

As adjusted:2

Net sales

$

888,469

$

(9,241

)

$

897,710

$

850,283

4.5

%

5.6

%

Gross profit

391,509

(3,078

)

394,587

340,465

15.0

15.9

Operating profit

125,975

(558

)

126,533

94,824

32.9

33.4

Diluted earnings per share from continuing

operations3

$

0.17

$

0.00

$

0.17

$

0.05

240.0

%

240.0

%

1

Effect of the change in foreign currency

exchange rates year-over-year. Calculated by applying prior period

exchange rates to the current year financial results.

2

Results for the quarters ended December

28, 2024 and December 30, 2023 reflect adjustments for

restructuring and other action-related charges. See "Reconciliation

of Select GAAP Measures to Non-GAAP Measures" in Table 6-A.

3

Amounts may not be additive due to

rounding.

Year Ended December 28,

2024

As Reported

Impact from Foreign

Currency1

Constant Currency

Year Ended December 30,

2023

% Change, As

Reported

% Change, Constant

Currency

As reported under GAAP:

Net sales

$

3,507,438

$

(39,532

)

$

3,546,970

$

3,639,386

(3.6

)%

(2.5

)%

Gross profit

1,359,524

(19,858

)

1,379,382

1,291,890

5.2

6.8

Operating profit

185,948

(7,077

)

193,025

266,278

(30.2

)

(27.5

)

Diluted earnings (loss) per share from

continuing operations3

$

(0.28

)

$

(0.01

)

$

(0.27

)

$

0.08

(450.0

)%

(437.5

)%

As adjusted:2

Net sales

$

3,507,438

$

(39,532

)

$

3,546,970

$

3,639,386

(3.6

)%

(2.5

)%

Gross profit

1,450,703

(19,858

)

1,470,561

1,294,043

12.1

13.6

Operating profit

415,171

(7,077

)

422,248

289,077

43.6

46.1

Diluted earnings (loss) per share from

continuing operations 3

$

0.40

$

(0.01

)

$

0.41

$

(0.07

)

(671.4

)%

(685.7

)%

1

Effect of the change in foreign currency

exchange rates year-over-year. Calculated by applying prior period

exchange rates to the current year financial results.

2

Results for the years ended December 28,

2024 and December 30, 2023 reflect adjustments for restructuring

and other action-related charges. See "Reconciliation of Select

GAAP Measures to Non-GAAP Measures" in Table 6-A.

3

Amounts may not be additive due to

rounding.

TABLE 2-B

HANESBRANDS INC.

Supplemental Financial

Information

Organic Constant

Currency

(in thousands, except per

share data)

(Unaudited)

The following tables present a

reconciliation of reported results on an organic constant currency

basis for the quarter and year ended December 28, 2024 and a

comparison to prior year:

Quarter Ended December 28,

2024

Quarter Ended December 30,

2023

As Reported

Impact from Foreign

Currency1

Less Other

Sales2

Organic Constant

Currency

As Reported

Less Other

Sales2

Organic

% Change, As

Reported

% Change, Organic

Constant Currency

Net sales

$

888,469

$

(9,241

)

$

16,783

$

880,927

$

850,283

$

1,787

$

848,496

4.5

%

3.8

%

1

Effect of the change in foreign currency

exchange rates year-over-year. Calculated by applying prior period

exchange rates to the current year financial results.

2

Other sales consist of the Company’s U.S.

Sheer Hosiery business (prior to the September 29, 2023 sale) as

well as certain sales from the Company’s supply chain and short

term support/transition services agreements for disposed

businesses.

Year Ended December 28,

2024

Year Ended December 30,

2023

As Reported

Impact from Foreign

Currency1

Less Other

Sales2

Organic Constant

Currency

As Reported

Less Other

Sales2

Organic

% Change, As

Reported

% Change, Organic

Constant Currency

Net sales

$

3,507,438

$

(39,532

)

$

17,868

$

3,529,102

$

3,639,386

$

69,663

$

3,569,723

(3.6

)%

(1.1

)%

1

Effect of the change in foreign currency

exchange rates year-over-year. Calculated by applying prior period

exchange rates to the current year financial results.

2

Other sales consist of the Company’s U.S.

Sheer Hosiery business (prior to the September 29, 2023 sale) as

well as certain sales from the Company’s supply chain and short

term support/transition services agreements for disposed

businesses.

TABLE 3

HANESBRANDS INC.

Supplemental Financial

Information

By Business Segment

(in thousands)

(Unaudited)

Quarters Ended

Years Ended

December 28,

2024

December 30,

2023

% Change

December 28,

2024

December 30,

2023

% Change

Segment net sales:

U.S.

$

618,747

$

600,733

3.0

%

$

2,581,137

$

2,636,656

(2.1

)%

International

252,939

247,763

2.1

908,433

933,067

(2.6

)

Total segment net sales

871,686

848,496

2.7

3,489,570

3,569,723

(2.2

)

Other net sales

16,783

1,787

839.2

17,868

69,663

(74.4

)

Total net sales

$

888,469

$

850,283

4.5

%

$

3,507,438

$

3,639,386

(3.6

)%

Segment operating profit:

U.S.

$

142,738

$

106,933

33.5

%

$

548,852

$

404,273

35.8

%

International

31,764

44,699

(28.9

)

106,506

108,833

(2.1

)

Total segment operating profit

174,502

151,632

15.1

655,358

513,106

27.7

Other profit (loss)

3,988

(1,319

)

(402.4

)

2,550

(1,189

)

(314.5

)

General corporate expenses

(48,644

)

(50,781

)

(4.2

)

(225,997

)

(204,019

)

10.8

Amortization of intangibles

(3,871

)

(4,708

)

(17.8

)

(16,740

)

(18,821

)

(11.1

)

Total operating profit before

restructuring and other action-related charges

125,975

94,824

32.9

415,171

289,077

43.6

Restructuring and other action-related

charges

(6,275

)

(385

)

1,529.9

(229,223

)

(22,799

)

905.4

Total operating profit

$

119,700

$

94,439

26.7

%

$

185,948

$

266,278

(30.2

)%

Quarters Ended

Years Ended

December 28,

2024

December 30,

2023

Basis Points Change

December 28,

2024

December 30,

2023

Basis Points Change

Segment operating margin:

U.S.

23.1

%

17.8

%

527

21.3

%

15.3

%

593

International

12.6

18.0

(548

)

11.7

11.7

6

Total segment operating profit

20.0

17.9

215

18.8

14.4

441

Other profit (loss)

23.8

(73.8

)

9,757

14.3

(1.7

)

1,598

General corporate expenses

(5.5

)

(6.0

)

50

(6.4

)

(5.6

)

(84

)

Amortization of intangibles

(0.4

)

(0.6

)

12

(0.5

)

(0.5

)

4

Total operating margin before

restructuring and other action-related charges

14.2

11.2

303

11.8

7.9

389

Restructuring and other action-related

charges

(0.7

)

—

(66

)

(6.5

)

(0.6

)

(591

)

Total operating margin

13.5

%

11.1

%

237

5.3

%

7.3

%

(202

)

TABLE 4

HANESBRANDS INC.

Condensed Consolidated Balance

Sheets

(in thousands)

(Unaudited)

December 28,

2024

December 30,

2023

Assets

Cash and cash equivalents

$

214,854

$

185,217

Trade accounts receivable, net

376,195

423,682

Inventories

871,044

956,430

Other current assets

152,853

113,281

Current assets held for sale

100,430

597,605

Total current assets

1,715,376

2,276,215

Property, net

188,259

353,035

Right-of-use assets

222,759

271,751

Trademarks and other identifiable

intangibles, net

886,264

959,851

Goodwill

638,370

659,361

Deferred tax assets

13,591

18,176

Other noncurrent assets

116,729

135,247

Noncurrent assets held for sale

59,593

966,678

Total assets

$

3,840,941

$

5,640,314

Liabilities

Accounts payable

$

593,377

$

538,782

Accrued liabilities

452,940

410,152

Lease liabilities

64,233

64,547

Accounts Receivable Securitization

Facility

95,000

6,000

Current portion of long-term debt

—

59,000

Current liabilities held for sale

42,990

312,087

Total current liabilities

1,248,540

1,390,568

Long-term debt

2,186,057

3,235,640

Lease liabilities - noncurrent

206,124

235,453

Pension and postretirement benefits

66,171

98,170

Other noncurrent liabilities

67,452

121,150

Noncurrent liabilities held for sale

32,587

139,980

Total liabilities

3,806,931

5,220,961

Stockholders’ equity

Preferred stock

—

—

Common stock

3,525

3,501

Additional paid-in capital

373,213

353,367

Retained earnings

234,494

554,796

Accumulated other comprehensive loss

(577,222

)

(492,311

)

Total stockholders’ equity

34,010

419,353

Total liabilities and stockholders’

equity

$

3,840,941

$

5,640,314

TABLE 5

HANESBRANDS INC.

Condensed Consolidated

Statements of Cash Flows1

(in thousands)

(Unaudited)

Quarters Ended

Years Ended

December 28,

2024

December 30,

2023

December 28,

2024

December 30,

2023

Operating activities:

Net income (loss)

$

(12,880

)

$

77,941

$

(320,431

)

$

(17,726

)

Adjustments to reconcile net income (loss)

to net cash from operating activities:

Depreciation

11,355

19,022

69,861

75,268

Amortization of acquisition

intangibles

1,893

4,091

12,020

16,569

Other amortization

1,979

3,344

10,174

13,200

Impairment of long-lived assets and

goodwill

—

—

76,746

—

Inventory write-down charges, net of

recoveries

6,220

—

119,748

—

Loss on extinguishment of debt

9,412

—

9,412

8,466

Loss on sale of businesses and

classification of assets held for sale

63,831

—

114,161

3,641

Amortization of debt issuance costs and

debt discount

4,887

2,362

12,535

8,939

Stock compensation expense

4,711

4,527

25,845

20,546

Deferred taxes

(11,895

)

(85,595

)

(11,974

)

(84,745

)

Other

(3,317

)

8,495

909

610

Changes in assets and liabilities:

Accounts receivable

84,821

162,080

(1,785

)

174,249

Inventories

59,095

155,390

114,931

599,982

Other assets

30,441

103,505

17,555

82,672

Accounts payable

(67,408

)

(69,191

)

17,649

(194,602

)

Accrued pension and postretirement

benefits

(2,045

)

2,618

(4,662

)

6,799

Accrued liabilities and other

(113,669

)

(114,184

)

1,549

(152,119

)

Net cash from operating activities

67,431

274,405

264,243

561,749

Investing activities:

Capital expenditures

(5,710

)

(8,266

)

(37,889

)

(44,056

)

Proceeds from sales of assets

26

159

12,362

331

Proceeds from (payments for) disposition

of businesses

850,560

—

838,560

1,300

Other

—

1

—

18,942

Net cash from investing activities

844,876

(8,106

)

813,033

(23,483

)

Financing Activities:

Borrowings on Term Loan Facilities

—

—

—

891,000

Repayments on Term Loan Facilities

(1,097,983

)

(14,750

)

(1,127,483

)

(44,250

)

Borrowings on Accounts Receivable

Securitization Facility

220,000

541,500

1,831,000

2,270,000

Repayments on Accounts Receivable

Securitization Facility

(125,000

)

(736,000

)

(1,742,000

)

(2,473,500

)

Borrowings on Revolving Loan

Facilities

—

306,500

613,500

1,923,000

Repayments on Revolving Loan

Facilities

—

(367,000

)

(613,500

)

(2,275,500

)

Borrowings on Senior Notes

—

—

—

600,000

Repayments on Senior Notes

—

—

—

(1,436,884

)

Payments to amend and refinance credit

facilities

(71

)

(2,517

)

(783

)

(31,020

)

Other

(3,505

)

(37

)

(7,454

)

(2,921

)

Net cash from financing activities

(1,006,559

)

(272,304

)

(1,046,720

)

(580,075

)

Effect of changes in foreign exchange

rates on cash

(17,305

)

20,415

(20,703

)

8,897

Change in cash and cash equivalents

(111,557

)

14,410

9,853

(32,912

)

Cash and cash equivalents at beginning of

period

326,911

191,091

205,501

238,413

Cash and cash equivalents at end of

period

$

215,354

$

205,501

$

215,354

$

205,501

Balances included in the Consolidated

Balance Sheets:

Cash and cash equivalents

$

214,854

$

185,217

$

214,854

$

185,217

Cash and cash equivalents included in

current assets held for sale

$

500

$

20,284

$

500

$

20,284

Cash and cash equivalents at end of

year

$

215,354

$

205,501

$

215,354

$

205,501

1

The cash flows related to discontinued

operations have not been segregated and remain included in the

major classes of assets and liabilities. Accordingly, the

Consolidated Statements of Cash Flows include the results of

continuing and discontinued operations.

TABLE 6-A

HANESBRANDS INC.

Supplemental Financial

Information

Reconciliation of Select GAAP

Measures to Non-GAAP Measures

(in thousands, except per

share data)

(Unaudited)

The following tables present a

reconciliation of results from continuing operations as reported

under GAAP to the results from continuing operations as adjusted

for the quarter and year ended December 28, 2024 and a comparison

to prior year. The results of continuing operations exclude the

results of the global Champion business, the Champion Japan

business and the U.S.-based outlet store business, which have been

reclassified to discontinued operations for all periods presented.

The Company has chosen to present the following non-GAAP measures

to investors to enable additional analyses of past, present and

future operating performance and as a supplemental means of

evaluating continuing operations absent the effect of restructuring

and other actions that are deemed to be material stand-alone

initiatives apart from the Company’s core operations. While these

costs are not expected to continue for any singular transaction on

an ongoing basis, similar types of costs, expenses and charges have

occurred in prior periods and may recur in future periods depending

upon future business plans and circumstances.

Restructuring and other action-related

charges in 2024 and 2023 include the following:

Supply chain restructuring and

consolidation

In 2024, represents charges as a result of

the sale of the global Champion business, which was completed in

the fourth quarter of 2024 on September 30, 2024, and the completed

exit of the U.S.-based outlet store business in July 2024 related

to significant restructuring and consolidation efforts within the

Company’s supply chain network, both manufacturing and

distribution, to align the Company’s network to its continuing

operations to drive stronger operating performance and margin

expansion. In 2023, represents charges related to supply chain

segmentation to restructure and position the Company’s distribution

and manufacturing network to align with its demand trends, simplify

operations and improve efficiencies.

Corporate asset impairment charges

Primarily represents charges related to a

contract terminated in the second quarter of 2024 and impairment of

the Company’s headquarters location that was classified as held for

sale in the second quarter of 2024.

Headcount actions and related

severance

Represents charges related to operating

model initiatives primarily headcount actions and related severance

charges and adjustments related to restructuring activities.

Professional services

Represents professional fees, primarily

including consulting and advisory services, related to

restructuring activities.

Technology

Represents technology charges related to

the implementation of the Company’s technology modernization

initiative which includes a global enterprise resource planning

platform.

Gain/loss on sale of business and

classification of assets held for sale

Represents the gain/loss associated with

the sale of the Company’s U.S. Sheer Hosiery business and

adjustments to the related valuation allowance prior to the sale on

September 29, 2023, primarily from the changes in carrying value

due to changes in working capital.

Loss on extinguishment of debt

Represents charges for the write-off of

unamortized debt issuance costs related to the requirement to pay

down a portion of the Company’s outstanding term debt under the

Senior Secured Credit Facility with the net proceeds from the sale

of the global Champion business in the fourth quarter of 2024 and

charges related to the redemption of the Company’s 4.625% Senior

Notes and 3.5% Senior Notes in the first quarter of 2023.

Gain on final settlement of cross currency

swap contracts

Primarily represents the remaining gain

related to cross-currency swap contracts previously designated as

cash flow hedges in accumulated other comprehensive loss which was

released into earnings as the Company unwound the cross-currency

swap contracts in connection with the redemption of the 3.5% Senior

Notes at the time of settlement in the first quarter of 2023.

Discrete tax benefit

In 2023, represents an adjustment to

non-cash reserves established at December 31, 2022 related to

deferred taxes established for Swiss statutory impairments, which

are not indicative of the Company’s core business operations. In

2022, represents non-cash reserves established relating to deferred

taxes.

Tax effect on actions

Represents the applicable effective tax

rate on the restructuring and other action-related charges based on

the jurisdiction of where the charges were incurred.

Quarters Ended

Years Ended

December 28,

2024

December 30,

2023

December 28,

2024

December 30,

2023

Gross profit, as reported under

GAAP

$

390,271

$

341,593

$

1,359,524

$

1,291,890

As a % of net sales

43.9

%

40.2

%

38.8

%

35.5

%

Restructuring and other action-related

charges:

Supply chain restructuring and

consolidation

1,238

(1,284

)

80,748

1,128

Corporate asset impairment charges

—

—

10,395

—

Headcount actions and related

severance

—

156

36

1,025

Gross profit, as adjusted

$

391,509

$

340,465

$

1,450,703

$

1,294,043

As a % of net sales

44.1

%

40.0

%

41.4

%

35.6

%

Quarters Ended

Years Ended

December 28,

2024

December 30,

2023

December 28,

2024

December 30,

2023

Selling, general and administrative

expenses, as reported under GAAP

$

270,571

$

247,154

$

1,173,576

$

1,025,612

As a % of net sales

30.5

%

29.1

%

33.5

%

28.2

%

Restructuring and other action-related

charges:

Supply chain restructuring and

consolidation

(667

)

—

(90,781

)

—

Corporate asset impairment charges

—

—

(9,712

)

—

Headcount actions and related

severance

860

(573

)

(16,957

)

(4,124

)

Professional services

(4,611

)

(6

)

(16,488

)

(3,819

)

Technology

(1,032

)

(657

)

(1,859

)

(8,347

)

(Loss) gain on sale of business and

classification of assets held for sale

—

—

—

(3,641

)

Other

413

(277

)

(2,247

)

(715

)

Selling, general and administrative

expenses, as adjusted

$

265,534

$

245,641

$

1,035,532

$

1,004,966

As a % of net sales

29.9

%

28.9

%

29.5

%

27.6

%

Quarters Ended

Years Ended

December 28,

2024

December 30,

2023

December 28,

2024

December 30,

2023

Operating profit, as reported under

GAAP

$

119,700

$

94,439

$

185,948

$

266,278

As a % of net sales

13.5

%

11.1

%

5.3

%

7.3

%

Restructuring and other action-related

charges:

Supply chain restructuring and

consolidation

1,905

(1,284

)

171,529

1,128

Corporate asset impairment charges

—

—

20,107

—

Headcount actions and related

severance

(860

)

729

16,993

5,149

Professional services

4,611

6

16,488

3,819

Technology

1,032

657

1,859

8,347

Loss (gain) on sale of business and

classification of assets held for sale

—

—

—

3,641

Other

(413

)

277

2,247

715

Operating profit, as adjusted

$

125,975

$

94,824

$

415,171

$

289,077

As a % of net sales

14.2

%

11.2

%

11.8

%

7.9

%

Quarters Ended

Years Ended

December 28,

2024

December 30,

2023

December 28,

2024

December 30,

2023

Interest expense, net and other

expenses, as reported under GAAP

$

64,917

$

60,780

$

243,342

$

251,948

Restructuring and other action-related

charges:

Loss on extinguishment of debt

(9,412

)

—

(9,412

)

(8,466

)

Gain on final settlement of cross currency

swaps

—

—

—

1,370

Interest expense, net and other expenses,

as adjusted

$

55,505

$

60,780

$

233,930

$

244,852

Quarters Ended

Years Ended

December 28,

2024

December 30,

2023

December 28,

2024

December 30,

2023

Income (loss) from continuing

operations before income taxes, as reported under GAAP

$

54,783

$

33,659

$

(57,394

)

$

14,330

Restructuring and other action-related

charges:

Supply chain restructuring and

consolidation

1,905

(1,284

)

171,529

1,128

Corporate asset impairment charges

—

—

20,107

—

Headcount actions and related

severance

(860

)

729

16,993

5,149

Professional services

4,611

6

16,488

3,819

Technology

1,032

657

1,859

8,347

Loss (gain) on sale of business and

classification of assets held for sale

—

—

—

3,641

Other

(413

)

277

2,247

715

Loss on extinguishment of debt

9,412

—

9,412

8,466

Gain on final settlement of cross currency

swaps

—

—

—

(1,370

)

Income from continuing operations before

income taxes, as adjusted

$

70,470

$

34,044

$

181,241

$

44,225

Quarters Ended

Years Ended

December 28,

2024

December 30,

2023

December 28,

2024

December 30,

2023

Income tax expense (benefit), as

reported under GAAP

$

9,115

$

(65,104

)

$

40,601

$

(14,818

)

Restructuring and other action-related

charges:

Discrete tax (expense) benefit

—

80,859

—

85,122

Tax effect on actions

—

—

—

—

Income tax expense, as adjusted

$

9,115

$

15,755

$

40,601

$

70,304

Quarters Ended

Years Ended

December 28,

2024

December 30,

2023

December 28,

2024

December 30,

2023

Income (loss) from continuing

operations, as reported under GAAP

$

45,668

$

98,763

$

(97,995

)

$

29,148

Restructuring and other action-related

charges:

Supply chain restructuring and

consolidation

1,905

(1,284

)

171,529

1,128

Corporate asset impairment charges

—

—

20,107

—

Headcount actions and related

severance

(860

)

729

16,993

5,149

Professional services

4,611

6

16,488

3,819

Technology

1,032

657

1,859

8,347

Loss (gain) on sale of business and

classification of assets held for sale

—

—

—

3,641

Other

(413

)

277

2,247

715

Loss on extinguishment of debt

9,412

—

9,412

8,466

Gain on final settlement of cross currency

swaps

—

—

—

(1,370

)

Discrete tax expense (benefit)

—

(80,859

)

—

(85,122

)

Tax effect on actions

—

—

—

—

Income (loss) from continuing operations,

as adjusted

$

61,355

$

18,289

$

140,640

$

(26,079

)

Quarters Ended

Years Ended

December 28,

2024

December 30,

2023

December 28,

2024

December 30,

2023

Diluted earnings (loss) per share from

continuing operations, as reported under GAAP1

$

0.13

$

0.28

$

(0.28

)

$

0.08

Restructuring and other action-related

charges:

Supply chain restructuring and

consolidation

0.01

0.00

0.48

0.00

Corporate asset impairment charges

—

—

0.06

—

Headcount actions and related

severance

0.00

0.00

0.05

0.01

Professional services

0.01

0.00

0.05

0.01

Technology

0.00

0.00

0.01

0.02

Loss (gain) on sale of business and

classification of assets held for sale

—

—

—

0.01

Other

0.00

0.00

0.01

0.00

Loss on extinguishment of debt

0.03

—

0.03

0.02

Gain on final settlement of cross currency

swaps

—

—

—

0.00

Discrete tax expense (benefit)

—

(0.23

)

—

(0.24

)

Tax effect on actions

—

—

—

—

Diluted earnings (loss) per share from

continuing operations, as adjusted

$

0.17

$

0.05

$

0.40

$

(0.07

)

1

Amounts may not be additive due to

rounding.

TABLE 6-B

HANESBRANDS INC.

Supplemental Financial

Information

Reconciliation of Select GAAP

Measures to Non-GAAP Measures

(in thousands, except per

share data)

(Unaudited)

Last Twelve Months

December 28,

2024

December 30,

2023

Leverage Ratio:

EBITDA1:

Income (loss) from continuing

operations

$

(97,995

)

$

29,148

Interest expense, net

195,901

214,187

Income tax expense (benefit)

40,601

(14,818

)

Depreciation and amortization

79,080

79,954

Total EBITDA

217,587

308,471

Total restructuring and other

action-related charges (excluding tax effect on actions)2

238,635

29,895

Other net losses, charges and

expenses3

123,499

93,774

Total EBITDA from discontinued operations,

as adjusted4

10,420

170,013

Total EBITDA, as adjusted

$

590,141

$

602,153

Net debt:

Debt (current and long-term debt and

Accounts Receivable Securitization Facility excluding long term

debt issuance costs and debt discount of $17,210 and $36,110,

respectively)

$

2,298,267

$

3,336,750

(Less) debt related to an unrestricted

subsidiary5

(95,000

)

(6,000

)

Other debt and cash adjustments6

3,549

24,469

(Less) Cash and cash equivalents of

continuing operations

(214,854

)

(205,501

)

(Less) Cash and cash equivalents of

discontinued operations

(500

)

(20,284

)

Net debt

$

1,991,462

$

3,129,434

Debt/Income (loss) from continuing

operations7

(23.5

)

114.5

Net debt/EBITDA, as adjusted8

3.4

5.2

1

Earnings from continuing operations before

interest, taxes, depreciation and amortization (EBITDA) is a

non-GAAP financial measure.

2

The last twelve months ended December 28,

2024 includes $172 million of supply chain restructuring and

consolidation charges, $20 million of corporate asset impairment

charges, $17 million of headcount actions and related severance

charges, $16 million of professional services, $9 million of a loss

on extinguishment of debt, $2 million related to other

restructuring and other action-related charges and $2 million of

technology charges. The last twelve months ended December 30, 2023

includes $8 million of a loss on extinguishment of debt, $8 million

of technology charges, $5 million of headcount actions and related

severance charges, $4 million of professional services, $4 million

of a loss on the classification of assets held for sale, $1 million

of supply chain restructuring and consolidation charges,

approximately $1 million related to other restructuring and other

action-related charges, and $(1) million of a gain on the final

settlement of cross currency swap contracts. The items included in

restructuring and other action-related charges are described in

more detail in Table 6-A.

3

Represents other net losses, charges and

expenses that can be excluded from the Company’s leverage ratio as

defined under its Fifth Amended and Restated Credit Agreement,

dated November 19, 2021, as amended. The last twelve months ended

December 28, 2024, primarily includes $58 million of excess and

obsolete inventory write-offs, $19 million in other compensation

related items primarily stock compensation expense, $16 million of

pension non-cash expense, $15 million in charges related to sales

incentive amortization, $12 million of non-cash cloud computing

expense, $6 million of charges related to the net unrealized losses

due to hedging activities, $5 million of other non-cash related

charges, $(3) million of bad debt expense and $(4) million of

interest expense on debt and amortization of debt issuance costs

related to an unrestricted subsidiary. The last twelve months ended

December 30, 2023, primarily includes $41 million of excess and

obsolete inventory write-offs, $18 million in other compensation

related items primarily stock compensation expense, $16 million of

pension non-cash expense, $12 million in charges related to sales

incentive amortization, $8 million of non-cash cloud computing

expense and $2 million in charges related to the ransomware attack

and extraordinary events, approximately $1 million of bad debt

expense and $(5) million of interest expense on debt and

amortization of debt issuance costs related to an unrestricted

subsidiary.

4

Represents Total EBITDA from discontinued

operations, as adjusted related to businesses still owned at period

end, as adjusted for all items that can be excluded from the

Company’s leverage ratio as defined under its Fifth Amended and

Restated Credit Agreement, dated November 19, 2021, as amended. In

2024, EBITDA from discontinued operations, as adjusted excludes

EBITDA related to the Initial Close of the global Champion business

and U.S. outlet stores business as the sale of these businesses

were completed before the period end.

5

Represents amounts outstanding under an

existing accounts receivable securitization facility entered into

by an unrestricted subsidiary of the Company.

6

Includes drawn and undrawn letters of

credit, financing leases and cash balances in certain

geographies.

7

Represents Debt divided by Income (loss)

from continuing operations which is the most comparable GAAP

financial measure to Net debt/EBITDA, as adjusted.

8

Represents the Company’s leverage ratio

defined as Consolidated Net Total Leverage Ratio under its Fifth

Amended and Restated Credit Agreement, dated November 19, 2021, as

amended, which excludes net other losses, charges and expenses in

addition to restructuring and other action-related charges.

Quarters Ended

Years Ended

December 28,

2024

December 30,

2023

December 28,

2024

December 30,

2023

Free cash flow1:

Net cash from operating activities

$

67,431

$

274,405

$

264,243

$

561,749

Capital expenditures

(5,710

)

(8,266

)

(37,889

)

(44,056

)

Free cash flow

$

61,721

$

266,139

$

226,354

$

517,693

1

Free cash flow includes the results from

continuing and discontinued operations for all periods

presented.

TABLE 7

HANESBRANDS INC.

Supplemental Financial

Information

Reconciliation of GAAP Outlook

to Adjusted Outlook

(in thousands, except per

share data)

(Unaudited)

Quarter Ended

Year Ended

March 29, 2025

January 3, 2026

Operating profit outlook, as calculated

under GAAP

$55,000

$420,000 to $440,000

Restructuring and other action-related

charges

10,000

$25,000 to $30,000

Operating profit outlook, as adjusted

$65,000

$450,000 to $465,000

Other expenses outlook, as calculated

under GAAP

$21,000

$49,000

Restructuring and other action-related

charges

(13,000)

(13,000)

Other expenses outlook, as adjusted

$8,000

$36,000

Diluted earnings (loss) per share from

continuing operations, as calculated under GAAP1

$(0.05)

$0.39 to 0.45

Restructuring and other action-related

charges

0.07

0.10 to 0.12

Diluted earnings (loss) per share from

continuing operations, as adjusted

$0.02

$0.51 to $0.55

Cash flow from operations outlook, as

calculated under GAAP

$350,000

Capital expenditures outlook

50,000

Free cash flow outlook

$300,000

1

The company expects approximately 354

million diluted weighted average shares outstanding, as calculated

under GAAP (no dilution due to GAAP loss from continuing

operations) and approximately 359 million diluted weighted average

shares outstanding, as adjusted, for the quarter ended March 29,

2025. The company expects approximately 361 million diluted

weighted average shares outstanding for the year ended January 3,

2026.

The Company is unable to reconcile projections of financial

performance beyond 2025 without unreasonable efforts, because the

Company cannot predict, with a reasonable degree of certainty, the

type and extent of certain items that would be expected to impact

these figures in 2025 and beyond, such as net sales, operating

profit, tax rates and action related charges.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250213774231/en/

News Media contact: Jonathan Binder (336) 682-9654 Analysts and

Investors contact: T.C. Robillard (336) 519-2115

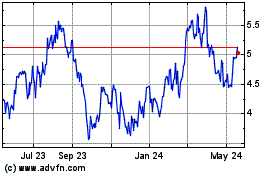

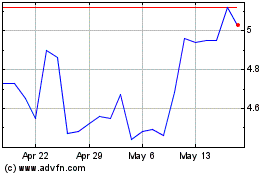

Hanesbrands (NYSE:HBI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Hanesbrands (NYSE:HBI)

Historical Stock Chart

From Feb 2024 to Feb 2025