Helmerich & Payne, Inc. (NYSE: HP) reported net income of

$55 million, or $0.54 per diluted share, from operating revenues of

$677 million for the quarter ended December 31, 2024, compared to

net income of $75 million, or $0.76 per diluted share, from

operating revenues of $694 million for the quarter ended September

30, 2024. The net income per diluted share for the first quarter of

fiscal 2025 and fourth quarter of fiscal year 2024 include net

$(0.17) and $0.00 of after-tax gains and losses, respectively,

comprised of select items(1).

Net cash provided by operating activities was $158 million for

the first quarter of fiscal year 2025 compared to net cash provided

by operating activities of $169 million for the fourth quarter of

fiscal year 2024.

Quarter Highlights

- The Company reported fiscal first quarter Adjusted EBITDA(2) of

$199 million

- The North America Solutions ("NAS") segment exited the first

quarter of fiscal year 2025 with 148 active rigs and recognized

revenue per day of $38,600/day with associated direct margins(3)

per day of $19,400 day during the quarter

- Quarterly NAS operating income decreased $4 million to $152

million, from the fourth fiscal quarter of 2024; while direct

margins(3) decreased by $9 million to $266 million as revenues

decreased by $20 million to $598 million and expenses decreased by

$11 million to $333 million

- Completed the exportation of eight super-spec FlexRigs into our

Saudi Arabia operations

- On December 11, 2024, the Board of Directors of the Company

declared a quarterly cash dividend of $0.25 per share, payable on

February 28, 2025 to stockholders of record at the close of

business on February 14, 2025

On January 16th, the Company completed the acquisition of KCA

Deutag, which establishes H&P as a global leader in onshore

drilling and positions the Company for value creation opportunities

in the years ahead. Key highlights of the acquisition include:

- An increase in our contracted rig count in key Middle Eastern

markets from 11 to 65, with significant sources of cash flows in

Saudi Arabia, Oman, Kuwait, and Bahrain

- Substantial growth in our offshore business, with exposure now

to stable markets in the North Sea, U.S. Gulf of Mexico, the

Caspian Sea, and offshore Canada

- Growth in key customer relationships, with legacy KCA Deutag

activity already generating incremental new commercial interest for

H&P's leading technology solution offerings

- The addition of approximately $5.5(4) billion in backlog with

high-quality, investment-grade customers

- Maintenance of H&P's own strong, investment-grade credit

profile, with additional cash flow diversification to provide

stability across a variety of market environments

- Enhances geographic footprint, with the Company levered to the

most resilient basins in the world

Commentary

President and CEO John Lindsay commented, "During the first

fiscal quarter of 2025, the Company executed at a high level on

multiple fronts. Our NAS segment maintained its industry leading

position with a financial performance and a stable rig count

reflecting the value proposition we are providing to customers. In

our International Solutions segment, we completed the exportation

of eight rigs into Saudi Arabia during the quarter, three of which

have spud. We are looking forward to more of those rigs commencing

operations in the coming months.

"Crude oil prices and industry rig counts were relatively steady

during the quarter, but market sentiment remained cautious in the

face of a multitude of economic and geopolitical uncertainties that

have materialized over the past several quarters. Contractual churn

in our NAS rig count continues to characterize the market, yet we

have been successful in managing that volatility by consistently

delivering drilling performance and efficiencies for our customers.

Looking through the remainder of the second fiscal quarter we

expect our NAS rig count to remain relatively flat and exit the

quarter in a range of 146-152 active rigs.

"Results in our International Solutions and Offshore Solutions

segments were in line with recent quarter norms but are poised to

increase significantly in the second fiscal quarter. In addition to

the direct margin contributions from KCA Deutag's core Middle East

operations, the eight rigs recently delivered into Saudi Arabia are

also expected to be a factor in improving this segment's overall

direct margins and collectively positions the Company as a leading

land driller in the region. In terms of magnitude, KCA Deutag's

core Middle East assets drive H&P's rig count in the Middle

East from 11 rigs contracted as of December 31, 2024 to

approximately 65 rigs contracted at the end of March 31, 2025. In

South America, tendering activity has increased and we see the

potential to add 1-3 rigs later in calendar 2025. Regarding the

Offshore Solutions segment, the addition of approximately 30

management contracts from the KCA Deutag acquisition will

meaningfully increase this segment's contribution to the overall

Company as well."

Senior Vice President and CFO Kevin Vann also commented, "As

John mentioned, we are excited about the recent completion of the

KCA Deutag acquisition as it substantially accelerates our

international growth, and we are looking forward to the benefits of

being a larger and more diversified company. We expect operations

in our North America Solutions segment to continue generating

significant levels of cash flow. We believe that cash generation

combined with a lower capex outlook for fiscal 2025 for H&P's

legacy operations relative to fiscal 2024 and the inclusion of KCA

Deutag's cash flow from operations, will create free cash flow that

we intend to use to service our near-term debt reduction goals as

well as continue to provide a competitive dividend to our

shareholders."

John Lindsay concluded, “Over the past several months H&P

and KCA Deutag employees have been working on integration planning,

and now with the acquisition complete that integration is underway.

I have been impressed by the hard work of our employees while

maintaining our focus on safety. We realize that it may take

several months to fully harmonize the new organization, but we

believe the leadership and plans are in place to achieve that end.

During this time of internal integration, our external focus will

remain on our customers. We will continue to have a customer

centric approach, putting safety and value creation at the

forefront of our operations."

Operating Segment Results for the First

Quarter of Fiscal Year 2025

North America Solutions:

This segment had operating income of $152.0 million compared to

operating income of $155.7 million during the previous quarter, a

decrease of $3.7 million. The decrease in operating income was

primarily attributable to lower revenue and fewer revenue days

during the quarter; offset to some extent by lower depreciation and

selling, general and administrative expenses. Direct margin(3)

decreased by $9.1 million to $265.5 million sequentially.

International Solutions:

This segment had an operating loss of $15.2 million compared to

an operating loss of $5.1 million during the previous quarter. The

decrease in operating income was mainly due to start-up costs

associated with our Saudi Arabia operations. Direct margin(3)

during the first fiscal quarter was a loss of $7.6 million compared

to $0.3 million during the previous quarter. Current quarter

results included a $0.9 million foreign currency loss compared to a

$1.1 million foreign currency loss in the previous quarter.

Offshore Gulf of Mexico (Note: Naming convention changed to

Offshore Solutions effective 1/16/25):

This segment had operating income of $3.5 million compared to

operating income of $4.3 million during the previous quarter.

Direct margin(3) for the quarter was $6.5 million compared to $7.1

million in the previous quarter.

Select Items(1) Included in Net Income

per Diluted Share

First quarter of fiscal year 2025 net income of $0.54 per

diluted share included a net impact $(0.17) per share in after-tax

gains and losses comprised of the following:

- $0.02 of after-tax gains related to an insurance claim

- $(0.01) of after-tax losses related to fees associated with

acquisition financing

- $(0.08) of after-tax losses related to transaction and

integration costs

- $(0.10) of non-cash after-tax losses related to fair market

value adjustments to equity investments

Fourth quarter of fiscal year 2024 net income of $0.76 per

diluted share included a net impact of $0.00 in after-tax gains and

losses comprised of the following:

- $0.10 of non-cash after-tax gains related to fair market value

adjustments to equity investments

- $(0.05) of after-tax losses related to fees associated with

acquisition financing

- $(0.05) of after-tax losses related to transaction and

integration costs

Operational Outlook for the Second

Quarter of Fiscal Year 2025

The below guidance represents our expectations as of the date of

this release.

North America Solutions:

- Direct margins(3) to be between $240-$260 million

- Exit the quarter between approximately 146-152 contracted

rigs

International Solutions:

- Direct margin(3) contribution from H&P's legacy operations

to be between $(7)-$(3) million, exclusive of any foreign exchange

gains or losses

- Direct margin(3) contribution from KCA Deutag's legacy

operations to be between $35-$50 million, exclusive of any foreign

exchange gains or losses

- Collectively exit the quarter between approximately 88-94

contracted rigs, of which 71-77 are expected to be generating

revenue

Offshore Solutions:

- Direct margin(3) contribution from H&P's legacy operations

to be between $6-$8 million

- Direct margin(3) contribution from KCA Deutag's legacy

operations to be between $18-$25 million

- Collectively exit the quarter between approximately 35-39

management contracts and contracted platform rigs

Other:

- Direct margin(3) contribution from the Company's other

operations to be between $4-$6 million

Other Estimates for Fiscal Year 2025

(inclusive of KCA Deutag's legacy operations)

- Gross capital expenditures are now expected to be approximately

$360-$395 million;

- Ongoing asset sales that include reimbursements for lost and

damaged tubulars and sales of other used drilling equipment offset

a portion of the gross capital expenditures, and are still expected

to total approximately $45 million in fiscal year 2025

- Depreciation for H&P's legacy operations fiscal year 2025

is still expected to be approximately $400 million; purchase price

accounting for the KCA Deutag acquisition has not been

completed

- Research and development expenses for fiscal year 2025 are

still expected to be roughly $32 million

- General and administrative expenses for fiscal year 2025 are

now expected to be approximately $280 million

- Cash taxes to be paid in fiscal year 2025 are now expected to

be approximately $190-$240 million

- Interest expense for the remainder of fiscal year 2025 (Q2-Q4)

is expected to be approximately $75 million

Conference Call

A conference call will be held on Thursday, February 6, 2024 at

11:00 a.m. (ET) with John Lindsay, President and CEO, Kevin Vann,

Senior Vice President and CFO, and Dave Wilson, Vice President of

Investor Relations, to discuss the Company’s first quarter fiscal

year 2025 results. Dial-in information for the conference call is

(800) 445-7795 for domestic callers or (785) 424-1699 for

international callers. The call access code is ‘Helmerich’. You may

also listen to the conference call that will be broadcast live over

the Internet and can access the Company's earnings presentation by

logging on to the Company’s website at

http://www.helmerichpayne.com and accessing the corresponding link

through the investor relations section by clicking on “Investors”

and then clicking on “News and Events - Events & Presentations”

to find the event and the link to the webcast and presentation.

About Helmerich & Payne,

Inc.

Founded in 1920, Helmerich & Payne, Inc. (H&P) (NYSE:

HP) is committed to delivering industry leading levels of drilling

productivity and reliability. H&P operates with the highest

level of integrity, safety and innovation to deliver superior

results for its customers and returns for shareholders. Through its

subsidiaries, the Company designs, fabricates and operates

high-performance drilling rigs in conventional and unconventional

plays around the world. H&P also develops and implements

advanced automation, directional drilling and survey management

technologies. At December 31, 2024, H&P's fleet included 225

land rigs in the United States, 30 international land rigs and

seven offshore platform rigs. For more information, see H&P

online at www.helmerichpayne.com.

Forward-Looking

Statements

This release includes “forward-looking statements” within the

meaning of the Securities Act of 1933 and the Securities Exchange

Act of 1934, and such statements are based on current expectations

and assumptions that are subject to risks and uncertainties. All

statements other than statements of historical facts included in

this release, including, without limitation, statements regarding

the anticipated benefits (including synergies and cash flow and

free cash flow accretion) of the acquisition and integration of KCA

Deutag, the anticipated impact of the acquisition of KCA Deutag on

the Company's business and future financial and operating results,

the anticipated timing of expected synergies and returns from the

acquisition of KCA Deutag, the anticipated impact of suspended rigs

related to the Acquisition, the timing and terms of recommencement

of suspended rigs related to the Acquisition, the Company’s

business strategy, future financial position, operations outlook,

future cash flow, future use of generated cash flow, dividend

amounts and timing, amounts of any future dividends, investments,

active rig count projections, projected costs and plans, objectives

of management for future operations, contract terms, financing and

funding, capex spending and budgets, outlook for domestic and

international markets, future commodity prices, future customer

activity and relationships and the expected impact of the

integration of KCA Deutag are forward-looking statements. For

information regarding risks and uncertainties associated with the

Company’s business, please refer to the “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” sections and other disclosures in the

Company’s SEC filings, including but not limited to its annual

report on Form 10‑K and quarterly reports on Form 10‑Q. As a result

of these factors, Helmerich & Payne, Inc.’s actual results may

differ materially from those indicated or implied by such

forward-looking statements. Investors are cautioned not to put

undue reliance on such statements. We undertake no duty to publicly

update or revise any forward-looking statements, whether as a

result of new information, changes in internal estimates,

expectations or otherwise, except as required under applicable

securities laws.

Helmerich & Payne uses its Investor Relations website as a

channel of distribution for material company information. Such

information is routinely posted and accessible on its Investor

Relations website at www.helmerichpayne.com. Information on our

website is not part of this release.

Note Regarding Trademarks. Helmerich & Payne, Inc. owns or

has rights to the use of trademarks, service marks and trade names

that it uses in conjunction with the operation of its business.

Some of the trademarks that appear in this release or otherwise

used by H&P include FlexRig, which may be registered or

trademarked in the United States and other jurisdictions.

(1) Select items are considered non-GAAP metrics and are

included as a supplemental disclosure as the Company believes

identifying and excluding select items is useful in assessing and

understanding current operational performance, especially in making

comparisons over time involving previous and subsequent periods

and/or forecasting future periods results. Select items are

excluded as they are deemed to be outside the Company's core

business operations. See Non-GAAP Measurements.

(2) Adjusted EBITDA is considered to be a non-GAAP metric.

Adjusted EBITDA is defined as net income (loss) before taxes,

depreciation and amortization, gains and losses on asset sales,

other income and expense - which includes interest income and

interest expense, and excludes the impact of 'select items' which

management defines as certain items that do not reflect the ongoing

performance of our core business operations. Adjusted EBITDA is

included as supplemental disclosure as management uses it to assess

and understand current operational performance, especially in

analyzing historical trends which are used in forecasting future

period results. For this reason, we believe this measure will be

useful to information to investors. The presence of non-GAAP

metrics is not intended to suggest that such measures should be

considered as a substitute for certain GAAP metrics and, given that

not all companies define Adjusted EBITDA the same way, this

financial measure may not be comparable to similarly titled metrics

disclosed by other companies. See Non-GAAP Measurements for a

reconciliation of net income to Adjusted EBITDA.

(3) Direct margin, which is considered a non-GAAP metric, is

defined as operating revenues (less reimbursements) less direct

operating expenses (less reimbursements) and is included as a

supplemental disclosure. We believe it is useful in assessing and

understanding our current operational performance, especially in

making comparisons over time. See Non-GAAP Measurements for a

reconciliation of segment operating income(loss) to direct margin.

Expected direct margin for the second quarter of fiscal 2025 is

provided on a non-GAAP basis only because certain information

necessary to calculate the most comparable GAAP measure is

unavailable due to the uncertainty and inherent difficulty of

predicting the occurrence and the future financial statement impact

of certain items. Therefore, as a result of the uncertainty and

variability of the nature and amount of future items and

adjustments, which could be significant, we are unable to provide a

reconciliation of expected direct margin to the most comparable

GAAP measure without unreasonable effort.

(4) With the completion of the KCA Deutag acquisition on January

16, 2025, the Company added approximately $5.5 billion to its

contract backlog.

HELMERICH & PAYNE, INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

Three Months Ended

(in thousands, except per share

amounts)

December 31,

September 30,

December 31,

2024

2024

2023

OPERATING REVENUES

Drilling services

$

674,613

$

691,293

$

674,565

Other

2,689

2,500

2,582

677,302

693,793

677,147

OPERATING COSTS AND EXPENSES

Drilling services operating expenses,

excluding depreciation and amortization

411,857

408,043

403,303

Other operating expenses

1,156

1,176

1,137

Depreciation and amortization

99,080

100,992

93,991

Research and development

9,359

8,862

8,608

Selling, general and administrative

63,062

66,923

56,577

Acquisition transaction costs

10,535

7,452

—

Gain on reimbursement of drilling

equipment

(9,403

)

(8,622

)

(7,494

)

Other (gain) loss on sale of assets

1,673

2,421

(2,443

)

587,319

587,247

553,679

OPERATING INCOME

89,983

106,546

123,468

Other income (expense)

Interest and dividend income

21,741

11,979

10,734

Interest expense

(22,298

)

(16,124

)

(4,372

)

Gain (loss) on investment securities

(13,367

)

13,851

(4,034

)

Other

360

102

(543

)

(13,564

)

9,808

1,785

Income before income taxes

76,419

116,354

125,253

Income tax expense

21,647

40,878

30,080

NET INCOME

$

54,772

$

75,476

$

95,173

Basic earnings per common share

$

0.55

$

0.75

$

0.95

Diluted earnings per common share

$

0.54

$

0.76

$

0.94

Weighted average shares outstanding:

Basic

98,867

98,755

99,143

Diluted

99,159

98,995

99,628

HELMERICH & PAYNE, INC.

UNAUDITED CONDENSED CONSOLIDATED

BALANCE SHEETS

December 31,

September 30,

(in thousands except share data and share

amounts)

2024

2024

ASSETS

Current Assets:

Cash and cash equivalents

$

391,179

$

217,341

Restricted cash

73,216

68,902

Short-term investments

135,317

292,919

Accounts receivable, net of allowance of

$2,720 and $2,977, respectively

426,933

418,604

Inventories of materials and supplies,

net

127,288

117,884

Prepaid expenses and other, net

70,898

76,419

Total current assets

1,224,831

1,192,069

Investments

101,652

100,567

Property, plant and equipment, net

3,009,360

3,016,277

Other Noncurrent Assets:

Goodwill

45,653

45,653

Intangible assets, net

52,547

54,147

Operating lease right-of-use asset

67,510

67,076

Restricted cash

1,242,124

1,242,417

Other assets, net

72,944

63,692

Total other noncurrent assets

1,480,778

1,472,985

Total assets

$

5,816,621

$

5,781,898

LIABILITIES & SHAREHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

148,752

$

135,084

Dividends payable

25,154

25,024

Accrued liabilities

261,807

286,841

Total current liabilities

435,713

446,949

Noncurrent Liabilities:

Long-term debt, net

1,781,674

1,782,182

Deferred income taxes

485,682

495,481

Other

166,771

140,134

Total noncurrent liabilities

2,434,127

2,417,797

Shareholders' Equity:

Common stock, $0.10 par value, 160,000,000

shares authorized, 112,222,865 shares issued as of December 31,

2024 and September 30, 2024, and 99,186,843 and 98,755,412 shares

outstanding as of December 31, 2024 and September 30, 2024,

respectively

11,222

11,222

Preferred stock, no par value, 1,000,000

shares authorized, no shares issued

—

—

Additional paid-in capital

501,516

518,083

Retained earnings

2,913,211

2,883,590

Accumulated other comprehensive loss

(5,987

)

(6,350

)

Treasury stock, at cost, 13,036,022 shares

and 13,467,453 shares as of December 31, 2024 and September 30,

2024, respectively

(473,181

)

(489,393

)

Total shareholders’ equity

2,946,781

2,917,152

Total liabilities and shareholders'

equity

$

5,816,621

$

5,781,898

HELMERICH & PAYNE, INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

Three Months Ended December

31,

(in thousands)

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net income

$

54,772

$

95,173

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

99,080

93,991

Amortization of debt discount and debt

issuance costs

2,390

148

Stock-based compensation

6,851

7,672

Loss on investment securities

13,367

4,034

Gain on reimbursement of drilling

equipment

(9,403

)

(7,494

)

Other (gain) loss on sale of assets

1,673

(2,443

)

Deferred income tax benefit

(9,923

)

(7,829

)

Other

(381

)

305

Changes in assets and liabilities

(68

)

(8,759

)

Net cash provided by operating

activities

158,358

174,798

CASH FLOWS FROM INVESTING

ACTIVITIES:

Capital expenditures

(106,485

)

(136,411

)

Purchase of short-term investments

(95,956

)

(46,250

)

Purchase of long-term investments

(646

)

(291

)

Proceeds from sale of short-term

investments

242,920

57,956

Insurance proceeds from involuntary

conversion

698

—

Proceeds from asset sales

12,120

11,929

Net cash provided by (used in) investing

activities

52,651

(113,067

)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Dividends paid

(25,021

)

(42,294

)

Debt issuance costs

(1,216

)

—

Payments for employee taxes on net

settlement of equity awards

(6,913

)

(8,820

)

Payment of contingent consideration from

acquisition of business

—

(250

)

Share repurchases

—

(47,364

)

Net cash used in financing activities

(33,150

)

(98,728

)

Net increase (decrease) in cash and cash

equivalents and restricted cash

177,859

(36,997

)

Cash and cash equivalents and restricted

cash, beginning of period

1,528,660

316,238

Cash and cash equivalents and restricted

cash, end of period

$

1,706,519

$

279,241

HELMERICH & PAYNE, INC.

SEGMENT REPORTING

Three Months Ended

December 31,

September 30,

December 31,

(in thousands, except operating

statistics)

2024

2024

2023

NORTH AMERICA SOLUTIONS

Operating revenues

$

598,145

$

618,285

$

594,282

Direct operating expenses

332,602

343,651

338,208

Depreciation and amortization

88,336

92,647

87,019

Research and development

9,440

8,987

8,689

Selling, general and administrative

expense

15,773

17,305

15,876

Segment operating income

$

151,994

$

155,695

$

144,490

Financial Data and Other Operating

Statistics1:

Direct margin (Non-GAAP)2

$

265,543

$

274,634

$

256,074

Revenue days3

13,708

13,871

13,711

Average active rigs4

149

151

149

Number of active rigs at the end of

period5

148

151

151

Number of available rigs at the end of

period

225

228

233

Reimbursements of "out-of-pocket"

expenses

$

68,426

$

76,148

$

69,728

INTERNATIONAL SOLUTIONS

Operating revenues

$

47,480

$

45,463

$

54,752

Direct operating expenses

55,114

45,155

44,519

Depreciation

4,828

3,314

2,334

Selling, general and administrative

expense

2,708

2,091

2,476

Segment operating income (loss)

$

(15,170

)

$

(5,097

)

$

5,423

Financial Data and Other Operating

Statistics1:

Direct margin (Non-GAAP)2

$

(7,634

)

$

308

$

10,233

Revenue days3

1,689

1,336

1,173

Average active rigs4

18

15

13

Number of active rigs at the end of

period5

20

16

12

Number of available rigs at the end of

period

30

27

22

Reimbursements of "out-of-pocket"

expenses

$

2,119

$

1,065

$

3,384

OFFSHORE GULF OF MEXICO

Operating revenues

$

29,210

$

27,545

$

25,531

Direct operating expenses

22,661

20,468

19,579

Depreciation

1,980

1,723

2,068

Selling, general and administrative

expense

1,064

1,079

832

Segment operating income

$

3,505

$

4,275

$

3,052

Financial Data and Other Operating

Statistics1:

Direct margin (Non-GAAP)2

$

6,549

$

7,077

$

5,952

Revenue days3

276

276

289

Average active rigs4

3

3

3

Number of active rigs at the end of

period5

3

3

3

Number of available rigs at the end of

period

7

7

7

Reimbursements of "out-of-pocket"

expenses

$

7,225

$

7,287

$

7,827

(1)

These operating metrics and financial

data, including average active rigs, are provided to allow

investors to analyze the various components of segment financial

results in terms of activity, utilization and other key results.

Management uses these metrics to analyze historical segment

financial results and as the key inputs for forecasting and

budgeting segment financial results.

(2)

Direct margin, which is considered a

non-GAAP metric, is defined as operating revenues (less

reimbursements) less direct operating expenses (less

reimbursements) and is included as a supplemental disclosure

because we believe it is useful in assessing and understanding our

current operational performance, especially in making comparisons

over time. See — Non-GAAP Measurements below for a reconciliation

of segment operating income (loss) to direct margin.

(3)

Defined as the number of contractual days

we recognized revenue for during the period.

(4)

Active rigs generate revenue for the

Company; accordingly, 'average active rigs' represents the average

number of rigs generating revenue during the applicable time

period. This metric is calculated by dividing revenue days by total

days in the applicable period (i.e. 92 days for the three months

ended December 31, 2024, September 30, 2024, and December 31,

2023.)

(5)

Defined as the number of rigs generating

revenue at the applicable end date of the time period.

Segment operating income (loss) for all segments is a non-GAAP

financial measure of the Company’s performance, as it excludes

acquisition transaction costs, gain on reimbursement of drilling

equipment, other gain (loss) on sale of assets, corporate selling,

general and administrative expenses and corporate depreciation. The

Company considers segment operating income (loss) to be an

important supplemental measure of operating performance for

presenting trends in the Company’s core businesses. This measure is

used by the Company to facilitate period-to-period comparisons in

operating performance of the Company’s reportable segments in the

aggregate by eliminating items that affect comparability between

periods. The Company believes that segment operating income (loss)

is useful to investors because it provides a means to evaluate the

operating performance of the segments and the Company on an ongoing

basis using criteria that are used by our internal decision makers.

Additionally, it highlights operating trends and aids analytical

comparisons. However, segment operating income (loss) has

limitations and should not be used as an alternative to operating

income or loss, a performance measure determined in accordance with

GAAP, as it excludes certain costs that may affect the Company’s

operating performance in future periods.

The following table reconciles operating income per the

information above to income (loss) from continuing operations

before income taxes as reported on the Unaudited Condensed

Consolidated Statements of Operations:

Three Months Ended

December 31,

September 30,

December 31,

(in thousands)

2024

2024

2023

Operating income (loss)

North America Solutions

$

151,994

$

155,695

$

144,490

International Solutions

(15,170

)

(5,097

)

5,423

Offshore Gulf of Mexico

3,505

4,275

3,052

Other

774

714

(67

)

Eliminations

102

2,315

334

Segment operating income

$

141,205

$

157,902

$

153,232

Acquisition transaction costs

(10,535

)

(7,452

)

—

Gain on reimbursement of drilling

equipment

9,403

8,622

7,494

Other gain (loss) on sale of assets

(1,673

)

(2,421

)

2,443

Corporate selling, general and

administrative costs and corporate depreciation

(48,417

)

(50,105

)

(39,701

)

Operating income

$

89,983

$

106,546

$

123,468

Other income (expense):

Interest and dividend income

21,741

11,979

10,734

Interest expense

(22,298

)

(16,124

)

(4,372

)

Gain (loss) on investment securities

(13,367

)

13,851

(4,034

)

Other

360

102

(543

)

Total unallocated amounts

(13,564

)

9,808

1,785

Income before income taxes

$

76,419

$

116,354

$

125,253

SUPPLEMENTARY STATISTICAL

INFORMATION

Unaudited

H&P GLOBAL LAND RIG

COUNTS, MARKETABLE FLEET

& MANAGEMENT CONTRACT

STATISTICS

February 5,

December 31,

September 30,

Q1F25

2025

2024

2024

Average

North American

Solutions

Term Contract Rigs

87

87

88

86

Spot Contract Rigs

61

61

63

63

Total Contracted Rigs

148

148

151

149

Idle or Other Rigs

77

77

77

77

Total Marketable Fleet

225

225

228

226

International

Solutions

Total Contracted Rigs(1)

89

20

16

18

Idle or Other Rigs

64

10

11

11

Total Marketable Fleet

153

30

27

29

Offshore

Solutions

Total Platform Rigs

3

3

3

3

Idle or Other Rigs

4

4

4

4

Total Fleet

7

7

7

7

Total Management Contracts

34

3

3

3

(1)

Includes 17 rigs, 5 rigs, and 5 rigs as

February 5, 2025, December 31, 2024, and September 30, 2024,

respectively that are contracted but not earning revenue.

NON-GAAP MEASUREMENTS

NON-GAAP RECONCILIATION OF

SELECT ITEMS AND ADJUSTED NET INCOME(**)

Three Months Ended December

31, 2024

(in thousands, except per share data)

Pretax

Tax Impact

Net

EPS

Net income (GAAP basis)

$

54,772

$

0.54

(-) Gains related to an insurance

claim

$

2,366

$

656

$

1,710

$

0.02

(-) Losses related to fees associated with

acquisition financing

$

(1,468

)

$

(407

)

$

(1,061

)

$

(0.01

)

(-) Losses related to transaction and

integration costs

$

(10,535

)

$

(2,918

)

$

(7,617

)

$

(0.08

)

(-) Fair market adjustment to equity

investments

$

(13,427

)

$

(3,719

)

$

(9,708

)

$

(0.10

)

Adjusted net income

$

71,448

$

0.71

Three Months Ended September

30, 2024

(in thousands, except per share data)

Pretax

Tax Impact

Net

EPS

Net income (GAAP basis)

$

75,476

$

0.76

(-) Fair market adjustment to equity

investments

$

13,764

$

4,073

$

9,691

$

0.10

(-) Fees associated with the acquisition

financing

$

(7,167

)

$

(2,043

)

$

(5,124

)

$

(0.05

)

(-) Expenses related to transaction and

integration costs

$

(7,452

)

$

(2,287

)

$

(5,165

)

$

(0.05

)

Adjusted net income

$

76,074

$

0.76

(**)The Company believes identifying and excluding select items

is useful in assessing and understanding current operational

performance, especially in making comparisons over time involving

previous and subsequent periods and/or forecasting future period

results. Select items are excluded as they are deemed to be outside

of the Company's core business operations.

NON-GAAP

RECONCILIATION OF DIRECT MARGIN

Direct margin is considered a non-GAAP metric. We define "direct

margin" as operating revenues (less reimbursements) less direct

operating expenses (less reimbursements). Direct margin is included

as a supplemental disclosure because we believe it is useful in

assessing and understanding our current operational performance,

especially in making comparisons over time. Direct margin is not a

substitute for financial measures prepared in accordance with GAAP

and should therefore be considered only as supplemental to such

GAAP financial measures.

The following table reconciles direct margin to segment

operating income (loss), which we believe is the financial measure

calculated and presented in accordance with GAAP that is most

directly comparable to direct margin.

Three Months Ended

December 31,

September 30,

December 31,

(in thousands)

2024

2024

2023

NORTH AMERICA SOLUTIONS

Segment operating income

$

151,994

$

155,695

$

144,490

Add back:

Depreciation and amortization

88,336

92,647

87,019

Research and development

9,440

8,987

8,689

Selling, general and administrative

expense

15,773

17,305

15,876

Direct margin (Non-GAAP)

$

265,543

$

274,634

$

256,074

INTERNATIONAL SOLUTIONS

Segment operating income (loss)

$

(15,170

)

$

(5,097

)

$

5,423

Add back:

Depreciation and amortization

4,828

3,314

2,334

Selling, general and administrative

expense

2,708

2,091

2,476

Direct margin (Non-GAAP)

$

(7,634

)

$

308

$

10,233

OFFSHORE GULF OF MEXICO

Segment operating income

$

3,505

$

4,275

$

3,052

Add back:

Depreciation and amortization

1,980

1,723

2,068

Selling, general and administrative

expense

1,064

1,079

832

Direct margin (Non-GAAP)

$

6,549

$

7,077

$

5,952

NON-GAAP

RECONCILIATION OF ADJUSTED EBITDA

Adjusted EBITDA and 'Select Items' are considered to be non-GAAP

metrics. Adjusted EBITDA is defined as net income(loss) before

taxes, depreciation and amortization, gains and losses on asset

sales, other income and expense - which includes interest income

and interest expense, and excludes the impact of 'select items'

which management defines as certain items that do not reflect the

ongoing performance of our core business operations. These metrics

are included as supplemental disclosures as management uses them to

assess and understand current operational performance, especially

in analyzing historical trends which are used in forecasting future

period results. For this reason, we believe this measure will be

useful to information to investors. The presence of non-GAAP

metrics is not intended to suggest that such measures should be

considered as a substitute for certain GAAP metrics and, given that

not all companies define Adjusted EBITDA the same way, this

financial measure may not be comparable to similarly titled metrics

disclosed by other companies.

Three Months Ended

December 31,

September 30,

December 31,

(in thousands)

2024

2024

2023

Net income

$

54,772

$

75,476

$

95,173

Add back:

Income tax expense

21,647

40,878

30,080

Other income (expense)

Interest and dividend income

(21,741

)

(11,979

)

(10,734

)

Interest expense

22,298

16,124

4,372

(Gain) loss on investment securities

13,367

(13,851

)

4,034

Other

(360

)

(102

)

543

Depreciation and amortization

99,080

100,992

93,991

Other (gain) loss on sale of assets

1,673

2,421

(2,443

)

Excluding Select Items (Non-GAAP)

Expenses related to transaction and

integration costs

10,535

7,452

—

Gains related to an insurance claim

(2,366

)

—

—

Adjusted EBITDA (Non-GAAP)

$

198,905

$

217,411

$

215,016

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250205447985/en/

Dave Wilson, Vice President of Investor Relations

investor.relations@hpinc.com (918) 588‑5190

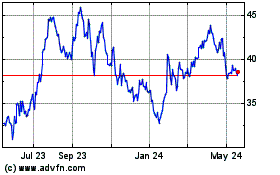

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Feb 2025 to Mar 2025

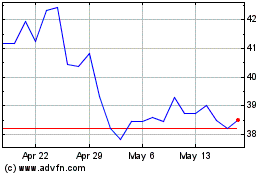

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Mar 2024 to Mar 2025