ICE Launches Long European Union Bond Index Futures

December 10 2024 - 6:00AM

Business Wire

Futures Reference ICE 8-13 Year European Union

Index

Intercontinental Exchange, Inc. (NYSE:ICE), a leading global

provider of technology and data today announced the launch of Long

European Union (EU) Bond Index futures along with the first trades

in the contract.

The cash-settled futures contract references the ICE 8-13 Year

European Union Index (Ticker: G0EU8T13) which tracks the

performance of long-term debt issued by the EU.

“This innovative product provides a much-needed solution for

managing exposure to EU sovereign bonds efficiently,” said Mirco

Bulega, Partner at ExodusPoint Capital Management U.K. “We are

pleased to see ICE leading the way in bringing such tools to

market.”

The Index is produced by ICE Data Indices (IDI), a recognized

third country benchmark administrator under the U.K. Benchmarks

Regulation. The ICE 8-13 Year European Union Index is a subset of

the ICE European Union Index, including all securities with a

remaining term to final maturity greater than or equal to 8 years

and less than 13 years. The Index tracks exposure to a specific

point on the EU curve and the historical volatility of the Index is

similar to other European Bond futures.

“Harmonized EU debt is an emerging space and as it scales,

market participants need a futures hedging tool to help them manage

risk,” said Caterina Caramaschi, Vice President, Financial

Derivatives at ICE. “By introducing an equity-style index-based

instrument that is cash-settled, ICE is opening up EU debt to a

potentially larger pool of liquidity.”

“With the interest and debate around the status of European

Union bonds not being included in sovereign bond indices, we saw

that customers wanted a way to invest in, and manage, exposure to

EU debt,” said Varun Pawar, Chief Product Officer of ICE Fixed

Income and Data Services. “By leveraging ICE’s leading fixed income

pricing and reference data, IDI’s index construction capabilities,

and ICE’s global futures team, we have created a product that

allows customers to manage this risk, demonstrating the product

innovation we can bring to customers across global financial

markets.”

The contract is available to trade and clear alongside ICE’s

deeply liquid, multi-currency European, U.K. and Swiss interest

rate markets, including benchmarks Euribor, €STR, SONIA and SARON

as well as Gilts, the benchmark for the U.K. government bond yield

curve. Open interest is up over 20% year-over-year across ICE’s

interest rate derivatives complex.

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune 500

company that designs, builds and operates digital networks that

connect people to opportunity. We provide financial technology and

data services across major asset classes helping our customers

access mission-critical workflow tools that increase transparency

and efficiency. ICE’s futures, equity, and options exchanges –

including the New York Stock Exchange – and clearing houses help

people invest, raise capital and manage risk. We offer some of the

world’s largest markets to trade and clear energy and environmental

products. Our fixed income, data services and execution

capabilities provide information, analytics and platforms that help

our customers streamline processes and capitalize on opportunities.

At ICE Mortgage Technology, we are transforming U.S. housing

finance, from initial consumer engagement through loan production,

closing, registration and the long-term servicing relationship.

Together, ICE transforms, streamlines and automates industries to

connect our customers to opportunity.

Trademarks of ICE and/or its affiliates include Intercontinental

Exchange, ICE, ICE block design, NYSE and New York Stock Exchange.

Information regarding additional trademarks and intellectual

property rights of Intercontinental Exchange, Inc. and/or its

affiliates is located here. Key Information Documents for certain

products covered by the EU Packaged Retail and Insurance-based

Investment Products Regulation can be accessed on the relevant

exchange website under the heading “Key Information Documents

(KIDS).”

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 – Statements in this press release regarding

ICE's business that are not historical facts are "forward-looking

statements" that involve risks and uncertainties. For a discussion

of additional risks and uncertainties, which could cause actual

results to differ from those contained in the forward-looking

statements, see ICE's Securities and Exchange Commission (SEC)

filings, including, but not limited to, the risk factors in ICE's

Annual Report on Form 10-K for the year ended December 31, 2023, as

filed with the SEC on February 8, 2024.

ICE Data Indices, LLC (“IDI”), its affiliates and its third

party suppliers make no representations or warranties regarding the

advisability of investing in securities generally, in any financial

product or the ability of any index to track general market

performance. Past performance of an index is not an indicator of or

a guarantee of future results. For important information (including

the methodologies), limitations, and disclaimers regarding the

indices, please visit indices.ice.com.

Category: EXCHANGES

ICE-CORP

Source: Intercontinental Exchange

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241209199598/en/

ICE Media: Jess Tatham jess.tatham@ice.com +44 7377

947136 ICE Investor: Katia Gonzalez katia.gonzalez@ice.com

(678) 981-3882

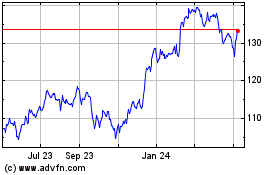

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Feb 2025 to Mar 2025

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Mar 2024 to Mar 2025