IDEX Corporation Announces Pricing of Public Offering of Senior Notes

August 07 2024 - 4:35PM

Business Wire

IDEX Corporation (NYSE: IEX) (“IDEX” or the “company”) today

announced the pricing of its public offering of $500 million

principal amount of 4.950% Senior Notes due 2029. The notes will be

unsecured senior obligations that rank equal in right of payment to

all of IDEX’s existing and future senior indebtedness. Closing of

the offering is expected to occur on August 21, 2024, subject to

the satisfaction of customary closing conditions.

IDEX estimates that the net proceeds from the offering will be

approximately $495.0 million, after deducting underwriting

discounts and commissions and its estimated offering expenses. The

company intends to use the net proceeds from this offering,

together with available revolving credit facility borrowings and

cash on hand, to (i) fund the cash consideration payable by IDEX to

consummate its previously announced acquisition of all of the

issued and outstanding capital stock of Mott Corporation and its

subsidiaries and (ii) pay fees and expenses in respect of the

foregoing.

Wells Fargo Securities, LLC, BofA Securities, Inc. and J.P.

Morgan Securities LLC are acting as joint book-running managers for

the offering.

IDEX is making this offering pursuant to a shelf registration

statement that automatically became effective upon filing with the

Securities and Exchange Commission (the “SEC”). This offering will

be made solely by means of a prospectus and prospectus supplement.

You may obtain a copy of the preliminary prospectus supplement, the

accompanying prospectus and the final prospectus supplement, when

available, for free by visiting EDGAR on the SEC website at

www.sec.gov. Alternatively, any underwriter or any dealer

participating in the offering will arrange to send you any of those

documents upon request by contacting the joint book-running

managers at:

Wells Fargo Securities, LLC, 608 2nd Avenue South, Suite

1000, Minneapolis, Minnesota 55402, Attn: WFS Customer Service;

Telephone (800) 645-3751 or Email:

wfscustomerservice@wellsfargo.com

BofA Securities, Inc., 201 North Tryon Street

(NC1-022-02-25), Charlotte, North Carolina 28255-0001, Attn:

Prospectus Department; Telephone: (800) 294-1322 or Email:

dg.prospectus_requests@bofa.com

J.P. Morgan Securities LLC, 383 Madison Avenue, New York,

New York, 10179, Attn: Investment Grade Syndicate Desk, 3rd Floor;

Telephone: (212) 834-4533.

This press release shall not constitute a solicitation of an

offer to buy, nor shall there be any sale of these securities in

any state or jurisdiction in which such offer, solicitation or sale

would be unlawful prior to the registration or qualification under

the securities laws of any such jurisdiction.

Forward-Looking Statements

This press release contains “forward-looking” statements within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, as amended. These

forward-looking statements relate to, among other things,

expectations regarding the anticipated closing of the notes

offering and IDEX’s intended use of net proceeds therefrom.

Statements which are not historical facts and relate to future

plans, events or performance are forward-looking statements that

are based upon management’s current expectations and are subject to

risks and uncertainties. The forward-looking statements are based

on management’s current expectations and should not be construed in

any manner as a guarantee that such events or results will in fact

occur. All forward-looking statements speak only as of the date of

this press release and IDEX undertakes no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise. Detailed information

regarding risk factors with respect to IDEX and the offering are

included in the company’s filings with the SEC, including the

prospectus and prospectus supplement for the offering. The

forward-looking statements included here are only made as of the

date of this press release, and management undertakes no obligation

to publicly update them to reflect subsequent events or

circumstances, except as may be required by law. Investors are

cautioned not to rely unduly on forward-looking statements when

evaluating the information presented here. Any such forward-looking

statements are not guarantees of future performances and actual

results, developments and business decisions may differ from those

contemplated by such forward-looking statements.

About IDEX

IDEX Corporation (NYSE: IEX) designs and builds engineered

products and mission-critical components that make everyday life

better. IDEX precision components help craft the microchip powering

your electronics, treat water so it is safe to drink, and protect

communities and the environment from sewer overflows. Our optics

enable communications across outer space, and our pumps move

challenging fluids that range from hot, to viscous, to caustic.

IDEX components assist healthcare professionals in saving lives as

part of many leading diagnostic machines, including DNA sequencers

that help doctors personalize treatment. And our fire and rescue

tools, including the industry-leading Hurst Jaws of Life®, are

trusted by rescue workers around the world. These are just some of

the thousands of products that help IDEX live its purpose – Trusted

Solutions, Improving Lives™. Founded in 1988 with three small,

entrepreneurial manufacturing companies, IDEX now includes more

than 50 diverse businesses around the world. With about 8,800

employees and manufacturing operations in more than 20 countries,

IDEX is a diversified, high-performing, global company with

approximately $3.3 billion in annual sales.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807414722/en/

Investor Contact:

Wendy Palacios Vice President FP&A and Investor Relations +1

847.457.3723 investorrelations@idexcorp.com

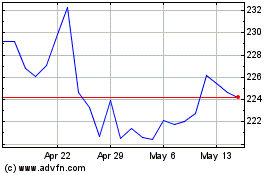

IDEX (NYSE:IEX)

Historical Stock Chart

From Nov 2024 to Dec 2024

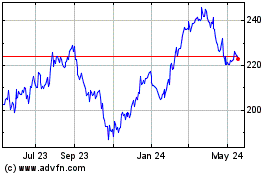

IDEX (NYSE:IEX)

Historical Stock Chart

From Dec 2023 to Dec 2024