IFF (NYSE: IFF) reported financial results for the third quarter

ended September 30, 2024.

Third Quarter 2024 Consolidated

Summary:

Reported

(GAAP)

Adjusted

(Non-GAAP)1

Sales

Income Before Taxes

EPS

Operating EBITDA

Operating EBITDA

Margin

EPS ex Amortization

$2.9 B

$95 M

$0.23

$568 M

19.4%

$1.04

First Nine Months 2024

Consolidated Summary:

Reported

(GAAP)

Adjusted

(Non-GAAP)1

Sales

Income Before Taxes

EPS

Operating EBITDA

Operating EBITDA

Margin

EPS ex Amortization

$8.7 B

$393 M

$1.13

$1.7 B

19.9%

$3.34

Management Commentary

“We are pleased to report a strong performance in the third

quarter, with growth across all business segments,” stated IFF CEO

Erik Fyrwald. “Market recovery off prior year lows and our global

team's passion to address the needs of our customers drove notable

volume recovery in every division. This achievement, coupled with

our focus on productivity, has resulted in significant bottom-line

improvement compared to the same period last year. Taking into

account our strong performance in the third quarter and our

continued cautiously optimistic outlook for the fourth quarter, we

are increasing our full year 2024 financial guidance. We are making

solid progress but have a lot of exciting work ahead of us to

unleash the full potential of IFF.”

Third Quarter 2024 Consolidated Financial Results

- Reported net sales for the third quarter were $2.93 billion, an

increase of 4% versus the prior-year period. On a comparable

basis2, currency neutral sales1 increased 9% versus the prior-year

period led by broad-based growth including double digit

performances by Health & Biosciences and Scent as well as

high-single digit increases in Nourish and Pharma Solutions. Volume

grew high-single digits and improved across all businesses.

- Income before taxes on a reported basis for the third quarter

was $95 million. Adjusted operating EBITDA1 for the third quarter

was $568 million. On a comparable basis2, adjusted operating

EBITDA1 improved 16% versus the prior-year period, led by volume

growth and productivity gains.

- Reported earnings per share (EPS) for the third quarter was

$0.23. Adjusted EPS excluding amortization1 was $1.04 per diluted

share, increasing 17% versus the prior year period as strong profit

performance and lower interest expense were mitigated by foreign

exchange impacts in other expense.

- Cash flows from operations at the end of the third quarter was

$702 million, and free cash flow1 defined as cash flows from

operations less capital expenditures totaled $399 million. Total

debt to trailing twelve months net loss at the end of the third

quarter was (3.9)x. Net debt to credit adjusted EBITDA1 at the end

of the third quarter was 3.9x.

Third Quarter 2024 Segment Summary:

Growth vs. Prior Year

Reported

(GAAP)

Comparable Currency

Neutral

(Non-GAAP)1 2

Adjusted

(Non-GAAP)1

Comparable Adjusted

(Non-GAAP)1 2

Sales

Sales

Operating EBITDA

Operating EBITDA

Nourish

3%

7%

16%

18%

Health & Biosciences

10%

12%

15%

15%

Scent

0%

10%

(3)%

7%

Pharma Solutions

8%

8%

32%

32%

Nourish Segment

- On a reported basis, third quarter sales were $1.49 billion. On

a comparable basis2, currency neutral sales1 increased 7% driven by

strong double-digit growth in Flavors. Functional Ingredients sales

improved modestly as high-single digit volume growth was mostly

offset by pricing actions.

- Nourish adjusted operating EBITDA1 was $206 million and

adjusted operating EBITDA margin1 was 13.9% in the third quarter.

On a comparable basis2, adjusted operating EBITDA1 increased 18%

led by volume growth and productivity gains.

Health & Biosciences Segment

- On a reported basis, third quarter sales were $570 million. On

a comparable basis2, currency neutral sales1 increased 12% driven

by strong double-digit performances across all businesses.

- Health & Biosciences adjusted operating EBITDA1 was $173

million and adjusted operating EBITDA margin1 was 30.4% in the

third quarter. On a comparable basis2, adjusted operating EBITDA1

improved 15% led primarily by volume growth and productivity

gains.

Scent Segment

- On a reported basis, third quarter sales were $613 million. On

a comparable basis2, currency neutral sales1 increased 10% led by

double-digit growth in Consumer Fragrance and Fine Fragrance and a

high-single digit increase in Fragrance Ingredients.

- Scent adjusted operating EBITDA1 was $127 million and adjusted

operating EBITDA margin1 was 20.7% in the third quarter. On a

comparable basis2, adjusted operating EBITDA1 increased 7% led

primarily by volume growth and productivity gains.

Pharma Solutions Segment

- On a reported basis, third quarter sales were $256 million. On

a comparable basis2, currency neutral sales1 increased 8% driven by

volume growth in both Industrial and Core Pharma.

- Pharma Solutions adjusted operating EBITDA1 was $62 million and

adjusted operating EBITDA margin1 was 24.2% in the third quarter.

On a comparable basis2, adjusted operating EBITDA1 increased 32%

led by volume growth and productivity gains.

Financial Guidance

The Company is increasing its expectations for the full year

2024. It now expects sales to be in the range of $11.3 billion to

$11.4 billion versus the previously expected range of $11.1 billion

to $11.3 billion, and adjusted operating EBITDA to be at the

high-end of its previously communicated guidance range of $2.1

billion to $2.17 billion. The Company now expects volume to

increase 5% to 6% versus the previously expected range of 3% to 5%,

with improvements across the majority of the portfolio. Pricing

impact is now expected to be flat versus approximately a 1%

increase previously, principally driven by the impact of foreign

exchange rate changes in emerging markets where the Company has

index pricing to US and/or EURO exchange rates.

Based on current market foreign exchange rates, the Company

expects that foreign exchange will have an approximately 3% adverse

impact to sales growth versus the previously expected range of 3%

to 4%.

The Company cannot reconcile its expected adjusted operating

EBITDA without unreasonable effort because certain items that

impact net income and other reconciling metrics are out of the

Company's control and/or cannot be reasonably predicted at this

time. These items include but are not limited to acquisition,

divestiture and integration related costs, gains (losses) on

business disposals and regulatory costs.

Audio Webcast

A live webcast to discuss the Company’s third quarter 2024

financial results will be held on November 6, 2024, at 9:00 a.m.

ET. The webcast and accompanying slide presentation may be accessed

on the Company’s IR website at ir.iff.com. For those unable to

listen to the live webcast, a recorded version will be made

available on the Company’s website approximately one hour after the

event and will remain available on IFF’s website for one year.

Cautionary Statement Under The Private

Securities Litigation Reform Act of 1995

Statements in this press release, which are not historical facts

or information, are “forward-looking statements” within the meaning

of The Private Securities Litigation Reform Act of 1995. Such

forward-looking statements are based on management’s current

assumptions, estimates and expectations including those concerning

expected cash flow and availability of capital resources to fund

our operations and meet our debt service requirements; our ability

to execute on our strategic and financial transformation, including

the progress and success of our portfolio optimization strategy

(including the sale process for our Pharma Solutions disposal

group), through non-core business divestitures and acquisitions,

and expectations regarding the implementation of our refreshed

growth-focused strategy and expectations around our business

divestitures; our ability to continue to generate value for, and

return cash to, our shareholders; expectations of the impact of

inflationary pressures and the pricing actions to offset exposure

to such impacts; the impact of high input costs, including

commodities, raw materials, transportation and energy; the expected

impact of global supply chain challenges; our ability to enhance

our innovation efforts, drive cost efficiencies and execute on

specific consumer trends and demands; the growth potential of the

markets in which we operate, including the emerging markets;

expectations regarding sales and profit for the fiscal year 2024,

including the impact of foreign exchange, pricing actions, raw

materials, energy, and sourcing, logistics and manufacturing costs;

the impact of global economic uncertainty and recessionary

pressures on demand for consumer products; the success of our

integration efforts, following the N&B Transaction, and ability

to deliver on our synergy commitments as well as future

opportunities for the combined company; our strategic investments

in capacity and increasing inventory to drive improved

profitability; our ability to drive cost discipline measures and

the ability to recover margin to pre-inflation levels; expected

capital expenditures in 2024; and the expected costs and benefits

of our ongoing optimization of our manufacturing operations,

including the expected number of closings.

These forward-looking statements should be evaluated with

consideration given to the many risks and uncertainties inherent in

our business that could cause actual results and events to differ

materially from those in the forward-looking statements. Certain of

such forward-looking information may be identified by such terms as

“expect”, “anticipate”, “believe”, “intend”, “outlook”, “may”,

“estimate”, “should”, “predict” and similar terms or variations

thereof. Such forward-looking statements are based on a series of

expectations, assumptions, estimates and projections about the

Company, are not guarantees of future results or performance, and

involve significant risks, uncertainties and other factors,

including assumptions and projections, for all forward periods. Our

actual results may differ materially from any future results

expressed or implied by such forward-looking statements.

Such risks, uncertainties and other factors include, among

others, the following: (1) our substantial amount of indebtedness

and its impact on our liquidity, credit ratings and ability to

return capital to its shareholders; (2) our ability to successfully

execute the next phase of our strategic transformation; (3) our

ability to declare and pay dividends which is subject to certain

considerations; (4) the impact of the outcomes of legal claims,

disputes, regulatory investigations and litigation; (5)

inflationary trends, including in the price of our input costs,

such as raw materials, transportation and energy; (6) supply chain

disruptions, geopolitical developments, including the

Russia-Ukraine war, the Israel-Hamas war and wider Middle East

developments (including disruptions to the Red Sea passage) or

climate-change related events (including severe weather events in

the U.S. and abroad) that may affect our suppliers or procurement

of raw materials; (7) our ability to attract and retain key

employees, and manage turnover of top executives; (8) our ability

to successfully market to our expanded and diverse customer base;

(8) our ability to effectively compete in our market and develop

and introduce new products that meet customers’ needs; (9) changes

in demand from large multi-national customers due to increased

competition and our ability to maintain “core list” status with

customers; (10) our ability to successfully develop innovative and

cost-effective products that allow customers to achieve their own

profitability expectations; (11) disruption in the development,

manufacture, distribution or sale of our products from

international conflicts (such as the Russia-Ukraine war and the

Israel-Hamas war), geopolitical events, trade wars, natural

disasters, public health crises (such as the COVID-19 pandemic),

terrorist acts, labor strikes, political or economic crises (such

as the uncertainty related to U.S. government funding

negotiations), accidents and similar events; (12) the impact of a

significant data breach or other disruption in our information

technology systems, and our ability to comply with data protection

laws in the U.S. and abroad; (13) our ability to benefit from our

investments and expansion in emerging markets; (14) the impact of

currency fluctuations or devaluations in the principal foreign

markets in which we operate; (15) economic, regulatory and

political risks associated with our international operations; (16)

the impact of global economic uncertainty (including increased

inflation) on demand for consumer products; (17) our ability to

integrate the N&B Business and realize anticipated synergies,

among other benefits; (18) our ability to react in a timely and

cost-effective manner to changes in consumer preferences and

demands, including increased awareness of health and wellness; (19)

our ability to meet increasing customer, consumer, shareholder and

regulatory focus on sustainability; (20) our ability to

successfully manage our working capital and inventory balances;

(21) any impairment on our tangible or intangible long-lived

assets; (22) our ability to enter into or close strategic

transactions or divestments, or successfully establish and manage

acquisitions, collaborations, joint ventures or partnerships; (23)

changes in market conditions or governmental regulations relating

to our pension and postretirement obligations; (24) the impact of

the phase out of the London Interbank Offered Rate (“LIBOR”) on our

variable rate interest expense; (25) our ability to comply with,

and the costs associated with compliance with, regulatory

requirements and industry standards, including regarding product

safety, quality, efficacy and environment impact; (26) defects,

quality issues (including product recalls), inadequate disclosure

or misuse with respect to the products and capabilities; (27) our

ability to comply with, and the costs associated with compliance

with, U.S. and foreign environmental protection laws; (28) the

impact of our or our counterparties’ failure to comply with the

U.S. Foreign Corrupt Practices Act, similar U.S. or foreign

anti-bribery and anti-corruption laws and regulations, applicable

sanctions laws and regulations in the jurisdictions in which we

operate or ethical business practices and related laws and

regulations; (29) our ability to protect our intellectual property

rights; (30) the impact of changes in federal, state, local and

international tax legislation or policies and adverse results of

tax audits, assessments, or disputes; (31) the impact of any tax

liability resulting from the N&B Transaction; and (32) our

ability to comply with data protection laws in the U.S. and

abroad.

The foregoing list of important factors does not include all

such factors, nor necessarily present them in order of importance.

In addition, you should consult other disclosures made by the

Company (such as in our other filings with the SEC or in company

press releases) for other factors that may cause actual results to

differ materially from those projected by the Company. Please refer

to Part I. Item 1A., Risk Factors, of the Company’s Annual Report

on Form 10-K filed with the SEC on February 28, 2024 for additional

information regarding factors that could affect our results of

operations, financial condition and liquidity.

We intend our forward-looking statements to speak only as of the

time of such statements and do not undertake or plan to update or

revise them as more information becomes available or to reflect

changes in expectations, assumptions or results. We can give no

assurance that such expectations or forward-looking statements will

prove to be correct. An occurrence of, or any material adverse

change in, one or more of the risk factors or risks and

uncertainties referred to in this press release or included in our

other periodic reports filed with the SEC could materially and

adversely impact our operations and our future financial results.

Any public statements or disclosures made by us following this

press release that modify or impact any of the forward-looking

statements contained in or accompanying this press release will be

deemed to modify or supersede such outlook or other forward-looking

statements in or accompanying this press release.

Use of Non-GAAP Financial

Measures

We provide in this press release non-GAAP financial measures,

including: (i) comparable currency neutral sales; (ii) adjusted

operating EBITDA and comparable adjusted operating EBITDA; (iii)

adjusted operating EBITDA margin; (iv) adjusted EPS ex

amortization; (v) free cash flow; and (vi) net debt to credit

adjusted EBITDA.

Our non-GAAP financial measures are defined below.

Currency Neutral metrics eliminate the effects that result from

translating non-U.S. currencies to U.S. dollars. We calculate

currency neutral numbers by translating current year invoiced sale

amounts at the exchange rates used for the corresponding prior year

period. We use currency neutral results in our analysis of

subsidiary or segment performance. We also use currency neutral

numbers when analyzing our performance against our competitors.

Adjusted operating EBITDA and adjusted operating EBITDA margin

exclude depreciation and amortization, interest expense, other

(expense) income, net, and certain non-recurring or unusual items

that are not part of recurring operations such as, restructuring

and other charges, impairment of goodwill, gains (losses) on

business disposals, loss on assets classified as held for sale,

acquisition, divestiture and integration costs, strategic

initiatives costs, regulatory costs and other items.

Adjusted EPS ex Amortization excludes the impact of

non-operational items including, restructuring and other charges,

impairment of goodwill, (gains) losses on business disposals, loss

on assets classified as held for sale, strategic initiatives costs,

regulatory costs and other items that are not a part of recurring

operations.

Free Cash Flow is operating cash flow (i.e. cash flow from

operations) less capital expenditures.

Net debt to credit adjusted EBITDA is the leverage ratio used in

our credit agreements and defined as net debt (which is debt for

borrowed money less cash and cash equivalents) divided by the

trailing 12-month credit adjusted EBITDA. Credit adjusted EBITDA is

defined as income (loss) before interest expense, income taxes,

depreciation and amortization, specified items and non-cash

items.

Comparable results for the second quarter exclude the impact of

divestitures and acquisitions.

These non-GAAP measures are intended to provide additional

information regarding our underlying operating results and

comparable year-over-year performance. Such information is

supplemental to information presented in accordance with GAAP and

is not intended to represent a presentation in accordance with

GAAP. In discussing our historical and expected future results and

financial condition, we believe it is meaningful for investors to

be made aware of and to be assisted in a better understanding of,

on a period-to-period comparable basis, financial amounts both

including and excluding these identified items, as well as the

impact of exchange rate fluctuations. These non-GAAP measures

should not be considered in isolation or as substitutes for

analysis of the Company’s results under GAAP and may not be

comparable to other companies’ calculation of such metrics.

The Company cannot reconcile its expected adjusted operating

EBITDA under "Financial Guidance" without unreasonable effort

because certain items that impact net income and other reconciling

metrics are out of the Company's control and/or cannot be

reasonably predicted at this time. These items include but are not

limited to acquisition, divestiture and integration costs, gains

(losses) on business disposals, and regulatory costs.

Welcome to IFF

At IFF (NYSE: IFF), an industry leader in food, beverage, scent,

health and biosciences, science and creativity meet to create

essential solutions for a better world – from global icons to

unexpected innovations and experiences. With the beauty of art and

the precision of science, we are an international collective of

thinkers who partners with customers to bring scents, tastes,

experiences, ingredients and solutions for products the world

craves. Together, we will do more good for people and planet. Learn

more at iff.com, Twitter, Facebook, Instagram, and LinkedIn.

_________________________ 1 Schedules at the end of this release

contain reconciliations of reported GAAP to Non-GAAP metrics. See

Use of Non-GAAP Financial Measures for explanations of our Non-GAAP

metrics. 2 Comparable results for the third quarter exclude the

impact of divestitures.

International Flavors &

Fragrances Inc.

Consolidated Statements of

Income (Loss)

(Amounts in millions except

per share data)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

% Change

2024

2023

% Change

Net sales

$

2,925

$

2,820

4%

$

8,713

$

8,776

(1)%

Cost of Sales

1,873

1,896

(1)%

5,569

5,955

(6)%

Gross profit

1,052

924

14%

3,144

2,821

11%

Research and development expenses

162

157

3%

501

479

5%

Selling and administrative expenses

495

444

11%

1,478

1,343

10%

Amortization of acquisition-related

intangibles

146

170

(14)%

467

513

(9)%

Impairment of goodwill

—

—

NMF

64

—

NMF

Restructuring and other charges

1

2

(50)%

6

61

(90)%

(Gains) losses on sale of assets

(1

)

1

(200)%

(11

)

(1

)

NMF

Operating profit

249

150

66%

639

426

50%

Interest expense

74

90

(18)%

236

291

(19)%

(Gains) losses on business disposals

20

10

100%

(348

)

29

NMF

Loss on assets classified as held for

sale

32

—

NMF

314

—

NMF

Other expense (income), net

28

(9

)

NMF

44

(17

)

NMF

Income before income taxes

95

59

61%

393

123

220%

Provision for income taxes

35

32

9%

100

77

30%

Net income

60

27

122%

293

46

NMF

Net income attributable to non-controlling

interests

1

2

(50)%

4

3

33%

Net income attributable to IFF

shareholders

$

59

$

25

136%

$

289

$

43

NMF

Net income per share - basic and

diluted

$

0.23

$

0.10

$

1.13

$

0.16

Average number of shares outstanding -

basic

256

255

255

255

Average number of shares outstanding -

diluted

257

256

256

255

NMF Not meaningful

International Flavors &

Fragrances Inc.

Condensed Consolidated Balance

Sheets

(Amounts in millions)

(Unaudited)

September 30,

December 31,

2024

2023

Cash, cash equivalents, and restricted

cash

$

567

$

709

Receivables, net

1,772

1,726

Inventories

2,200

2,477

Other current assets

3,884

1,381

Total current assets

8,423

6,293

Property, plant and equipment, net

3,772

4,240

Goodwill and other intangibles, net

16,119

18,992

Other assets

1,614

1,453

Total assets

$

29,928

$

30,978

Short-term borrowings

$

468

$

885

Other current liabilities

2,750

2,873

Total current liabilities

3,218

3,758

Long-term debt

8,631

9,186

Non-current liabilities

3,269

3,392

Shareholders' equity

14,810

14,642

Total liabilities and shareholders'

equity

$

29,928

$

30,978

International Flavors &

Fragrances Inc.

Consolidated Statements of

Cash Flows

(Amounts in millions)

(Unaudited)

Nine Months Ended

September 30,

2024

2023

Cash flows from operating

activities:

Net income

$

293

$

46

Adjustments to reconcile to net cash

provided by operating activities

Depreciation and amortization

772

855

Deferred income taxes

(128

)

(59

)

Loss on assets classified as held for

sale

314

—

Gains on sale of assets

(11

)

(1

)

(Gains) Losses on business disposals

(348

)

29

Stock-based compensation

59

50

Pension contributions

(17

)

(25

)

Impairment of goodwill

64

—

Inventory write-down

—

62

Changes in assets and liabilities:

Trade receivables

(276

)

(78

)

Inventories

(3

)

489

Accounts payable

(34

)

(240

)

Accruals for incentive compensation

119

(40

)

Other current payables and accrued

expenses

65

(216

)

Other assets/liabilities, net

(167

)

(77

)

Net cash provided by operating

activities

702

795

Cash flows from investing

activities:

Additions to property, plant and

equipment

(303

)

(390

)

Additions to intangible assets

(5

)

—

Proceeds from sale of assets

18

22

Net proceeds received from business

disposals

876

1,006

Net cash provided by investing

activities

586

638

Cash flows from financing

activities:

Cash dividends paid to shareholders

(411

)

(619

)

Decrease in revolving credit facility and

short-term borrowings

—

(100

)

Net borrowings of commercial paper

(maturities less than three months)

—

(187

)

Principal payments of debt

(974

)

(355

)

Deferred and contingent consideration

paid

(36

)

(6

)

Withholding tax paid on stock-based

compensation

(15

)

(12

)

Other, net

(8

)

(14

)

Net cash used in financing activities

(1,444

)

(1,293

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

(10

)

(30

)

Net change in cash, cash equivalents

and restricted cash

(166

)

110

Cash, cash equivalents and restricted cash

at beginning of year

735

552

Cash, cash equivalents and restricted

cash at end of period

$

569

$

662

The following table reconciles cash, cash equivalents and

restricted cash between the Company's statement of cash flows for

the periods ended September 30, 2024 and September 30, 2023 to the

amounts reported on the Company's balance sheet:

AMOUNTS IN MILLIONS

September 30,

2024

December 31,

2023

September 30,

2023

December 31,

2022

Current assets

Cash and cash equivalents

$

567

$

703

$

629

$

483

Cash and cash equivalents included in

Assets held for sale

2

26

23

52

Restricted cash

—

6

10

10

Non-current assets

Restricted cash included in Other

assets

—

—

—

7

Cash, cash equivalents and restricted

cash

$

569

$

735

$

662

$

552

International Flavors &

Fragrances Inc.

Reportable Segment

Performance

(Amounts in millions)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Net Sales

Nourish

$

1,486

$

1,449

$

4,460

$

4,666

Health & Biosciences

570

518

1,659

1,553

Scent

613

615

1,861

1,815

Pharma Solutions

256

238

733

742

Consolidated

$

2,925

$

2,820

$

8,713

$

8,776

Segment Adjusted Operating

EBITDA

Nourish

$

206

$

178

$

654

$

567

Health & Biosciences

173

150

497

426

Scent

127

131

421

353

Pharma Solutions

62

47

162

173

Total

568

506

1,734

1,519

Depreciation & Amortization

(248

)

(292

)

(772

)

(855

)

Interest Expense

(74

)

(90

)

(236

)

(291

)

Other (Expense) Income, net

(28

)

9

(44

)

17

Restructuring and Other Charges

(1

)

(2

)

(6

)

(61

)

Impairment of Goodwill

—

—

(64

)

—

Gains (Losses) on Business Disposals

(20

)

(10

)

348

(29

)

Loss on Assets Classified as Held for

Sale

(32

)

—

(314

)

—

Acquisition, Divestiture and Integration

Costs

(55

)

(42

)

(172

)

(118

)

Strategic Initiatives Costs

(6

)

(6

)

(22

)

(28

)

Regulatory Costs

(10

)

(13

)

(64

)

(32

)

Other

1

(1

)

5

1

Income Before Taxes

$

95

$

59

$

393

$

123

Segment Adjusted Operating EBITDA

Margin

Nourish

13.9

%

12.3

%

14.7

%

12.2

%

Health & Biosciences

30.4

%

29.0

%

30.0

%

27.4

%

Scent

20.7

%

21.3

%

22.6

%

19.4

%

Pharma Solutions

24.2

%

19.7

%

22.1

%

23.3

%

Consolidated

19.4

%

17.9

%

19.9

%

17.3

%

International Flavors & Fragrances

Inc. GAAP to Non-GAAP Reconciliation

(Unaudited)

The following information and schedules provide

reconciliation information between reported GAAP amounts and

non-GAAP certain adjusted amounts. This information and schedules

are not intended as, and should not be viewed as, a substitute for

reported GAAP amounts or financial statements of the Company

prepared and presented in accordance with GAAP.

Reconciliation of Gross

Profit

Third Quarter

(DOLLARS IN MILLIONS)

2024

2023

Reported (GAAP)

$

1,052

$

924

Adjusted (Non-GAAP)

$

1,052

$

924

Reconciliation of Selling and

Administrative Expenses

Third Quarter

(DOLLARS IN MILLIONS)

2024

2023

Reported (GAAP)

$

495

$

444

Acquisition, Divestiture and Integration

Costs (d)

(55

)

(42

)

Strategic Initiatives Costs (e)

(6

)

(6

)

Regulatory Costs (f)

(10

)

(13

)

Other (g)

(1

)

—

Adjusted (Non-GAAP)

$

423

$

383

International Flavors & Fragrances

Inc. GAAP to Non-GAAP Reconciliation

(Unaudited)

The following information and schedules provide

reconciliation information between reported GAAP amounts and

non-GAAP certain adjusted amounts. This information and schedules

are not intended as, and should not be viewed as, a substitute for

reported GAAP amounts or financial statements of the Company

prepared and presented in accordance with GAAP.

Reconciliation of Net Income

(Loss) and EPS

Third Quarter

2024

2023

(DOLLARS IN MILLIONS

EXCEPT PER SHARE AMOUNTS)

Income

before

taxes

Provision

for income

taxes

Net income

attributable

to IFF (i)

Diluted

EPS

Income

before

taxes

Provision

for income

taxes (h)

Net income

attributable

to IFF (i)

Diluted

EPS

Reported (GAAP)

$

95

$

35

$

59

$

0.23

$

59

$

32

$

25

$

0.10

Restructuring and Other Charges (a)

1

—

1

—

2

—

2

0.01

Losses on Business Disposals (b)

20

—

20

0.08

10

(6

)

16

0.06

Loss on Assets Classified as Held for Sale

(c)

32

5

27

0.11

—

—

—

—

Acquisition, Divestiture and Integration

Costs (d)

55

15

40

0.16

42

4

38

0.15

Strategic Initiatives Costs (e)

6

1

5

0.02

6

1

5

0.02

Regulatory Costs (f)

10

3

7

0.03

13

3

10

0.04

Other (g)

(1

)

—

(1

)

(0.01

)

1

1

—

—

Adjusted (Non-GAAP)

$

218

$

59

$

158

$

0.62

$

133

$

35

$

96

$

0.38

Reconciliation of Adjusted

(Non-GAAP) EPS ex. Amortization

Third Quarter

(DOLLARS AND SHARE

AMOUNTS IN MILLIONS)

2024

2023

Numerator

Adjusted (Non-GAAP) Net Income

$

158

$

96

Amortization of Acquisition related

Intangible Assets

146

170

Tax impact on Amortization of Acquisition

related Intangible Assets

36

39

Amortization of Acquisition related

Intangible Assets, net of tax (j)

110

131

Adjusted (Non-GAAP) Net Income ex.

Amortization

$

268

$

227

Denominator

Weighted average shares assuming dilution

(diluted)

257

256

Adjusted (Non-GAAP) EPS ex.

Amortization

$

1.04

$

0.89

(a)

For 2024, represents costs

related to lease impairment and severance as part of the Company's

restructuring efforts. For 2023, represents costs primarily related

to severance as part of the Company's restructuring efforts.

(b)

For 2024, primarily represents

losses recognized as part of the sale of the Flavors & Essences

UK business. For 2023, primarily represents losses recognized as

part of the sale of the Flavors Specialty Ingredients business.

(c)

Represents the losses recognized

on assets classified as held for sale of the Pharma Solutions

disposal group and portion of the Savory Solutions business in

Turkey.

(d)

For 2024 and 2023, primarily

represents costs related to the Company's actual and planned

acquisitions and divestitures and integration activities primarily

for N&B. These costs primarily consisted of external consulting

fees, professional and legal fees and salaries of individuals who

are fully dedicated to such efforts.

For the three months ended

September 30, 2024, business divestiture costs were approximately

$55 million. For the three months ended September 30, 2023,

business divestiture, integration and acquisition costs were

approximately $29 million, $12 million and $1 million,

respectively.

(e)

Represents costs related to the

Company's strategic assessment and business portfolio optimization

efforts and reorganizing the Global Business Services Centers,

primarily consulting fees.

(f)

Represents costs primarily

related to legal fees incurred and provisions recognized for the

ongoing investigations of the fragrance businesses.

(g)

Represents (gains) losses from

sale of assets, executive employee separation costs and costs

related to the Company's entity realignment project to optimize the

structure of holding companies, primarily consulting fees.

(h)

The income tax effects of

non-GAAP adjustments are calculated based on the applicable

statutory tax rate for the relevant jurisdiction, except for those

items which are non-taxable or subject to valuation allowances for

which the tax expense (benefit) was calculated at 0%. The tax

benefit for amortization is calculated in a similar manner as the

tax effects of the non-GAAP adjustments.

(i)

For the three months ended

September 30, 2024 and September 30, 2023, reported and adjusted

net income are each decreased by income attributable to

non-controlling interest of $1 million and $2 million,

respectively.

(j)

Represents all amortization of

intangible assets acquired in connection with acquisitions, net of

tax.

International Flavors & Fragrances

Inc. GAAP to Non-GAAP Reconciliation

(Unaudited)

The following information and schedules provide

reconciliation information between reported GAAP amounts and

non-GAAP certain adjusted amounts. This information and schedules

are not intended as, and should not be viewed as, a substitute for

reported GAAP amounts or financial statements of the Company

prepared and presented in accordance with GAAP.

Reconciliation of Gross

Profit

Third Quarter

Year-to-Date

(DOLLARS IN

MILLIONS)

2024

2023

Reported (GAAP)

$

3,144

$

2,821

Acquisition, Divestiture and Integration

Costs (e)

1

—

Adjusted (Non-GAAP)

$

3,145

$

2,821

Reconciliation of Selling and

Administrative Expenses

Third Quarter

Year-to-Date

(DOLLARS IN

MILLIONS)

2024

2023

Reported (GAAP)

$

1,478

$

1,343

Acquisition, Divestiture and Integration

Costs (e)

(171

)

(118

)

Strategic Initiatives Costs (g)

(22

)

(28

)

Regulatory Costs (h)

(64

)

(32

)

Other (i)

(6

)

—

Adjusted (Non-GAAP)

$

1,215

$

1,165

International Flavors & Fragrances

Inc. GAAP to Non-GAAP Reconciliation

(Unaudited)

The following information and schedules provide

reconciliation information between reported GAAP amounts and

non-GAAP certain adjusted amounts. This information and schedules

are not intended as, and should not be viewed as, a substitute for

reported GAAP amounts or financial statements of the Company

prepared and presented in accordance with GAAP.

Reconciliation of Net Income

(Loss) and EPS

Third Quarter

Year-to-Date

2024

2023

(DOLLARS IN MILLIONS

EXCEPT PER SHARE AMOUNTS)

Income

before

taxes

Provision

for income

taxes (j)

Net income

attributable

to IFF (k)

Diluted

EPS

Income

before

taxes

Provision

for income

taxes (j)

Net income

attributable

to IFF (k)

Diluted

EPS

Reported (GAAP)

$

393

$

100

$

289

$

1.13

$

123

$

77

$

43

$

0.16

Restructuring and Other Charges (a)

6

1

5

0.02

61

16

45

0.18

Impairment of Goodwill (b)

64

—

64

0.25

—

—

—

—

(Gains) Losses on Business Disposals

(c)

(348

)

(23

)

(325

)

(1.27

)

29

(11

)

40

0.15

Loss on Assets Classified as Held for Sale

(d)

314

63

251

0.98

—

—

—

—

Acquisition, Divestiture and Integration

Costs (e)

169

18

151

0.60

118

4

114

0.45

Gain on China Facility Relocation (f)

—

—

—

—

(22

)

(6

)

(16

)

(0.06

)

Strategic Initiatives Costs (g)

22

5

17

0.07

28

6

22

0.09

Regulatory Costs (h)

64

11

53

0.21

32

7

25

0.10

Other (i)

(5

)

(3

)

(2

)

(0.03

)

(1

)

—

(1

)

—

Adjusted (Non-GAAP)

$

679

$

172

$

503

$

1.96

$

368

$

93

$

272

$

1.07

Reconciliation of Adjusted

(Non-GAAP) EPS ex. Amortization

Third Quarter

Year-to-Date

(DOLLARS AND SHARE AMOUNTS IN

MILLIONS)

2024

2023

Numerator

Adjusted (Non-GAAP) Net Income

$

503

$

272

Amortization of Acquisition related

Intangible Assets

467

513

Tax impact on Amortization of Acquisition

related Intangible Assets (j)

115

117

Amortization of Acquisition related

Intangible Assets, net of tax (l)

352

396

Adjusted (Non-GAAP) Net Income ex.

Amortization

$

855

$

668

Denominator

Weighted average shares assuming dilution

(diluted)

256

255

Adjusted (Non-GAAP) EPS ex.

Amortization

$

3.34

$

2.61

(a)

For 2024, represents costs

related to lease impairment and severance as part of the Company's

restructuring efforts. For 2023, represents costs primarily related

to severance as part of the Company's restructuring efforts.

(b)

Represents costs related to the

impairment of goodwill related to the Pharma Solutions disposal

group.

(c)

For 2024, primarily represents

gains recognized as part of the sale of the Cosmetic Ingredients

business and losses recognized as part of the sale of the Flavors

& Essences UK business. For 2023, primarily represents losses

recognized as part of the sale of the Flavors Specialty Ingredients

business, a portion of the Savory Solutions business, and

liquidation of a business in Russia for the sale of a portion of

the Savory Solutions business.

(d)

Represents the losses recognized

on assets classified as held for sale of the Pharma Solutions

disposal group and portion of the Savory Solutions business in

Turkey.

(e)

For 2024 and 2023, primarily

represents costs related to the Company's actual and planned

acquisitions and divestitures and integration activities primarily

for N&B. These costs primarily consisted of external consulting

fees, professional and legal fees and salaries of individuals who

are fully dedicated to such efforts.

For the nine months ended

September 30, 2024, business divestiture and integration costs were

approximately $167 million and $5 million, respectively. For the

nine months ended September 30, 2023, business divestiture,

integration and acquisition costs were approximately $70 million,

$42 million, and $6 million, respectively

(f)

For 2023, represents gain

recognized from the completion of the relocation of a facility in

China.

(g)

Represents costs related to the

Company's strategic assessment and business portfolio optimization

efforts and reorganizing the Global Business Services Centers,

primarily consulting fees.

(h)

Represents costs primarily

related to legal fees incurred and provisions recognized for the

ongoing investigations of the fragrance businesses.

(i)

Represents (gains) losses from

sale of assets, executive employee separation costs and costs

related to the Company's entity realignment project to optimize the

structure of holding companies, primarily consulting fees.

(j)

The income tax effects of

non-GAAP adjustments are calculated based on the applicable

statutory tax rate for the relevant jurisdiction, except for those

items which are non-taxable or subject to valuation allowances for

which the tax expense (benefit) was calculated at 0%. The tax

benefit for amortization is calculated in a similar manner as the

tax effects of the non-GAAP adjustments.

(k)

For the nine months ended

September 30, 2024 and 2023, reported and adjusted net income are

each decreased by income attributable to non-controlling interest

of $4 million and $3 million, respectively.

(l)

Represents all amortization of

intangible assets acquired in connection with acquisitions, net of

tax.

International Flavors & Fragrances

Inc. Debt Covenants (Amounts in millions)

(Unaudited)

The following information and schedules provide

reconciliation information between reported GAAP amounts and

non-GAAP certain adjusted amounts. This information and schedules

are not intended as, and should not be viewed as, a substitute for

reported GAAP amounts or financial statements of the Company

prepared and presented in accordance with GAAP.

Reconciliation of Credit

Adjusted EBITDA to Net Loss

(DOLLARS IN

MILLIONS)

Twelve Months Ended

September 30, 2024

Net loss

$

(2,321

)

Interest expense(1)

325

Income taxes

68

Depreciation and amortization

1,059

Specified items(2)

3,038

Non-cash items(3)

32

Credit Adjusted EBITDA

$

2,201

_______________________

(1)

Certain adjustments were made to

interest expense associated with our cash pooling arrangements for

the fourth quarter of 2023.

(2)

Specified items consisted of

restructuring and other charges, impairment of goodwill,

acquisition, divestiture and integration costs, strategic

initiatives costs, regulatory costs and other costs that are not

related to recurring operations.

(3)

Non-cash items consisted of

losses (gains) on sale of assets, losses (gains) on business

disposals, loss on assets classified as held for sale, write-down

of inventory related to Locust Bean Kernel and stock-based

compensation.

Net Debt to Total Debt

(DOLLARS IN

MILLIONS)

September 30, 2024

Total debt(1)

$

9,127

Adjustments:

Cash and cash equivalents(2)

569

Net debt

$

8,558

_______________________

(1)

Total debt used for the

calculation of net debt consisted of short-term debt, long-term

debt, short-term finance lease obligations and long-term finance

lease obligations.

(2)

Cash and cash equivalents

included approximately $2 million currently in Assets held for sale

on the Consolidated Balance Sheets.

International Flavors & Fragrances

Inc. Comparable Reportable Segment Performance

(Amounts in millions) (Unaudited)

The following information and schedule provides

reconciliation information between reported GAAP amounts and

non-GAAP certain adjusted amounts. This information and schedule is

not intended as, and should not be viewed as, a substitute for

reported GAAP amounts or financial statements of the Company

prepared and presented in accordance with GAAP.

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Net Sales

Nourish(1)

$

1,486

$

1,441

$

4,460

$

4,426

Health & Biosciences

570

518

1,659

1,553

Scent(2)

613

588

1,861

1,723

Pharma Solutions

256

238

733

742

Consolidated

$

2,925

$

2,785

$

8,713

$

8,444

Segment Adjusted Operating

EBITDA

Nourish(1)

$

206

$

174

$

654

$

537

Health & Biosciences

173

150

497

426

Scent(2)

127

119

421

319

Pharma Solutions

62

47

162

173

Total

568

490

1,734

1,455

Depreciation & Amortization

(248

)

(292

)

(772

)

(855

)

Interest Expense

(74

)

(90

)

(236

)

(291

)

Other (Expense) Income, net

(28

)

9

(44

)

17

Restructuring and Other Charges

(1

)

(2

)

(6

)

(61

)

Impairment of Goodwill

—

—

(64

)

—

Gains (Losses) on Business Disposals

(20

)

(10

)

348

(29

)

Loss on Assets Classified as Held for

Sale

(32

)

—

(314

)

—

Acquisition, Divestiture and Integration

Costs

(55

)

(42

)

(172

)

(118

)

Strategic Initiatives Costs

(6

)

(6

)

(22

)

(28

)

Regulatory Costs

(10

)

(13

)

(64

)

(32

)

Other

1

(1

)

5

1

Impact of Business Divestitures(3)

—

16

—

64

Income Before Taxes

$

95

$

59

$

393

$

123

Segment Adjusted Operating EBITDA

Margin

Nourish

13.9

%

12.1

%

14.7

%

12.1

%

Health & Biosciences

30.4

%

29.0

%

30.0

%

27.4

%

Scent

20.7

%

20.2

%

22.6

%

18.5

%

Pharma Solutions

24.2

%

19.7

%

22.1

%

23.3

%

Consolidated

19.4

%

17.6

%

19.9

%

17.2

%

______________________

(1)

Nourish sales and segment

adjusted operating EBITDA for the three and nine months ended

September 30, 2023 exclude the results of a portion of the Savory

Solutions business, Sonarome business, and Flavors & Essences

UK business that were divested to present fully comparable

scenarios. The divestitures were completed on May 31, 2023,

December 1, 2023 and September 1, 2024, respectively.

(2)

Scent sales and segment adjusted

operating EBITDA for the three and nine months ended September 30,

2023 exclude the results of the Flavor Specialty Ingredients

business and Cosmetic Ingredients business that were divested to

present fully comparable scenarios. The divestitures were completed

on August 1, 2023 and April 2, 2024, respectively.

(3)

Amounts exclude the results of a

portion of the Savory Solutions business, Flavor Specialty

Ingredients business, Sonarome business, Cosmetic Ingredients

business, and Flavors & Essences UK business that were divested

in the second quarter of 2023 (May 31, 2023), third quarter of 2023

(August 1, 2023), fourth quarter of 2023 (December 1, 2023), second

quarter of 2024 (April 2, 2024), and third quarter of 2024

(September 1, 2024), respectively, to present fully comparable

scenarios.

International Flavors &

Fragrances Inc.

GAAP to Non-GAAP

Reconciliation

Comparable Foreign Exchange

Impact

(Unaudited)

Q3

Nourish

Sales

Segment Adjusted

Operating EBITDA

Segment Adjusted

Operating EBITDA

Margin

% Change - Reported

3%

16%

1.6%

Portfolio Impact

1%

3%

0.2%

% Change - Comparable

3%

18%

1.8%

Currency Impact

4%

% Change - Currency Neutral

7%

Q3 Health &

Biosciences

Sales

Segment Adjusted

Operating EBITDA

Segment Adjusted

Operating EBITDA

Margin

% Change - Reported

10%

15%

1.4%

Portfolio Impact

0%

0%

0.0%

% Change - Comparable

10%

15%

1.4%

Currency Impact

2%

% Change - Currency Neutral

12%

Q3 Scent

Sales

Segment Adjusted

Operating EBITDA

Segment Adjusted

Operating EBITDA

Margin

% Change - Reported

0%

(3)%

(0.6)%

Portfolio Impact

5%

10%

1.1%

% Change - Comparable

4%

7%

0.5%

Currency Impact

6%

% Change - Currency Neutral

10%

Q3 Pharma

Solutions

Sales

Segment Adjusted

Operating EBITDA

Segment Adjusted

Operating EBITDA

Margin

% Change - Reported

8%

32%

4.5%

Portfolio Impact

0%

0%

0.0%

% Change - Comparable

8%

32%

4.5%

Currency Impact

0%

% Change - Currency Neutral

8%

Q3

Consolidated

Sales

Adjusted Operating

EBITDA

Adjusted Operating

EBITDA Margin

% Change - Reported

4%

12%

1.5%

Portfolio Impact

1%

4%

0.3%

% Change - Comparable

5%

16%

1.8%

Currency Impact

4%

% Change - Currency Neutral

9%

_______________________ Note: The sum of

these items may not foot due to rounding.

International Flavors &

Fragrances Inc.

GAAP to Non-GAAP

Reconciliation

Comparable Foreign Exchange

Impact

(Unaudited)

YTD

Nourish

Sales

Segment Adjusted

Operating EBITDA

Segment Adjusted

Operating EBITDA

Margin

% Change - Reported

(4)%

15%

2.5%

Portfolio Impact

5%

6%

0.1%

% Change - Comparable

1%

22%

2.6%

Currency Impact

3%

% Change - Currency Neutral

4%

YTD Health &

Biosciences

Sales

Segment Adjusted

Operating EBITDA

Segment Adjusted

Operating EBITDA

Margin

% Change - Reported

7%

17%

2.6%

Portfolio Impact

0%

0%

0.0%

% Change - Comparable

7%

17%

2.6%

Currency Impact

2%

% Change - Currency Neutral

9%

YTD Scent

Sales

Segment Adjusted

Operating EBITDA

Segment Adjusted

Operating EBITDA

Margin

% Change - Reported

3%

19%

3.2%

Portfolio Impact

5%

13%

0.9%

% Change - Comparable

8%

32%

4.1%

Currency Impact

6%

% Change - Currency Neutral

14%

YTD Pharma

Solutions

Sales

Segment Adjusted

Operating EBITDA

Segment Adjusted

Operating EBITDA

Margin

% Change - Reported

(1)%

(6)%

(1.2)%

Portfolio Impact

0%

0%

0.0%

% Change - Comparable

(1)%

(6)%

(1.2)%

Currency Impact

0%

% Change - Currency Neutral

(1)%

YTD

Consolidated

Sales

Adjusted Operating

EBITDA

Adjusted Operating

EBITDA Margin

% Change - Reported

(1)%

14%

2.6%

Portfolio Impact

4%

5%

0.1%

% Change - Comparable

3%

19%

2.7%

Currency Impact

4%

% Change - Currency Neutral

7%

_______________________ Note: The sum of

these items may not foot due to rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105987264/en/

Media Relations: Paulina Heinkel 332.877.5339

Media.request@iff.com

Investor Relations: Michael Bender 212.708.7263

Investor.Relations@iff.com

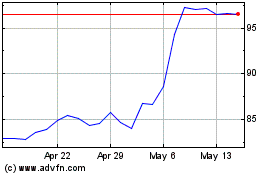

International Flavors an... (NYSE:IFF)

Historical Stock Chart

From Oct 2024 to Nov 2024

International Flavors an... (NYSE:IFF)

Historical Stock Chart

From Nov 2023 to Nov 2024