UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission File Number: 001-39591

iHuman Inc.

(Registrant’s Name)

Floor 8, Building B,

No. 1 Wangjing East Road,

Chaoyang District, Beijing 100102

People’s Republic of China

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

iHuman Inc. |

| |

|

| |

|

|

|

| |

By |

: |

/s/ Vivien Weiwei Wang |

| |

Name |

: |

Vivien Weiwei Wang |

| |

Title |

: |

Director and Chief Financial Officer |

Date:

December 28, 2023

Exhibit 99.1

iHuman

Inc. Announces Third Quarter 2023 Unaudited Financial Results

BEIJING,

China, December 28, 2023 -- iHuman Inc. (NYSE: IH) (“iHuman” or the “Company”), a leading provider

of tech-powered, intellectual development products in China, today announced its unaudited financial results for the third quarter ended

September 30, 2023.

Third Quarter 2023 Highlights

| ● | Revenues were RMB261.5 million (US$35.8 million), compared with RMB251.5 million in the same period last

year. |

| ● | Gross profit was RMB186.6 million (US$25.6 million), compared with RMB177.1 million in the same period

last year. |

| ● | Operating income was RMB40.4 million (US$5.5 million), compared with RMB38.5 million in the same period

last year. |

| ● | Adjusted operating income1

was RMB42.9 million (US$5.9 million), compared with RMB42.5 million in the same period last year. |

| ● | Net income was RMB51.9 million (US$7.1 million), compared with RMB39.5 million in the same period last

year. |

| ● | Adjusted net income1 was RMB54.4 million (US$7.5 million), compared with RMB43.5 million in

the same period last year. |

| ● | Average total MAUs2

reached a record-high of 25.36 million, a year-over-year increase of 22.9%. |

Dr. Peng

Dai, Director and Chief Executive Officer of iHuman, commented, “We are excited to announce another strong quarter of results with

average total MAUs increasing an impressive 22.9% year-over-year to reach another record-high of 25.36 million, which I believe

reflects our unwavering commitment to delivering exceptional experiences and value to our users.”

“During

the quarter, we focused squarely on strengthening our product portfolio in both domestic and international markets. Domestically, we further

refined our industry-leading offerings with improvements to both content and functionality. We launched two additional exciting themes

for iHumanpedia, “Earth Treasure Hunt” and “Animal Architects,” which were specifically

designed to nurture the scientific curiosity of children. As we continue to expand our content library, we are constantly developing innovative

ways to engage users and enrich their experiences. For example, we hosted popular science competitions that encouraged participants to

create science-themed short-form videos, among which the most outstanding entries would be featured on the iHumanpedia app. These

initiatives as well as others we have rolled out all received enthusiastic feedback from users and are encouraging more active participation

and contributing to a more vibrant community.”

“Internationally,

we enhanced the appeal of our products by rolling out popular seasonal themes that resonate with overseas users. For example, we launched

a Halloween pack for Aha World which offered a wide selection of classic Halloween costumes and immersive, spooky experiences

that were highly popular among younger audiences. Aha World has recently surged to rank among the top three most popular children’s

apps on Apple’s app store in the U.S. These ongoing efforts to drive product excellence are increasingly earning us international

recognition. Notably, we were awarded the prestigious w3 Gold Award in the Mobile Apps & Sites - Family & Kids category,

for bekids Reading. With thousands of entries from across the globe annually, the w3 Awards is one of the most prestigious honors

in digital design, marketing, media and technology that recognizes the industry’s best across user experiences, content, and creativity.

Winning the w3 Gold Award represents a substantial recognition of the high quality and innovative nature of our products and marks another

significant milestone for us as a company specialized in child intellectual development.”

1

“Adjusted operating income” and “adjusted net income” exclude share-based compensation expenses.

Please see “Non-GAAP Financial Measures” and “Unaudited Reconciliation of GAAP and non-GAAP Results” at the end

of this press release.

2

“Average total MAUs” refers to the monthly average of the sum of the MAUs of each of the Company’s apps

during a specific period, which is counted based on the number of unique mobile devices through which such app is accessed at least once

in a given month, and duplicate access to different apps is not eliminated from the total MAUs calculation.

“Our

smart devices business also continued to make solid progress with the launch of the second generation of Logic Pal, an easy-to-operate

device designed to facilitate early childhood word recognition, pronunciation, and cognitive growth through pluggable cards and interactive

activities. To diversify our offerings, we have also launched Diandian Storyteller, a portable device that empowers children to

enhance their storytelling abilities and expand their imagination.”

“We are truly encouraged by the momentum

across our entire portfolio and take great pride in our team’s resolve and consistent execution. I am excited about the opportunities

that lie ahead and the potential for our continuous growth and innovation,” concluded Dr. Dai.

Ms. Vivien Weiwei Wang, Director and Chief

Financial Officer of iHuman, added, “With an unwavering focus on long-term growth, we continue to invest in refining our product

lineup while steadily expanding our overseas presence. Our dedication and relentless efforts to the business have enabled us to achieve

another solid quarter. We once again recorded revenue growth on both an annual and sequential basis, marking our seventh consecutive profitable

quarter. This remarkable achievement has further solidified our financial position, establishing a solid foundation for our future expansion.”

“While

we continue to advance our strategic priorities, we are also actively engaged in public initiatives that aim to inspire young minds and

support their holistic development. Since the launch of bekids Coding, we have been enthusiastic participants in the Hour

of Code, a global initiative that introduces tens of millions of students worldwide to computer science and programming through free coding

tutorials and activities. In 2022, several elementary schools across the United States completed our Hour of Code challenge and shared

their experiences on social media. This year, we are thrilled to participate in the Hour of Code initiative again, aiming to further inspire

and engage children worldwide. Our participation in such events has strengthened our brand profile and influence internationally. As we

move forward, our commitment to managing a strong portfolio of products and driving business growth will remain central to our strategy,

ensuring sustainable development and creating more value for our shareholders.”

Third Quarter 2023 Unaudited Financial Results

Revenues

Revenues

were RMB261.5 million (US$35.8 million), an increase of 4.0% from RMB251.5 million in the same period last year, primarily driven

by user expansion and enhanced user engagement.

Average

total MAUs for the quarter were 25.36 million, an increase of 22.9% year-over-year from 20.63 million in the same period last year.

The number of paying users3 was 1.54 million.

Cost of Revenues

Cost

of revenues was RMB74.9 million (US$10.3 million), maintaining approximately the same level of RMB74.4 million in the same period

last year.

Gross Profit and Gross Margin

Gross

profit was RMB186.6 million (US$25.6 million), an increase of 5.4% from RMB177.1 million in the same period last year. Gross margin

was 71.4%, compared with 70.4% in the same period last year.

Operating Expenses

Total operating expenses were RMB146.2 million

(US$20.0 million), an increase of 5.5% from RMB138.6 million in the same period last year.

3

“Paying users” refers to users who paid subscription fees for premium content on any of the Company’s

apps during a specific period; a user who makes payments across different apps using the same registered account is counted as one paying

user, and a user who makes payments for the same app multiple times in the same period is counted as one paying user.

Research

and development expenses were RMB66.2 million (US$9.1 million), a decrease of 7.9% from RMB71.9 million in the same period last

year, primarily due to payroll-related cost savings and decreased outsourcing expenses as a result of the continued optimization of our

operational efficiency.

Sales

and marketing expenses were RMB54.0 million (US$7.4 million), an increase of 29.6% from RMB41.7 million in the same period last

year, primarily due to increased strategic spending on promotional activities.

General

and administrative expenses were RMB26.1 million (US$3.6 million), compared with RMB25.0 million in the same period last year.

Operating

Income

Operating

income was RMB40.4 million (US$5.5 million), compared with RMB38.5 million in the same period last year.

Excluding

share-based compensation expenses, adjusted operating income was RMB42.9 million (US$5.9 million), compared with RMB42.5 million

in the same period last year.

Net Income

Net

income was RMB51.9 million (US$7.1 million), an increase of 31.5% from RMB39.5 million in the same period last year.

Adjusted net income was RMB54.4 million (US$7.5

million), an increase of 25.1% from RMB43.5 million in the same period last year.

Basic

and diluted net income per ADS were RMB0.98 (US$0.13) and RMB0.95 (US$0.13), respectively, compared with RMB0.74 and RMB0.73 in

the same period last year. Each ADS represents five Class A ordinary shares of the Company.

Adjusted

diluted net income per ADS was RMB0.99 (US$0.14), compared with RMB0.80 in the same period last year.

Deferred

Revenue and Customer Advances

Deferred revenue and customer advances were RMB320.4

million (US$43.9 million) as of September 30, 2023, compared with RMB379.1 million as of December 31, 2022.

Cash, Cash Equivalents and Time Deposits

Cash,

cash equivalents and time deposits were RMB1,174.2 million (US$160.9 million) as of September 30, 2023, compared with RMB1,050.0

million as of December 31, 2022.

Extension of Share Repurchase Program

Given its confidence in the Company's business prospects, the board

of directors (the “Board”) has authorized another extension of the Company’s existing share repurchase program, as authorized

in December 2021 and extended in December 2022, by twelve months through December 31, 2024. Pursuant to the extended share

repurchase program, the Company’s proposed repurchases may be made from time to time through open market transactions at prevailing

market prices, in privately negotiated transactions, in block trades and/or through other legally permissible means, depending on the

market conditions and in accordance with applicable rules and regulations. The timing and dollar amount of repurchase transactions

will be subject to the Securities and Exchange Commission Rule 10b-18 and Rule 10b5-1 requirements. The Board will continue

to review the extended share repurchase program periodically, and may authorize adjustments to its terms and size. The Company expects

to continue to fund the repurchases under the extended share repurchase program with its existing cash balance.

Exchange Rate Information

The U.S. dollar (US$) amounts disclosed in this

press release, except for those transaction amounts that were actually settled in U.S. dollars, are presented solely for the convenience

of the reader. The conversion of Renminbi (RMB) into US$ in this press release is based on the exchange rate set forth in the H.10 statistical

release of the Board of Governors of the Federal Reserve System as of September 29, 2023, which was RMB7.2960 to US$1.00. The percentages

stated in this press release are calculated based on the RMB amounts.

Non-GAAP Financial Measures

iHuman

considers and uses non-GAAP financial measures, such as adjusted operating income, adjusted net income and adjusted diluted net income

per ADS, as supplemental metrics in reviewing and assessing its operating performance and formulating its business plan. The presentation

of non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared

and presented in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

iHuman defines adjusted operating income, adjusted net income and adjusted diluted net income per ADS as operating income, net income

and diluted net income per ADS excluding share-based compensation expenses, respectively. Adjusted operating income, adjusted net income

and adjusted diluted net income per ADS enable iHuman’s management to assess its operating results without considering the impact

of share-based compensation expenses, which are non-cash charges. iHuman believes that these non-GAAP financial measures provide useful

information to investors in understanding and evaluating the Company’s current operating performance and prospects in the same manner

as management does, if they so choose.

Non-GAAP financial measures are not defined under

U.S. GAAP and are not presented in accordance with U.S. GAAP. Non-GAAP financial measures have limitations as analytical tools, which

possibly do not reflect all items of expense that affect our operations. Share-based compensation expenses have been and may continue

to be incurred in our business and are not reflected in the presentation of the non-GAAP financial measures. In addition, the non-GAAP

financial measures iHuman uses may differ from the non-GAAP measures used by other companies, including peer companies, and therefore

their comparability may be limited. The presentation of these non-GAAP financial measures is not intended to be considered in isolation

from or as a substitute for the financial information prepared and presented in accordance with GAAP.

Safe Harbor Statement

This announcement contains forward-looking statements.

These statements are made under the “safe harbor” provisions of the United States Private Securities Litigation Reform Act

of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,”

“future,” “intends,” “plans,” “believes,” “estimates” and similar statements.

Statements that are not historical facts, including statements about iHuman’s beliefs and expectations, are forward-looking statements.

Among other things, the description of the management’s quotations in this announcement contains forward-looking statements. iHuman

may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”),

in its annual report to shareholders, in press releases and other written materials, and in oral statements made by its officers, directors

or employees to third parties. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual

results to differ materially from those contained in any forward-looking statement, including but not limited to the following: iHuman’s

growth strategies; its future business development, financial condition and results of operations; its ability to continue to attract

and retain users, convert non-paying users into paying users and increase the spending of paying users, the trends in, and size of, the

market in which iHuman operates; its expectations regarding demand for, and market acceptance of, its products and services; its expectations

regarding its relationships with business partners; general economic and business conditions; regulatory environment; and assumptions

underlying or related to any of the foregoing. Further information regarding these and other risks is included in iHuman’s filings

with the SEC. All information provided in this press release is as of the date of this press release, and iHuman does not undertake any

obligation to update any forward-looking statement, except as required under applicable law.

About iHuman Inc.

iHuman Inc. is a leading provider of tech-powered,

intellectual development products in China that is committed to making the child-upbringing experience easier for parents and transforming

intellectual development into a fun journey for children. Benefiting from a deep legacy that combines over two decades of experience in

the parenthood industry, superior original content, advanced high-tech innovation DNA and research & development capabilities

with cutting-edge technologies, iHuman empowers parents with tools to make the child-upbringing experience more efficient. iHuman’s

unique, fun and interactive product offerings stimulate children’s natural curiosity and exploration. The Company’s comprehensive

suite of innovative and high-quality products include self-directed apps, interactive content and smart devices that cover a broad variety

of areas to develop children’s abilities in speaking, critical thinking, independent reading and creativity, and foster their natural

interest in traditional Chinese culture. Leveraging advanced technological capabilities, including 3D engines, AI/AR functionality, and

big data analysis on children’s behavior & psychology, iHuman believes it will continue to provide superior experience

that is efficient and relieving for parents, and effective and fun for children, in China and all over the world, through its integrated

suite of tech-powered, intellectual development products.

For more information about iHuman, please visit

https://ir.ihuman.com/.

For investor and media enquiries, please contact:

iHuman Inc.

Mr. Justin

Zhang

Investor Relations Director

Phone: +86 10 5780-6606

E-mail: ir@ihuman.com

Christensen

In China

Ms. Alice Li

Phone: +86-13381389369

E-mail: alice.li@christensencomms.com

In the US

Ms. Linda Bergkamp

Phone: +1-480-614-3004

E-mail: linda.bergkamp@christensencomms.com

iHuman Inc.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands of Renminbi (“RMB”)

and U.S. dollars (“US$”)

except

for number of shares, ADSs, per share and per ADS data)

| | |

December 31, | | |

September 30, | | |

September 30, | |

| | |

2022 | | |

2023 | | |

2023 | |

| | |

RMB | | |

RMB | | |

US$ | |

| ASSETS | |

| | | |

| | | |

| | |

| Current assets | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 1,049,999 | | |

| 1,037,751 | | |

| 142,236 | |

| Time deposits | |

| - | | |

| 136,416 | | |

| 18,697 | |

| Accounts receivable, net | |

| 79,614 | | |

| 69,381 | | |

| 9,509 | |

| Inventories, net | |

| 19,127 | | |

| 13,457 | | |

| 1,844 | |

| Amounts due from related parties | |

| 2,286 | | |

| 1,979 | | |

| 271 | |

| Prepayments and other current assets | |

| 102,765 | | |

| 83,999 | | |

| 11,513 | |

| Total current assets | |

| 1,253,791 | | |

| 1,342,983 | | |

| 184,070 | |

| Non-current assets | |

| | | |

| | | |

| | |

| Property and equipment, net | |

| 9,205 | | |

| 6,530 | | |

| 895 | |

| Intangible assets, net | |

| 24,872 | | |

| 24,093 | | |

| 3,302 | |

| Operating lease right-of-use assets | |

| 12,782 | | |

| 4,056 | | |

| 556 | |

| Long-term investment | |

| 26,333 | | |

| 26,333 | | |

| 3,609 | |

| Other non-current assets | |

| 6,416 | | |

| 7,843 | | |

| 1,076 | |

| Total non-current assets | |

| 79,608 | | |

| 68,855 | | |

| 9,438 | |

| Total assets | |

| 1,333,399 | | |

| 1,411,838 | | |

| 193,508 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | |

| Accounts payable | |

| 24,206 | | |

| 16,235 | | |

| 2,225 | |

| Deferred revenue and customer advances | |

| 379,063 | | |

| 320,438 | | |

| 43,920 | |

| Amounts due to related parties | |

| 6,944 | | |

| 10,917 | | |

| 1,496 | |

| Accrued expenses and other current liabilities | |

| 144,717 | | |

| 131,722 | | |

| 18,054 | |

| Current operating lease liabilities | |

| 6,123 | | |

| 1,818 | | |

| 249 | |

| Total current liabilities | |

| 561,053 | | |

| 481,130 | | |

| 65,944 | |

| Non-current liabilities | |

| | | |

| | | |

| | |

| Non-current operating lease liabilities | |

| 2,894 | | |

| 2,361 | | |

| 324 | |

| Total non-current liabilities | |

| 2,894 | | |

| 2,361 | | |

| 324 | |

| Total liabilities | |

| 563,947 | | |

| 483,491 | | |

| 66,268 | |

| SHAREHOLDERS’ EQUITY | |

| | | |

| | | |

| | |

| Ordinary shares (par value of US$0.0001 per share, 700,000,000 Class A shares authorized as of December 31, 2022 and September 30, 2023; 125,122,382 Class A shares issued and 121,722,467 outstanding as of December 31, 2022; 125,122,382 Class A shares issued and 119,698,967 outstanding as of September 30, 2023; 200,000,000 Class B shares authorized, 144,000,000 Class B ordinary shares issued and outstanding as of December 31, 2022 and September 30, 2023; 100,000,000 shares (undesignated) authorized, nil shares (undesignated) issued and outstanding as of December 31, 2022 and September 30, 2023) | |

| 185 | | |

| 185 | | |

| 25 | |

| Additional paid-in capital | |

| 1,079,099 | | |

| 1,086,502 | | |

| 148,917 | |

| Treasury stock | |

| (7,123 | ) | |

| (16,665 | ) | |

| (2,284 | ) |

| Statutory reserves | |

| 7,967 | | |

| 7,967 | | |

| 1,092 | |

| Accumulated other comprehensive income | |

| 10,497 | | |

| 23,895 | | |

| 3,275 | |

| Accumulated deficit | |

| (321,173 | ) | |

| (173,537 | ) | |

| (23,785 | ) |

| Total shareholders’ equity | |

| 769,452 | | |

| 928,347 | | |

| 127,240 | |

| Total liabilities and shareholders’ equity | |

| 1,333,399 | | |

| 1,411,838 | | |

| 193,508 | |

iHuman Inc.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS

(Amounts in thousands of Renminbi (“RMB”)

and U.S. dollars (“US$”)

except for number of shares, ADSs, per share

and per ADS data)

| | |

For

the three months ended | | |

For

the nine months ended | |

| | |

September 30, | | |

June 30, | | |

September 30, | | |

September 30, | | |

September 30, | | |

September 30, | | |

September 30, | |

| | |

2022 | | |

2023 | | |

2023 | | |

2023 | | |

2022 | | |

2023 | | |

2023 | |

| | |

RMB | | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Revenues | |

| 251,527 | | |

| 240,993 | | |

| 261,496 | | |

| 35,841 | | |

| 724,813 | | |

| 767,692 | | |

| 105,221 | |

| Cost of revenues | |

| (74,422 | ) | |

| (70,160 | ) | |

| (74,871 | ) | |

| (10,262 | ) | |

| (214,636 | ) | |

| (224,667 | ) | |

| (30,793 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross

profit | |

| 177,105 | | |

| 170,833 | | |

| 186,625 | | |

| 25,579 | | |

| 510,177 | | |

| 543,025 | | |

| 74,428 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Research and development expenses | |

| (71,859 | ) | |

| (63,412 | ) | |

| (66,168 | ) | |

| (9,069 | ) | |

| (246,685 | ) | |

| (191,253 | ) | |

| (26,213 | ) |

| Sales and marketing expenses | |

| (41,669 | ) | |

| (40,564 | ) | |

| (53,994 | ) | |

| (7,400 | ) | |

| (111,105 | ) | |

| (134,993 | ) | |

| (18,502 | ) |

| General

and administrative expenses | |

| (25,035 | ) | |

| (25,982 | ) | |

| (26,070 | ) | |

| (3,573 | ) | |

| (79,942 | ) | |

| (78,787 | ) | |

| (10,799 | ) |

| Total

operating expenses | |

| (138,563 | ) | |

| (129,958 | ) | |

| (146,232 | ) | |

| (20,042 | ) | |

| (437,732 | ) | |

| (405,033 | ) | |

| (55,514 | ) |

| Operating

income | |

| 38,542 | | |

| 40,875 | | |

| 40,393 | | |

| 5,537 | | |

| 72,445 | | |

| 137,992 | | |

| 18,914 | |

| Other income,

net | |

| 9,611 | | |

| 8,132 | | |

| 19,507 | | |

| 2,674 | | |

| 15,875 | | |

| 33,721 | | |

| 4,622 | |

| Income before income taxes | |

| 48,153 | | |

| 49,007 | | |

| 59,900 | | |

| 8,211 | | |

| 88,320 | | |

| 171,713 | | |

| 23,536 | |

| Income tax

expenses | |

| (8,675 | ) | |

| (6,933 | ) | |

| (7,984 | ) | |

| (1,094 | ) | |

| (13,934 | ) | |

| (24,077 | ) | |

| (3,300 | ) |

| Net

income | |

| 39,478 | | |

| 42,074 | | |

| 51,916 | | |

| 7,117 | | |

| 74,386 | | |

| 147,636 | | |

| 20,236 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income per ADS: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| - Basic | |

| 0.74 | | |

| 0.80 | | |

| 0.98 | | |

| 0.13 | | |

| 1.39 | | |

| 2.79 | | |

| 0.38 | |

| - Diluted | |

| 0.73 | | |

| 0.77 | | |

| 0.95 | | |

| 0.13 | | |

| 1.38 | | |

| 2.70 | | |

| 0.37 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of ADSs: | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| - Basic | |

| 53,240,710 | | |

| 52,804,594 | | |

| 52,747,426 | | |

| 52,747,426 | | |

| 53,341,120 | | |

| 52,834,352 | | |

| 52,834,352 | |

| - Diluted | |

| 54,114,651 | | |

| 54,725,528 | | |

| 54,772,536 | | |

| 54,772,536 | | |

| 54,043,728 | | |

| 54,753,124 | | |

| 54,753,124 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total share-based compensation expenses included in: | | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| 77 | | |

| 70 | | |

| 67 | | |

| 9 | | |

| 180 | | |

| 235 | | |

| 32 | |

| Research and development expenses | |

| 2,045 | | |

| 1,142 | | |

| 1,160 | | |

| 159 | | |

| 3,813 | | |

| 2,940 | | |

| 403 | |

| Sales and marketing expenses | |

| 698 | | |

| 59 | | |

| 147 | | |

| 20 | | |

| 1,040 | | |

| 585 | | |

| 80 | |

| General and administrative expenses | |

| 1,187 | | |

| 1,160 | | |

| 1,105 | | |

| 151 | | |

| 2,963 | | |

| 3,557 | | |

| 488 | |

iHuman Inc.

UNAUDITED RECONCILIATION OF GAAP AND NON-GAAP

RESULTS

(Amounts in thousands of Renminbi (“RMB”)

and U.S. dollars (“US$”)

except for number of shares, ADSs, per share

and per ADS data)

| | |

For

the three months ended | | |

For

the nine months ended | |

| | |

September 30, | | |

June 30, | | |

September 30, | | |

September 30, | | |

September 30, | | |

September 30, | | |

September 30, | |

| | |

2022 | | |

2023 | | |

2023 | | |

2023 | | |

2022 | | |

2023 | | |

2023 | |

| | |

RMB | | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Operating income | |

| 38,542 | | |

| 40,875 | | |

| 40,393 | | |

| 5,537 | | |

| 72,445 | | |

| 137,992 | | |

| 18,914 | |

| Share-based

compensation expenses | |

| 4,007 | | |

| 2,431 | | |

| 2,479 | | |

| 339 | | |

| 7,996 | | |

| 7,317 | | |

| 1,003 | |

| Adjusted

operating income | |

| 42,549 | | |

| 43,306 | | |

| 42,872 | | |

| 5,876 | | |

| 80,441 | | |

| 145,309 | | |

| 19,917 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| 39,478 | | |

| 42,074 | | |

| 51,916 | | |

| 7,117 | | |

| 74,386 | | |

| 147,636 | | |

| 20,236 | |

| Share-based

compensation expenses | |

| 4,007 | | |

| 2,431 | | |

| 2,479 | | |

| 339 | | |

| 7,996 | | |

| 7,317 | | |

| 1,003 | |

| Adjusted

net income | |

| 43,485 | | |

| 44,505 | | |

| 54,395 | | |

| 7,456 | | |

| 82,382 | | |

| 154,953 | | |

| 21,239 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Diluted net income per ADS | |

| 0.73 | | |

| 0.77 | | |

| 0.95 | | |

| 0.13 | | |

| 1.38 | | |

| 2.70 | | |

| 0.37 | |

| Impact of

non-GAAP adjustments | |

| 0.07 | | |

| 0.04 | | |

| 0.04 | | |

| 0.01 | | |

| 0.14 | | |

| 0.13 | | |

| 0.02 | |

| Adjusted

diluted net income per ADS | |

| 0.80 | | |

| 0.81 | | |

| 0.99 | | |

| 0.14 | | |

| 1.52 | | |

| 2.83 | | |

| 0.39 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of

ADSs – diluted | |

| 54,114,651 | | |

| 54,725,528 | | |

| 54,772,536 | | |

| 54,772,536 | | |

| 54,043,728 | | |

| 54,753,124 | | |

| 54,753,124 | |

| Weighted average number

of ADSs – adjusted | |

| 54,114,651 | | |

| 54,725,528 | | |

| 54,772,536 | | |

| 54,772,536 | | |

| 54,043,728 | | |

| 54,753,124 | | |

| 54,753,124 | |

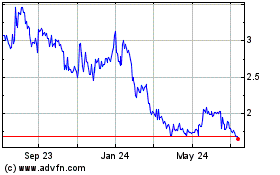

iHuman (NYSE:IH)

Historical Stock Chart

From Jan 2025 to Feb 2025

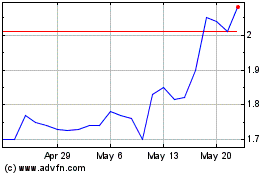

iHuman (NYSE:IH)

Historical Stock Chart

From Feb 2024 to Feb 2025