UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number: 001-39591

iHuman Inc.

(Registrant’s Name)

Floor 8, Building B,

No. 1 Wangjing East Road,

Chaoyang District, Beijing 100102

People’s Republic of China

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

By |

: |

/s/ Vivien Weiwei Wang |

| |

Name |

: |

Vivien Weiwei Wang |

| |

Title |

: |

Director and Chief Financial Officer |

Date: February 29, 2024

Exhibit 99.1

iHuman Inc. Announces Fourth Quarter and Fiscal

Year 2023 Unaudited Financial Results

BEIJING, China, February 29, 2024 -- iHuman Inc.

(NYSE: IH) (“iHuman” or the “Company”), a leading provider of tech-powered, intellectual development products

in China, today announced its unaudited financial results for the fourth quarter and fiscal year ended December 31, 2023.

Fourth Quarter 2023 Highlights

| · | Revenues

were RMB250.4 million (US$35.3 million), compared with RMB260.7 million in the same period

last year. |

| · | Gross

profit was RMB178.2 million (US$25.1 million), compared with RMB181.0 million in the same

period last year. |

| · | Operating

income was RMB21.9 million (US$3.1 million), compared with RMB39.1 million in the same period

last year. |

| · | Net

income was RMB33.3 million (US$4.7 million), compared with RMB35.4 million in the same period

last year. |

| · | Average

total MAUs1 reached a record-high of 25.38

million, a year-over-year increase of 14.2%. |

Fiscal Year 2023 Highlights

| · | Revenues

were RMB1,018.1 million (US$143.4 million), compared with RMB985.5 million in fiscal year

2022. |

| · | Gross

profit was RMB721.3 million (US$101.6 million), compared with RMB691.2 million in fiscal

year 2022. |

| · | Operating

income was RMB159.9 million (US$22.5 million), compared with RMB111.6 million in fiscal year

2022. |

| · | Net

income was RMB180.9 million (US$25.5 million), compared with RMB109.8 million in fiscal year

2022. |

| · | Average

total MAUs were 23.04 million, a year-over-year increase of 16.0%. |

Dr. Peng Dai, Director and Chief Executive Officer

of iHuman, commented, “As we look back on 2023, I am truly inspired by the accomplishments that we have achieved, especially considering

the decline in China’s newborn population over the past few years. In response to the challenges posed by the declining birth rate,

we have been actively expanding our presence in the international markets, diversifying our product portfolio, and developing products

that cover a broader age demographic. These strategic efforts have helped us achieve remarkable progress. For instance, our globally-oriented

app, Aha World, delivered impressive performance in 2023. By the end of the year, its YouTube and TikTok accounts collectively

attracted over 200 million views. It also earned YouTube’s Silver Creator Award and rose to rank among the top three most popular

children’s apps on the U.S. Apple app store in the fourth quarter. Meanwhile, our flagship product, iHuman Chinese, has

consistently held the No.1 spot in the top-grossing category for children’s apps on the Apple app store in China for iPad users

for nearly 4.5 years, according to Appfigures, a reputable American data analytics company. This past year has been marked by revenue

growth and sustained profitability, and we once again set a new record for average total MAUs in the fourth quarter which further solidified

our position as an industry leader.”

“We are also thrilled to announce the acquisition

of intellectual property assets related to “Cosmicrew” from Kunpeng, an animation production studio within the Perfect

World Group. This strategic acquisition is expected to generate significant synergies with our business. Firstly, “Cosmicrew”

is a popular cartoon adventure series that has established a strong presence in the children’s entertainment sector. The light-hearted

and delightful nature of this cartoon IP seamlessly compliments our overall product style and aesthetic. With the IP already integrated

into some of our products before the acquisition, we now have greater autonomy over our creative content. In addition, we now can expand

our product range further by developing additional IP offerings and derivatives, including animations, toys, and more.

At the market level, “Cosmicrew” is a popular cartoon with a large audience base, and this acquisition will enable

us to further extend our market reach and engage with a broader audience.”

1 “Average total MAUs”

refers to the monthly average of the sum of the MAUs of each of the Company’s apps during a specific period, which is counted based

on the number of unique mobile devices through which such app is accessed at least once in a given month, and duplicate access to different

apps is not eliminated from the total MAUs calculation.

“As we continue to progress on our strategic

initiatives, we remain fully dedicated to strengthening our core competencies through ongoing product enhancement. We have been enriching

the content and functionality of our app products to elevate the digital experience of our users and have made further strides in integrating

our online and offline offerings to create a more immersive and holistic journey for users. For example, we rolled out both multi-leveled

physical books and a specially developed smart reading pen that complement our leveled English reading app, iHuman Fantastic Friends.

This combination allows kids to explore captivating original English stories tailored to their proficiency level in physical and digital

formats, offering them a flexible and simple reading experience while enhancing their understanding and engagement with the content.”

“In 2023, we further strengthened our comprehensive

product suite, significantly expanded our international presence, and earned increased market recognition with several prestigious industry

accolades. We achieved all these milestones despite a highly volatile and challenging macroeconomic climate, which I believe is a testament

to the caliber of our products, the effectiveness of our strategies, and the resilience of our team in overcoming diverse economic challenges.

As we enter 2024, I am filled with anticipation for the continued success that lies ahead.”

Ms. Vivien Weiwei Wang, Director and Chief Financial

Officer of iHuman, added, “Our fourth quarter results ended 2023 on a positive note despite a turbulent global economic environment.

While our fourth quarter results saw a marginal decrease year-over-year, it reflected a normalization from the exceptional fourth quarter

performance last year, which was caused by a heightened demand driven by more indoor activities during the pandemic. From a full year

perspective in 2023, despite the fact that everybody shifted back to regular routines and spent less time at home after the pandemic,

we still achieved satisfactory growth as both revenues and MAUs increased compared to fiscal year 2022. We are also proud to announce

our eighth consecutive quarter of profitability, with annual net income reaching RMB180.9 million. This achievement marks our second

straight year of profitability since our IPO in 2020 and demonstrates that we have successfully charted a path of healthy and sustainable

growth. The momentum we have sustained in our business operations has further solidified our financial position, which not only bolsters

our capacity for ongoing growth and innovation, but also enables us to enhance returns to our shareholders through issuing a special

cash dividend of US$0.02 per ordinary share, or US$0.10 per ADS. The approval of the special dividend by our board of directors reflects

our confidence in our long-term growth potential and strong balance sheet. Moving forward, we will continue to execute on our strategic

priorities and maintain a growth-oriented approach to create even greater value for our users and shareholders.”

Fourth Quarter 2023 Unaudited Financial Results

Revenues

Revenues were RMB250.4 million (US$35.3 million),

compared with RMB260.7 million in the same period last year.

Average total MAUs for the quarter were 25.38

million, an increase of 14.2% year-over-year from 22.22 million in the same period last year. The number of paying users2

was 1.45 million.

Cost of Revenues

Cost of revenues was RMB72.2 million (US$10.2

million), a decrease of 9.4% from RMB79.7 million in the same period last year, primarily due to decreased channel costs.

Gross Profit and Gross Margin

Gross profit was RMB178.2 million (US$25.1 million),

compared with RMB181.0 million in the same period last year. Gross margin was 71.2%, compared with 69.4% in the same period last year.

2 “Paying users” refers

to users who paid subscription fees for premium content on any of the Company’s apps during a specific period; a user who makes

payments across different apps using the same registered account is counted as one paying user, and a user who makes payments for the

same app multiple times in the same period is counted as one paying user.

Operating Expenses

Total operating expenses were RMB156.4 million

(US$22.0 million), an increase of 10.2% from RMB141.9 million in the same period last year.

Research and development expenses were RMB66.3

million (US$9.3 million), compared with RMB66.8 million in the same period last year.

Sales and marketing expenses were RMB64.5 million (US$9.1 million),

an increase of 40.8% from RMB45.8 million in the same period last year, primarily due to increased strategic spending on promotional

activities and brand enhancement.

General and administrative expenses were RMB25.5

million (US$3.6 million), a decrease of 12.7% from RMB29.3 million in the same period last year, primarily due to payroll related cost-savings

and other decreased expenses as a result of the continued optimization of our operational efficiency.

Operating Income

Operating income was RMB21.9 million (US$3.1

million), compared with RMB39.1 million in the same period last year.

Net Income

Net income was RMB33.3 million (US$4.7 million),

compared with RMB35.4 million in the same period last year.

Basic and diluted net income per ADS were RMB0.63

(US$0.09) and RMB0.61 (US$0.09), respectively, compared with RMB0.67 and RMB0.66 in the same period last year. Each ADS represents five

Class A ordinary shares of the Company.

Deferred Revenue and Customer Advances

Deferred revenue and customer advances were RMB318.6

million (US$44.9 million) as of December 31, 2023, compared with RMB379.1 million as of December 31, 2022.

Cash and Cash Equivalents

Cash and cash equivalents were RMB1,213.8 million

(US$171.0 million) as of December 31, 2023, compared with RMB1,050.0 million as of December 31, 2022.

Fiscal Year 2023 Unaudited Financial Results

Revenues

Revenues were RMB1,018.1 million (US$143.4 million),

an increase of 3.3% from RMB985.5 million in fiscal year 2022.

Average total MAUs were 23.04 million, an increase

of 16.0% year-over-year from 19.86 million in fiscal year 2022. The number of paying users for the year was 4.27 million.

Cost of Revenues

Cost of revenues was RMB296.9 million (US$41.8

million), compared with RMB294.3 million in fiscal year 2022.

Gross Profit and Gross Margin

Gross profit was RMB721.3 million (US$101.6 million),

an increase of 4.4% from RMB691.2 million in fiscal year 2022. Gross margin was 70.8%, compared with 70.1% in fiscal year 2022.

Operating Expenses

Total operating expenses were RMB561.4 million

(US$79.1 million), a decrease of 3.1% from RMB579.6 million in fiscal year 2022.

Research and development expenses were RMB257.5

million (US$36.3 million), a decrease of 17.8% from RMB313.5 million in fiscal year 2022, primarily due to cost savings in payroll-related

expenses and outsourcing expenses.

Sales and marketing expenses were RMB199.5 million

(US$28.1 million), an increase of 27.1% from RMB156.9 million in fiscal year 2022, primarily due to increased strategic spending on promotional

activities and brand enhancement.

General and administrative expenses were RMB104.3

million (US$14.7 million), a decrease of 4.5% from RMB109.2 million in fiscal year 2022.

Operating Income

Operating income was RMB159.9 million (US$22.5

million), compared with RMB111.6 million in fiscal year 2022.

Net Income

Net income was RMB180.9 million (US$25.5 million),

compared with RMB109.8 million in fiscal year 2022.

Basic and diluted net income per ADS were RMB3.43

(US$0.48) and RMB3.30 (US$0.46), respectively, compared with RMB2.06 and RMB2.03 in fiscal year 2022. Each ADS represents five Class

A ordinary shares of the Company.

Special Cash Dividend

To deliver return of capital to shareholders,

the Company’s board of directors (the “Board”) approved a special cash dividend of US$0.02 per ordinary share, or US$0.10

per ADS, to holders of ordinary shares and holders of ADSs as of the close of business on March 28, 2024 New York Time, payable in U.S.

dollars. The aggregate amount of the special dividend will be approximately US$5.3 million. The payment date is expected to be on or

around May 8, 2024 and May 15, 2024 for holders of ordinary shares and holders of ADSs, respectively.

Acquisition of IP Assets

The Company, through one of its consolidated

affiliated entities, entered into an asset transfer agreement (the “Asset Transfer Agreement”) with Kunpeng, an animation

production studio within the Perfect World Group (the “Transferors”). Pursuant to the Asset Transfer Agreement, the Company

will acquire intellectual property assets related to “Cosmicrew” from Kunpeng, including copyrights and trademarks,

among others, for a total consideration of RMB64.0 million. The consideration of the transaction was determined with the assistance of

an independent third-party valuation firm. As the Transferors are related parties of the Company, the transaction has been approved by

the Board and the audit committee of the Board, and is subject to customary closing conditions.

Exchange Rate Information

The U.S. dollar (US$) amounts disclosed in this

press release, except for those transaction amounts that were actually settled in U.S. dollars, are presented solely for the convenience

of the reader. The conversion of Renminbi (RMB) into US$ in this press release is based on the exchange rate set forth in the H.10 statistical

release of the Board of Governors of the Federal Reserve System as of December 29, 2023, which was RMB7.0999 to US$1.00. The percentages

stated in this press release are calculated based on the RMB amounts.

Non-GAAP Financial Measures

iHuman considers and uses non-GAAP financial

measures, such as adjusted operating income, adjusted net income and adjusted diluted net income per ADS, as supplemental metrics in

reviewing and assessing its operating performance and formulating its business plan. The presentation of non-GAAP financial measures

is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with

accounting principles generally accepted in the United States of America (“U.S. GAAP”). iHuman

defines adjusted operating income, adjusted net income and adjusted diluted net income per ADS as operating income, net income and diluted

net income per ADS excluding share-based compensation expenses, respectively. Adjusted operating income, adjusted net income and adjusted

diluted net income per ADS enable iHuman’s management to assess its operating results without considering the impact of share-based

compensation expenses, which are non-cash charges. iHuman believes that these non-GAAP financial measures provide useful information

to investors in understanding and evaluating the Company’s current operating performance and prospects in the same manner as management

does, if they so choose.

Non-GAAP financial measures are not defined under

U.S. GAAP and are not presented in accordance with U.S. GAAP. Non-GAAP financial measures have limitations as analytical tools, which

possibly do not reflect all items of expense that affect our operations. Share-based compensation expenses have been and may continue

to be incurred in our business and are not reflected in the presentation of the non-GAAP financial measures. In addition, the non-GAAP

financial measures iHuman uses may differ from the non-GAAP measures used by other companies, including peer companies, and therefore

their comparability may be limited. The presentation of these non-GAAP financial measures is not intended to be considered in isolation

from or as a substitute for the financial information prepared and presented in accordance with GAAP.

Safe Harbor Statement

This announcement contains forward-looking statements.

These statements are made under the “safe harbor” provisions of the United States Private Securities Litigation Reform Act

of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,”

“future,” “intends,” “plans,” “believes,” “estimates” and similar statements.

Statements that are not historical facts, including statements about iHuman’s beliefs and expectations, are forward-looking statements.

Among other things, the description of the management’s quotations in this announcement contains forward-looking statements. iHuman

may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the

“SEC”), in its annual report to shareholders, in press releases and other written materials, and in oral statements made

by its officers, directors or employees to third parties. Forward-looking statements involve inherent risks and uncertainties. A number

of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited

to the following: iHuman’s growth strategies; its future business development, financial condition and results of operations; its

ability to continue to attract and retain users, convert non-paying users into paying users and increase the spending of paying users,

the trends in, and size of, the market in which iHuman operates; its expectations regarding demand for, and market acceptance of, its

products and services; its expectations regarding its relationships with business partners; general economic and business conditions;

regulatory environment; and assumptions underlying or related to any of the foregoing. Further information regarding these and other

risks is included in iHuman’s filings with the SEC. All information provided in this press release is as of the date of this press

release, and iHuman does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

About iHuman Inc.

iHuman Inc. is a leading provider of tech-powered,

intellectual development products in China that is committed to making the child-upbringing experience easier for parents and transforming

intellectual development into a fun journey for children. Benefiting from a deep legacy that combines over two decades of experience

in the parenthood industry, superior original content, advanced high-tech innovation DNA and research & development capabilities

with cutting-edge technologies, iHuman empowers parents with tools to make the child-upbringing experience more efficient. iHuman’s

unique, fun and interactive product offerings stimulate children’s natural curiosity and exploration. The Company’s comprehensive

suite of innovative and high-quality products include self-directed apps, interactive content and smart devices that cover a broad variety

of areas to develop children’s abilities in speaking, critical thinking, independent reading and creativity, and foster their natural

interest in traditional Chinese culture. Leveraging advanced technological capabilities, including 3D engines, AI/AR functionality, and

big data analysis on children’s behavior & psychology, iHuman believes it will continue to provide superior experience that

is efficient and relieving for parents, and effective and fun for children, in China and all over the world, through its integrated suite

of tech-powered, intellectual development products.

For more information about iHuman, please visit

https://ir.ihuman.com/.

For investor and media enquiries, please contact:

iHuman Inc.

Mr. Justin Zhang

Investor Relations Director

Phone: +86 10 5780-6606

E-mail: ir@ihuman.com

Christensen

In China

Ms. Alice Li

Phone: +86-10-5900-1548

E-mail: alice.li@christensencomms.com

In the US

Ms. Linda Bergkamp

Phone: +1-480-614-3004

E-mail: linda.bergkamp@christensencomms.com

iHuman Inc.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands of Renminbi (“RMB”)

and U.S. dollars (“US$”)

except for number of shares, ADSs, per share

and per ADS data)

| | |

December 31, | | |

December 31, | | |

December 31, | |

| | |

2022 | | |

2023 | | |

2023 | |

| | |

RMB | | |

RMB | | |

US$ | |

| ASSETS | |

| | | |

| | | |

| | |

| Current assets | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 1,049,999 | | |

| 1,213,767 | | |

| 170,956 | |

| Accounts receivable, net | |

| 79,614 | | |

| 60,832 | | |

| 8,568 | |

| Inventories, net | |

| 19,127 | | |

| 16,518 | | |

| 2,327 | |

| Amounts due from related parties | |

| 2,286 | | |

| 1,810 | | |

| 255 | |

| Prepayments and other current assets | |

| 102,765 | | |

| 89,511 | | |

| 12,607 | |

| Total current assets | |

| 1,253,791 | | |

| 1,382,438 | | |

| 194,713 | |

| Non-current assets | |

| | | |

| | | |

| | |

| Property and equipment, net | |

| 9,205 | | |

| 6,169 | | |

| 869 | |

| Intangible assets, net | |

| 24,872 | | |

| 23,245 | | |

| 3,274 | |

| Operating lease right-of-use assets | |

| 12,782 | | |

| 3,648 | | |

| 514 | |

| Long-term investment | |

| 26,333 | | |

| 26,333 | | |

| 3,709 | |

| Other non-current assets | |

| 6,416 | | |

| 8,662 | | |

| 1,218 | |

| Total non-current

assets | |

| 79,608 | | |

| 68,057 | | |

| 9,584 | |

| Total assets | |

| 1,333,399 | | |

| 1,450,495 | | |

| 204,297 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | |

| Accounts payable | |

| 24,206 | | |

| 22,139 | | |

| 3,118 | |

| Deferred revenue and customer advances | |

| 379,063 | | |

| 318,587 | | |

| 44,872 | |

| Amounts due to related parties | |

| 6,944 | | |

| 4,428 | | |

| 624 | |

| Accrued expenses and other current liabilities | |

| 144,717 | | |

| 143,677 | | |

| 20,236 | |

| Current operating lease liabilities | |

| 6,123 | | |

| 1,927 | | |

| 271 | |

| Total current liabilities | |

| 561,053 | | |

| 490,758 | | |

| 69,121 | |

| Non-current liabilities | |

| | | |

| | | |

| | |

| Non-current operating lease liabilities | |

| 2,894 | | |

| 1,933 | | |

| 272 | |

| Total non-current

liabilities | |

| 2,894 | | |

| 1,933 | | |

| 272 | |

| Total liabilities | |

| 563,947 | | |

| 492,691 | | |

| 69,393 | |

| SHAREHOLDERS’ EQUITY | |

| | | |

| | | |

| | |

| Ordinary shares (par value of US$0.0001 per share, 700,000,000

Class A shares authorized as of December 31, 2022 and December 31, 2023; 125,122,382 Class A shares issued and 121,722,467 outstanding

as of December 31, 2022; 125,122,382 Class A shares issued and 119,704,787 outstanding as of December 31, 2023; 200,000,000 Class

B shares authorized, 144,000,000 Class B ordinary shares issued and outstanding as of December 31, 2022 and December 31, 2023; 100,000,000

shares (undesignated) authorized, nil shares (undesignated) issued and outstanding as of December 31, 2022 and December 31, 2023) | |

| 185 | | |

| 185 | | |

| 26 | |

| Additional paid-in capital | |

| 1,079,099 | | |

| 1,088,628 | | |

| 153,330 | |

| Treasury stock | |

| (7,123 | ) | |

| (16,665 | ) | |

| (2,347 | ) |

| Statutory reserves | |

| 7,967 | | |

| 8,164 | | |

| 1,150 | |

| Accumulated other comprehensive income | |

| 10,497 | | |

| 17,955 | | |

| 2,529 | |

| Accumulated deficit | |

| (321,173 | ) | |

| (140,463 | ) | |

| (19,784 | ) |

| Total shareholders’

equity | |

| 769,452 | | |

| 957,804 | | |

| 134,904 | |

| Total liabilities and

shareholders’ equity | |

| 1,333,399 | | |

| 1,450,495 | | |

| 204,297 | |

iHuman Inc.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS

(Amounts in thousands of Renminbi (“RMB”)

and U.S. dollars (“US$”)

except for number of shares, ADSs, per share

and per ADS data)

| | |

For the three months

ended | | |

For the year ended | |

| | |

December 31, | | |

September 30, | | |

December 31, | | |

December 31, | | |

December 31, | | |

December 31, | | |

December 31, | |

| | |

2022 | | |

2023 | | |

2023 | | |

2023 | | |

2022 | | |

2023 | | |

2023 | |

| | |

RMB | | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Revenues | |

| 260,704 | | |

| 261,496 | | |

| 250,447 | | |

| 35,275 | | |

| 985,517 | | |

| 1,018,139 | | |

| 143,402 | |

| Cost of revenues | |

| (79,707 | ) | |

| (74,871 | ) | |

| (72,201 | ) | |

| (10,169 | ) | |

| (294,343 | ) | |

| (296,868 | ) | |

| (41,813 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross

profit | |

| 180,997 | | |

| 186,625 | | |

| 178,246 | | |

| 25,106 | | |

| 691,174 | | |

| 721,271 | | |

| 101,589 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Research and development expenses | |

| (66,796 | ) | |

| (66,168 | ) | |

| (66,293 | ) | |

| (9,337 | ) | |

| (313,481 | ) | |

| (257,546 | ) | |

| (36,275 | ) |

| Sales and marketing expenses | |

| (45,811 | ) | |

| (53,994 | ) | |

| (64,511 | ) | |

| (9,086 | ) | |

| (156,916 | ) | |

| (199,504 | ) | |

| (28,100 | ) |

| General and administrative

expenses | |

| (29,253 | ) | |

| (26,070 | ) | |

| (25,547 | ) | |

| (3,598 | ) | |

| (109,195 | ) | |

| (104,334 | ) | |

| (14,695 | ) |

| Total

operating expenses | |

| (141,860 | ) | |

| (146,232 | ) | |

| (156,351 | ) | |

| (22,021 | ) | |

| (579,592 | ) | |

| (561,384 | ) | |

| (79,070 | ) |

| Operating

income | |

| 39,137 | | |

| 40,393 | | |

| 21,895 | | |

| 3,085 | | |

| 111,582 | | |

| 159,887 | | |

| 22,519 | |

| Other income, net | |

| 5,315 | | |

| 19,507 | | |

| 8,965 | | |

| 1,263 | | |

| 21,190 | | |

| 42,686 | | |

| 6,012 | |

| Income before income

taxes | |

| 44,452 | | |

| 59,900 | | |

| 30,860 | | |

| 4,348 | | |

| 132,772 | | |

| 202,573 | | |

| 28,531 | |

| Income tax (expenses)

/ benefits | |

| (9,019 | ) | |

| (7,984 | ) | |

| 2,411 | | |

| 340 | | |

| (22,953 | ) | |

| (21,666 | ) | |

| (3,052 | ) |

| Net

income | |

| 35,433 | | |

| 51,916 | | |

| 33,271 | | |

| 4,688 | | |

| 109,819 | | |

| 180,907 | | |

| 25,479 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income per ADS: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| - Basic | |

| 0.67 | | |

| 0.98 | | |

| 0.63 | | |

| 0.09 | | |

| 2.06 | | |

| 3.43 | | |

| 0.48 | |

| - Diluted | |

| 0.66 | | |

| 0.95 | | |

| 0.61 | | |

| 0.09 | | |

| 2.03 | | |

| 3.30 | | |

| 0.46 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of ADSs: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| - Basic | |

| 53,205,925 | | |

| 52,747,426 | | |

| 52,740,067 | | |

| 52,740,067 | | |

| 53,307,044 | | |

| 52,810,587 | | |

| 52,810,587 | |

| - Diluted | |

| 54,033,560 | | |

| 54,772,536 | | |

| 54,753,503 | | |

| 54,753,503 | | |

| 54,040,908 | | |

| 54,753,025 | | |

| 54,753,025 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total share-based

compensation expenses included in: | | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| 168 | | |

| 67 | | |

| 64 | | |

| 9 | | |

| 348 | | |

| 299 | | |

| 42 | |

| Research and development expenses | |

| 2,564 | | |

| 1,160 | | |

| 1,115 | | |

| 157 | | |

| 6,377 | | |

| 4,055 | | |

| 571 | |

| Sales and marketing expenses | |

| 559 | | |

| 147 | | |

| 122 | | |

| 17 | | |

| 1,599 | | |

| 707 | | |

| 100 | |

| General and administrative expenses | |

| 1,757 | | |

| 1,105 | | |

| 817 | | |

| 115 | | |

| 4,720 | | |

| 4,374 | | |

| 616 | |

iHuman Inc.

UNAUDITED RECONCILIATION OF GAAP AND NON-GAAP

RESULTS

(Amounts in thousands of Renminbi (“RMB”)

and U.S. dollars (“US$”)

except for number of shares, ADSs, per share

and per ADS data)

| | |

For

the three months ended | | |

For

the year ended | |

| | |

December 31, | | |

September 30, | | |

December 31, | | |

December 31, | | |

December 31, | | |

December 31, | | |

December 31, | |

| | |

2022 | | |

2023 | | |

2023 | | |

2023 | | |

2022 | | |

2023 | | |

2023 | |

| | |

RMB | | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Operating

income | |

| 39,137 | | |

| 40,393 | | |

| 21,895 | | |

| 3,085 | | |

| 111,582 | | |

| 159,887 | | |

| 22,519 | |

| Share-based

compensation expenses | |

| 5,048 | | |

| 2,479 | | |

| 2,118 | | |

| 298 | | |

| 13,044 | | |

| 9,435 | | |

| 1,329 | |

| Adjusted

operating income | |

| 44,185 | | |

| 42,872 | | |

| 24,013 | | |

| 3,383 | | |

| 124,626 | | |

| 169,322 | | |

| 23,848 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

income | |

| 35,433 | | |

| 51,916 | | |

| 33,271 | | |

| 4,688 | | |

| 109,819 | | |

| 180,907 | | |

| 25,479 | |

| Share-based

compensation expenses | |

| 5,048 | | |

| 2,479 | | |

| 2,118 | | |

| 298 | | |

| 13,044 | | |

| 9,435 | | |

| 1,329 | |

| Adjusted

net income | |

| 40,481 | | |

| 54,395 | | |

| 35,389 | | |

| 4,986 | | |

| 122,863 | | |

| 190,342 | | |

| 26,808 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Diluted net

income per ADS | |

| 0.66 | | |

| 0.95 | | |

| 0.61 | | |

| 0.09 | | |

| 2.03 | | |

| 3.30 | | |

| 0.46 | |

| Impact

of non-GAAP adjustments | |

| 0.09 | | |

| 0.04 | | |

| 0.04 | | |

| 0.00 | | |

| 0.24 | | |

| 0.18 | | |

| 0.03 | |

| Adjusted

diluted net income per ADS | |

| 0.75 | | |

| 0.99 | | |

| 0.65 | | |

| 0.09 | | |

| 2.27 | | |

| 3.48 | | |

| 0.49 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted

average number of ADSs – diluted | |

| 54,033,560 | | |

| 54,772,536 | | |

| 54,753,503 | | |

| 54,753,503 | | |

| 54,040,908 | | |

| 54,753,025 | | |

| 54,753,025 | |

| Weighted

average number of ADSs – adjusted | |

| 54,033,560 | | |

| 54,772,536 | | |

| 54,753,503 | | |

| 54,753,503 | | |

| 54,040,908 | | |

| 54,753,025 | | |

| 54,753,025 | |

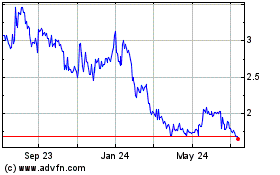

iHuman (NYSE:IH)

Historical Stock Chart

From Jan 2025 to Feb 2025

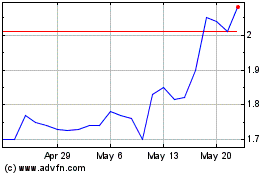

iHuman (NYSE:IH)

Historical Stock Chart

From Feb 2024 to Feb 2025