JBG SMITH Declares a Quarterly Common Dividend of $0.175 Per Share

February 14 2024 - 3:15PM

Business Wire

JBG SMITH (NYSE: JBGS), a leading owner and developer of

high-quality, mixed-use properties in the Washington, DC market,

today announced that its Board of Trustees has declared a quarterly

dividend of $0.175 per common share, a new indicated annual rate of

$0.70 per share, a 22.2% reduction to the prior dividend. The

dividend will be paid on March 15, 2024 to common shareholders of

record as of March 1, 2024.

Our Board of Trustees, in consultation with management, elected

to reduce the dividend taking into consideration several factors,

including (i) our on-going capital recycling strategy, (ii) the

expected performance and capital requirements of our commercial

portfolio, and (iii) the upcoming delivery of our 1,583

under-construction multifamily units (upon delivery, capitalized

interest ceases which reduces FAD and taxable income).

We believe the reduced dividend rate will help preserve JBG

SMITH’s financial flexibility, reinforce our already strong

financial position, continue to cover our taxable income

distribution requirements, and enhance the Company’s ability to

take advantage of compelling opportunities, such as share

repurchases, as they arise. Share buybacks are a form of capital

return to investors, as are dividends. At our current discount to

NAV, we believe buybacks are more accretive to our long-term NAV

per share than excess (above taxable income) dividends. Having

bought back approximately 32% of the shares and OP units that were

outstanding when we began our buyback program, we have eliminated

approximately $33.8 million in annual dividends on those securities

at the current dividend level.

About JBG SMITH

JBG SMITH owns, operates, invests in, and develops mixed-use

properties in high growth and high barrier-to-entry submarkets in

and around Washington, DC. Through an intense focus on placemaking,

JBG SMITH cultivates vibrant, amenity-rich, walkable neighborhoods

throughout the Washington, DC metropolitan area. Approximately

two-thirds of JBG SMITH's holdings are in the National Landing

submarket in Northern Virginia, which is anchored by four key

demand drivers: Amazon's new headquarters; Virginia Tech's

under-construction $1 billion Innovation Campus; the submarket’s

proximity to the Pentagon; and JBG SMITH’s deployment of

next-generation public and private 5G digital infrastructure. JBG

SMITH's dynamic portfolio currently comprises 14.7 million square

feet of high-growth office, multifamily, and retail assets at

share, 99% of which are Metro-served. It also maintains a

development pipeline encompassing 9.8 million square feet of

mixed-use, primarily multifamily, development opportunities. JBG

SMITH is committed to the operation and development of green,

smart, and healthy buildings and plans to maintain carbon neutral

operations annually. For more information on JBG SMITH please visit

www.jbgsmith.com.

Forward-Looking Statements

Certain statements contained herein may constitute

"forward-looking statements" as such term is defined in Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements are not guarantees of performance. They represent our

intentions, plans, expectations, and beliefs and are subject to

numerous assumptions, risks, and uncertainties. Consequently, the

future results, financial condition, and business of JBG SMITH

Properties ("JBG SMITH", the "Company", "we", "us", "our" or

similar terms) may differ materially from those expressed in these

forward-looking statements. You can find many of these statements

by looking for words such as "approximate", "hypothetical",

"potential", "believes", "expects", "anticipates", "estimates",

"intends", "plans", "would", "may" or similar expressions in this

press release. We also note the following forward-looking

statements: our expected annual dividend rate, the expected

continuation of our capital recycling strategy, the expected

performance and capital requirements of our commercial portfolio,

the upcoming delivery of under-construction multifamily units, our

ability to preserve JBG SMITH’s financial flexibility, reinforce

our already strong financial position, continue to cover our

taxable income distribution requirements, and our ability to take

advantage of compelling opportunities.

Many of the factors that will determine the outcome of these,

and our other forward-looking statements, are beyond our ability to

control or predict. These factors include, among others: adverse

economic conditions in the Washington, DC metropolitan area, the

timing of and costs associated with development and property

improvements, financing commitments, and general competitive

factors. For further discussion of factors that could materially

affect the outcome of our forward-looking statements and other

risks and uncertainties, see "Risk Factors," "Management's

Discussion and Analysis of Financial Condition and Results of

Operations" and the Cautionary Statement Concerning Forward-Looking

Statements in the Company's Annual Report on Form 10‑K for the year

ended December 31, 2022, and other periodic reports the Company

files with the Securities and Exchange Commission. For these

statements, we claim the protection of the safe harbor for

forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995. You are cautioned not to place undue

reliance on our forward-looking statements. All subsequent written

and oral forward-looking statements attributable to us or any

person acting on our behalf are expressly qualified in their

entirety by the cautionary statements contained or referred to in

this section. We do not undertake any obligation to release

publicly any revisions to our forward-looking statements to reflect

events or circumstances occurring after the date hereof.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240214207648/en/

Kevin Connolly JBG SMITH Executive Vice President, Portfolio

Management & Investor Relations (240) 333-3837

kconnolly@jbgsmith.com

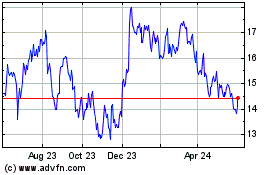

JBG SMITH Properties (NYSE:JBGS)

Historical Stock Chart

From Dec 2024 to Jan 2025

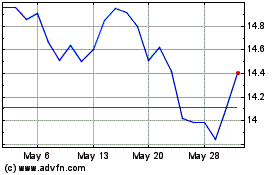

JBG SMITH Properties (NYSE:JBGS)

Historical Stock Chart

From Jan 2024 to Jan 2025