UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

January 17, 2025

NORDSTROM, INC.

(Exact name of registrant as specified in its charter)

| Washington |

|

001-15059 |

|

91-0515058 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1617 Sixth Avenue, Seattle, Washington 98101

(Address of principal executive offices)

Registrant’s telephone number, including

area code (206) 628-2111

Inapplicable

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☒ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common stock, without par value |

|

JWN |

|

New York Stock Exchange |

| Common stock purchase rights |

|

|

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

ITEM 5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

As previously disclosed, on December 22, 2024,

Nordstrom, Inc., a Washington corporation (the “Company”), entered into an Agreement and Plan of Merger (the

“Merger Agreement”) with Norse Holdings, Inc., a Delaware corporation (“Parent”) and

Navy Acquisition Co. Inc., a Washington corporation and a direct, wholly owned subsidiary of Parent (“Acquisition Sub”).

The Merger Agreement provides that, on the terms and subject to the conditions of the Merger Agreement, Acquisition Sub will merge with

and into the Company (the “Merger”), with the Company continuing as the surviving corporation in the Merger

and becoming a wholly-owned subsidiary of Parent.

On January 17 and 23, 2025, the following named

executive officers of the Company (each, an “NEO”) entered into retention bonus agreements with the Company

in respect of a grant under a cash-based retention bonus program relating to the Merger (the “Retention Program”),

which was previously approved in a joint meeting of the Compensation, People and Culture Committee and the Special Committee of the Company’s

Board of Directors. Allocations of awards to the NEOs under the Retention Program are as follows: Kenneth J. Worzel, Chief Customer Officer,

$1,790,000; Catherine R. Smith, Chief Financial Officer, $1,750,000; and Jason Morris, Chief Technology and Information Officer, $1,660,000.

Each retention bonus granted pursuant to the Retention Program will be subject to the terms and conditions of the applicable retention

bonus agreement, and paid as follows: (i) 25% of the retention bonus will be paid within 30 days following the earlier of (A) the date

of the closing of the Merger (the “Closing Date”) and (B) December 15, 2025, (ii) subject to the occurrence

of the closing of the Merger, 25% of the retention bonus will be paid within 30 days following the first anniversary of the Closing Date,

(iii) subject to the occurrence of the closing of the Merger, 50% of the retention bonus will be paid within 30 days following the second

anniversary of the Closing Date, in each case, subject to (x) the NEO’s continuous employment with the Company through the applicable

payment date and (y) the NEO’s job performance continuing to meet the Company’s expectations through the applicable payment

date.

The Retention Program is intended to help promote

retention of each NEO, together with each other eligible participant who receives an award pursuant to the Retention Program, through

critical retention periods, including through the earlier of the Closing Date and December 15, 2025 and, at Parent’s request, the

two year period following the Closing Date.

ITEM 9.01 Financial Statements and Exhibits

| Exhibit No. |

|

Description |

| 104* |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Additional Information

Regarding the Merger and Where to Find It

This Current Report on Form 8-K relates to the

proposed transaction (the “proposed transaction”) involving the Company, Parent and Acquisition Sub, whereby

the Company would become a wholly-owned subsidiary of Parent. This Current Report on Form 8-K does not constitute an offer to sell or

the solicitation of an offer to buy any securities of the Company or any other person or the solicitation of any vote or approval. The

Company and affiliates of the Company intend to jointly file a transaction statement on Schedule 13E-3 (the “Schedule 13E-3”)

relating to the proposed transaction, and the Company intends to file a proxy statement on Schedule 14A relating to a special meeting

of shareholders to approve the proposed transaction, each of which will be mailed or otherwise disseminated to the shareholders of the

Company entitled to vote on the proposed transaction. The Company may also file other relevant documents with the SEC regarding the proposed

transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION, INVESTORS AND SECURITY HOLDERS

OF THE COMPANY ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTION (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS

THERETO), THE SCHEDULE 13E-3 (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH

THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED

TRANSACTION. Investors and security holders may obtain free copies of the definitive proxy statement, any amendments or supplements thereto

and other documents containing important information about the Company, once such documents are filed with the SEC, through the website

maintained by the SEC at www.sec.gov. In addition, shareholders of the Company may obtain free copies of such documents by accessing the

Investor Relations portion of the Company’s website at https://nordstrom.gcs-web.com/financial-information/sec-filings.

Participants in the Solicitation

The Company and each of its directors (namely,

James L. Donald, Kirsten A. Green, Glenda G. McNeal, Erik B. Nordstrom, Peter E. Nordstrom, Amie Thuener O’Toole, Guy B. Persaud,

Eric D. Sprunk, Bradley D. Tilden, Mark J. Tritton, and Atticus N. Tysen) and two of its non-director executive officers (namely, Cathy

R. Smith, Chief Financial Officer, and James F. Nordstrom, Jr., Chief Merchandising Officer) are, under the rules of the SEC, deemed to

be participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive

officers of the Company is set forth in the Company’s definitive proxy statement on Schedule 14A for the 2024 annual meeting of

the shareholders of the Company, filed with the SEC on April 11, 2024 (available here), under the sections “Corporate Governance—Director

Compensation and Stock Ownership Guidelines,” “Compensation of Executive Officers,” and “Security Ownership of

Certain Beneficial Owners and Management.” To the extent the security holdings of directors and executive officers have changed

since the amounts described in these filings, such changes are set forth on Initial Statements of Beneficial Ownership on Form 3 or Statements

of Change in Ownership on Form 4 filed with the SEC on June 4, 2024 for Mr. Donald (available here); on June 4, 2024 for Ms. Green (available

here); on June 4, 2024 for Ms. McNeal (available here); on December 6, 2024 for Mr. Erik Nordstrom (available here); on December 6, 2024

for Mr. Peter Nordstrom (available here); on June 4, 2024 for Ms. Thuener O’Toole (available here); on June 4, 2024 for Mr. Persaud

(available here); on June 4, 2024 for Mr. Sprunk (available here); on December 20, 2024 for Mr. Tilden (available here); on June 4, 2024

for Mr. Tritton (available here); on June 4, 2024 for Mr. Tysen (available here); on December 6, 2024 for Ms. Smith (available here);

and on September 13, 2024 for Mr. James Nordstrom, Jr. (available here). Updated information regarding the identity of participants and

their direct or indirect interests, by security holdings or otherwise, in the Company will be set forth in the Company’s Proxy Statement

on Schedule 14A regarding the approval of the proposed transaction and other relevant documents to be filed with the SEC, if and when

they become available. These documents will be available free of charge as described above.

Cautionary Statement Regarding Forward-Looking

Statements

This Current Report on Form 8-K contains forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, including, without limitation, statements regarding the anticipated timing of the consummation of the proposed transaction.

Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that does

not directly relate to any historical or current fact. Forward-looking statements can also be identified by words such as “anticipates,”

“believes,” “plans,” “expects,” “future,” “intends,” “may,” “will,”

“would,” “could,” “should,” “estimates,” “predicts,” “potential,”

“continues,” “target,” “outlook” and similar terms and expressions, but the absence of these words

does not mean that the statement is not forward-looking. Actual results may differ significantly from management’s expectations

due to various risks and uncertainties including, without limitation: (i) the risk that the proposed transaction may not be completed

in a timely manner, or at all; (ii) the failure to satisfy the conditions to the consummation of the proposed transaction, including,

without limitation, the receipt of shareholder approvals or the absence of a Below Investment Grade Rating Event; (iii) unanticipated

difficulties or expenditures relating to the proposed transaction; (iv) the effect of the announcement or pendency of the proposed transaction

on the plans, business relationships, operating results and operations; (v) potential difficulties retaining employees, suppliers and

customers as a result of the announcement and pendency of the proposed transaction; (vi) the response of employees, suppliers and customers

to the announcement of the proposed transaction; (vii) risks related to diverting management’s attention from the Company’s

ongoing business operations; (viii) legal proceedings, including those that may be instituted against the Company, its board of directors,

its executive officers or others following the announcement of the proposed transaction; and (ix) risks regarding the failure to obtain

the necessary financing or have a sufficient amount of Company cash on hand to complete the proposed transaction or pay the full amount

of the Special Dividend. In addition, a description of certain other factors that could affect the Company’s business, financial

condition or results of operations is included in the Company’s most recent Annual Report on Form 10-K and most recent Quarterly

Report on Form 10-Q filed with the SEC. Forward-looking statements reflect the Company’s good faith beliefs, assumptions and expectations

but are not guarantees of future performance or events. Readers are cautioned not to place undue reliance on these forward-looking statements,

which speak only as of the date of this Current Report on Form 8-K. The Company undertakes no obligation to update any forward-looking

statements to reflect events or circumstances after the date hereof, except as may be required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

NORDSTROM, INC. |

| |

(Registrant) |

| |

|

| |

/s/ Ann Munson Steines |

| |

Ann Munson Steines |

| |

Chief Legal Officer, |

| |

General Counsel and Corporate Secretary |

Date: January 24, 2025

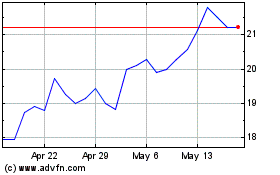

Nordstrom (NYSE:JWN)

Historical Stock Chart

From Feb 2025 to Mar 2025

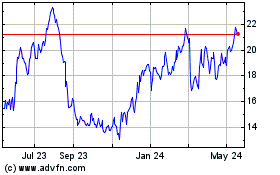

Nordstrom (NYSE:JWN)

Historical Stock Chart

From Mar 2024 to Mar 2025