UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

13E-3

RULE

13E-3 TRANSACTION STATEMENT UNDER SECTION 13(E)

OF

THE SECURITIES EXCHANGE ACT OF 1934

NORDSTROM,

INC.

(Name

of the Issuer)

Nordstrom,

Inc.

Norse

Holdings, Inc.

Navy

Acquisition Co. Inc.

El

Puerto de Liverpool, S.A.B. de C.V.

Anne

E. Gittinger

Anne

E. Gittinger Trust u/w Everett W. Nordstrom

1976

Elizabeth J. Nordstrom Trust FBO Anne Gittinger

Charles

W. Riley, Jr., solely in his capacity as trustee of Anne E. Gittinger Trust u/w Everett W. Nordstrom and as co-trustee of

Trust

A u/w Frances W. Nordstrom and not in any individual capacity

Estate

of Bruce A. Nordstrom

1976

Bruce A. Nordstrom Trust (aka 1976 Elizabeth J. Nordstrom Trust FBO Bruce A. Nordstrom)

Trust

A u/w Frances W. Nordstrom

Margaret

Jean O'Roark Nordstrom, in her capacity as co-executor of the Estate of Bruce A. Nordstrom

Peter

E. Nordstrom

Erik

B. Nordstrom

James

F. Nordstrom, Jr.

Katharine

T. Nordstrom 2007 Trust Agreement

Julia

K. Nordstrom 2007 Trust Agreement

Audrey

G. Nordstrom 2007 Trust Agreement

Erik

and Julie Nordstrom 2012 Sara D. Nordstrom Trust

Bruce

and Jeannie Nordstrom 2010 MFN Trust

Pete

and Brandy Nordstrom 2010 MFN Trust

Bruce

and Jeannie Nordstrom 2012 CFN Trust

Pete

and Brandy Nordstrom 2012 CFN Trust

Pete

and Brandy Nordstrom 2012 Children’s Trust

(Names

of Persons Filing Statement)

Common

Stock, without par value

(Title

of Class of Securities)

655664100

(CUSIP

Number of Class of Securities)

Nordstrom,

Inc.

1617 Sixth Avenue

Seattle, Washington 98101

Tel: (206) 628-2111 |

|

Norse

Holdings, Inc.

Navy Acquisition Co. Inc.

Anne

E. Gittinger

Anne

E. Gittinger Trust u/w Everett W. Nordstrom

1976

Elizabeth J. Nordstrom Trust FBO Anne Gittinger

Charles

W. Riley, Jr., solely in his capacity as trustee of Anne E. Gittinger Trust u/w Everett W. Nordstrom and as co-trustee of Trust A

u/w Frances W. Nordstrom and not in any individual capacity

Estate

of Bruce A. Nordstrom

1976

Bruce A. Nordstrom Trust (aka 1976 Elizabeth J. Nordstrom Trust FBO Bruce A. Nordstrom)

Trust

A u/w Frances W. Nordstrom

Margaret

Jean O'Roark Nordstrom, in her capacity as co-executor of the Estate of Bruce A. Nordstrom

Peter

E. Nordstrom

Erik

B. Nordstrom

James

F. Nordstrom, Jr.

Katharine

T. Nordstrom 2007 Trust Agreement

Julia

K. Nordstrom 2007 Trust Agreement

Audrey

G. Nordstrom 2007 Trust Agreement

Erik

and Julie Nordstrom 2012 Sara D. Nordstrom Trust

Bruce

and Jeannie Nordstrom 2010 MFN Trust

Pete

and Brandy Nordstrom 2010 MFN Trust

Bruce

and Jeannie Nordstrom 2012 CFN Trust

Pete

and Brandy Nordstrom 2012 CFN Trust

Pete

and Brandy Nordstrom 2012 Children’s Trust

c/o Nordstrom, Inc.

1617 Sixth Avenue

Seattle, Washington 98101

Tel: (206) 628-2111 |

|

El

Puerto de Liverpool, S.A.B. de C.V.

Mario Pani No. 200,

Col.

Santa Fe, Del. Cuajimalpa

CDMX

C.P. 05348

Tel: 52-55-5268-3000 |

(Name,

Address, and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of the Persons Filing Statement)

With

copies to:

Derek

Zaba

Sidley Austin LLP

1001 Page Mill Road,

Building

1

Palo Alto, CA 94304

Tel: (650) 565-7000 |

|

Gary

Gerstman

Scott

Williams

Sidley Austin LLP

One South Dearborn

Chicago, IL 60603

Tel: (312) 853-7000 |

|

Keith

Trammell

Michael

Gilligan

Glenn

R. Pollner

Wilmer Cutler Pickering

Hale & Dorr LLP

7 World Trade Center

250

Greenwich Street

New York, NY 10007

Tel: (212) 295-6329 |

|

Benjamin

P. Schaye

Juan

F. Méndez

Benjamin

A. Bodurian

Simpson

Thacher & Bartlett LLP

425 Lexington Avenue

New York, NY 10017

Tel: (212) 455-7866 |

This

statement is filed in connection with (check the appropriate box):

| a. |

☒ |

The

filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the

Securities Exchange Act of 1934. |

| b. |

☐ |

The

filing of a registration statement under the Securities Act of 1933. |

| c. |

☐ |

A

tender offer. |

| d. |

☐ |

None

of the above. |

Check

the following box if the soliciting materials or information statement referred to in checking box (a) are preliminary copies: ☒

Check

the following box if the filing is a final amendment reporting the results of the transaction: ☐

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of this transaction, passed upon

the merits or fairness of this transaction, or passed upon the adequacy or accuracy of the disclosure in this transaction statement on

Schedule 13E-3. Any representation to the contrary is a criminal offense.

TABLE

OF CONTENTS

INTRODUCTION

This

Transaction Statement on Schedule 13E-3 (this “Transaction Statement”) is being filed with the U.S. Securities and

Exchange Commission (the “SEC”) pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), jointly by the following persons (each, a “Filing Person,” and collectively, the

“Filing Persons”): (1) Nordstrom, Inc., a Washington corporation (“Nordstrom”) and the issuer of

the Nordstrom common stock, no par value per share (the “Nordstrom Common Stock”), that is the subject of the Rule

13e-3 transaction; (2) Norse Holdings, Inc., a Delaware corporation (“Parent”); (3) Navy Acquisition Co. Inc., a Washington

corporation and wholly owned subsidiary of Parent (“Acquisition Sub”); (4) El Puerto de Liverpool, S.A.B. de C.V.,

a Mexican corporation (sociedad anónima bursátil) (“Liverpool”); and (5) Anne E. Gittinger, Anne

E. Gittinger Trust u/w Everett W. Nordstrom, 1976 Elizabeth J. Nordstrom Trust FBO Anne Gittinger, Charles W. Riley, Jr., solely in his

capacity as trustee of Anne E. Gittinger Trust u/w Everett W. Nordstrom and as co-trustee of Trust A u/w Frances W. Nordstrom and not

in any individual capacity, Estate of Bruce A. Nordstrom, 1976 Bruce A. Nordstrom Trust (aka 1976 Elizabeth J. Nordstrom Trust FBO Bruce

A. Nordstrom), Trust A u/w Frances W. Nordstrom, Margaret Jean O'Roark Nordstrom, in her capacity as co-executor of the Estate of Bruce

A. Nordstrom, Peter E. Nordstrom, Erik B. Nordstrom, James F. Nordstrom, Jr., Katharine T. Nordstrom 2007 Trust Agreement, Julia K. Nordstrom

2007 Trust Agreement, Audrey G. Nordstrom 2007 Trust Agreement, Erik and Julie Nordstrom 2012 Sara D. Nordstrom Trust, Bruce and Jeannie

Nordstrom 2010 MFN Trust, Pete and Brandy Nordstrom 2010 MFN Trust, Bruce and Jeannie Nordstrom 2012 CFN Trust, Pete and Brandy Nordstrom

2012 CFN Trust and Pete and Brandy Nordstrom 2012 Children’s Trust.

This

Transaction Statement relates to the Agreement and Plan of Merger, dated December 22, 2024 (including all exhibits and documents attached

thereto, and as it may be amended, supplemented or modified, from time to time, the “Merger Agreement”), by and among

Nordstrom, Parent and Acquisition Sub. The Merger Agreement provides that, subject to the terms and conditions set forth in the Merger

Agreement, Acquisition Sub will merge with and into Nordstrom (the “Merger”), with Nordstrom surviving the Merger

and becoming a wholly owned subsidiary of Parent.

At

the effective time of the Merger (the “Effective Time”), each share of Nordstrom Common Stock issued and outstanding

as of immediately prior to the Effective Time (other than shares of Nordstrom Common Stock that are (i) held by Nordstrom or owned of

record by Nordstrom or any of its subsidiaries, (ii) held, directly or indirectly, by Parent or Acquisition Sub or any of their wholly-owned

subsidiaries (other than, in each case of clauses (i) and (ii), shares held on behalf of a third party), (iii) to be contributed

to Parent pursuant to the Rollover and Support Agreements (as defined below) or (iv) held by a person who has not voted in favor of or

consented to the approval of the Merger Agreement and the Merger and has complied with all other provisions of the Washington Business

Corporation Act, as amended, concerning dissenters’ rights with respect to the Merger Agreement) will be cancelled and automatically

converted into the right to receive the merger consideration of $24.25 per share in cash, without interest thereon, subject to any required

tax withholding in accordance with the terms of the Merger Agreement. In addition, the Nordstrom Board of Directors (the “Nordstrom

Board”) intends to authorize a special dividend of up to $0.25 per share (based on the amount of available cash on hand of

Nordstrom and its subsidiaries) prior to and contingent on the close of the Merger. Following the Merger, Nordstrom Common Stock will

no longer be publicly traded, and Nordstrom’s shareholders (other than the Family Group (as defined in the Proxy Statement (as

defined herein)) and Liverpool, indirectly through Parent) will cease to have any ownership interest in Nordstrom.

In

connection with entering into the Merger Agreement, on December 22, 2024, Parent and Nordstrom entered into rollover, voting and support

agreements with the Family Group and Liverpool (together, the “Rollover and Support Agreements”). Pursuant to the

Rollover and Support Agreements, the Family Group and Liverpool agreed to vote all of their shares of Nordstrom Common Stock in favor

of the approval of the Merger Agreement and the transactions contemplated thereby, including the Merger, in favor of any proposal by

Nordstrom to adjourn, recess or postpone any meeting of the shareholders to a later date that complies with the Merger Agreement, in

favor of any other proposal considered and voted upon by shareholders of Nordstrom necessary for the consummation of the Merger and the

other transactions contemplated by the Merger Agreement, and against any other proposal that would reasonably be expected to result in

any of the conditions to the consummation of the Merger under the Merger Agreement not being fulfilled or impede, frustrate, interfere

with, delay, postpone or adversely affect the Merger and the other transactions contemplated by the Merger Agreement. In addition, the

Family Group and Liverpool agreed pursuant to the Rollover and Support Agreements to transfer, contribute and deliver to Parent certain

shares of Nordstrom Common Stock in exchange for a number of newly issued shares of common stock of Parent, subject to the substantially

simultaneous, but subsequent, consummation of the Merger in accordance with the terms of the Merger Agreement.

The

Nordstrom Board formed a special committee (the “Special Committee”) to consider and evaluate the advisability of

an acquisition by one or more persons of all of the outstanding shares of Nordstrom Common Stock (except for shares owned by one or more

shareholders who are retaining their interests), and any alternative transaction to a potential transaction that the Special Committee

deems appropriate, and delegated to the Special Committee certain powers of the Nordstrom Board with respect to a potential transaction

and any alternative transaction. The Special Committee is composed solely of members of the Nordstrom Board who are independent of and

disinterested with respect to the Family Group, Liverpool, the Merger Agreement and the transactions contemplated thereby. The Special

Committee, as more fully described in the preliminary Proxy Statement, evaluated the Merger, with the assistance of its own independent

financial and legal advisors. After careful consideration, the Special Committee, pursuant to resolutions adopted at a meeting of the

Special Committee held on December 22, 2024, unanimously (1) determined and declared that the Merger Agreement and the consummation by

Nordstrom of the transactions contemplated thereby, including the Merger, are advisable, fair to and in the best interests of Nordstrom

and its shareholders and (2) recommended that the Nordstrom Board, among other things, approve the Merger Agreement and, subject to receiving

the Requisite Shareholder Approvals (as defined herein), the consummation of the transactions contemplated thereby, including the Merger,

and recommend the approval of the Merger Agreement and the transactions contemplated thereby, including the Merger, by Nordstrom’s

shareholders.

The

Nordstrom Board, acting on the unanimous recommendation of the Special Committee, unanimously (with Messrs. Erik and Peter Nordstrom

recusing themselves), among other things, (1) determined and declared that the Merger Agreement and the consummation by Nordstrom of

the transactions contemplated thereby, including the Merger, are advisable, fair to and in the best interests of Nordstrom and its shareholders,

(2) approved the Merger Agreement and, subject to receiving the Requisite Shareholder Approvals, the consummation of the transactions

contemplated thereby, including the Merger, and (3) upon the terms and subject to the conditions of the Merger Agreement, resolved to

recommend the approval of the Merger Agreement and the transactions contemplated thereby, including the Merger, by Nordstrom’s

shareholders.

The

Merger cannot be consummated without the affirmative vote of (1) the holders of shares of Nordstrom Common Stock representing two-thirds

of the outstanding shares of Nordstrom Common Stock entitled to vote thereon at the Special Meeting and (2) the holders of shares of

Nordstrom Common Stock representing a majority of the outstanding shares of Nordstrom Common Stock entitled to vote thereon at the Special

Meeting other than shares owned, directly or indirectly, by Parent, Acquisition Sub, the Family Group, Liverpool and their respective

affiliates or by any director or officer (within the meaning of Rule 16a-1(f) of the Exchange Act) of Nordstrom (together the “Requisite

Shareholder Approvals”).

Concurrently

with the filing of this Transaction Statement, Nordstrom is filing a proxy statement (the “Proxy Statement”) under

Regulation 14A of the Exchange Act with the SEC, pursuant to which Nordstrom is soliciting proxies from Nordstrom’s shareholders

in connection with the Merger. The Proxy Statement is attached hereto as Exhibit (a)(1). A copy of the Merger Agreement is attached to

the Proxy Statement as Annex A. As of the date hereof, the Proxy Statement is in preliminary form, and is subject to completion or amendment.

Pursuant

to General Instruction F to Schedule 13E-3, the information in the Proxy Statement, including all annexes thereto, is expressly incorporated

by reference herein in its entirety, and responses to each item herein are qualified in their entirety by the information contained in

the Proxy Statement. The cross-references below are being supplied pursuant to General Instruction G to Schedule 13E-3 and show the location

in the Proxy Statement of the information required to be included in response to the items of Schedule 13E-3.

While

each of the Filing Persons acknowledges that the Merger may be deemed to constitute a “going private” transaction for purposes

of Rule 13e-3 under the Exchange Act, the filing of this Transaction Statement shall not be construed as an admission by any Filing Person,

or by any affiliate of a Filing Person, that Nordstrom is “controlled” by any of the Filing Persons and/or their respective

affiliates.

The

information concerning Nordstrom contained in, or incorporated by reference into, this Transaction Statement and the Proxy Statement

was supplied by Nordstrom. Similarly, all information concerning each other Filing Person contained in, or incorporated by reference

into, this Transaction Statement and the Proxy Statement was supplied by such Filing Person. No Filing Person, including Nordstrom, is

responsible for the accuracy of any information supplied by any other Filing Person.

SCHEDULE

13E-3 ITEMS

Item

1. Summary Term Sheet

The

information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

Item

2. Subject Company Information

| (a) | Name

and address. The information set forth in the Proxy Statement under the following

captions is incorporated herein by reference: |

| ● | “Summary

Term Sheet—The Parties to the Merger—Nordstrom” |

| | | |

| | ● | “Questions

and Answers” |

| ● | “The

Parties to the Merger—Nordstrom” |

| ● | “Important

Information Regarding Nordstrom” |

| (b) | Securities.

The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference: |

| ● | “Summary

Term Sheet—The Special Meeting—Record Date; Shares Entitled to Vote; Quorum” |

| | | |

| | ● | “Questions

and Answers” |

| ● | “The

Special Meeting—Record Date; Shares Entitled to Vote; Quorum” |

| ● | “Important

Information Regarding Nordstrom—Security Ownership of Certain Beneficial Owners and

Management” |

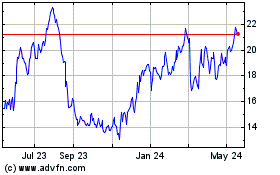

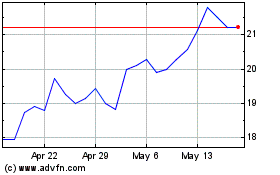

| (c) | Trading

market and price. The information set forth in the Proxy Statement under the following

caption is incorporated herein by reference: |

| ● | “Important

Information Regarding Nordstrom—Market Price of Nordstrom Common Stock” |

| (d) | Dividends.

The information set forth in the Proxy Statement under the following caption is incorporated

herein by reference: |

| ● | “The

Merger Agreement—Special Dividend and Stub Period Dividend” |

| ● | “The

Merger Agreement—Covenants Regarding Conduct of Business by Nordstrom Prior to the

Merger” |

| ● | “Important

Information Regarding Nordstrom—Dividends” |

| (e) | Prior

public offerings. The information set forth in the Proxy Statement under the following

caption is incorporated herein by reference: |

| ● | “Important

Information Regarding Nordstrom—Prior Public Offerings” |

| (f) | Prior

stock purchases. The information set forth in the Proxy Statement under the following

captions is incorporated herein by reference: |

| ● | “Important

Information Regarding Nordstrom—Prior Public Offerings” |

| ● | “Important

Information Regarding Nordstrom—Transactions in Nordstrom Common Stock” |

Item

3. Identity and Background of Filing Person

(a)

— (c) Name and address; Business and background of entities; Business and background of natural persons. The information

set forth in the Proxy Statement under the following captions is incorporated herein by reference:

| ● | “Summary

Term Sheet—The Parties to the Merger—Parent” |

| ● | “Summary

Term Sheet—The Parties to the Merger—Acquisition Sub” |

| ● | “The

Parties to the Merger—Parent Entities” |

| ● | “Important

Information Regarding Nordstrom” |

| ● | “Important

Information Regarding the Parent Filing Parties” |

Item

4. Terms of the Transaction

| (a) | (1)

Material terms. Tender offers. Not applicable |

| (2) | Material

terms. Mergers or similar transactions. The information set forth in the Proxy Statement

under the following captions is incorporated herein by reference: |

| ● | “Special

Factors—Background of the Merger” |

| ● | “Special

Factors—Reasons for the Merger; Recommendation of the Special Committee and the Nordstrom

Board” |

| ● | “Special

Factors—Position of the Parent Filing Parties as to the Fairness of the Merger” |

| ● | “Special

Factors—Plans for Nordstrom After the Merger” |

| ● | “Special

Factors—Purposes and Reasons of the Parent Filing Parties for the Merger” |

| ● | “Special

Factors—Certain Effects of the Merger” |

| ● | “Special

Factors—Benefits of the Merger for the Unaffiliated Security Holders” |

| ● | “Special

Factors—Detriments of the Merger to the Unaffiliated Security Holders” |

| | | |

| | ● | “Special

Factors—Certain Effects of the Merger for the Parent Filing Parties” |

| ● | “Special

Factors—Certain Effects on Nordstrom if the Merger is Not Consummated” |

| ● | “Special

Factors—Interests of Nordstrom’s Directors and Executive Officers in the Merger” |

| ● | “Special

Factors—Intent of Nordstrom’s Directors and Executive Officers to Vote in Favor

of the Merger” |

| ● | “Special

Factors—Intent of Certain Shareholders to Vote in Favor of the Merger” |

| | | |

| | ● | “Special

Factors—Accounting Treatment” |

| ● | “Special

Factors—U.S. Federal Income Tax Considerations of the Merger” |

| ● | “The

Special Meeting—Votes Required” |

| ● | “The

Merger Agreement—Merger Consideration” |

| ● | “The

Merger Agreement—Exchange Procedures” |

| ● | “The

Merger Agreement—Conditions to the Merger” |

| ● | Annex

A—Agreement and Plan of Merger |

| (c) | Different

terms. The information set forth in the Proxy Statement under the following captions

is incorporated herein by reference: |

| ● | “Special

Factors—Purposes and Reasons of the Parent Filing Parties for the Merger” |

| ● | “Special

Factors—Certain Effects of the Merger” |

| ● | “Special

Factors—Benefits of the Merger for the Unaffiliated Security Holders” |

| ● | “Special

Factors—Detriments of the Merger to the Unaffiliated Security Holders” |

| ● | “Special

Factors—Certain Effects of the Merger for the Parent Filing Parties” |

| ● | “Special

Factors—Certain Effects on Nordstrom if the Merger is Not Consummated” |

| ● | “Special

Factors—Interests of Nordstrom’s Directors and Executive Officers in the Merger” |

| ● | “Special

Factors—Financing of the Merger” |

| ● | “Special

Factors—Limited Guaranties” |

| ● | “Special

Factors—Intent of Certain Shareholders to Vote in Favor of the Merger” |

| ● | “The

Merger Agreement—Merger Consideration” |

| ● | “The

Merger Agreement—Exchange Procedures” |

| ● | “The

Merger Agreement—Directors’ & Officers’ Indemnification and Insurance” |

| ● | “The

Merger Agreement—Employee Benefits” |

| ● | “The

Rollover and Support Agreements” |

| ● | “Proposal

2: The Compensation Proposal” |

| ● | Annex

A—Agreement and Plan of Merger |

| ● | Annex

D—Rollover, Voting and Support Agreement (Family Group) |

| ● | Annex

E— Rollover, Voting and Support Agreement (Liverpool) |

| (d) | Appraisal

rights. The information set forth in the Proxy Statement under the following captions

is incorporated herein by reference: |

| ● | “Summary

Term Sheet—Dissenters’ Rights” |

| ● | “The

Special Meeting—Dissenters’ Rights” |

| ● | “The

Merger Agreement—Dissenting Shares” |

| (e) | Provisions

for unaffiliated security holders. The information set forth in the Proxy Statement

under the following captions is incorporated herein by reference: |

| ● | “Special

Factors—Reasons for the Merger; Recommendation of the Special Committee and the Nordstrom

Board” |

| ● | “Provisions

for Unaffiliated Company Shareholders” |

| (f) | Eligibility

for listing or trading. Not applicable. |

Item

5. Past Contacts, Transactions, Negotiations and Agreements

| (a) | (1)–(2)

Transactions. The information set forth in the Proxy Statement under the following

captions is incorporated herein by reference: |

| ● | “Special

Factors—Background of the Merger” |

| ● | “Special

Factors—Certain Effects of the Merger” |

| ● | “Special

Factors—Certain Effects of the Merger for the Parent Filing Parties” |

| ● | “Special

Factors—Interests of Nordstrom’s Directors and Executive Officers in the Merger” |

| ● | “Special

Factors—Intent of Certain Shareholders to Vote in Favor of the Merger” |

| ● | “Special

Factors—Financing of the Merger” |

| ● | “Special

Factors—Limited Guaranties” |

| ● | “Special

Factors—Fees and Expenses” |

| ● | “The

Rollover and Support Agreements” |

| ● | “Important

Information Regarding Nordstrom—Prior Public Offerings” |

| ● | “Important

Information Regarding Nordstrom—Transactions in Nordstrom Common Stock” |

| ● | “Important

Information Regarding Nordstrom—Past Contracts, Transactions, Negotiations and Agreements” |

| ● | “Important

Information Regarding the Parent Filing Parties” |

| ● | “Proposal

2: The Compensation Proposal” |

| ● | Annex

A—Agreement and Plan of Merger |

| ● | Annex

D—Rollover, Voting and Support Agreement (Family Group) |

| ● | Annex

E—Rollover, Voting and Support Agreement (Liverpool) |

| (b) | —

(c) Significant corporate events; Negotiations or contacts. The information

set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| ● | “Special

Factors—Background of the Merger” |

| ● | “Special

Factors—Reasons for the Merger; Recommendation of the Special Committee and the Nordstrom

Board” |

| ● | “Special

Factors—Position of the Parent Filing Parties as to the Fairness of the Merger” |

| ● | “Special

Factors—Purposes and Reasons of the Parent Filing Parties for the Merger” |

| ● | “Special

Factors—Interests of Nordstrom’s Directors and Executive Officers in the Merger” |

| ● | “Special

Factors—Limited Guaranties” |

| ● | “The

Rollover and Support Agreements” |

| ● | “Important

Information Regarding Nordstrom—Transactions in Nordstrom Common Stock” |

| ● | “Important

Information Regarding Nordstrom—Past Contracts, Transactions, Negotiations and Agreements” |

| ● | Annex

A—Agreement and Plan of Merger |

| ● | Annex

D—Rollover, Voting and Support Agreement (Family Group) |

| ● | Annex

E—Rollover, Voting and Support Agreement (Liverpool) |

| (e) | Agreements

involving the subject company’s securities. The information set forth in the

Proxy Statement under the following captions is incorporated herein by reference: |

| ● | “Special

Factors—Background of the Merger” |

| ● | “Special

Factors—Reasons for the Merger; Recommendation of the Special Committee and the Nordstrom

Board” |

| ● | “Special

Factors—Position of the Parent Filing Parties as to the Fairness of the Merger” |

| ● | “Special

Factors—Certain Effects of the Merger” |

| ● | “Special

Factors—Certain Effects of the Merger for the Parent Filing Parties” |

| ● | “Special

Factors—Interests of Nordstrom’s Directors and Executive Officers in the Merger” |

| ● | “Special

Factors—Intent of Nordstrom’s Directors and Executive Officers to Vote in Favor

of the Merger” |

| ● | “Special

Factors—Intent of Certain Shareholders to Vote in Favor of the Merger” |

| ● | “Special

Factors—Financing of the Merger” |

| ● | “Special

Factors—Limited Guaranties” |

| ● | “Special

Factors—Fees and Expenses” |

| ● | “The

Special Meeting—Votes Required” |

| ● | “The

Rollover and Support Agreements” |

| ● | “Proposal

2: The Compensation Proposal” |

| ● | Annex

A—Agreement and Plan of Merger |

| ● | Annex

D—Rollover, Voting and Support Agreement (Family Group) |

| ● | Annex

E—Rollover, Voting and Support Agreement (Liverpool) |

Item

6. Purposes of the Transaction and Plans or Proposals

| (b) | Use

of securities acquired. The information set forth in the Proxy Statement under the

following captions is incorporated herein by reference: |

| ● | “Special

Factors—Plans for Nordstrom After the Merger” |

| ● | “Special

Factors—Purposes and Reasons of the Parent Filing Parties for the Merger” |

| ● | “Special

Factors—Certain Effects of the Merger” |

| ● | “Special

Factors—Certain Effects of the Merger for the Parent Filing Parties” |

| ● | “Special

Factors—Certain Effects on Nordstrom if the Merger is Not Consummated” |

| ● | “Special

Factors—Interests of Nordstrom’s Directors and Executive Officers in the Merger” |

| ● | “Special

Factors—Financing of the Merger” |

| ● | “Special

Factors—Delisting and Deregistration of Nordstrom Common Stock” |

| ● | “The

Merger Agreement—Effect of the Merger” |

| ● | “The

Merger Agreement—Articles of Incorporation and Bylaws; Board of Directors and Officers” |

| ● | “The

Merger Agreement—Merger Consideration” |

| ● | “The

Merger Agreement—Exchange Procedures” |

| ● | “The

Merger Agreement—Treatment of Outstanding Equity Awards and Equity Plans” |

| ● | Annex

A—Agreement and Plan of Merger |

| (c) | (1)

— (8) Plans. The information set forth in the Proxy Statement under the

following captions is incorporated herein by reference: |

| ● | “Special

Factors—Background of the Merger” |

| ● | “Special

Factors—Reasons for the Merger; Recommendation of the Special Committee and the Nordstrom

Board” |

| ● | “Special

Factors—Opinion of Morgan Stanley & Co. LLC to the Special Committee” |

| ● | “Special

Factors—Opinion of Centerview Partners LLC to the Special Committee” |

| ● | “Special

Factors—Position of the Parent Filing Parties as to the Fairness of the Merger” |

| ● | “Special

Factors—Plans for Nordstrom After the Merger” |

| ● | “Special

Factors—Purposes and Reasons of the Parent Filing Parties for the Merger” |

| ● | “Special

Factors—Certain Effects of the Merger” |

| ● | “Special

Factors—Certain Effects of the Merger for the Parent Filing Parties” |

| ● | “Special

Factors—Certain Effects on Nordstrom if the Merger is Not Consummated” |

| ● | “Special

Factors—Interests of Nordstrom’s Directors and Executive Officers in the Merger” |

| ● | “Special

Factors—Intent of Nordstrom’s Directors and Executive Officers to Vote in Favor

of the Merger” |

| ● | “Special

Factors—Intent of Certain Shareholders to Vote in Favor of the Merger” |

| ● | “Special

Factors—Financing of the Merger” |

| ● | “Special

Factors—Delisting and Deregistration of Nordstrom Common Stock” |

| ● | “The

Merger Agreement—Effect of the Merger” |

| ● | “The

Merger Agreement—Articles of Incorporation and Bylaws; Board of Directors and Officers” |

| ● | “The

Merger Agreement—Merger Consideration” |

| ● | “The

Merger Agreement—Special Dividend and Stub Period Dividend” |

| ● | “The

Merger Agreement—Directors’& Officers’ Indemnification and Insurance” |

| ● | “The

Merger Agreement—Employee Benefits” |

| ● | “The

Rollover and Support Agreements” |

| ● | “Important

Information Regarding Nordstrom—Dividends” |

| ● | Annex

A—Agreement and Plan of Merger |

| ● | Annex

B—Opinion of Morgan Stanley |

| ● | Annex

C—Opinion of Centerview Partners |

Item

7. Purposes, Alternatives, Reasons and Effects

| (a) | Purposes.

The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference: |

| ● | “Special

Factors—Background of the Merger” |

| ● | “Special

Factors—Reasons for the Merger; Recommendation of the Special Committee and the Nordstrom

Board” |

| ● | “Special

Factors—Opinion of Morgan Stanley & Co. LLC to the Special Committee” |

| ● | “Special

Factors—Opinion of Centerview Partners LLC to the Special Committee” |

| ● | “Special

Factors—Position of the Parent Filing Parties as to the Fairness of the Merger” |

| ● | “Special

Factors—Plans for Nordstrom After the Merger” |

| ● | “Special

Factors—Purposes and Reasons of the Parent Filing Parties for the Merger” |

| ● | “Special

Factors—Certain Effects of the Merger” |

| ● | “Special

Factors—Certain Effects of the Merger for the Parent Filing Parties” |

| ● | Annex

B—Opinion of Morgan Stanley |

| ● | Annex

C—Opinion of Centerview Partners |

| (b) | Alternatives.

The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference: |

| ● | “Special

Factors—Background of the Merger” |

| ● | “Special

Factors—Reasons for the Merger; Recommendation of the Special Committee and the Nordstrom

Board” |

| ● | “Special

Factors—Position of the Parent Filing Parties as to the Fairness of the Merger” |

| ● | “Special

Factors—Plans for Nordstrom After the Merger” |

| ● | “Special

Factors—Purposes and Reasons of the Parent Filing Parties for the Merger” |

| ● | “Special

Factors—Certain Effects on Nordstrom if the Merger is Not Consummated” |

| (c) | Reasons.

The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference: |

| ● | “Special

Factors—Background of the Merger” |

| ● | “Special

Factors—Reasons for the Merger; Recommendation of the Special Committee and the Nordstrom

Board” |

| ● | “Special

Factors—Opinion of Morgan Stanley & Co. LLC to the Special Committee” |

| ● | “Special

Factors—Opinion of Centerview Partners LLC to the Special Committee” |

| ● | “Special

Factors—Position of the Parent Filing Parties as to the Fairness of the Merger” |

| ● | “Special

Factors—Plans for Nordstrom After the Merger” |

| ● | “Special

Factors—Purposes and Reasons of the Parent Filing Parties for the Merger” |

| ● | “Special

Factors—Certain Effects of the Merger” |

| ● | “Special

Factors—Certain Effects of the Merger for the Parent Filing Parties” |

| ● | “Special

Factors—Certain Effects on Nordstrom if the Merger is Not Consummated” |

| ● | “Special

Factors—Unaudited Prospective Financial Information” |

| ● | Annex

B—Opinion of Morgan Stanley |

| ● | Annex

C—Opinion of Centerview Partners |

| (d) | Effects.

The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference: |

| ● | “Special

Factors—Background of the Merger” |

| ● | “Special

Factors—Reasons for the Merger; Recommendation of the Special Committee and the Nordstrom

Board” |

| ● | “Special

Factors—Opinion of Morgan Stanley & Co. LLC to the Special Committee” |

| ● | “Special

Factors—Opinion of Centerview Partners LLC to the Special Committee” |

| ● | “Special

Factors—Position of the Parent Filing Parties as to the Fairness of the Merger” |

| ● | “Special

Factors—Plans for Nordstrom After the Merger” |

| ● | “Special

Factors—Purposes and Reasons of the Parent Filing Parties for the Merger” |

| ● | “Special

Factors—Certain Effects of the Merger” |

| ● | “Special

Factors—Benefits of the Merger for the Unaffiliated Security Holders” |

| ● | “Special

Factors—Detriments of the Merger to the Unaffiliated Security Holders” |

| ● | “Special

Factors—Certain Effects of the Merger for the Parent Filing Parties” |

| ● | “Special

Factors—Certain Effects on Nordstrom if the Merger is Not Consummated” |

| ● | “Special

Factors—Interests of Nordstrom’s Directors and Executive Officers in the Merger” |

| ● | “Special

Factors—U.S. Federal Income Tax Considerations of the Merger” |

| ● | “Special

Factors—Financing of the Merger” |

| ● | “Special

Factors—Fees and Expenses” |

| ● | “Special

Factors—Delisting and Deregistration of Nordstrom Common Stock” |

| ● | “The

Merger Agreement—Effect of the Merger” |

| ● | “The

Merger Agreement—Articles of Incorporation and Bylaws; Board of Directors and Officers” |

| ● | “The

Merger Agreement—Merger Consideration” |

| ● | “The

Merger Agreement—Special Dividend and Stub Period Dividend” |

| ● | “The

Merger Agreement—Treatment of Outstanding Equity Awards and Equity Plans” |

| ● | “The

Merger Agreement—Directors’ & Officers’ Indemnification and Insurance” |

| ● | “The

Merger Agreement—Employee Benefits” |

| ● | “Proposal

2: The Compensation Proposal” |

| ● | Annex

A—Agreement and Plan of Merger |

| ● | Annex

B—Opinion of Morgan Stanley |

| ● | Annex

C—Opinion of Centerview Partners |

Item

8. Fairness of the Transaction

| (a) | —

(b) Fairness; Factors considered in determining fairness. The information set

forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| ● | “Special

Factors—Background of the Merger” |

| ● | “Special

Factors—Reasons for the Merger; Recommendation of the Special Committee and the Nordstrom

Board” |

| ● | “Special

Factors—Opinion of Morgan Stanley & Co. LLC to the Special Committee” |

| ● | “Special

Factors—Opinion of Centerview Partners LLC to the Special Committee” |

| ● | “Special

Factors—Position of the Parent Filing Parties as to the Fairness of the Merger” |

| ● | “Special

Factors—Purposes and Reasons of the Parent Filing Parties for the Merger” |

| ● | “Special

Factors—Certain Effects of the Merger” |

| ● | “Special

Factors—Benefits of the Merger for the Unaffiliated Security Holders” |

| ● | “Special

Factors—Detriments of the Merger to the Unaffiliated Security Holders” |

| ● | “Special

Factors—Certain Effects of the Merger for the Parent Filing Parties” |

| ● | “Special

Factors—Interests of Nordstrom’s Directors and Executive Officers in the Merger” |

| ● | Annex

B—Opinion of Morgan Stanley |

| ● | Annex

C—Opinion of Centerview Partners |

| (c) | Approval

of security holders. The information set forth in the Proxy Statement under the following

captions is incorporated herein by reference: |

| ● | “Special

Factors—Reasons for the Merger; Recommendations of the Special Committee and the Nordstrom

Board” |

| ● | “Special

Factors—Position of the Parent Filing Parties as to the Fairness of the Merger” |

| | | |

| | ● | “Special

Factors—Purposes and Reasons of the Parent Filing Parties for the Merger” |

| ● | “The

Special Meeting—Record Date; Shares Entitled to Vote; Quorum” |

| ● | “The

Special Meeting—Votes Required” |

| ● | “The

Special Meeting—Voting of Proxies” |

| ● | “The

Special Meeting—Revocability of Proxies” |

| ● | “The

Merger Agreement—Conditions to the Merger” |

| ● | “Proposal

1: The Merger Proposal” |

| ● | Annex

A—Agreement and Plan of Merger |

| (d) | Unaffiliated

representative. The information set forth in the Proxy Statement under the following

captions is incorporated herein by reference: |

| ● | “Special

Factors—Background of the Merger” |

| ● | “Special

Factors—Reasons for the Merger; Recommendation of the Special Committee and the Nordstrom

Board” |

| ● | “Special

Factors—Position of the Parent Filing Parties as to the Fairness of the Merger” |

| | | |

| | ● | “Special

Factors—Purposes and Reasons of the Parent Filing Parties for the Merger” |

| ● | “Special

Factors—Opinion of Morgan Stanley & Co. LLC to the Special Committee” |

| ● | “Special

Factors—Opinion of Centerview Partners LLC to the Special Committee” |

| ● | Annex

B—Opinion of Morgan Stanley |

| ● | Annex

C—Opinion of Centerview Partners |

| (e) | Approval

of directors. The information set forth in the Proxy Statement under the following

captions is incorporated herein by reference: |

| ● | “Special

Factors—Background of the Merger” |

| ● | “Special

Factors—Reasons for the Merger; Recommendation of the Special Committee and the Nordstrom

Board” |

| ● | “Special

Factors—Position of the Parent Filing Parties as to the Fairness of the Merger” |

| | | |

| | ● | “Special

Factors—Purposes and Reasons of the Parent Filing Parties for the Merger” |

| ● | “Special

Factors—Interests of Nordstrom’s Directors and Executive Officers in the Merger” |

| ● | “Special

Factors—Intent of Nordstrom’s Directors and Executive Officers to Vote in Favor

of the Merger” |

| (f) | Other

offers. The information set forth in the Proxy Statement under the following captions

is incorporated herein by reference: |

| ● | “Special

Factors—Background of the Merger” |

| ● | “Special

Factors—Reasons for the Merger; Recommendation of the Special Committee and the Nordstrom

Board” |

| ● | “Special

Factors—Purposes and Reasons of the Parent Filing Parties for the Merger” |

Item

9. Reports, Opinions, Appraisals and Negotiations

| (a) | —

(b) Report, opinion or appraisal; Preparer and summary of the report, opinion or appraisal.

The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference: |

| ● | “Special

Factors—Background of the Merger” |

| ● | “Special

Factors—Reasons for the Merger; Recommendation of the Special Committee and the Nordstrom

Board” |

| ● | “Special

Factors—Opinion of Morgan Stanley & Co. LLC to the Special Committee” |

| ● | “Special

Factors—Opinion of Centerview Partners LLC to the Special Committee” |

| ● | “Special

Factors—Position of the Parent Filing Parties as to the Fairness of the Merger” |

| ● | “Special

Factors—Materials Provided to Liverpool by J.P. Morgan Securities LLC” |

| ● | “Special

Factors—Purposes and Reasons of the Parent Filing Parties for the Merger” |

| ● | “Where

You Can Find Additional Information” |

| ● | Annex

B—Opinion of Morgan Stanley |

| ● | Annex

C—Opinion of Centerview Partners |

| (c) | Availability

of documents. The information set forth in the Proxy Statement under the following

caption is incorporated herein by reference: |

| ● | “Where

You Can Find Additional Information” |

| ● | The

reports, opinions or appraisals referenced in this Item 9 will be made available for inspection

and copying at the principal executive offices of Nordstrom during its regular business hours

by any interested equity holder of Nordstrom Common Stock or by a representative who has

been so designated in writing. |

Item

10. Source and Amounts of Funds or Other Consideration

| (a) | —

(b), (d) Source of funds; Conditions; Borrowed funds. The information set forth

in the Proxy Statement under the following captions is incorporated herein by reference: |

| ● | “Special

Factors—Interests of Nordstrom’s Directors and Executive Officers in the Merger” |

| ● | “Special

Factors—Financing of the Merger” |

| ● | “Special

Factors—Limited Guaranties” |

| ● | “The

Merger Agreement—Covenants Regarding Conduct of Business by Nordstrom Prior to the

Merger” |

| ● | “The

Merger Agreement—Financing” |

| ● | “The

Merger Agreement—Financing Cooperation; Notes Offer and Consent Solicitation” |

| ● | “The

Merger Agreement—Other Covenants and Agreements” |

| ● | “The

Merger Agreement—Conditions to the Merger” |

| ● | Annex

A—Agreement and Plan of Merger |

| (c) | Expenses.

The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference: |

| ● | “Special

Factors—Certain Effects on Nordstrom if the Merger is Not Consummated” |

| ● | “Special

Factors—Limited Guaranties” |

| ● | “Special

Factors—Fees and Expenses” |

| ● | “The

Special Meeting—Solicitation of Proxies” |

| ● | “The

Merger Agreement—Termination of the Merger Agreement—Termination Rights Exercisable

by Nordstrom” |

| ● | “The

Merger Agreement— Termination

of the Merger Agreement—Termination Rights Exercisable by Parent” |

| ● | “The

Merger Agreement—Termination Fees” |

| ● | “The

Merger Agreement—Miscellaneous—Expenses” |

| ● | Annex

A—Agreement and Plan of Merger |

Item

11. Interest in Securities of the Subject Company

| (a) | Securities

ownership. The information set forth in the Proxy Statement under the following captions

is incorporated herein by reference: |

| ● | “Special

Factors—Interests of Nordstrom’s Directors and Executive Officers in the Merger” |

| ● | “Important

Information Regarding Nordstrom—Security Ownership of Certain Beneficial Owners and

Management” |

| ● | “Important

Information Regarding the Parent Filing Parties” |

| ● | “The

Rollover and Support Agreements” |

| ● | Annex

D—Rollover, Voting and Support Agreement (Family Group) |

| ● | Annex

E—Rollover, Voting and Support Agreement (Liverpool) |

| (b) | Securities

transactions. The information set forth in the Proxy Statement under the following

captions is incorporated herein by reference: |

| ● | “Special

Factors—Background of the Merger” |

| ● | “Important

Information Regarding Nordstrom—Security Ownership of Certain Beneficial Owners and

Management” |

| ● | “Important

Information Regarding Nordstrom—Transactions in Nordstrom Common Stock” |

| ● | “Important

Information Regarding Nordstrom—Prior Public Offerings” |

| | | |

| | ● | “Important

Information Regarding the Parent Filing Parties” |

| ● | “The

Rollover and Support Agreements” |

| ● | Annex

A—Agreement and Plan of Merger |

| ● | Annex

D—Rollover, Voting and Support Agreement (Family Group) |

| ● | Annex

E—Rollover, Voting and Support Agreement (Liverpool) |

Item

12. The Solicitation or Recommendation

| (d) | Intent

to tender or vote in a going-private transaction. The information set forth in the

Proxy Statement under the following captions is incorporated herein by reference: |

| ● | “Special

Factors—Background of the Merger” |

| ● | “Special

Factors—Reasons for the Merger; Recommendation of the Special Committee and the Nordstrom

Board” |

| ● | “Special

Factors—Position of the Parent Filing Parties as to the Fairness of the Merger” |

| | | |

| | ● | “Special

Factors—Purposes and Reasons of the Parent Filing Parties for the Merger” |

| ● | “Special

Factors—Intent of Nordstrom’s Directors and Executive Officers to Vote in Favor

of the Merger” |

| ● | “Special

Factors—Intent of Certain Shareholders to Vote in Favor of the Merger” |

| ● | “The

Special Meeting—Votes Required” |

| ● | “The

Rollover and Support Agreements” |

| ● | Annex

D—Rollover, Voting and Support Agreement (Family Group) |

| ● | Annex

E—Rollover, Voting and Support Agreement (Liverpool) |

| (e) | Recommendation

of others. The information set forth in the Proxy Statement under the following captions

is incorporated herein by reference: |

| ● | “Special

Factors—Background of the Merger” |

| ● | “Special

Factors—Reasons for the Merger; Recommendation of the Special Committee and the Nordstrom

Board” |

| ● | “Special

Factors—Position of the Parent Filing Parties as to the Fairness of the Merger” |

| | | |

| | ● | “Special

Factors—Purposes and Reasons of the Parent Filing Parties for the Merger” |

| ● | “Proposal

1: The Merger Proposal” |

Item

13. Financial Information

| (a) | Financial

statements. The audited consolidated financial statements set forth in Item 8 of

Nordstrom’s Annual Report on Form 10-K for the fiscal year ended February 3, 2024 and

the financial statements set forth in Item 1 of Nordstrom’s Quarterly Report on Form

10-Q for the quarterly period ended November 2, 2024 are incorporated herein by reference. |

The

information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

| ● | “Special

Factors—Certain Effects of the Merger” |

| ● | “Special

Factors—Unaudited Prospective Financial Information” |

| ● | “Important

Information Regarding Nordstrom—Selected Historical Consolidated Financial Data” |

| ● | “Important

Information Regarding Nordstrom—Book Value Per Share” |

| ● | “Where

You Can Find Additional Information” |

| (b) | Pro

forma information. Not applicable. |

Item

14. Persons/Assets, Retained, Employed, Compensated or Used

| (a) | —

(b) Solicitations or recommendations; Employees and corporate assets. The information

set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

| ● | “Special

Factors—Background of the Merger” |

| ● | “Special

Factors—Reasons for the Merger; Recommendation of the Special Committee and the Nordstrom

Board” |

| ● | “Special

Factors—Position of the Parent Filing Parties as to the Fairness of the Merger” |

| ● | “Special

Factors—Plans for Nordstrom After the Merger” |

| ● | “Special

Factors—Purposes and Reasons of the Parent Filing Parties for the Merger” |

| ● | “Special

Factors—Interests of Nordstrom’s Directors and Executive Officers in the Merger” |

| ● | “Special

Factors—Fees and Expenses” |

| ● | “The

Special Meeting—Solicitation of Proxies” |

Item

15. Additional Information

| (b) | Golden

Parachute Compensation. The information set forth in the Proxy Statement under the

following captions is incorporated herein by reference: |

| ● | “Special

Factors—Interests of Nordstrom’s Directors and Executive Officers in the Merger” |

| ● | “The

Merger Agreement—Merger Consideration” |

| ● | “The

Merger Agreement—Treatment of Outstanding Equity Awards and Equity Plans” |

| ● | “Proposal

2: The Compensation Proposal” |

| ● | Annex

A—Agreement and Plan of Merger |

| (c) | Other

material information. The information set forth in the Proxy Statement, including

all annexes thereto, is incorporated herein by reference. |

Item

16. Exhibits

The

following exhibits are filed herewith:

SIGNATURES

After

due inquiry and to the best of the undersigned’s knowledge and belief, the undersigned certifies that the information set forth

in this statement is true, complete and correct.

Dated:

March 4, 2025

| NORDSTROM,

INC. |

|

| |

|

|

| By: |

/s/

Ann Munson Steines |

|

| |

Name:

|

Ann

Munson Steines |

|

| |

Title:

|

Chief

Legal Officer, General Counsel and Corporate Secretary |

|

| |

|

|

| NORSE

HOLDINGS, INC. |

|

| |

|

|

| By: |

/s/

Erik B. Nordstrom |

|

| |

Name:

|

Erik

B. Nordstrom |

|

| |

Title:

|

Co-Chief

Executive Officer |

|

| |

|

| NAVY

ACQUISITION CO. INC. |

|

| |

|

|

| By: |

/s/

Erik B. Nordstrom |

|

| |

Name:

|

Erik

B. Nordstrom |

|

| |

Title:

|

President,

Treasurer and Secretary |

|

| |

|

|

| EL

PUERTO DE LIVERPOOL, S.A.B. DE C.V. |

|

| |

|

|

| By: |

/s/

Graciano Guichard González |

|

| |

Name:

|

Graciano

Guichard González |

|

| |

Title:

|

Chairman

of the Board |

|

| |

|

|

| By: |

/s/

Enrique Guijosa Hidalgo |

|

| |

Name:

|

Enrique

Guijosa Hidalgo |

|

| |

Title:

|

Chief

Executive Officer |

|

| ANNE

E. GITTINGER |

| |

|

| /s/

Anne E. Gittinger |

|

| ANNE

E. GITTINGER TRUST U/W EVERETT W. NORDSTROM |

| |

|

|

| By: |

/s/

Charles W. Riley, Jr. |

|

| |

Name: |

Charles

W. Riley, Jr. |

|

| |

Title:

|

Trustee |

|

1976

ELIZABETH J. NORDSTROM TRUST FBO ANNE GITTINGER

| By: |

/s/

Anne E. Gittinger |

|

| |

Name:

|

Anne E.

Gittinger |

|

| |

Title:

|

Trustee |

|

| CHARLES

W. RILEY, JR., SOLELY IN HIS CAPACITY AS TRUSTEE OF ANNE E. GITTINGER TRUST U/W EVERETT W. NORDSTROM AND AS CO-TRUSTEE OF TRUST A

U/W FRANCES W. NORDSTROM AND NOT IN ANY INDIVIDUAL CAPACITY |

| |

|

|

| By: |

/s/

Charles W. Riley, Jr. |

|

| |

Name:

|

Charles

W. Riley, Jr. |

|

| |

Title:

|

Trustee |

|

| ESTATE

OF BRUCE A. NORDSTROM |

|

| |

|

|

| By: |

/s/

Margaret Jean O’Roark Nordstrom |

|

| |

Name:

|

Margaret

Jean O’Roark Nordstrom |

|

| |

Title:

|

Co-Executor |

|

| |

|

|

| By: |

/s/

Peter E. Nordstrom |

|

| |

Name:

|

Peter

E. Nordstrom |

|

| |

Title:

|

Co-Executor |

|

| |

|

|

| By: |

/s/

Erik B. Nordstrom |

|

| |

Name:

|

Erik

B. Nordstrom |

|

| |

Title:

|

Co-Executor |

|

1976

BRUCE A. NORDSTROM TRUST (AKA 1976 ELIZABETH J. NORDSTROM TRUST FBO BRUCE A. NORDSTROM)

| By: |

/s/

Peter E. Nordstrom |

|

| |

Name:

|

Peter

E. Nordstrom |

|

| |

Title:

|

Co-Trustee |

|

| |

|

|

| By: |

/s/

Erik B. Nordstrom |

|

| |

Name:

|

Erik

B. Nordstrom |

|

| |

Title:

|

Co-Trustee |

|

| TRUST

A U/W FRANCES W. NORDSTROM |

|

| |

|

|

| By: |

/s/

Peter E. Nordstrom |

|

| |

Name:

|

Peter

E. Nordstrom |

|

| |

Title:

|

Co-Trustee |

|

| |

|

|

| By: |

/s/

Erik B. Nordstrom |

|

| |

Name:

|

Erik

B. Nordstrom |

|

| |

Title:

|

Co-Trustee |

|

| |

|

|

| By: |

/s/

Charles W. Riley, Jr. |

|

| |

Name:

|

Charles

W. Riley, Jr. |

|

| |

Title:

|

Co-Trustee |

|

MARGARET

JEAN O'ROARK NORDSTROM, IN HER CAPACITY AS CO-EXECUTOR OF THE ESTATE OF BRUCE A. NORDSTROM

| /s/

Margaret Jean O’Roark Nordstrom |

|

| PETER

E. NORDSTROM |

| |

|

| /s/

Peter E. Nordstrom |

|

| ERIK

B. NORDSTROM |

| |

|

| /s/

Erik B. Nordstrom |

|

| JAMES

F. NORDSTROM, JR. |

| |

|

| /s/

James F. Nordstrom, Jr. |

|

| KATHARINE

T. NORDSTROM 2007 TRUST AGREEMENT |

| |

|

|

| By: |

/s/

James F. Nordstrom, Jr. |

|

| |

Name:

|

James

F. Nordstrom, Jr. |

|

| |

Title:

|

Trustee |

|

| JULIA

K. NORDSTROM 2007 TRUST AGREEMENT |

| |

|

|

| By: |

/s/

James F. Nordstrom, Jr. |

|

| |

Name:

|

James

F. Nordstrom, Jr. |

|

| |

Title:

|

Trustee |

|

| AUDREY

G. NORDSTROM 2007 TRUST AGREEMENT |

| |

|

|

| By: |

/s/

James F. Nordstrom, Jr. |

|

| |

Name:

|

James

F. Nordstrom, Jr. |

|

| |

Title:

|

Trustee |

|

| ERIK

AND JULIE NORDSTROM 2012 SARA D. NORDSTROM TRUST |

| |

|

|

| By: |

/s/

Peter E. Nordstrom |

|

| |

Name:

|

Peter

E. Nordstrom |

|

| |

Title:

|

Trustee |

|

| BRUCE

AND JEANNIE NORDSTROM 2010 MFN TRUST |

| |

|

|

| By: |

/s/

Peter E. Nordstrom |

|

| |

Name: |

Peter

E. Nordstrom |

|

| |

Title:

|

Trustee |

|

| PETE

AND BRANDY NORDSTROM 2010 MFN TRUST |

| |

|

|

| By: |

/s/

Erik B. Nordstrom |

|

| |

Name:

|

Erik

B. Nordstrom |

|

| |

Title:

|

Trustee |

|

| BRUCE

AND JEANNIE NORDSTROM 2012 CFN TRUST |

| |

|

|

| By: |

/s/

Peter E. Nordstrom |

|

| |

Name:

|

Peter

E. Nordstrom |

|

| |

Title:

|

Trustee |

|

| PETE

AND BRANDY NORDSTROM 2012 CFN TRUST |

| |

|

|

| By: |

/s/

Erik B. Nordstrom |

|

| |

Name: |

Erik

B. Nordstrom |

|

| |

Title:

|

Trustee |

|

| PETE

AND BRANDY NORDSTROM 2012 CHILDREN’S TRUST |

| |

|

|

| By: |

/s/

Erik B. Nordstrom |

|

| |

Name:

|

Erik

B. Nordstrom |

|

| |

Title:

|

Trustee |

|

Exhibit 16(b)(i)

Execution Version

|

WELLS FARGO BANK, NATIONAL ASSOCIATION

125 High Street, 11th Floor

Boston, Massachusetts 02110 |

JPMORGAN CHASE BANK, N.A.

383 Madison Avenue

New York, New York 10179 |

Highly Confidential

December 22, 2024

Norse Holdings, Inc.

1617 Sixth Avenue

Seattle, Washington 98101

c/o Norse Holdings, Inc.

Project Norse

$1,200 million ABL Facility

Commitment Letter

Ladies and Gentlemen:

You have advised Wells Fargo

Bank, National Association (“Wells Fargo”), , JPMorgan Chase Bank, N.A. (“JPMorgan” and together

with Wells Fargo, the “Initial Commitment Parties” and, together with each other person, if any, added as a commitment

party after the date of this Commitment Letter, “we” or “us” and each, a “Commitment Party”)

Norse Holdings, Inc., a domestic entity (“you” or “Holdings”) formed at the direction of a group

composed of Erik and Peter Nordstrom, certain other members of the Nordstrom family and related trusts (“Nordstrom Family”),

and El Puerto de Liverpool S.A.B. de C.V. (“Liverpool,” and collectively with the Nordstrom Family, the “Buyer

Group”), intends, directly or indirectly, to acquire Nordstrom, Inc. (the “Company” and, together with its

subsidiaries, the “Acquired Business”) and to consummate the other transactions described in Exhibit A hereto.

Capitalized terms used but not defined herein have the meanings assigned to them in the exhibits hereto.

In connection with the Transactions,

Wells Fargo and JPMorgan (in such capacity, each an “Initial ABL Lender” and, together, the “Initial ABL Lenders”),

commit to provide severally and not jointly the amount set forth next to its name in the table below of the ABL Facility on the terms

set forth in the Term Sheet attached hereto as Exhibit B.

| Initial ABL Lender | |

ABL Facility Commitment | | |

Commitment Percentage of

ABL Facility | |

| Wells Fargo | |

$ | 600,000,000.00 | | |

| 50 | % |

| JPMorgan | |

$ | 600,000,000.00 | | |

| 50 | % |

| | 1 | Project Norse – Commitment Letter |

The ABL Facility will contain

the terms set forth on the Term Sheet, and the commitments of each Initial ABL Lender are subject only to the conditions set forth on

the Conditions Annex (as defined below). The commitments with respect to the ABL Facility are on a several, and not joint and several,

basis.

This commitment letter, together

with the Term Sheet and the other attachments hereto and thereto, is referred to herein as this “Commitment Letter.”

This Commitment Letter and the Fee Letters (as defined below in Section 5), together, are referred to herein as the “Commitment

Papers.”

It is agreed that (a) Wells

Fargo and JPMorgan will act as joint lead arrangers and bookrunning managers for the ABL Facility (in such capacities, collectively the

“Lead Arrangers”, and each a “Lead Arranger”). It is further understood and agreed that (x) Wells

Fargo will have “lead left” and “highest” placement on all marketing materials relating to the ABL Facility and

will perform the duties and, to the extent not inconsistent with the other terms of this Commitment Letter, exercise the authority conventionally

understood to be associated with such role, and (y) JPMorgan will receive “second placement” in any listing of Lead Arrangers

for the ABL Facility and (b) Wells Fargo will act as sole administrative agent and collateral agent for the ABL Facility (in such capacity,

the “ABL Administrative Agent”). You agree that JPMorgan may perform its responsibilities as a Lead Arranger through

its affiliate, J.P. Morgan Securities LLC.

No other agents, co-agents,

lead arrangers, co-arrangers, bookrunners, managers or co-managers will be appointed, no other titles will be awarded and no compensation

to any of the foregoing or any Commitment Party (other than compensation expressly contemplated by the Commitment Papers) will be paid

in order to obtain a commitment to participate in the ABL Facility unless you and we agree in writing.

The Lead Arrangers reserve

the right, prior to or after the execution of the ABL Facility Documentation (as defined in Exhibit C to this Commitment Letter), to syndicate

all or a portion of the commitments with respect to the ABL Facility to a group of banks, financial institutions and other institutional

lenders that are identified by the Lead Arrangers and subject to your prior consent (such consent not to be unreasonably withheld or delayed)

(together with the Initial ABL Lenders, the “ABL Lenders”). The Lead Arrangers will not syndicate the commitments or

any portion thereof to the following entities (collectively, the “Disqualified Lenders”):

| (a) | those entities identified by or on behalf of you in writing, from time to time, as competitors of the

Acquired Business; |

| (b) | any persons that are engaged as principals primarily in private equity, mezzanine financing or venture

capital and such other persons that are, in each case, identified in writing by or on behalf of you to us on or prior to the date hereof

or with the consent of the ABL Administrative Agent, by the Borrower in writing at any time on and after the Closing Date; |

| (c) | any person that is an affiliate of the entities described in the preceding clauses (a) and (b) (other

than any bona fide debt fund affiliates thereof (except to the extent separately identified under clause (a) or (b) above)); provided

that such person is either reasonably identifiable as an affiliate solely on the basis of its name or is identified in writing to us by

or on behalf of you; and |

| | 2 | Project Norse – Commitment Letter |

| (d) | “Excluded Affiliates” (as defined below). |

No Disqualified Lender may

become an ABL Lender or have any commitment or right (including a participation right) with respect to the ABL Facility; provided

that, to the extent persons are identified as Disqualified Lenders in writing by you after the date of this Commitment Letter (or, if

after the Closing Date, by you to the ABL Administrative Agent) pursuant to clauses (a) or (c) above, the inclusion of such persons as

Disqualified Lenders shall not retroactively apply to prior assignments or participations made in compliance with applicable assignment

or participation provisions. Notwithstanding the Lead Arrangers’ right to syndicate the ABL Facility and receive commitments with

respect thereto, (i) no Initial ABL Lender will be relieved, released or novated from its obligations under the Commitment Papers

in connection with any syndication, assignment or participation of the ABL Facility, including its commitments and obligations to fund

such ABL Facility, until after the initial funding under the ABL Facility has occurred (or, if there is no funding of the ABL Facility

on the Closing Date, the date of the effectiveness of the ABL Facility), (ii) no assignment or novation will become effective (as

between you and the Initial ABL Lenders) with respect to all or any portion of the Initial ABL Lenders’ commitments in respect of

the ABL Facility until the initial funding of the ABL Facility has occurred (or, if there is no funding of the ABL Facility on the Closing

Date, the date of the effectiveness of the ABL Facility) and (iii) unless you otherwise expressly agree in writing, the Initial ABL

Lenders will retain exclusive control over all rights and obligations with respect to their commitments in respect of the ABL Facility,

including all rights with respect to consents, modifications, supplements, waivers and amendments, until the initial funding under the

ABL Facility has occurred (or, if there is no funding of the ABL Facility on the Closing Date, the date of the effectiveness of the ABL

Facility).

The Lead Arrangers intend to

commence syndication efforts promptly upon the execution of this Commitment Letter and, as part of their syndication efforts, it is the

Lead Arrangers’ intent to have ABL Lenders commit to the ABL Facility prior to the Closing Date (subject to the limitations set

forth in the preceding paragraph). You agree to use your commercially reasonable efforts to assist the Lead Arrangers in completing a

Successful ABL Syndication (as defined in the Arranger Fee Letter) until the date that is the earlier of (a) 60 days after the Closing

Date and (b) the date on which a Successful ABL Syndication is achieved (such earlier date, the “Syndication Date”).

Such assistance shall be limited to the following (and subject to the second to last paragraph of this Section 3), upon request:

| (i) | your using your commercially reasonable efforts to ensure that any syndication efforts benefit from your

existing lending and investment banking relationships and the existing lending and investment banking relationships of the Acquired Business; |

| (ii) | direct contact between your senior management (and you using your commercially reasonable efforts, to

the extent not in contravention of the terms of the Acquisition Agreement, to arrange for direct contact with senior management of the

Company) and the proposed ABL Lenders at times and locations to be mutually agreed upon (which meeting may be virtual); |

| (iii) | your assistance (and your using your commercially reasonable efforts, to the extent not in contravention

of the terms of the Acquisition Agreement, to cause the Company to assist) in the preparation of a customary confidential information

memorandum (the “Confidential Information Memorandum”) for the ABL Facility and other customary marketing materials

to be used in connection with the syndication of the ABL Facility; provided that (A) the Confidential Information Memorandum and

such marketing materials will be in a form consistent with confidential offering memoranda and marketing materials used in recent similar

transactions, (B) such assistance shall require delivery by you only of such information as is customarily delivered by a borrower in

debt facilities such as the ABL Facility and (C) such assistance shall not require delivery of any information customarily provided by

a financing source in the preparation of such Confidential Information Memorandum; |

| | 3 | Project Norse – Commitment Letter |

| (iv) | the hosting, with the Lead Arrangers, of one meeting (which may be held by telephone, video or other electronic

method) for the ABL Facility of prospective ABL Lenders at times and locations to be mutually agreed upon; and |

| (v) | using commercially reasonable efforts, to the extent not in contravention of the terms of the Acquisition

Agreement, to ensure that the ABL Administrative Agent has sufficient access to the Acquired Business to complete a field examination

and inventory appraisal with respect to assets to be included in the Borrowing Base; |

Until the Syndication Date:

| (A) | you agree to ensure that there will not be any competing issuances of your and your subsidiaries’

debt securities or your or your subsidiaries’ commercial bank or other credit facilities (and to use your commercially reasonable

efforts to ensure that there will not be any such competing issues or facilities of the Acquired Business), in each case being offered,

placed or arranged that would reasonably be expected to materially impair the primary syndication of the ABL Facility prior to the later

of the Closing Date and the Syndication Date without the prior written consent of the Lead Arrangers (it being agreed that this clause

(A) will not apply to any indebtedness (1) under the ABL Facility, (2) under a credit facility or other debt instrument made available

to Holdings by Liverpool or any of its affiliates in connection with the Acquisition (the “Parent SPV Loan”), (3) under

any credit facility made available to Liverpool or an affiliate thereof in connection with the Acquisition (each a “Liverpool

Loan”) or (4) permitted to be incurred prior to the Closing Date, or remain outstanding on or after the Closing Date, pursuant

to the terms of the Acquisition Agreement and it being understood and agreed that the Acquired Business’ ordinary course debt, drawings

on existing commitments under the existing credit agreement, short-term working capital facilities and ordinary course capital leases,

deferred purchase price obligations, surety bonds, bank guarantees, hedging arrangements, purchase money and equipment financings will

not materially impair the primary syndication of the ABL Facility); and |

| (B) | you agree to provide (and to use your commercially reasonable efforts to

cause the Acquired Business to provide) to the Lead Arrangers all customary information reasonably available to you with respect to (i)

you, (ii) the Acquired Business, (iii) your and its respective subsidiaries and (iv) the Transactions, including projections of the type

customarily included in a “private side” bank book (such projections, together with financial estimates, forecasts and other

forward-looking information, the “Projections”), as the Lead Arrangers may reasonably request in connection with the

syndication of the ABL Facility; provided, that the only other Projections, financial statements

and other financial information that shall be required to be provided to the Lead Arrangers shall be the Projections, financial statements

and other financial information already provided as of the date hereof or required to be delivered pursuant to paragraph 4 of the Conditions

Annex attached hereto. |

For the avoidance of doubt,

you will not be required to provide (or to cause any person to provide) any trade secrets or information to the extent that the provision

thereof would violate any law, rule or regulation, fiduciary duty, binding agreement, or any obligation of confidentiality binding upon,

or waive any privilege that may be asserted by, you, the Acquired Business or any of your or its respective affiliates (so long as such

obligation is not entered into in contemplation of this provision); provided that, in the event that you do not provide information

in reliance on this sentence, you shall provide notice to the Lead Arrangers promptly upon obtaining knowledge that such information is

being withheld, and you shall use your commercially reasonable efforts to communicate, to the extent feasible, the applicable information

in a way that would not violate the applicable obligation or risk waiver of such privilege; provided, further, that the

representation and warranty made by you with respect to information in Section 4 shall not be affected in any way by your decision not

to provide such information.

| | 4 | Project Norse – Commitment Letter |

Neither the commencement nor

the completion of any syndication of the ABL Facility (including the Successful ABL Syndication) nor compliance with the foregoing provisions

of this Section 3, will constitute a condition to the commitments of the Initial ABL Lenders hereunder or the funding of the ABL Facility

on the Closing Date (or, if there is no funding of the ABL Facility on the Closing Date, the date of the effectiveness of the ABL Facility).

We acknowledge that the Acquired Business and/or its affiliates are not restricted from incurring debt or liens prior to the date or time

that the Acquisition is required to be consummated pursuant to the terms of the Acquisition Agreement (the “Acquisition Date”),

except as specifically set forth in the Acquisition Agreement, and that prior to the Acquisition Date, the Acquired Business is obligated

to assist with respect to the ABL Facility, and any other financing for the Transactions, only to the extent set forth in the Acquisition

Agreement, and the extent of such restrictions and assistance (as set forth in the Acquisition Agreement) is acceptable to us. Your obligations

under the Commitment Papers to use “commercially reasonable efforts” (a) to take any action shall not require you or any of

your affiliates to make any equity contribution in excess of the Minimum Equity Contribution (as defined Exhibit A) or to incur any fee

not specifically contemplated by the Commitment Papers (including any “market flex” provisions) and (b) to cause the Acquired

Business or their respective management or affiliates to take (or to refrain from taking) any action is subject to the terms of the Acquisition

Agreement, and it will not require you, under any circumstances, to commence any litigation or to take any action that is not practical,

appropriate or reasonable in light of the circumstances or in contravention of the terms of the Acquisition Agreement, to take any action

that would reasonably be expected to permit the Acquisition Agreement to be terminated or to commence litigation with respect to the Acquisition