Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

October 24 2023 - 5:21AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2023

Commission File Number: 000-53445

KB Financial Group Inc.

(Translation of registrant’s name into English)

26, Gukjegeumyung-ro 8-gil, Yeongdeungpo-gu, Seoul 07331, Korea

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

2023 Third Quarter Preliminary Operating Results

On October 24, 2023, KB Financial Group Inc. (“KB Financial Group”) held an earnings conference and released its preliminary operating results

for the third quarter of fiscal year 2023. The following tables reflect the key figures released during the conference. The presentation materials for the conference, which contain further details, are available at KB Financial Group’s website

(http://www.kbfg.com).

The preliminary figures presented herein are based on International Financial Reporting Standards as adopted by the Republic of

Korea (“K-IFRS”) and are currently being reviewed by KB Financial Group’s independent auditors and are subject to change.

| 1. |

Preliminary Operating Results of KB Financial Group (Consolidated) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Won in millions, %) |

|

|

3Q 2023 |

|

|

2Q 2023 |

|

|

% Change

Increase

(Decrease)

(Q to Q) |

|

|

3Q 2022 |

|

|

% Change

Increase

(Decrease)

(Y to Y) |

|

| Operating revenue |

|

|

Specified Quarter |

|

|

|

18,643,843 |

|

|

|

15,900,286 |

|

|

|

17.25 |

|

|

|

31,466,917 |

|

|

|

(40.75 |

) |

| |

|

Cumulative |

|

|

|

59,305,899 |

|

|

|

40,662,056 |

|

|

|

— |

|

|

|

75,197,746 |

|

|

|

(21.13 |

) |

| Net operating profit |

|

|

Specified Quarter |

|

|

|

1,952,882 |

|

|

|

2,053,013 |

|

|

|

(4.88 |

) |

|

|

1,733,829 |

|

|

|

12.63 |

|

| |

|

Cumulative |

|

|

|

6,130,920 |

|

|

|

4,178,038 |

|

|

|

— |

|

|

|

5,107,000 |

|

|

|

20.05 |

|

| Profit before income tax |

|

|

Specified Quarter |

|

|

|

1,909,462 |

|

|

|

1,960,660 |

|

|

|

(2.61 |

) |

|

|

1,847,682 |

|

|

|

3.34 |

|

| |

|

Cumulative |

|

|

|

5,898,986 |

|

|

|

3,989,524 |

|

|

|

— |

|

|

|

5,422,781 |

|

|

|

8.78 |

|

| Profit for the period |

|

|

Specified Quarter |

|

|

|

1,341,970 |

|

|

|

1,504,771 |

|

|

|

(10.82 |

) |

|

|

1,360,007 |

|

|

|

(1.33 |

) |

| |

|

Cumulative |

|

|

|

4,345,955 |

|

|

|

3,003,985 |

|

|

|

— |

|

|

|

4,046,027 |

|

|

|

7.41 |

|

| Profit attributable to shareholders of the parent company |

|

|

Specified Quarter |

|

|

|

1,373,755 |

|

|

|

1,499,056 |

|

|

|

(8.36 |

) |

|

|

1,367,760 |

|

|

|

0.44 |

|

| |

|

Cumulative |

|

|

|

4,370,442 |

|

|

|

2,996,687 |

|

|

|

— |

|

|

|

4,038,283 |

|

|

|

8.23 |

|

|

|

|

|

|

| Notes: |

|

1) |

|

“Operating revenue” represents the sum of interest income, fee and commission income, insurance income, reinsurance income, gain on financial assets/liabilities at fair value through profit or loss, other insurance finance

income and other operating income. |

|

|

2) |

|

KB Financial Group’s preliminary operating results for the third quarter of 2023 reflect the application of K-IFRS 1117 (Insurance Contracts), a new accounting standard that became

effective on January 1, 2023. For comparison purposes, the figures for the third quarter of 2022 above have been restated retrospectively to reflect the application of K-IFRS 1117. |

| 2. |

Preliminary Operating Results of Kookmin Bank (Consolidated) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Won in millions, %) |

|

3Q 2023 |

|

|

2Q 2023 |

|

|

% Change

Increase

(Decrease)

(Q to Q) |

|

|

3Q 2022 |

|

|

% Change

Increase

(Decrease)

(Y to Y) |

|

| Operating revenue |

|

Specified Quarter |

|

|

10,884,265 |

|

|

|

8,817,685 |

|

|

|

23.44 |

|

|

|

20,807,633 |

|

|

|

(47.69 |

) |

| |

Cumulative |

|

|

34,621,072 |

|

|

|

23,736,807 |

|

|

|

— |

|

|

|

45,685,185 |

|

|

|

(24.22 |

) |

| Net operating profit |

|

Specified Quarter |

|

|

1,363,245 |

|

|

|

1,222,012 |

|

|

|

11.56 |

|

|

|

1,087,614 |

|

|

|

25.34 |

|

| |

Cumulative |

|

|

3,853,397 |

|

|

|

2,490,152 |

|

|

|

— |

|

|

|

3,295,222 |

|

|

|

16.94 |

|

| Profit before income tax |

|

Specified Quarter |

|

|

1,358,671 |

|

|

|

1,188,087 |

|

|

|

14.36 |

|

|

|

1,083,421 |

|

|

|

25.41 |

|

| |

Cumulative |

|

|

3,781,922 |

|

|

|

2,423,251 |

|

|

|

— |

|

|

|

3,314,297 |

|

|

|

14.11 |

|

| Profit for the period |

|

Specified Quarter |

|

|

963,888 |

|

|

|

919,941 |

|

|

|

4.78 |

|

|

|

796,711 |

|

|

|

20.98 |

|

| |

Cumulative |

|

|

2,805,753 |

|

|

|

1,841,865 |

|

|

|

— |

|

|

|

2,521,165 |

|

|

|

11.29 |

|

| Profit attributable to shareholders of the parent company |

|

Specified Quarter |

|

|

996,864 |

|

|

|

926,992 |

|

|

|

7.54 |

|

|

|

824,131 |

|

|

|

20.96 |

|

| |

Cumulative |

|

|

2,855,372 |

|

|

|

1,858,508 |

|

|

|

— |

|

|

|

2,550,571 |

|

|

|

11.95 |

|

|

|

|

|

|

| Note: |

|

|

|

“Operating revenue” represents the sum of interest income, fee and commission income, gain on financial assets/liabilities at fair value through profit or loss and other operating income. |

| 3. |

Preliminary Operating Results of KB Securities Co., Ltd. (“KB Securities”) (Consolidated)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Won in millions, %) |

|

3Q 2023 |

|

|

2Q 2023 |

|

|

% Change

Increase

(Decrease)

(Q to Q) |

|

|

3Q 2022 |

|

|

% Change

Increase

(Decrease)

(Y to Y) |

|

| Operating revenue |

|

Specified Quarter |

|

|

2,578,987 |

|

|

|

1,805,906 |

|

|

|

42.81 |

|

|

|

4,955,499 |

|

|

|

(47.96 |

) |

| |

Cumulative |

|

|

8,709,143 |

|

|

|

6,130,156 |

|

|

|

— |

|

|

|

13,947,049 |

|

|

|

(37.56 |

) |

| Net operating profit |

|

Specified Quarter |

|

|

153,053 |

|

|

|

194,063 |

|

|

|

(21.13 |

) |

|

|

112,777 |

|

|

|

35.71 |

|

| |

Cumulative |

|

|

611,315 |

|

|

|

458,262 |

|

|

|

— |

|

|

|

349,277 |

|

|

|

75.02 |

|

| Profit before income tax |

|

Specified Quarter |

|

|

150,636 |

|

|

|

142,728 |

|

|

|

5.54 |

|

|

|

166,273 |

|

|

|

(9.40 |

) |

| |

Cumulative |

|

|

482,176 |

|

|

|

331,540 |

|

|

|

— |

|

|

|

418,024 |

|

|

|

15.35 |

|

| Profit for the period |

|

Specified Quarter |

|

|

113,291 |

|

|

|

110,304 |

|

|

|

2.71 |

|

|

|

123,051 |

|

|

|

(7.93 |

) |

| |

Cumulative |

|

|

365,545 |

|

|

|

252,254 |

|

|

|

— |

|

|

|

309,153 |

|

|

|

18.24 |

|

| Profit attributable to shareholders of the parent company |

|

Specified Quarter |

|

|

112,936 |

|

|

|

110,345 |

|

|

|

2.35 |

|

|

|

122,650 |

|

|

|

(7.92 |

) |

| |

Cumulative |

|

|

365,175 |

|

|

|

252,239 |

|

|

|

— |

|

|

|

308,371 |

|

|

|

18.42 |

|

|

|

|

|

|

| Notes: |

|

1) |

|

Based on KB Securities’ consolidated financial statements, as a result of which the figures differ from KB Securities’ earnings results to be released at KB Financial Group’s 2023 third quarter earnings conference,

which are based on KB Financial Group’s consolidated financial statements. |

|

|

2) |

|

“Operating revenue” represents operating income based on KB Securities’ financial statements. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

KB Financial Group Inc. |

|

|

|

|

(Registrant) |

|

|

|

| Date: October 24, 2023 |

|

|

|

By: /s/ Scott Y. H. Seo |

|

|

|

|

(Signature) |

|

|

|

|

Name: Scott Y. H. Seo |

|

|

|

|

Title: Senior Executive Vice President and Chief Finance Officer |

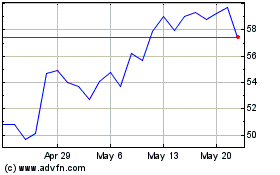

KB Financial (NYSE:KB)

Historical Stock Chart

From Apr 2024 to May 2024

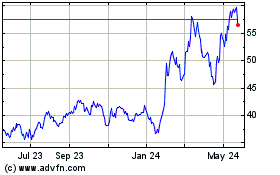

KB Financial (NYSE:KB)

Historical Stock Chart

From May 2023 to May 2024