KKR Provides $300 Million Corporate Credit Facility to Origis Energy

May 20 2024 - 6:00AM

Business Wire

KKR, a leading global investment firm and Origis Energy

(“Origis”), a leading renewable energy and decarbonization solution

platform, today announced that vehicles and accounts managed by

KKR’s insurance business have provided a $300 million corporate

financing facility to Origis. Proceeds from the facility will

support the continued development and construction of Origis’

pipeline of solar and storage projects.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240520357924/en/

S&P Global Commodity Insights recently ranked Origis third

on its list of ten largest owners of planned solar installations

through 2028. Since inception, Origis has developed more than 250

solar and storage projects. In the U.S., the company’s current

operating, contracted and mature development project portfolio

stands at more than 12 gigawatts (GW), with an additional 13 GW in

the pipeline.

“We are on a remarkable trajectory at Origis and focused on

delivering for our customers. We are pleased to be working with KKR

in this next phase of our growth,” said Vikas Anand, CEO of

Origis.

“Demand for renewable energy financing is stronger than ever and

we are pleased to support Origis Energy, one of the leading

developers in this space,” said Sam Mencoff, Director at KKR.

This investment aligns with KKR’s Asset-Based Finance (ABF)

strategy, which focuses on privately originated and negotiated

credit investments that are backed by large and diversified pools

of financial and hard assets, offering diversification to

traditional corporate credit and attractive risk-adjusted returns.

KKR’s ABF platform began investing in 2016 and now has

approximately $54 billion in ABF assets under management globally

across its High-Grade ABF and Opportunistic ABF strategies.

About KKR

KKR is a leading global investment firm that offers alternative

asset management as well as capital markets and insurance

solutions. KKR aims to generate attractive investment returns by

following a patient and disciplined investment approach, employing

world-class people, and supporting growth in its portfolio

companies and communities. KKR sponsors investment funds that

invest in private equity, credit and real assets and has strategic

partners that manage hedge funds. KKR’s insurance subsidiaries

offer retirement, life and reinsurance products under the

management of Global Atlantic Financial Group. References to KKR’s

investments may include the activities of its sponsored funds and

insurance subsidiaries. For additional information about KKR &

Co. Inc. (NYSE: KKR), please visit KKR’s website at www.kkr.com.

For additional information about Global Atlantic Financial Group,

please visit Global Atlantic Financial Group’s website at

www.globalatlantic.com.

About Origis Energy

Origis Energy is accelerating the transition to a carbon-free

future by Reimagining Zero sm. As one of America’s leading

renewable energy and decarbonization solution platforms, the

company continues to expand and reimagine its contribution to the

world’s net-zero goals. Origis Energy puts customers first to

deploy a wide range of sustainable solutions for grid and

distributed power generation, clean hydrogen and long-term

operation of solar, energy storage and clean hydrogen plants across

the U.S. Founded in 2008, Origis Energy is headquartered in Miami,

FL. Learn more at Origis Energy.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240520357924/en/

Media: KKR: Julia Kosygina +1 212-750-8300 Media@kkr.com

Origis Energy: Kerri Case 786.376.7596 media@origisenergy.com

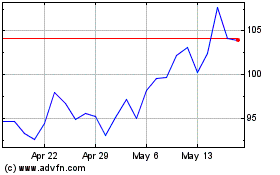

KKR (NYSE:KKR)

Historical Stock Chart

From Oct 2024 to Nov 2024

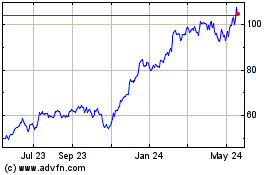

KKR (NYSE:KKR)

Historical Stock Chart

From Nov 2023 to Nov 2024