Kosmos Energy Ltd. (“Kosmos” or the “Company”) (NYSE/LSE: KOS)

announced today its financial and operating results for the fourth

quarter of 2024. For the quarter, the Company generated a net loss

of $7 million, or $0.01 per diluted share. When adjusted for

certain items that impact the comparability of results, the Company

generated an adjusted net loss(1) of $16 million, or $0.03 per

diluted share for the fourth quarter of 2024.

FOURTH QUARTER 2024 HIGHLIGHTS

- Zero lost-time injuries or total recordable injuries in

2024

- Net Production(2): ~66,800 barrels of oil equivalent per day

(boepd), with sales of ~65,700 boepd

- Revenues: $398 million, or $65.80 per boe (excluding the impact

of derivative cash settlements)

- Production expense: $153 million ($19.39 per boe excluding

$35.6 million of production expenses associated with the Greater

Tortue Ahmeyim (GTA) liquefied natural gas (LNG) project)

- Capital expenditures: $117 million

- Achieved first gas production at the GTA LNG project in

December; first LNG production achieved in February 2025

- Secured the Noble Venturer drilling rig for the 2025/2026

Jubilee drilling campaign; commenced a 4D seismic survey over

Jubilee and TEN in January 2025

- ~137% 2P reserve replacement ratio with year-end 2024 2P

reserves of ~528 million barrels of oil equivalent (mmboe),

representing a 22-year reserves-to-production ratio

- Maintained AAA rating with MSCI

Commenting on the Company’s 2024 performance, Chairman and Chief

Executive Officer Andrew G. Inglis said: "In 2022, we set out a

goal to materially grow production from several key projects across

our portfolio. 2024 was a year of delivering those projects, with

continued 2P reserve growth and production now increasing as the

projects ramp up. With the end of this highly capital-intensive

period for the company we will now prioritize the generation of

free cash flow from our increased production base together with

disciplined capital investment. Our forecast 2025 capex budget of

$400 million is a reduction of over 50% from recent years.

Operationally, we were pleased to see first gas production at

GTA at the end of 2024, followed earlier this month by first LNG

production, two significant milestones for the project, its

partners and the people of Mauritania and Senegal. The first cargo

is currently being prepared for loading. GTA is a world-scale asset

in the Kosmos portfolio and with the initial capital intensive

phase complete, we can focus on delivering the full potential of

the asset with significant room to grow production and cash

flow.

In the Gulf of America, we expect production to further increase

from the Winterfell 3&4 wells in the coming months and have

been pleased by the production optimization projects undertaken

during 2024. In Ghana, with the Jubilee 4D seismic and the upcoming

infill drilling program, we expect to see production increasing.

Jubilee is a world-class oil field and with the appropriate field

management, sustained water injection and high facility

reliability, the asset is capable of delivering strong production

volumes for many years to come."

FINANCIAL UPDATE

The Company generated net cash provided by operating activities

of approximately $176 million and free cash flow(1) of

approximately $14 million in the fourth quarter.

Kosmos exited the fourth quarter of 2024 with approximately $2.8

billion of total long-term debt and approximately $2.7 billion of

net debt(1) and available liquidity of approximately $535 million.

The Company has minimal near-term debt maturities with only $250

million in 2026, which it intends to fund from free cash flow.

Net capital expenditure for the fourth quarter of 2024 was $117

million, slightly higher than guidance primarily due to higher

startup costs associated with GTA. In 2025 capital expenditure is

expected to be $400 million or below, more than 50% lower than the

previous year as we prioritize cash generation through disciplined

capital allocation. Additionally, as a part of this ongoing

rigorous cost management, the Company is targeting a reduction in

annual overhead of around $25 million by year-end 2025.

RESERVES UPDATE

At year-end 2024, Kosmos 2P reserves were approximately 530

million boe, representing a reserve replacement ratio of 137% and a

2P reserves-to-production ratio of approximately 22 years,

demonstrating the longevity of the portfolio. The positive 2P

reserve replacement was largely driven by upward revisions in

Mauritania and Senegal. Kosmos 2P reserves do not include any

recognition for the Tiberius and Yakaar-Teranga discoveries. Kosmos

1P reserves were approximately 250 million barrels of oil

equivalent (boe), representing a 1P reserves to production ratio of

around 11 years and a reserve replacement ratio of -11% driven

primarily by annual production. Kosmos’ year-end reserves on all

assets have been independently evaluated by Ryder Scott.

OPERATIONAL UPDATE

Production

Total net production(2) in the fourth quarter of 2024 averaged

approximately 66,800 boepd. Production was below guidance primarily

due to lower production at Jubilee (flagged by the operator in

January) and the timing impact of new project startups. The Company

exited the quarter in a net underlift position of approximately 0.2

million barrels. While these projects are close to completing their

ramp-up within the next month, first quarter 2025 production is

also impacted by planned shut-downs at Jubilee in Ghana and at the

Devils Tower facility, which hosts Kodiak field, in the Gulf of

America.

Ghana

Production in Ghana averaged approximately 38,600 boepd net in

the fourth quarter of 2024. Kosmos lifted three cargos from Ghana

during the quarter, in line with guidance.

At Jubilee (38.6% working interest), oil production in the

fourth quarter averaged approximately 80,200 bopd gross with full

year production averaging approximately 87,000 bopd gross. Fourth

quarter production versus guidance was impacted by insufficient

water injection and reliability, primarily related to power

generation, and we are working with the operator to address these

field management issues. To moderate decline ahead of the upcoming

drilling campaign, a combination of high FPSO uptime, improved

facility reliability and voidage replacement in excess of 100% are

required, consistent with what has been delivered through the first

two months of 2025.

The Noble Venturer rig has been contracted to drill two wells in

2025 and is expected to arrive in May. The two wells, one Jubilee

producer and one Jubilee injector, are expected online in the third

quarter of 2025. The rig will then undergo scheduled maintenance

before returning for a planned four-well drilling campaign on

Jubilee in 2026.

In the fourth quarter of 2024, Jubilee gas production net to

Kosmos was approximately 5,700 boepd in line with expectations.

At TEN (20.4% working interest), oil production averaged

approximately 17,800 bopd gross for the fourth quarter.

Gulf of America

Production in the Gulf of America averaged approximately 18,200

boepd net (~83% oil) during the fourth quarter with Winterfell shut

in for most of the quarter due to previously communicated

Winterfell-3 issues. The Winterfell 1&2 wells were brought back

online in late-December. The rig contracted to drill the

Winterfell-4 well starting later this quarter is currently being

used for remediation of the Winterfell-3 well. Winterfell-3 is

expected online later this quarter with Winterfell-4 expected

online in the third quarter.

On Tiberius, Kosmos continues to progress the development and

expects to complete a farm down of the field around the time of

project sanction.

Kosmos has an attractive portfolio of infrastructure-led

exploration (ILX) opportunities that we will high-grade through

2025.

Equatorial Guinea

Production in Equatorial Guinea averaged approximately 28,500

bopd gross and 10,000 bopd net in the fourth quarter. Kosmos lifted

one cargo from Equatorial Guinea during the quarter, in line with

guidance. The Noble Venturer rig successfully completed the infill

drilling campaign with both wells now online.

The drilling campaign also included drilling of the S-6 “Akeng

Deep” ILX prospect in Block S offshore Equatorial Guinea in the

fourth quarter of 2024. The well was drilled to a total vertical

depth of approximately 13,225 feet (~4030 meters) and encountered

sub-commercial quantities of hydrocarbons. Kosmos recorded $28

million of exploration expense related to the well in the fourth

quarter and the well has now been plugged and abandoned. Kosmos

also wrote off $37.2 million of exploration expense off related to

the Asam discovery in Block S offshore Equatorial Guinea which was

successfully drilled in 2019, but is now not expected to be

developed in the near-term.

Mauritania and Senegal

The GTA LNG project achieved first gas production during the

fourth quarter, a significant milestone for the project partners

and the governments and people of Mauritania and Senegal,

establishing a new LNG production hub in the Atlantic basin.

Post quarter-end, the project achieved first LNG production,

another key milestone, which is when Kosmos will now start to

recognize entitlement production. The first LNG cargo is expected

later this quarter, with an LNG tanker currently standing by the

Hub Terminal ready for loading. Loading the first cargo is when the

partnership will start to recognize revenue from the project.

In addition, the partnership is working collaboratively to

prioritize both the low-cost brownfield expansion of the

development to fully utilize the existing infrastructure, and

future cost optimization for the first phase of GTA with the

near-term focus on the re-financing of the FPSO leaseback

arrangement.

(1) A Non-GAAP measure, see attached reconciliation of non-GAAP

measure. (2) Production means net entitlement volumes. In Ghana and

Equatorial Guinea, this means those volumes net to Kosmos' working

interest or participating interest and net of royalty or production

sharing contract effect. In the Gulf of America, this means those

volumes net to Kosmos' working interest and net of royalty.

Conference Call and Webcast Information

Kosmos will host a conference call and webcast to discuss fourth

quarter 2024 financial and operating results today, February 24,

2025, at 10:00 a.m. Central time (11:00 a.m. Eastern time). The

live webcast of the event can be accessed on the Investors page of

Kosmos’ website at

http://investors.kosmosenergy.com/investor-events. The dial-in

telephone number for the call is +1-877-407-0784. Callers in the

United Kingdom should call 0800 756 3429. Callers outside the

United States should dial +1-201-689-8560. A replay of the webcast

will be available on the Investors page of Kosmos’ website for

approximately 90 days following the event.

About Kosmos Energy

Kosmos Energy is a leading deepwater exploration and production

company focused on meeting the world’s growing demand for energy.

We have diversified oil and gas production from assets offshore

Ghana, Equatorial Guinea, Mauritania, Senegal and the Gulf of

America (formerly the U.S. Gulf of Mexico). Additionally, in the

proven basins where we operate we are advancing high-quality

development opportunities, which have come from our exploration

success. Kosmos is listed on the NYSE and LSE and is traded under

the ticker symbol KOS.

As an ethical and transparent company, Kosmos is committed to

doing things the right way. The Company’s Business Principles

articulate our commitment to transparency, ethics, human rights,

safety and the environment. Read more about this commitment in the

Kosmos Sustainability Report. For additional information, visit

www.kosmosenergy.com.

Non-GAAP Financial Measures

EBITDAX, Adjusted net income (loss), Adjusted net income (loss)

per share, free cash flow, and net debt are supplemental non-GAAP

financial measures used by management and external users of the

Company's consolidated financial statements, such as industry

analysts, investors, lenders and rating agencies. The Company

defines EBITDAX as Net income (loss) plus (i) exploration expense,

(ii) depletion, depreciation and amortization expense, (iii) equity

based compensation expense, (iv) unrealized (gain) loss on

commodity derivatives (realized losses are deducted and realized

gains are added back), (v) (gain) loss on sale of oil and gas

properties, (vi) interest (income) expense, (vii) income taxes,

(viii) debt modifications and extinguishments, (ix) doubtful

accounts expense and (x) similar other material items which

management believes affect the comparability of operating results.

The Company defines Adjusted net income (loss) as Net income (loss)

adjusted for certain items that impact the comparability of

results. The Company defines free cash flow as net cash provided by

operating activities less Oil and gas assets, Other property, and

certain other items that may affect the comparability of results

and excludes non-recurring activity such as acquisitions,

divestitures and National Oil Company ("NOC") financing. NOC

financing refers to the amounts funded by Kosmos under the Carry

Advance Agreements that the Company has in place with the national

oil companies of each of Mauritania and Senegal related to the

financing of the respective national oil companies’ share of

certain development costs at Greater Tortue Ahmeyim. The Company

defines net debt as total long-term debt less cash and cash

equivalents and total restricted cash.

We believe that EBITDAX, Adjusted net income (loss), Adjusted

net income (loss) per share, free cash flow, Net debt and other

similar measures are useful to investors because they are

frequently used by securities analysts, investors and other

interested parties in the evaluation of companies in the oil and

gas sector and will provide investors with a useful tool for

assessing the comparability between periods, among securities

analysts, as well as company by company. EBITDAX, Adjusted net

income (loss), Adjusted net income (loss) per share, free cash

flow, and net debt as presented by us may not be comparable to

similarly titled measures of other companies.

This release also contains certain forward-looking non-GAAP

financial measures, including free cash flow. Due to the

forward-looking nature of the aforementioned non-GAAP financial

measures, management cannot reliably or reasonably predict certain

of the necessary components of the most directly comparable

forward-looking GAAP measures, such as future impairments and

future changes in working capital. Accordingly, we are unable to

present a quantitative reconciliation of such forward-looking

non-GAAP financial measures to their most directly comparable

forward-looking GAAP financial measures. Amounts excluded from

these non-GAAP measures in future periods could be significant.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. All statements,

other than statements of historical facts, included in this press

release that address activities, events or developments that Kosmos

expects, believes or anticipates will or may occur in the future

are forward-looking statements. Kosmos’ estimates and

forward-looking statements are mainly based on its current

expectations and estimates of future events and trends, which

affect or may affect its businesses and operations. Although Kosmos

believes that these estimates and forward-looking statements are

based upon reasonable assumptions, they are subject to several

risks and uncertainties and are made in light of information

currently available to Kosmos. When used in this press release, the

words “anticipate,” “believe,” “intend,” “expect,” “plan,” “will”

or other similar words are intended to identify forward-looking

statements. Such statements are subject to a number of assumptions,

risks and uncertainties, many of which are beyond the control of

Kosmos, which may cause actual results to differ materially from

those implied or expressed by the forward-looking statements.

Further information on such assumptions, risks and uncertainties is

available in Kosmos’ Securities and Exchange Commission (“SEC”)

filings. Kosmos undertakes no obligation and does not intend to

update or correct these forward-looking statements to reflect

events or circumstances occurring after the date of this press

release, except as required by applicable law. You are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the date of this press release. All

forward-looking statements are qualified in their entirety by this

cautionary statement.

Kosmos Energy Ltd.

Consolidated Statements of

Operations

(In thousands, except per

share amounts, unaudited)

Three Months Ended

Years Ended

December 31,

December 31,

2024

2023

2024

2023

Revenues and other income:

Oil and gas revenue

$

397,561

$

507,765

$

1,675,358

$

1,701,608

Gain on sale of assets

—

—

—

—

Other income, net

95

42

204

(73

)

Total revenues and other income

397,656

507,807

1,675,562

1,701,535

Costs and expenses:

Oil and gas production

152,692

103,800

530,514

390,097

Exploration expenses

79,915

8,973

119,907

42,278

General and administrative

23,431

21,801

100,155

99,532

Depletion, depreciation and

amortization

145,024

113,293

456,774

444,927

Impairment of long-lived assets

—

222,278

—

222,278

Interest and other financing costs,

net

12,759

21,525

88,598

95,904

Derivatives, net

6,383

(31,034

)

12,099

11,128

Other expenses, net

11,285

5,792

17,703

23,656

Total costs and expenses

431,489

466,428

1,325,750

1,329,800

Income (loss) before income taxes

(33,833

)

41,379

349,812

371,735

Income tax expense (benefit)

(27,254

)

19,698

159,961

158,215

Net income (loss)

$

(6,579

)

$

21,681

$

189,851

$

213,520

Net income (loss) per share:

Basic

$

(0.01

)

$

0.05

$

0.40

$

0.46

Diluted

$

(0.01

)

$

0.04

$

0.40

$

0.44

Weighted average number of shares used to

compute net income (loss) per share:

Basic

471,894

460,129

470,844

459,641

Diluted

471,894

483,252

476,691

481,070

Kosmos Energy Ltd.

Condensed Consolidated Balance

Sheets

(In thousands,

unaudited)

December 31,

December 31,

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

84,972

$

95,345

Receivables, net

164,959

120,733

Other current assets

196,201

206,635

Total current assets

446,132

422,713

Property and equipment, net

4,444,221

4,160,229

Other non-current assets

418,635

355,192

Total assets

$

5,308,988

$

4,938,134

Liabilities and stockholders’

equity

Current liabilities:

Accounts payable

$

349,994

$

248,912

Accrued liabilities

244,954

302,815

Other current liabilities

—

3,103

Total current liabilities

594,948

554,830

Long-term liabilities:

Long-term debt, net

2,744,712

2,390,914

Deferred tax liabilities

313,433

363,918

Other non-current liabilities

455,471

596,135

Total long-term liabilities

3,513,616

3,350,967

Total stockholders’ equity

1,200,424

1,032,337

Total liabilities and stockholders’

equity

$

5,308,988

$

4,938,134

Kosmos Energy Ltd.

Condensed Consolidated

Statements of Cash Flow

(In thousands,

unaudited)

Three Months Ended

Years Ended

December 31,

December 31,

2024

2023

2024

2023

Operating activities:

Net income (loss)

$

(6,579

)

$

21,681

$

189,851

$

213,520

Adjustments to reconcile net income to net

cash provided by operating activities:

Depletion, depreciation and amortization

(including deferred financing costs)

146,919

115,671

465,483

454,848

Deferred income taxes

(63,454

)

(70,079

)

(52,174

)

(107,560

)

Unsuccessful well costs and leasehold

impairments

70,617

(36

)

74,489

2,208

Impairment of long-lived assets

—

222,278

—

222,278

Change in fair value of derivatives

2,939

(24,118

)

14,747

28,349

Cash settlements on derivatives,

net(1)

(4,898

)

(10,948

)

(19,652

)

(32,426

)

Equity-based compensation

10,102

10,915

37,951

42,693

Debt modifications and extinguishments

379

—

25,173

1,503

Other

(1,609

)

3,162

(13,735

)

5,709

Changes in assets and liabilities:

Net changes in working capital

21,331

25,250

(43,884

)

(65,952

)

Net cash provided by operating

activities

175,747

293,776

678,249

765,170

Investing activities

Oil and gas assets

(161,421

)

(320,689

)

(933,659

)

(932,603

)

Notes receivable and other investing

activities

(29,822

)

(15,615

)

(32,397

)

(62,247

)

Net cash used in investing activities

(191,243

)

(336,304

)

(966,056

)

(994,850

)

Financing activities:

Borrowings under long-term debt

50,000

—

325,000

300,000

Payments on long-term debt

—

—

(350,000

)

(145,000

)

Net proceeds from issuance of senior

notes

—

—

885,285

—

Purchase of capped call transactions

—

—

(49,800

)

—

Repurchase of senior notes

—

—

(499,515

)

—

Dividends

—

—

—

(166

)

Other financing costs

(1,113

)

(869

)

(36,647

)

(13,214

)

Net cash provided by (used in) financing

activities

48,887

(869

)

274,323

141,620

Net increase (decrease) in cash, cash

equivalents and restricted cash

33,391

(43,397

)

(13,484

)

(88,060

)

Cash, cash equivalents and restricted cash

at beginning of period

51,886

142,158

98,761

186,821

Cash, cash equivalents and restricted cash

at end of period

$

85,277

$

98,761

$

85,277

$

98,761

__________________________________ (1)

Cash settlements on commodity hedges were

$(2.5) million and $(4.1) million for the three months ended

December 31, 2024 and 2023, respectively, and $(12.5) million and

$(16.4) million for the years ended December 31, 2024 and 2023,

respectively.

Kosmos Energy Ltd.

EBITDAX

(In thousands,

unaudited)

Three Months Ended

Years ended

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Net income (loss)

$

(6,579

)

$

21,681

$

189,851

$

213,520

Exploration expenses

79,915

8,973

119,907

42,278

Depletion, depreciation and

amortization

145,024

113,293

456,774

444,927

Impairment of long-lived assets

—

222,278

—

222,278

Equity-based compensation

10,102

10,915

37,951

42,693

Derivatives, net

6,383

(31,034

)

12,099

11,128

Cash settlements on commodity

derivatives

(2,532

)

(4,105

)

(12,488

)

(16,448

)

Other expenses, net(1)

11,285

5,792

17,703

23,656

Interest and other financing costs,

net

12,759

21,525

88,598

95,904

Income tax expense (benefit)

(27,254

)

19,698

159,961

158,215

EBITDAX

$

229,103

$

389,016

$

1,070,356

$

1,238,151

__________________________________ (1)

Commencing in the first quarter of 2023,

the Company combined the lines for "Restructuring and other" and

"Other, net" in its presentation of EBITDAX into a single line

titled "Other expenses, net."

The following table presents our net debt as of December 31,

2024 and December 31, 2023:

December 31,

December 31,

2024

2023

Total long-term debt

$

2,800,274

$

2,425,000

Cash and cash equivalents

84,972

95,345

Total restricted cash

305

3,416

Net debt

$

2,714,997

$

2,326,239

Kosmos Energy Ltd.

Adjusted Net Income

(Loss)

(In thousands, except per

share amounts, unaudited)

Three Months Ended

Years Ended

December 31,

December 31,

2024

2023

2024

2023

Net income (loss)

$

(6,579

)

$

21,681

$

189,851

$

213,520

Derivatives, net

6,383

(31,034

)

12,099

11,128

Cash settlements on commodity

derivatives

(2,532

)

(4,105

)

(12,488

)

(16,448

)

Impairment of long-lived assets

—

222,278

—

222,278

Other, net(2)

8,178

5,744

14,070

23,598

Impairment of suspended well costs

37,175

—

37,175

—

Debt modifications and extinguishments

379

—

25,173

1,503

Total selected items before tax

49,583

192,883

76,029

242,059

Income tax (expense) benefit on

adjustments(1)

(2,291

)

(65,763

)

(22

)

(75,608

)

Impact of valuation adjustments and other

tax items

(56,295

)

—

(64,258

)

—

Adjusted net income (loss)

$

(15,582

)

148,801

201,600

379,971

Net income (loss) per diluted share

$

(0.01

)

$

0.04

$

0.40

$

0.44

Derivatives, net

0.01

(0.06

)

0.03

0.02

Cash settlements on commodity

derivatives

(0.01

)

(0.01

)

(0.03

)

(0.03

)

Impairment of long-lived assets

—

0.46

—

0.46

Other, net(2)

0.03

0.01

0.03

0.05

Impairment of suspended well costs

0.08

—

0.08

—

Debt modifications and extinguishments

—

—

0.05

—

Total selected items before tax

0.11

0.40

0.16

0.50

Income tax (expense) benefit on

adjustments(1)

—

(0.13

)

—

(0.15

)

Impact of valuation adjustments and other

tax items

(0.13

)

—

(0.14

)

—

Adjusted net income (loss) per diluted

share

$

(0.03

)

$

0.31

$

0.42

$

0.79

Weighted average number of diluted

shares

471,894

483,252

476,691

481,070

__________________________________

(1)

Income tax expense is calculated at the

statutory rate in which such item(s) reside. Statutory rates for

the U.S. and Ghana/Equatorial Guinea are 21% and 35%,

respectively.

(2)

Commencing in the first quarter of 2023,

the Company combined the lines for "Restructuring and other" and

"Other, net" in its presentation of Adjusted net income into a

single line titled "Other, net."

Kosmos Energy Ltd.

Free Cash Flow

(In thousands,

unaudited)

Three Months Ended

Years Ended

December 31,

December 31,

2024

2023

2024

2023

Reconciliation of free cash

flow:

Net cash provided by operating

activities

$

175,747

$

293,776

$

678,249

$

765,170

Net cash used for oil and gas assets -

base business

(85,921

)

(204,177

)

(469,747

)

(541,665

)

Base business free cash flow

89,826

89,599

208,502

223,505

Net cash used for oil and gas assets -

Mauritania/Senegal

(75,500

)

(116,512

)

(463,912

)

(390,938

)

Free cash flow

$

14,326

$

(26,913

)

$

(255,410

)

$

(167,433

)

__________________________________

Kosmos Energy Ltd.

Operational Summary

(In thousands, except barrel

and per barrel data, unaudited)

Three Months Ended

Years Ended

December 31,

December 31,

2024

2023

2024

2023

Net Volume Sold

Oil (MMBbl)

5.238

5.937

20.472

20.385

Gas (MMcf)

4.189

4.155

16.180

13.737

NGL (MMBbl)

0.106

0.083

0.338

0.382

Total (MMBoe)

6.042

6.713

23.507

23.057

Total (Mboepd)

65.676

72.962

64.226

63.168

Revenue

Oil sales

$

380,397

$

491,438

$

1,611,169

$

1,658,421

Gas sales

15,025

14,793

57,243

35,307

NGL sales

2,139

1,534

6,946

7,880

Total oil and gas revenue

397,561

507,765

1,675,358

1,701,608

Cash settlements on commodity

derivatives

(2,532

)

(4,105

)

(12,488

)

(16,448

)

Realized revenue

$

395,029

$

503,660

$

1,662,870

$

1,685,160

Oil and Gas Production Costs

$

152,692

$

103,800

$

530,514

$

390,097

Sales per Bbl/Mcf/Boe

Average oil sales price per Bbl

$

72.62

$

82.78

$

78.70

$

81.35

Average gas sales price per Mcf

3.59

3.56

3.54

2.57

Average NGL sales price per Bbl

20.18

18.48

20.55

20.61

Average total sales price per Boe

65.80

75.64

71.27

73.80

Cash settlements on commodity derivatives

per Boe

(0.42

)

(0.61

)

(0.53

)

(0.71

)

Realized revenue per Boe

65.38

75.03

70.74

73.09

Oil and gas production costs per

Boe

$

25.27

$

15.46

$

22.57

$

16.92

__________________________________

(1)

Cash settlements on commodity derivatives

are only related to Kosmos and are calculated on a per barrel basis

using Kosmos' Net Oil Volumes Sold.

Kosmos was underlifted by approximately 0.2 million barrels as

of December 31, 2024.

Kosmos Energy Ltd.

Hedging Summary

As of December 31,

2024(1)

(Unaudited)

Weighted Average Price per

Bbl

Index

MBbl

Swap

Floor(2)

Ceiling

2025:

Two-way collars 1H25 (3)

Dated Brent

2,000

$

—

$

70.00

$

85.00

Swaps 1H25

Dated Brent

2,000

75.48

—

—

Two-way collars FY25

Dated Brent

2,000

—

70.00

85.00

Three-way collars FY25

Dated Brent

2,000

—

70.00

85.00

__________________________________

(1)

Please see the Company’s filed 10-K for

additional disclosure on hedging material. Includes hedging

position as of December 31, 2024 and hedges put in place through

filing date.

(2)

“Floor” represents floor price for collars

and strike price for purchased puts.

(3)

We entered into Dated Brent call spread

contracts with a purchased price of $95.00 per barrel and a sold

price of $85.00 per barrel for 2.0 MMBbl, effectively reducing the

ceiling on our 1H25 two-way collars to $85.00 per barrel.

2025 Guidance

1Q 2025

FY 2025 Guidance

Production(1,2,3)

62,000 - 66,000 boe per day

70,000 - 80,000 boe per day

Opex(4)

$23.00 - $25.00 per boe

$18.00 - $20.00 per boe

DD&A

$25.00 - $27.00 per boe

$22.00 - $24.00 per boe

G&A(~65% cash)

~$25 million

$80 - $100 million

Exploration Expense(5)

~$10 million

$25 - $45 million

Net Interest Expense

~$45 million

$180 - $200 million

Tax

$3.00 - $5.00 per boe

$6.00 - $8.00 per boe

Capital Expenditure

$100 - $120 million

<$400 million

__________________________________

Note: Ghana / Equatorial Guinea / Mauritania & Senegal revenue

calculated by number of cargos.

(1)

1Q 2025 net cargo forecast – Ghana: 2

cargos / Equatorial Guinea: 0.5 cargo. FY 2025 Ghana: 11-12 cargos

/ Equatorial Guinea 3.5 cargos. Average cargo sizes 950,000 barrels

of oil.

(2)

1Q 2025 gross cargo forecast - Mauritania

& Senegal: 2 cargos. FY 2025: 20-25 cargos. Average cargo size

~170,000 m3 with Kosmos NRI of ~24%. 1Q 2025 cargo sizes likely

impacted by project commissioning.

(3)

Gulf of America Production: 1Q 2025

forecast 16,500 - 18,500 boe per day. FY 2025: 17,000-20,000 boe

per day. Oil/Gas/NGL split for 2025: ~84%/~10%/~6%.

(4)

FY 2025 opex excludes operating costs

associated with GTA, which are expected to total approximately $225

- $245 million net ($45 - $65 million in 1Q 2025).These values

include cost associated with the FPSO lease which total

approximately $60 million FY 2025 and $15 million 1Q 2025.

(5)

Excludes leasehold impairments and dry

hole costs

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250223860811/en/

Investor Relations Jamie Buckland +44 (0) 203 954 2831

jbuckland@kosmosenergy.com

Media Relations Thomas Golembeski +1-214-445-9674

tgolembeski@kosmosenergy.com

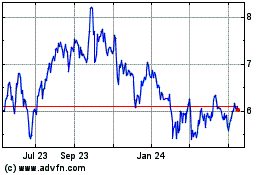

Kosmos Energy (NYSE:KOS)

Historical Stock Chart

From Jan 2025 to Feb 2025

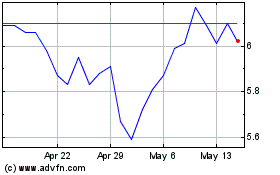

Kosmos Energy (NYSE:KOS)

Historical Stock Chart

From Feb 2024 to Feb 2025