Form SCHEDULE 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

January 28 2025 - 7:37PM

Edgar (US Regulatory)

Exhibit 99.4

January 27, 2025

Board of Directors

Lamb Weston Holdings, Inc.

599 S. Rivershore Lane

Eagle, ID 83616

Board of Directors,

JANA Partners (“JANA,” “we”

or “us”), together with our strategic and operating partners, beneficially owns more than 5% of the outstanding shares of

Lamb Weston Holdings, Inc. (“Lamb Weston” or the “Company”), making us one of the Company’s largest shareholders.

The Board’s recent decision to double down on a broken status quo, after already subjecting shareholders to years of systemic failures

across nearly all key dimensions of operating the business, highlights just how detached the Board is from the urgent need for wholesale

change at Lamb Weston. We are therefore writing to inform the Board of the shareholder feedback we have received and the overwhelming

support for significant Board and leadership change.

Lamb Weston’s earnings report on December

19, 2024 further underscored the urgent need for change at the Company:

| · |

First, Lamb Weston again reported extremely poor financial metrics that were well below expectations. The Company made a significant cut to fiscal 2025 guidance – the latest in a series of recent cuts – resulting in the stock plummeting 20% in one day and now trading near its 52-week low;1 |

| |

|

| · |

Second, the Board’s response to shareholder pressure was to make a long overdue CEO change. But by replacing the CEO with his ‘right hand’ COO, a 17-year veteran and long-time senior Lamb Weston executive, the Board demonstrated its continued failure to recognize the magnitude of changes required at the Company; |

| |

|

| · |

Third, the Board once again opted to shirk accountability for the self-inflicted missteps that have led to substantial share losses, which we believe to be the primary driver of Lamb Weston’s significant volume declines and large performance gap to North American peers (who we believe are operating at higher capacity utilization). After previously trying to blame its self-induced volume losses on restaurant traffic, on the December call the departing CEO once again strained credulity – citing potential future competitor capacity additions to normalize current and ongoing underperformance. After spending billions in shareholder capital to expand capacity and acquire its European joint venture – while at the same time voluntarily walking away from customers – the Company now claims ignorance regarding potential competitor capacity additions, despite their multi-year lead time and evidence to the contrary. The Board’s approval of this disingenuous presentation of the facts – presumably in a bid to save itself from blame – only adds to the damage; |

| |

|

____________________

1 “Lamb reported another in a series of truly bad prints

(typically we might say “soft” or “underwhelming,” but euphemisms don’t suffice today).” (JP Morgan,

12/19/24); “[I]t’s difficult to have much confidence in guidance (management is in the midst of a miss-and-lower run, and

LW has produced some of the worst day-of-print stock performances in the group’s history).” (JP Morgan, 1/7/25).

| · |

The market reaction to these events was so overwhelmingly negative that it prompted one long-tenured analyst to write, “Having missed and lowered guidance 4 times in the past 5 quarters, we too have lost confidence in mgmt's oversight”2 while another seasoned analyst titled his report, “Strategic Change Increasingly Likely.”3 |

Our discussions with investors and other stakeholders

have revealed a staggering level of frustration and loss of confidence in Lamb Weston’s Board and leadership. We summarize below

the feedback from roughly 70% of the top 70 Lamb Weston shareholders who participated in an independent shareholder perception study.

These views – both quantitative and qualitative – loudly echo what investors have told us directly. While the ratings for

nearly all key areas including leadership, operational execution and capital allocation were extremely weak, product quality stood out

in sharp contrast and was nearly a 10 – highlighting how severely the Company has squandered its leading market position and reputation.

Excerpt of Quantitative Feedback from Perception

Study

The extensive qualitative feedback provided by

Lamb Weston shareholders participating in the study paints a similar picture:

| · |

“It's among the worst managed companies in 2024… They've not been proactive, and so maybe it is time to go for the management team and start fresh and try to right the ship.” |

| |

|

| · |

“So, yeah, there's not much for me to say on the board other than I think we need a whole new board to really drive value creation.” |

| |

|

| · |

“They've gone nowhere fast and oftentimes a wholesale change at the top can be the difference maker.” |

___________________

2 TD Cowen, 12/20/24.

3 Barclays, 12/20/24.

| · |

“The board seems to be non-existent… Many of the investors see the C-suite as the biggest hindrance as well as the board. If they're gone, they will have a chance to regroup and then go towards improving their lot and then moving forward. Because right now they seem to be completely floundering.” |

| |

|

| · |

“I think they are probably on the medal platform for worst run company of 2024. That is not a distinction I think you want, but it is one that they have earned, and by a wide margin from our perspective." |

| |

|

Put simply, after more than $6bn4

of value destruction, shareholders are done with ‘business as usual’ and are clamoring for dramatic change at the Company.

If the Board remains unwilling to adopt the necessary Board and leadership changes needed to remediate Lamb Weston’s issues, JANA

is committed to providing shareholders with an alternative to the status quo at the Company’s 2025 Annual Meeting: highly qualified

and engaged new directors who will oversee improved execution and capital allocation and ensure the right leadership team is in place

and is held accountable to investors.

JANA has a multi-decade reputation of working

constructively with boards to drive change and improve performance, and our offer to work constructively with Lamb Weston continues to

stand. We and our team of highly regarded industry executives remain prepared to immediately join the Board and help rehabilitate the

Company and drive long-term value. If, however, the Board remains unwilling to adopt the significant changes needed to repair the Company,

Lamb Weston should pursue a sale transaction.

Sincerely,

Scott Ostfeld

Managing Partner & Portfolio Manager

___________________

4 Based on the change in market cap from market close as of 12/29/23

to market close as of 1/24/25 per Bloomberg.

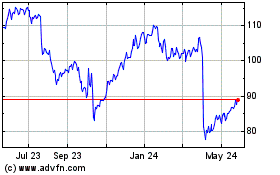

Lamb Weston (NYSE:LW)

Historical Stock Chart

From Feb 2025 to Mar 2025

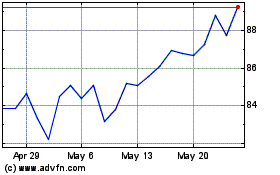

Lamb Weston (NYSE:LW)

Historical Stock Chart

From Mar 2024 to Mar 2025