MISTRAS Group, Inc. (MG: NYSE), a leading "one source"

multinational provider of integrated technology-enabled asset

protection solutions, reported financial results for its fourth

quarter and twelve months ended December 31, 2024.

Highlights of the Fourth Quarter 2024*

- Income from Operations of $10.5 million

- Net income of $5.3 million and

Earnings Per Diluted Share of $0.17

- Adjusted EBITDA of $20.9 million, an increase of

9.2%

- Net Cash from Operations of $25.7 million and Free Cash

Flow of $20.8 million

Highlights of the Full Year 2024*

- Income from Operations of $39.8 million

- Net income of $19.0 million and Earnings Per Diluted

Share of $0.60

- Adjusted EBITDA of $82.5 million, an increase of

25.3%

- Net Cash from Operations of $50.1 million and Free Cash

Flow of $27.1 million

* All comparisons are consolidated and versus the

equivalent prior year period, unless otherwise noted. Please see

the reconciliations of non-GAAP financial measures to the most

directly comparable GAAP measures and additional information about

the non-GAAP financial measures set forth in tables attached to

this press release.

Manny Stamatakis, Executive Chairman of the Board of Directors

commented “I want to reflect on the life of Dr. Sotirios J.

Vahaviolos, the Company’s Founder, Chairman Emeritus, and a

Director on the Board of Directors, given his passing nearly one

month ago on February 6, 2025. On behalf of the Board of Directors

and the entire MISTRAS family I want to express our profound

appreciation for the immeasurable contributions Dr. Vahaviolos made

to our Company, our shareholders, and the communities we serve. A

visionary leader and pioneer in the field of non-destructive

testing (“NDT”) and acoustic emission (“AE”), Dr. Vahaviolos

founded MISTRAS (originally Physical Acoustics Corporation) in

1978, and dedicated over four decades to building the Company into

a global leader in testing, inspection, and asset protection

solutions. His expertise, leadership, and commitment to excellence

were instrumental in shaping the Company’s strategic direction and

fostering a culture of innovation that remains at the core of

MISTRAS today. His legacy will endure and live on as we move

MISTRAS forward in his memory. Our Products and Systems segment,

along with our NDT and AE services will remain essential

competencies at the core of MISTRAS, enabling the Company to

deliver on its overall mission and purpose.”

Mr. Stamatakis continued, “the Company’s consolidated fourth

quarter results exceeded our annual revised guidance, with the

bottom line expanding significantly, demonstrating the margin

accretive actions that we have instituted into our business model.

On a full year basis, revenue was up in all reported segments and

across all of our industries that we serve, illustrating the

increasing diversity of our growing end markets. Adjusted EBITDA

was up over 25% versus the prior year, reflecting significant

improvement in our operating leverage, and our Adjusted EBITDA

margin expanded by 200 basis points over the prior year.

Our income from operations of $39.8 million for the full year

2024 was the highest level for this metric since 2016. I am also

pleased with our fourth consecutive quarter generating Net Income

growth, which was a function of continued annual revenue growth,

gross profit expansion, and selling, general and administrative

expenses (“SG&A”) reduction. I am extremely confident in the

future of MISTRAS, and I will remain involved in overseeing the

strategic path forward for the new invigorated senior leadership

team, led by our new President and Chief Executive Officer, Natalia

Shuman.”

Ms. Shuman commented, “I am honored to be leading MISTRAS into

its next phase of growth, building on our strong foundation and

driving meaningful value for all our stakeholders. I have spent my

first sixty days on the job, actively talking to customers, being

in the field at our In-house Laboratories meeting with employees,

as well as discussing strategy with Manny, the Board of Directors

and other stakeholders. Given the Company’s strong partnerships

with our valuable customers, leading technologies, and committed

management team, which come together to create a solid foundation

that aligns with our long-term vision, I am very excited for our

prospect of continued profitable growth heading into 2025 and

beyond.”

Edward Prajzner, Senior Executive Vice President and Chief

Financial Officer, commented, “due to our improved results and

operating leverage, we generated $25.7 million of operating cash

flow and $20.8 million of free cash flow during the fourth quarter.

We used this cash flow to pay down $20.1 million of bank borrowings

during the fourth quarter, and our bank defined leverage level

dropped to below 2.5X as of December 31, 2024. We continue to fund

our organic growth initiatives, including our investment in capital

expenditures, with our operating cash flow, strengthening our

capabilities and footprint to better support our customers.”

Full year 2024 consolidated revenue was $729.6 million, a 3.4%

increase. Revenue increased in all reported segments and across all

industries served in 2024, led by strong performance in the

Aerospace and Defense industry, which experienced a substantial

revenue increase of 13.0% on a full year basis to $87.0

million.

Full year 2024 gross profit increased to $213.1 million compared

to the prior period, with gross profit margin expanding 30 basis

points. The increase in gross profit margin to 29.2% was primarily

due to the strong growth in our Aerospace and Defense industry

business, which has higher margins.

SG&A for the full year 2024 was $156.4 million, down 6.2%

compared to $166.7 million in 2023, as a result of ongoing cost

calibration discipline. SG&A for the twelve months ended

December 31, 2024 was 21.4% of revenue, a 220 basis point reduction

from the prior year period.

Reorganization and other costs were $5.5 million for full year

2024, compared with $12.3 million in the prior year period. These

costs were incurred to facilitate the Company’s cost containment

and recalibration of our initiatives.

The Company reported net income of $19.0 million, or $0.60 per

diluted share for the year ended December 31, 2024. Full year 2024

net income excluding special items (non-GAAP) was $22.7 million or

$0.72 per diluted share excluding special items (non-GAAP).

Adjusted EBITDA was $82.5 million for the full year 2024

compared to $65.8 million in the prior year period, an increase of

25.3%. The increase in Adjusted EBITDA was primarily attributable

to a favorable business mix and overhead cost containment

initiatives.

Performance by certain segments during the fourth quarter was as

follows:

North America segment fourth quarter 2024

revenue was $136.9 million, down 7.5% from $148.0 million in the

prior year period. The revenue decrease was primarily due to the

anticipated decrease in revenue in the Oil & Gas industry as a

result of a moderate Fall turnaround season in 2024. For the fourth

quarter of 2024, gross profit was $38.9 million, compared to $42.9

million in the prior year period. Gross profit margin was 28.4% for

the fourth quarter of 2024, a 60 basis point decrease from the

prior year period. This decrease in gross profit margin was

primarily due to an unfavorable sale mix.

International segment fourth quarter 2024

revenue was $35.0 million, up 3.6% from $33.8 million in the prior

year period. Our International segment revenue increased each

quarter of 2024 compared to the prior year periods, with an

increase of 9.3% on a full year basis. International segment fourth

quarter 2024 gross profit was $10.1 million, with a gross profit

margin of 29.0%, compared to 27.7% in the prior year period. On a

full year basis, our International segment 2024 gross profit was

$39.8 million, an increase of $6.2 million, or 18.5%, over the

prior year period, with gross profit margin increasing to 29.3% in

2024 from 27.0% in 2023. This 230-basis point increase was

primarily attributable to improved operating leverage and a

favorable business mix.

Products and Systems segment experienced a

strong growth in profitability with a 5.2% increase in revenue to

$13.7 million for full year 2024 compared to $13.0 million in 2023,

and an 840.1% increase in income from operations to $2.5 million in

2024 compared to $0.3 million in 2023. This success was driven by

cost reductions and efficiency improvements.

Cash Flow and Balance Sheet The Company’s net

cash provided by operating activities was $50.1 million for the

full year 2024, compared to $26.7 million in the prior year period.

Free cash flow, a non-GAAP financial measure, was $27.1 million for

full year 2024, compared to $3.1 million in the prior year period.

This increase was primarily attributable to significantly improved

financial results in 2024 and improvements in working capital

management, particularly an accounts receivable reduction despite

the higher level of revenue. Capital expenditures were fairly

consistent year over year, at $23.0 million for full year 2024

compared to $23.6 million in the prior year period. The Company is

continuing to invest in efficiency opportunities including internal

workflow automation, and productivity enhancements.

The Company’s gross debt was $169.6 million as of December 31,

2024, compared to $190.4 million as of December 31, 2023, a

decrease of $20.8 million. The decrease in gross debt year over

year was attributable to the favorable cash flow impacts described

above. The Company’s net debt, a non-GAAP financial measure, was

$151.3 million as of December 31, 2024, compared to $172.8 million

as of December 31, 2023.

2025 OutlookThe Company is not providing full

year guidance for fiscal 2025 at this juncture and will continue to

review its entire portfolio with a focus on continuing to grow

Adjusted EBITDA and earnings per share, and to improve margins.

Additionally, the US Dollar to Euro exchange rate strengthened

since the Company set its budget for 2025, and this unanticipated

foreign exchange translation (“FX”) risk could unfavorably impact

actual revenue translation in 2025. The Company believes this FX

risk will be essentially neutral on Adjusted EBITDA margin and

other profitability metrics. Nevertheless, the Company will be

assessing this FX risk, as well as the potential impact of the

recently announced U.S. foreign tariffs on its business and

financial results for fiscal 2025. Once this evaluation is

complete, the Company anticipates releasing guidance for fiscal

2025, with the goal of driving profitable growth.

Conference Call In connection with this

release, MISTRAS will hold a conference call on March 6, 2025, at

9:00 a.m. (Eastern).To listen to the live webcast of the conference

call, visit the Investor Relations section of MISTRAS’ website at

www.mistrasgroup.com. Individuals wishing to participate may

preregister

at: https://register.vevent.com/register/BIf16da158e8294da5b6ef32a17c5655a8

Upon registering, a dial-in number and unique PIN will be

provided to join the conference call. Following the conference

call, an archived webcast of the event will be available for one

year by visiting the Investor Relations section of MISTRAS’

website.

About MISTRAS Group, Inc. - One Source for Asset

Protection Solutions®MISTRAS Group, Inc. (NYSE: MG) is a

leading "one source" multinational provider of integrated

technology-enabled asset protection solutions, helping to maximize

the safety and operational uptime for civilization’s most critical

industrial and civil assets.

Backed by an innovative, data-driven asset protection portfolio,

proprietary technologies, strong commitment to Environmental,

Social, and Governance (ESG) initiatives, and a decades-long legacy

of industry leadership, MISTRAS leads clients in the oil and gas,

petrochemical, aerospace and defense, industrials, power generation

and transmission (including alternative and renewable energy),

other process industries and infrastructure, research and

engineering and other industries towards achieving and maintaining

operational excellence. By supporting these customers that help

fuel our vehicles and power our society and inspecting components

that are trusted for commercial, defense, and private space MISTRAS

helps the world at large with its asset integrity risk

mitigation.

MISTRAS enhances value for its clients by integrating asset

protection throughout supply chains and centralizing integrity data

through a suite of Industrial Internet of Things -connected digital

software and monitoring solutions. The Company’s core capabilities

also include non-destructive testing field and inspections enhanced

by advanced robotics, laboratory quality control, laboratory

materials services, in-house laboratory assurance testing, sensing

technologies and NDT equipment, asset and mechanical integrity

engineering services, and light mechanical maintenance and access

services.

For more information about how MISTRAS helps protect

civilization’s critical infrastructure and the environment, visit

https://www.mistrasgroup.com/.

MEDIA CONTACT:Nestor S. MakarigakisGroup

Vice-President of Marketing and Communications+1 (609)

716-4000 | marcom@mistrasgroup.com

Forward-Looking and Cautionary

StatementsCertain statements contained in this press

release are "forward-looking statements" within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. Such

forward-looking statements include, but are not limited to, the

impacts of foreign currency exchange risks and recently announced

U.S. foreign tariffs on our business and financial results, costs

savings and other benefits we expect to continue to realize from

our previously announced Project Phoenix initiatives and additional

operational and strategic actions that we expect or seek to take in

furtherance of our strategies and activities to enhance our

financial results and future growth. Such forward-looking

statements relate to MISTRAS' financial results and estimates,

products and services, business model, Project Phoenix initiatives,

operational and strategic initiatives to improve operating

leverage, strategy, growth opportunities, profitability and

competitive position, and other matters. These forward-looking

statements generally use words such as "future," "possible,"

"potential," "targeted," "anticipate," "believe," "estimate,"

"expect," "intend," "plan," "predict," "project," "will," "may,"

"should," "could," "would" and other similar words and phrases.

Such statements are not guarantees of future performance or results

and will not necessarily be accurate indications of the times at,

or by which, such performance or results will be achieved, if at

all. These statements are subject to risks and uncertainties that

could cause actual performance or results to differ materially from

those expressed in these statements. A list, description and

discussion of these and other risks and uncertainties can be found

in the "Risk Factors" section of the Company's 2023 Annual Report

on Form 10-K filed on March 11, 2024, as updated by our reports on

Form 10-Q and Form 8-K. The forward-looking statements are made as

of the date hereof, and MISTRAS undertakes no obligation to update

such statements as a result of new information, future events or

otherwise.

Use of Non-GAAP Financial MeasuresIn addition

to financial information prepared in accordance with generally

accepted accounting principles in the U.S. (GAAP), this press

release also contains adjusted financial measures that are not

prepared in accordance with GAAP and that we believe provide

investors and management with supplemental information relating to

the Company’s operating performance and trends that facilitate

comparisons between periods and with respect to trends and

projected information. The term "Adjusted EBITDA" used in this

release is a financial measure not calculated in accordance with

GAAP and is defined by the Company as net income attributable to

MISTRAS Group, Inc. plus: interest expense, provision for income

taxes, depreciation and amortization, share-based compensation

expense, certain acquisition related costs (including transaction

due diligence costs and adjustments to the fair value of contingent

consideration), foreign exchange (gain) loss, non-cash impairment

charges, reorganization and other costs and, if applicable, certain

additional special items which are noted. A reconciliation of

Adjusted EBITDA to Net Income (Loss) as computed under GAAP is set

forth in a table attached to this press release. The Company also

uses the term “free cash flow”, a non-GAAP financial measure the

Company defines as cash provided by operating activities less

capital expenditures (which is classified as an investing

activity). The Company additionally uses the terms:

“Segment and Total Company Income (Loss) from Operations (GAAP)

to Income (Loss) from Operations before Special Items (non-GAAP)”,

“Net Income (Loss) (GAAP) and Diluted EPS (GAAP) to Net Income

Excluding Special Items (non-GAAP) and Diluted EPS Excluding

Special Items (non-GAAP)” which reconciles the non-GAAP amounts to

the GAAP financial measure. This press release also includes the

term “net debt”, a non-GAAP financial measure which the Company

defines as the sum of the current and long-term portions of long

term debt, less cash and cash equivalents. Reconciliations of these

non-GAAP financial measures to the most directly comparable GAAP

measures are also set forth in tables attached to this press

release. Each of these non-GAAP financial measures has material

limitations as a performance or liquidity measure and should not be

considered alternatives to Net Income (Loss) or any other measures

derived in accordance with GAAP. Because Income (loss) from

operations before special items and other non-GAAP financial

measures used in this press release may not be calculated in the

same manner by all companies, these measures may not be comparable

to other similarly-titled measures used by other companies.

|

Mistras Group, Inc. and

SubsidiariesUnaudited Consolidated Balance

Sheets(in thousands, except share and per

share data) |

| |

| |

December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| ASSETS |

|

|

|

| Current Assets |

|

|

|

|

Cash and cash equivalents |

$ |

18,317 |

|

|

$ |

17,646 |

|

|

Accounts receivable, net |

|

127,281 |

|

|

|

132,847 |

|

|

Inventories |

|

14,485 |

|

|

|

15,283 |

|

|

Prepaid expenses and other current assets |

|

12,387 |

|

|

|

14,580 |

|

|

Total current assets |

|

172,470 |

|

|

|

180,356 |

|

| Property, plant and equipment,

net |

|

80,892 |

|

|

|

80,972 |

|

| Intangible assets, net |

|

39,708 |

|

|

|

43,994 |

|

| Goodwill |

|

181,442 |

|

|

|

187,354 |

|

| Deferred income taxes |

|

6,267 |

|

|

|

2,316 |

|

| Other assets |

|

42,259 |

|

|

|

39,784 |

|

|

Total Assets |

$ |

523,038 |

|

|

$ |

534,776 |

|

| |

|

|

|

| LIABILITIES AND

EQUITY |

|

|

|

| Current Liabilities |

|

|

|

|

Accounts payable |

$ |

11,128 |

|

|

$ |

17,032 |

|

|

Accrued expenses and other current liabilities |

|

85,233 |

|

|

|

84,331 |

|

|

Current portion of long-term debt |

|

11,591 |

|

|

|

8,900 |

|

|

Current portion of finance lease obligations |

|

5,317 |

|

|

|

5,159 |

|

|

Income taxes payable |

|

1,656 |

|

|

|

1,101 |

|

|

Total current liabilities |

|

114,925 |

|

|

|

116,523 |

|

| Long-term debt, net of current

portion |

|

158,056 |

|

|

|

181,499 |

|

| Obligations under finance

leases, net of current portion |

|

15,162 |

|

|

|

11,261 |

|

| Deferred income taxes |

|

1,973 |

|

|

|

2,552 |

|

| Other long-term

liabilities |

|

34,027 |

|

|

|

32,438 |

|

|

Total Liabilities |

$ |

324,143 |

|

|

$ |

344,273 |

|

| |

|

|

|

| Equity |

|

|

|

|

Preferred stock, 10,000,000 shares authorized |

|

— |

|

|

|

— |

|

|

Common stock, $0.01 par value, 200,000,000 shares authorized,

31,010,375 and 30,597,633 shares issued |

|

402 |

|

|

|

305 |

|

|

Additional paid-in capital |

|

250,832 |

|

|

|

247,165 |

|

|

Accumulated Deficit |

|

(9,984 |

) |

|

|

(28,942 |

) |

|

Accumulated other comprehensive loss |

|

(42,682 |

) |

|

|

(28,336 |

) |

|

Total Mistras Group, Inc. stockholders’ equity |

|

198,568 |

|

|

|

190,192 |

|

|

Non-controlling interests |

|

327 |

|

|

|

311 |

|

|

Total Equity |

|

198,895 |

|

|

|

190,503 |

|

|

Total Liabilities and Equity |

$ |

523,038 |

|

|

$ |

534,776 |

|

|

Mistras Group, Inc. and

SubsidiariesUnaudited Consolidated Statements of

Income (Loss)(in thousands, except per share data) |

| |

| |

For the quarter endedDecember

31, |

|

For the year endedDecember

31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

| Revenue |

$ |

172,731 |

|

|

$ |

182,073 |

|

|

$ |

729,640 |

|

|

$ |

705,473 |

|

|

Cost of revenue |

|

115,358 |

|

|

|

122,365 |

|

|

|

492,928 |

|

|

|

477,671 |

|

|

Depreciation |

|

6,047 |

|

|

|

6,081 |

|

|

|

23,603 |

|

|

|

23,995 |

|

| Gross

profit |

|

51,326 |

|

|

|

53,627 |

|

|

|

213,109 |

|

|

|

203,807 |

|

|

Selling, general and administrative expenses |

|

35,289 |

|

|

|

42,914 |

|

|

|

156,388 |

|

|

|

166,749 |

|

|

Reorganization and other costs |

|

2,085 |

|

|

|

6,252 |

|

|

|

5,515 |

|

|

|

12,269 |

|

|

Environmental expense |

|

872 |

|

|

|

— |

|

|

|

1,660 |

|

|

|

— |

|

|

Legal settlement and litigation charges (benefit), net |

|

— |

|

|

|

908 |

|

|

|

(808 |

) |

|

|

1,058 |

|

|

Goodwill impairment charges |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

13,799 |

|

|

Research and engineering |

|

303 |

|

|

|

295 |

|

|

|

1,119 |

|

|

|

1,723 |

|

|

Depreciation and amortization |

|

2,237 |

|

|

|

2,548 |

|

|

|

9,407 |

|

|

|

10,104 |

|

|

Acquisition-related expense, net |

|

1 |

|

|

|

4 |

|

|

|

2 |

|

|

|

9 |

|

| Income (loss) from

operations |

|

10,540 |

|

|

|

706 |

|

|

|

39,826 |

|

|

|

(1,904 |

) |

|

Other income |

|

(6 |

) |

|

|

— |

|

|

|

(1,485 |

) |

|

|

— |

|

|

Interest expense |

|

3,883 |

|

|

|

4,668 |

|

|

|

17,067 |

|

|

|

16,761 |

|

| Income (loss) before

provision (benefit) for income taxes |

|

6,663 |

|

|

|

(3,962 |

) |

|

|

24,244 |

|

|

|

(18,665 |

) |

|

Provision (benefit) for income taxes |

|

1,365 |

|

|

|

(1,449 |

) |

|

|

5,274 |

|

|

|

(1,220 |

) |

| Net income

(loss) |

|

5,298 |

|

|

|

(2,513 |

) |

|

|

18,970 |

|

|

|

(17,445 |

) |

|

Less: net income attributable to noncontrolling interests, net of

taxes |

|

20 |

|

|

|

1 |

|

|

|

12 |

|

|

|

8 |

|

| Net income (loss)

attributable to Mistras Group, Inc. |

$ |

5,278 |

|

|

$ |

(2,514 |

) |

|

$ |

18,958 |

|

|

$ |

(17,453 |

) |

| Earnings (loss) per common

share |

|

|

|

|

|

|

|

|

Basic |

$ |

0.17 |

|

|

$ |

(0.08 |

) |

|

$ |

0.61 |

|

|

$ |

(0.58 |

) |

|

Diluted |

$ |

0.17 |

|

|

$ |

(0.08 |

) |

|

$ |

0.60 |

|

|

$ |

(0.58 |

) |

| Weighted average common shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

31,002 |

|

|

|

30,473 |

|

|

|

30,926 |

|

|

|

30,330 |

|

|

Diluted |

|

31,660 |

|

|

|

30,473 |

|

|

|

31,608 |

|

|

|

30,330 |

|

|

Mistras Group, Inc. and

SubsidiariesUnaudited Operating Data by

Segment(in thousands) |

| |

| |

For the quarter endedDecember

31, |

|

For the year endedDecember

31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

|

|

|

|

|

|

|

| North America |

$ |

136,938 |

|

|

$ |

148,035 |

|

|

$ |

593,527 |

|

|

$ |

579,330 |

|

| International |

|

34,998 |

|

|

|

33,750 |

|

|

|

135,969 |

|

|

|

124,414 |

|

| Products and Systems |

|

3,802 |

|

|

|

3,089 |

|

|

|

13,661 |

|

|

|

12,986 |

|

| Corporate and

eliminations |

|

(3,007 |

) |

|

|

(2,801 |

) |

|

|

(13,517 |

) |

|

|

(11,257 |

) |

|

Total |

$ |

172,731 |

|

|

$ |

182,073 |

|

|

$ |

729,640 |

|

|

$ |

705,473 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

For the quarter endedDecember

31, |

|

For the year endedDecember

31, |

| |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Gross

profit |

|

|

|

|

|

|

|

| North America |

$ |

38,866 |

|

|

$ |

42,872 |

|

|

$ |

165,679 |

|

|

$ |

163,960 |

|

| International |

|

10,145 |

|

|

|

9,363 |

|

|

|

39,812 |

|

|

|

33,610 |

|

| Products and Systems |

|

2,293 |

|

|

|

1,684 |

|

|

|

7,526 |

|

|

|

6,457 |

|

| Corporate and

eliminations |

|

21 |

|

|

|

(294 |

) |

|

|

92 |

|

|

|

(220 |

) |

|

Total |

$ |

51,325 |

|

|

$ |

53,625 |

|

|

$ |

213,109 |

|

|

$ |

203,807 |

|

|

Gross profit as a % of Revenue |

|

29.7 |

% |

|

|

29.5 |

% |

|

|

29.2 |

% |

|

|

28.9 |

% |

|

Mistras Group, Inc. and

SubsidiariesUnaudited Revenues by

Category(in thousands) |

| |

Revenue by industry was as follows:

| Three Months Ended

December 31, 2024 |

North America |

|

International |

|

Products |

|

Corp/Elim |

|

Total |

|

Oil & Gas |

$ |

86,490 |

|

|

$ |

10,474 |

|

|

$ |

35 |

|

|

$ |

— |

|

|

$ |

96,999 |

|

| Aerospace & Defense |

|

14,959 |

|

|

|

5,693 |

|

|

|

20 |

|

|

|

— |

|

|

|

20,672 |

|

| Industrials |

|

11,263 |

|

|

|

7,018 |

|

|

|

379 |

|

|

|

— |

|

|

|

18,660 |

|

| Power Generation &

Transmission |

|

8,082 |

|

|

|

1,612 |

|

|

|

285 |

|

|

|

— |

|

|

|

9,979 |

|

| Other Process Industries |

|

6,221 |

|

|

|

4,853 |

|

|

|

147 |

|

|

|

— |

|

|

|

11,221 |

|

| Infrastructure, Research &

Engineering |

|

4,869 |

|

|

|

2,844 |

|

|

|

1,499 |

|

|

|

— |

|

|

|

9,212 |

|

| Petrochemical |

|

2,970 |

|

|

|

234 |

|

|

|

— |

|

|

|

— |

|

|

|

3,204 |

|

| Other |

|

2,084 |

|

|

|

2,270 |

|

|

|

1,437 |

|

|

|

(3,007 |

) |

|

|

2,784 |

|

|

Total |

$ |

136,938 |

|

|

$ |

34,998 |

|

|

$ |

3,802 |

|

|

$ |

(3,007 |

) |

|

$ |

172,731 |

|

| Three Months Ended

December 31, 2023 |

North America |

|

International |

|

Products |

|

Corp/Elim |

|

Total |

|

Oil & Gas |

$ |

97,558 |

|

|

$ |

10,324 |

|

|

$ |

72 |

|

|

$ |

— |

|

|

$ |

107,954 |

|

| Aerospace & Defense |

|

14,484 |

|

|

|

4,817 |

|

|

|

11 |

|

|

|

— |

|

|

|

19,312 |

|

| Industrials |

|

11,825 |

|

|

|

8,018 |

|

|

|

437 |

|

|

|

— |

|

|

|

20,280 |

|

| Power Generation &

Transmission |

|

5,764 |

|

|

|

1,769 |

|

|

|

578 |

|

|

|

— |

|

|

|

8,111 |

|

| Other Process Industries |

|

8,129 |

|

|

|

3,889 |

|

|

|

39 |

|

|

|

— |

|

|

|

12,057 |

|

| Infrastructure, Research &

Engineering |

|

3,924 |

|

|

|

2,773 |

|

|

|

409 |

|

|

|

— |

|

|

|

7,106 |

|

| Petrochemical |

|

3,189 |

|

|

|

329 |

|

|

|

— |

|

|

|

— |

|

|

|

3,518 |

|

| Other |

|

3,162 |

|

|

|

1,831 |

|

|

|

1,543 |

|

|

|

(2,801 |

) |

|

|

3,735 |

|

|

Total |

$ |

148,035 |

|

|

$ |

33,750 |

|

|

$ |

3,089 |

|

|

$ |

(2,801 |

) |

|

$ |

182,073 |

|

| Year ended December

31, 2024 |

North America |

|

International |

|

Products |

|

Corp/Elim |

|

Total |

|

Oil & Gas |

$ |

376,333 |

|

|

$ |

42,315 |

|

|

$ |

275 |

|

|

$ |

— |

|

|

$ |

418,923 |

|

| Aerospace & Defense |

|

63,111 |

|

|

|

23,785 |

|

|

|

120 |

|

|

|

— |

|

|

|

87,016 |

|

| Industrials |

|

44,310 |

|

|

|

25,498 |

|

|

|

1,857 |

|

|

|

— |

|

|

|

71,665 |

|

| Power Generation and

Transmission |

|

27,035 |

|

|

|

7,629 |

|

|

|

1,854 |

|

|

|

— |

|

|

|

36,518 |

|

| Other Process Industries |

|

32,353 |

|

|

|

17,190 |

|

|

|

302 |

|

|

|

— |

|

|

|

49,845 |

|

| Infrastructure, Research &

Engineering |

|

19,155 |

|

|

|

10,606 |

|

|

|

3,400 |

|

|

|

— |

|

|

|

33,161 |

|

| Petrochemical |

|

14,437 |

|

|

|

1,134 |

|

|

|

— |

|

|

|

— |

|

|

|

15,571 |

|

| Other |

|

16,793 |

|

|

|

7,812 |

|

|

|

5,853 |

|

|

|

(13,517 |

) |

|

|

16,941 |

|

|

Total |

$ |

593,527 |

|

|

$ |

135,969 |

|

|

$ |

13,661 |

|

|

$ |

(13,517 |

) |

|

$ |

729,640 |

|

| |

|

|

|

|

|

|

|

|

|

| Year ended December

31, 2023 |

North America |

|

International |

|

Products |

|

Corp/Elim |

|

Total |

|

Oil & Gas |

$ |

379,221 |

|

|

$ |

36,615 |

|

|

$ |

159 |

|

|

$ |

— |

|

|

$ |

415,995 |

|

| Aerospace & Defense |

|

56,000 |

|

|

|

20,711 |

|

|

|

286 |

|

|

|

— |

|

|

|

76,997 |

|

| Industrials |

|

42,518 |

|

|

|

26,292 |

|

|

|

1,773 |

|

|

|

— |

|

|

|

70,583 |

|

| Power Generation and

Transmission |

|

23,598 |

|

|

|

6,609 |

|

|

|

3,767 |

|

|

|

— |

|

|

|

33,974 |

|

| Other Process Industries |

|

33,035 |

|

|

|

14,456 |

|

|

|

112 |

|

|

|

— |

|

|

|

47,603 |

|

| Infrastructure, Research &

Engineering |

|

16,620 |

|

|

|

9,320 |

|

|

|

3,168 |

|

|

|

— |

|

|

|

29,108 |

|

| Petrochemical |

|

13,216 |

|

|

|

1,216 |

|

|

|

— |

|

|

|

— |

|

|

|

14,432 |

|

| Other |

|

15,122 |

|

|

|

9,195 |

|

|

|

3,721 |

|

|

|

(11,257 |

) |

|

|

16,781 |

|

|

Total |

$ |

579,330 |

|

|

$ |

124,414 |

|

|

$ |

12,986 |

|

|

$ |

(11,257 |

) |

|

$ |

705,473 |

|

|

Mistras Group, Inc. and

SubsidiariesUnaudited Revenues by Category

(continued)(in thousands) |

| |

Revenue by Oil & Gas Sub-category was as follows:

| |

For the quarter ended December 31, |

|

Year ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Oil and Gas Revenue by

sub-category |

|

|

|

|

|

|

|

|

Upstream |

$ |

39,790 |

|

|

$ |

40,887 |

|

|

$ |

167,741 |

|

|

$ |

157,828 |

|

|

Midstream |

|

20,401 |

|

|

|

26,539 |

|

|

|

88,630 |

|

|

|

101,278 |

|

|

Downstream |

|

36,808 |

|

|

|

40,528 |

|

|

|

162,552 |

|

|

|

156,889 |

|

|

Total |

$ |

96,999 |

|

|

$ |

107,954 |

|

|

$ |

418,923 |

|

|

$ |

415,995 |

|

|

|

Consolidated Revenue by type was as follows:

| |

For the quarter ended December 31, |

|

For the year ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

| Field Services |

$ |

114,681 |

|

|

$ |

121,932 |

|

|

$ |

502,810 |

|

|

$ |

470,433 |

|

| Shop Laboratories |

|

15,417 |

|

|

|

15,972 |

|

|

|

64,564 |

|

|

|

58,188 |

|

| Data Analytical Solutions |

|

17,353 |

|

|

|

19,542 |

|

|

|

69,152 |

|

|

|

72,457 |

|

| Other |

|

25,280 |

|

|

|

24,627 |

|

|

|

93,114 |

|

|

|

104,394 |

|

|

Total |

$ |

172,731 |

|

|

$ |

182,073 |

|

|

$ |

729,640 |

|

|

$ |

705,472 |

|

|

Mistras Group, Inc. and

SubsidiariesUnaudited Reconciliation

ofSegment and Total Company Income (Loss) from

Operations (GAAP) to Income (Loss) from Operations before

Special Items (non-GAAP)(in thousands) |

| |

| |

For the quarter endedDecember

31, |

|

For the year

endedDecember 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| North

America: |

|

|

|

|

|

|

|

|

Income from operations (GAAP) |

$ |

12,544 |

|

|

$ |

15,451 |

|

|

$ |

62,286 |

|

|

$ |

55,170 |

|

|

Reorganization and other costs |

|

1,119 |

|

|

|

386 |

|

|

|

2,046 |

|

|

|

960 |

|

|

Legal settlement and insurance (recoveries) charges, net |

|

— |

|

|

|

908 |

|

|

|

(808 |

) |

|

|

1,058 |

|

|

Income before special items (unaudited, non-GAAP) |

$ |

13,663 |

|

|

$ |

16,745 |

|

|

$ |

63,524 |

|

|

$ |

57,188 |

|

| |

|

|

|

|

|

|

|

|

International: |

|

|

|

|

|

|

|

|

Income (loss) from operations (GAAP) |

$ |

1,727 |

|

|

$ |

802 |

|

|

$ |

6,275 |

|

|

$ |

(12,229 |

) |

|

Goodwill Impairment charges |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

13,799 |

|

|

Reorganization and other costs |

|

676 |

|

|

|

123 |

|

|

|

1,086 |

|

|

|

351 |

|

|

Income before special items (unaudited, non-GAAP) |

$ |

2,403 |

|

|

$ |

925 |

|

|

$ |

7,361 |

|

|

$ |

1,921 |

|

| |

|

|

|

|

|

|

|

| Products and

Systems: |

|

|

|

|

|

|

|

|

Income from operations (GAAP) |

$ |

1,031 |

|

|

$ |

345 |

|

|

$ |

2,510 |

|

|

$ |

267 |

|

|

Reorganization and other costs |

|

— |

|

|

|

193 |

|

|

|

184 |

|

|

|

382 |

|

|

Income before special items (unaudited, non-GAAP) |

$ |

1,031 |

|

|

$ |

538 |

|

|

$ |

2,694 |

|

|

$ |

649 |

|

| |

|

|

|

|

|

|

|

| Corporate and

Eliminations: |

|

|

|

|

|

|

|

|

Loss from operations (GAAP) |

$ |

(4,762 |

) |

|

$ |

(15,892 |

) |

|

$ |

(31,245 |

) |

|

$ |

(45,112 |

) |

|

Environmental expense |

|

872 |

|

|

|

— |

|

|

|

1,660 |

|

|

|

— |

|

|

Reorganization and other costs |

|

290 |

|

|

|

5,550 |

|

|

|

2,199 |

|

|

|

10,576 |

|

|

Acquisition-related expense, net |

|

2 |

|

|

|

4 |

|

|

|

2 |

|

|

|

9 |

|

|

Loss before special items (unaudited, non-GAAP) |

$ |

(3,598 |

) |

|

$ |

(10,338 |

) |

|

$ |

(27,384 |

) |

|

$ |

(34,527 |

) |

| |

|

|

|

|

|

|

|

| Total

Company |

|

|

|

|

|

|

|

|

Income (loss) from operations (GAAP) |

$ |

10,540 |

|

|

$ |

706 |

|

|

$ |

39,826 |

|

|

$ |

(1,904 |

) |

|

Goodwill Impairment charges |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

13,799 |

|

|

Reorganization and other costs |

|

2,085 |

|

|

|

6,252 |

|

|

|

5,515 |

|

|

|

12,269 |

|

|

Legal settlement and insurance (recoveries) charges, net |

|

— |

|

|

|

908 |

|

|

|

(808 |

) |

|

|

1,058 |

|

|

Environmental expense |

|

872 |

|

|

|

— |

|

|

|

1,660 |

|

|

|

— |

|

|

Acquisition-related expense, net |

|

1 |

|

|

|

4 |

|

|

|

2 |

|

|

|

9 |

|

|

Income before special items (unaudited, non-GAAP) |

$ |

13,498 |

|

|

$ |

7,870 |

|

|

$ |

46,195 |

|

|

$ |

25,231 |

|

|

Mistras Group, Inc. and SubsidiariesUnaudited

Summary Cash Flow Information(in thousands) |

| |

| |

For the quarter endedDecember

31, |

|

For the year endedDecember

31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net cash provided by (used

in): |

|

|

|

|

|

|

|

|

Operating activities |

$ |

25,658 |

|

|

$ |

16,064 |

|

|

$ |

50,129 |

|

|

$ |

26,748 |

|

|

Investing activities |

|

(4,214 |

) |

|

|

(6,963 |

) |

|

|

(21,366 |

) |

|

|

(22,133 |

) |

|

Financing activities |

|

(21,151 |

) |

|

|

(5,867 |

) |

|

|

(27,398 |

) |

|

|

(7,706 |

) |

| Effect of exchange rate

changes on cash |

|

(2,336 |

) |

|

|

1,660 |

|

|

|

(694 |

) |

|

|

249 |

|

| Net change in cash and cash

equivalents |

$ |

(2,043 |

) |

|

$ |

4,894 |

|

|

$ |

671 |

|

|

$ |

(2,842 |

) |

|

Mistras Group, Inc. and

SubsidiariesUnaudited Reconciliation of

Net Cash Provided by Operating Activities (GAAP) to Free

Cash Flow (non-GAAP)(in thousands) |

| |

| |

For the quarter endedDecember

31, |

|

For the year endedDecember

31, |

| |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

| Net cash provided by

operating activities (GAAP) |

$ |

25,658 |

|

|

$ |

16,064 |

|

|

$ |

50,129 |

|

|

$ |

26,748 |

|

| Less: |

|

|

|

|

|

|

|

|

Purchases of property, plant and equipment |

|

(3,587 |

) |

|

|

(6,451 |

) |

|

|

(17,902 |

) |

|

|

(20,854 |

) |

|

Purchases of intangible assets |

|

(1,252 |

) |

|

|

(927 |

) |

|

|

(5,084 |

) |

|

|

(2,795 |

) |

| Free cash flow

(non-GAAP) |

$ |

20,819 |

|

|

$ |

8,686 |

|

|

$ |

27,143 |

|

|

$ |

3,099 |

|

|

Mistras Group, Inc. and

SubsidiariesUnaudited Reconciliation of

Gross Debt (GAAP) to Net Debt (non-GAAP)(in

thousands) |

| |

| |

For the year

endedDecember 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

| Current portion of long-term

debt |

$ |

11,591 |

|

|

$ |

8,900 |

|

| Long-term debt, net of current

portion |

|

158,056 |

|

|

|

181,499 |

|

| Total Gross Debt

(GAAP) |

|

169,647 |

|

|

|

190,399 |

|

| Less: Cash and cash

equivalents |

|

(18,317 |

) |

|

|

(17,646 |

) |

| Total Net Debt

(non-GAAP) |

$ |

151,330 |

|

|

$ |

172,753 |

|

|

Mistras Group, Inc. and

SubsidiariesUnaudited Reconciliation

ofNet Income (Loss) (GAAP) to Adjusted EBITDA

(non-GAAP)(in thousands) |

| |

| |

For the quarter endedDecember

31, |

|

For the year

endedDecember 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

| Net income

(loss) |

$ |

5,298 |

|

|

$ |

(2,513 |

) |

|

|

18,970 |

|

|

$ |

(17,445 |

) |

|

Less: Net income attributable to noncontrolling interests, net of

taxes |

|

20 |

|

|

|

1 |

|

|

|

12 |

|

|

|

8 |

|

| Net income (loss)

attributable to Mistras Group, Inc. |

$ |

5,278 |

|

|

$ |

(2,514 |

) |

|

$ |

18,958 |

|

|

$ |

(17,453 |

) |

|

Interest expense |

|

3,883 |

|

|

|

4,668 |

|

|

|

17,067 |

|

|

|

16,761 |

|

|

Provision (benefit) for income taxes |

|

1,365 |

|

|

|

(1,449 |

) |

|

|

5,274 |

|

|

|

(1,220 |

) |

|

Depreciation and amortization |

|

8,284 |

|

|

|

8,629 |

|

|

|

33,010 |

|

|

|

34,099 |

|

|

Share-based compensation expense |

|

957 |

|

|

|

1,498 |

|

|

|

5,071 |

|

|

|

5,147 |

|

|

Goodwill Impairment charges |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

13,799 |

|

|

Reorganization and other related costs, net |

|

2,085 |

|

|

|

6,252 |

|

|

|

5,515 |

|

|

|

12,269 |

|

|

Legal settlement and insurance recoveries, net |

|

— |

|

|

|

908 |

|

|

|

(808 |

) |

|

|

1,058 |

|

|

Acquisition-related expense, net |

|

1 |

|

|

|

4 |

|

|

|

2 |

|

|

|

9 |

|

|

Environmental expense |

|

872 |

|

|

|

— |

|

|

|

1,660 |

|

|

|

— |

|

|

Other Income |

|

(6 |

) |

|

|

— |

|

|

|

(1,485 |

) |

|

|

— |

|

|

Foreign exchange (gain) loss |

|

(1,784 |

) |

|

|

1,182 |

|

|

|

(1,807 |

) |

|

|

1,331 |

|

| Adjusted

EBITDA |

$ |

20,935 |

|

|

$ |

19,178 |

|

|

$ |

82,457 |

|

|

$ |

65,800 |

|

|

Mistras Group, Inc. and

SubsidiariesUnaudited Reconciliation

ofNet Income (Loss) (GAAP) and Diluted EPS (GAAP)

to Net Income Excluding Special Items (non-GAAP)

and Diluted EPS Excluding Special Items

(non-GAAP)(tabular dollars in thousands, except per share

data) |

| |

| |

For the quarter ended December 31, |

|

For the year ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net income (loss)

attributable to Mistras Group, Inc. (GAAP) |

$ |

5,278 |

|

|

$ |

(2,514 |

) |

|

$ |

18,958 |

|

|

$ |

(17,453 |

) |

|

Other Income |

|

(6 |

) |

|

|

— |

|

|

|

(1,485 |

) |

|

|

— |

|

|

Goodwill Impairment charges |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

13,799 |

|

|

Reorganization and other related costs, net |

|

2,085 |

|

|

|

6,252 |

|

|

|

5,515 |

|

|

|

12,269 |

|

|

Environmental Expense |

|

872 |

|

|

|

— |

|

|

|

1,660 |

|

|

|

— |

|

|

Legal settlement and insurance recoveries, net |

|

— |

|

|

|

908 |

|

|

|

(808 |

) |

|

|

1,058 |

|

|

Acquisition-related expense, net |

|

1 |

|

|

|

4 |

|

|

|

2 |

|

|

|

9 |

|

|

Special items total |

|

2,952 |

|

|

|

7,164 |

|

|

|

4,884 |

|

|

|

27,135 |

|

|

Tax impact on special items |

|

(704 |

) |

|

|

(1,787 |

) |

|

|

(1,168 |

) |

|

|

(3,256 |

) |

|

Special items, net of tax |

$ |

2,248 |

|

|

$ |

5,377 |

|

|

$ |

3,716 |

|

|

$ |

23,879 |

|

| Net income

attributable to Mistras Group, Inc. Excluding Special Items

(non-GAAP) |

$ |

7,526 |

|

|

$ |

2,863 |

|

|

$ |

22,674 |

|

|

$ |

6,426 |

|

| |

|

|

|

|

|

|

|

| Diluted EPS

(GAAP) |

$ |

0.17 |

|

|

$ |

(0.08 |

) |

|

$ |

0.60 |

|

|

$ |

(0.58 |

) |

|

Special items, net of tax |

|

0.07 |

|

|

|

0.18 |

|

|

|

0.12 |

|

|

|

0.79 |

|

| Diluted EPS Excluding

Special Items (non-GAAP) |

$ |

0.24 |

|

|

$ |

0.10 |

|

|

$ |

0.72 |

|

|

$ |

0.21 |

|

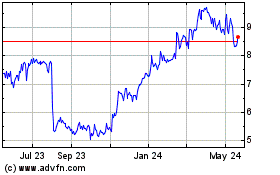

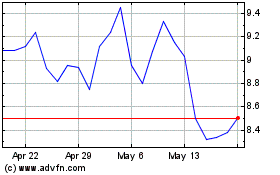

Mistras (NYSE:MG)

Historical Stock Chart

From Feb 2025 to Mar 2025

Mistras (NYSE:MG)

Historical Stock Chart

From Mar 2024 to Mar 2025