Medical Properties Trust Announces Prospect’s Binding Agreement to Sell Managed Care Business to Astrana Health

November 08 2024 - 7:08AM

Business Wire

MPT Expects Approximately $200 Million in

Cash Proceeds

Astrana Health, a leading provider-centric healthcare company

based in California, entered into a binding agreement on November 8

to purchase the majority of Prospect’s managed care platform for

approximately $745 million and the assumption of certain

liabilities. After satisfaction of obligations to the managed care

platform’s senior creditor and other liabilities, MPT expects to

receive approximately $200 million in total proceeds. The majority

of this cash is expected to be received in the first half of 2025,

while a $50 million payment is expected by 2027. The transaction

remains subject to regulatory approval and other closing

conditions.

About Medical Properties Trust, Inc.

Medical Properties Trust, Inc. is a self-advised real estate

investment trust formed in 2003 to acquire and develop net-leased

hospital facilities. From its inception in Birmingham, Alabama, the

Company has grown to become one of the world’s largest owners of

hospital real estate with 402 facilities and approximately 40,000

licensed beds in nine countries and across three continents as of

September 30, 2024. MPT’s financing model facilitates acquisitions

and recapitalizations and allows operators of hospitals to unlock

the value of their real estate assets to fund facility

improvements, technology upgrades and other investments in

operations. For more information, please visit the Company’s

website at www.medicalpropertiestrust.com.

Forward-Looking Statements

This press release includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements can generally be identified by

the use of forward-looking words such as “may”, “will”, “would”,

“could”, “expect”, “intend”, “plan”, “estimate”, “target”,

“anticipate”, “believe”, “objectives”, “outlook”, “guidance” or

other similar words, and include statements regarding our

strategies, objectives, asset sales and other liquidity

transactions (including the use of proceeds thereof), expected

re-tenanting of vacant facilities and any related regulatory

approvals, expected outcomes from Steward’s Chapter 11

restructuring process, and the terms of the agreement described in

this press release. Forward-looking statements involve known and

unknown risks and uncertainties that may cause our actual results

or future events to differ materially from those expressed in or

underlying such forward-looking statements, including, but not

limited to: (i) the risk that the outcome and terms of the

bankruptcy restructuring of Steward will not be consistent with

those anticipated by the Company; (ii) the risk that the Company is

unable to successfully re-tenant the Steward portfolio hospitals,

on the terms described herein or at all; (iii) the risk that

previously announced or contemplated property sales, loan

repayments, and other capital recycling transactions do not occur

as anticipated or at all; (iv) the risk that MPT is not able to

attain its leverage, liquidity and cost of capital objectives

within a reasonable time period or at all; (v) MPT’s ability to

obtain debt financing on attractive terms or at all, as a result of

changes in interest rates and other factors, which may adversely

impact its ability to pay down, refinance, restructure or extend

its indebtedness as it becomes due, or pursue acquisition and

development opportunities; (vi) the ability of our tenants,

operators and borrowers to satisfy their obligations under their

respective contractual arrangements with us; (vii) the ability of

our tenants and operators to operate profitably and generate

positive cash flow, remain solvent, comply with applicable laws,

rules and regulations in the operation of our properties, to

deliver high-quality services, to attract and retain qualified

personnel and to attract patients; (viii) the risk that we are

unable to monetize our investments in certain tenants at full value

within a reasonable time period or at all, (ix) our success in

implementing our business strategy and our ability to identify,

underwrite, finance, consummate and integrate acquisitions and

investments; and (x) the risks and uncertainties of litigation or

other regulatory proceedings.

The risks described above are not exhaustive and additional

factors could adversely affect our business and financial

performance, including the risk factors discussed under the section

captioned “Risk Factors” in our most recent Annual Report on Form

10-K and our Form 10-Q, and as may be updated in our other filings

with the SEC. Forward-looking statements are inherently uncertain

and actual performance or outcomes may vary materially from any

forward-looking statements and the assumptions on which those

statements are based. Readers are cautioned to not place undue

reliance on forward-looking statements as predictions of future

events. We disclaim any responsibility to update such

forward-looking statements, which speak only as of the date on

which they were made.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241108666805/en/

Drew Babin, CFA, CMA Head of Financial Strategy and Investor

Relations Medical Properties Trust, Inc. (646) 884-9809

dbabin@medicalpropertiestrust.com

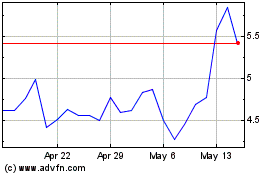

Medical Properties (NYSE:MPW)

Historical Stock Chart

From Oct 2024 to Nov 2024

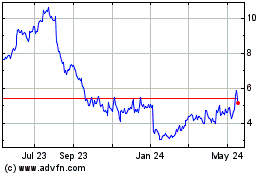

Medical Properties (NYSE:MPW)

Historical Stock Chart

From Nov 2023 to Nov 2024