McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is

pleased to provide new assay results from the Grey Fox deposit,

part of our Fox Complex. The results in

Table 1

demonstrate intriguing explorations targets at depth and attractive

near surface gold grades with potential to be recovered utilizing

lower cost open pit mining methods.

Gold at Grey Fox has

been found in multiple zones, including Gibson, Whiskey-Jack, 147

and Grey Fox South (GFS). The current resource estimate for Grey

Fox is 1,168,000 oz gold at a grade of

4.80 g/t Au Indicated and 236,000 oz

gold at 4.35 g/t Au Inferred. An updated

resource estimate will be completed in late September. Much of the

drilling performed in 2023 and continuing into 2024 was focused on

increasing the existing resource in addition to identifying new

mineralized horizons.

Geological

interpretations suggest that Grey Fox sits stratigraphically above

the mineralization of the Black Fox & Froome mines.

Consequently, there is potential for deeper Black Fox & Froome

style mineralization directly below some of the Grey Fox zones.

Historical production from these two mines is more than

1,000,000 oz gold.

Figure

1 shows the location of the Grey Fox zones relative to the

Black Fox and Froome mines, on the same large property, separated

by approximately 3 kilometers (1.9 miles). There has been

limited drilling between Black Fox and Grey Fox, despite historical

drill results that indicate similar rock types associated with the

A1 Fault, the principal structure that controls the mineralization

at Black Fox.

Gibson

Zone

The Gibson zone has a

history that made it an obvious target. A bulk sample taken in 1989

had historical documentation suggesting an average gold grade in

excess of 27 g/t Au. Results from our recent

drilling have established Gibson as a high priority target. The

Gibson zone consists primarily of a syenite intrusion with

sediments lying to the East (see Figure 2). This

geological setting is similar to the Young-Davidson Mine, which has

estimated gold reserves of about

3,300,000 oz gold at a grade of

2.3 g/t Au. This mine is located about 100

kilometers (62 miles) southwest of Grey Fox.

In Figure

2 we illustrate some of the newly received drill

intercepts at Gibson, which are conveniently located close to

surface and close to the historical ramp used to take the bulk

sample (e.g., 22GF-1366: 8.8 g/t Au over

3.9 m and 24GF-1397: 17.4 g/t

Au over 4.2 m). In addition, these

results demonstrate the potential for higher grading mineralization

within the current resource.

We have just commenced

an aggressive follow-up infill program at Gibson, designed to

identify near-term mineralization. Figure 3 shows

the first two holes (24GF-1452 and 24GF-1453; assays pending) for

this program, drilled in proximity to the Gibson Ramp. Both

drillholes have multiple occurrences of visible gold (VG). Much of

the VG is associated with existing mineralized lenses, indicating

the current resource model is performing well, i.e., the

mineralization is being intersected where it is anticipated to be

present.

Earlier drilling in

the sediments to the east of the Gibson syenite also generated

attractive assay results (e.g., 21GF-1333: 5.6 g/t

Au over 10.2 m from 386 m to 403.6 m

downhole, at 365 m elevation), which shows the possible extension

of favorable mineralization. In addition, limited recent deep

drilling at Gibson showed evidence for mineralization at depths

greater than 600 m (e.g., 23GF-1389: 4.4 g/t Au

over 5.9 m within the Gibson syenite), indicating

the resource growth potential for the Grey Fox area. Many of the

intercepts reported for the Gibson zone are also open in most

directions, including at depth.

Whiskey-Jack,

GFS & 147 Zones

The Whiskey-Jack zone

is the highest grading portion of the Grey Fox deposit, with

current Indicated resource of approximately 80,000 oz

gold at a grade of 7.0 g/t Au and an

Inferred resource of approximately

43,000 oz gold at a grade of

6.1 g/t Au. Located at the NW corner of the

current Grey Fox resource, it is associated with a local NW bend in

the stratigraphy controlled by the A1 splay fault (see

Figure 2). The A1 fault is interpreted to extend

from Black Fox south to Grey Fox and may mark the boundary between

shallow Grey Fox style mineralization and deeper-seated Black Fox

style mineralization. A regional exploration campaign is currently

underway at Grey Fox to test for this deeper style of

mineralization East of the A1 fault and to verify historical

drilling, which indicated mineralization in that area that could

extend northwest back to Black Fox.

Geological

interpretations suggests that the mineralization at Whiskey-Jack

extends from less than 50 m below surface down to a depth of at

least 275 m and remains open at depth.

Two other targets are

the GFS and 147 zones, located near the Southern edge of the

Grey Fox deposit. Figure 2 shows the

locations of the newly received intercepts for both zones. The

better gold grades and intercept widths are generally located

within the north-south oriented variolitic mafic volcanics (e.g.,

24GF-1426: 586.7 g/t Au over 0.5

m and 24GF-1424: 14.3 g/t Au

over 5.0 m). This is likely due to their

enrichment in iron, which is a more favorable host rock and is a

high priority target at GFS. The very high-grade value seen in

24GF-1426 also warrants additional follow-up drilling.

Mineralization at GFS also begins at shallow depths (less than 50

m) and thus is amenable to open pit mining methods. The following

features make Grey Fox a strong candidate for open pit mining:

- The gold grades

are above average for an open pit mine;

- Relatively

shallow overburden;

- Much of the gold

mineralization identified starts at less than 50 m below surface

with the majority of the current resources less than 300 m below

surface;

- Much of the

mineralization is hosted in sub-parallel ‘stacked’ lenses located

in proximity to each other with a steep (approx. 70°) dip, which

means they are ideal for surface mining, e.g., more optimal

blasting patterns and less dilution, with a potentially low strip

ratio.

An active exploration

program will continue throughout the year and into 2025.

Figure 1 –

Surface Plan View of the Geology for the Black Fox and Grey Fox

Deposits

Figure 2 – Plan

View Map for the Grey Fox Area With Highlighted Assay

Intercepts

Figure 3 –

Mineralization in Proximity of the Historical Gibson Ramp (Cross

Section Looking North-East)

Table 1 –

Highlights of Recent Drill Intercepts From the Grey Fox Exploration

Program

|

Hole ID |

From(m) |

To(m) |

CoreLength(m) |

TrueWidth(m) |

True Width(ft) |

Au Uncapped (g/t) |

Au x

TWUncapped(GxM) |

|

21GF-1333* |

386.0 |

403.6 |

17.6 |

12.1 |

39.7 |

5.6 |

68.1 |

|

22GF-1366 |

151.8 |

157.4 |

5.7 |

3.9 |

12.8 |

8.8 |

34.5 |

|

And |

265.0 |

266.0 |

1.0 |

0.7 |

2.3 |

18.8 |

13.1 |

|

22GF-1372 |

229.1 |

231.0 |

1.9 |

1.2 |

3.9 |

7.3 |

8.4 |

|

23GF-1382 |

94.0 |

97.0 |

3.0 |

2.6 |

8.5 |

4.1 |

10.7 |

|

And |

276.5 |

279.0 |

2.5 |

2.2 |

7.2 |

10.2 |

22.2 |

|

And |

585.0 |

590.0 |

5.0 |

4.5 |

14.8 |

3.5 |

15.7 |

|

23GF-1389 |

714.0 |

722.0 |

8.0 |

5.8 |

19.0 |

4.4 |

25.7 |

|

23GF-1393 |

73.9 |

76.2 |

2.4 |

1.9 |

6.2 |

13.5 |

25.6 |

|

And |

216.0 |

216.6 |

0.6 |

0.5 |

1.6 |

17.1 |

8.4 |

|

And |

649.0 |

650.0 |

1.0 |

0.8 |

2.6 |

18.2 |

15.3 |

|

23GF-1394 |

375.6 |

378.0 |

2.4 |

2.0 |

6.6 |

6.4 |

12.8 |

|

And |

563.0 |

576.7 |

13.7 |

11.8 |

38.7 |

2.8 |

33.2 |

|

And |

590.0 |

597.0 |

7.0 |

2.3 |

7.5 |

8.2 |

18.8 |

|

23GF-1395 |

612.0 |

615.0 |

3.0 |

2.4 |

7.9 |

7.2 |

17.4 |

|

24GF-1397 |

151.0 |

157.0 |

6.0 |

4.2 |

13.8 |

17.4 |

73.1 |

|

24GF-1402 |

189.0 |

191.0 |

2.0 |

1.3 |

4.3 |

7.7 |

9.9 |

|

24GF-1407 |

316.9 |

322.2 |

5.3 |

1.2 |

3.9 |

10.3 |

12.6 |

|

24GF-1420 |

280.0 |

286.5 |

6.4 |

5.0 |

16.4 |

4.1 |

20.7 |

|

24GF-1424 |

95.0 |

101.4 |

6.4 |

5.0 |

16.4 |

14.3 |

71.4 |

|

24GF-1426 |

200.3 |

200.9 |

0.7 |

0.5 |

1.6 |

586.7 |

274.1 |

|

24GF-1436 |

187.0 |

190.2 |

3.2 |

2.3 |

7.5 |

4.1 |

9.3 |

* - Previously

reported drill results

Technical Information

Technical information pertaining to the Fox

Complex exploration contained in this news release has been

prepared under the supervision of Sean Farrell, P.Geo., Chief

Exploration Geologist, who is a Qualified Person as defined by

Canadian Securities Administrators National Instrument 43-101

"Standards of Disclosure for Mineral Projects."

The technical information related to resource

and reserve estimates in this news release has been reviewed and

approved by Luke Willis, P.Geo., McEwen Mining’s Director of

Resource Modelling and is a Qualified Person as defined by SEC S-K

1300 and Canadian Securities Administrators National Instrument

43-101 "Standards of Disclosure for Mineral Projects."

Exploration drill core samples at Grey Fox were

typically submitted as 1/2 core. Analyses reported herein were

performed either by the fire assay method at the accredited

laboratories: Pangea Laboratorio in Sinaloa, Mexico

(NMX-EC-17025-IMNC-2018, ISO /IEC 17025:2017), owned and operated

by an indirect subsidiary of the Company, ACT Labs (ISO 9001 &

ISO 17025:2017), ALS laboratory (ISO 9001 & ISO 17025:2017), or

by the photon assay method at the accredited laboratory MSA Labs

(ISO 9001 & ISO 17025) in Timmins, Ontario, Canada.

For a list of drilling results at Grey

Fox since Nov 28, 2022, including hole location and alignment,

click here:

https://www.mcewenmining.com/files/doc_news/archive/2024/2024_05_Grey_Fox_drill_results.xlsx

CAUTION CONCERNING FORWARD-LOOKING

STATEMENTS

This news release contains certain

forward-looking statements and information, including

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. The forward-looking

statements and information expressed, as at the date of this news

release, McEwen Mining Inc.'s (the "Company") estimates, forecasts,

projections, expectations or beliefs as to future events and

results. Forward-looking statements and information are necessarily

based upon a number of estimates and assumptions that, while

considered reasonable by management, are inherently subject to

significant business, economic and competitive uncertainties, risks

and contingencies, and there can be no assurance that such

statements and information will prove to be accurate. Therefore,

actual results and future events could differ materially from those

anticipated in such statements and information. Risks and

uncertainties that could cause results or future events to differ

materially from current expectations expressed or implied by the

forward-looking statements and information include, but are not

limited to, effects of the COVID-19 pandemic, fluctuations in the

market price of precious metals, mining industry risks, political,

economic, social and security risks associated with foreign

operations, the ability of the corporation to receive or receive in

a timely manner permits or other approvals required in connection

with operations, risks associated with the construction of mining

operations and commencement of production and the projected costs

thereof, risks related to litigation, the state of the capital

markets, environmental risks and hazards, uncertainty as to

calculation of mineral resources and reserves, and other risks.

Readers should not place undue reliance on forward-looking

statements or information included herein, which speak only as of

the date hereof. The Company undertakes no obligation to reissue or

update forward-looking statements or information as a result of new

information or events after the date hereof except as may be

required by law. See McEwen Mining's Annual Report on Form 10-K for

the fiscal year ended December 31, 2023, and other filings with the

Securities and Exchange Commission, under the caption "Risk

Factors", for additional information on risks, uncertainties and

other factors relating to the forward-looking statements and

information regarding the Company. All forward-looking statements

and information made in this news release are qualified by this

cautionary statement.

The NYSE and TSX have not reviewed and do not

accept responsibility for the adequacy or accuracy of the contents

of this news release, which has been prepared by management of

McEwen Mining Inc.

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with

operations in Nevada, Canada, Mexico and Argentina. McEwen Mining

also holds a 47.7% interest in McEwen Copper, which is developing

the large, advanced-stage Los Azules copper project in Argentina.

The Company’s goal is to improve the productivity and life of its

assets with the objective of increasing the share price and

providing a yield. Rob McEwen, Chairman and Chief Owner, has a

personal investment in the Company of US$220 million.

Want News Fast?Subscribe to our

email list by clicking

here:https://www.mcewenmining.com/contact-us/#section=followUsand

receive news as it happens!

|

|

|

|

|

|

|

|

|

|

WEB SITE |

|

SOCIAL

MEDIA |

|

|

|

|

|

www.mcewenmining.com |

|

McEwen Mining |

Facebook: |

facebook.com/mcewenmining |

|

|

|

|

|

LinkedIn: |

linkedin.com/company/mcewen-mining-inc- |

|

|

|

CONTACT

INFORMATION |

|

Twitter: |

twitter.com/mcewenmining |

|

|

|

150 King Street West |

|

Instagram: |

instagram.com/mcewenmining |

|

|

|

Suite 2800, PO Box 24 |

|

|

|

|

|

|

|

Toronto, ON, Canada |

|

McEwen Copper |

Facebook: |

facebook.com/

mcewencopper |

|

|

|

M5H 1J9 |

|

LinkedIn: |

linkedin.com/company/mcewencopper |

|

|

|

|

|

Twitter: |

twitter.com/mcewencopper |

|

|

|

Relationship with

Investors: |

|

Instagram: |

instagram.com/mcewencopper |

|

|

|

(866)-441-0690 - Toll free line |

|

|

|

|

|

|

|

(647)-258-0395 |

|

Rob

McEwen |

Facebook: |

facebook.com/mcewenrob |

|

|

|

Mihaela Iancu ext. 320 |

|

LinkedIn: |

linkedin.com/in/robert-mcewen-646ab24 |

|

|

|

info@mcewenmining.com |

|

Twitter: |

twitter.com/robmcewenmux |

|

|

|

|

|

|

|

|

|

Photos accompanying this announcement are available

at:https://www.globenewswire.com/NewsRoom/AttachmentNg/07f25f5f-cfaa-4171-a18e-5c9b2dc22f51https://www.globenewswire.com/NewsRoom/AttachmentNg/efca557c-ba5a-470a-b28c-1541956dd1cbhttps://www.globenewswire.com/NewsRoom/AttachmentNg/bb7f45f8-70ab-4f3d-9971-0ca104bdef8f

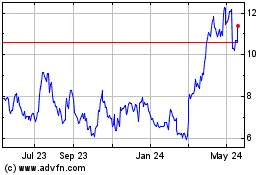

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Nov 2024 to Dec 2024

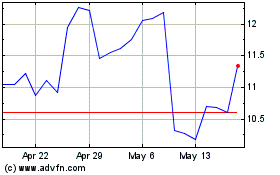

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Dec 2023 to Dec 2024