false

0000314203

0000314203

2024-11-05

2024-11-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported): |

November 5, 2024 |

McEWEN MINING INC.

(Exact name of registrant as specified in

its charter)

| Colorado |

|

001-33190 |

|

84-0796160 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

150 King Street West, Suite 2800

Toronto,

Ontario, Canada

|

M5H 1J9 |

| (Address of principal executive offices) |

(Zip Code) |

| Registrant’s telephone number including area code: |

(866) 441-0690 |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

MUX |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

On November 5, 2024, McEwen Mining Inc. (the

“Company”) issued a press release summarizing its third quarter and nine-month results for the period ended September 30,

2024 and announcing the quarter-end conference call and webcast to discuss those results. A copy of that press release is furnished with

this report as Exhibit 99.1.

The information furnished under this Item 2.02,

including the referenced exhibit, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly

set forth by reference to such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

The following exhibits are furnished or filed with this report, as applicable:

Cautionary Statement

With the exception of historical matters, the matters

discussed in the press release include forward-looking statements within the meaning of applicable securities laws that involve risks

and uncertainties that could cause actual results to differ materially from projections or estimates contained therein. Such forward-looking

statements include, among others, statements regarding future production and cost estimates, exploration, development, construction and

production activities. Factors that could cause actual results to differ materially from projections or estimates include, among others,

future drilling results, metal prices, economic and market conditions, operating costs, receipt of permits, and receipt of working capital,

as well as other factors described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and

other filings with the United States Securities and Exchange Commission. Most of these factors are beyond the Company’s ability

to predict or control. The Company disclaims any obligation to update any forward-looking statement made in the press release, whether

as a result of new information, future events, or otherwise. Readers are cautioned not to put undue reliance on forward-looking statements.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

McEWEN MINING INC. |

| |

|

| Date: November 8, 2024 |

By: |

/s/ Carmen Diges |

| |

|

Carmen Diges, General Counsel |

Exhibit 99.1

McEWEN MINING: Q3 2024 RESULTS

TORONTO, November 5th,

2024 - McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) today released its financial and operational results for the third quarter

ended September 30, 2024 (“Q3”). The Company achieved significant improvements in revenue and operating profitability,

driven by higher gold prices and strong production. The results reflect McEwen Mining’s ongoing commitment to expanding gold and

silver production, advancing its large copper project and robust investment in exploration programs.

Financial Highlights (Q3 2024 vs Q3 2023)

| · | Revenue

increased 36% to $52.3 million due to higher realized gold prices and an increase in

gold equivalent ounces (GEOs) produced for our 100%-owned mines. Average gold price sold

was $2,499 per ounce in Q3 vs $1,920 in Q3 2023. |

| · | Gross

profit increased 268% to $13.8 million due to higher gold prices, improved operational

efficiencies and higher production. |

| · | Net

loss significantly decreased to $2.1 million or $0.04 per share, compared to a net loss

of $18.5 million or $(0.39) per share in Q3 2023, reflecting the Company’s focused

efforts on cost controls and lower expenditures at the Los Azules copper project. |

| · | Operating

cash flow increased to $23.2 million or $0.45 per share, compared to negative operating

cash flow of $2.3 million or $(0.04) per share in Q3 2023, primarily reflecting the improvement

in gross profit above. |

| · | Adjusted

EBITDA(1) increased 586% to $10.5 million or $0.20 per share, compared

to $1.5 million or $0.03 per share in Q3 2023. Adjusted EBITDA excludes the impact of McEwen

Copper’s results and reflects the operating earnings of our mining assets, including

the San José mine. This measure underscores McEwen Mining’s success in improving

cash flow and operating performance across its production portfolio. |

Operational Highlights

| · | Gold

Bar Mine, Nevada: Production reached 13,640 oz Au(1) in Q3, a

43% increase compared to the same period in 2023, driven by higher gold grades and improved

recovery rates. The site is on track to meet its annual production guidance of 40,000 to

43,000 oz Au. |

| · | Fox

Complex, Canada: Production totaled 7,855 oz Au(1) down 30% year-over-year,

impacted by a temporary shortfall in development due to a stope failure in Q2 2024 that limited

stope availability. However, the Company anticipates enhanced stope availability in Q4 2024,

which will support increased production. The Fox Complex is expected to produce approximately

15-20% fewer ounces compared to its annual guidance of 40,000 to 42,000 oz Au. |

|

|

|

|

|

McEwen Mining Inc. |

Page 1

|

|

|

| · | San

José Mine, Argentina: The 49% share of production from the San José Mine

in Argentina was 13,684 GEOs(1)(3). Lower than anticipated grades

contributed to a 23% decrease from Q3 2023. Nevertheless, Hochschild plc, as operator of

the San José mine, expects to achieve its annual guidance for San José, which

stands at 50,000 to 60,000 GEOs for McEwen Mining’s attributable share. The improved

metal price environment has allowed the San José mine to build a strong liquidity

position, with an increase of $40.4 million in working capital from $34.1 million at September 30,

2023 to $75.5 million at September 30, 2024, while also investing $8.5 million in exploration

and $3.5 million in expanding the mill during 2024. |

| |

Time

Since Last Lost Time Injury (LTI) |

| Gold

Bar mine |

54

months no LTI |

| Fox

Complex |

33

months no LTI |

| Los

Azules project |

1.3

million manhours no LTI |

Corporate Developments

McEwen Copper recently raised $56 million at

$30 per share to fund the ongoing development of its Los Azules copper project in Argentina. Of the total raised, $14 million was contributed

by McEwen Mining, $5 million by Rob McEwen, $35 million by Nuton LLC, a Rio Tinto venture, and $2 million by two individual investors.

Following these investments, McEwen Mining’s ownership in McEwen Copper now stands at 46.4% and the post-money market value of

McEwen Copper is now $984 million. Over $350 million have been invested in exploration to develop Los Azules as a world-class copper

deposit, including amounts spent by Minera Andes Inc. until 2012 and McEwen Mining until 2021.

McEwen Mining completed the acquisition of Timberline

Resources in August, thereby expanding our exploration and potential production footprint in Nevada. This acquisition includes three

properties in Nevada: Eureka, which is close to our Gold Bar Mine, and contains an oxide gold resource of 423,000 oz (Measured and Indicated)

and 84,000 oz (Inferred) plus attractive exploration targets; Paiute, which is adjacent to McEwen Copper’s Elder Creek project;

and Seven Troughs, which is purported to host the highest grade historical gold mine in the State of Nevada(4), with production

starting from 1907. All represent opportunities for long-term growth.

Exploration and Development Investments Driving

Future Growth

The investment in exploration and development

continued in the quarter with $6.1 million on the Los Azules copper project and $5.3 million across Gold Bar and Fox Complex. Activities

during the quarter were:

| · | Los

Azules Copper Project, Argentina: Our flagship copper development project is moving steadily

towards completion of the feasibility study scheduled for publication in the first half of

2025. The latest private placement funding of $56 million will allow McEwen Copper to complete

this study. Additional funding will support other initiatives, including discovery-oriented

exploration programs. |

| · | Gold

Bar Mine, Nevada: Exploration activities are focused on near-mine drilling, aimed at

extending the mine life and identifying new resource areas. A mine plan is in place to extend

production from Gold Bar into 2029, and additional opportunities at the Eureka property,

obtained through the Timberline acquisition, could potentially contribute to production beginning

in 2027, depending on permitting and exploration outcomes. |

|

|

|

|

|

McEwen Mining Inc. |

Page 2

|

|

|

| · | Fox

Complex, Canada: During the first nine months (9M) of 2024, $5.5 million was invested

developing our Stock project at the Fox Complex. Earthworks have been completed in preparation

for our mine portal construction later in 2024, with the intent of driving a ramp connecting

the Stock East, Stock Main and Stock West zones. Rehabilitation of the historic Stock shaft

is being considered to provide alternative means of accessing these zones to facilitate increased

production. |

Individual Mine

Performance (See Table 1):

Gold Bar production

increased 43% to 13,640 oz Au(1) in Q3, compared to 9,507 oz Au in Q3 2023 due to higher mined

grades and recovery rates. During 9M 2024, gold production was 37,654 oz Au and the mine remains on track to meet annual costs per ounce

guidance and production of 40,000 to 43,000 oz Au.

Cash costs and AISC per GEO sold(2) in

Q3 were $1,281 and $1,822, respectively, due to higher planned stripping costs in the quarter. Operations are expected to deliver on

full-year cost guidance.

Gold

Bar Mine ($

millions) | |

Q3

2024 | | |

Q3

2023 | | |

9M

2024 | | |

9M

2023 | |

| Revenue

from gold sales | |

| 33.3 | | |

| 18.0 | | |

| 88.2 | | |

| 45.5 | |

| Cash costs | |

| 17.1 | | |

| 14.4 | | |

| 49.5 | | |

| 41.5 | |

| Gross margin | |

| 16.2 | | |

| 3.6 | | |

| 38.7 | | |

| 4.0 | |

| Gross margin % | |

| 48.6 | % | |

| 20.0 | % | |

| 43.9 | % | |

| 8.8 | % |

Fox gold production

was 7,855 oz Au(1), a 30% decrease compared to 11,174 oz Au in Q3 2023 due to a stope failure in Q2 2024, which

led to a shortfall in development and limited stope availability during the quarter. During 9M 2024, gold production was 23,600 oz Au

vs 34,200 oz Au in 9M 2023. While stope availability is expected to improve during Q4 2024, resulting in higher gold production compared

to prior quarters in 2024, annual production is projected to be 15-20% below our guidance of 40,000 to 42,000 oz Au.

Cash costs and AISC per GEO sold(2) in

Q3 were $1,572 and $1,953, respectively. Accelerated development costs to improve stope availability for Q4 2024 increased unit costs

during the third quarter. While we expect production to improve in the fourth quarter, including by adding new production from our Black

Fox mine, we expect unit costs to be 15 to 20% higher than guidance.

Fox

Complex ($

millions) | |

Q3 2024 | | |

Q3 2023 | | |

9M 2024 | | |

9M 2023 | |

| Revenue

from gold sales | |

| 19.0 | | |

| 20.3 | | |

| 51.5 | | |

| 61.9 | |

| Cash costs | |

| 12.6 | | |

| 12.1 | | |

| 37.3 | | |

| 38.6 | |

| Gross margin | |

| 5.9 | | |

| 8.2 | | |

| 14.2 | | |

| 23.2 | |

| Gross margin % | |

| 33.7 | % | |

| 40.4 | % | |

| 27.5 | % | |

| 37.5 | % |

San José’s

attributable production was 13,684 GEOs, a 23% decrease from 17,798 GEOs in Q3 2023. Production was impacted by lower gold

and silver grades mined. Production is expected to increase during Q4 2024. During 9M 2024, 41,290 attributable GEOs were produced. Hochschild

Mining, our joint venture partner and mine operator, asserts that the mine remains on track to meet annual production guidance, with

our attributable portion at 50,000 to 60,000 GEOs.

|

|

|

|

|

McEwen Mining Inc. |

Page 3

|

|

|

Cash costs per GEO sold(2) in

Q3 was $2,173 and AISC per GEO sold was $2,675. While cost inflation remained high from an Argentine perspective, the relative strength

of the Peso against the US Dollar continued to increase costs in US Dollar terms. Combined with temporary lower than expected mined grades,

unit costs were higher than planned. While production is expected to recover in Q4 2024 through mining from new areas, unit costs are

expected to remain above guidance due to macroeconomic factors.

San

José Mine—100% basis ($

millions) | |

Q3 2024 | | |

Q3 2023 | | |

9M 2024 | | |

9M 2023 | |

| Revenue

from gold and silver sales | |

| 70.4 | | |

| 64.5 | | |

| 210.6 | | |

| 179.4 | |

| Cash costs | |

| 58.0 | | |

| 43.4 | | |

| 154.1 | | |

| 131.4 | |

| Gross margin | |

| 12.4 | | |

| 20.8 | | |

| 44.2 | | |

| 25.4 | |

| Gross margin % | |

| 17.6 | % | |

| 32.2 | % | |

| 21.0 | % | |

| 14.2 | % |

Management Conference Call

Management will discuss our Q3 financial results

and project developments and follow with a question-and-answer session. Questions can be asked directly by participants over the phone

during the webcast.

Wednesday

November 6th 2024

at 11:00 AM EST |

Toll-Free

Dial-In North America: |

(888)

210-3454 |

| Toll-Free

Dial-In Other Countries: |

https://events.q4irportal.com/custom/access/2324/ |

| Toll

Dial-In: |

(646)

960-0130 |

| Conference

ID Number: |

3232920 |

| Webcast

Link: |

https://events.q4inc.com/attendee/716235143/guest |

An archived replay

of the webcast will be available approximately 2 hours following the conclusion of the live event. Access the replay on the Company’s

media page at https://www.mcewenmining.com/media.

Table 1

below provides production and cost results for Q3 & 9M 2024 with comparative results for Q3 & 9M 2023 and our Guidance

for 2024.

| | |

| Q3 | | |

| 9M | | |

| 2024 | |

| | |

| 2023 | | |

| 2024 | | |

| 2023 | | |

| 2024 | | |

| Guidance | |

| Consolidated Production | |

| | | |

| | | |

| | | |

| | | |

| | |

| GEOs(1) | |

| 38,500 | | |

| 35,200 | | |

| 104,400 | | |

| 103,500 | | |

| 130,000-145,000 | |

| Gold Bar Mine, Nevada | |

| | | |

| | | |

| | | |

| | | |

| | |

| GEOs(1) | |

| 9,500 | | |

| 13,600 | | |

| 23,800 | | |

| 37,700 | | |

| 40,000-43,000 | |

| Cash

Costs per GEO Sold(2) | |

| 1,529 | | |

| 1,281 | | |

| 1,743 | | |

| 1,302 | | |

$ | 1,450-1,550 | |

| AISC

per GEO Sold(2) | |

| 2,160 | | |

| 1,822 | | |

| 2,203 | | |

| 1,548 | | |

$ | 1,650-1,750 | |

| Fox Complex, Canada | |

| | | |

| | | |

| | | |

| | | |

| | |

| GEOs(1) | |

| 11,200 | | |

| 7,900 | | |

| 34,200 | | |

| 23,600 | | |

| 40,000-42,000 | |

| Cash

Costs per GEO Sold(2) | |

| 1,078 | | |

| 1,572 | | |

| 1,129 | | |

| 1,572 | | |

$ | 1,225-1,325 | |

| AISC

per GEO Sold(2) | |

| 1,288 | | |

| 1,953 | | |

| 1,321 | | |

| 1,909 | | |

$ | 1,450-1,550 | |

| San

José Mine, Argentina (49%)(3) | |

| | | |

| | | |

| | | |

| | | |

| | |

GEOs(1) | |

| 17,800 | | |

| 13,700 | | |

| 46,400 | | |

| 41,300 | | |

| 50,000-60,000 | |

| Cash

Costs per GEO Sold(2) | |

| 1,445 | | |

| 2,173 | | |

| 1,505 | | |

| 1,788 | | |

$ | 1,300-1,500 | |

| AISC

per GEO Sold(2) | |

| 1,953 | | |

| 2,675 | | |

| 1,971 | | |

| 2,194 | | |

$ | 1,500-1,700 | |

|

|

|

|

|

McEwen Mining Inc. |

Page 4

|

|

|

| 1. | 'Gold

Equivalent Ounces' are calculated based on a gold to silver price ratio of 85:1 for Q3 2024

and 82:1 for Q3 2023. 2024 production guidance is calculated based on an 85:1

gold to silver price ratio. Gold Bar and Fox mines produce insignificant (silver) co-products

with gold, therefore GEOs and ‘Oz Au’ are equivalent measures. |

| 2. | Cash costs per ounce and all-in sustaining

costs (AISC) per ounce are non-GAAP financial performance measures with no standardized definition

under U.S. GAAP. For a definition of the non-GAAP measures see "Non-GAAP-

Financial Measures" section in this press release; for the reconciliation of the

non-GAAP measures to the closest U.S. GAAP measures, see the Management Discussion and Analysis

for the quarter ended September 30, 2024, filed on EDGAR and SEDAR Plus. |

| 3. | Represents the portion attributable to

us from our 49% interest in the San José Mine. |

| 4. | Records indicate historic production from

1907-1955 was 158,468 oz. gold grading 35.6 g/t and 995,876 oz. of silver grading 223.9 g/t. |

Technical Information

The technical content of this news release related

to financial results, mining and development projects has been reviewed and approved by William (Bill) Shaver, P.Eng., COO of McEwen

Mining and a Qualified Person as defined by SEC S-K 1300 and the Canadian Securities Administrators National Instrument 43-101 "Standards

of Disclosure for Mineral Projects."

Reliability of Information Regarding San José

Minera Santa Cruz S.A (MSC)., the owner of the

San José Mine, is responsible for and has supplied the Company with all reported results from the San José Mine. McEwen

Mining’s joint venture partner, a subsidiary of Hochschild Mining plc, and its affiliates other than MSC do not accept responsibility

for the use of project data or the adequacy or accuracy of this release.

NON-GAAP FINANCIAL PERFORMANCE MEASURES

We have included in

this report certain non-GAAP performance measures as detailed below. In the gold mining industry, these are common performance measures

but do not have any standardized meaning and are considered non-GAAP measures. We use these measures to evaluate our business on an ongoing

basis and believe that, in addition to conventional measures prepared in accordance with GAAP, certain investors use such non-GAAP measures

to evaluate our performance and ability to generate cash flow. We also report these measures to provide investors and analysts with useful

information about our underlying costs of operations and clarity over our ability to finance operations. Accordingly, they are intended

to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in

accordance with GAAP. There are limitations associated with the use of such non-GAAP measures. We compensate for these limitations by

relying primarily on our US GAAP results and using the non-GAAP measures supplementally.

The non-GAAP measures

are presented for our wholly owned mines and our interest in the San José mine. The amounts in the reconciliation tables labeled

“49% basis” were derived by applying to each financial statement line item the ownership percentage interest used to arrive

at our share of net income or loss during the period when applying the equity method of accounting. We do not control the interest in

or operations of MSC and the presentations of assets and liabilities and revenues and expenses of MSC do not represent our legal claim

to such items. The amount of cash we receive is based upon specific provisions of the Option and Joint Venture Agreement (“OJVA”)

and varies depending on factors including the profitability of the operations.

The presentation of

these measures, including the minority interest in the San José mine, has limitations as an analytical tool. Some of these limitations

include:

| · | The

amounts shown on the individual line items were derived by applying our overall economic

ownership interest percentage determined when applying the equity method of accounting and

do not represent our legal claim to the assets and liabilities, or the revenues and expenses;

and |

| · | Other

companies in our industry may calculate their cash costs, cash cost per ounce, all-in sustaining

costs, all-in sustaining cost per ounce, adjusted EBITDA and average realized price per ounce

differently than we do, limiting the usefulness as a comparative measure. |

Cash Costs and All-In Sustaining Costs

The terms cash costs, cash cost per ounce, all-in

sustaining costs (“AISC”), and all-in sustaining cost per ounce used in this report are non-GAAP financial measures. We report

these measures to provide additional information regarding operational efficiencies on an individual mine basis, and believe these measures

used by the mining industry provide investors and analysts with useful information about our underlying costs of operations.

Cash costs consist of mining, processing, on-site

general and administrative expenses, community and permitting costs related to current operations, royalty costs, refining and treatment

charges (for both doré and concentrate products), sales costs, export taxes and operational stripping costs, but exclude depreciation

and amortization (non-cash items). The sum of these costs is divided by the corresponding gold equivalent ounces sold to determine a

per ounce amount.

All-in sustaining costs consist of cash costs

(as described above), plus accretion of retirement obligations and amortization of the asset retirement costs related to operating sites,

environmental rehabilitation costs for mines with no reserves, sustaining exploration and development costs, sustaining capital expenditures

and sustaining lease payments. Our all-in sustaining costs exclude the allocation of corporate general and administrative costs. The

following is additional information regarding our all-in sustaining costs:

|

|

|

|

|

McEwen Mining Inc. |

Page 5

|

|

|

| · | Sustaining

operating costs represent expenditures incurred at current operations that are considered

necessary to maintain current annual production at the mine site and include mine development

costs and ongoing replacement of mine equipment and other capital facilities. Sustaining

capital costs do not include the costs of expanding the project that would result in improved

productivity of the existing asset, increased existing capacity or extended useful life. |

| · | Sustaining

exploration and development costs include expenditures incurred to sustain current operations

and to replace reserves and/or resources extracted as part of the ongoing production. Exploration

activity performed near-mine (brownfield) or new exploration projects (greenfield) are classified

as non-sustaining. |

The sum of all-in sustaining costs is divided

by the corresponding gold equivalent ounces sold to determine a per ounce amount.

Costs excluded from cash costs and all-in sustaining

costs, in addition to depreciation and depletion, are income and mining tax expense, all corporate financing charges, costs related to

business combinations, asset acquisitions and asset disposals, impairment charges and any items that are deducted for the purpose of

normalizing items.

The following tables reconcile these non-GAAP

measures to the most directly comparable GAAP measure, production costs applicable to sales:

| | |

Three

months ended September 30, 2024 | | |

Nine months

ended September 30, 2024 | |

| | |

Gold Bar | | |

Fox Complex | | |

Total | | |

Gold Bar | | |

Fox Complex | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(in thousands, except per ounce) | | |

(in thousands, except per ounce) | |

| Production costs applicable

to sales (100% owned) | |

$ | 17,078 | | |

$ | 12,604 | | |

$ | 29,682 | | |

$ | 49,515 | | |

$ | 37,343 | | |

$ | 86,858 | |

| Mine site reclamation, accretion and amortization | |

| 328 | | |

| 162 | | |

| 490 | | |

| 943 | | |

| 433 | | |

| 1,376 | |

| In-mine exploration | |

| 165 | | |

| — | | |

| 165 | | |

| 647 | | |

| — | | |

| 647 | |

| Capitalized mine development (sustaining) | |

| 5,246 | | |

| 2,870 | | |

| 8,116 | | |

| 5,246 | | |

| 7,275 | | |

| 12,521 | |

| Capital expenditures on plant and equipment

(sustaining) | |

| 1,459 | | |

| — | | |

| 1,459 | | |

| 2,438 | | |

| — | | |

| 2,438 | |

| Sustaining leases | |

| 17 | | |

| 24 | | |

| 41 | | |

| 70 | | |

| 290 | | |

| 360 | |

| All-in sustaining costs | |

$ | 24,293 | | |

$ | 15,660 | | |

$ | 39,953 | | |

$ | 58,860 | | |

$ | 45,341 | | |

$ | 104,200 | |

| Ounces sold, including stream (GEO) | |

| 13.3 | | |

| 8.0 | | |

| 21.3 | | |

| 38.0 | | |

| 23.8 | | |

| 61.8 | |

| Cash cost per ounce sold ($/GEO) | |

$ | 1,281 | | |

$ | 1,572 | | |

$ | 1,390 | | |

$ | 1,302 | | |

$ | 1,572 | | |

$ | 1,406 | |

| AISC per ounce sold ($/GEO) | |

$ | 1,822 | | |

$ | 1,953 | | |

$ | 1,871 | | |

$ | 1,548 | | |

$ | 1,909 | | |

$ | 1,687 | |

| | |

Three months

ended September 30, 2023 | | |

Nine months

ended September 30, 2023 | |

| | |

Gold Bar | | |

Fox Complex | | |

Total | | |

Gold Bar | | |

Fox Complex | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(in thousands, except per ounce) | | |

(in thousands, except per ounce) | |

| Production costs applicable

to sales - Cash costs (100% owned) | |

$ | 14,399 | | |

$ | 12,069 | | |

$ | 26,468 | | |

$ | 41,446 | | |

$ | 38,597 | | |

$ | 80,043 | |

| Mine site reclamation, accretion and amortization | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| In-mine exploration | |

| 1,457 | | |

| — | | |

| 1,457 | | |

| 3,054 | | |

| — | | |

| 3,054 | |

| Capitalized underground mine development

(sustaining) | |

| — | | |

| 2,227 | | |

| 2,227 | | |

| — | | |

| 6,058 | | |

| 6,058 | |

| Capital expenditures on plant and equipment

(sustaining) | |

| 4,478 | | |

| — | | |

| 4,478 | | |

| 7,655 | | |

| — | | |

| 7,655 | |

| Sustaining leases | |

| 8 | | |

| 124 | | |

| 132 | | |

| 237 | | |

| 523 | | |

| 760 | |

| All-in sustaining costs | |

$ | 20,342 | | |

$ | 14,420 | | |

$ | 34,762 | | |

$ | 52,392 | | |

$ | 45,178 | | |

$ | 97,570 | |

| Ounces sold, including stream (GEO) | |

| 9.4 | | |

| 11.2 | | |

| 20.6 | | |

| 23.8 | | |

| 34.2 | | |

| 58.0 | |

| Cash cost per ounce sold ($/GEO) | |

$ | 1,529 | | |

$ | 1,078 | | |

$ | 1,284 | | |

$ | 1,743 | | |

$ | 1,129 | | |

$ | 1,381 | |

| AISC per ounce sold ($/GEO) | |

$ | 2,160 | | |

$ | 1,288 | | |

$ | 1,686 | | |

$ | 2,203 | | |

$ | 1,321 | | |

$ | 1,683 | |

| | |

Three months

ended September 30, | | |

Nine months

ended September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(in thousands, except per ounce) | |

| San José mine cash costs (100% basis) | |

| | | |

| | | |

| | | |

| | |

| Production costs applicable

to sales - Cash costs | |

$ | 58,031 | | |

$ | 43,380 | | |

$ | 154,136 | | |

$ | 131,434 | |

| Mine site reclamation, accretion and amortization | |

| 338 | | |

| — | | |

| 1,003 | | |

| 386 | |

| Site exploration expenses | |

| 1,605 | | |

| 2,538 | | |

| 4,926 | | |

| 7,336 | |

| Capitalized underground mine development

(sustaining) | |

| 7,045 | | |

| 11,890 | | |

| 21,425 | | |

| 27,939 | |

| Less: Depreciation | |

| (616 | ) | |

| (909 | ) | |

| (2,036 | ) | |

| (2,162 | ) |

| Capital expenditures

(sustaining) | |

| 5,031 | | |

| 1,718 | | |

| 9,674 | | |

| 7,119 | |

| All-in sustaining costs | |

$ | 71,434 | | |

$ | 58,617 | | |

$ | 189,128 | | |

$ | 172,052 | |

| Ounces sold (GEO) | |

| 26.7 | | |

| 29.8 | | |

| 86.2 | | |

| 87.5 | |

| Cash cost per ounce sold ($/GEO) | |

$ | 2,173 | | |

$ | 1,445 | | |

$ | 1,788 | | |

$ | 1,505 | |

| AISC per ounce sold ($/GEO) | |

$ | 2,675 | | |

$ | 1,953 | | |

$ | 2,194 | | |

$ | 1,971 | |

|

|

|

|

|

McEwen Mining Inc. |

Page 6

|

|

|

Adjusted EBITDA and adjusted EBITDA per share

Adjusted earnings before interest, taxes, depreciation,

and amortization (“Adjusted EBITDA”) is a non-GAAP financial measure and does not have any standardized meaning. We use adjusted

EBITDA to evaluate our operating performance and ability to generate cash flow from our wholly owned operations in production; we disclose

this metric as we believe this measure provides valuable assistance to investors and analysts in evaluating our ability to finance our

precious metal operations and capital activities separately from our copper exploration operations. The most directly comparable measure

prepared in accordance with GAAP is net loss before income and mining taxes. Adjusted EBITDA is calculated by adding back McEwen Copper's

income or loss impacts on our consolidated income or loss before income and mining taxes.

The following tables present a reconciliation of adjusted EBITDA:

| | |

Three months

ended September 30, | | |

Nine months

ended September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| | |

(in thousands) | | |

(in thousands) | |

| Adjusted EBITDA | |

| | | |

| | | |

| | | |

| | |

| Net loss before income and mining taxes | |

$ | (1,267 | ) | |

$ | (28,617 | ) | |

$ | (39,578 | ) | |

$ | (110,873 | ) |

| Less: | |

| | | |

| | | |

| | | |

| | |

| Depreciation and depletion | |

| 8,921 | | |

| 8,506 | | |

| 24,009 | | |

| 24,286 | |

| Loss from investment in McEwen Copper Inc. (Note 9) | |

| 1,852 | | |

| — | | |

| 36,680 | | |

| — | |

| Advanced Projects – McEwen Copper Inc. | |

| — | | |

| 18,478 | | |

| — | | |

| 78,883 | |

| General, interest and other – McEwen Copper Inc. | |

| — | | |

| 2,179 | | |

| — | | |

| (3,033 | ) |

| Interest expense | |

| 983 | | |

| 982 | | |

| 2,928 | | |

| 4,007 | |

| Adjusted EBITDA | |

$ | 10,489 | | |

$ | 1,528 | | |

$ | 24,039 | | |

$ | (6,730 | ) |

| Weighted average shares outstanding (thousands) | |

| 51,953 | | |

| 47,471 | | |

| 50,380 | | |

| 47,442 | |

| Adjusted EBITDA per share | |

$ | 0.20 | | |

$ | 0.03 | | |

$ | 0.48 | | |

$ | (0.14 | ) |

Average realized price

The term average realized price per ounce used

in this report is also a non-GAAP financial measure. We prepare this measure to evaluate our performance against the market (London P.M. Fix).

The average realized price for our 100% owned properties is calculated as gross sales of gold and silver, less streaming revenue, divided

by the number of net ounces sold in the period, less ounces sold under the streaming agreement.

The following table reconciles the average realized

prices to the most directly comparable U.S. GAAP measure, revenue from gold and silver sales. Ounces of gold and silver sold for

the San José mine are provided to us by MSC.

| | |

Three months

ended September 30, | | |

Nine months

ended September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| | |

(in thousands, except per ounce) | |

| Average realized price - 100% owned | |

| | | |

| | | |

| | | |

| | |

| Revenue from gold and silver sales | |

$ | 52,250 | | |

$ | 38,404 | | |

$ | 140,954 | | |

$ | 107,551 | |

| Less: revenue from

gold sales, stream | |

| 349 | | |

| 527 | | |

| 1,283 | | |

| 1,567 | |

| Revenue from gold and silver sales, excluding

stream | |

$ | 51,901 | | |

$ | 37,877 | | |

$ | 139,671 | | |

$ | 105,984 | |

| GEOs sold | |

| 21.3 | | |

| 20.6 | | |

| 61.8 | | |

| 58.0 | |

| Less: gold ounces

sold, stream | |

| 0.6 | | |

| 0.9 | | |

| 2.1 | | |

| 2.7 | |

| GEOs sold, excluding stream | |

| 20.8 | | |

| 19.7 | | |

| 59.6 | | |

| 55.3 | |

| Average realized price per GEO sold,

excluding stream | |

$ | 2,499 | | |

$ | 1,920 | | |

$ | 2,342 | | |

$ | 1,916 | |

| | |

| | |

| | |

| | |

| |

| | |

Three months

ended September 30, | | |

Nine months

ended September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| | |

(in thousands, except per ounce) | |

| Average realized price - San José mine (100% basis) | |

| | | |

| | | |

| | | |

| | |

| Gold sales | |

$ | 41,739 | | |

$ | 38,563 | | |

$ | 125,422 | | |

$ | 105,319 | |

| Silver sales | |

| 28,622 | | |

| 25,932 | | |

| 85,214 | | |

| 74,124 | |

| Gold and silver sales | |

$ | 70,361 | | |

$ | 64,495 | | |

$ | 210,636 | | |

$ | 179,443 | |

| Gold ounces sold | |

| 15.8 | | |

| 18.0 | | |

| 51.3 | | |

| 51.5 | |

| Silver ounces sold | |

| 928 | | |

| 994 | | |

| 2,957 | | |

| 2,979 | |

| GEOs sold | |

| 26.7 | | |

| 30.0 | | |

| 86.2 | | |

| 87.3 | |

| Average realized price per gold ounce sold | |

$ | 2,639 | | |

$ | 2,138 | | |

$ | 2,445 | | |

$ | 2,044 | |

| Average realized price per silver ounce sold | |

$ | 30.83 | | |

$ | 26.08 | | |

$ | 28.82 | | |

$ | 24.88 | |

| Average realized price per GEO sold | |

$ | 2,635 | | |

$ | 2,149 | | |

$ | 2,443 | | |

$ | 2,055 | |

|

|

|

|

|

McEwen Mining Inc. |

Page 7

|

|

|

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking

statements and information, including "forward-looking statements" within the meaning of the Private Securities Litigation

Reform Act of 1995. The forward-looking statements and information expressed, as at the date of this news release, McEwen Mining Inc.'s

(the "Company") estimates, forecasts, projections, expectations or beliefs as to future events and results. Forward-looking

statements and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management,

are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no

assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially

from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ

materially from current expectations expressed or implied by the forward-looking statements and information include, but are not limited

to, fluctuations in the market price of precious metals, mining industry risks, political, economic, social and security risks associated

with foreign operations, the ability of the Company to receive or receive in a timely manner permits or other approvals required in connection

with operations, risks associated with the construction of mining operations and commencement of production and the projected costs thereof,

risks related to litigation, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of mineral

resources and reserves, foreign exchange volatility, foreign exchange controls, foreign currency risk, and other risks. Readers should

not place undue reliance on forward-looking statements or information included herein, which speak only as of the date hereof. The Company

undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after

the date hereof except as may be required by law. See McEwen Mining's Annual Report on Form 10-K for the fiscal year ended December 31,

2023, Quarterly Report on Form 10-Q for the three months ended March 31, 2024, June 30, 2024, and September 30, 2024,

and other filings with the Securities and Exchange Commission, under the caption "Risk Factors", for additional information

on risks, uncertainties and other factors relating to the forward-looking statements and information regarding the Company. All forward-looking

statements and information made in this news release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do

not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by the management

of McEwen Mining Inc.

ABOUT MCEWEN MINING

McEwen

Mining is a gold and silver producer with operations in Nevada, Canada, Mexico and Argentina. In addition, it owns 46.4% of McEwen Copper

which owns the large, advanced-stage Los Azules copper project in Argentina. The Company’s objective is to improve the productivity

and life of its assets with the goal of increasing its share price and providing an investor yield. Rob McEwen, Chairman and Chief Owner,

has a personal investment in the companies of US$225 million. His annual salary is US$1.

Want News Fast?

Subscribe to our

email list by clicking here:

https://www.mcewenmining.com/contact-us/#section=followUs

and receive news as it happens!

| |

|

|

|

|

|

|

| |

WEB

SITE |

|

SOCIAL

MEDIA |

|

|

|

| |

www.mcewenmining.com

|

|

McEwen

Mining |

Facebook: |

facebook.com/mcewenmining |

|

| |

|

|

LinkedIn: |

linkedin.com/company/mcewen-mining-inc-

|

|

| |

CONTACT

INFORMATION |

|

Twitter: |

twitter.com/mcewenmining |

|

| |

150

King Street West |

|

Instagram:

|

instagram.com/mcewenmining |

|

| |

Suite 2800,

PO Box 24 |

|

|

|

|

|

| |

Toronto,

ON, Canada |

|

McEwen

Copper |

Facebook: |

facebook.com/

mcewencopper |

|

| |

M5H

1J9 |

|

LinkedIn: |

linkedin.com/company/mcewencopper |

|

| |

|

|

Twitter: |

twitter.com/mcewencopper |

|

| |

Relationship

with Investors: |

|

Instagram:

|

instagram.com/mcewencopper |

|

| |

(866)-441-0690

- Toll free line |

|

|

|

|

|

| |

(647)-258-0395

|

|

Rob

McEwen |

Facebook: |

facebook.com/mcewenrob |

|

| |

Mihaela

Iancu ext. 320 |

|

LinkedIn: |

linkedin.com/in/robert-mcewen-646ab24 |

|

| |

info@mcewenmining.com

|

|

Twitter:

|

twitter.com/robmcewenmux

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

McEwen Mining Inc. |

Page 8

|

|

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

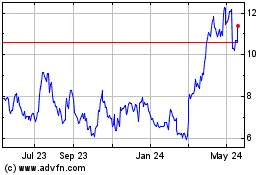

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Nov 2024 to Dec 2024

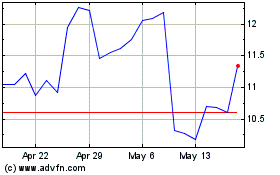

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Dec 2023 to Dec 2024