McEwen Copper Announces an Additional US$35 Million Investment by Nuton, a Rio Tinto Venture

October 24 2024 - 6:30AM

McEwen Copper Inc., a subsidiary

of McEwen Mining Inc. (NYSE: MUX) (TSX:

MUX),

is pleased to announce closing of an

additional $35 million investment by Nuton LLC,

a

Rio Tinto Venture.

McEwen Copper previously announced a

non-brokered private placement financing of up

to 2,333,333 common shares at a subscription price

of US$30.00 per common share, for gross proceeds of up

to US$70 million (the "Offering"). The first tranche of

the Offering was led by a $14 million investment by McEwen Mining

and a $5 million investment by Rob McEwen.

In this second tranche of the Offering, Nuton (a

Rio Tinto Venture) has purchased an additional 1,166,666 common

shares of McEwen Copper for $35 million and two other investors

have acquired 66,669 common shares for $2 million. Following the

closing of this second tranche of the Offering, McEwen Copper has

raised a total of $56 million.

Nuton now owns 17.2% of McEwen Copper on a fully

diluted basis. Following these share issuances, McEwen Copper will

have 32,804,284 common shares outstanding, giving it a post-money

market value of $984 million, and its shareholders are: McEwen

Mining Inc. 46.4%, Stellantis 18.3%, Nuton 17.2%, Rob McEwen 12.7%,

Victor Smorgon Group 3.0%, and other shareholders 2.0%.

Proceeds from the Offering will be used to

advance ongoing work on the feasibility study for the Los Azules

copper project, which is scheduled for publication in the first

half of 2025.

Subscription for the

remaining 466,664 common shares in the Offering is

available to qualified accredited investors, subject to

a US$1 million minimum investment and certain other

conditions. The securities sold in the Offering are private and

subject to transfer restrictions until such time when they become

listed on a public exchange.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of these securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful.

About Nuton

Nuton is an innovative venture that aims to help

grow Rio Tinto’s copper business. At the core of Nuton is a

portfolio of proprietary copper leaching related technologies and

capability – a product of almost 30 years of research and

development. Nuton offers the potential to economically unlock

copper from primary sulfide resources through leaching, achieving

market-leading recovery rates and contributing to an increase in

copper production at new and ongoing operations. One of the key

differentiators of Nuton is the ambition to produce the world’s

lowest footprint copper while having at least one Positive Impact

at each of our deployment sites, across our five pillars: water,

energy, land, materials and society.

About McEwen Copper

McEwen Copper Inc. holds a 100% interest in the

Los Azules copper project in San Juan, Argentina and the Elder

Creek copper/gold project in Nevada, USA.

Los Azules was ranked in the top 10 largest

undeveloped copper deposits in the world by Mining Intelligence

(2022). A PEA published in June 2023 for the project estimated a

$2.7 billion after-tax NPV8% at $3.75/lb Cu, a 27-year mine life,

and an updated copper resource of 10.9 billion pounds at grade

0.40% Cu (Indicated category) and an additional 26.7

billion pounds at grade 0.31% Cu (Inferred category). For more

details about the Los Azules PEA click here.

CAUTION CONCERNING FORWARD-LOOKING

STATEMENTS

This news release contains certain

forward-looking statements and information, including

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. The forward-looking

statements and information expressed, as at the date of this news

release, McEwen Mining Inc.'s (the "Company") estimates, forecasts,

projections, expectations or beliefs as to future events and

results. Forward-looking statements and information are necessarily

based upon a number of estimates and assumptions that, while

considered reasonable by management, are inherently subject to

significant business, economic and competitive uncertainties, risks

and contingencies, and there can be no assurance that such

statements and information will prove to be accurate. Therefore,

actual results and future events could differ materially from those

anticipated in such statements and information. Risks and

uncertainties that could cause results or future events to differ

materially from current expectations expressed or implied by the

forward-looking statements and information include, but are not

limited to, fluctuations in the market price of precious metals,

mining industry risks, political, economic, social and security

risks associated with foreign operations, the ability of the

corporation to receive or receive in a timely manner permits or

other approvals required in connection with operations, risks

associated with the construction of mining operations and

commencement of production and the projected costs thereof, risks

related to litigation, the state of the capital markets,

environmental risks and hazards, uncertainty as to calculation of

mineral resources and reserves, and other risks. Readers should not

place undue reliance on forward-looking statements or information

included herein, which speak only as of the date hereof. The

Company undertakes no obligation to reissue or update

forward-looking statements or information as a result of new

information or events after the date hereof except as may be

required by law. See McEwen Mining's Annual Report on Form 10-K for

the fiscal year ended December 31, 2023 and other filings with the

Securities and Exchange Commission, under the caption "Risk

Factors", for additional information on risks, uncertainties and

other factors relating to the forward-looking statements and

information regarding the Company. All forward-looking statements

and information made in this news release are qualified by this

cautionary statement.

The NYSE and TSX have not reviewed and do not

accept responsibility for the adequacy or accuracy of the contents

of this news release, which has been prepared by management of

McEwen Mining Inc.

About McEwen Mining

McEwen Mining is a gold and silver producer with

operations in Nevada, Canada, Mexico and Argentina. In addition, it

owns approximately 46.4% of McEwen Copper which owns the large,

advanced stage Los Azules copper project in Argentina. The

Company’s goal is to improve the productivity and life of its

assets with the objective of increasing its share price and

providing a yield. Rob McEwen, Chairman and Chief Owner, has

personally invested $225 million in the companies and takes an

annual salary of $1.

| WEB

SITEwww.mcewenmining.comCONTACT

INFORMATION150 King Street WestSuite 2800, PO Box

24Toronto, ON, CanadaM5H 1J9Relationship with

Investors:(866)-441-0690 Toll free(647)-258-0395Mihaela

Iancu ext. 320info@mcewenmining.com |

SOCIAL

MEDIA |

|

| |

McEwen Mining |

|

Facebook:LinkedIn:Twitter:Instagram: |

facebook.com/mcewenmininglinkedin.com/company/mcewen-mining-inc-twitter.com/mcewenmininginstagram.com/mcewenmining |

| |

| |

McEwen Copper |

|

Facebook:LinkedIn:Twitter:Instagram: |

facebook.com/mcewencopperlinkedin.com/company/mcewencoppertwitter.com/mcewencopperinstagram.com/mcewencopper |

| |

| |

Rob McEwen |

|

Facebook:LinkedIn:Twitter: |

facebook.com/mcewenroblinkedin.com/in/robert-mcewen-646ab24twitter.com/robmcewenmux |

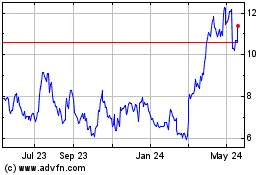

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Nov 2024 to Dec 2024

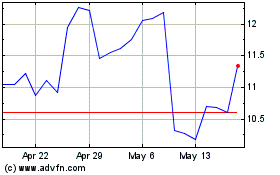

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Dec 2023 to Dec 2024