Form SCHEDULE 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

March 07 2025 - 3:56PM

Edgar (US Regulatory)

EXHIBIT 4

Schedule A

This Schedule sets forth information with respect to each purchase and sale of Common Shares which were effectuated by Saba Capital from the filing of the Schedule 13D/A on 2/25/25 to 3/5/25, the date of the event which required filing of this Schedule 13D/A. All transactions were effectuated in the open market through a broker.

|

Trade Date

|

Buy/Sell

|

Shares

|

Price

|

|

2/25/2025

|

Buy

|

28,491

|

13.13

|

|

2/26/2025

|

Buy

|

30,534

|

13.27

|

|

2/27/2025

|

Buy

|

22,238

|

13.21

|

|

3/3/2025

|

Buy

|

18,232

|

13.09

|

|

3/4/2025

|

Buy

|

55,443

|

12.72

|

|

3/5/2025

|

Buy

|

10,096

|

12.88

|

March 5, 2025

Via Electronic Mail and Courier

Ms. Claudia A. Brandon, Executive Vice President and Secretary

Neuberger Berman Next Generation Connectivity Fund Inc.

c/o Neuberger Berman Investment Advisers LLC

1290 Avenue of the Americas

New York, New York 10104-0002

Re: Neuberger Berman Next Generation Connectivity Fund Inc. (the "Fund")

Dear Ms. Brandon,

Saba Capital Management, L.P. ("Saba") is the investment adviser to Saba Capital Master Fund, Ltd. (the "Proponent"), the owner of 2,348,282 shares of common stock, par value $0.0001 per share of the Fund (the "Common Shares"). The Proponent has held Common Shares representing a market value of $25,000 or more continuously for more than one year prior to and including the date hereof.

In accordance with Rule 14a-8 promulgated under the Securities and Exchange Act of 1934, as amended (the "Exchange Act"), Saba, on behalf of the Proponent, submits the following proposal for presentation to the Fund's stockholders at the Fund's 2026 annual meeting of stockholders, including any postponement or adjournment or special meeting held in lieu thereof (the "Meeting").

The Proponent's proposal pursuant to Rule 14a-8 of the Exchange Act (the "Proposal") is as follows:

RESOLVED, that the shareholders of Neuberger Berman Next Generation Connectivity Fund Inc. (the "Fund") request that the Board of Directors of the Fund (the "Board") take all necessary steps in its power to declassify the Board so that all directors are elected on an annual basis starting at the next annual meeting of shareholders. Such declassification shall be completed in a manner that does not affect the unexpired terms of the previously elected directors.

Saba hereby represents that the Proponent has continuously and beneficially owned Common Shares with a market value of not less than $25,000 for at least one year prior to the date of the submission of Proposal, and intends to continue to hold the requisite number of Common Shares through the date of the Meeting. A letter from the Proponent's broker confirming the above ownership is attached as Exhibit A hereto.

In accordance with Rule 14a-8(b)(1)(iii) of the Exchange Act, the Proponent represents that its representatives are able to meet with the Fund via teleconference no less than 10 calendar days, nor more than 30 calendar days, after submission of the Proposal. The Proponent will assume that the regular business hours of the Fund's principal executive offices, which are located in New York, are between 9:00 a.m. and 5:30 p.m. ET, unless otherwise notified by the Fund. To that end, certain representatives of the Proponent are available to discuss the Proposal during the following business days and at the following times by teleconference:

- March 17, 2025, between 9:00 a.m. and 12 p.m. ET

- March 18, 2025, between 9:00 a.m. and 12 p.m. ET

- March 19, 2025, between 9:00 a.m. and 12 p.m. ET

The Proponent's contact information is as follows:

c/o Saba Capital Management, L.P.

405 Lexington Avenue, 58th Floor

New York, New York 10174

Attn: Michael D'Angelo

Email: Michael.Dangelo@sabacapital.com

In addition, Saba would appreciate that copies of all written notices and other written or electronic communications (which shall not constitute notice) be sent to:

Schulte Roth & Zabel LLP

919 Third Avenue, Suite 2300

New York, New York 10022

Attn: Abraham Schwartz

Email: Abraham.Schwartz@srz.com

Please notify us as soon as possible if you would like any further information or if you believe this notice is deficient in any way or if additional information is required so that the Proponent may promptly provide it to you in order to cure any deficiency.

Thank you for your time and consideration.

| |

Sincerely, |

| |

|

|

| |

|

|

| |

By: |

Saba Capital Management, L.P. |

| |

|

|

| |

|

/s/ Michael D'Angelo

|

| |

|

Name: Michael D'Angelo

Title: Chief Operating Officer and General Counsel

|

| |

|

|

| |

|

|

| |

|

cc: The Board of Directors of the Fund |

EXHIBIT A

Broker Letter

[See attached]

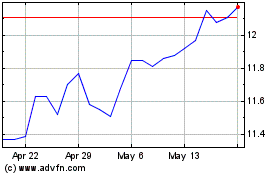

Neuberger Berman Next Ge... (NYSE:NBXG)

Historical Stock Chart

From Feb 2025 to Mar 2025

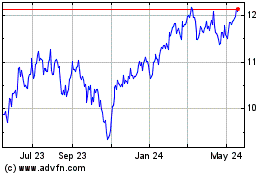

Neuberger Berman Next Ge... (NYSE:NBXG)

Historical Stock Chart

From Mar 2024 to Mar 2025