Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

September 23 2024 - 2:17PM

Edgar (US Regulatory)

Consolidated Schedule of Investments Next Generation Connectivity Fund Inc.^ (Unaudited)

July 31, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Communications Equipment 1.0%

|

|

|

|

|

Diversified Telecommunication Services 1.3%

|

|

|

|

|

Electronic Equipment, Instruments & Components 0.7%

|

|

|

|

|

|

|

|

|

Live Nation Entertainment, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health Care Equipment & Supplies 1.7%

|

|

|

|

|

Hotels, Restaurants & Leisure 3.4%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interactive Media & Services 5.9%

|

|

|

Meta Platforms, Inc. Class A

|

|

|

|

Tencent Holdings Ltd. ADR

|

|

|

|

|

|

|

|

|

|

International Business Machines Corp.

|

|

Semiconductors & Semiconductor Equipment 32.5%

|

|

|

Advanced Micro Devices, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BE Semiconductor Industries NV

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lattice Semiconductor Corp.

|

|

|

|

|

|

See Notes to Consolidated Schedule of Investments

Consolidated Schedule of Investments Next Generation Connectivity Fund Inc.^ (Unaudited) (cont’d)

|

|

|

Semiconductors & Semiconductor Equipment – cont'd

|

|

|

|

|

|

|

Monolithic Power Systems, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taiwan Semiconductor Manufacturing Co. Ltd. ADR

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Arctic Wolf Networks, Inc.

|

|

|

|

Cadence Design Systems, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SentinelOne, Inc. Class A

|

|

|

|

|

|

|

|

|

|

Technology Hardware, Storage & Peripherals 7.1%

|

|

|

|

|

|

|

Dell Technologies, Inc. Class C

|

|

|

|

|

|

|

|

|

|

Wireless Telecommunication Services 1.0%

|

|

|

|

|

|

|

Total Common Stocks (Cost $894,176,827)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cybereason, Inc., Series F

|

|

|

|

|

|

|

|

|

|

Grammarly, Inc., Series 3

|

|

See Notes to Consolidated Schedule of Investments

Consolidated Schedule of Investments Next Generation Connectivity Fund Inc.^ (Unaudited) (cont’d)

|

|

|

|

|

|

|

Videoamp, Inc., Series F1

|

|

|

|

|

|

Total Preferred Stocks (Cost $107,834,415)

|

|

|

|

|

|

|

|

|

|

|

|

Arctic Wolf Networks, Inc., 0.00% Cash/3.00% PIK, due 9/29/2027

(Cost $5,000,000)

|

|

|

|

|

|

|

Short-Term Investments 2.6%

|

Investment Companies 2.6%

|

|

|

State Street Institutional U.S. Government Money Market Fund Premier Class, 5.26%(g)

(Cost $29,036,920)

|

|

Total Investments 100.3% (Cost $1,036,048,162)

|

|

Liabilities Less Other Assets (0.3)%

|

|

Net Assets Applicable to Common Stockholders 100.0%

|

|

|

|

Non-income producing security.

|

|

|

All or a portion of this security is pledged as collateral for options written.

|

|

|

Value determined using significant unobservable inputs.

|

|

|

Security fair valued as of July 31, 2024 in accordance with procedures approved by

the valuation designee.

Total value of all such securities at July 31, 2024 amounted to $160,838,113, which

represents 14.7% of

net assets applicable to common stockholders of the Fund.

|

|

|

Security represented in Units.

|

|

|

Represents less than 0.05% of net assets applicable to common stockholders of the

Fund.

|

|

|

Payment-in-kind (PIK) security.

|

|

|

Represents 7-day effective yield as of July 31, 2024.

|

|

|

Includes the impact of the Fund’s open positions in derivatives at July 31, 2024.

|

# This security is subject to restrictions on resale. Total value of all such securities

at July 31, 2024 amounted to $160,838,113, which represents 14.7% of net assets applicable to common stockholders

of the Fund. Acquisition dates shown with a range, if any, represent securities that were acquired

over the period shown in the table.

|

|

|

|

|

Fair Value

Percentage

of Net Assets

Applicable

to Common

Stockholders

as of

7/31/2024

|

A24 Films LLC (Preferred Units)

|

|

|

|

|

See Notes to Consolidated Schedule of Investments

Consolidated Schedule of Investments Next Generation Connectivity Fund Inc.^ (Unaudited) (cont’d)

Restricted Security (cont’d)

|

|

|

|

Fair Value

Percentage

of Net Assets

Applicable

to Common

Stockholders

as of

7/31/2024

|

Arctic Wolf Networks, Inc.

|

|

|

|

|

Arctic Wolf Networks, Inc. (Convertible Bonds)

|

|

|

|

|

Celonis SE (Series D Preferred Shares)

|

|

|

|

|

Cybereason, Inc. (Series F Preferred Shares)

|

|

|

|

|

Fabletics LLC (Series G Preferred Shares)

|

|

|

|

|

Grammarly, Inc. (Series 3 Preferred Shares)

|

|

|

|

|

|

|

|

|

|

|

Savage X, Inc. (Series C Preferred Shares)

|

|

|

|

|

Videoamp, Inc. (Series F1 Preferred Shares)

|

|

|

|

|

|

|

|

|

|

|

See Notes to Consolidated Schedule of Investments

Consolidated Schedule of Investments Next Generation Connectivity Fund Inc.^ (Unaudited) (cont’d)

|

|

|

|

|

Percentage of Net

Assets Applicable

to Common

Stockholders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-Term Investments and Other Liabilities—Net

|

|

|

|

|

|

|

See Notes to Consolidated Schedule of Investments

Consolidated Schedule of Investments Next Generation Connectivity Fund Inc.^ (Unaudited) (cont’d)

Derivative Instruments

Written option contracts ("options written")

At July 31, 2024, the Fund had outstanding options written as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Equipment, Instruments & Components

|

|

|

|

|

|

|

|

|

|

Live Nation Entertainment, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hotels, Restaurants & Leisure

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interactive Media & Services

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

International Business Machines Corp.

|

|

|

|

|

|

Semiconductors & Semiconductor Equipment

|

Advanced Micro Devices, Inc.

|

|

|

|

|

|

Advanced Micro Devices, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Consolidated Schedule of Investments

Consolidated Schedule of Investments Next Generation Connectivity Fund Inc.^ (Unaudited) (cont’d)

|

|

|

|

|

|

|

Semiconductors & Semiconductor Equipment (cont’d)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lattice Semiconductor Corp.

|

|

|

|

|

|

Lattice Semiconductor Corp.

|

|

|

|

|

|

|

|

|

|

|

|

|

Monolithic Power Systems, Inc.

|

|

|

|

|

|

Monolithic Power Systems, Inc.

|

|

|

|

|

|

Monolithic Power Systems, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taiwan Semiconductor Manufacturing

Co. Ltd.

|

|

|

|

|

|

Taiwan Semiconductor Manufacturing

Co. Ltd.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cadence Design Systems, Inc.

|

|

|

|

|

|

Cadence Design Systems, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Technology Hardware, Storage & Peripherals

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Consolidated Schedule of Investments

Consolidated Schedule of Investments Next Generation Connectivity Fund Inc.^ (Unaudited) (cont’d)

|

|

|

|

|

|

|

Technology Hardware, Storage & Peripherals (cont’d)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wireless Telecommunication Services

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Live Nation Entertainment, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hotels, Restaurants & Leisure

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interactive Media & Services

|

|

|

|

|

|

|

|

Semiconductors & Semiconductor Equipment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taiwan Semiconductor Manufacturing

Co. Ltd.

|

|

|

|

|

|

See Notes to Consolidated Schedule of Investments

Consolidated Schedule of Investments Next Generation Connectivity Fund Inc.^ (Unaudited) (cont’d)

|

|

|

|

|

|

|

Semiconductors & Semiconductor Equipment (cont’d)

|

Taiwan Semiconductor Manufacturing

Co. Ltd.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cadence Design Systems, Inc.

|

|

|

|

|

|

CrowdStrike Holdings, Inc.

|

|

|

|

|

|

CrowdStrike Holdings, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Technology Hardware, Storage & Peripherals

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total options written (premium received $2,902,510)

|

|

|

|

|

|

|

Value determined using significant unobservable inputs.

|

|

|

Security fair valued as of July 31, 2024 in accordance with procedures approved by

the valuation designee.

|

At July 31, 2024, the Fund had securities pledged in the amount of $50,445,600 to

cover collateral requirements for options written.

The following is a summary, categorized by Level (see the Notes to Consolidated Schedule

of Investments), of inputs used to value the Fund’s investments as of July 31, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Semiconductors & Semiconductor Equipment

|

|

|

|

|

|

|

|

|

|

|

Technology Hardware, Storage & Peripherals

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Consolidated Schedule of Investments provides information on the industry or sector

categorization as

well as a Positions by Country summary.

|

See Notes to Consolidated Schedule of Investments

Consolidated Schedule of Investments Next Generation Connectivity Fund Inc.^ (Unaudited) (cont’d)

|

|

The following is a reconciliation between the beginning and ending balances of investments

in which

significant unobservable inputs (Level 3) were used in determining value:

|

|

|

Beginning

balance as

of 11/1/2023

|

Accrued

discounts/

(premiums)

|

|

Change

in unrealized

appreciation/

(depreciation)

|

|

|

|

|

|

Net change in

unrealized

appreciation/

(depreciation)

from

investments

still held as of

7/31/2024

|

Investments in Securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

Quantitative Information about Level 3 Fair Value Measurements:

|

|

|

|

|

Significant unobservable

input(s)

|

|

|

Impact to

valuation

from

increase

in input(b)

|

|

|

|

|

Enterprise value/Revenue

multiple(c) (EV/Revenue)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enterprise value/Revenue

multiple(c) (EV/Revenue)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

The weighted averages disclosed in the table above were weighted by relative fair

value.

|

(b)

Represents the expected directional change in the fair value of the Level 3 investments

that

would result from an increase or decrease in the corresponding input. Significant

changes in

these inputs could result in significantly higher or lower fair value measurements.

|

(c)

Represents amounts used when the reporting entity has determined that market participants

would use such multiples when pricing the investments.

|

The following is a summary, categorized by Level (see the Notes to Consolidated Schedule

of Investments), of inputs used to value the Fund’s derivatives as of July 31, 2024:

Other Financial Instruments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Consolidated Schedule of Investments

Consolidated Schedule of Investments Next Generation Connectivity Fund Inc.^ (Unaudited) (cont’d)

|

|

The following is a reconciliation between the beginning and ending balances of derivative

investments in

which significant unobservable inputs (Level 3) were used in determining value:

|

|

|

Beginning

balance as

of 11/1/2023

|

Accrued

discounts/

(premiums)

|

|

Change

in unrealized

appreciation/

(depreciation)

|

Purchases/

Closing

of options

|

Sales/

Writing

of options

|

|

|

|

Net change in

unrealized

appreciation/

(depreciation)

from

investments

still held as of

7/31/2024

|

Other Financial Instruments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

At July 31, 2024, these investments were valued in accordance with procedures approved

by the

valuation designee. These investments did not have a material impact on the Fund's

net assets

applicable to common stockholders and, therefore, disclosure of significant unobservable

inputs used

in formulating valuations is not presented.

|

^ A balance indicated with a "—", reflects either a zero balance or an amount that rounds to less than 1.

See Notes to Consolidated Schedule of Investments

Notes to Consolidated Schedule of Investments Next Generation Connectivity Fund Inc. (Unaudited)

In accordance with Accounting Standards Codification 820 "Fair Value Measurement"

("ASC 820"), all investments held by Neuberger Berman Next Generation Connectivity Fund Inc. (the "Fund")

are carried at the value that Management believes the Fund would receive upon selling an investment in

an orderly transaction to an independent buyer in the principal or most advantageous market for the investment

under current market conditions. Various inputs, including the volume and level of activity for the asset

or liability in the market, are considered in valuing the Fund's investments, some of which are discussed below. At

times, Management may need to apply significant judgment to value investments in accordance with ASC 820.

ASC 820 established a three-tier hierarchy of inputs to create a classification of

value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad Levels

listed below.

•

Level 1 – unadjusted quoted prices in active markets for identical investments

•

Level 2 – other observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, amortized cost, etc.)

•

Level 3 – unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing an investment are not necessarily an indication

of the risk associated with investing in those securities.

The value of the Fund's investments in equity securities, preferred stocks, and exchange-traded

options written, for which market quotations are available, is generally determined by Management by

obtaining valuations from independent pricing services based on the latest sale price quoted on a principal

exchange or market for that security (Level 1 inputs). Securities traded primarily on the NASDAQ Stock Market

are normally valued at the NASDAQ Official Closing Price ("NOCP") provided by NASDAQ each business day. The NOCP

is the most recently reported price as of 4:00:02 p.m., Eastern Time, unless that price is outside the

range of the "inside" bid and asked prices (i.e., the bid and asked prices that dealers quote to each other when

trading for their own accounts); in that case, NASDAQ will adjust the price to equal the inside bid or asked price,

whichever is closer. Because of delays in reporting trades, the NOCP may not be based on the price of the last trade

to occur before the market closes. If there is no sale of a security on a particular day, the independent pricing

services may value the security based on market quotations.

The value of the Fund's investments in debt securities is determined by Management

primarily by obtaining valuations from independent pricing services based on bid quotations, or if quotations

are not available, by methods that include various considerations based on security type (generally Level

2 inputs). In addition to the consideration of yields or prices of securities of comparable quality, coupon, maturity

and type, indications as to values from dealers, and general market conditions, the following is a description

of other Level 2 inputs and related valuation techniques used by independent pricing services to value certain

types of debt securities held by the Fund:

Convertible Bonds. Inputs used to value convertible bonds generally include underlying stock data, conversion rates, credit-specific details, relevant listed bond and preferred stock

prices and other market information, which may include benchmark yield curves, reported trades, broker-dealer

quotes, issuer spreads, comparable securities, and reference data, such as market

research publications, when available.

Management has developed a process to periodically review information provided by

independent pricing services for all types of securities.

Investments in non-exchange traded investment companies are valued using the respective

fund's daily calculated net asset value per share (Level 2 inputs), when available.

For information on the Fund's significant accounting policies, please refer to the

Fund's most recent stockholder reports.

Notes to Consolidated Schedule of Investments Next Generation Connectivity Fund Inc. (Unaudited) (cont’d)

If a valuation is not available from an independent pricing service, or if Management

has reason to believe that the valuation received does not represent the amount the Fund might reasonably expect

to receive on a current sale in an orderly transaction, Management seeks to obtain quotations from brokers

or dealers (generally considered Level 2 or Level 3 inputs depending on the number of quotes available).

If such quotations are not available, the security is valued using methods Management has approved in the good-faith

belief that the resulting valuation will reflect the fair value of the security. Pursuant to Rule

2a-5 under the Investment Company Act of 1940, the Fund's Board of Directors designated Management as the Fund's valuation

designee. As the Fund's valuation designee, Management is responsible for determining fair value in

good faith for all Fund investments. Inputs and assumptions considered in determining fair value of a security

based on Level 2 or Level 3 inputs may include, but are not limited to, the type of security; the initial cost

of the security; the existence of any contractual restrictions on the security's disposition; the price and extent of public

trading in similar securities of the issuer or of comparable companies; quotations or evaluated prices from broker-dealers

or pricing services; information obtained from the issuer and analysts; an analysis of the company's or

issuer's financial statements; an evaluation of the inputs that influence the issuer and the market(s) in which the

security is purchased and sold.

The value of the Fund's investments in foreign securities is generally determined

using the same valuation methods and inputs as other Fund investments, as discussed above. Foreign security

prices expressed in local currency values are normally translated from the local currency into U.S. dollars

using the exchange rates as of 4:00 p.m., Eastern Time, on days the New York Stock Exchange ("NYSE") is open for

business. Management has approved the use of ICE Data Services ("ICE") to assist in determining the fair value

of foreign equity securities when changes in the value of a certain index suggest that the closing prices on the

foreign exchanges may no longer represent the amount that the Fund could expect to receive for those securities

or when foreign markets are closed and U.S. markets are open. In each of these events, ICE will provide adjusted

prices for certain foreign equity securities using a statistical analysis of historical correlations of multiple

factors (Level 2 inputs). In the absence of precise information about the market values of these foreign securities

as of the time at which the Fund's share price is calculated, Management has determined based on available data

that prices adjusted or evaluated in this way are likely to be closer to the prices the Fund could realize

on a current sale than the prices of those securities established at the close of the foreign markets in which the securities

primarily trade.

Fair value prices are necessarily estimates, and there is no assurance that such a

price will be at or close to the price at which the security is next quoted or traded.

To facilitate compliance with certain requirements necessary to maintain its status

as a regulated investment company, the Fund formed NB A24 NBXG Blocker LLC (the "Blocker"), a Delaware limited

liability company, to hold interests in certain private placements. The Blocker is a wholly owned subsidiary

of the Fund and the Fund will remain its sole member.

As of July 31, 2024, the value of the Fund's investment in the Blocker was as follows:

|

|

|

Percentage of

Net Assets

Applicable

to Common

Stockholders

|

|

|

|

|

For information on the Fund's significant accounting policies, please refer to the

Fund's most recent stockholder reports.

Notes to Consolidated Schedule of Investments Next Generation Connectivity Fund Inc. (Unaudited) (cont'd)

|

|

|

|

= American Depositary Receipt

|

|

|

= Neuberger Berman Investment Advisers LLC

|

For information on the Fund's significant accounting policies, please refer to the

Fund's most recent stockholder reports.

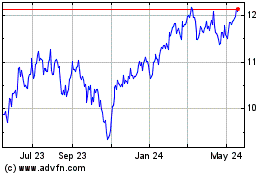

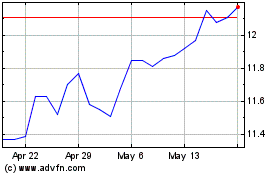

Neuberger Berman Next Ge... (NYSE:NBXG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Neuberger Berman Next Ge... (NYSE:NBXG)

Historical Stock Chart

From Dec 2023 to Dec 2024