false

0001164727

0001164727

2024-07-26

2024-07-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 26, 2024

NEWMONT CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 001-31240 | 84-1611629 |

(State or Other Jurisdiction of Incorporation or Organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

6900 E Layton Ave

Denver, Colorado | 80237 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including

area code (303) 863-7414

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class |

|

Trading

Symbol |

|

Name of each exchange on which registered |

| Common stock, par value $1.60 per share |

|

NEM |

|

New York Stock Exchange |

|

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

ITEM 8.01. OTHER

EVENTS

As previously disclosed, Newmont Corporation

(“Newmont”) completed its business combination transaction with Newcrest Mining Limited, an Australian public company limited

by shares (“Newcrest”), whereby Newmont, through its indirect wholly owned subsidiary, Newmont Overseas Holdings Pty Ltd,

an Australian proprietary company limited by shares, acquired all of the issued and fully paid ordinary shares of Newcrest (such acquisition,

the “Transaction”).

This Current Report on Form 8-K is

being made to provide certain unaudited pro forma condensed combined financial information of Newmont giving effect to the Transaction

and related notes for the year ended December 31, 2023 required pursuant to Article 11 of Regulation S-X filed herewith as

Exhibit 99.1 and incorporated herein by reference.

The pro forma financial information included

herein has been presented for informational purposes only. It does not purport to represent the actual financial position or results

of operations that Newmont and Newcrest would have achieved had the companies been combined as of the date or during the periods presented

in the pro forma financial information and is not intended to project the future financial position or results of operations that the

combined company may achieve following implementation of the Transaction.

ITEM 9.01. FINANCIAL

STATEMENTS AND EXHIBITS

(b) Pro Forma Financial Information.

The unaudited pro forma condensed combined

financial information of Newmont reflecting the Transaction and related notes for the year ended December 31, 2023 are incorporated

herein by reference as Exhibit 99.1.

(d) Exhibits.

The exhibits to this Current Report on

Form 8-K are as follows:

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

NEWMONT CORPORATION |

| |

|

|

| Date: July 26, 2024 |

By: |

/s/ LOGAN HENNESSEY |

| |

|

Logan Hennessey |

| |

|

Vice President, Deputy General Counsel and Corporate Secretary |

Exhibit 99.1

UNAUDITED PRO FORMA CONDENSED COMBINED

FINANCIAL INFORMATION

The following unaudited pro forma condensed

combined financial information (“unaudited pro forma financial information”) has been prepared based on the historical audited

and unaudited consolidated statements of operations of Newmont Corporation (“Newmont”) and Newcrest Mining Limited, a public

Australian mining company limited by shares ("Newcrest"), as indicated below, after giving effect to the acquisition by Newmont,

through its indirect wholly owned subsidiary, Newmont Overseas Holdings Pty Ltd, an Australian proprietary company limited by

shares (“Newmont Sub”), of all ordinary shares of Newcrest (the “Transaction”). The unaudited pro forma financial

information is intended to provide you with information about how the Transaction might have affected Newmont’s historical consolidated

statement of operations.

The unaudited pro forma condensed combined statement of operations

(“unaudited pro forma statement of operations”) for the year ended December 31, 2023 combines the historical audited

consolidated statements of operations of Newmont for the corresponding period, with the respective historical audited and unaudited consolidated

income statements of Newcrest, as derived from the audited and unaudited consolidated financial statements of Newcrest as indicated below,

as if the Transaction had occurred on January 1, 2023.

The unaudited pro forma financial information does not include an

unaudited pro forma condensed combined balance sheet as of December 31, 2023 as the Transaction was completed on November 6,

2023 and is reflected in Newmont's historical audited consolidated balance sheet as of December 31, 2023 included in Newmont's annual

report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 29, 2024 (“Newmont’s

2023 annual report on Form 10-K”).

The unaudited pro forma financial information has been developed from

and should be read in conjunction with:

| · | the accompanying notes to the unaudited pro forma financial information; |

| · | the historical audited consolidated statement of operations of

Newmont for the year ended December 31, 2023, included in Newmont’s 2023 annual

report on Form 10-K; |

| · | the historical audited consolidated income statement of Newcrest

for the fiscal year ended June 30, 2023, included as Annex B to Newmont’s definitive

proxy statement on Schedule 14A filed with the SEC on September 5, 2023 in connection

with the Transaction; |

| · | the historical unaudited consolidated income statement of Newcrest

for the six months ended December 31, 2022, included in Newcrest’s Australian

Securities Exchange (“ASX”) Appendix 4D and Financial Report as filed with the

ASX on February 16, 2023; and |

| · | the historical unaudited consolidated income statement of Newcrest

from July 1, 2023 to November 5, 2023, included in Note 3 to the unaudited pro

forma financial information and accompanying notes thereto. |

The unaudited pro forma financial information is presented using the

acquisition method of accounting, as further described in Note 2, with Newmont as the acquirer of Newcrest. Under the acquisition method

of accounting, the purchase price is allocated to the underlying tangible and intangible assets acquired and liabilities assumed of Newcrest

based on their respective fair market values with any excess purchase price allocated to goodwill.

The unaudited pro forma financial information is presented for informational

purposes only. The information has been adjusted to include estimated Transaction accounting adjustments, which reflect the application

of the accounting in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”).

The information is not necessarily indicative of the results of operations

that actually would have been achieved had the Transaction occurred as of the dates indicated herein, nor do they purport to project

the future operating results of Newmont. The unaudited pro forma financial information also does not reflect the costs of any integration

activities or cost savings or synergies expected to be achieved as a result of the Transaction and, accordingly, do not attempt to predict

or suggest future results of operations of Newmont.

Newmont Corporation

Unaudited Pro Forma Condensed Combined Statement

of Operations

For the Year Ended December 31, 2023

| | |

Historical | | |

Reclassified

Historical | | |

IFRS to U.S.

GAAP and

Accounting

Policy | | |

| |

Accounting

Transaction | | |

| |

Pro | |

| in millions (U.S. dollars) | |

Newmont | | |

Newcrest

(Note 3) | | |

Adjustments

(Note 4) | | |

(Note) | |

Adjustments

(Note 5) | | |

(Note) | |

Forma

Combined | |

| Sales | |

$ | 11,812 | | |

$ | 3,679 | | |

$ | (59 | ) | |

4(a) | |

$ | — | | |

| |

$ | 15,432 | |

| | |

| | | |

| | | |

| | | |

| |

| | | |

| |

| | |

| Costs and expenses: | |

| | | |

| | | |

| | | |

| |

| | | |

| |

| | |

| Costs applicable to sales (1) | |

| 6,699 | | |

| 1,997 | | |

| 76 | | |

4(a)(c)(g)(i)(j) | |

| (146 | ) | |

5(a) | |

| 8,626 | |

| Depreciation and amortization | |

| 2,108 | | |

| 669 | | |

| (128 | ) | |

4(b)(c)(d)(g)(j) | |

| 39 | | |

5(a)(b) | |

| 2,688 | |

| Reclamation and remediation | |

| 1,533 | | |

| 14 | | |

| — | | |

| |

| — | | |

| |

| 1,547 | |

| Exploration | |

| 265 | | |

| 74 | | |

| 7 | | |

4(e) | |

| — | | |

| |

| 346 | |

| Advanced projects, research and development | |

| 200 | | |

| 4 | | |

| — | | |

| |

| — | | |

| |

| 204 | |

| General and administrative | |

| 299 | | |

| 109 | | |

| — | | |

| |

| — | | |

| |

| 408 | |

| Impairment charges | |

| 1,891 | | |

| — | | |

| — | | |

| |

| — | | |

| |

| 1,891 | |

| Other expense, net (2) | |

| 517 | | |

| 96 | | |

| 2 | | |

4(a) | |

| — | | |

| |

| 615 | |

| | |

| 13,512 | | |

| 2,963 | | |

| (43 | ) | |

| |

| (107 | ) | |

| |

| 16,325 | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| |

| | | |

| |

| | |

| Other income (loss), net | |

| (88 | ) | |

| 122 | | |

| (21 | ) | |

4(f)(h) | |

| — | | |

| |

| 13 | |

| Interest expense, net of capitalized interest | |

| (243 | ) | |

| (111 | ) | |

| — | | |

4(j) | |

| (68 | ) | |

5(d) | |

| (422 | ) |

| | |

| (331 | ) | |

| 11 | | |

| (21 | ) | |

| |

| (68 | ) | |

| |

| (409 | ) |

| Income (loss) before income and mining tax and other items | |

| (2,031 | ) | |

| 727 | | |

| (37 | ) | |

| |

| 39 | | |

| |

| (1,302 | ) |

| Income and mining tax benefit (expense) | |

| (526 | ) | |

| (228 | ) | |

| 5 | | |

4(b)(c)(e)(g)(h)(i) | |

| (10 | ) | |

5(e) | |

| (759 | ) |

| Equity income (loss) of affiliates | |

| 63 | | |

| 12 | | |

| 31 | | |

4(f) | |

| (30 | ) | |

5(c) | |

| 76 | |

| Net income (loss) from continuing operations | |

| (2,494 | ) | |

| 511 | | |

| (1 | ) | |

| |

| (1 | ) | |

| |

| (1,985 | ) |

| Net loss (income) from continuing operations attributable to noncontrolling interests | |

| (27 | ) | |

| — | | |

| — | | |

| |

| — | | |

| |

| (27 | ) |

| Net income (loss) from continuing operations attributable to Newmont stockholders | |

$ | (2,521 | ) | |

$ | 511 | | |

$ | (1 | ) | |

| |

$ | (1 | ) | |

| |

$ | (2,012 | ) |

| | |

| | | |

| | | |

| | | |

| |

| | | |

| |

| | |

| Basic loss per common share from continuing operations attributable to Newmont stockholders | |

$ | (3.00 | ) | |

| | | |

| | | |

| |

| | | |

| |

$ | (1.74 | ) |

| Diluted loss per common share from continuing operations attributable to Newmont stockholders (3) | |

$ | (3.00 | ) | |

| | | |

| | | |

| |

| | | |

| |

$ | (1.74 | ) |

| (1) | Excludes Depreciation and amortization and Reclamation

and remediation. |

| (2) | Newmont Historical includes $464 of Newcrest transaction and

integration costs. |

| (3) | Potentially dilutive shares were excluded in the computation

of diluted loss per common share from continuing operations attributable to Newmont stockholders

as they were antidilutive. |

Notes to Unaudited Pro Forma Condensed Combined Financial Information

| 1. | Description of the Transaction |

On November 6, 2023 (the “Acquisition Date”), Newmont

completed its acquisition of Newcrest, whereby Newmont, through Newmont Sub, acquired all of the ordinary shares of Newcrest in a fully

stock transaction for total non-cash consideration of $13,549. Newcrest became a direct wholly owned subsidiary of Newmont Sub and an

indirect wholly owned subsidiary of Newmont (such acquisition, the “Transaction”). Newmont continues to be traded on the

New York Stock Exchange under the ticker NEM. Newmont is also listed on the Toronto Stock Exchange under the ticker NGT, on the Australian

Securities Exchange under the ticker NEM, and on the Papua New Guinea Securities Exchange under the ticker NEM.

The Acquisition Date fair value of the consideration transferred consisted

of the following:

| (in millions, except share and per share data) | |

Shares | | |

Per Share | | |

Purchase

Consideration | |

| Stock Consideration | |

| | | |

| | | |

| | |

| Shares of Newmont exchanged for Newcrest outstanding ordinary shares | |

| 357,691,627 | | |

$ | 37.88 | | |

$ | 13,549 | |

| | |

| | | |

| | | |

| | |

| Total Purchase Price | |

| | | |

| | | |

$ | 13,549 | |

The accompanying unaudited pro forma financial information presents

the unaudited pro forma statement of operations of Newmont. Newmont prepares its consolidated statement of operations on the basis of

a fiscal year ended December 31, 2023. The consolidated income statements of Newcrest have historically been prepared on a basis

of a fiscal year ended June 30, 2023. In accordance with applicable SEC rules, if the fiscal year end of an acquired entity differs

from the acquirer's fiscal year end by more than 93 days, the acquired entity's income statement must be brought up within 93 days of

the acquirer's fiscal year end. Financial information for Newcrest for the year ended December 31, 2023 has been derived for purposes

of the preparation of the unaudited pro forma financial information. The unaudited pro forma statements of operations were prepared using:

| · | the historical audited consolidated statement of operation of

Newmont for the year ended December 31, 2023. This includes Newcrest’s results

of operation from November 6, 2023 through December 31, 2023; and |

| · | Newcrest’s historical unaudited consolidated income statement

representing its results of operations for the period beginning January 1, 2023, to

ended November 5, 2023, (“the period prior to acquisition”). This was derived

from Newcrest’s historical audited consolidated income statement for the fiscal year

ended June 30, 2023, less its historical unaudited consolidated income statement for

the six months ended December 31, 2022, plus its historical unaudited consolidated income

statement from July 1, 2023 through November 5, 2023 (refer to Note 3). |

The historical audited consolidated statement of operations of Newmont

is prepared in accordance with U.S. GAAP and is reported in U.S. dollars. The historical audited and unaudited consolidated income statements

of Newcrest are prepared in accordance with IFRS as issued by the IASB and are reported in U.S. dollars.

The unaudited pro forma statements of operations gives effect to the

Transaction as if it had occurred on January 1, 2023.

The Transaction is accounted for using the acquisition method of accounting,

as prescribed in Accounting Standards Codification 805, Business Combinations, (“ASC 805”), under U.S. GAAP. Accordingly,

the purchase price is allocated to the assets acquired and liabilities assumed, based on their estimated fair values as of the date of

the Acquisition Date. As of the date of this filing, Newmont has not fully completed the analysis to assign fair values to all assets

acquired and liabilities assumed, and therefore the purchase price allocation for Newcrest is preliminary. At December 31, 2023,

remaining items to finalize included the fair value of materials and supplies inventories, property plant and mine development (including

mineral interest), goodwill, reclamation and remediation liabilities, employee-related benefits, unrecognized tax benefits, and deferred

income tax assets and liabilities. The preliminary purchase price allocation will be subject to further refinement as Newmont continues

to refine its estimates and assumptions based on information available at the Acquisition Date. These refinements may result in material

changes to the estimated fair value of assets acquired and liabilities assumed. The purchase price allocation adjustments can be made

throughout the end of Newmont’s measurement period, which is not to exceed one year from the Acquisition Date. Refer to Item 8,

Financial Statements and Supplementary Data, Note 3 of Newmont’s 2023 annual report on Form 10-K for information on

the purchase consideration, fair value estimates of the assets acquired and liabilities assumed, and resulting goodwill as of the Acquisition

Date.

Material adjustments have been made to reflect Newcrest’s historical

audited and unaudited consolidated income statements on a U.S. GAAP basis for purposes of presenting the unaudited pro forma financial

information and to align Newcrest’s historical significant accounting policies under IFRS to Newmont’s significant accounting

policies under U.S. GAAP. These adjustments represent Newmont management’s best estimates and are based upon currently available

information and certain assumptions that Newmont believes are reasonable under the circumstances.

The preliminary pro forma adjustments have been made solely for the

purpose of providing the unaudited pro forma financial information presented herein. Newmont had not fully completed the analysis to

assign fair values to all assets acquired and liabilities assumed, and therefore the purchase price allocation for Newcrest is preliminary.

Any increases or decreases in the fair value of assets acquired and liabilities assumed upon completion of the final valuations will

result in adjustments to the unaudited pro forma statements of operations. The final purchase price allocation may be materially different

than that reflected in the pro forma purchase price allocation presented herein.

| 3. | Newcrest Historical Financial Statements |

Newcrest historical figures were derived from Newcrest’s historical

audited and unaudited consolidated income statements as described above and are presented under IFRS and are in U.S. dollars. The historical

figures reflect certain reclassifications of Newcrest’s consolidated income statements categories to conform to Newmont’s

presentation in its consolidated statement of operations. In addition, material adjustments have been made to align Newcrest’s

historical significant accounting policies under IFRS to Newmont’s significant accounting policies under U.S. GAAP.

The historical unaudited consolidated income statement of Newcrest

derived as described in Note 2 is as follows:

| Income Statement Information for the period ended November 5, 2023 |

| |

|

[A] |

|

|

[B] |

|

|

[C] |

|

|

[A]-[B]+[C] |

|

| |

|

Audited |

|

|

Unaudited |

|

|

Unaudited |

|

|

Unaudited |

|

| (in millions) |

|

Annual Report

for year ended

June 30, 2023 |

|

|

Half-year

Financial Report

for six months ended

December 31, 2022 |

|

|

Interim Financial

Information for the

period July 1, 2023 -

November 5, 2023 |

|

|

Historical for

for the period

ended

November 5, 2023 |

|

| Revenue |

|

$ |

4,508 |

|

|

$ |

2,121 |

|

|

$ |

1,292 |

|

|

$ |

3,679 |

|

| Cost of sales |

|

|

(3,282 |

) |

|

|

(1,632 |

) |

|

|

(1,002 |

) |

|

|

(2,652 |

) |

| Gross profit |

|

|

1,226 |

|

|

|

489 |

|

|

|

290 |

|

|

|

1,027 |

|

| Exploration expenses |

|

|

(76 |

) |

|

|

(38 |

) |

|

|

(36 |

) |

|

|

(74 |

) |

| Corporate administration expenses |

|

|

(138 |

) |

|

|

(63 |

) |

|

|

(48 |

) |

|

|

(123 |

) |

| Other income/(expenses) |

|

|

141 |

|

|

|

72 |

|

|

|

(86 |

) |

|

|

(17 |

) |

| Share of profit/(loss) of associates |

|

|

19 |

|

|

|

— |

|

|

|

(7 |

) |

|

|

12 |

|

| Profit before interest and income tax |

|

|

1,172 |

|

|

|

460 |

|

|

|

113 |

|

|

|

825 |

|

| Finance income |

|

|

41 |

|

|

|

20 |

|

|

|

18 |

|

|

|

39 |

|

| Finance costs |

|

|

(137 |

) |

|

|

(66 |

) |

|

|

(54 |

) |

|

|

(125 |

) |

| Net finance costs |

|

|

(96 |

) |

|

|

(46 |

) |

|

|

(36 |

) |

|

|

(86 |

) |

| Profit before income tax |

|

|

1,076 |

|

|

|

414 |

|

|

|

77 |

|

|

|

739 |

|

| Income tax expense |

|

|

(298 |

) |

|

|

(121 |

) |

|

|

(51 |

) |

|

|

(228 |

) |

| Profit after income tax |

|

$ |

778 |

|

|

$ |

293 |

|

|

$ |

26 |

|

|

$ |

511 |

|

The reclassifications are summarized below:

| Income Statement Information for the period ended November 5, 2023 |

| Newcrest Income Statement Line |

|

Newcrest

Historical Amount |

|

|

Reclassifications |

|

|

Newcrest Historical

Reclassified Amount |

|

|

Newmont Statement

of Operations Line |

| (in millions) |

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

3,679 |

|

|

$ |

— |

|

|

$ |

3,679 |

|

|

Sales |

| Cost of sales |

|

|

(2,652 |

) |

|

|

655 |

(1) |

|

|

(1,997 |

) |

|

Costs applicable to sales |

| |

|

|

— |

|

|

|

(669 |

)(1) |

|

|

(669 |

) |

|

Depreciation and amortization |

| |

|

|

— |

|

|

|

(14 |

)(2) |

|

|

(14 |

) |

|

Reclamation and remediation |

| Exploration expenses |

|

|

(74 |

) |

|

|

— |

|

|

|

(74 |

) |

|

Exploration |

| |

|

|

— |

|

|

|

(4 |

)(3) |

|

|

(4 |

) |

|

Advanced projects, research and development |

| Corporate administration expenses |

|

|

(123 |

) |

|

|

14 |

(1) |

|

|

(109 |

) |

|

General and administrative |

| Other income/(expenses) |

|

|

(17 |

) |

|

|

(79 |

)(3)(4) |

|

|

(96 |

) |

|

Other expense, net |

| Share of profit/(loss) of associates |

|

|

12 |

|

|

|

(12 |

)(5) |

|

|

— |

|

|

|

| Finance income |

|

|

39 |

|

|

|

83 |

(4) |

|

|

122 |

|

|

Other income (loss), net |

| Finance costs |

|

|

(125 |

) |

|

|

14 |

(2) |

|

|

(111 |

) |

|

Interest expense, net of capitalized |

| Income tax expense |

|

|

(228 |

) |

|

|

— |

|

|

|

(228 |

) |

|

Income and mining tax benefit (expense) |

| |

|

|

— |

|

|

|

12 |

(5) |

|

|

12 |

|

|

Equity income (loss) of affiliates |

| Profit after income tax |

|

$ |

511 |

|

|

$ |

— |

|

|

$ |

511 |

|

|

Net income from continuing operations |

| (1) | Represents a reclassification of Newcrest’s depreciation

and amortization, historically included in Cost of sales and Corporate administration

expenses, to Depreciation and amortization at Newmont. |

| (2) | Represents a reclassification of Newcrest’s accretion

expense, historically included in Finance costs, to Reclamation and remediation

at Newmont. |

| (3) | Represents a reclassification of Newcrest’s exploration,

evaluation, and research and development expenses, historically included in Other income/(expenses),

to Advanced projects, research and development at Newmont. |

| (4) | Represents a reclassification of Newcrest’s other income,

historically included in Other income/(expenses), to Other income (loss), net

at Newmont. |

| (5) | Represents a reclassification of Newcrest’s share of

earnings from equity method investments, historically included in Share of profit/(loss)

of associates, to Equity income (loss) of affiliates at Newmont. |

| 4. | IFRS to U.S. GAAP and Accounting Policy Alignment

Adjustments |

IFRS differs in certain material respects from U.S. GAAP. The following

material adjustments have been made to reflect Newcrest’s historical audited and unaudited consolidated income statement on a U.S.

GAAP basis for the purposes of the unaudited pro forma statement of operations. In addition, material adjustments have also been made

to align Newcrest’s significant accounting policies under IFRS to Newmont’s significant accounting policies under U.S. GAAP.

| (a) | By-product versus co-product revenue accounting |

Under Newmont’s accounting policy, a metal is considered a by-product

when sales represent less than 10 percent and up to 20 percent of the total sales from all metals on a life of mine basis and revenue

from by-product metal sales is recognized as a reduction to Cost applicable to sales. Additionally, mark-to-market impacts related

to provisionally priced by-product sales are recognized in Cost applicable to sales, while mark-to-market impacts related to provisionally

priced co-product sales are recognized in Sales.

Newcrest’s accounting policy was to recognize proceeds from

sales of all metals in Sales and all mark-to-market impacts of provisionally priced sales within Other expense, net.

The following table reflects the impact of reclassifying sales for

certain metals that are considered by-products metals by Newmont, and the reclassification of mark-to-market impacts of provisionally

priced co-product sales from Other expense, net to Sales:

| (in millions) |

|

For the period ended

November 5, 2023 |

|

| Condensed Statements of Operations |

|

|

|

|

| Decrease to sales |

|

$ |

(59 |

) |

| Decrease to cost applicable to sales |

|

$ |

(61 |

) |

| Increase to other expense, net |

|

$ |

2 |

|

Under both U.S. GAAP and IFRS, long-lived assets are tested for impairment

when events or changes in circumstances indicate that the carrying amounts may be impaired. Under U.S. GAAP, an asset group is first

tested for recoverability by determining if the carrying amount exceeded the expected future cash flows from the asset group on an undiscounted

basis. If the asset group is determined not to be recoverable on an undiscounted basis, an impairment expense is recorded for the excess

of the asset group’s carrying amount over its fair value. Further, future reversal of a previously recognized impairment loss is

prohibited.

Under IFRS, when an impairment indicator is determined to exist, an

impairment expense is recorded for the excess of a cash generating unit’s carrying amount over the greater of its fair value less

costs of disposal and its value in use. Impairment expense previously recorded is reversible in subsequent periods under certain conditions.

The following table reflects the reversal of impairment expense recognized

by Newcrest under IFRS, when assessed under U.S. GAAP on an undiscounted cash flow basis, after adjusting the carrying value of the property,

plant and mine development for (i) incremental depreciation expense which would have been recorded had the asset not been impaired,

(ii) the exclusion of resources from recoverable ounces, utilized in calculating depreciation expense, to align with Newmont’s

accounting policy, and (iii) reversing mine development and stripping costs capitalized by Newcrest, as outlined in Note 4(c):

| (in millions) |

|

For the period ended

November 5, 2023 |

|

| Condensed Statements of Operations |

|

|

|

|

| Increase to depreciation and amortization |

|

$ |

22 |

|

| Increase to income and mining tax benefit (expense) |

|

$ |

7 |

|

| (c) | Mine development and stripping costs |

Under U.S. GAAP, Newmont capitalizes mine development costs and stripping

costs to access the main ore body after mineralization is classified as proven and probable reserves, and before the production phase

of the mine. After the production phase of a mine is achieved, stripping costs are included as variable production costs of stockpiles

and ore on leach pads.

Under IFRS, Newcrest capitalizes mine development costs, including

stripping costs to remove overburden and waste to access the main ore body, and in addition, Newcrest continues to capitalize stripping

costs after the production phase of a mine if certain conditions are met and when the strip ratio exceeds the estimated life of mine

strip ratio of the open pit mine. The capitalized stripping costs are depreciated over the expected useful life of the identified component

of the ore body that is made more accessible by the activity, on a units-of-production basis.

The following table reflects the reversal of mine development and

stripping costs capitalized by Newcrest before mineralization is classified as proven and probable reserves and after the production

phase of a mine is achieved, net of depreciation and amortization. Stripping costs incurred during the production phase of a mine are

included as variable production costs, as further outlined in Note 4(g):

| (in millions) |

|

For the period ended

November 5, 2023 |

|

| Condensed Statements of Operations |

|

|

|

|

| Increase to cost applicable to sales |

|

$ |

131 |

|

| Decrease to depreciation and amortization |

|

$ |

(148 |

) |

| Decrease to income and mining tax benefit (expense) |

|

$ |

(5 |

) |

| (d) | Depreciation and amortization |

Under U.S. GAAP, Newmont’s accounting policy is to amortize

certain mine development costs using the units-of-production method based on estimated recoverable ounces or pounds in proven and probable

reserves. Under IFRS, Newcrest included estimated recoverable ounces contained in proven and probable reserves and, at certain operations,

a portion of resources that are considered to be highly probable of being economically recovered.

The impact of excluding resources from recoverable ounces in units-of-production

method based depreciation expense calculations is included in certain adjustments and is noted where applicable.

| (e) | Exploration and evaluation costs |

Under U.S. GAAP, Newmont incurs exploration and evaluation costs during

exploration and development phases. Costs incurred during the exploration phase and before mineralization is classified as proven and

probable reserves are expensed. Costs incurred during the development phase and after mineralization is classified as proven and probable

reserves are capitalized.

Under IFRS, an entity is able to make an accounting policy election

on whether to expense or capitalize exploration, evaluation and deferred feasibility costs. Newcrest capitalizes exploration, evaluation

and deferred feasibility costs if either such costs are expected to be recouped, significant exploration activity is ongoing with a reasonable

assessment of the existence of economically recoverable reserves, or when expenditures are incurred to enable a development decision.

The following table reflects the impact of expensing a portion of

the exploration, evaluation and deferred feasibility costs capitalized by Newcrest under IFRS as those costs were incurred before declaration

of proven and probable reserves as required for capitalization under U.S. GAAP:

| (in millions) |

|

For the period ended

November 5, 2023 |

|

| Condensed Statements of Operations |

|

|

|

|

| Increase to exploration |

|

$ |

7 |

|

| Increase to income and mining tax benefit (expense) |

|

$ |

3 |

|

| (f) | Equity method investments |

Under U.S. GAAP, the equity method is applied if an investor has the

ability to exercise significant influence over the operating and financial policies of an investee. A common stock investment in a corporate

entity that provides an investor with ownership of 20 percent or more of the investee’s voting stock, but with less than a controlling

financial interest, leads to a presumption that the investor has the ability to exercise significant influence over the investee. Conversely,

an investment of less than 20 percent of the voting stock of an investee leads to a presumption that an investor does not have the ability

to exercise significant influence unless such ability can be demonstrated. Newmont’s accounting policy considers both ownership

percentage and other factors impacting the ability to exercise significant influence, such as present voting rights related to board

representation and other advisory arrangements, when assessing whether an investor has significant influence. The evaluation of significant

influence is generally consistent under both IFRS and U.S. GAAP, except U.S. GAAP considers only present voting rights while IFRS also

takes into consideration potential voting rights that are currently exercisable.

Certain investments held by Newcrest are below the presumed 20 percent

ownership, have the current rights to board representation that are unfulfilled, and have separate advisory arrangements. Therefore,

the presumption of significant influence is not met under U.S. GAAP.

The following table reflects the impact of converting certain interests

held by Newcrest from the equity method of accounting under IFRS to a marketable equity security under U.S. GAAP as the percentage ownership

is less than 20 percent:

| (in millions) |

|

For the period ended

November 5, 2023 |

|

| Condensed Statements of Operations |

|

|

|

|

| Decrease to other income (loss), net |

|

$ |

(24 |

) |

| Increase to equity income (loss) of affiliates |

|

$ |

31 |

|

| (g) | Stockpiles and ore on leach pads |

Under U.S. GAAP, costs that are incurred in or benefit the production

process are accumulated as stockpiles and ore on leach pads. Stockpiles and ore on leach pads are carried at the lower of average cost

or net realizable value. Net realizable value represents the estimated future sales price of the product based on current and long-term

metals prices, less the estimated costs to complete production and bring the product to sale. Costs are added to stockpiles and ore on

leach pads based on current mining costs, including stripping costs incurred during the production phase of a mine (refer to Note 4(c)),

and applicable depreciation and amortization relating to mining operations. Costs are removed from stockpiles and ore on leach pads based

on the average cost per estimated recoverable ounce as material is processed.

Under IFRS, ore stockpiles are largely accounted for in the same manner

with the exception of stripping costs during the production phase of a mine, which are capitalized when certain conditions are met. Under

Newcrest’s accounting policy, costs were added to stockpiles based on current mining costs incurred including applicable overheads

and depreciation and amortization on a unit of production basis for mining operations and removed on the basis of each stockpile’s

average cost per tonne as material is processed. Production stripping costs were capitalized separately for each component of the mine,

which is defined as a specific volume of the ore body that is made accessible by the stripping activity and amortized on a unit of production

basis.

The following table reflects the impact of alignment of Newcrest’s

accounting policies to Newmont’s accounting policies on inventory valuation methodology, and is comprised of: (i) the reversal

of stripping costs capitalized by Newcrest, as outlined in Note 4(c), (ii) the reversal of previous impairment expense recognized

by Newcrest, as outlined in Note 4(b), (iii) the allocation of mining costs per ounce on the basis of recoverable ounces as compared

to on a per tonne basis, and (iv) alignment relating to the capitalization of costs for ore stockpiles:

| (in millions) |

|

For the period ended

November 5, 2023 |

|

| Condensed Statements of Operations |

|

|

|

|

| Decrease to costs applicable to sales |

|

$ |

(22 |

) |

| Increase to depreciation and amortization |

|

$ |

18 |

|

| Decrease to income and mining tax benefit (expense) |

|

$ |

(1 |

) |

Under U.S. GAAP, the definition of a derivative requires the existence

of a notional amount, a payment provision or both. In circumstances in which a notional amount is not determinable (e.g., when the quantification

of such an amount is highly subjective and relatively unreliable) and no payment provision exists, the contract would not be accounted

for as a derivative. Under IFRS, the definition of a derivative does not require the existence of a notional amount or payment provision.

The following table reflects the impact of the reversal of fair value

associated with the derivative instruments determined not to meet the definition of a derivative under U.S. GAAP:

| (in millions) |

|

For the period ended

November 5, 2023 |

|

| Condensed Statements of Operations |

|

|

|

|

| Increase to other income (loss), net |

|

$ |

3 |

|

| Decrease to income and mining tax benefit (expense) |

|

$ |

(1 |

) |

| (i) | Employee-related benefits |

Under U.S. GAAP, an entity uses the service period approach to account

for termination benefits when certain conditions are met. Benefits accumulate over time based on length of service. Under this approach,

the benefit cost is accrued over an employee’s service period.

Under IFRS, an entity recognizes termination benefits as a liability

and an expense only when an entity is demonstrably committed to the redundancies by having (i) a detailed plan for the terminations

and (ii) when it can no longer withdraw the offer made in relation to termination benefits. This generally results in termination

benefits being recognized when the closure date for a mine site has been announced and other recognition criteria have been met.

The following table reflects the accrual of employee severance for

Newcrest and its consolidated subsidiaries as well as the impact of revaluation of the accrual for the periods presented:

| (in millions) |

|

For the period ended

November 5, 2023 |

|

| Condensed Statements of Operations |

|

|

|

|

| Increase to costs applicable to sales |

|

$ |

8 |

|

| Increase to income and mining tax benefit (expense) |

|

$ |

2 |

|

| (j) | Lease and other financing obligations |

Under U.S. GAAP, a lessee identifies a lease at inception of the agreement

and classifies it as either a finance lease or an operating lease based on the application of five specific criteria. Under IFRS, similar

to U.S. GAAP, a lessee identifies a lease at inception of the agreement but does not distinguish between an operating lease and a finance

lease. A single recognition and measurement model is applied to all leases under IFRS.

While the initial measurement and recognition of a lease is similar

under U.S. GAAP and IFRS, the subsequent measurement differs. Under U.S. GAAP, a straight-line expense is recognized for an operating

lease, as opposed to IFRS, which yields a higher expense in earlier years of the lease term.

The following table reflects the impact of reclassifying certain Newcrest

leases as operating leases under U.S. GAAP:

| (in millions) |

|

For the period ended

November 5, 2023 |

|

| Condensed Statements of Operations |

|

|

|

|

| Increase to cost applicable to sales |

|

$ |

20 |

|

| Decrease to depreciation and amortization |

|

$ |

(20 |

) |

| Decrease to interest expense, net of capitalized interest |

|

$ |

— |

|

| 1. | Transaction Accounting Adjustments |

The following adjustments have been made to the unaudited pro forma

statement of operations for the year ended December 31, 2023 to reflect certain preliminary purchase price accounting and other

pro forma adjustments. The finalization of the preliminary purchase price allocation may result in additional adjustments that could

have a material impact on the unaudited pro forma statement of operations of Newmont.

| (a) | Inventories and Stockpiles and ore on leach pads |

The decrease to Costs applicable to sales of $146 million and

the decrease to Depreciation and amortization by $18 million for the year ended December 31, 2023 was a result of the decrease

in fair value of the Inventories and Stockpiles and ore on leach pads as of the Acquisition Date.

| (b) | Property, plant and mine development, net |

The adjustment to increase Depreciation and amortization by

$57 million for the year ended December 31, 2023 reflects the depreciation expense related to the increase in fair value on acquired

Property, plant and mine development, net as of the Acquisition Date.

The adjustment to decrease Equity income (loss) of affiliates by

$30 million for the year ended December 31, 2023 reflects the amortization of the basis difference arising from an increase in the

fair value of certain equity method investments as of the Acquisition Date.

The adjustment to increase Interest expense, net of capitalized

interest by $68 million for the year ended December 31, 2023 reflects (i) a $55 million increase relating higher assumed

debt balance as of the Acquisition date, and (ii) a $13 million increase relating to the accretion of the debt discount arising

from a decrease in the fair value of the assumed corporate bonds as of the Acquisition Date.

The estimated income and mining tax expense impact of the pro forma

adjustments has been recognized based upon the statutory tax rates applicable on a jurisdictional basis.

The pro forma combined basic and diluted weighted average shares outstanding

are a combination of historic weighted average shares of Newmont common stock and the issuance of the 358 million shares of Newmont common

stock in relation to the Transaction as if the Transaction had occurred on January 1, 2023. The pro forma basic and diluted weighted

average shares outstanding are as follows:

| (in millions, except per share) | |

For the year ended

December 31, 2023 | |

| Pro forma net income (loss) from continuing operations attributable to Newmont stockholders | |

$ | (2,012 | ) |

| Pro forma basic weighted average Newmont shares outstanding (1) | |

| 1,158 | |

| Pro forma basic earnings (loss) per share | |

$ | (2.00 | ) |

| Pro forma diluted weighted average Newmont shares outstanding (2) | |

| 1,158 | |

| Pro forma diluted earnings (loss) per share (3) | |

$ | (2.00 | ) |

| (1) | For the year ended December 31, 2023, basic shares outstanding

of 1,158 million is comprised of 800 million shares of Newmont common stock and 358 million

shares of Newmont common stock issued on the Acquisition Date to acquire the outstanding

Newcrest ordinary shares, as if the Transaction had occurred on January 1, 2023. The

800 million shares of Newmont common stock are calculated based on the 799 million shares

outstanding as at December 31, 2023 and the weighted average adjustment to the 1 million

shares issued during the year ended December 31, 2023 in relation to stock-based awards. |

| (2) | For the year ended December 31, 2023, diluted shares

outstanding of 1,158 million is comprised of 800 million shares of Newmont common stock and

358 million shares of Newmont common stock issued on the Acquisition Date to acquire

the outstanding Newcrest ordinary shares, as if the Transaction had occurred on January 1,

2023. The 800 million shares of Newmont common stock are calculated based on the 799 million

shares outstanding as at December 31, 2023 and the weighted average adjustment to the

1 million shares issued during the year ended December 31, 2023 in relation to stock-based

awards. |

| (3) | Potentially dilutive shares were excluded in the computation

of diluted loss per share for the year ended December 31, 2023 as they were antidilutive. |

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

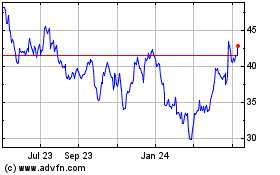

Newmont (NYSE:NEM)

Historical Stock Chart

From Nov 2024 to Dec 2024

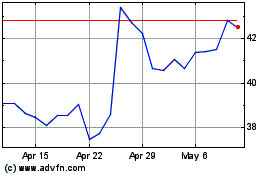

Newmont (NYSE:NEM)

Historical Stock Chart

From Dec 2023 to Dec 2024