- Achieved Total Revenue of $36.3 million

- Exceeded profitability targets for 6th consecutive quarter

- Generated positive operating and free cash flow for 3rd

consecutive quarter

- Stabilization of install base continued with high single digit

year-over-year improvement in gross retention

- Percentage of ARR in multi-year agreements and percentage of

customers using two or more products achieved another record

quarter

ON24 (NYSE: ONTF), a leading intelligent engagement platform for

B2B sales and marketing, today announced financial results for the

third quarter ended September 30, 2024.

“Our third quarter results reflected an improved retention

profile, operating expense discipline, and positive free cash

flow,” said Sharat Sharan, co-founder and CEO of ON24. “Our

AI-powered ACE solution has become a strong growth vector. In Q3,

ACE ARR increased again as a percentage of growth ARR. We are

seeing encouraging signs of customer winbacks, and our focus on

mission-critical use cases in regulated industries, like life

sciences, has helped in stabilizing our business. We remain focused

on leveraging our strategic pillars to achieve our goal of driving

sustainable growth.”

Third Quarter 2024 Financial

Highlights

- Revenue:

- Revenue from our Core Platform, including services, was $35.6

million.

- Total revenue was $36.3 million.

- ARR:

- Core Platform ARR of $129.7 million as of September 30,

2024.

- Total ARR of $132.2 million as of September 30, 2024.

- GAAP Operating Loss was $13.3 million, compared to GAAP

operating loss of $14.1 million in the third quarter of 2023.

- Non-GAAP Operating Loss was $0.8 million, compared to

non-GAAP operating loss of $1.1 million in the third quarter of

2023.

- GAAP Net Loss was $11.4 million, or $(0.27) per diluted

share, compared to GAAP net loss of $11.5 million, or $(0.26) per

diluted share in the third quarter of 2023.

- Non-GAAP Net Income was $1.1 million, or $0.02 per

diluted share, compared to non-GAAP net income of $1.5 million, or

$0.03 per diluted share in the third quarter of 2023.

- Adjusted EBITDA was $0.2 million.

- Cash Flow: Net cash provided by operating activities was

$0.3 million, compared to $2.9 million used in operating activities

in the third quarter of 2023. Free cash flow was $0.1 million for

the quarter, compared to $(3.2) million in the third quarter of

2023.

- Cash, Cash Equivalents and Marketable Securities totaled

$188.8 million as of September 30, 2024.

For more information regarding non-GAAP operating income (loss),

non-GAAP net income (loss) and free cash flows, see the section

titled “Non-GAAP Financial Measures” below. For reconciliations of

these non-GAAP financial measures to the most directly comparable

GAAP financial measure, see the tables at the end of this press

release.

Recent Business Highlights:

- Customer winbacks with boomerang customers contributed to

ON24’s return to stability.

- AI-powered ACE ARR performance reached a new high as a

percentage of growth ARR.

- Ranked a Top Engagement Platform for Sales and Marketing Teams

in G2 Fall 2024 Report, recognized by customers for strong market

presence and overall customer support and satisfaction.

Financial Outlook

For the fourth quarter of 2024, ON24 expects:

- Core Platform Revenue, including services, to be in the range

of $34.7 million to $35.7 million.

- Total revenue of $35.4 million to $36.4 million.

- Non-GAAP operating loss of $1.3 million to $0.3 million.

- Non-GAAP net income per share of $0.01 to $0.02 using

approximately 45.7 million diluted shares outstanding.

- Restructuring charge of $0.4 million to $0.7 million, excluded

from the non-GAAP amounts above.

For the full year 2024, ON24 now expects:

- Core Platform Revenue, including services, to be in the range

of $143.6 million to $144.6 million.

- Total revenue of $146.8 million to $147.8 million.

- Non-GAAP operating loss of $3.3 million to $2.3 million.

- Non-GAAP net income per share of $0.08 to $0.10 using

approximately 45.8 million diluted shares outstanding.

Conference Call Information

ON24 will host a conference call and live webcast for analysts

and investors today at 2:00 p.m. Pacific Time. Parties in the

United States can access the call by dialing 877-497-9071 or

201-689-8727.

A webcast and management’s prepared remarks for today’s call

will be accessible on ON24’s investor relations website at

investors.on24.com. Approximately one hour after completion of the

live call, an archived version of the webcast will be available on

the Company’s investor relations website.

Definitions of Certain Key Business Metrics

Core Platform: The ON24 Core

Platform products include:

ON24 Elite: live, interactive

webinar experience that engages prospective customers in real-time

and can be made available in an on-demand format.

ON24 Breakouts: live breakout room

experience that facilitates networking, collaboration and

interactivity between users.

ON24 Forums: live, interactive

experience that facilitates video-to-video interaction between

presenters and audiences.

ON24 Go Live: live, interactive

video event experience that enables presenters and attendees to

engage face-to-face in real-time and can also be made available in

an on-demand format.

ON24 Engagement Hub: always-on,

rich multimedia content experience that prospective customers can

engage anytime, anywhere.

ON24 Target: personalize and

curate, rich landing page experience that engages specific segments

of prospective customers to drive desired action.

ON24 AI-powered ACE: the next

generation AI-powered analytics and content engine.

Annual Recurring Revenue (“ARR”): ARR is calculated as

the sum of the annualized value of our subscription contracts as of

the measurement date, including existing customers with expired

contracts that we expect to be renewed. Our ARR amounts exclude

professional services, overages from subscription customers and

Legacy revenue.

Non-GAAP Financial Measures

In addition to our results determined in accordance with

generally accepted accounting principles in the United States, or

“GAAP”, we consider our non-GAAP operating income (loss), non-GAAP

net income (loss), Adjusted EBITDA, and free cash flow in

evaluating our operating performance. We define non-GAAP operating

income (loss) as net income (loss) excluding, interest expense,

other (income) expense, net, provision for income taxes,

stock-based compensation, amortization of acquired intangible

assets, shareholder activism related costs, restructuring costs,

impairment charges for underutilized real estate, and certain other

costs. We define non-GAAP net income (loss) as net income (loss)

excluding stock-based compensation, amortization of acquired

intangible assets, shareholder activism related costs,

restructuring costs, charges for underutilized real estate, and

certain other costs. We define Adjusted EBITDA as net income (loss)

excluding interest expense, other (income) expense, net, provision

for income taxes, depreciation and amortization, amortization of

acquired intangible assets, amortization of cloud implementation

costs, stock-based compensation, restructuring costs, impairment

charges for underutilized real estate, and shareholder activism

related costs. We define free cash flow as net cash provided by

(used in) operating activities, less purchases of property and

equipment.

We use non-GAAP operating income (loss), non-GAAP net income

(loss), and Adjusted EBITDA to evaluate our ongoing operations and

for internal planning and forecasting purposes, and we use free

cash flow to measure and evaluate cash generated through normal

business operations. We believe non-GAAP operating income (loss),

non-GAAP net income (loss), and Adjusted EBITDA may be helpful to

investors because they provide consistency and comparability with

past financial performance. We believe free cash flow may be

helpful to investors because it reflects that some purchases of

property and equipment are necessary to support ongoing operations,

while providing a measure of cash available to acquire customers,

expand within existing customers and otherwise pursue our business

strategies.

However, these non-GAAP financial measures are each presented

for supplemental informational purposes only, have limitations as

analytical tools and should not be considered in isolation or as a

substitute for financial information presented in accordance with

GAAP. Non-GAAP financial measures have no standardized meanings

prescribed by GAAP and are not prepared under a comprehensive set

of accounting rules or principles. In addition, other companies,

including companies in our industry, may calculate similarly-titled

non-GAAP financial measures differently or may use other measures

to evaluate their performance, all of which could reduce the

usefulness of our non-GAAP financial measure as a tool for

comparison.

We do not provide a quantitative reconciliation of the

forward-looking non-GAAP financial measures included in this press

release to the most directly comparable GAAP measures due to the

high variability and difficulty to predict certain items excluded

from these non-GAAP financial measures; in particular, the effects

of stock-based compensation expense, and restructuring and

transaction expenses. We expect the variability of these excluded

items may have a significant, and potentially unpredictable, impact

on our future GAAP financial results.

Reconciliations of these non-GAAP financial measures to their

most directly comparable GAAP financial measure are included in the

tables at the end of this press release.

Forward-Looking Statements

This document contains “forward-looking statements” under

applicable securities laws. Such statements can be identified by

words such as: “outlook,” “expect,” “target,” “believe,” “plan,”

“future,” “may,” “should,” “will,” and similar references to future

periods. Forward-looking statements include express or implied

statements regarding our expected financial and operating results,

the execution of our capital return program, the size of our market

opportunity, the success of our new products and capabilities,

including our new AI-powered Analytics and Content Engine, and

other statements regarding our ability to achieve our business

strategies, growth, or other future events or conditions. Such

statements are based on our current beliefs, expectations, and

assumptions about future events or conditions, which are subject to

inherent risks and uncertainties, including our ability to attract

new customers and expand sales to existing customers; declines in

our growth rate; fluctuation in our performance; our history of net

losses; competition; technological development in our markets;

decline in demand for our solutions; our ability to expand our

sales and marketing capabilities and otherwise achieve our growth;

the impact of the resumption of in-person marketing activities on

our customer growth rate; disruptions or other issues with our

technology or third-party services; compliance with data privacy,

import and export controls, customs, sanctions and other laws and

regulations; intellectual property matters; and matters relating to

our common stock, along with the other risks and uncertainties

discussed in the filings we make from time to time with the

Securities and Exchange Commission. Actual results may differ

materially from those indicated in forward-looking statements, and

you should not place undue reliance on them. All statements herein

are based only on information currently available to us and speak

only as of the date hereof. Except as required by law, we undertake

no obligation to update any such statement.

About ON24

ON24 is on a mission to help businesses bring their go-to-market

strategy into the AI era and drive cost-effective revenue growth.

Through its leading intelligent engagement platform, ON24 enables

customers to combine best-in-class experiences with personalization

and content, to capture and act on connected insights at scale.

ON24 provides industry-leading companies, including 4 of the 5

largest global software companies, 3 of the 5 top global asset

management firms, 3 of the 5 largest global healthcare companies

and 3 of the 5 largest global industrial companies, with a valuable

source of first-party data to drive sales and marketing innovation,

improve efficiency and increase business results. Headquartered in

San Francisco, ON24 has offices globally in North America, EMEA and

APAC. For more information, visit www.ON24.com.

© 2024 ON24, Inc. All rights reserved. ON24 and the ON24 logo

are trademarks owned by ON24, Inc., and are registered in the

United States Patent and Trademark Office and in other

countries.

ON24, INC.

Condensed Consolidated Balance

Sheets (Unaudited)

(in thousands)

September 30, 2024

December 31, 2023

Assets

Current assets

Cash and cash equivalents

$

11,017

$

53,209

Marketable securities

177,829

145,497

Accounts receivable, net

23,750

37,939

Deferred contract acquisition costs,

current

11,312

12,428

Prepaid expenses and other current

assets

6,742

4,714

Total current assets

230,650

253,787

Property and equipment, net

4,400

5,371

Operating right-of-use assets

1,900

2,981

Intangible asset, net

853

1,305

Deferred contract acquisition costs,

non-current

12,433

15,756

Other long-term assets

695

1,102

Total assets

$

250,931

$

280,302

Liabilities and Stockholders’

Equity

Current liabilities

Accounts payable

$

2,687

$

1,914

Accrued and other current liabilities

14,781

16,907

Deferred revenue

63,631

74,358

Finance lease liabilities, current

—

127

Operating lease liabilities, current

2,926

2,779

Total current liabilities

84,025

96,085

Operating lease liabilities,

non-current

440

2,483

Other long-term liabilities

1,583

1,517

Total liabilities

86,048

100,085

Stockholders’ equity

Common stock

4

4

Additional paid-in capital

502,813

485,291

Accumulated deficit

(338,797

)

(305,513

)

Accumulated other comprehensive income

(loss)

863

435

Total stockholders’ equity

164,883

180,217

Total liabilities and stockholders’

equity

$

250,931

$

280,302

ON24, INC.

Condensed Consolidated

Statements of Operations (Unaudited)

(in thousands, except share

and per share data)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenue:

Subscription and other platform

$

33,860

$

36,430

$

102,836

$

114,130

Professional services

2,465

2,792

8,565

10,241

Total revenue

36,325

39,222

111,401

124,371

Cost of revenue:

Subscription and other platform(1)(4)

7,136

8,390

21,514

27,345

Professional services(1)(4)

2,202

2,457

7,144

8,908

Total cost of revenue

9,338

10,847

28,658

36,253

Gross profit

26,987

28,375

82,743

88,118

Operating expenses:

Sales and marketing(1)(4)

19,498

21,510

59,029

68,555

Research and development(1)(2)(4)

9,180

9,730

27,370

31,759

General and administrative(1)(3)(4)

11,654

11,200

35,222

37,583

Total operating expenses

40,332

42,440

121,621

137,897

Loss from operations

(13,345

)

(14,065

)

(38,878

)

(49,779

)

Interest expense

6

18

27

80

Other income, net

(2,128

)

(2,718

)

(6,710

)

(8,483

)

Loss before provision for income taxes

(11,223

)

(11,365

)

(32,195

)

(41,376

)

Provision for income taxes

183

109

1,089

535

Net loss

(11,406

)

(11,474

)

(33,284

)

(41,911

)

Net loss per share:

Basic and diluted

$

(0.27

)

$

(0.26

)

$

(0.80

)

$

(0.92

)

Weighted-average shares used in computing

net loss per share:

Basic and diluted

41,870,709

43,832,475

41,725,990

45,655,106

(1)

Includes stock-based compensation as follows:

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Cost of revenue

Subscription and other platform

$

692

$

638

$

2,047

$

2,132

Professional services

119

123

369

419

Total cost of revenue

811

761

2,416

2,551

Sales and marketing

3,253

3,693

9,649

10,305

Research and development

2,322

2,332

6,696

6,716

General and administrative

5,490

4,779

15,528

13,719

Total stock-based compensation expense

$

11,876

$

11,565

$

34,289

$

33,291

(2)

Research and development expense includes amortization of

acquired intangible asset of $140 thousand and $416 thousand for

the three and nine months ended September 30, 2024, respectively,

and $142 thousand and $419 thousand for the three and nine months

ended September 30, 2023, respectively, in connection with the

Vibbio acquisition in April 2022.

(3)

General and administrative expense includes professional

advisory expenses associated with activism defense and related

costs of nil and $2,656 thousand for the three and nine months

ended September 30, 2023, respectively. We did not incur such costs

in the three and nine months ended September 30, 2024.

(4)

The results of operations for the three and nine months ended

September 30, 2024 and 2023 includes restructuring costs, which

primarily represent severance and related expense due to

restructuring activities, and impairment charge on our

headquarters’ lease, as follows:

Three Months Ended September

30, 2024

Nine Months Ended September

30, 2024

Severance

and related

Charges

Lease

Impairment

Charge

Total

Severance

and related

Charges

Lease

Impairment

Charge

Total

Cost of revenue

Subscription and other platform

$

137

$

—

$

137

$

350

$

—

$

350

Professional services

7

—

7

20

—

20

Total cost of revenue

144

—

144

370

—

370

Sales and marketing

342

—

342

1,347

—

1,347

Research and development

—

—

—

112

—

112

General and administrative

—

—

—

339

—

339

Total restructuring costs

$

486

$

—

$

486

$

2,168

$

—

$

2,168

Three Months Ended September

30, 2023

Nine Months Ended September

30, 2023

Severance

and related

Charges

Lease

Impairment

Charge

Total

Severance

and related

Charges

Lease

Impairment

Charge

Total

Cost of revenue

Subscription and other platform

$

629

$

19

$

648

$

2,134

$

108

$

2,242

Professional services

39

18

57

143

119

262

Total cost of revenue

668

37

705

2,277

227

2,504

Sales and marketing

150

48

198

1,958

256

2,214

Research and development

174

97

271

1,287

569

1,856

General and administrative

21

70

91

303

409

712

Total restructuring costs

$

1,013

$

252

$

1,265

$

5,825

$

1,461

$

7,286

ON24, INC.

Condensed Consolidated

Statements of Cash Flows (Unaudited)

(In thousands)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Cash flows from operating

activities:

Net loss

$

(11,406

)

$

(11,474

)

$

(33,284

)

$

(41,911

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

1,181

1,249

3,635

4,041

Stock-based compensation expense

11,876

11,565

34,289

33,291

Amortization of deferred contract

acquisition cost

3,638

3,777

11,233

11,621

Provision for allowance for doubtful

accounts and billing reserves

335

661

1,536

2,360

Non-cash lease expense

398

398

1,177

1,339

Accretion of marketable securities

(1,352

)

(2,142

)

(4,287

)

(5,853

)

Lease impairment charge

—

252

—

1,461

Other

30

50

100

206

Change in operating assets and

liabilities:

Accounts receivable

(60

)

4,768

12,653

15,512

Deferred contract acquisition cost

(2,060

)

(2,418

)

(6,794

)

(8,681

)

Prepaid expenses and other assets

(196

)

805

(1,939

)

(43

)

Accounts payable

323

(1,657

)

667

(2,128

)

Accrued liabilities

239

(290

)

(2,649

)

(3,037

)

Deferred revenue

(2,376

)

(7,856

)

(10,727

)

(16,850

)

Other liabilities

(275

)

(548

)

(1,789

)

(2,671

)

Net cash provided by (used in) operating

activities

295

(2,860

)

3,821

(11,343

)

Cash flows from investing

activities:

Purchase of property and equipment

(152

)

(344

)

(1,680

)

(1,076

)

Purchase of marketable securities

(26,504

)

(36,679

)

(152,925

)

(232,504

)

Proceeds from maturities of marketable

securities

22,900

42,996

114,548

319,466

Proceeds from sale of marketable

securities

6,196

8,418

10,556

17,739

Net cash provided by (used in) investing

activities

2,440

14,391

(29,501

)

103,625

Cash flows from financing

activities:

Proceeds from exercise of stock

options

690

457

1,684

1,341

Proceeds from issuance of common stock

under ESPP

—

—

367

546

Payment for repurchase of common stock

(8,327

)

(25,933

)

(18,603

)

(59,239

)

Payment of cash dividend

—

—

—

(49,872

)

Repayment of equipment loans

—

(56

)

(72

)

(187

)

Repayment of finance lease obligations

—

(373

)

(127

)

(1,315

)

Net cash used in financing activities

(7,637

)

(25,905

)

(16,751

)

(108,726

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

438

(65

)

241

164

Net decrease in cash, cash equivalents and

restricted cash

(4,464

)

(14,439

)

(42,190

)

(16,280

)

Cash, cash equivalents and restricted

cash, beginning of period

15,572

25,328

53,298

27,169

Cash, cash equivalents and restricted

cash, end of period

$

11,108

$

10,889

$

11,108

$

10,889

Reconciliation of cash, cash

equivalents, and restricted cash to the condensed consolidated

balance sheets:

Cash and cash equivalents

$

11,017

$

10,804

$

11,017

$

10,804

Restricted cash included in other assets,

non-current

91

85

91

85

Total cash, cash equivalent and restricted

cash

$

11,108

$

10,889

$

11,108

$

10,889

ON24, INC.

Reconciliation of GAAP to

Non-GAAP Results (Unaudited)

(in thousands, except share

and per share data)

Reconciliation of gross profit and

gross margin

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

GAAP gross profit

$

26,987

$

28,375

$

82,743

$

88,118

Add:

Stock-based compensation

811

761

2,416

2,551

Restructuring costs

144

668

370

2,277

Impairment charge

—

37

—

227

Non-GAAP gross profit

$

27,942

$

29,841

$

85,529

$

93,173

GAAP gross margin

74

%

72

%

74

%

71

%

Non-GAAP gross margin

77

%

76

%

77

%

75

%

Reconciliation of operating

expenses

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

GAAP sales and marketing

$

19,498

$

21,510

$

59,029

$

68,555

Less:

Stock-based compensation

(3,253

)

(3,693

)

(9,649

)

(10,305

)

Restructuring costs

(342

)

(150

)

(1,347

)

(1,958

)

Impairment charge

—

(48

)

—

(256

)

Non-GAAP sales and marketing

$

15,903

$

17,619

$

48,033

$

56,036

GAAP research and development

$

9,180

$

9,730

$

27,370

$

31,759

Less:

Stock-based compensation

(2,322

)

(2,332

)

(6,696

)

(6,716

)

Restructuring costs

—

(174

)

(112

)

(1,287

)

Impairment charge

—

(97

)

—

(569

)

Amortization of acquired intangible

asset

(140

)

(142

)

(416

)

(419

)

Non-GAAP research and

development

$

6,718

$

6,985

$

20,146

$

22,768

GAAP general and administrative

$

11,654

$

11,200

$

35,222

$

37,583

Less:

Stock-based compensation

(5,490

)

(4,779

)

(15,528

)

(13,719

)

Restructuring costs

—

(21

)

(339

)

(303

)

Impairment charge

—

(70

)

—

(409

)

Fees related to shareholder activism

—

—

—

(2,656

)

Non-GAAP general and

administrative

$

6,164

$

6,330

$

19,355

$

20,496

ON24, INC.

Reconciliation of GAAP to

Non-GAAP Results (Unaudited)

(in thousands, except share

and per share data)

Reconciliation of net loss to non-GAAP

operating loss

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net loss

$

(11,406

)

$

(11,474

)

$

(33,284

)

$

(41,911

)

Add:

Interest expense

6

18

27

80

Other income, net

(2,128

)

(2,718

)

(6,710

)

(8,483

)

Provision for income taxes

183

109

1,089

535

Stock-based compensation

11,876

11,565

34,289

33,291

Amortization of acquired intangible

asset

140

142

416

419

Restructuring costs

486

1,013

2,168

5,825

Impairment charge

—

252

—

1,461

Fees related to shareholder activism

—

—

—

2,656

Non-GAAP operating loss

$

(843

)

$

(1,093

)

$

(2,005

)

$

(6,127

)

Reconciliation of net loss to Adjusted

EBITDA

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net loss

$

(11,406

)

$

(11,474

)

$

(33,284

)

$

(41,911

)

Add:

Interest expense

6

18

27

80

Other income, net

(2,128

)

(2,718

)

(6,710

)

(8,483

)

Provision for income taxes

183

109

1,089

535

Depreciation and amortization

1,041

1,107

3,219

3,622

Amortization of acquired intangible

asset

140

142

416

419

Amortization of cloud implementation

costs

30

37

101

111

Stock-based compensation

11,876

11,565

34,289

33,291

Restructuring costs

486

1,013

2,168

5,825

Impairment charge

—

252

—

1,461

Fees related to shareholder activism

—

—

—

2,656

Adjusted EBITDA

$

228

$

51

$

1,315

$

(2,394

)

Reconciliation of net loss to non-GAAP

net income

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net loss

$

(11,406

)

$

(11,474

)

$

(33,284

)

$

(41,911

)

Add:

Stock-based compensation

11,876

11,565

34,289

33,291

Amortization of acquired intangible

asset

140

142

416

419

Restructuring costs

486

1,013

2,168

5,825

Impairment charge

—

252

—

1,461

Fees related to shareholder activism

—

—

—

2,656

Non-GAAP net income

$

1,096

$

1,498

$

3,589

$

1,741

ON24, INC.

Reconciliation of GAAP to

Non-GAAP Results (Unaudited)

(in thousands, except share

and per share data)

Reconciliation of GAAP to Non-GAAP

basic and diluted net income (loss) per share

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

GAAP basic and diluted net loss per

share:

Net loss

$

(11,406

)

$

(11,474

)

$

(33,284

)

$

(41,911

)

Weighted average common stock outstanding,

basic and diluted

41,870,709

43,832,475

41,725,990

45,655,106

Net loss per share, basic and diluted

$

(0.27

)

$

(0.26

)

$

(0.80

)

$

(0.92

)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Non-GAAP basic and diluted net income

per share:

Net loss

$

(11,406

)

$

(11,474

)

$

(33,284

)

$

(41,911

)

Add:

Stock-based compensation

11,876

11,565

34,289

33,291

Amortization of acquired intangible

asset

140

142

416

419

Restructuring costs

486

1,013

2,168

5,825

Impairment charge

—

252

—

1,461

Fees related to shareholder activism

—

—

—

2,656

Non-GAAP net income

$

1,096

$

1,498

$

3,589

$

1,741

Non-GAAP weighted-average common stock

outstanding

Basic

41,870,709

43,832,475

41,725,990

45,655,106

Diluted

45,582,143

48,314,373

45,670,383

50,175,084

Non-GAAP net income per share of common

stock:

Basic

$

0.03

$

0.03

$

0.09

$

0.04

Diluted

$

0.02

$

0.03

$

0.08

$

0.03

ON24, INC.

Reconciliation of GAAP to

Non-GAAP Results (Unaudited)

(in thousands)

Reconciliation of GAAP Cash Flow from

Operating Activities to Free Cash Flow

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net cash provided by (used in) operating

activities:

$

295

$

(2,860

)

$

3,821

$

(11,343

)

Less: Purchases of property and

equipment

(152

)

(344

)

(1,680

)

(1,076

)

Free cash flow

$

143

$

(3,204

)

$

2,141

$

(12,419

)

ON24, INC.

Revenue

(in thousands)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Core Platform

Subscription and other platform

$

33,272

$

35,505

$

100,811

$

110,316

Professional services

2,336

2,644

8,097

9,499

Total core platform revenue

$

35,608

$

38,149

$

108,908

$

119,815

Virtual Conference

Subscription and other platform

$

588

$

925

$

2,025

$

3,814

Professional services

129

148

468

742

Total virtual conference revenue

$

717

$

1,073

$

2,493

$

4,556

Revenue

Subscription and other platform

$

33,860

$

36,430

$

102,836

$

114,130

Professional services

2,465

2,792

8,565

10,241

Total revenue

$

36,325

$

39,222

$

111,401

$

124,371

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107018590/en/

Media Contact: Gabriella Kose press@on24.com

Investor Contact: Irmina Blaszczyk, The Blueshirt Group

for ON24 investorrelations@on24.com

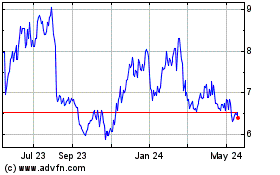

ON24 (NYSE:ONTF)

Historical Stock Chart

From Oct 2024 to Nov 2024

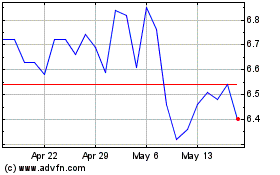

ON24 (NYSE:ONTF)

Historical Stock Chart

From Nov 2023 to Nov 2024