0001568651FALSE00015686512024-02-072024-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 7, 2024

Oscar Health, Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-40154 | | 46-1315570 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

75 Varick Street, 5th Floor

New York, New York 10013

(Address of Principal Executive Offices) (Zip Code)

(646) 403-3677

(Registrant’s telephone number, including area code)

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425). |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12). |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbols | | Name of each exchange on which registered |

| Class A Common Stock, $0.00001 par value per share | | OSCR | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 7, 2024, Oscar Health, Inc. (the “Company”) announced the Company’s financial results for the fourth quarter and year ended December 31, 2023. A copy of the press release issued in connection with the announcement is attached and furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

The information in Item 2.02 and Exhibit 99.1 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information and exhibits be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Oscar Health, Inc. |

| | |

| By: | | /s/ R. Scott Blackley |

| Name: | | R. Scott Blackley |

| Title: | | Chief Financial Officer |

Date: February 7, 2024

| | | | | |

| |

Oscar Health, Inc. ir.hioscar.com News Release | |

Oscar Health Announces Strong Results for Fourth Quarter and Full Year 2023; Introduces Full Year 2024 Outlook Including Total Company Adjusted EBITDA Profitability

February 7, 2024

•For the year ended December 31, 2023:

◦Direct and Assumed Policy Premiums of $6.6 billion, a 3% decrease YoY

◦Premiums earned of $5.7 billion, a 47% increase YoY

◦Medical Loss Ratio of 81.6%, a 370 bps improvement YoY

◦InsuranceCo Administrative Expense Ratio of 17.9%, a 270 bps improvement YoY

◦InsuranceCo Combined Ratio of 99.5%, a 640 bps improvement YoY

◦Adjusted Administrative Expense Ratio of 21.0%, a 350 bps improvement YoY

◦Net loss of $271 million, an improvement of $339 million YoY

◦Adjusted EBITDA loss of $45 million, an improvement of $417 million YoY

New York, NY, February 7, 2024 - Oscar Health, Inc. (“Oscar” or the “Company”) (NYSE: OSCR), a leading healthcare technology company, today announced its financial results for the fourth quarter and full year ended December 31, 2023.

“Oscar reported strong 2023 results with most core metrics exceeding our expectations for the full year. We delivered on our commitment for Insurance Company Adjusted EBITDA profitability and have a clear line of sight into consolidated Adjusted EBITDA profitability in 2024,” said Mark Bertolini, CEO of Oscar. “We are pleased to serve more than 1.3 million members this year and remain focused on driving long-term sustainable margin expansion.”

Total Direct and Assumed Policy Premiums for 2023 were $6.6 billion, down 3% year-over-year (“YoY”), driven primarily by lower membership, partially offset by rate increases. Premiums earned of $5.7 billion for the year increased 47% YoY, driven primarily by the impact of deposit accounting for quota share reinsurance agreements, and lower risk transfer per member as a percent of premiums.

Oscar’s InsuranceCo Combined Ratio, which is the sum of its Medical Loss Ratio (“MLR”) and the InsuranceCo Administrative Expense Ratio, improved 640 bps YoY to 99.5% for 2023, driven by both an improved MLR and administrative cost efficiencies. Specifically, the MLR improved 370 bps YoY to 81.6%, due to targeted rate increases and a disciplined pricing strategy and total cost of care initiatives. The InsuranceCo Administrative Expense Ratio improved 270 bps YoY to 17.9%, due to lower distribution expenses and higher net premiums as a result of lower risk transfer per member as a percent of premiums.

The Adjusted Administrative Expense Ratio for 2023 improved 350 bps YoY to 21.0%, due to lower distribution expenses, higher net premiums as a result of lower risk transfer per member as a percent of premiums, and higher net investment income. The Adjusted EBITDA loss of $45 million improved by $417 million YoY, and decreased as a percentage of premiums before ceded reinsurance by 8 points as compared to the prior year. Net loss of $271 million improved by $339 million YoY and decreased as a percentage of premiums before ceded reinsurance by 7 points compared to the prior year.

The Company is introducing its outlook for 2024 including two new metrics, Total Revenue and SG&A Expense Ratio. The Company anticipates Total Revenue of $8.3 billion to $8.4 billion, a Medical Loss Ratio of 80.2% to 81.2%, a SG&A Expense Ratio of 20.5% to 21.0%, and Total Company Adjusted EBITDA of $125 million to $175 million. For more information on these metrics, see the “2024 Outlook and Supplemental Information” on page 3 in this release.

Oscar Health, Inc.

News Release

| | | | | | | | | | | | | | | | | | | | | | | |

| Financial Results Summary |

| | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Premiums before ceded reinsurance | $ | 1,391,193 | | | $ | 1,332,931 | | | $ | 5,696,978 | | | $ | 5,334,520 | |

| Reinsurance premiums ceded | (798) | | | (365,474) | | | (10,909) | | | (1,463,403) | |

| Premiums earned | $ | 1,390,395 | | | $ | 967,457 | | | $ | 5,686,069 | | | $ | 3,871,117 | |

| Total revenue | $ | 1,431,658 | | | $ | 995,127 | | | $ | 5,862,869 | | | $ | 3,963,638 | |

| Total operating expenses | $ | 1,577,135 | | | $ | 1,217,606 | | | $ | 6,098,484 | | | $ | 4,553,505 | |

| Net loss | $ | (149,838) | | | $ | (226,560) | | | $ | (270,594) | | | $ | (609,552) | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Key Metrics and Non-GAAP Financial Metrics | | |

| | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, | | |

| (in thousands, except percentages) | 2023 | | 2022 | | 2023 | | 2022 | | |

| | | | | | | | | |

| Direct and Assumed Policy Premiums | $ | 1,676,673 | | | $ | 1,784,012 | | | $ | 6,647,658 | | | $ | 6,842,439 | | | |

| Medical Loss Ratio | 86.4 | % | | 91.6 | % | | 81.6 | % | | 85.3 | % | | |

| InsuranceCo Administrative Expense Ratio | 18.8 | % | | 22.3 | % | | 17.9 | % | | 20.6 | % | | |

InsuranceCo Combined Ratio | 105.2 | % | | 113.9 | % | | 99.5 | % | | 105.8 | % | | |

| Adjusted Administrative Expense Ratio | 22.7 | % | | 26.0 | % | | 21.0 | % | | 24.6 | % | | |

Adjusted EBITDA (1) | $ | (111,593) | | | $ | (189,656) | | | $ | (45,238) | | | $ | (462,255) | | | |

(1) Adjusted EBITDA is a non-GAAP measure. See “Key Operating and Non-GAAP Financial Metrics - Adjusted EBITDA” in this release for a reconciliation to net loss, the most directly comparable GAAP measure, and for information regarding Oscar’s use of Adjusted EBITDA.

| | | | | | | | | | | | | | |

| Membership by Offering | | As of December 31, |

| | 2023 | | 2022 |

| Individual and Small Group | | 967,002 | | | 1,084,404 | |

| Medicare Advantage | | 1,781 | | | 4,452 | |

Cigna + Oscar (1) | | 67,500 | | | 62,627 | |

| Total Members | | 1,036,283 | | | 1,151,483 | |

(1)Represents total membership for Oscar’s co-branded partnership with Cigna.

2024 Outlook and Supplemental Information

We regularly review a number of metrics to evaluate our business, measure our performance, identify trends in our business, prepare financial projections, and make strategic decisions. Beginning in 2024, the Company intends to provide guidance on four metrics: Total Revenue, Medical Loss Ratio, SG&A Expense Ratio and Adjusted EBITDA. The following table presents the Company’s 2024 financial outlook, along with full year 2023 results for such measures, calculated in accordance with the Company’s intended reporting approach for future periods.

The information included in this table represents management's current estimates as of the date of this release. Actual results may differ materially depending on a number of factors. Investors are urged to read the Cautionary Note Regarding Forward-Looking Statements included in this release. Management does not assume any obligation to update these estimates. The historical financial information included in this table is unaudited and has no impact on the Company’s audited financial statements and results of operations to be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

Oscar Health, Inc.

News Release

| | | | | | | | | | | | | | | | | |

| Oscar Health, Inc. |

| 2024 Financial Guidance Summary |

| | | | | |

| | | Full Year 2024 Outlook |

| (in thousands, except percentages) | Full Year 2023 Actual | | Low | | High |

Total Revenue (1) | $ | 5,862,869 | | | $ | 8,300,000 | | | $ | 8,400,000 | |

| | | | | |

Medical Loss Ratio (2) | 81.6 | % | | 80.2 | % | | 81.2 | % |

| | | | | |

SG&A Expense Ratio (3) | 24.3 | % | | 20.5 | % | | 21.0 | % |

| | | | | |

Adjusted EBITDA (4) (5) | $ | (45,238) | | | $ | 125,000 | | | $ | 175,000 | |

(1) Total Revenue includes Net Premiums, Service revenue generated from our +Oscar business, and Investment (and other) income. We believe Revenue is an important metric to assess the growth of our insurance business and our +Oscar business, as well as the earnings potential of our investment portfolio.

(2) Medical loss ratio (MLR) is total medical expenses incurred less any member cost sharing as a percentage of premiums before ceded reinsurance. We believe MLR is an important metric to demonstrate the ratio of our costs to pay for healthcare of our members to the premiums before ceded reinsurance.

(3) The Selling, General, and Administrative (SG&A) Expense ratio is calculated as selling, general and administrative expenses as a percentage of Total Revenue. We believe the SG&A Expense ratio is useful to evaluate our ability to manage our overall selling, general, and administrative cost base.

(4) Adjusted EBITDA, a non-GAAP measure, is defined as Net Income (Loss) for the Company and its consolidated subsidiaries before interest expense, income tax expense (benefit), depreciation and amortization, as further adjusted for stock-based compensation, and other items that are considered unusual or not representative of underlying trends of our business, where applicable for the period presented. We present Adjusted EBITDA because we consider it to be an important supplemental measure of our performance and believe it is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in our industry.

(5) Oscar has not provided a quantitative reconciliation of forecasted Adjusted EBITDA to forecasted GAAP net loss within this press release because Oscar is unable, without making unreasonable efforts, to calculate certain reconciling items with confidence. These items include, but are not limited to, stock-based compensation expense. These items, which could materially affect the computation of forecasted GAAP net loss, are inherently uncertain and depend on various factors, some of which are outside of Oscar’s control. As such, any associated estimate and its impact on GAAP net loss could vary materially.

Oscar Health, Inc.

News Release

Quarterly Conference Call Details

Oscar will host a conference call to discuss the financial results today, February 7, 2024, at 5:00 p.m. (ET). A live audio webcast will be available via the Investor Relations page of Oscar’s website at ir.hioscar.com. A replay of the webcast will be available for on-demand listening shortly after the completion of the call, at the same web link, and will remain available for approximately 90 days.

Non-GAAP Financial Information

This release presents Adjusted EBITDA and InsuranceCo Adjusted EBITDA, non-GAAP financial metrics, which are provided as a complement to the results provided in accordance with accounting principles generally accepted in the United States of America (“GAAP”). A reconciliation of historical non-GAAP financial information to the most directly comparable GAAP financial measure is provided in the accompanying tables found at the end of this release. For more information regarding Adjusted EBITDA, please see “Key Operating and Non-GAAP Financial Metrics” below.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact contained herein are forward-looking statements. These statements include, but are not limited to, statements about our financial outlook and estimates, including Total Revenue, Medical Loss Ratio, SG&A Expense Ratio and Adjusted EBITDA and other financial performance metrics, and the related underlying assumptions, our business and financial prospects, and our management’s plans and objectives for future operations, expectations and business strategy. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” or “continue” or the negative of these terms or other similar expressions. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions, and uncertainties that are difficult to predict and generally beyond our control.

Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, there are or will be important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements, including, but not limited to, the following: our ability to execute our strategy and manage our growth effectively; our ability to retain and expand our member base; heightened competition in the markets in which we participate; our ability to accurately estimate our incurred medical expenses or effectively manage our medical costs or related administrative costs; our ability to achieve or maintain profitability in the future; changes in federal or state laws or regulations, including changes with respect to the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010, as amended (collectively, the “ACA”) and any regulations enacted thereunder; our ability to comply with ongoing regulatory requirements, including capital reserve and surplus requirements and applicable performance standards; changes or developments in the health insurance markets in the United States, including passage and implementation of a law to create a single-payer or government-run health insurance program; our, or any of our vendor’s, ability to comply with laws, regulations, and standards related to the handling of information about individuals or applicable consumer protection laws, including as a result of our participation in government-sponsored programs, such as Medicare; our ability to arrange for the delivery of quality care and maintain good relations with the physicians, hospitals, and other providers within and outside our provider networks; unanticipated results of, or changes to, risk adjustment programs; our ability to utilize quota share reinsurance to reduce our capital and surplus requirements and protect against downside risk on medical claims; unfavorable or otherwise costly outcomes of lawsuits and claims that arise from the extensive laws and regulations to which we are subject; our ability to attract and retain qualified personnel; incurrence of data security breaches of our and our partners’ information and technology systems; our ability to detect and prevent material weaknesses or significant control deficiencies in our internal controls over financial reporting or other failure to maintain an effective system of internal controls; adverse publicity or other adverse consequences related to our dual class structure or “controlled company” status; and the other factors set forth under the caption “Risk Factors” in our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2023, filed with the Securities and Exchange Commission (“SEC”), and our other filings with the SEC, including our Annual Report on Form 10-K for the annual period ended December 31, 2023, to be filed with the SEC.

You are cautioned not to place undue reliance on any forward-looking statements made in this press release. Any forward-looking statement speaks only as of the date as of which it is made, and, except as otherwise required by law, we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New factors emerge from time to time, and it is not possible for us to predict which will arise.

Oscar Health, Inc.

News Release

About Oscar Health

Oscar Health, Inc. (“Oscar”) is the first health insurance company built around a full stack technology platform and a relentless focus on serving its members. At Oscar, our mission is to make a healthier life accessible and affordable for all. Headquartered in New York City, Oscar has been challenging the healthcare system's status quo since our founding in 2012. The company’s member-first philosophy and innovative approach to care has earned us the trust of one million members, as of December 31, 2023. We offer Individual & Family and Small Group plans, and +Oscar, our full stack technology platform, to others within the provider and payor space. Our vision is to refactor healthcare to make good care cost less. Refactor is a term used in software engineering that means to improve the design, structure, and implementation of the software, while preserving its functionality. At Oscar, we take this definition a step further. We improve our members’ experience by building trust through deep engagement, personalized guidance, and rapid iteration.

Investor Contact:

Chris Potochar

VP of Investor Relations

ir@hioscar.com

Media Contact:

Kristen Prestano

VP of Communications

press@hioscar.com

Source: Oscar Health, Inc.

Oscar Health, Inc.

News Release

Oscar Health, Inc.

Consolidated Statements of Operations

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, | | |

| (in thousands, except share and per share amounts) | 2023 | | 2022 | | 2023 | | 2022 | | |

| (unaudited) | | (unaudited) | | (unaudited) | | | | |

| Revenue | | | | | | | | | |

| Premiums before ceded reinsurance | $ | 1,391,193 | | | $ | 1,332,931 | | | $ | 5,696,978 | | | $ | 5,334,520 | | | |

| Reinsurance premiums ceded | (798) | | | $ | (365,474) | | | (10,909) | | | (1,463,403) | | | |

| Premiums earned | 1,390,395 | | | 967,457 | | | 5,686,069 | | | 3,871,117 | | | |

| Administrative services revenue | 3,830 | | | 2,681 | | | 15,442 | | | 61,047 | | | |

| Investment income and other revenue | 37,433 | | | 24,989 | | | 161,358 | | | 31,474 | | | |

| Total revenue | 1,431,658 | | | 995,127 | | | 5,862,869 | | | 3,963,638 | | | |

| | | | | | | | | |

| Operating Expenses | | | | | | | | | |

| Claims incurred, net | 1,205,239 | | | 884,904 | | | 4,642,024 | | | 3,280,798 | | | |

| Other insurance costs | 206,379 | | | 195,859 | | | 824,457 | | | 706,439 | | | |

| General and administrative expenses | 85,610 | | | 75,808 | | | 339,716 | | | 309,783 | | | |

| Federal and state assessments | 74,311 | | | 71,788 | | | 290,725 | | | 281,518 | | | |

| Premium deficiency reserve (release) | 5,596 | | | (10,753) | | | 1,562 | | | (25,033) | | | |

| Total operating expenses | 1,577,135 | | | 1,217,606 | | | 6,098,484 | | | 4,553,505 | | | |

| Loss from operations | (145,477) | | | (222,479) | | | (235,615) | | | (589,867) | | | |

| Interest expense | 6,217 | | | 6,135 | | | 24,603 | | | 22,623 | | | |

| Other expenses (income) | (1,050) | | | (1,339) | | | 7,082 | | | (2,415) | | | |

| Loss before income taxes | (150,644) | | | (227,275) | | | (267,300) | | | (610,075) | | | |

| Income tax expense (benefit) | (806) | | | (715) | | | 3,294 | | | (523) | | | |

| Net loss | (149,838) | | | (226,560) | | | (270,594) | | | (609,552) | | | |

| Less: Net income (loss) attributable to noncontrolling interests | $ | 192 | | | $ | (514) | | | $ | 134 | | | $ | (3,277) | | | |

| Net loss attributable to Oscar Health, Inc. | $ | (150,030) | | | $ | (226,046) | | | $ | (270,728) | | | $ | (606,275) | | | |

| | | | | | | | | |

| Earnings (Loss) per Share | | | | | | | | | |

| Net loss per share attributable to Oscar Health, Inc., basic and diluted | $ | (0.66) | | | $ | (1.05) | | | $ | (1.22) | | | $ | (2.85) | | | |

| Weighted average common shares outstanding, basic and diluted | 227,082,062 | | | 215,194,230 | | | 221,655,493 | | | 212,474,615 | | | |

Oscar Health, Inc.

News Release

Oscar Health, Inc.

Consolidated Balance Sheets

| | | | | | | | | | | |

(in thousands, except share and per share amounts) | December 31, 2023 | | December 31, 2022 |

| (unaudited) | | |

| Assets: | | | |

| Current Assets: | | | |

| Cash and cash equivalents | 1,870,315 | | | 1,558,595 | |

| Short-term investments | 689,833 | | | 1,397,287 | |

| Premiums and accounts receivable (net of allowance for credit losses of $31,600 and $2,988) | 201,269 | | | 216,475 | |

| Risk adjustment transfer receivable | 51,925 | | | 49,861 | |

| Reinsurance recoverable | 241,194 | | | 892,887 | |

| Other current assets | 6,564 | | | 6,450 | |

| Total current assets | 3,061,100 | | | 4,121,555 | |

| Property, equipment, and capitalized software, net | 61,930 | | | 59,888 | |

| Long-term investments | 365,309 | | | 222,919 | |

| Restricted deposits | 29,870 | | | 27,483 | |

| Other assets | 83,271 | | | 94,756 | |

| Total Assets | 3,601,480 | | | 4,526,601 | |

| | | |

| Liabilities and Stockholders' Equity | | |

| Current Liabilities: | | | |

| Benefits payable | 965,986 | | | 937,727 | |

| Risk adjustment transfer payable | 1,056,941 | | | 1,517,493 | |

| Premium deficiency reserve | 5,776 | | | 4,214 | |

| Unearned premiums | 65,918 | | | 78,998 | |

| Accounts payable and other liabilities | 273,367 | | | 297,841 | |

| Reinsurance payable | 61,024 | | | 427,649 | |

| Total current liabilities | 2,429,012 | | | 3,263,922 | |

| Long-term debt | 298,777 | | | 297,999 | |

| Other liabilities | 67,574 | | | 72,280 | |

| Total liabilities | 2,795,363 | | | 3,634,201 | |

| Commitments and contingencies | | | |

| Stockholders' Equity | | | |

| Class A common stock, $0.00001 par value; 825,000,000 shares authorized, 193,874,843 and 181,176,239 shares outstanding as of December 31, 2023 and 2022, respectively | 2 | | | 2 | |

| Class B common stock, $0.00001 par value; 82,500,000 shares authorized, 35,514,201 and 35,115,807 shares outstanding as of December 31, 2023 and 2022, respectively | — | | | — | |

| Treasury stock (314,600 shares as of December 31, 2023 and 2022) | (2,923) | | | (2,923) | |

| Additional paid-in capital | 3,682,294 | | | 3,509,007 | |

| Accumulated deficit | (2,876,715) | | | (2,605,987) | |

| Accumulated other comprehensive income (loss) | 1,309 | | | (9,715) | |

| Total Oscar Health, Inc. stockholders’ equity | 803,967 | | | 890,384 | |

| Noncontrolling interests | 2,150 | | | 2,016 | |

| Total stockholders’ equity | 806,117 | | | 892,400 | |

| Total Liabilities and Stockholders' Equity | 3,601,480 | | | 4,526,601 | |

Oscar Health, Inc.

News Release

Oscar Health, Inc.

Consolidated Statements of Cash Flows

| | | | | | | | | | | |

| Year Ended December 31, |

(in thousands) | 2023 | | 2022 |

| (unaudited) | | |

| Cash flows from operating activities: | | | |

| Net loss | (270,594) | | | $ | (609,552) | |

| Adjustments to reconcile net loss to net cash (used in) provided by operating activities: | | | |

| Deferred taxes | 58 | | | (165) | |

| Net realized loss (gain) on sale of financial instruments | 70 | | | 1,274 | |

| | | |

| Depreciation and amortization expense | 30,694 | | | 15,283 | |

| Amortization of debt issuance costs | 778 | | | 713 | |

| Stock-based compensation expense | 159,683 | | | 112,329 | |

| Net amortization (accretion) of investments | (29,374) | | | 2,480 | |

| | | |

| Provision for credit losses | 28,612 | | | 2,988 | |

| Changes in assets and liabilities: | | | |

| (Increase) / decrease in: | | | |

| Premiums and accounts receivable | (13,405) | | | (81,049) | |

| Risk adjustment transfer receivable | (2,063) | | | (9,202) | |

| | | |

| Reinsurance recoverable | 651,693 | | | (460,897) | |

| Other assets | 11,307 | | | (243) | |

| | | |

| Increase / (decrease) in: | | | |

| Benefits payable | 28,258 | | | 424,146 | |

| Unearned premiums | (13,080) | | | 3,953 | |

| Premium deficiency reserve | 1,562 | | | (25,033) | |

| Accounts payable and other liabilities | (29,180) | | | 57,811 | |

| Reinsurance payable | (366,626) | | | 222,418 | |

| Risk adjustment transfer payable | (460,552) | | | 723,095 | |

| Net cash (used in) provided by operating activities | (272,159) | | | 380,349 | |

| Cash flows from investing activities: | | | |

| Purchase of investments | (836,982) | | | (1,192,706) | |

| Sale of investments | 31,857 | | | 360,616 | |

| Maturity of investments | 1,410,166 | | | 633,467 | |

| Purchase of property, equipment and capitalized software | (25,577) | | | (29,012) | |

| Change in restricted deposits | (2,277) | | | 1,116 | |

| | | |

| Net cash (used in) provided by investing activities | 577,187 | | | (226,519) | |

| Cash flows from financing activities: | | | |

| Proceeds from long-term debt | — | | | 305,000 | |

| Payments of debt issuance costs | — | | | (7,035) | |

| Proceeds from joint venture contribution | 2,490 | | | 1,846 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Proceeds from exercise of stock options | 3,956 | | | 1,299 | |

| Net cash provided by financing activities | 6,446 | | | 301,110 | |

| Increase in cash, cash equivalents and restricted cash equivalents | 311,474 | | | 454,940 | |

| Cash, cash equivalents, restricted cash and cash equivalents—beginning of period | 1,580,497 | | | 1,125,557 | |

| Cash, cash equivalents, restricted cash and cash equivalents—end of period | $ | 1,891,971 | | | $ | 1,580,497 | |

| | | |

| Cash and cash equivalents | 1,870,315 | | | 1,558,595 | |

| Restricted cash and cash equivalents included in restricted deposits | 21,656 | | | 21,902 | |

| Total cash, cash equivalents and restricted cash and cash equivalents | $ | 1,891,971 | | | $ | 1,580,497 | |

| | | | | | | | | | | |

| Year Ended December 31, |

(in thousands) | 2023 | | 2022 |

| Supplemental Disclosures: | | | |

| Interest payments | $ | 23,156 | | | $ | 10,079 | |

| Income tax payments | $ | 2,414 | | | $ | 1,893 | |

| | | |

| | | |

| | | |

| | | |

| | | |

Oscar Health, Inc.

News Release

Key Operating and Non-GAAP Financial Metrics

We regularly review a number of metrics, including the following key operating and non-GAAP financial metrics, to evaluate our business, measure our performance, identify trends in our business, prepare financial projections, and make strategic decisions. We believe these operational and financial measures are useful in evaluating our performance, in addition to our financial results prepared in accordance with GAAP.

Members

Members are defined as any individual covered by a health plan that we offer directly or through a co-branded arrangement. We view the number of members enrolled in our health plans as an important metric to help evaluate and estimate revenue and market share. Additionally, the more members we enroll, the more data we have, which allows us to improve the functionality of our platform.

Direct and Assumed Policy Premiums

Direct policy premiums are defined as the premiums collected from our members or from the federal government during the period indicated, before risk adjustment and reinsurance. These premiums include APTC, or premium subsidies, which are available to individuals and families with certain annual incomes.

Assumed policy premiums are premiums we receive primarily as part of our reinsurance arrangement under our Cigna+Oscar Small Group plan offering, and are presented here net of risk adjustment.

We believe Direct and Assumed Policy Premiums is an important metric to assess the growth of our individual and small group plan offerings going forward. Management also views Direct and Assumed Policy Premiums as a key operating metric because Direct and Assumed Policy Premiums are a key input in the calculation of our MLR, InsuranceCo Administrative Expense Ratio, InsuranceCo Combined Ratio and Adjusted Administrative Expense Ratio.

Medical Loss Ratio

Medical Loss Ratio is calculated as set forth in the table below. Direct claims incurred before ceded reinsurance are medical claims, the total medical expenses incurred in order for members to utilize healthcare services less any member cost sharing. These services include inpatient, outpatient, pharmacy, and physician costs. Direct claims incurred before ceded reinsurance also include risk sharing arrangements with certain of our providers. The impact of the federal risk adjustment program is included in the denominator of our MLR. We believe MLR is an important metric to demonstrate the ratio of our costs to pay for healthcare of our members to net premiums before ceded quota share reinsurance. MLRs in our existing products are subject to various federal and state minimum requirements.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| (in thousands, except percentages) | 2023 | | 2022 | | 2023 | | 2022 |

Direct claims incurred before ceded reinsurance (1) | $ | 1,158,278 | | | $ | 1,172,279 | | | $ | 4,459,702 | | | $ | 4,428,000 | |

| Assumed reinsurance claims | 57,864 | | | 47,683 | | | 227,058 | | | 143,147 | |

Excess of loss ceded claims (2) | 2,921 | | | (4,316) | | | (3,117) | | | (18,632) | |

State reinsurance (3) | (17,102) | | | (1,901) | | | (43,676) | | | (30,544) | |

Net claims before ceded quota share reinsurance (A) | $ | 1,201,961 | | | $ | 1,213,745 | | | $ | 4,639,967 | | | $ | 4,521,971 | |

| | | | | | | |

| Premiums before ceded reinsurance | $ | 1,391,193 | | | $ | 1,332,931 | | | $ | 5,696,978 | | | $ | 5,334,520 | |

| | | | | | | |

Excess of loss reinsurance premiums (4) | (717) | | | (8,115) | | | (8,698) | | | (31,502) | |

Net premiums before ceded quota share reinsurance (B) | $ | 1,390,476 | | | $ | 1,324,816 | | | $ | 5,688,280 | | | $ | 5,303,018 | |

Medical Loss Ratio (A divided by B) | 86.4 | % | | 91.6 | % | | 81.6 | % | | 85.3 | % |

(1)See the Appendix to this release for a reconciliation of direct claims incurred to claims incurred, net appearing on the face of our statement of operations.

(2)Represents claims ceded to reinsurers pursuant to an excess of loss treaty, for which such reinsurers are financially liable. We use excess of loss reinsurance to limit the losses on individual claims of our members.

(3)Represents payments made by certain state-run reinsurance programs established subject to CMS approval under Section 1332 of the ACA.

(4)Represents excess of loss reinsurance premiums paid.

Oscar Health, Inc.

News Release

InsuranceCo Administrative Expense Ratio

InsuranceCo Administrative Expense Ratio is calculated as set forth in the table below. The ratio reflects the costs associated with running our insurance companies. We believe InsuranceCo Administrative Expense Ratio is useful to evaluate our ability to manage our expenses as a percentage of net premiums before quota share reinsurance. Expenses necessary to run the insurance companies are included in Other insurance costs and Federal and state assessments. These expenses include variable expenses paid to distribution partners and vendors, premium taxes and healthcare exchange fees, employee-related compensation, benefits, marketing costs, and other administrative expenses.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| (in thousands, except percentages) | 2023 | | 2022 | | 2023 | | 2022 |

| Other insurance costs | $ | 206,379 | | | $ | 195,859 | | | $ | 824,457 | | | $ | 706,439 | |

Impact of quota share reinsurance (1) | (7,023) | | | 40,745 | | | (30,454) | | | 154,741 | |

| | | | | | | |

| | | | | | | |

| Stock-based compensation expense | (11,458) | | | (13,043) | | | (66,060) | | | (51,495) | |

Federal and state assessment of health insurance subsidiaries | 73,915 | | | 71,471 | | | 289,647 | | | 281,049 | |

Health insurance subsidiary adjusted administrative expenses (A) | $ | 261,813 | | | $ | 295,032 | | | $ | 1,017,590 | | | $ | 1,090,734 | |

| | | | | | | |

| Premiums before ceded reinsurance | $ | 1,391,193 | | | $ | 1,332,931 | | | $ | 5,696,978 | | | $ | 5,334,520 | |

| | | | | | | |

| Excess of loss reinsurance premiums | (717) | | | (8,115) | | | (8,698) | | | (31,502) | |

Net premiums before ceded quota share reinsurance (B) | $ | 1,390,476 | | | $ | 1,324,816 | | | $ | 5,688,280 | | | $ | 5,303,018 | |

InsuranceCo Administrative Expense Ratio (A divided by B) | 18.8 | % | | 22.3 | % | | 17.9 | % | | 20.6 | % |

(1)Includes ceding commissions received from reinsurers, net of the impact of deposit accounting of $(6,996) and $(1,788) for the three months ended December 31, 2023 and 2022, respectively and $(29,451) and $(7,205) for the year ended December 31, 2023 and 2022, respectively.

InsuranceCo Combined Ratio

InsuranceCo Combined Ratio is defined as the sum of MLR and InsuranceCo Administrative Expense Ratio. We believe this ratio best represents the core performance of the insurance business, prior to the impact of quota share and net investment income.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Medical Loss Ratio | 86.4 | % | | 91.6 | % | | 81.6 | % | | 85.3 | % |

| InsuranceCo Administrative Expense Ratio | 18.8 | % | | 22.3 | % | | 17.9 | % | | 20.6 | % |

InsuranceCo Combined Ratio | 105.2 | % | | 113.9 | % | | 99.5 | % | | 105.8 | % |

Oscar Health, Inc.

News Release

Adjusted Administrative Expense Ratio

The Adjusted Administrative Expense Ratio is an operating ratio that reflects the Company’s total administrative expenses (“Total Administrative Expenses”), net of non-cash and non-recurring items (as adjusted, “Adjusted Administrative Expenses”), as a percentage of total revenue, excluding the impact of quota share reinsurance premiums less excess of loss reinsurance premiums ceded (“Adjusted Total Revenue”). Total Administrative Expenses are calculated as Total operating expenses, excluding non-administrative insurance-based expenses and the impact of quota share reinsurance. Adjusted Administrative Expenses are Total Administrative Expenses, net of non-cash and non-recurring expense items. We believe Adjusted Administrative Expense Ratio is useful to evaluate our ability to manage our overall administrative expense base. This ratio also provides further clarity into our overall path to profitability.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| (in thousands, except percentages) | 2023 | | 2022 | | 2023 | | 2022 |

| Total Operating Expenses | $ | 1,577,135 | | | $ | 1,217,606 | | | $ | 6,098,484 | | | $ | 4,553,505 | |

| Claims incurred, net | (1,205,239) | | | (884,904) | | | (4,642,024) | | | (3,280,798) | |

| Premium deficiency reserve (release) | (5,596) | | | 10,753 | | | (1,562) | | | 25,033 | |

Impact of quota share reinsurance (1) | (7,023) | | | 40,745 | | | (30,454) | | | 154,741 | |

| | | | | | | |

| Total Administrative Expenses | $ | 359,277 | | | $ | 384,200 | | | $ | 1,424,444 | | | $ | 1,452,481 | |

| Stock-based compensation expense | (26,142) | | | (29,088) | | | (159,683) | | | (112,329) | |

| Depreciation and amortization | (7,742) | | | (3,735) | | | (30,694) | | | (15,283) | |

| | | | | | | |

Adjusted Administrative Expenses (A) | $ | 325,393 | | | $ | 351,377 | | | $ | 1,234,067 | | | $ | 1,324,869 | |

| Total Revenue | $ | 1,431,658 | | | $ | 995,127 | | | $ | 5,862,869 | | | $ | 3,963,638 | |

| Reinsurance premiums ceded | 798 | | | 365,474 | | | 10,909 | | | 1,463,403 | |

| Excess of loss reinsurance premiums | (717) | | | (8,115) | | | (8,698) | | | (31,502) | |

| | | | | | | |

Adjusted Total Revenue (B) | $ | 1,431,739 | | | $ | 1,352,486 | | | $ | 5,865,080 | | | $ | 5,395,539 | |

Adjusted Administrative Expense Ratio (A divided by B) | 22.7 | % | | 26.0 | % | | 21.0 | % | | 24.6 | % |

(1)Includes ceding commissions received from reinsurers, net of the impact of deposit accounting of $(6,996) and $(1,788) for the three months ended December 31, 2023 and 2022, respectively, and $(29,451) and $(7,205) for the year ended December 31, 2023 and 2022, respectively.

SG&A Expense Ratio

The Company is transitioning to the SG&A Expense Ratio as the operating ratio that reflects the Company’s administrative expenses, as a percentage of total revenue, without exclusions for the impact of quota share, premium deficiency reserve (release), or stock compensation. Total SG&A Expenses are calculated as Total operating expenses, less Claims incurred, net, and Depreciation and amortization. The SG&A Expense ratio is calculated as selling, general and administrative expenses as a percentage of Total Revenue. We believe the SG&A Expense Ratio is useful to evaluate our ability to manage our administrative expenses.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| (in thousands, except percentages) | 2023 | | 2022 | | 2023 | | 2022 |

| Adjusted Administrative Expenses | $ | 325,393 | | | $ | 351,377 | | | $ | 1,234,067 | | | $ | 1,324,869 | |

| Premium deficiency reserve (release) | 5,596 | | | (10,753) | | | 1,562 | | | (25,033) | |

Impact of quota share reinsurance (1) | 7,023 | | | (40,745) | | | 30,454 | | | (154,741) | |

| Stock-based compensation expense | 26,142 | | | 29,088 | | | 159,683 | | | 112,329 | |

Total SG&A Expenses (A) | $ | 364,154 | | | $ | 328,967 | | | $ | 1,425,766 | | | $ | 1,257,424 | |

Total Revenue (B) | $ | 1,431,658 | | | $ | 995,127 | | | $ | 5,862,869 | | | $ | 3,963,638 | |

SG&A Expense Ratio (A divided by B) | 25.4 | % | | 33.1 | % | | 24.3 | % | | 31.7 | % |

Oscar Health, Inc.

News Release

Adjusted EBITDA

Adjusted EBITDA is defined as Net loss for the Company and its consolidated subsidiaries before interest expense, income tax expense (benefit), and depreciation and amortization as further adjusted for stock-based compensation, and other items that are considered unusual or not representative of underlying trends of our business, where applicable for the period presented. We present Adjusted EBITDA because we consider it to be an important supplemental measure of our performance and believe it is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in our industry. Adjusted EBITDA is a non-GAAP measure. Management believes that investors’ understanding of our performance is enhanced by including this non-GAAP financial measure as a reasonable basis for comparing our ongoing results of operations.

We caution investors that amounts presented in accordance with our definition of Adjusted EBITDA may not be comparable to similar measures disclosed by our competitors, because not all companies and analysts calculate Adjusted EBITDA in the same manner.

Management uses Adjusted EBITDA:

•as a measurement of operating performance because it assists us in comparing the operating performance of our business on a consistent basis, as it removes the impact of items not directly resulting from our core operations;

•for planning purposes, including the preparation of our internal annual operating budget and financial projections;

•to evaluate the performance and effectiveness of our operational strategies; and

•to evaluate our capacity to expand our business.

By providing this non-GAAP financial measure, together with a reconciliation to the most comparable U.S. GAAP measure, Net loss, we believe we are enhancing investors’ understanding of our business and our results of operations, as well as assisting investors in evaluating how well we are executing our strategic initiatives. Adjusted EBITDA has limitations as an analytical tool, and should not be considered in isolation, or as an alternative to, or a substitute for Net loss or other financial statement data presented in our Consolidated Financial Statements as indicators of financial performance.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Net loss | $ | (149,838) | | | $ | (226,560) | | | $ | (270,594) | | | $ | (609,552) | |

| Interest expense | 6,217 | | | 6,135 | | | 24,603 | | | 22,623 | |

| Other expenses (income) | (1,050) | | | (1,339) | | | 7,082 | | | (2,415) | |

| Income tax expense (benefit) | (806) | | | (715) | | | 3,294 | | | (523) | |

| Depreciation and amortization (“D&A”) | 7,742 | | | 3,735 | | | 30,694 | | | 15,283 | |

Stock-based compensation (“SBC”) (1) | 26,142 | | | 29,088 | | | 159,683 | | | 112,329 | |

| | | | | | | |

| Adjusted EBITDA | $ | (111,593) | | | $ | (189,656) | | | $ | (45,238) | | | $ | (462,255) | |

| | | | | | | |

| General and administrative expenses (excluding SBC and D&A) | $ | 70,505 | | | $ | 59,341 | | | $ | 244,085 | | | $ | 246,735 | |

| Administrative services revenue | $ | (3,830) | | | $ | (2,682) | | | $ | (15,442) | | | (61,047) | |

| Investment income and other revenue (Non-InsuranceCo) | $ | (4,735) | | | $ | (2,027) | | | $ | (14,672) | | | $ | (5,711) | |

InsuranceCo Adjusted EBITDA (2) | $ | (49,653) | | | $ | (135,024) | | | $ | 168,733 | | | $ | (282,278) | |

(1)Represents non-cash expenses related to equity-based compensation programs, which vary from period to period depending on various factors including the timing, number, and the valuation of awards. Year ended December 31, 2023 includes a non-recurring charge of $46.3 million related to accelerated stock-based compensation expense recognized as a result of the cancellation of the Founders Awards previously granted to Mario Schlosser and Joshua Kushner.

(2)We believe that InsuranceCo Adjusted EBITDA provides investors with additional insight into the earnings and capital generation potential of the Company’s insurance subsidiaries.

Oscar Health, Inc.

News Release

Appendix

Oscar Health, Inc.

News Release

Reinsurance Impact

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Quota share ceded premiums | $ | 222 | | | $ | (372,168) | | | $ | 7,329 | | | $ | (1,489,525) | |

| Quota share ceded claims | (3,277) | | | 328,841 | | | (2,056) | | | 1,241,173 | |

Ceding commission, net of deposit accounting impact (1) | (7,023) | | | 40,745 | | | (30,454) | | | 154,741 | |

| Experience refund | (302) | | | 14,809 | | | (9,540) | | | 57,625 | |

| Net quota share impact | $ | (10,380) | | | $ | 12,227 | | | $ | (34,721) | | | $ | (35,986) | |

(1)Includes ceding commissions received from reinsurers, net of the impact of deposit accounting of $(6,996) and $(1,788) for the three months ended December 31, 2023 and 2022, respectively, and $(29,451) and $(7,205) for the year ended December 31, 2023 and 2022, respectively.

The composition of total reinsurance premiums ceded and reinsurance premiums assumed, which are included as components of total premiums earned in the consolidated statement of operations, is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Reinsurance premiums ceded, gross | (1,458) | | | (380,592) | | | 56 | | | (1,524,157) | |

| Experience refunds | 660 | | | 15,118 | | | (10,965) | | | 60,754 | |

| Reinsurance premiums ceded | (798) | | | (365,474) | | | (10,909) | | | (1,463,403) | |

| Reinsurance premiums assumed | 54,620 | | | 41,815 | | | 228,786 | | | 138,109 | |

| Total reinsurance premiums (ceded) and assumed, net | 53,822 | | | (323,659) | | | 217,877 | | | (1,325,294) | |

The Company records claims expense net of reinsurance recoveries. The following table reconciles the total claims expense to the net claims expense as presented in the consolidated statement of operations:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Direct claims incurred | 1,158,278 | | | 1,172,279 | | | 4,459,702 | | | 4,428,000 | |

| Ceded reinsurance claims | (10,903) | | | (335,058) | | | (44,736) | | | (1,290,349) | |

| Assumed reinsurance claims | 57,864 | | | 47,683 | | | 227,058 | | | 143,147 | |

| Claims incurred, net | 1,205,239 | | | 884,904 | | | 4,642,024 | | | 3,280,798 | |

The Company records selling, general and administrative expenses net of ceding commissions. The following table reconciles total other insurance costs to the amount presented in the consolidated statement of operations:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Other insurance costs, gross | 206,353 | | | 238,392 | | | 823,455 | | | 868,385 | |

| Reinsurance ceding commissions | 26 | | | (42,533) | | | 1,002 | | | (161,946) | |

| Other insurance costs | 206,379 | | | 195,859 | | | 824,457 | | | 706,439 | |

Oscar Health, Inc.

News Release

The Company classifies reinsurance recoverable within current assets on its consolidated balance sheets. The composition of the reinsurance recoverable balance is as follows:

| | | | | | | | | | | | | | | | | | |

| | As of December 31, | | | | |

| (in thousands) | | 2023 | | 2022 | | | | |

| Ceded reinsurance claim recoverables | | $ | 225,705 | | | $ | 776,266 | | | | | |

| Reinsurance ceding commissions | | 6,185 | | | 42,805 | | | | | |

| Experience refunds on reinsurance agreements | | 9,304 | | | 73,816 | | | | | |

| Reinsurance recoverable | | $ | 241,194 | | | $ | 892,887 | | | | | |

v3.24.0.1

Cover Page

|

Feb. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 07, 2024

|

| Entity Registrant Name |

Oscar Health, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40154

|

| Entity Tax Identification Number |

46-1315570

|

| Entity Address, Address Line One |

75 Varick Street, 5th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10013

|

| City Area Code |

646

|

| Local Phone Number |

403-3677

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.00001 par value per share

|

| Trading Symbol |

OSCR

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001568651

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

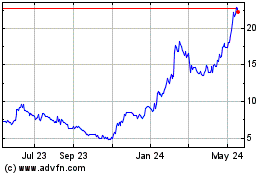

Oscar Health (NYSE:OSCR)

Historical Stock Chart

From Jan 2025 to Feb 2025

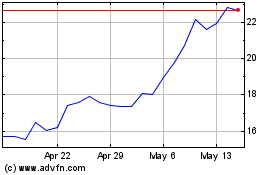

Oscar Health (NYSE:OSCR)

Historical Stock Chart

From Feb 2024 to Feb 2025