UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN

ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

SECURITIES EXCHANGE

ACT OF 1934

For the month of March,

2025

(Commission File

No. 001-34429),

PAMPA ENERGIA S.A.

(PAMPA ENERGY INC.)

Argentina

(Jurisdiction of

incorporation or organization)

Maipú 1

C1084ABA

City of Buenos Aires

Argentina

(Address of principal

executive offices)

(Indicate by check

mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F ___X___ Form 40-F ______

(Indicate

by check mark whether the registrant by furnishing the

information contained in this form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.)

Yes ______ No ___X___

(If "Yes"

is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): 82- .)

This Form 6-K

for Pampa Energía S.A. (“Pampa” or the “Company”) contains:

Exhibit

1: Letter dated March 10, 2025 entitled “Board proposals for the General Ordinary and Extraordinary Shareholders’ Meeting called for

April 7, 2025.”

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date: March 10, 2025

| Pampa Energía S.A. |

| |

|

|

| |

|

|

| By: |

/s/ Gustavo Mariani

|

|

| |

Name: Gustavo Mariani

Title: Chief Executive Officer |

|

FORWARD-LOOKING

STATEMENTS

This press release may contain

forward-looking statements. These statements are statements that are not historical facts, and are based on management's current

view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates",

"believes", "estimates", "expects", "plans" and similar expressions, as they relate to

the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends,

the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations

and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements.

Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee

that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including

general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors

could cause actual results to differ materially from current expectations.

Board proposals regarding the assorted

items on the Agenda for the General Ordinary and Extraordinary Shareholders’ Meeting called for April 7, 2025.

The President informs that article 70 of the

Argentine Capital Markets Law establishes that the Board of Directors has to put forward to the Shareholders their proposals regarding

the items to be dealt with at the General Ordinary and Extraordinary Shareholders’ Meeting. Consequently:

| 1. | Regarding the first Agenda item, i.e., “Appointment of shareholders to approve and sign

the Meeting minutes,” the Board of Directors, by unanimous vote, proposed that the Shareholders’ Meeting appoint the representatives

of JP Morgan and the Sustainability Guaranty Fund under the charge of the Social Security Office (Administración Nacional de

la Seguridad Social - ANSES) to sign the minutes. |

| 2. | As concerns the second Agenda item, i.e., “Consideration of the Company’s Balance

Sheet, Statement of Comprehensive Income, Statement of Changes in Shareholders’ Equity, Statement of Cash Flows, Notes, Independent

Auditor’s Report, Supervisory Committee’s Report, Annual Report and Report on Compliance with the Corporate Governance Code,

Management’s Discussion and Analysis required by the Regulations of the Argentine Securities Commission and the additional information

required by the applicable rules, all for the fiscal year ended December 31, 2024,” it is informed that the Board of Directors

considered and approved the Financial Statements and supplementary documents and, as a consequence, proposes the approval of the documents

mentioned above. |

| 3. | As concerns the third Agenda item, i.e., “Consideration of the results for the year and

allocation thereof (upon dealing with this item, the Meeting will qualify as an Extraordinary Shareholders’ Meeting in accordance

with Article 70 of the Argentine Corporations Law No 19,550),” it was informed that the fiscal year recorded a profit of Ps.

564,5871 million which, in addition to the currency exchange differences

allocated to the unallocated results amounting Ps. 201,4862 million,

the retained earnings amounted to a gain of Ps. 766,0733 million

as of December 31, 2024. Consequently, the Board unanimously decided to propose to the shareholders’ meeting that the sum of Ps.

766,073 million be allocated to set up a voluntary reserve. |

Likewise, it is informed that the Company does

not expect to declare dividends. Thus, the Company shall retain all the funds to allocate them to and/or have them available for:

1

Equivalent to US$532,488,588 according to the exchange rate information published

by the Banco de la Nación Argentina as of December 31, 2024.

2

Equivalent to US$190,030,935.22 according to the exchange rate information published

by the Banco de la Nación Argentina as of December 31, 2024.

3

Equivalent to US$722,519,523.14 according to the exchange rate information published

by the Banco de la Nación Argentina as of December 31, 2024.

| i. | Driving our businesses’ operation and expansion through key investments, both ordinary and extraordinary.

This includes continued oil and gas exploration and production in Vaca Muerta, particularly in Rincón de Aranda, as well as equity

commitments in the projects we are part of; |

| ii. | Maximizing investment opportunities that can foster significant growth, business expansion and generation

of strategic synergies; |

| iii. | Taking the necessary measures to safeguard the Company shareholders’ interests and investment value

given the current market volatility scenario. |

All of this is in line with the Company’s

Dividend Policy.

| 4. | As concerns the fourth Agenda item, i.e., “Consideration of the Directors and Supervisory Committee’s

performance for the fiscal year ended December 31, 2024.” the Board of Directors abstained from making any proposal to avoid

a potential conflict of interests concerning the approval of the performance of their duties. As for the performance of duties

of the Supervisory Committee, the Board of Directors unanimously proposed that the Shareholders’ Meeting approve it. |

| 5. | As concerns the fifth Agenda item, i.e., “Consideration of the Director’s fees for the

fiscal year ended December 31, 2024, within the 5% legal limit in relation to profits in accordance with Article 261 of Argentine Law

No. 19,550 and the regulations of the Argentine Comisión Nacional de Valores and the Supervisory Committee’s fees for the

fiscal year ended December 31, 2024”, it is informed that the Shareholders’ Meeting held on April 29, 2024, authorized

the payment of advance fees to the directors and the members of the Supervisor Committee until the date of the Shareholders’ Meeting

that shall deal with the financial statements as of December 31, 2024. |

In view of the aforementioned, the

Board of Directors unanimously proposed that the Shareholders’ Meeting: (i) approve the fees payable to the Board of Directors in

the amount of Ps. 14.058.362.655,424 for the fiscal year ended on

December 31, 2024; (ii) approve the fees payable to the Supervisory Committee in the amount of Ps. 63,113,4455

for the fiscal year ended on December 31, 2024; and (iii) authorize for the advance payment of fees to members of the Board of Directors

and the de Supervisory Committee until the date of the Shareholders’ Meeting that shall consider the financial statements as of

December 31, 2025.

Regarding the proposed fees for the

Board of Directors for the fiscal year ended December 31, 2024, the following details are provided:

4

Equivalent to US$13,259,103.87 according to the exchange rate information published

by the Banco de la Nación Argentina as of December 31, 2024.

5

Equivalent to US$59,525.26 according to the exchange rate information published

by the Banco de la Nación Argentina as of December 31, 2024.

(i) Honorariums: the amount

paid during the fiscal year ended December 31, 2024, totals Ps. 189,694,6906,

which was paid as advances pursuant to the approval of the Ordinary and Extraordinary General Shareholders’ Meeting held on April

29, 2024.

(ii) Fees for technical-administrative

functions include:

a. Salary, along with all associated

benefits and the Stock Compensation Plan approved by the Board of Directors on February 8, 2017, exclusively for those directors who are

beneficiaries of such plan, for a total amount of $3,589,947,965.427,

which has already been paid; and

b. The Executive Compensation Plan

approved by the Board of Directors on June 2, 2017, is to be paid in 2025 for the amount of Ps. 10,278,720,0008.

The Stock Compensation Plan and the

Executive Compensation Plan aim to align the interests of key personnel and senior executives, respectively, with value creation for the

Company and shareholders.

The Executive Compensation Plan is

calculated as a percentage of the Company’s market value appreciation, considering the average market value achieved by the Company

during the last 30 trading days of each fiscal year. In this way, the incentive is only earned to the extent that the shareholders of

the Company have seen an increase in the value of their shares.

The amount thus calculated is paid

in two annual installments of 50% each. However, the annual payment is capped at 1.5% of the EBITDA for the year, which prevents the amount

payable by the Company from becoming overly burdensome in years when the Company’s market capitalization increases significantly,

but the Company’s profits do not grow at the same magnitude. The amount not paid to the Executives due to exceeding the aforementioned

EBITDA cap will remain as a credit in favor of the beneficiaries, which will be paid in subsequent fiscal years, always considering the

mentioned EBITDA cap.

(iii) The Board of Directors considers

that the fees assigned to its members during the fiscal year under consideration are appropriate and reasonable, taking into account market

remuneration at the local level, the particular circumstances of the Company, the responsibilities assumed by the aforementioned individuals,

the time dedicated to their roles, their competence, and professional reputation; and

6

Equivalent to US$178,909.99 according to the exchange rate information published

by the Banco de la Nación Argentina as of December 31, 2024.

7

Equivalent to US$3,385,848.98 according to the exchange rate information published

by the Banco de la Nación Argentina as of December 31, 2024.

8

Equivalent to US$9,694,344.89 according to the exchange rate information published

by the Banco de la Nación Argentina as of December 31, 2024.

(iv) All of the above has been analyzed

and evaluated by the Company’s Remuneration Committee, with no objections raised by such Committee regarding the proposed amount.

| 6. | As concerns the sixth Agenda item, i.e., “Consideration of fees payable to the Independent

Auditor,” the Board of Directors proposed, by unanimous vote, that the Shareholders’ Meeting approve fees payable to the

certifying accountant for work performed in the fiscal year ended December 31, 2024, for Ps. 1,065,665,4569,

including fees for the SOX 404 certification, required by the U.S. Securities and Exchange Commission. |

| 7. | Regarding the seventh Agenda item, i.e., “Appointment of Regular and Alternate Directors,”

first of all, the Board of Directors would like to highlight that (i) on December 31, 2024, the mandates of the regular directors Carlos

Correa Urquiza, Carolina Zang, Lucas Sebastian Amado and Julia Pomares, and the alternate directors Mariana de la Fuente, Clarisa Lifsic,

Lorena Rappaport, Diego Martin Salaverri and Veronica Cheja, expired; and (ii) on [March 5, 2025], M. María Carolina Sigwald resigned

from his position as regular director for strictly personal reasons, effective upon the appointment of her replacement by the Shareholders’

Meeting, it is necessary to renew the expired positions and replace the resigning director. |

In this regard, the Board of Directors

proposed, by unanimous vote, that the Shareholders’ Meeting approve:

(i) the re-election of Ms. Carolina

Zang and Ms. Julia Pomares as regular directors, and Ms. Clarisa Lifsic, Ms. Lorena Rappaport, and Mr. Diego Martin Salaverri as alternate

directors, maintaining the non-independent status for Mr. Diego Martin Salaverri, and the independent status for Ms. Carolina Zang, Ms.

Julia Pomares, Ms. Clarisa Lifsic and Ms. Lorena Rappaport; and appoint Mr. Carlos Szpiegel and Ms. Daniela Rivarola Meilan as regular

director with and independent status and Ms. Flavia Bevilacqua as alternate director with independent status. The abovementioned appointments

will be for a term of 3 fiscal years, with their respective mandates expiring on December 31, 2027;

(ii) the appointment of Mr. Nicolas

Mindlin as a non-independent regular director in replacement of Ms. María Carolina Sigwald until the expiration of the mandate

of María Carolina Sigwald; and the appointment of Ms. María Carolina Sigwald as a non-independent alternate director. In

accordance with the proposal, Mr. Mindlin’s term will expire on December 31, 2026, and Ms. Sigwald’s term will expire on December

31, 2027, and

(iii) the appointment of Gabriel Szpiegel

and Ms. Carolina Zang as regular members of the Auditors Committee and the appointment of Ms. Clarisa Lifsic as a regular member of the

Auditors Committee.

9

Equivalent to US$1,005,079.2 according to the exchange rate information published by the Banco de la Nación Argentina as of December

31, 2024.

Furthermore, the Board expresses that,

upon approval of the proposed appointments, the Company will maintain a Board where the majority of all its members are women, achieving

unprecedented gender equality in the securities market of the Argentine Republic. With this, Pampa will be at the forefront of implementing

various gender policies promoted by multiple government agencies of the Argentine Republic, including the CNV, as well as the United Nations

Sustainable Development Agenda, with gender equality being one of its objectives. Additionally, the Board continues to be composed of

the same number of independent members (50%), who, with their diverse business perspectives based on their different professions, add

significant value to Pampa, particularly through their interactions with the executive directors, who maintain continuous contact with

the various areas of the Company and its daily operations. This convergence provides the Board with a comprehensive view of the business

and constant updates on relevant matters.

Silvana Wasersztrom had the floor,

in her capacity as Chair of the Company’s Nominations Committee, and informed that such committee had evaluated the candidates to

be proposed to the Shareholders’ Meeting and, considering the independence, diversity, age, skills, experience, knowledge of the

company business and industry factors, the referred Committee had no objections to such candidates. Likewise, Pampa will upload a brief

biographical description of the proposed directors on its institutional website.

| 8. | Regarding the eighth Agenda item, i.e., “Appointment of an Alternate member of the Supervisory

Committee,” the Board of Directors proposed, by unanimous vote, that the Shareholders’ Meeting approve the renewal of

the mandate of Ms. Noemí Ivonne Cohn as an alternate member of the Supervisory Committee, whose mandate will expire on December

31, 2026. |

| 9. | As concerns the ninth Agenda item, i.e., “Appointment of Regular Independent Auditor and Alternate

Independent Auditor who shall render an opinion on the financial statements for the fiscal year started on January 1, 2025,”

the Board of Directors proposed, by unanimous vote, that the Shareholders’ Meeting appoint Price Waterhouse & Co. S.R.L., member

of PriceWaterhouseCoopers, appointing Mr. Carlos Martín Barbafina as certifying accountant, and Mr. [Fernando Rodríguez

and Mr. Ezequiel Mirazón] as alternate certifying accountants for the fiscal year ended December 31, 2025. |

| 10. | As concerns the tenth Agenda item, i.e., “Determination of fees payable to the Regular Independent

Auditor and Alternate Independent Auditor who shall render an opinion on the financial statements for the fiscal year commenced on January

1, 2025”, the Board of Directors proposed, by unanimous vote, that the Shareholders’ Meeting postpone the resolution regarding

the approval of fees payable to the independent auditor for the fiscal year ending December 31, 2025, until the next annual Shareholders’

Meeting. |

| 11. | As concerns the eleventh Agenda item, i.e., “Consideration of allocation of a budgetary item

for the operation of the Audit Committee,” the Board of Directors proposed, by unanimous vote, to the Shareholders’

Meeting that the Audit Committee’s budget for the fiscal year 2025 amount to Ps. 20,750,00010. |

10

Equivalent to US$19,570.3 according to the exchange rate information published

by the Banco de la Nación Argentina as of December 31, 2024.

| 12. | As concerns the twelfth Agenda item, i.e., “Consideration of an amendment of the Bylaws. Approval

of a Restated Bylaws Text,” the Board states that the Company is analyzing the possibility of making investments in the fertilizer

(urea) sector in order to monetize its gas reserves held in various concessioned areas. In this regard, the Board of Directors proposed,

by unanimous vote, that the Shareholders’ Meeting approve: |

(i) to amend the Bylaws in order to

include more detailed information on the chemical and petrochemical products included in the Company’s industrial activity, with

Article 4 of the Bylaws being amended as follows: “Section 4. The Company’s purpose is to carry out in its own name, through

or in association with third parties, for its own account or on behalf of third parties, in Argentina or abroad, the following activities:

(a) Industrial: 1) Operations for the generation, transformation, transmission and distribution of electric power; 2) To explore, exploit,

prospect, detect, probe and drill hydrocarbon and any other fields, areas and/or wells, and to develop mining activities generally; 3)

to purchase, sell, lease and exploit drilling equipment, any spare parts and accessories thereof, and enter into any contracts and perform

any acts and transactions related to mining extraction; 4) to manufacture, process, industrialize, purchase, sell, import, export and

transport (i) hydrocarbons and any byproducts thereof belonging to the Company or to third parties, either liquid, solid or gaseous; and

(ii) chemical products and those derived from the petrochemical industry, such as, without limitation, fertilizers; 5) to enter into any

kind of contracts for the performance of works and/or services related to the foregoing activities; 6) Exploitation in any manner of agriculture,

livestock-farming, fruit-growing, winemaking, olive grove, forestry growth and/or farming establishments; and 7) Production through any

form of industrial process of agricultural or winemaking products or byproducts. (b) Commercial: Commercial transactions by importing,

exporting, selling and purchasing, transporting, storing and distributing products, byproducts and goods related to the electric power

generation process, mining production and agricultural and winemaking products and byproducts including the exercise or performance of

activities as representative or commission, consignment and other agents. (c) Financial: Financial transactions generally; to extend loans

and/or make capital contributions to individuals and companies in connection with business operations performed or to be performed; to

provide guarantees, collateral and surety in favor of third parties; to sell, purchase and manage shares, governmental securities, debentures

and other securities on any of the systems and in any form created or to be created, other than transactions falling within the scope

of the Financial Entities Law. (d) Investment: Investing activities in undertakings and companies of any nature, in accordance with and

subject to the limitations established by applicable laws and regulations; the Company may organize or take part in the organization of

companies or purchase and hold equity interests in companies now

existing or to be created in the

future in Argentina or abroad, be a party to temporary business associations, cooperative associations, joint ventures and business associations.

The Company may also, for investment purposes, purchase, develop and dispose of real and private property of any kind, encumber and convey

and receive such property under a lease, a concession or a financial lease. (e) Services: To provide services or act as an agent in its

name or for the benefit of third parties. To fulfill this purpose, the Company has the full legal capacity to acquire rights and incur

obligations and to perform any acts not prohibited by the laws and these bylaws” and

(ii) To approve a restated Bylaws

text containing the proposed amendments, with the proposal to omit its reading and have it transcribed following the minutes of the Shareholders’

Meeting.

| 13. | As concerns the thirteenth Agenda item, i.e., “Consideration of the increase in the maximum amount

of the US$1,400,000,000 global note program for the issuance of convertible and non-convertible obligaciones negociables (the “Program”),

by the sum of US$700,000,000 (or its equivalent in other currencies or value units), that is, from the actual sum of US$1,400,000,000

(or its equivalent in other currencies or value units) to the sum of US$2,100,000,000 (or its equivalent in other currencies or value

units), Regarding the current Program and considering the prevailing market conditions, the Board of Directors proposed, by unanimous

vote, to (i) approve an increase in the maximum amount of the Program, by the sum of US$700,000,000 (or its equivalent in other currencies

or value units), that is, from the actual sum of US$1,400,000,000 (or its equivalent in other currencies or value units) to the sum of

US$2,100,000,000 (or its equivalent in other currencies or value units); (ii) delegate to the Board of Directors the broadest powers to,

without the need for subsequent ratification by the shareholders’ meeting, (a) determine all the terms and conditions of the Program

(including, without limitation, the timing, price, form, payment terms, currency, and destination of the funds) and of the different classes

and/or series of notes to be issued, including the ability to modify the terms and conditions approved by the shareholders’ meeting

to the extent permitted by applicable legislation; (b) to approve, execute, grant, and/or subscribe any agreement, contract, document,

instrument, and/or title related to the Program, including the renewal or extension of the established deadlines and the validity of these

documents, and/or the issuance of the different classes and/or series of notes under the Program, including, without limitation, any prospectus,

supplement, contract, instrument, or placement agreement with an intermediary agent. Furthermore, to authorize them to make all necessary

submissions and declarations, any requests, procedures, and/or actions before the regulatory bodies, as well as incorporate any modifications

that may be required, particularly to comply with the requirements set by the Argentine Comisión Nacional de Valores, Bolsas

y Mercados Argentinos S.A., the Mercado Abierto Electrónico S.A., the Securities and Exchange Commission, or other stock exchanges

or securities markets, as may be determined by the Board of Directors or individuals authorized by the Board in relation to the Program

and/or the notes issued thereunder; and (c) to subdelegate in one or more of its members, and/or in one or more individuals that they

may consider appropriate, all the powers and authorizations referred to in points (a) to (b) above. It is noted that the listed powers

are merely exemplary and not limiting for the purpose of authorizing the subdelegates to perform all acts and proceedings that directly or

indirectly relate to what is considered in this item of the agenda. |

| 14. | As concerns the fourteenth Agenda item, i.e., “Grant of authorizations to carry out the proceedings

and filings necessary to obtain the relevant registrations,” the Board of Directors proposed, by unanimous vote, that the Shareholders’

Meeting grant the relevant authorizations to María Carolina Sigwald, Gerardo Carlos Paz, María Agustina Montes, Maite Zornoza,

Juan Manuel Recio, Camila Mindlin, Katia Natalia Szischik, Diego Alexi Vaca Diez Eguez, Luis Agustín León Longombardo, María

José Maure Bruno, María Victoria Ritondale, Sofia Lara Pellizzaro Arena, Inés María Bellucci, Martín

Ezequiel Gardella, Fabiana Marcela Vidal, Alejandra Paulina Brasesco, Fernando Nicolás Villarruel, Rodolfo María Peralta,

Mauricio Penta, Martín García Arango, Fernando Rizzi, and/or Vanesa Russo to register the resolutions adopted by the Shareholders’

Meeting and to carry out such other dealings as may be necessary before the relevant entities. |

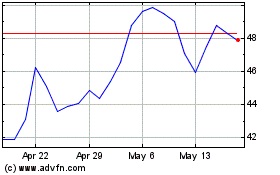

Pampa Energia (NYSE:PAM)

Historical Stock Chart

From Feb 2025 to Mar 2025

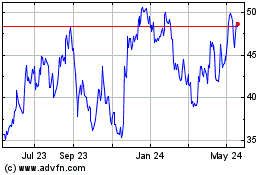

Pampa Energia (NYSE:PAM)

Historical Stock Chart

From Mar 2024 to Mar 2025