0001042776false00010427762025-02-132025-02-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 13, 2025

Piedmont Office Realty Trust, Inc.

(Exact name of registrant as specified in its charter)

Commission File Number: 001-34626

| | | | | | | | |

| Maryland | | 58-2328421 |

| (State or other jurisdiction of | | (IRS Employer |

| incorporation) | | Identification No.) |

5565 Glenridge Connector Ste. 450

Atlanta, Georgia 30342

(Address of principal executive offices, including zip code)

(770) 418-8800

(Registrant's telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $0.01 par value | | PDM | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.o

Item 2.02 Results of Operations and Financial Condition.

On February 13, 2025, Piedmont Office Realty Trust, Inc. (the "Registrant") issued a press release announcing its financial results for the fourth quarter 2024, as well as the year ended December 31, 2024, and published supplemental information for the fourth quarter 2024, as well as the year ended December 31, 2024, to its website. The press release and the supplemental information are attached hereto as Exhibit 99.1 and 99.2, respectively, and are incorporated herein by reference. Pursuant to the rules and regulations of the Securities and Exchange Commission, such exhibits and the information set forth therein are deemed to have been furnished and shall not be deemed to be “filed” under the Securities Exchange Act of 1934.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| | |

| 99.2 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | | | Piedmont Office Realty Trust, Inc. |

| | | | | (Registrant) |

| | | | | |

| Dated: | February 13, 2025 | | By: | | /s/ Sherry L. Rexroad |

| | | | | Sherry L. Rexroad |

| | | | | Chief Financial Officer and Executive Vice President |

EXHIBIT 99.1

Piedmont Office Realty Trust Reports Fourth Quarter and Annual 2024 Results

ATLANTA, February 13, 2025--Piedmont Office Realty Trust, Inc. ("Piedmont" or the "Company") (NYSE:PDM), an owner of Class A office properties located primarily in major U.S. Sunbelt markets, today announced its results for the quarter and year ended December 31, 2024.

Highlights for the Three Months and Year Ended December 31, 2024:

Financial Results:

| | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| (in 000s other than per share amounts ) | December 31, 2024 | December 31, 2023 | | December 31, 2024 | December 31, 2023 |

| Net loss applicable to Piedmont | $(29,978) | $(28,030) | | $(79,069) | $(48,387) |

| Net loss per share applicable to common stockholders - basic and diluted | $(0.24) | $(0.23) | | $(0.64) | $(0.39) |

| | | | | |

| | | | | |

| Impairment charges | $15,400 | $18,489 | | $33,832 | $29,446 |

| | | | | |

| | | | | |

| Executive separation costs | $4,831 | $— | | $4,831 | $— |

| Interest expense, net of interest income | $30,100 | $28,185 | | $119,243 | $97,722 |

| NAREIT FFO applicable to common stock | $41,605 | $50,624 | | $180,350 | $214,399 |

| Core FFO applicable to common stock | $46,436 | $50,624 | | $185,567 | $215,219 |

| NAREIT FFO per diluted share | $0.33 | $0.41 | | $1.44 | $1.73 |

| Core FFO per diluted share | $0.37 | $0.41 | | $1.49 | $1.74 |

| | | | | |

| | | | | |

| Adjusted FFO applicable to common stock | $27,671 | $31,833 | | $109,239 | $153,008 |

| Same Store NOI - cash basis | 0.9 | % | | | 2.6 | % | |

| Same Store NOI - accrual basis | 2.5 | % | | | 1.6 | % | |

•Piedmont recognized a net loss of $30.0 million, or $0.24 per diluted share, for the fourth quarter of 2024, as compared to a net loss of $28.0 million, or $0.23 per diluted share, for the fourth quarter of 2023, with both periods reflecting impairment charges and elevated interest expense, net of interest income, as a result of recent refinancing activity in a higher interest rate environment. Additionally, the results for the fourth quarter of 2024 included $4.8 million of executive separation costs.

•Core FFO, which removes the impairment charges and separation costs mentioned above, as well as loss on sale of real estate assets, loss on early extinguishment of debt, and depreciation and amortization expense, was $0.37 per diluted share for the fourth quarter of 2024, as compared to $0.41 per diluted share for the fourth quarter of 2023. Approximately $0.02 of the decrease is due to the increased interest expense, net of interest income, mentioned above, with the remaining

decrease attributable to the sale of two properties and the downtime between the expiration of a few large leases during the year ended December 31, 2024, before newly executed leases commence.

•Same Store NOI - cash basis for the three months and year ended December 31, 2024 increased 0.9% and 2.6%, respectively, reflecting the fourth straight year of positive growth.

Leasing:

| | | | | | | | | | | |

| Three Months Ended December 31, 2024 | | Year Ended December 31, 2024 |

| # of lease transactions | 45 | | 230 | |

Total leasing sf (in 000s) | 433 | | 2,431 |

New tenant leasing sf (in 000s) | 94 | | 1,032 |

| Cash rent roll up | 11.5 | % | | 11.9 | % |

| Accrual rent roll up | 14.7 | % | | 18.9 | % |

| | | |

| Leased Percentage as of period end | 88.4 | % | | |

•The Company completed approximately 433,000 square feet of leasing during the fourth quarter, bringing total completed leasing for the year to approximately 2.4 million square feet, the most leasing completed on an annual basis since 2015 and above the Company's original expected 2024 leasing goal.

•Over a million square feet, or 42%, of the Company's 2024 leasing activity pertained to new tenant leasing, which is the largest amount of new leasing the Company has completed in a year since 2016.

•Rental rates on leases executed during the three months and year ended December 31, 2024 for space vacant one year or less increased approximately 11.5% and 11.9% on a cash basis, respectively, and 14.7% and 18.9% on an accrual basis, respectively.

•The Company's leased percentage for its in-service portfolio as of December 31, 2024 was 88.4%, as compared to 87.1% as of December 31, 2023, with the increase attributable to net leasing activity completed, as well as the sale of two assets and the reclassification of two projects to out-of-service, during the year ended December 31, 2024.

•As of December 31, 2024, the Company had approximately 1.4 million square feet of executed leases for vacant space that is yet to commence or is currently under rental abatement, representing approximately $46 million of future additional annual cash rents.

Balance Sheet (including subsequent events):

| | | | | | | | | | | |

| (in 000s except for ratios) | December 31, 2024 | | December 31, 2023 |

| Cash and Cash Equivalents | $109,637 | | $825 |

| Total Real Estate Assets | $3,461,239 | | $3,512,527 |

| Total Assets | $4,114,651 | | $4,057,082 |

| Total Debt | $2,222,346 | | $2,054,596 |

| Weighted Average Cost of Debt | 6.01 | % | | 5.82 | % |

| | | |

| Net Principal Amount of Debt*/Total Gross Assets less Cash and Cash Equivalents | 39.2 | % | | 38.2 | % |

| Average Net Debt-to-Core EBITDA (qtr) | 6.8 x | | 6.5 x |

•As of December 31, 2024, the Company's total liquidity was $710 million comprised of an unused $600 million line of credit and approximately $110 million in cash and cash equivalents.

•Subsequent to December 31, 2024, the Company amended its $200 million syndicated bank term loan to increase the principal amount of the loan by $125 million (to a total of $325 million) and add two six month extension options for a final maturity date of January 29, 2028. The net proceeds from the increased principal, along with cash on hand and the Company's line of credit were used to repay a $250 million unsecured bank term loan that was scheduled to mature in March of 2025.

•Also subsequent to December 31, 2024, the Company recast its $600 million revolving credit facility to extend the maturity date to June 30, 2028, with two additional one year extension options, for a final maturity date of June 30, 2030. The Company currently has approximately $500 million of availability under this $600 million revolving credit facility.

•As a result of the above refinancing activity, the Company currently has no debt with a final maturity until 2028.

ESG and Operations:

•Five projects in the Company's portfolio won TOBY (The Outstanding Building of the Year) recognition in their respective categories during the fourth quarter.

•As of December 31, 2024, approximately 84% and 72% of the Company's portfolio was ENERGY STAR rated and LEED certified, respectively, and 61% of its portfolio is certified LEED gold or higher.

Commenting on the Company's results, Brent Smith, Piedmont's President and Chief Executive Officer, said, "2024 was an extremely successful year from a leasing perspective as we completed the greatest volume of leasing on an annual basis since 2015. Over a million square feet of that leasing was related to new tenant leases, resulting in absorption for our in-service portfolio and a year-end leased percentage of 88.4%, significantly above our original projections for the year. Furthermore, the leases we executed during 2024 reflected strong rental rate growth - approximately 12% on a cash basis and almost 20% on an accrual basis. At the end of 2024 our contractual backlog of leased space yet to commence or begin paying cash rents, stood at $46 million of future annual cash flow, which we expect will bolster our financial results during the latter half of 2025 as those leases commence or reach the end of their abatement period. Continuing, Mr. Smith added "Further, the refinancing activity we completed today means that we have no remaining debt with a final maturity until 2028."

First Quarter 2025 Dividend

As previously announced, on February 3, 2025, the board of directors of Piedmont declared a dividend for the first quarter of 2025 in the amount of $0.125 per share on its common stock to stockholders of record as of the close of business on February 21, 2025, payable on March 14, 2025.

Guidance for 2025

The Company is introducing guidance for the year ending December 31, 2025 as follows:

| | | | | | | | | | | | | | | |

| | | |

| (in millions, except per share data) | Low | | High | | | | |

| Net loss | $ | (49) | | | $ | (46) | | | | | |

| Add: | | | | | | | |

| Depreciation | 165 | | | 168 | | | | | |

| Amortization | 58 | | | 60 | | | | | |

| NAREIT FFO applicable to common stock | 174 | | | 182 | | | | | |

| Loss on early extinguishment of debt | 0.5 | | | 0.5 | | | | | |

| | | | | | | |

| | | | | | | |

| Core FFO applicable to common stock | $ | 175 | | | $ | 183 | | | | | |

| Core FFO applicable to common stock per diluted share | $1.38 | | $1.44 | | | | |

This guidance is based on information available to management as of the date of this release and reflects management's view of current market conditions, including the following specific assumptions and projections:

Property Operation Assumptions:

•Executed leasing for the year of approximately 1.4-1.6 million square feet resulting in an increase in the anticipated year-end leased percentage for the Company's in-service portfolio to approximately 89-90%, exclusive of any speculative acquisition or disposition activity;

•Same Store NOI of flat to 3% increase on both a cash and accrual basis for the year;

Financing Assumptions:

•Interest expense (net of interest income) of approximately $127-129 million as compared to $119 million in 2024, reflecting a full year of higher interest rates as a result of refinancing activity completed by the Company during 2024 and early 2025;

Other Assumptions:

•General and administrative expense of approximately $30-32 million;

•Weighted average shares outstanding of 126-127 million;

•No speculative acquisitions, dispositions, or refinancing are included in the above guidance. The Company will adjust guidance if such transactions occur.

Below is a roll forward of 2024 Actual Core FFO per diluted share to the Company's 2025 Guidance Range, given the assumptions listed above:

| | | | | | | | | | | | |

| Low | | | High |

| 2024 Annual Core FFO (actual) | $ | 1.49 | | | | $ | 1.49 | |

| | | | |

| Increase in property net operating income | 0.04 | | | | 0.08 | |

| Decrease in property net operating income due to 2024 dispositions of assets | (0.02) | | | | (0.02) | |

| Increase in interest expense (net of interest income) | (0.08) | | | | (0.07) | |

| Increase in general and administrative costs | (0.02) | | | | (0.01) | |

| Decrease in third-party management revenue | (0.01) | | | | (0.01) | |

| | | | |

| $ | (0.09) | | | | $ | (0.03) | |

| Dilution due to increase in weighted average shares outstanding | (0.02) | | | | (0.02) | |

| | | | |

| 2025 Annual Core FFO Guidance Range | $ | 1.38 | | | | $1.44 |

| | | | |

Note that actual results could differ materially from these estimates and individual quarters may fluctuate on both a cash basis and an accrual basis due to the timing of any future dispositions, significant lease commencements and expirations, abatement periods, repairs and maintenance expenses, capital expenditures, capital markets activities, general and administrative expenses, accrued potential performance-based compensation expense, one-time revenue or expense events, and other factors discussed under "Forward Looking Statements" below.

Non-GAAP Financial Measures

To supplement the presentation of the Company’s financial results prepared in accordance with U.S. generally accepted accounting principles ("GAAP"), this release and the accompanying quarterly supplemental information as of and for the period ended December 31, 2024 contain certain financial measures that are not prepared in accordance with GAAP, including FFO, Core FFO, AFFO, Same Store NOI (cash and accrual basis), Property NOI (cash and accrual basis), EBITDAre, and Core EBITDA. Definitions and reconciliations of each of these non-GAAP measures to their most comparable GAAP metrics are included below and in the accompanying quarterly supplemental information.

Each of the non-GAAP measures included in this release and the accompanying quarterly supplemental financial information has limitations as an analytical tool and should not be considered in isolation or as a substitute for an analysis of the Company’s results calculated in accordance with GAAP. In addition, because not all companies use identical calculations, the Company’s presentation of non-GAAP measures in this release and the accompanying quarterly supplemental information may not be comparable to similarly titled measures disclosed by other companies, including other REITs. The Company may also change the calculation of any of the non-GAAP measures included in this release and the accompanying quarterly supplemental financial information from time to time in light of its then existing operations.

Conference Call Information

Piedmont has scheduled a conference call and an audio web cast for Friday, February 14, 2025, at 9:00 A.M. Eastern time. The live, listen-only, audio web cast of the call may be accessed on the Company's website at http://investor.piedmontreit.com/news-and-events/events-calendar. Dial-in numbers for analysts who plan to actively participate in the call are (888) 506-0062 for participants in the United States and Canada and (973) 528-0011 for international participants. Participant Access Code is 864662. A replay of the conference call will be available through February 28, 2025, and may be accessed by dialing (877) 481-4010 for participants in the United States and Canada and (919) 882-2331 for international participants, followed by conference identification code 51895. A web cast replay will also be available after the conference call in the Investor Relations section of the Company's website. During the audio web cast and conference call, the Company's management team will review fourth quarter and annual 2024 performance, discuss recent events, and conduct a question-and-answer period.

Supplemental Information

Quarterly supplemental information as of and for the year ended December 31, 2024 can be accessed on the Company`s website under the Investor Relations section at www.piedmontreit.com.

About Piedmont Office Realty Trust

Piedmont Office Realty Trust, Inc. (NYSE: PDM) is an owner, manager, developer, redeveloper, and operator of high-quality, Class A office properties located primarily in the Sunbelt. Its approximately $5 billion, predominantly unencumbered portfolio is currently comprised of approximately 16 million square feet. The Company is a fully integrated, self-managed real estate investment trust (REIT) with local management offices in each of its markets and is investment-grade rated by Moody’s (Baa3) and Fitch (BBB-). Piedmont is a 2024 ENERGY STAR Partner of the Year – Sustained Excellence. For more information, see www.piedmontreit.com.

Forward-Looking Statements

Certain statements contained in this press release constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). The Company intends for all such forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act, as applicable. Such information is subject to certain known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. Therefore, such statements are not intended to be a guarantee of the Company`s performance in future periods. Such forward-looking statements can generally be identified by the Company's use of forward-looking terminology such as "may," "will," "expect," "intend," "anticipate," "estimate," "believe," "continue" or similar words or phrases that indicate predictions of future events or trends or that do not relate solely to historical matters. Examples of such statements in this press release include the Company's estimated range of Net Income/(Loss), Depreciation, Amortization, NAREIT FFO, Core FFO and Core FFO per diluted share for the year ending December 31, 2025. These statements are based on beliefs and assumptions of Piedmont’s management, which in turn are based on information available at the time the statements are made.

The following are some of the factors that could cause the Company's actual results and its expectations to differ materially from those described in the Company's forward-looking statements:

•Economic, regulatory, socio-economic (including work from home and "hybrid" work policies), technological (e.g. artificial intelligence and machine learning, virtual meeting platforms, etc.), and other changes that impact the real estate market generally, the office sector or the patterns of use of commercial office space in general, or the markets where we primarily operate or have high concentrations of revenue;

•The impact of competition on our efforts to renew existing leases or re-let space on terms similar to existing leases;

•Lease terminations, lease defaults, lease contractions, or changes in the financial condition of our tenants, particularly by one of our large tenants;

•Impairment charges on our long-lived assets or goodwill resulting therefrom;

•The success of our real estate strategies and investment objectives, including our ability to implement successful redevelopment and development strategies or identify and consummate suitable acquisitions and divestitures;

•The illiquidity of real estate investments, including economic changes, such as rising interest rates, costs of construction and available financing, which could impact the number of buyers/sellers of our target properties, and regulatory restrictions to which real estate investment trusts ("REITs") are subject and the resulting impediment on our ability to quickly respond to adverse changes in the performance of our properties;

•The risks and uncertainties associated with our acquisition and disposition of properties, many of which risks and uncertainties may not be known at the time of acquisition or disposition;

•Development and construction delays, including the potential of supply chain disruptions, and resultant increased costs and risks;

•Future acts of terrorism, civil unrest, or armed hostilities in any of the major metropolitan areas in which we own properties;

•Risks related to the occurrence of cybersecurity incidents, including cybersecurity incidents against us or any of our properties, vendors, or tenants, or a deficiency in our identification, assessment or management of cybersecurity threats impacting our operations and the public's reaction to reported cybersecurity incidents, including the reputational impact on our business and value of our common stock;

•Costs of complying with governmental laws and regulations, including environmental standards imposed on office building owners;

•Uninsured losses or losses in excess of our insurance coverage, and our inability to obtain adequate insurance coverage at a reasonable cost;

•Additional risks and costs associated with directly managing properties occupied by government tenants, such as potential changes in the political environment, a reduction in federal or state funding of our governmental tenants, or an increased risk of default by government tenants during periods in which state or federal governments are shut down or on furlough;

•Significant price and volume fluctuations in the public markets, including on the exchange which we listed our common stock;

•Risks associated with incurring mortgage and other indebtedness, including changing capital reserve requirements on our lenders and rising interest rates for new debt financings;

•A downgrade in our credit ratings, the credit ratings of Piedmont Operating Partnership, L.P. (the "Operating Partnership") or the credit ratings of our or the Operating Partnership's unsecured debt securities, which could, among other effects, trigger an increase in the stated rate of one or more of our unsecured debt instruments;

•The effect of future offerings of debt or equity securities on the value of our common stock;

•Additional risks and costs associated with inflation and potential increases in the rate of inflation, including the impact of a possible recession, and any changes in governmental rules, regulations, and fiscal policies;

•Uncertainties associated with environmental and regulatory matters;

•Changes in the financial condition of our tenants directly or indirectly resulting from geopolitical developments that could negatively affect important supply chains and international trade, the termination or threatened termination of existing international trade agreements, or the implementation of tariffs or retaliatory tariffs on imported or exported goods;

•The effect of any litigation to which we are, or may become, subject;

•Additional risks and costs associated with owning properties occupied by tenants in particular industries, such as oil and gas, hospitality, travel, co-working, etc., including risks of default during start-up and during economic downturns;

•Changes in tax laws impacting REITs and real estate in general, as well as our ability to continue to qualify as a REIT under the Internal Revenue Code of 1986, as amended (the “Code”), or other tax law changes which may adversely affect our stockholders;

•The future effectiveness of our internal controls and procedures;

•Actual or threatened public health epidemics or outbreaks of highly infectious or contagious diseases, such as the COVID-19 pandemic, as well as immediate and long-term governmental and private measures taken to combat such health crises; and

•Other factors, including the risk factors described in Item 1A. of our Annual Report on Form 10-K for the year ended December 31, 2023.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company cannot guarantee the accuracy of any such forward-looking statements contained in this press release, and the Company does not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Research Analysts/ Institutional Investors Contact:

770-418-8592

investor.relations@piedmontreit.com

Shareholder Services/Transfer Agent Services Contact:

Computershare, Inc.

866-354-3485

investor.services@piedmontreit.com

| | | | | | | | | | | | | | | | |

| Piedmont Office Realty Trust, Inc. | | | | | | |

| Consolidated Balance Sheets (Unaudited) | | | | | | |

| (in thousands) | | | | | | |

| | | | | | |

| | December 31, 2024 | | December 31, 2023 | | |

| Assets: | | | | | | |

Real estate assets, at cost: | | | | | | |

Land | | $ | 552,744 | | | $ | 559,384 | | | |

Buildings and improvements | | 3,894,804 | | | 3,788,249 | | | |

Buildings and improvements, accumulated depreciation | | (1,150,892) | | | (1,039,136) | | | |

Intangible lease assets | | 136,461 | | | 170,654 | | | |

Intangible lease assets, accumulated amortization | | (75,982) | | | (88,066) | | | |

Construction in progress | | 104,104 | | | 85,239 | | | |

| Real estate assets held for sale, gross | | — | | | 43,579 | | | |

Real estate assets held for sale, accumulated depreciation and amortization | | — | | | (7,376) | | | |

Total real estate assets | | 3,461,239 | | | 3,512,527 | | | |

Cash and cash equivalents | | 109,637 | | | 825 | | | |

Tenant receivables | | 5,524 | | | 7,915 | | | |

Straight line rent receivables | | 193,783 | | | 182,856 | | | |

| | | | | | |

Restricted cash and escrows | | 4,245 | | | 3,381 | | | |

Prepaid expenses and other assets | | 25,792 | | | 27,559 | | | |

Goodwill | | 53,491 | | | 53,491 | | | |

Interest rate swaps | | 671 | | | 3,032 | | | |

Deferred lease costs | | 464,419 | | | 485,531 | | | |

Deferred lease costs, accumulated depreciation | | (204,150) | | | (223,248) | | | |

Other assets held for sale, gross | | — | | | 3,879 | | | |

Other assets held for sale, accumulated depreciation | | — | | | (666) | | | |

| Total assets | | $ | 4,114,651 | | | $ | 4,057,082 | | | |

| Liabilities: | | | | | | |

Unsecured debt, net of discount and unamortized debt issuance costs of $20,077 and $15,437, respectively | | $ | 2,029,923 | | | $ | 1,858,717 | | | |

| Secured Debt | | 192,423 | | | 195,879 | | | |

Accounts payable, accrued expenses, and accrued capital expenditures | | 149,048 | | | 131,516 | | | |

Dividends payable | | 15,298 | | | 15,143 | | | |

Deferred income | | 107,030 | | | 89,930 | | | |

Intangible lease liabilities, less accumulated amortization | | 32,794 | | | 42,925 | | | |

Interest rate swaps | | 8 | | | — | | | |

| | | | | | |

| Total liabilities | | 2,526,524 | | | 2,334,110 | | | |

| Stockholders' equity: | | | | | | |

Common stock (124,083,038 and 123,715,298 shares issued and outstanding as of December 31, 2024 and December 31, 2023, respectively) | | 1,241 | | | 1,237 | | | |

Additional paid in capital | | 3,723,680 | | | 3,716,742 | | | |

Cumulative distributions in excess of earnings | | (2,128,194) | | | (1,987,147) | | | |

Other comprehensive income | | (10,123) | | | (9,418) | | | |

| Piedmont stockholders' equity | | 1,586,604 | | | 1,721,414 | | | |

Noncontrolling interest | | 1,523 | | | 1,558 | | | |

| | | | | | |

| Total stockholders' equity | | 1,588,127 | | | 1,722,972 | | | |

| Total liabilities and stockholders' equity | | $ | 4,114,651 | | | $ | 4,057,082 | | | |

| | | | | | |

| | | | | | |

| *Net Principal Amount of Debt Outstanding (Unsecured and Secured Debt plus discounts and unamortized debt issuance costs less Cash and cash equivalents and Restricted cash and escrows) | | 2,128,541 | | | 2,065,827 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Piedmont Office Realty Trust, Inc. | | | | | | | |

| Consolidated Statements of Operations | | | | | | | |

| Unaudited (in thousands, except for per share data) | | | | | | | |

| | | | | | | |

| Three Months Ended | | Year Ended |

| 12/31/2024 | | 12/31/2023 | | 12/31/2024 | | 12/31/2023 |

| Revenues: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Rental and tenant reimbursement revenue | $ | 135,481 | | | $ | 139,447 | | | $ | 544,064 | | | $ | 555,313 | |

| Property management fee revenue | 203 | | | 389 | | | 1,738 | | | 1,729 | |

| Other property related income | 7,547 | | | 5,495 | | | 24,522 | | | 20,714 | |

Total revenues | 143,231 | | | 145,331 | | | 570,324 | | | 577,756 | |

| Expenses: | | | | | | | |

| Property operating costs | 58,605 | | | 59,085 | | | 234,124 | | | 235,091 | |

| Depreciation | 40,150 | | | 38,036 | | | 156,833 | | | 148,458 | |

| Amortization | 16,422 | | | 24,232 | | | 69,706 | | | 87,756 | |

| Impairment charges | 15,400 | | | 18,489 | | | 33,832 | | | 29,446 | |

| General and administrative | 12,650 | | | 7,177 | | | 35,423 | | | 29,190 | |

Total operating expenses | 143,227 | | | 147,019 | | | 529,918 | | | 529,941 | |

| | | | | | | |

| Other income (expense): | | | | | | | |

| Interest expense | (31,629) | | | (28,431) | | | (122,984) | | | (101,258) | |

Other income(1) | 1,648 | | | 146 | | | 4,345 | | | 3,940 | |

| Loss on early extinguishment of debt | — | | | — | | | (386) | | | (820) | |

| Gain/(loss) on sale of real estate assets | — | | | 1,946 | | | (445) | | | 1,946 | |

| | | | | | | |

Total other income (expense) | (29,981) | | | (26,339) | | | (119,470) | | | (96,192) | |

| Net loss | (29,977) | | | (28,027) | | | (79,064) | | | (48,377) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net income applicable to noncontrolling interest | (1) | | | (3) | | | (5) | | | (10) | |

| Net loss applicable to Piedmont | $ | (29,978) | | | $ | (28,030) | | | $ | (79,069) | | | $ | (48,387) | |

| Weighted average common shares outstanding - basic and diluted | 124,001 | | | 123,714 | | | 123,939 | | | 123,659 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net loss per share applicable to common stockholders - basic and diluted | $ | (0.24) | | | $ | (0.23) | | | $ | (0.64) | | | $ | (0.39) | |

| | | | | | | |

(1) Includes interest income (in thousands) of approximately $1,529 and $246 for the three months ended December 31, 2024 and 2023, respectively, and $3,741 and $3,536 for the year ended December 31, 2024 and 2023, respectively.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Piedmont Office Realty Trust, Inc. | | | | | | | | |

| Funds from Operations ("FFO"), Core FFO and Adjusted FFO | | | |

| Unaudited (in thousands, except for per share data) | | | | | |

| | | | | | | | |

| Three Months Ended | | Year Ended | |

| 12/31/2024 | | 12/31/2023 | | 12/31/2024 | | 12/31/2023 | |

| GAAP net loss applicable to common stock | $ | (29,978) | | | $ | (28,030) | | | $ | (79,069) | | | $ | (48,387) | | |

Depreciation of real estate assets(1) | 39,769 | | | 37,889 | | | 155,468 | | | 147,569 | | |

Amortization of lease-related costs | 16,414 | | | 24,222 | | | 69,674 | | | 87,717 | | |

Impairment charges | 15,400 | | | 18,489 | | | 33,832 | | | 29,446 | | |

Loss on sale of real estate assets | — | | | (1,946) | | | 445 | | | (1,946) | | |

| NAREIT FFO applicable to common stock* | 41,605 | | | 50,624 | | | 180,350 | | | 214,399 | | |

| Executive separation costs | 4,831 | | | — | | | 4,831 | | | — | | |

Loss on early extinguishment of debt | — | | | — | | | 386 | | | 820 | | |

| Core FFO applicable to common stock* | 46,436 | | | 50,624 | | | 185,567 | | | 215,219 | | |

Amortization of debt issuance costs and discounts on debt | 1,463 | | | 1,481 | | | 5,142 | | | 5,442 | | |

Depreciation of non real estate assets | 370 | | | 136 | | | 1,320 | | | 847 | | |

Straight-line effects of lease revenue | (2,901) | | | (908) | | | (9,233) | | | (7,268) | | |

Stock-based compensation adjustments | 1,392 | | | 1,989 | | | 6,632 | | | 6,337 | | |

Amortization of lease-related intangibles | (2,351) | | | (2,869) | | | (10,019) | | | (13,879) | | |

Non-incremental capital expenditures(2) | (16,738) | | | (18,620) | | | (70,170) | | | (53,690) | | |

| Adjusted FFO applicable to common stock* | $ | 27,671 | | | $ | 31,833 | | | $ | 109,239 | | | $ | 153,008 | | |

Weighted average common shares outstanding - diluted(3) | 125,614 | | | 123,846 | | | 124,926 | | | 123,702 | | |

| NAREIT FFO per share (diluted) | $ | 0.33 | | | $ | 0.41 | | | $ | 1.44 | | | $ | 1.73 | | |

| Core FFO per share (diluted) | $ | 0.37 | | | $ | 0.41 | | | $ | 1.49 | | | $ | 1.74 | | |

| | | | | | | | |

(1)Excludes depreciation of non real estate assets.

(2)Capital expenditures of a recurring nature related to tenant improvements, leasing commissions and building capital that do not incrementally enhance the underlying assets' income generating capacity. Tenant improvements, leasing commissions, building capital and deferred lease incentives incurred to lease space that was vacant at acquisition, leasing costs for spaces vacant for greater than one year, leasing costs for spaces at newly acquired properties for which in-place leases expire shortly after acquisition, improvements associated with the expansion of a building and renovations that either enhance the rental rates of a building or change the property’s underlying classification, such as from a Class B to a Class A property, are excluded from this measure.

(3)Includes potential dilution under the treasury stock method that would occur if our remaining unvested and potential stock awards vested and resulted in additional common shares outstanding. Such shares were not included when calculating net loss per diluted share applicable to Piedmont for the three months and years ended December 31, 2024 and 2023 as they would reduce the loss per share presented.

| | | | | | | | | | | | | | | | | | | | | | | |

| Piedmont Office Realty Trust, Inc. | | | | | | | |

EBITDAre, Core EBITDA, Property Net Operating Income (Cash and Accrual), Same Store Net Operating Income (Cash and Accrual) | | | |

| Unaudited (in thousands) | | | | | | | |

| | | | | | | |

| Cash Basis | | Accrual Basis |

| Three Months Ended | | Three Months Ended |

| 12/31/2024 | | 12/31/2023 | | 12/31/2024 | | 12/31/2023 |

| | | | | | | |

| Net loss applicable to Piedmont (GAAP) | $ | (29,978) | | $ | (28,030) | | | $ | (29,978) | | $ | (28,030) | |

Net income applicable to noncontrolling interest | 1 | | 3 | | | 1 | | 3 | |

Interest expense | 31,629 | | 28,431 | | | 31,629 | | 28,431 | |

Depreciation | 40,139 | | 38,025 | | | 40,139 | | 38,025 | |

Amortization | 16,414 | | 24,223 | | | 16,414 | | 24,223 | |

| Depreciation and amortization attributable to noncontrolling interests | 19 | | 20 | | | 19 | | 20 | |

Impairment charges | 15,400 | | 18,489 | | | 15,400 | | 18,489 | |

Loss on sale of real estate assets | — | | (1,946) | | | — | | (1,946) | |

EBITDAre* | 73,624 | | 79,215 | | | 73,624 | | 79,215 | |

| Executive separation costs | 4,831 | | — | | | 4,831 | | — | |

| | | | | | | |

| Core EBITDA* | 78,455 | | 79,215 | | | 78,455 | | 79,215 | |

General and administrative expenses | 7,819 | | 7,177 | | | 7,819 | | 7,177 | |

Management fee revenue | (126) | | (247) | | | (126) | | (247) | |

Other income | (1,540) | | (38) | | | (1,540) | | (38) | |

| | | | | | | |

Straight-line effects of lease revenue | (2,901) | | (908) | | | | | |

| Straight-line effects of lease revenue attributable to noncontrolling interests | 2 | | (3) | | | | | |

Amortization of lease-related intangibles | (2,351) | | (2,869) | | | | | |

| Property NOI* | 79,358 | | 82,327 | | | 84,608 | | 86,107 | |

| Net operating income from: | | | | | | | |

Acquisitions | — | | — | | | — | | — | |

Dispositions | (35) | | (990) | | | (35) | | (974) | |

Other investments(1) | 92 | | (2,609) | | | (67) | | (2,658) | |

| Same Store NOI* | $ | 79,415 | | $ | 78,728 | | | $ | 84,506 | | $ | 82,475 | |

| Change period over period in Same Store NOI | 0.9% | | N/A | | 2.5 | % | | N/A |

(1)Other investments consist of active, out-of-service or recently completed redevelopment projects, and land. The operating results of 222 South Orange Avenue in Orlando, FL, as well as Meridian and 9320 Excelsior Boulevard in suburban Minneapolis, MN, are currently included in this line item.

| | | | | | | | | | | | | | | | | | | | | | | |

| Piedmont Office Realty Trust, Inc. | | | | | | | |

EBITDAre, Core EBITDA, Property Net Operating Income (Cash and Accrual), Same Store Net Operating Income (Cash and Accrual) | | | |

| Unaudited (in thousands) | | | | | | | |

| | | | | | | |

| Cash Basis | | Accrual Basis |

| Year Ended | | Year Ended |

| 12/31/2024 | | 12/31/2023 | | 12/31/2024 | | 12/31/2023 |

| | | | | | | |

| Net loss applicable to Piedmont (GAAP) | $ | (79,069) | | $ | (48,387) | | | $ | (79,069) | | $ | (48,387) | |

Net income applicable to noncontrolling interest | 5 | | 10 | | | 5 | | 10 | |

Interest expense | 122,984 | | 101,258 | | | 122,984 | | 101,258 | |

Depreciation | 156,787 | | 148,417 | | | 156,787 | | 148,417 | |

Amortization | 69,674 | | 87,717 | | | 69,674 | | 87,717 | |

| Depreciation and amortization attributable to noncontrolling interests | 79 | | 80 | | | 79 | | 80 | |

Impairment charges | 33,832 | | 29,446 | | | 33,832 | | 29,446 | |

Loss on sale of real estate assets | 445 | | (1,946) | | | 445 | | (1,946) | |

EBITDAre* | 304,737 | | 316,595 | | | 304,737 | | 316,595 | |

| Executive separation costs | 4,831 | | — | | | 4,831 | | — | |

| Loss on early extinguishment of debt | 386 | | 820 | | | 386 | | 820 | |

| Core EBITDA* | 309,954 | | 317,415 | | | 309,954 | | 317,415 | |

General and administrative expenses | 30,592 | | 29,190 | | | 30,592 | | 29,190 | |

Management fee revenue | (1,091) | | (1,004) | | | (1,091) | | (1,004) | |

Other income | (3,915) | | (3,256) | | | (3,915) | | (3,256) | |

| Reversal of non-cash general reserve for uncollectible accounts | — | | (1,000) | | | | | |

Straight-line effects of lease revenue | (9,233) | | (7,268) | | | | | |

| Straight-line effects of lease revenue attributable to noncontrolling interests | 3 | | (10) | | | | | |

Amortization of lease-related intangibles | (10,019) | | (13,879) | | | | | |

| Property NOI* | 316,291 | | 320,188 | | | 335,540 | | 342,345 | |

| Net operating (income)/loss from: | | | | | | | |

Acquisitions | — | | — | | | — | | — | |

Dispositions | (1,783) | | (3,343) | | | (2,067) | | (4,132) | |

Other investments(1) | (745) | | (10,957) | | | (1,198) | | (11,046) | |

| Same Store NOI* | $ | 313,763 | | $ | 305,888 | | | $ | 332,275 | | $ | 327,167 | |

| Change period over period in Same Store NOI | 2.6 | % | | N/A | | 1.6 | % | | N/A |

(1)Other investments consist of active, out-of-service or recently completed redevelopment projects, and land. The operating results of 222 South Orange Avenue in Orlando, FL, as well as Meridian and 9320 Excelsior Boulevard in suburban Minneapolis, MN, are currently included in this line item.

*Definitions:

Funds From Operations ("FFO"): The Company calculates FFO in accordance with the current National Association of Real Estate Investment Trusts (“NAREIT”) definition. NAREIT currently defines FFO as net income/(loss) (calculated in accordance with GAAP), excluding depreciation and amortization related to real estate, gains and losses from the sale of certain real estate assets, gains and losses from change in control, and impairment write-downs of certain real estate assets, goodwill, and investment in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity, along with appropriate adjustments to those reconciling items for joint ventures, if any. These adjustments can vary among owners of identical assets in similar conditions based on historical cost accounting and useful-life estimates. FFO is a non-GAAP financial measure and should not be viewed as an alternative to net income calculated in accordance with GAAP as a measurement of the Company’s operating performance. The Company believes that FFO is helpful to investors as a supplemental performance measure because it excludes the effects of depreciation, amortization and gains or losses from sales of real estate, all of which are based on historical costs, which implicitly assumes that the value of real estate diminishes predictably over time. The Company also believes that FFO can help facilitate comparisons of operating performance between periods and with other REITs. However, other REITs may not define FFO in accordance with the NAREIT definition, or may interpret the current NAREIT definition differently than the Company; therefore, the Company’s computation of FFO may not be comparable to that of such other REITs.

Core Funds From Operations ("Core FFO"): The Company calculates Core FFO by starting with FFO, as defined by NAREIT, and adjusting for gains or losses on the extinguishment of swaps and/or debt and any significant non-recurring items. Core FFO is a non-GAAP financial measure and should not be viewed as an alternative to net income calculated in accordance with GAAP as a measurement of the Company’s operating performance. The Company believes that Core FFO is helpful to investors as a supplemental performance measure because it excludes the effects of certain infrequent or non-recurring items which can create significant earnings volatility, but which do not directly relate to the Company’s core business operations. As a result, the Company believes that Core FFO can help facilitate comparisons of operating performance between periods and provides a more meaningful predictor of future earnings potential. Other REITs may not define Core FFO in the same manner as the Company; therefore, the Company’s computation of Core FFO may not be comparable to that of other REITs.

Adjusted Funds From Operations ("AFFO"): The Company calculates AFFO by starting with Core FFO and adjusting for non-incremental capital expenditures and then adding back non-cash items including: non-real estate depreciation, straight-lined rents and fair value lease adjustments, non-cash components of interest expense and compensation expense, and by making similar adjustments for joint ventures, if any. AFFO is a non-GAAP financial measure and should not be viewed as an alternative to net income calculated in accordance with GAAP as a measurement of the Company’s operating performance. The Company believes that AFFO is helpful to investors as a meaningful supplemental comparative performance measure of our ability to make incremental capital investments. Other REITs may not define AFFO in the same manner as the Company; therefore, the Company’s computation of AFFO may not be comparable to that of other REITs.

EBITDAre: The Company calculates EBITDAre in accordance with the current National Association of Real Estate Investment Trusts (“NAREIT”) definition. NAREIT currently defines EBITDAre as net income/(loss) (computed in accordance with GAAP) adjusted for gains or losses from sales of property, impairment charges, depreciation on real estate assets, amortization on real estate assets, interest expense and taxes, along with the same adjustments for joint ventures. Some of the adjustments mentioned can vary among owners of identical assets in similar conditions based on historical cost accounting and useful-life estimates. EBITDAre is a non-GAAP financial measure and should not be viewed as an alternative to net income calculated in accordance with GAAP as a measurement of the Company’s operating performance. The Company believes that EBITDAre is helpful to investors as a supplemental performance measure because it provides a metric for understanding the Company’s results from ongoing operations without taking into account the effects of non-cash expenses (such as depreciation and amortization) and capitalization and capital structure expenses (such as interest expense and taxes). The Company also believes that EBITDAre can help facilitate comparisons of operating performance between periods and with other REITs. However, other REITs may not define EBITDAre in accordance with the NAREIT definition, or may interpret the current NAREIT definition differently than the Company; therefore, the Company’s computation of EBITDAre may not be comparable to that of such other REITs.

Core EBITDA: The Company calculates Core EBITDA as net income/(loss) (computed in accordance with GAAP) before interest, taxes, depreciation and amortization and removing any impairment charges, gains or losses from sales of property and other significant infrequent items that create volatility within our earnings and make it difficult to determine the earnings generated by our core ongoing business. Core EBITDA is a non-GAAP financial measure and should not be viewed as an alternative to net income calculated in accordance with GAAP as a measurement of the Company’s operating performance. The Company believes that Core EBITDA is helpful to investors as a supplemental performance measure because it provides a metric for understanding the performance of the Company’s results from ongoing operations without taking into account the effects of non-cash expenses (such as depreciation and amortization), as well as items that are not part of normal day-to-day operations of the Company’s business. Other REITs may not define Core EBITDA in the same manner as the Company; therefore, the Company’s computation of Core EBITDA may not be comparable to that of other REITs.

Average Net Debt to Core EBITDA: Calculated using the sum of Core EBITDA for the trailing twelve month period and the average daily principal balance of debt outstanding for the trailing twelve months less the average balance of cash and escrow deposits and restricted cash during the trailing twelve month period.

Property Net Operating Income ("Property NOI"): The Company calculates Property NOI by starting with Core EBITDA and adjusting for general and administrative expense, income associated with property management performed by Piedmont for other organizations and other income or expense items for the Company, such as interest income from loan investments or costs from the pursuit of non-consummated transactions. The Company may present this measure on an accrual basis or a cash basis. When presented on a cash basis, the effects of non-cash general reserve for uncollectible accounts, straight lined rents and fair value lease revenue are also eliminated. Property NOI is a non-GAAP financial measure and should not be viewed as an alternative to net income calculated in accordance with GAAP as a measurement of the Company’s operating performance. The Company believes that Property NOI is helpful to investors as a supplemental comparative performance measure of income generated by its properties alone without the administrative overhead of the Company. Other REITs may not define Property NOI in the same manner as the Company; therefore, the Company’s computation of Property NOI may not be comparable to that of other REITs.

Same Store Net Operating Income ("Same Store NOI"): The Company calculates Same Store NOI as Property NOI attributable to the properties for which the following criteria were met during the entire span of the current and prior year reporting periods: (i) they were owned, (ii) they were not under development / redevelopment, and (iii) none of the operating expenses for which were capitalized. Same Store NOI also excludes amounts attributable to land assets. The Company may present this measure on an accrual basis or a cash basis. Same Store NOI is a non-GAAP financial measure and should not be viewed as an alternative to net income calculated in accordance with GAAP as a measurement of the Company’s operating performance. The Company believes that Same Store NOI is helpful to investors as a supplemental comparative performance measure of the income generated from the same group of properties from one

period to the next. Other REITs may not define Same Store NOI in the same manner as the Company; therefore, the Company’s computation of Same Store NOI may not be comparable to that of other REITs.

Piedmont Office Realty Trust, Inc.

Quarterly Supplemental Information

Index

| | | | | | | | | | | | | | |

| Page | | | Page |

| | | | |

| Introduction | | | | |

| Corporate Data | | | | |

| Investor Information | | | Supporting Information | |

| Earnings Release | | | Definitions | |

| Key Performance Indicators | | | Research Coverage | |

| Financials | | | Non-GAAP Reconciliations | |

| Balance Sheets | | | In-Service Portfolio Detail | |

| Income Statements | | | Major Leases Not Yet Commenced and Major Abatements | |

| Funds From Operations / Adjusted Funds From Operations | | | Risks, Uncertainties and Limitations | |

| Same Store Analysis | | | | |

| Capitalization Analysis | | | | |

| Debt Summary | | | | |

| Debt Detail | | | | |

| Debt Covenant & Ratio Analysis | | | | |

| Operational & Portfolio Information - Office Property Investments | | | | |

| Tenant Diversification | | | | |

| Tenant Credit Rating & Lease Distribution Information | | | | |

| Leased Percentage Information | | | | |

| Rental Rate Roll Up / Roll Down Analysis | | | | |

| Lease Expiration Schedule | | | | |

| Quarterly Lease Expirations | | | | |

| Annual Lease Expirations | | | | |

| Contractual Tenant Improvements & Leasing Commissions | | | | |

| Geographic Diversification | | | | |

| Geographic Diversification by Location Type | | | | |

| Industry Diversification | | | | |

| Property Investment Activity | | | | |

| | |

|

|

| Notice to Readers: |

Please refer to page 40 for a discussion of important risks related to the business of Piedmont Office Realty Trust, Inc., as well as an investment in its securities, including risks that could cause actual results and events to differ materially from results and events referred to in the forward-looking information. Considering these risks, uncertainties, assumptions, and limitations, the forward-looking statements about leasing, financial operations, leasing prospects, acquisitions, dispositions, etc. contained in this quarterly supplemental information report may differ from actual results. |

| Certain prior period amounts have been reclassified to conform to the current period financial statement presentation. In addition, many of the schedules herein contain rounding to the nearest thousands or millions and, therefore, the schedules may not total due to this rounding convention. |

To supplement the presentation of the Company’s financial results prepared in accordance with U.S. generally accepted accounting principles (GAAP), this report contains certain financial measures that are not prepared in accordance with GAAP, including FFO, Core FFO, AFFO, Same Store NOI, Property NOI, EBITDAre and Core EBITDA. Definitions and reconciliations of these non-GAAP measures to their most comparable GAAP metrics are included beginning on page 33. Each of the non-GAAP measures included in this report has limitations as an analytical tool and should not be considered in isolation or as a substitute for an analysis of the Company’s results calculated in accordance with GAAP. In addition, because not all companies use identical calculations, the Company’s presentation of non-GAAP measures in this report may not be comparable to similarly titled measures disclosed by other companies, including other REITs. The Company may also change the calculation of any of the non-GAAP measures included in this report from time to time in light of its then existing operations. |

|

Piedmont Office Realty Trust, Inc.

Corporate Data

Piedmont Office Realty Trust, Inc. (also referred to herein as "Piedmont" or the "Company") (NYSE: PDM) is an owner, manager, developer, redeveloper, and operator of high-quality, Class A office properties located primarily in the Sunbelt. The Company is a fully integrated, self-managed real estate investment trust (REIT) headquartered in Atlanta, Georgia with local management offices in each of its markets. The Company's senior unsecured notes are investment-grade rated by Moody's, Standard & Poor's and Fitch Ratings. Piedmont is a 2024 ENERGY STAR Partner of the Year – Sustained Excellence. For more information, see www.piedmontreit.com.

This data supplements the information provided in our reports filed with the Securities and Exchange Commission as of December 31, 2024 and should be reviewed in conjunction with such filings.

| | | | | | | | | |

| | | |

| As of | | As of |

| December 31, 2024 | | December 31, 2023 |

Number of in-service projects (1) | 30 | | 34 |

Rentable in-service square footage (in thousands) (1) | 15,323 | | 16,563 |

Percent leased (2) | 88.4 | % | | 87.1 | % |

| Capitalization (in thousands): | | | |

| Total debt - GAAP | $2,222,346 | | $2,054,596 |

Total net principal amount of debt outstanding (net of cash and investments on hand at period end) (3) (excludes premiums, discounts, and deferred financing costs) | $2,128,541 | | $2,065,827 |

Equity market capitalization (4) | $1,135,360 | | $879,616 |

Total market capitalization (4) | $3,377,783 | | $2,949,649 |

| | | |

Average net principal amount of debt to Core EBITDA - quarterly (5) | 6.8 x | | 6.5 x |

Average net principal amount of debt to Core EBITDA - trailing twelve months (6) | 6.8 x | | 6.4 x |

| | | |

Net principal amount of debt / Total gross assets less cash and cash equivalents (3) | 39.2 | % | | 38.2 | % |

| Common stock data: | | | |

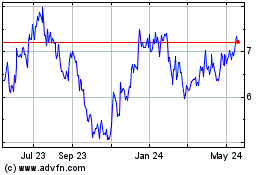

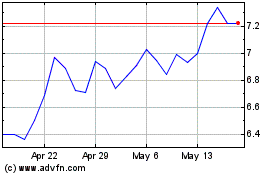

| High closing price during quarter | $11.07 | | $7.50 |

| Low closing price during quarter | $8.52 | | $5.07 |

| Closing price of common stock at period end | $9.15 | | $7.11 |

| Weighted average fully diluted shares outstanding during quarter (in thousands) | 125,614 | | 123,846 |

| Shares of common stock issued and outstanding at period end (in thousands) | 124,083 | | 123,715 |

Annualized current dividend per share (7) | $0.50 | | $0.50 |

Issuer Credit Ratings (Moody's / Standard & Poor's / Fitch) (8) | Baa3 / BB+ / BBB- | | Baa3 / BBB- / NA |

Senior Unsecured Notes Ratings (Moody's / Standard & Poor's / Fitch) (8) | Baa3 / BBB- / BBB- | | Baa3 / BBB- / NA |

| Employees | 150 | | 150 |

| | | |

| | | | | |

| (1) | As of December 31, 2024, the Company's in-service office portfolio excluded three projects currently held out of service for redevelopment, totaling 784,000 square feet. During the twelve months ended December 31, 2024, the Company sold two assets, totaling 572,000 square feet in Dallas, TX. Additional information on these projects can be found on page 32. |

| (2) | Please refer to page 23 for additional analysis and definition regarding the Company's leased percentage. |

| (3) | At December 31, 2024, the Company held a total of $113.9 million in cash and cash equivalents, escrow deposits and restricted cash to be used primarily for future debt retirement in early 2025; the metric shown is on a net debt basis to account for this elevated cash balance. |

| (4) | Reflects common stock closing price, shares outstanding and principal amount of debt outstanding as of the end of the reporting period. |

| (5) | Calculated using the annualized Core EBITDA for the quarter and the average daily principal balance of debt outstanding during the quarter less the average balance of cash and escrow deposits and restricted cash during the quarter. |

| (6) | Calculated using the sum of Core EBITDA for the trailing twelve month period and the average daily principal balance of debt outstanding for the trailing twelve months less the average balance of cash and escrow deposits and restricted cash during the trailing twelve month period. |

| (7) | Annualized amount based on the regular dividends per share recorded for the most recent quarter. |

| (8) | Fitch Ratings coverage was initiated on Feb 6, 2025. |

Piedmont Office Realty Trust, Inc.

| | | | | | | | | | | |

| Executive Management |

| | | |

| C. Brent Smith | Sherry L. Rexroad | George Wells | Laura P. Moon |

| Chief Executive Officer and President | Chief Financial Officer | Chief Operating Officer and | Chief Accounting Officer and Treasurer |

| and Director | and Executive Vice President | Executive Vice President, Northeast Region | and Senior Vice President |

| | | |

| Kevin D. Fossum | Christopher A. Kollme | Thomas A. McKean | Damian J. Miller |

| Executive Vice President, | Executive Vice President, | Senior Vice President, | Executive Vice President, |

| Property Management | Investments | Associate General Counsel and | Dallas and Minneapolis |

| | Corporate Secretary | |

| | | |

| Lisa M. Tyler | Alex Valente | | |

| Senior Vice President, | Executive Vice President, | | |

| Human Resources | Southeast Region and Washington, DC | | |

| | | |

| Board of Directors |

| | | |

| Kelly H. Barrett | Dale H. Taysom | Glenn G. Cohen | Venkatesh S. Durvasula |

| Chair of the Board of Directors | Vice Chair of the Board of Directors | Director | Director |

| Chair of the Audit Committee | Chair of the Capital Committee | Chair of the Compensation Committee | Member of the Capital Committee |

| Member of the Governance Committee | Member of the Audit Committee | Member of the Audit Committee | Member of the Compensation Committee |

| | Member of the Capital Committee | |

| | | |

| Mary Hager | Barbara B. Lang | C. Brent Smith | |

| Director | Director | Director | |

| Member of the Capital Committee | Chair of the Governance Committee | Chief Executive Officer and President | |

| Member of the Governance Committee | Member of the Compensation Committee | | |

| | | |

| | | | | | | | | | | |

| Contact Information |

| Corporate Headquarters | Research Analysts /

Institutional Investors | Shareholder Services /

Transfer Agent Services | Corporate Counsel |

| | | |

| 5565 Glenridge Connector, Suite 450 | 770.418.8592 | Computershare, Inc. | King & Spalding |

| Atlanta, Georgia 30342 | investor.relations@piedmontreit.com | 866.354.3485 | 1180 Peachtree Street, NE |

| 770.418.8800 | | investor.services@piedmontreit.com | Atlanta, GA 30309 |

| www.piedmontreit.com | | | 404.572.4600 |

Piedmont Office Realty Trust, Inc.

Earnings Release

Piedmont Office Realty Trust Reports Fourth Quarter and Annual 2024 Results

ATLANTA, February 13, 2025--Piedmont Office Realty Trust, Inc. ("Piedmont" or the "Company") (NYSE:PDM), an owner of Class A office properties located primarily in major U.S. Sunbelt markets, today announced its results for the quarter and year ended December 31, 2024.

Highlights for the Three Months and Year Ended December 31, 2024:

Financial Results:

| | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| (in 000s other than per share amounts) | December 31, 2024 | December 31, 2023 | | December 31, 2024 | December 31, 2023 |

| Net loss applicable to Piedmont | $(29,978) | $(28,030) | | $(79,069) | $(48,387) |

| Net loss per share applicable to common stockholders - basic and diluted | $(0.24) | $(0.23) | | $(0.64) | $(0.39) |

| | | | | |

| | | | | |

| Impairment charges | $15,400 | $18,489 | | $33,832 | $29,446 |

| | | | | |

| | | | | |

| Executive separation costs | $4,831 | $0 | | $4,831 | $0 |

| Interest expense, net of interest income | $30,100 | $28,185 | | $119,243 | $97,722 |

| NAREIT FFO applicable to common stock | $41,605 | $50,624 | | $180,350 | $214,399 |

| Core FFO applicable to common stock | $46,436 | $50,624 | | $185,567 | $215,219 |

| NAREIT FFO per diluted share | $0.33 | $0.41 | | $1.44 | $1.73 |

| Core FFO per diluted share | $0.37 | $0.41 | | $1.49 | $1.74 |

| | | | | |

| | | | | |

| Adjusted FFO applicable to common stock | $27,671 | $31,833 | | $109,239 | $153,008 |

| Same Store NOI - cash basis | 0.9 | % | | | 2.6 | % | |

| Same Store NOI - accrual basis | 2.5 | % | | | 1.6 | % | |

•Piedmont recognized a net loss of $30.0 million, or $0.24 per diluted share, for the fourth quarter of 2024, as compared to a net loss of $28.0 million, or $0.23 per diluted share, for the fourth quarter of 2023, with both periods reflecting impairment charges and elevated interest expense, net of interest income, as a result of recent refinancing activity in a higher interest rate environment. Additionally, the results for the fourth quarter of 2024 included $4.8 million of executive separation costs.

•Core FFO, which removes the impairment charges and separation costs mentioned above, as well as loss on sale of real estate assets, loss on early extinguishment of debt, and depreciation and amortization expense, was $0.37 per diluted share for the fourth quarter of 2024, as compared to $0.41 per diluted share for the fourth quarter of 2023. Approximately $0.02 of the decrease is due to the increased interest expense, net of interest income, mentioned above, with the remaining decrease attributable to the sale of two properties and the downtime between the expiration of a few large leases during the year ended December 31, 2024, before newly executed leases commence.

•Same Store NOI - cash basis for the three months and year ended December 31, 2024 increased 0.9% and 2.6%, respectively, reflecting the fourth straight year of positive growth.

Leasing:

| | | | | | | | | | |

| Three Months Ended December 31, 2024 | Year Ended

December 31, 2024 | | |

| # of lease transactions | 45 | 230 | | |

Total leasing sf (in 000s) | 433 | 2,431 | | |

New tenant leasing sf (in 000s) | 94 | 1,032 | | |

| Cash rent roll up | 11.5% | 11.9% | | |

| Accrual rent roll up | 14.7% | 18.9% | | |

| | | | |

| Leased percentage as of period end | 88.4% | | | |

•The Company completed approximately 433,000 square feet of leasing during the fourth quarter, bringing total completed leasing for the year to approximately 2.4 million square feet, the most leasing completed on an annual basis since 2015 and above the Company's original expected 2024 leasing goal.

•Over a million square feet, or 42%, of the Company's 2024 leasing activity pertained to new tenant leasing, which is the largest amount of new leasing the Company has completed in a year since 2016.

•Rental rates on leases executed during the three months and year ended December 31, 2024 for space vacant one year or less increased approximately 11.5% and 11.9% on a cash basis, respectively, and 14.7% and 18.9% on an accrual basis, respectively.

•The Company's leased percentage for its in-service portfolio as of December 31, 2024 was 88.4%, as compared to 87.1% as of December 31, 2023, with the increase attributable to net leasing activity completed, as well as the sale of two assets and the reclassification of two projects to out-of-service, during the year ended December 31, 2024.

•As of December 31, 2024, the Company had approximately 1.4 million square feet of executed leases for vacant space that is yet to commence or is currently under rental abatement, representing approximately $46 million of future additional annual cash rents.

Balance Sheet (including subsequent events):

| | | | | | | | | | | |

| (in 000s except for ratios) | December 31, 2024 | | December 31, 2023 |

| Cash and Cash Equivalents | $109,637 | | $825 |

| Total Real Estate Assets | $3,461,239 | | $3,512,527 |

| Total Assets | $4,114,651 | | $4,057,082 |

| | | |

| | | |

| Total Debt | $2,222,346 | | $2,054,596 |

| Weighted Average Cost of Debt | 6.01 | % | | 5.82% |

| | | |

| Net Principal Amount of Debt / Total Gross Assets less Cash and Cash Equivalents | 39.2 | % | | 38.2% |

| Average Net Debt to Core EBITDA (qtr) | 6.8 x | | 6.5 x |

•As of December 31, 2024, the Company's total liquidity was $710 million comprised of an unused $600 million line of credit and approximately $110 million in cash and cash equivalents.

•Subsequent to December 31, 2024, the Company amended its $200 million syndicated bank term loan to increase the principal amount of the loan by $125 million (to a total of $325 million) and add two six month extension options for a final maturity date of January 29, 2028. The net proceeds from the increased principal, along with cash on hand and the Company's line of credit were used to repay a $250 million unsecured bank term loan that was scheduled to mature in March of 2025.

•Also subsequent to December 31, 2024, the Company recast its $600 million revolving credit facility to extend the maturity date to June 30, 2028, with two additional one year extension options, for a final maturity date of June 30, 2030. The Company currently has approximately $500 million of availability under this $600 million revolving credit facility.

•As a result of the above refinancing activity, the Company currently has no debt with a final maturity until 2028.

ESG and Operations:

•Five projects in the Company's portfolio won TOBY (The Outstanding Building of the Year) recognition in their respective categories during the fourth quarter.

•As of December 31, 2024, approximately 84% and 72% of the Company's portfolio was ENERGY STAR rated and LEED certified, respectively, and 61% of its portfolio is certified LEED gold or higher.

Commenting on the Company's results, Brent Smith, Piedmont's President and Chief Executive Officer, said, "2024 was an extremely successful year from a leasing perspective as we completed the greatest volume of leasing on an annual basis since 2015. Over a million square feet of that leasing was related to new tenant leases, resulting in absorption for our in-service portfolio and a year-end leased percentage of 88.4%, significantly above our original projections for the year. Furthermore, the leases we executed during 2024 reflected strong rental rate growth - approximately 12% on a cash basis and almost 20% on an accrual basis. At the end of 2024 our contractual backlog of leased space yet to commence or begin paying cash rents, stood at $46 million of future annual cash flow, which we expect will bolster our financial results during the latter half of 2025 as those leases commence or reach the end of their abatement period. Continuing, Mr. Smith added "Further, the refinancing activity we completed today means that we have no remaining debt with a final maturity until 2028."

First Quarter 2025 Dividend:

As previously announced, on February 3, 2025, the board of directors of Piedmont declared a dividend for the first quarter of 2025 in the amount of $0.125 per share on its common stock to stockholders of record as of the close of business on February 21, 2025, payable on March 14, 2025.

Guidance for 2025:

The Company is introducing guidance for the year ending December 31, 2025 as follows:

| | | | | | | | | | | | | | | |

| | | |

| (in millions, except per share data) | Low | | High | | | | |

| Net loss | $ | (49) | | | $ | (46) | | | | | |

| Add: | | | | | | | |

| Depreciation | 165 | | | 168 | | | | | |

| Amortization | 58 | | | 60 | | | | | |

| NAREIT FFO applicable to common stock | 174 | | | 182 | | | | | |

| Loss on early extinguishment of debt | 0.5 | | | 0.5 | | | | | |

| | | | | | | |

| Core FFO applicable to common stock | $ | 175 | | | $ | 183 | | | | | |

| Core FFO applicable to common stock per diluted share | $1.38 | | $1.44 | | | | |

| | | | | | | |

This guidance is based on information available to management as of the date of this release and reflects management's view of current market conditions, including the following specific assumptions and projections:

Property Operation Assumptions:

•Executed leasing for the year of approximately 1.4-1.6 million square feet resulting in an increase in the anticipated year-end leased percentage for the Company's in-service portfolio to approximately 89-90%, exclusive of any speculative acquisition or disposition activity;

•Same Store NOI of flat to 3% increase on both a cash and accrual basis for the year;

Financing Assumptions:

•Interest expense (net of interest income) of approximately $127-129 million as compared to $119 million in 2024, reflecting a full year of higher interest rates as a result of refinancing activity completed by the Company during 2024 and early 2025;

Other Assumptions:

•General and administrative expense of approximately $30-32 million;

•Weighted average shares outstanding of 126-127 million.

No speculative acquisitions, dispositions, or refinancing are included in the above guidance. The Company will adjust guidance if such transactions occur.

Below is a roll forward of 2024 Actual Core FFO per diluted share to the Company's 2025 Guidance Range, given the assumptions listed above:

| | | | | | | | | | | | | | | | |

| Low | | | High | | | | |

| 2024 Annual Core FFO (actual) | $ | 1.49 | | | | $ | 1.49 | | | | | |

| | | | | | | | |

| Increase in property net operating income | 0.04 | | | | 0.08 | | | | | |

| Decrease in property net operating income due to 2024 dispositions of assets | (0.02) | | | | (0.02) | | | | | |

| Increase in interest expense (net of interest income) | (0.08) | | | | (0.07) | | | | | |

| Increase in general and administrative costs | (0.02) | | | | (0.01) | | | | | |

| Decrease in third-party management revenue | (0.01) | | | | (0.01) | | | | | |

| | | | | | | | |

| $ | (0.09) | | | | $ | (0.03) | | | | | |

| Dilution due to increase in weighted average shares outstanding | (0.02) | | | | (0.02) | | | | | |

| | | | | | | | |

| 2025 Annual Core FFO Guidance Range | $ | 1.38 | | | | $1.44 | | | | |

| | | | | | | | |

Note that actual results could differ materially from these estimates and individual quarters may fluctuate on both a cash basis and an accrual basis due to the timing of any future dispositions, significant lease commencements and expirations, abatement periods, repairs and maintenance expenses, capital expenditures, capital markets activities, seasonal general and administrative expenses, accrued potential performance-based compensation expense, one-time revenue or expense events, and other factors discussed under "Risks, Uncertainties & Limitations" below.

Piedmont Office Realty Trust, Inc.

Key Performance Indicators

Unaudited (in thousands except for per share data and ratios)

| | |

This section of our supplemental report includes non-GAAP financial measures, including, but not limited to, Earnings Before Interest, Taxes, Depreciation, and Amortization for real estate (EBITDAre), Core Earnings Before Interest, Taxes, Depreciation, and Amortization (Core EBITDA), Funds from Operations (FFO), Core Funds from Operations (Core FFO), Adjusted Funds from Operations (AFFO), and Same Store Net Operating Income (Same Store NOI). Definitions of these non-GAAP measures are provided on page 33 and reconciliations are provided beginning on page 35. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| | | | | | | | | | |

| | | | | | | | | | |

| Selected Operating Data | 12/31/2024 | | 9/30/2024 | | 6/30/2024 | | 3/31/2024 | | 12/31/2023 | |

| | | | | | | | | |

Percent leased | 88.4 | % | | 88.8 | % | | 87.3 | % | | 87.8 | % | | 87.1 | % | |

Percent leased - economic (1) | 80.7 | % | | 80.6 | % | | 78.8 | % | | 81.2 | % | | 81.5 | % | |

| Total revenues | $143,231 | | $139,293 | | $143,262 | | $144,538 | | $145,331 | |

| Net income (loss) applicable to Piedmont | -$29,978 | | -$11,519 | | -$9,809 | | -$27,763 | | -$28,030 | |

| Net income (loss) per share applicable to common stockholders - diluted | -$0.24 | | -$0.09 | | -$0.08 | | -$0.22 | | -$0.23 | |

| Core EBITDA | $78,455 | | $77,065 | | $76,673 | | $77,760 | | $79,215 | |

| Core FFO applicable to common stock | $46,436 | | $44,627 | | $46,751 | | $47,753 | | $50,624 | |

| Core FFO per share - diluted | $0.37 | | $0.36 | | $0.37 | | $0.39 | | $0.41 | |

| AFFO applicable to common stock | $27,671 | | $29,069 | | $27,758 | | $24,741 | | $31,833 | |

Gross regular dividends (2) | $15,500 | | $15,500 | | $15,499 | | $15,479 | | $15,464 | |

Regular dividends per share (2) | $0.125 | | $0.125 | | $0.125 | | $0.125 | | $0.125 | |

| | | | | | | | | | |

| | | | | | | | | | |

Same store net operating income - accrual basis (3) | 2.5 | % | | -2.1 | % | | 3.7 | % | | 2.1 | % | | 1.1 | % | |

Same store net operating income - cash basis (3) | 0.9 | % | | -0.8 | % | | 5.7 | % | | 5.1 | % | | 4.8 | % | |

Rental rate roll up / roll down - accrual rents | 14.7 | % | | 8.5 | % | | 23.0 | % | | 18.6 | % | | 11.3 | % | |

Rental rate roll up / roll down - cash rents | 11.5 | % | | 4.0 | % | | 15.2 | % | | 8.0 | % | | 0.0 | % | |

| Selected Balance Sheet Data | | | | | | | | | | |

| Total real estate assets, net | $3,461,239 | | $3,461,874 | | $3,468,030 | | $3,452,475 | | $3,512,527 | |

| Total assets | $4,114,651 | | $4,138,217 | | $4,158,643 | | $3,993,996 | | $4,057,082 | |

| Total liabilities | $2,526,524 | | $2,508,049 | | $2,500,319 | | $2,312,084 | | $2,334,110 | |

| Ratios & Information for Debt Holders | | | | | | | | | | |

Core EBITDA to total revenues | 54.8 | % | | 55.3 | % | | 53.5 | % | | 53.8 | % | | 54.5 | % | |

Fixed charge coverage ratio (4) | 2.2 x | | 2.1 x | | 2.3 x | | 2.3 x | | 2.5 x | |

Average net principal amount of debt to Core EBITDA - quarterly (5) | 6.8 x | | 6.8 x | | 6.8 x | | 6.8 x | | 6.5 x | |

| Total gross real estate assets | $4,688,113 | | $4,658,663 | | $4,636,715 | | $4,596,744 | | $4,647,105 | |

| Total debt - GAAP | $2,222,346 | | $2,221,907 | | $2,221,738 | | $2,070,070 | | $2,054,596 | |

Net principal amount of debt (6) | $2,128,541 | | $2,106,333 | | $2,100,347 | | $2,078,263 | | $2,065,827 | |

| | | | | |

| (1) | Economic leased percentage excludes the square footage associated with executed but not commenced leases for currently vacant spaces and the square footage associated with tenants receiving rental abatements. |

| (2) | Dividends are reflected in the quarter in which the record date occurred. |