SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of February 2025

Commission File Number 1-03006

PLDT Inc.

(Exact Name of Registrant as Specified in Its Charter)

Ramon Cojuangco Building

Makati Avenue

Makati City

Philippines

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.)

Form 20-F Form 40-F

(Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes No

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ________ )

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some information in this report may contain forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933 and Section 21E of the U.S. Securities Exchange Act of 1934. We have based these forward-looking statements on our current beliefs, expectations and intentions as to facts, actions and events that will or may occur in the future. Such statements generally are identified by forward-looking words such as “believe,” “plan,” “anticipate,” “continue,” “estimate,” “expect,” “may,” “will” or other similar words.

A forward-looking statement may include a statement of the assumptions or bases underlying the forward-looking statement. We have chosen these assumptions or bases in good faith. These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual results may differ materially from information contained in the forward-looking statements as a result of a number of factors, including, without limitation, the risk factors set forth in “Item 3. Key Information – Risk Factors” in our annual report on Form 20-F for the fiscal year ended December 31, 2023. You should also keep in mind that any forward-looking statement made by us in this report or elsewhere speaks only as at the date on which we made it. New risks and uncertainties come up from time to time, and it is impossible for us to predict these events or how they may affect us. We have no duty to, and do not intend to, update or revise the statements in this report after the date hereof. In light of these risks and uncertainties, you should keep in mind that actual results may differ materially from any forward-looking statement made in this report or elsewhere.

EXHIBITS

|

|

|

Exhibit Number |

|

Page |

|

Copies of the disclosure letters that PLDT Inc. (the “Company”) filed on February 27, 2025 with the Philippine Stock Exchange and the Philippine Securities and Exchange Commission in connection with the following: (a)Declaration of a regular cash dividend of P47.00 per outstanding share of Common Stock of the Company payable on April 3, 2025 to the holders of record as of March 13, 2025. The cash dividend was declared out of the audited unrestricted retained earnings of the Company as at December 31, 2024, which are sufficient to cover the total amount of dividend declared; (b)Press release on the audited consolidated financial results of the Company as at and for the year ended December 31, 2024; (c)Appointment of Mr. Robert Joseph M. de Claro as a Director of the Company; (d)Confirmation of appointment of Mr. Jose Roberto A. Alampay as First Vice President/Public Engagement and Corporate Communications Head of the Company; and (e)Notice of the Annual Stockholders’ Meeting for 2025. |

28 |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly authorized and caused this report to be signed on its behalf by the undersigned.

|

PLDT Inc. |

By : /s/Mark David P. Martinez Name : Mark David P. Martinez Title : Assistant Corporate Secretary Date : February 27, 2025 |

|

EXHIBITS

|

|

|

Exhibit Number |

|

Page |

|

Copies of the disclosure letters that PLDT Inc. (the “Company”) filed on February 27, 2025 with the Philippine Stock Exchange and the Philippine Securities and Exchange Commission in connection with the following: (a)Declaration of a regular cash dividend of P47.00 per outstanding share of Common Stock of the Company payable on April 3, 2025 to the holders of record as of March 13, 2025. The cash dividend was declared out of the audited unrestricted retained earnings of the Company as at December 31, 2024, which are sufficient to cover the total amount of dividend declared; (b)Press release on the audited consolidated financial results of the Company as at and for the year ended December 31, 2024; (c)Appointment of Mr. Robert Joseph M. de Claro as a Director of the Company; (d)Confirmation of appointment of Mr. Jose Roberto A. Alampay as First Vice President/Public Engagement and Corporate Communications Head of the Company; and (e)Notice of the Annual Stockholders’ Meeting for 2025. |

28 |

February 27, 2025

The Philippine Stock Exchange, Inc.

6/F Philippine Stock Exchange Tower

28th Street corner 5th Avenue

Bonifacio Global City, Taguig City

Attention: Atty. Stefanie Ann B. Go

Officer-in-Charge – Disclosure Department

Securities & Exchange Commission

7907 Makati Avenue, Salcedo Village,

Barangay Bel-Air, Makati City

Attention: Atty. Oliver O. Leonardo

Director – Markets and Securities Regulation Department

Dear All:

In compliance with Section 17.1 (b) of the Securities Regulation Code and SRC Rule 17.1.1.1.3(b).2, PLDT Inc. (the “Company”) hereby submits a copy of SEC Form 17-C regarding the declaration of a regular cash dividend of P47.00 per outstanding share of Common Stock of the Company payable on April 3, 2025 to the holders of record as of March 13, 2025.

Very truly yours,

/s/Mark David P. Martinez

Mark David P. Martinez

Assistant Corporate Secretary

PLDT Inc.

COVER SHEET

|

|

|

|

|

|

|

|

|

|

|

SEC Registration Number |

P |

W |

- |

5 |

5 |

|

|

|

|

|

|

Company Name

Principal Office (No./Street/Barangay/City/Town/Province)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R |

A |

M |

O |

N |

|

C |

O |

J |

U |

A |

N |

G |

C |

O |

|

B |

U |

I |

L |

D |

I |

N |

G |

|

|

|

|

|

|

|

M |

A |

K |

A |

T |

I |

|

A |

V |

E |

N |

U |

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

A |

K |

A |

T |

I |

|

C |

I |

T |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Type |

|

|

|

Department requiring the report |

|

|

|

Secondary License Type, If Applicable |

|

|

17 |

- |

C |

|

|

|

|

|

|

|

|

M |

S |

R |

D |

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPANY INFORMATION

|

|

|

|

|

|

|

|

Company’s Email Address |

|

Company’s Telephone Number/s |

|

Mobile Number |

|

|

|

|

88168553 |

|

|

|

|

|

|

|

|

|

|

|

No. of Stockholders |

|

Annual Meeting

Month/Day |

|

Fiscal Year

Month/Day |

|

|

11,347 As of January 31, 2025 |

|

Every 2nd Tuesday of June |

|

December 31 |

|

CONTACT PERSON INFORMATION

The designated contact person MUST be an Officer of the Corporation

|

|

|

|

|

|

|

Name of Contact Person |

|

Email Address |

|

Telephone Number/s |

|

Mobile Number |

Marilyn A. Victorio-Aquino |

|

mvaquino@pldt.com.ph |

|

82500254 |

|

|

|

Contact Person’s Address |

MGO Building, Legaspi St. corner Dela Rosa St., Makati City |

Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated.

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT UNDER SECTION 17

OF THE SECURITIES REGULATION CODE

AND SRC RULE 17.1

Date of Report (Date of earliest event reported)

2.SEC Identification Number PW-55

3.BIR Tax Identification No. 000-488-793

Exact name of issuer as specified in its charter

5. Philippines 6.____________ (SEC Use Only)

Province, country or other jurisdiction Industry Classification Code

of Incorporation

7. Ramon Cojuangco Building, Makati Avenue, Makati City 1200

Address of principal office Postal Code

8. (632) 8250-0254

Issuer's telephone number, including area code

9. Not Applicable

Former name or former address, if changed since last report

10.Securities registered pursuant to Sections 8 and 12 of the Securities Regulation Code and Sections 4 and 8 of the Revised Securities Act

|

|

Title of Each Class |

Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding |

________________________________________________________________

________________________________________________________________

________________________________________________________________

11. Item 9 (Other Events)

We disclose that at the meeting of the Board of Directors of PLDT Inc. (respectively, the “Board” and the “Company”) held on February 27, 2025, the Board declared a regular cash dividend of P47.00 per outstanding share of Common Stock of the Company payable on April 3, 2025 to the holders of record as of March 13, 2025.

The cash dividend was declared out of the audited unrestricted retained earnings of the Company as at December 31, 2024, which are sufficient to cover the total amount of dividend declared.

Pursuant to the requirements of the Securities Regulation Code, the Company has duly authorized and caused this report to be signed on its behalf by the undersigned.

PLDT Inc.

By:

/s/Mark David P. Martinez

Mark David P. Martinez

Assistant Corporate Secretary

February 27, 2025

February 27, 2025

The Philippine Stock Exchange, Inc.

6/F Philippine Stock Exchange Tower 28th Street corner 5th Avenue Bonifacio Global City, Taguig City

Attention: Atty. Stefanie Ann B. Go

Officer-in-Charge – Disclosure Department

Securities & Exchange Commission

7907 Makati Avenue, Salcedo Village, Barangay Bel-Air, Makati City

Attention: Atty. Oliver O. Leonardo

Director – Markets and Securities Regulation Department

Dear All:

In compliance with the PSE’s Revised Disclosure Rules, we submit herewith the press release of PLDT Inc. (the “Company”) in connection with the Company’s audited consolidated financial results as at and for the year ended December 31, 2024.

This submission shall also serve as our compliance with Section 17.1 of the Securities Regulation Code regarding the filing of reports on significant developments.

Very truly yours,

/s/Mark David P. Martinez

Mark David P. Martinez Assistant Corporate

Secretary

PLDT Inc.

COVER SHEET

SEC Registration Number

Company Name

Principal Office (No./Street/Barangay/City/Town/Province)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R |

A |

M |

O |

N |

|

C |

O |

J |

U |

A |

N |

G |

C |

O |

|

B |

U |

I |

L |

D |

I |

N |

G |

|

|

|

|

|

|

M |

A |

K |

A |

T |

I |

|

A |

V |

E |

N |

U |

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

A |

K |

A |

T |

I |

|

C |

I |

T |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Type |

Department requiring the report |

Secondary License Type, If Applicable |

17 |

- |

C |

M |

S |

R |

D |

|

COMPANY INFORMATION

|

|

|

|

|

Company’s Email Address |

|

Company’s Telephone Number/s |

|

Mobile Number |

|

|

|

|

|

No. of Stockholders |

|

Annual Meeting Month/Day |

|

Fiscal Year Month/Day |

11,347 As of January 31, 2025 |

|

Every 2nd Tuesday of June |

|

December 31 |

CONTACT PERSON INFORMATION

The designated contact person MUST be an Officer of the Corporation

|

|

|

|

|

|

|

Name of Contact Person |

|

Email Address |

|

Telephone Number/s |

|

Mobile Number |

Marilyn A. Victorio-Aquino |

|

mvaquino@pldt.com.ph |

|

82500254 |

|

|

|

Contact Person’s Address |

MGO Building, Legaspi St. corner Dela Rosa St., Makati City |

Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty

(30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated.

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT UNDER SECTION 17 OF THE SECURITIES REGULATION CODE AND SRC RULE 17.1

Date of Report (Date of earliest event reported)

2.SEC Identification Number: PW-55

3.BIR Tax Identification No.: 000-488-793

Exact name of issuer as specified in its charter

5.Philippines 6. (SEC Use Only)

Province, country or other jurisdiction Industry Classification Code of Incorporation

7.Ramon Cojuangco Building, Makati Avenue, Makati City 1200

Address of principal office Postal Code

Issuer's telephone number, including area code

Former name or former address, if changed since last report

10.Securities registered pursuant to Sections 8 and 12 of the Securities Regulation Code and Sections 4 and 8 of the Revised Securities Act

|

|

Title of Each Class |

Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding |

We disclose that at the meeting of the Board of Directors of PLDT Inc. (respectively, the “Board” and the “Company”) held on February 27, 2025, the Board approved the Company’s audited consolidated financial statements as at and for the year ended December 31, 2024.

A copy of the press release is attached herewith.

Pursuant to the requirements of the Securities Regulation Code, the Company has duly authorized and caused this report to be signed on its behalf by the undersigned.

PLDT INC.

By:

/s/Mark David P. Martinez

Mark David P. Martinez

Assistant Corporate Secretary

PLDT Inc.

February 27, 2025

CONSOLIDATED GROSS SERVICE REVENUES ROSE 3% TO ₱208.4 B IN 2024,

NET SERVICE REVENUES GREW 2% TO ₱194.7 B

NET SERVICE REVENUES UP 5% (EXCLUDING LEGACY DRAG)

DATA/BROADBAND NOW 83% OF SERVICE REVENUES, UP 3% TO ₱ 162.1B

CONSOLIDATED EBITDA 4% HIGHER AT ₱108.5 B

EBITDA MARGIN STEADY AT 52%

2024 TELCO CORE INCOME GREW 2% TO ₱35.1 B – IN LINE WITH GUIDANCE

REPORTED NET INCOME AT ₱32.3 B, 21% HIGHER THAN LAST YEAR

TELCO CORE EPS AT ₱162; REPORTED EPS AT ₱149;

FINAL DIVIDEND OF ₱47 PER SHARE

TOTAL DIVIDENDS PER SHARE FOR 2024 AT ₱97, REPRESENTING 60% PAYOUT

INDIVIDUAL WIRELESS REVENUES HIGHER BY 2% AT ₱83.5 B

MOBILE DATA REVENUES UP 5% TO ₱74.4 B

ACTIVE MOBILE DATA USERS AT 41.3 M

FIBER-ONLY REVENUES ROSE 6% TO ₱56.0 B,

92% OF TOTAL HOME REVENUES OF ₱60.7 B

ENTERPRISE REVENUES 3% HIGHER AT ₱48.4 B

CORPORATE DATA/ICT REVENUES UP BY 5% TO ₱35.0 B

VITRO STA. ROSA DATA CENTER SECURES ANCHOR LOCATORS

2024 CAPEX AT ₱78.2 B VS ₱85.1 B LAST YEAR

CAPEX INTENSITY LOWER AT 38%

MAYA BANK PROFITABLE STARTING SEPTEMBER 2024,

ENTIRE MAYA GROUP BOOKS PROFIT FOR DECEMBER 2024

PLDT THE ONLY PHILIPPINE COMPANY INCLUDED IN THE S&P GLOBAL SUSTAINABILITY YEARBOOK 2025 AND CITED AS “INDUSTRY MOVER” IN THE GLOBAL TELECOM INDUSTRY

PLDT RANKED #2 OVERALL UNDER THE GLOBAL CHILD FORUM BENCHMARK - #1 TELCO GLOBALLY

MANILA, Philippines 27th February 2025 – PLDT Inc. (“PLDT”) (PSE: TEL) (NYSE: PHI) reported a 3% rise (₱6.6 billion) in Gross Service Revenues to ₱208.4 billion, while

Consolidated Service Revenues (net of interconnect costs) grew by 2% (₱3.3 billion) to ₱194.7 billion in 2024. Data and broadband, which grew by 3% (₱4.5 billion) to ₱162.1 billion, contributed 83% to Consolidated Service Revenues. Excluding legacy drag, Consolidated Service Revenues were higher by 5% year-on-year.

Consolidated EBITDA grew by 4%, or ₱4.2 billion to ₱108.5 billion in the same period. EBITDA margin remained steady at 52% despite pressures from rising costs, which were tightly managed.

Telco Core Income, excluding the impact of asset sales and losses from Maya Innovations Holdings, reached ₱35.1 billion, up by 2% or ₱0.8 billion from the previous year. Reported Income was at ₱32.3 billion in 2024, up 21%.

The PLDT Board today approved the payout of a final dividend of ₱47 per share, which brings total dividends for 2024 to ₱97 per share or a payout of 60% of Telco Core EPS of ₱162. Reported EPS reached ₱149.

“Our 2024 results highlight PLDT’s resilience and the continued demand for reliable connectivity. But our intention is to use this as benchmark for even better performance in the coming years. The telco landscape is evolving quickly, and we will work non-stop to innovate, improve our services, and exceed customer expectations,” said Manuel V. Pangilinan, PLDT and Smart Chairman and CEO.

Consolidated Net Debt as of end-2024 amounted to ₱273.0 billion, while Net Debt-to-EBITDA stood at 2.52x. Gross Debt was at ₱283.6 billion, with maturities well spread out. 14% of Gross Debt is denominated in U.S. dollars while 5% of total debt is unhedged. PLDT’s credit ratings from Moody’s and S&P Global remain at investment grade.

Individual Wireless: Sustained positive growth momentum

PLDT’s Individual Wireless segment posted revenues of ₱83.5 billion in 2024, up by 2% year-on-year. Its revenues amounted to ₱21.4 billion in the fourth quarter alone—up by 6% from the previous quarter and the highest quarterly revenue total since the third quarter of 2021.

This performance was buoyed by steady growth in data usage, with data revenues growing by 5% year-on-year to ₱74.4 billion. Data revenues now account for 89% of the segment’s total revenues.

Active data users grew to 41.3 million at the end of December 2024, up 6% from the previous year. Mobile data traffic increased by 9% year-on-year to 5,359 Petabytes.

The segment also posted a 67% growth in 5G devices amid continued network upgrades

to expand 5G connectivity. In December 2024, Smart fired up BGC 5G City in Taguig, holding successful back-to-back events that stimulated data usage.

Smart is also adapting an institutionalized thrust for artificial intelligence, including harnessing AI-driven analytics and aftersales.

As of end-2024, Smart had registered 59.0 million mobile subscribers.

Home: Innovations and Expansion Driving Sustained Fiber Revenue Growth

PLDT Home posted ₱56.0 billion in fiber-only service revenues in 2024, marking a 6% year-on-year increase or an incremental ₱3.0 billion. Fiber-only revenues now account for 92% of PLDT Home’s total ₱60.7 billion revenues in 2024.

PLDT Home recorded the industry’s highest average revenue per user (ARPU) of ₱1,488, with more than 75% of new accounts opting for higher value plans (₱1,299 and up). PLDT Home also registered the industry’s best churn rate of 1.7%.

In Q1 2024, PLDT Home launched the country’s first Gigabit Fiber plans that deliver speeds of up to 10 Gbps, which has set a new industry benchmark for connectivity. Home also enhanced its Fiber Unli All plans to include unlimited mobile calls for up to five (5) Smart/TNT numbers, on top of unlimited fiber and unlimited entertainment via Cignal. To help widen digital access, it also introduced Fiber Plan 899 and Prepaid Fiber services in Q2 of 2024.

In Q4 of 2024, PLDT Home introduced the industry’s first Always On broadband service. This cutting-edge service leverages on the PLDT group’s strength with Fiber and mobile technology to deliver a superior Home broadband experience. PLDT Always On is a testament to PLDT’s commitment to provide a reliable and best-in-class broadband connection for the Home.

As of end 2024, PLDT Home’s total fiber subscribers reached 3.4 million, with Fiber net adds increasing by 190% between the 1st and 2nd half of 2024. Growth is driven by new Fiber products, Home’s commitment to innovation and continuous Fiber expansion.

Enterprise: Solutions and Data Driving Continued Growth

PLDT Enterprise, the corporate arm of PLDT, achieved net service revenues of ₱48.4 billion in 2024, reflecting the increasing demand for its core connectivity and ICT services.

2024 saw businesses continue reinforcing their digital infrastructure. Fixed data connectivity continued to gain momentum, with strong growth in Managed SD-WAN lines, which surged by 23%, and steady expansion of 9% in Fiber Internet lines. Revenues from wireless services likewise grew, with revenues from Internet of Things (IoT) services increasing by 313%, highlighting the company’s continued push towards next-generation digital capabilities.

Cloud Tech Services remain a key driver of ePLDT’s growth. ePLDT’s cloud services grew by 30%, while managed IT services rose by 48%. These results underscore the growing demand for solutions that enhance efficiency, scalability, and security.

VITRO Inc., the data center arm of PLDT, reported a 22% revenue growth in colocation services, driven by increasing demand from enterprises and cloud service providers. A key 2024 milestone was the energization of VITRO Santa Rosa (VSR) — the country’s first AI-ready hyperscale data center. Alongside achieving power readiness, VSR has also activated its Data Center Interconnect (DCI), seamlessly linking it with other major VITRO facilities across Metro Manila.

With VSR’s activation, VITRO has expanded its total IT capacity to 38 MW in 2024, with plans to reach 64 MW by 2026. Currently operating at 75% utilization and offering nearly 9,000 racks in ready capacity, VITRO is well-positioned to meet the growing data center demands of enterprises, the public sector, hyperscalers, and AI-driven workloads.

With live anchor tenants and a stream of new ones onboarding, VSR has also activated the NVIDIA-powered GPU servers within its facility, enhancing its AI capabilities and service offerings. In partnership with ePLDT, GPU-as-a-Service, will be rolled out to provide enterprises with a cost-efficient way to access high-performance computing capabilities. This latest innovation will further position VITRO as a key enabler of AI adoption in the country.

PLDT Enterprise has also been engaging with key industries such as mining, manufacturing, and logistics for Mobile Private Network (MPN) deployments, with strong interest from industry players. Additionally, the company has been exploring 5G standalone (SA) technologies, evaluating network slicing, edge computing, and ultra-reliable low-latency (URLLC) to support future-ready industry applications.

PLDT has strengthened its position as a leader in global connectivity through its robust international cable infrastructure. With a network of 13 international submarine cable systems, including the newest Asia Direct Cable (ADC), PLDT has ensured high-speed,

low-latency, and resilient connectivity for businesses. The ADC, which connects the Philippines to key Asian markets such as Japan, Singapore, and Hong Kong, has enhanced the country’s digital capabilities and supported the growing demand for bandwidth-intensive applications like cloud services, gaming, and video conferencing.

Network: Most extensive fiber footprint

The PLDT Group’s fiber footprint remains the most extensive in the Philippines. Homes passed reached 18.5 million in 73% of the country’s towns and 91% of total provinces.

Smart’s combined 5G/4G network covers around 97% of the population.

Capex for 2024 amounted to ₱78.2 billion, compared with ₱85.1 billion in the previous year. Capex intensity ratio (capex as a percentage of service revenues) landed at 38%, versus 42% in 2023.

Maya strengthens digital banking and payments leadership with record growth

Maya, the Philippines' leading fintech ecosystem, achieved significant milestones in 2024. It continues to drive financial inclusion with a record 5.4 million bank customers, reflecting a 71% year-on-year increase. It recorded 1.6 million borrowers, nearly double the previous year’s figure. The company has also maintained the largest market share in card acquiring and QRPH transactions, underscoring its dominance in the payments sector.

The digital banking arm of Maya showed a strong performance in deposits and lending, with a total deposit balance of ₱39 billion, marking a 59% increase year-on-year. Cumulative loan disbursements reached ₱92 billion. This impressive growth has contributed to Maya achieving a positive net income for the entire group as of December 2024, further strengthening its financial position. Notably, Maya's non-performing loan (NPL) ratio has consistently remained lower than industry averages, highlighting its prudent risk management strategies.

Maya has also successfully launched new consumer and enterprise products. Over 100,000 credit cards were issued in just five months under the Landers Cashback Credit Card. Meantime, Maya Business Deposit services and Maya Business Advance with custom loan terms have provided MSMEs with greater financial flexibility.

Kayana: Accelerating and standardizing data collaboration across MVP Group

Since its inception in 2024, Káyana has led the charge in accelerating and standardizing data collaboration across the MVP Group, forging key data management agreements, and building the foundational data platforms—effectively consolidating the group’s data into what could be the Group’s most valuable data asset. This rich, integrated data foundation is further amplified through Káyana’s collaboration with Accenture in the

Káyana Digital Factory, where cutting-edge data product and technical capabilities are being developed to unlock the full potential of this data, empowering our ability to drive growth and transformation both within and outside the MVP Group.

In addition, having invested in Bayad and Multipay, Káyana is enhancing synergies across the ecosystem, simplifying payments, improving access for billers, customers, and enterprises, and collecting and mining richer data and insights—paving the way for a more seamless and connected digital economy.

We at Káyana are focused on building the collective data and creating related platforms, products, and APIs to enable a more digital Philippines. The goal is to impact millions of customers by digitally enabling the businesses and institutions that serve them, ultimately improving the lives of Filipinos.

Sustainability

Sustainability remains one of PLDT’s key pillars of business strategy and performance. Throughout 2024, the Group pursued initiatives to align its environmental, social, and governance (ESG) performance with global best practices. As a result of these efforts, 2024 marked a record year for PLDT as it performed admirably in various third-party ESG ratings assessments and corporate benchmarking endeavors.

S&P Global Corporate Sustainability Assessment

For 2024, PLDT registered a 14-point increase in the S&P Global Corporate Sustainability Assessment (CSA). This merited the Company’s inclusion in the S&P Global Sustainability Yearbook 2025—signifying that it is in the top 15% of its industry, and within 30% of the industry’s top-performing company. PLDT’s score of 72 made it one of the 780 companies included in the Yearbook, out of 7,690 total assessed companies across 62 industries worldwide. PLDT was named an “Industry Mover” for being the most improved company in its industry and is the only Philippine company included in the 2025 Yearbook.

Global Child Forum Benchmark on Child Rights

PLDT emerged as the second highest ranked technology and telco company overall in the Global Child Forum (GCF) Benchmark Report 2024.

GCF, which was founded by the King and Queen of Sweden in collaboration with the Boston Consulting Group, evaluated 1,802 companies. It measured how companies uphold children’s rights in areas of governance and collaboration, workplace, marketplace, community and environment. PLDT scored a near-perfect score of 9.9 out of 10 in the 2024 GCF corporate benchmark.

CDP

PLDT regained a score of “B” “Management” rating in 2024 by CDP, a global non-profit that provides guidance on climate-focused disclosure metrics and conducts an independent assessment on the environmental management performance of companies, cities, states, and regions worldwide.

CDP rates organizations based on a variety of operational indicators, including climate mitigation, risk management, governance, and public policy engagements, as well as efforts to promote water conservation and security in business operations, among others.

PLDT’s B rating in the CDP, one notch higher than its previous year’s score, affirms its establishment of institutional measures to minimize its environmental impact, reduce greenhouse gas emissions, and manage climate risks across its operations.

FTSE4Good Index

PLDT has maintained its inclusion in the FTSE4Good Index for the seventh consecutive year. This is an indication of the company’s continuing alignment with global standards and best practices for its ESG performance.

Outlook

"There are countless challenges and opportunities in the horizon—among them are A.I., big data, and the transition to a completely digital native workforce. PLDT intends not just to survive the future, but to shape it. As the world evolves, the formula for success remains the same: to be bold, hardworking, and open to new ideas. We will continue harnessing technology to do our part in the grand task of nation building, and to improve the lives of FIlipinos," said Pangilinan.

X X X

PLDT INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

As at December 31, 2024 and 2023

(in million pesos)

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

ASSETS |

|

Noncurrent Assets |

|

|

|

|

|

|

Property and equipment |

|

|

318,069 |

|

|

|

287,103 |

|

Right-of-use assets |

|

|

39,111 |

|

|

|

32,717 |

|

Investments in associates and joint ventures |

|

|

52,764 |

|

|

|

50,308 |

|

Financial assets at fair value through profit or loss |

|

|

1,101 |

|

|

|

578 |

|

Debt instruments at amortized cost – net of current portion |

|

|

370 |

|

|

|

395 |

|

Investment properties |

|

|

3,000 |

|

|

|

1,315 |

|

Goodwill and intangible assets |

|

|

64,464 |

|

|

|

64,335 |

|

Deferred income tax assets – net |

|

|

14,643 |

|

|

|

18,172 |

|

Derivative financial assets – net of current portion |

|

|

385 |

|

|

|

96 |

|

Prepayments and other nonfinancial assets – net of current portion |

|

|

61,929 |

|

|

|

80,365 |

|

Contract assets – net of current portion |

|

|

485 |

|

|

|

531 |

|

Other financial assets – net of current portion |

|

|

3,126 |

|

|

|

3,481 |

|

Total Noncurrent Assets |

|

|

559,447 |

|

|

|

539,396 |

|

Current Assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

|

10,011 |

|

|

|

16,177 |

|

Short-term investments |

|

|

136 |

|

|

|

391 |

|

Trade and other receivables |

|

|

31,612 |

|

|

|

26,086 |

|

Inventories and supplies |

|

|

3,306 |

|

|

|

3,340 |

|

Current portion of contract assets |

|

|

1,401 |

|

|

|

1,387 |

|

Current portion of derivative financial assets |

|

|

30 |

|

|

|

— |

|

Current portion of debt instruments at amortized cost |

|

|

25 |

|

|

|

200 |

|

Current portion of prepayments and other nonfinancial assets |

|

|

9,975 |

|

|

|

13,215 |

|

Current portion of other financial assets |

|

|

831 |

|

|

|

320 |

|

|

|

|

57,327 |

|

|

|

61,116 |

|

Assets classified as held-for-sale |

|

|

6,501 |

|

|

|

9,007 |

|

Total Current Assets |

|

|

63,828 |

|

|

|

70,123 |

|

TOTAL ASSETS |

|

|

623,275 |

|

|

|

609,519 |

|

|

|

|

|

|

|

|

EQUITY AND LIABILITIES |

|

Equity |

|

|

|

|

|

|

Non-voting serial preferred stock |

|

|

360 |

|

|

|

360 |

|

Voting preferred stock |

|

|

150 |

|

|

|

150 |

|

Common stock |

|

|

1,093 |

|

|

|

1,093 |

|

Treasury stock |

|

|

(6,505 |

) |

|

|

(6,505 |

) |

Capital in excess of par value |

|

|

130,312 |

|

|

|

130,312 |

|

Retained earnings |

|

|

33,901 |

|

|

|

22,020 |

|

Other comprehensive loss |

|

|

(43,892 |

) |

|

|

(42,212 |

) |

Total Equity Attributable to Equity Holders of PLDT |

|

|

115,419 |

|

|

|

105,218 |

|

Noncontrolling interests |

|

|

1,316 |

|

|

|

5,168 |

|

TOTAL EQUITY |

|

|

116,735 |

|

|

|

110,386 |

|

PLDT INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (continued)

As at December 31, 2024 and 2023

(in million pesos)

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

Noncurrent Liabilities |

|

|

|

|

|

|

Interest-bearing financial liabilities – net of current portion |

|

|

258,246 |

|

|

|

243,152 |

|

Lease liabilities – net of current portion |

|

|

46,703 |

|

|

|

41,625 |

|

Deferred income tax liabilities – net |

|

|

60 |

|

|

|

165 |

|

Derivative financial liabilities – net of current portion |

|

|

— |

|

|

|

12 |

|

Customers’ deposits |

|

|

2,046 |

|

|

|

2,238 |

|

Pension and other employee benefits |

|

|

3,548 |

|

|

|

5,661 |

|

Deferred credits and other noncurrent liabilities |

|

|

7,475 |

|

|

|

9,607 |

|

Total Noncurrent Liabilities |

|

|

318,078 |

|

|

|

302,460 |

|

Current Liabilities |

|

|

|

|

|

|

Accounts payable |

|

|

66,722 |

|

|

|

81,014 |

|

Accrued expenses and other current liabilities |

|

|

85,488 |

|

|

|

88,750 |

|

Current portion of interest-bearing financial liabilities |

|

|

23,340 |

|

|

|

11,646 |

|

Current portion of lease liabilities |

|

|

7,335 |

|

|

|

5,921 |

|

Dividends payable |

|

|

2,005 |

|

|

|

1,912 |

|

Current portion of derivative financial liabilities |

|

|

97 |

|

|

|

1,021 |

|

Income tax payable |

|

|

1,860 |

|

|

|

4,630 |

|

|

|

|

186,847 |

|

|

|

194,894 |

|

Liabilities associated with assets classified as held-for-sale |

|

|

1,615 |

|

|

|

1,779 |

|

Total Current Liabilities |

|

|

188,462 |

|

|

|

196,673 |

|

TOTAL LIABILITIES |

|

|

506,540 |

|

|

|

499,133 |

|

TOTAL EQUITY AND LIABILITIES |

|

|

623,275 |

|

|

|

609,519 |

|

PLDT INC. AND SUBSIDIARIES

CONSOLIDATED INCOME STATEMENTS

For the Years Ended December 31, 2024, 2023 and 2022

(in million pesos, except earnings per common share amounts which are in pesos)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

2022(1) |

|

CONTINUING OPERATIONS |

|

|

|

|

|

|

|

|

|

REVENUES FROM CONTRACTS WITH CUSTOMERS |

|

|

|

|

|

|

|

|

|

Service revenues |

|

|

208,382 |

|

|

|

201,832 |

|

|

|

195,344 |

|

Non-service revenues |

|

|

8,451 |

|

|

|

9,121 |

|

|

|

9,018 |

|

|

|

|

216,833 |

|

|

|

210,953 |

|

|

|

204,362 |

|

EXPENSES |

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

|

78,308 |

|

|

|

81,876 |

|

|

|

84,476 |

|

Depreciation and amortization |

|

|

55,988 |

|

|

|

58,441 |

|

|

|

98,631 |

|

Cost of sales and services |

|

|

14,011 |

|

|

|

15,092 |

|

|

|

14,172 |

|

Asset impairment |

|

|

4,321 |

|

|

|

4,432 |

|

|

|

6,044 |

|

Interconnection costs |

|

|

13,718 |

|

|

|

10,418 |

|

|

|

6,104 |

|

|

|

|

166,346 |

|

|

|

170,259 |

|

|

|

209,427 |

|

|

|

|

50,487 |

|

|

|

40,694 |

|

|

|

(5,065 |

) |

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSES) – NET |

|

|

(7,794 |

) |

|

|

(4,217 |

) |

|

|

19,097 |

|

|

|

|

|

|

|

|

|

|

|

INCOME BEFORE INCOME TAX FROM CONTINUING OPERATIONS |

|

|

42,693 |

|

|

|

36,477 |

|

|

|

14,032 |

|

|

|

|

|

|

|

|

|

|

|

PROVISION FOR INCOME TAX |

|

|

10,138 |

|

|

|

9,612 |

|

|

|

2,697 |

|

NET INCOME FROM CONTINUING OPERATIONS |

|

|

32,555 |

|

|

|

26,865 |

|

|

|

11,335 |

|

|

|

|

|

|

|

|

|

|

|

NET LOSS FROM DISCONTINUED OPERATIONS |

|

|

— |

|

|

|

(41 |

) |

|

|

(600 |

) |

NET INCOME |

|

|

32,555 |

|

|

|

26,824 |

|

|

|

10,735 |

|

ATTRIBUTABLE TO: |

|

|

|

|

|

|

|

|

|

Equity holders of PLDT |

|

|

32,307 |

|

|

|

26,614 |

|

|

|

10,485 |

|

Noncontrolling interests |

|

|

248 |

|

|

|

210 |

|

|

|

250 |

|

|

|

|

32,555 |

|

|

|

26,824 |

|

|

|

10,735 |

|

Earnings Per Share Attributable to Common Equity Holders

of PLDT |

|

|

|

|

|

|

|

|

|

Basic |

|

|

149.26 |

|

|

|

122.91 |

|

|

|

48.26 |

|

Diluted |

|

|

149.26 |

|

|

|

122.91 |

|

|

|

48.26 |

|

Earnings Per Share from Continuing Operations Attributable to

Common Equity Holders of PLDT |

|

|

|

|

|

|

|

|

|

Basic |

|

|

149.26 |

|

|

|

123.10 |

|

|

|

51.03 |

|

Diluted |

|

|

149.26 |

|

|

|

123.10 |

|

|

|

51.03 |

|

(1) To be comparable with 2023, certain amounts for the year ended December 31, 2022 have been reclassified to reflect the discontinued operations of

certain ePLDT subsidiaries. See Note 2 – Summary of Material Accounting Policies – Discontinued Operations for further discussion.

|

|

|

|

|

|

|

|

PLDT Consolidated |

|

|

|

Full year |

|

(Php in mn) |

|

2024 |

2023 |

% Change |

|

|

|

|

|

|

|

Total revenues |

|

216,833 |

210,953 |

3% |

|

|

|

|

|

|

|

Service revenues (a) |

|

208,382 |

201,832 |

3% |

|

|

|

|

|

|

|

Expenses (b) |

|

166,346 |

170,259 |

(2%) |

|

|

|

|

|

|

|

EBITDA (c) |

|

108,515 |

104,297 |

4% |

|

EBITDA Margin |

|

52% |

52% |

|

|

|

|

|

|

|

|

Income before Income Tax |

|

42,693 |

36,477 |

17% |

|

|

|

|

|

|

|

Provision for Income Tax |

|

10,138 |

9,612 |

5% |

|

|

|

|

|

|

|

Net Income - Attributable to Equity Holders of PLDT |

|

32,307 |

26,614 |

21% |

|

|

|

|

|

|

|

Telco Core Income (d) |

|

35,138 |

34,341 |

2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Service Revenues, gross of interconnection costs |

|

|

|

|

|

Service Revenues, gross of interconnection costs |

|

208,382 |

201,832 |

3% |

|

Interconnection costs |

|

13,718 |

10,418 |

32% |

|

Service Revenues, net of interconnection costs |

|

194,664 |

191,414 |

2% |

|

|

|

|

|

|

|

(b) Expenses includes Interconnection Costs and MRP expenses |

(c) EBITDA excluding the impact of MRP |

|

|

|

|

|

(d) Net income as adjusted for the net effect of gain/loss on FX, derivative transactions, MRP and share in Maya Innovations Holdings losses |

This press release may contain some statements which constitute “forward-looking statements” that are subject to a number of risks and opportunities that could affect PLDT’s business and results of operations. Although PLDT believes that expectations reflected in any forward-looking statements are reasonable, it can give no guarantee of future performance, action or events.

For further information, please contact:

|

|

|

Jinggay N. Nograles |

Sarah Azucena-Reodica |

|

pldt_ir_center@pldt.com.ph |

corpcomm@pldt.com.ph |

|

About PLDT

PLDT is the Philippines' largest fully integrated telco company. Through its principal business groups — from fixed line to wireless — PLDT offers a wide range of telecommunications and digital services across the Philippines’ most extensive fiber optic backbone, and fixed line and cellular networks.

PLDT is listed on the Philippine Stock Exchange (PSE:TEL) and its American Depositary Shares are listed on the New York Stock Exchange (NYSE:PHI). PLDT has one of the largest market capitalizations among Philippine — listed companies.

Further information can be obtained by visiting www.pldt.com

February 27, 2025

The Philippine Stock Exchange, Inc.

6/F Philippine Stock Exchange Tower

28th Street corner 5th Avenue

Bonifacio Global City, Taguig City

Attention: Atty. Stefanie Ann B. Go

Officer-in-Charge – Disclosure Department

Securities & Exchange Commission

7907 Makati Avenue, Salcedo Village,

Barangay Bel-Air, Makati City

Attention: Atty. Oliver O. Leonardo

Director – Markets and Securities Regulation Department

Dear All:

In compliance with Section 17.1 (b) of the Securities Regulation Code and SRC Rule 17.1.1.1.3(b).2, PLDT Inc. hereby submits a copy of SEC Form 17-C regarding the election of a director and confirmation of appointment of an officer.

Very truly yours,

/s/Mark David P. Martinez

Mark David P. Martinez

Assistant Corporate Secretary

PLDT Inc.

COVER SHEET

|

|

|

|

|

|

|

|

|

|

|

SEC Registration Number |

P |

W |

- |

5 |

5 |

|

|

|

|

|

|

Company Name

Principal Office (No./Street/Barangay/City/Town/Province)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R |

A |

M |

O |

N |

|

C |

O |

J |

U |

A |

N |

G |

C |

O |

|

B |

U |

I |

L |

D |

I |

N |

G |

|

|

|

|

|

|

|

M |

A |

K |

A |

T |

I |

|

A |

V |

E |

N |

U |

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

A |

K |

A |

T |

I |

|

C |

I |

T |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Type |

|

|

|

Department requiring the report |

|

|

|

Secondary License Type, If Applicable |

|

|

17 |

- |

C |

|

|

|

|

|

|

|

|

M |

S |

R |

D |

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPANY INFORMATION

|

|

|

|

|

|

|

|

Company’s Email Address |

|

Company’s Telephone Number/s |

|

Mobile Number |

|

|

|

|

88168553 |

|

|

|

|

|

|

|

|

|

|

|

No. of Stockholders |

|

Annual Meeting

Month/Day |

|

Fiscal Year

Month/Day |

|

|

11,347 As of January 31, 2025 |

|

Every 2nd Tuesday of June |

|

December 31 |

|

CONTACT PERSON INFORMATION

The designated contact person MUST be an Officer of the Corporation

|

|

|

|

|

|

|

Name of Contact Person |

|

Email Address |

|

Telephone Number/s |

|

Mobile Number |

Marilyn A. Victorio-Aquino |

|

mvaquino@pldt.com.ph |

|

82500254 |

|

|

|

Contact Person’s Address |

MGO Building, Legaspi St. corner Dela Rosa St., Makati City |

Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated.

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT UNDER SECTION 17

OF THE SECURITIES REGULATION CODE

AND SRC RULE 17.1

Date of Report (Date of earliest event reported)

2.SEC Identification Number: PW-55

3.BIR Tax Identification No. 000-488-793

Exact name of issuer as specified in its charter

5. Philippines 6.____________ (SEC Use Only)

Province, country or other jurisdiction Industry Classification Code

of Incorporation

7. Ramon Cojuangco Building, Makati Avenue, Makati City 1200

Address of principal office Postal Code

8. (632) 8250-0254

Issuer's telephone number, including area code

9. Not Applicable

Former name or former address, if changed since last report

10.Securities registered pursuant to Sections 8 and 12 of the Securities Regulation Code and Sections 4 and 8 of the Revised Securities Act

|

|

Title of Each Class |

Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding |

________________________________________________________________

________________________________________________________________

________________________________________________________________

11. Item 4 (Resignation, Removal or Election of Directors or Officers)

We disclose that at the meeting of the Board of Directors of PLDT Inc. (respectively, the “Board” and the “Company”) held on February 27, 2025:

a.As recommended by the Governance, Nomination and Sustainability Committee which conducted the screening process and determined that director-nominee Mr. Robert Joseph M. de Claro possesses all the qualifications and has none of the disqualifications for directorship, the Board elected Mr. de Claro as a Director of the Company to hold office effective immediately and for the unexpired term of his predecessor in office, Atty. Santiago Dionisio R. Agdeppa, who resigned as Director of the Company effective February 1, 2025.

Mr. de Claro officially assumed the role of President and Chief Executive Officer of the SSS on December 6, 2024. Before becoming President and Chief Executive Officer of the SSS, he served as a member of the Social Security Commission (the “SSC”), representing the Employers sector. He also chaired the SSC Information Technology and Collection Committee and was a member of the SSC Audit Committee, SSC Risk Management and Investment Committee, and SSC Governance Committee. Additionally, Mr. de Claro represented the SSS in the Boards of the Union Bank of the Philippines, UBP Investment Management and Trust Corporation, and Ionics, Inc. He has held various leadership roles, including President and Chief Executive Officer of People4u, Inc., Operating Partner at FutureNow Business Services, Inc., President and General Manager of JMango Philippines, Inc., and General Manager, APAC for GlobalOne Solutions, Inc. and Cloud Sherpas.

Mr. de Claro holds a Bachelor of Science degree in Computer Science with a specialization in Information Technology from De La Salle University.

b.The Board confirmed the appointment of Mr. Jose Roberto A. Alampay as First Vice President/Public Engagement and Corporate Communications Head of the Company effective March 1, 2025.

Mr. Alampay is the founder, Chairman, and Executive Editor of PumaPublic Productions and concurrently serves as the Regional Adviser for Asia and the Philippines of International Media Support (IMS) Copenhagen. He also held various leadership roles such as: (a) Editor-in-Chief of Business World from 2014 to 2019; and (b) Vice President of TV5 and Editor-in-Chief of InterAksyon.com.

Mr. Alampay earned his BA Communications degree from the University of the Philippines and obtained a degree in MS Journalism from Columbia University – Graduate School of Journalism.

Pursuant to the requirements of the Securities Regulation Code, the Company has duly authorized and caused this report to be signed on its behalf by the undersigned.

PLDT Inc.

By:

/s/Mark David P. Martinez

Mark David P. Martinez

Assistant Corporate Secretary

February 27, 2025

February 27, 2025

The Philippine Stock Exchange, Inc.

6/F Philippine Stock Exchange Tower

28th Street corner 5th Avenue

Bonifacio Global City, Taguig City

Attention: Atty. Stefanie Ann B. Go

Officer-in-Charge – Disclosure Department

Securities & Exchange Commission

7907 Makati Avenue, Salcedo Village,

Barangay Bel-Air, Makati City

Attention: Atty. Oliver O. Leonardo

Director – Markets and Securities Regulation Department

Dear All:

In compliance with Section 17.1(b) of the Securities Regulation Code (SRC), SRC Rule 17.1.1.1.3(b)2 and the PSE Revised Disclosure Rules, we submit herewith a copy of SEC Form 17-C in connection with the Annual Meeting of Stockholders of PLDT Inc.

Very truly yours,

/s/Mark David P. Martinez

Mark David P. Martinez

Assistant Corporate Secretary

PLDT Inc.

COVER SHEET

|

|

|

|

|

|

|

|

|

|

|

SEC Registration Number |

P |

W |

- |

5 |

5 |

|

|

|

|

|

|

Company Name

Principal Office (No./Street/Barangay/City/Town/Province)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R |

A |

M |

O |

N |

|

C |

O |

J |

U |

A |

N |

G |

C |

O |

|

B |

U |

I |

L |

D |

I |

N |

G |

|

|

|

|

|

|

|

M |

A |

K |

A |

T |

I |

|

A |

V |

E |

N |

U |

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

A |

K |

A |

T |

I |

|

C |

I |

T |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Type |

|

|

|

Department requiring the report |

|

|

|

Secondary License Type, If Applicable |

|

|

17 |

- |

C |

|

|

|

|

|

|

|

|

M |

S |

R |

D |

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPANY INFORMATION

|

|

|

|

|

|

|

|

Company’s Email Address |

|

Company’s Telephone Number/s |

|

Mobile Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No. of Stockholders |

|

Annual Meeting

Month/Day |

|

Fiscal Year

Month/Day |

|

|

11,347 As of January 31, 2025 |

|

Every 2nd Tuesday of June |

|

December 31 |

|

CONTACT PERSON INFORMATION

The designated contact person MUST be an Officer of the Corporation

|

|

|

|

|

|

|

Name of Contact Person |

|

Email Address |

|

Telephone Number/s |

|

Mobile Number |

Marilyn A. Victorio-Aquino |

|

mvaquino@pldt.com.ph |

|

82500254 |

|

|

|

Contact Person’s Address |

MGO Building, Legaspi St. corner Dela Rosa St., Makati City |

Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated.

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT UNDER SECTION 17

OF THE SECURITIES REGULATION CODE

AND SRC RULE 17.1

Date of Report (Date of earliest event reported)

2.SEC Identification Number PW-55

3.BIR Tax Identification No. 000-488-793

Exact name of issuer as specified in its charter

5. PHILIPPINES 6.____________ (SEC Use Only)

Province, country or other jurisdiction Industry Classification Code

of Incorporation

7. Ramon Cojuangco Building, Makati Avenue, Makati City 1200

Address of principal office Postal Code

8. (632) 82500254

Issuer's telephone number, including area code

9. Not Applicable

Former name or former address, if changed since last report

10.Securities registered pursuant to Sections 8 and 12 of the Securities Regulation Code and Sections 4 and 8 of the Revised Securities Act

|

|

Title of Each Class |

Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding |

________________________________________________________________

________________________________________________________________

________________________________________________________________

11. Item 9 (Other events)

We disclose that at the meeting of the Board of Directors of PLDT Inc. (respectively, the “Board” and the “Company”) held on February 27, 2025, the Board approved the following items in connection with the Annual Meeting of Stockholders of the Company for 2025 (the “Annual Meeting”):

(a)The Annual Meeting will be held on June 10, 2025 at 3:00 p.m. Per the By-Laws of the Company, the Annual Meeting shall be held on the second Tuesday of June;

(b)In accordance with the Company’s By-Laws, the nominations for election of directors/independent directors at the Annual Meeting shall be submitted to the Board of Directors through the Chairman or Corporate Secretary at the Company’s principal place of business at least sixty (60) working days before the meeting or by March 12, 2025;

(c)The record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting is April 14, 2025. The stock and transfer books of the Company will not be closed;

(d)The last day for filing of proxies in connection with the Annual Meeting will be on May 30, 2025; and

(e)The validation of proxies in connection with the Annual Meeting will be completed on June 4, 2025.

The Notice, Agenda and other materials in connection with the Annual Meeting will be submitted to the Securities and Exchange Commission and the PSE in accordance with applicable rules.

Pursuant to the requirements of the Securities Regulation Code, the Company has duly authorized and caused this report to be signed on its behalf by the undersigned.

PLDT INC.

By:

/s/Mark David P. Martinez

Mark David P. Martinez

Assistant Corporate Secretary

February 27, 2025

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly authorized and caused this report to be signed on its behalf by the undersigned.

|

PLDT Inc. |

By : /s/Mark David P. Martinez Name : Mark David P. Martinez Title : Assistant Corporate Secretary Date : February 27, 2025 |

|

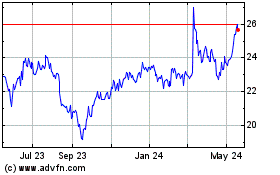

PLDT (NYSE:PHI)

Historical Stock Chart

From Feb 2025 to Mar 2025

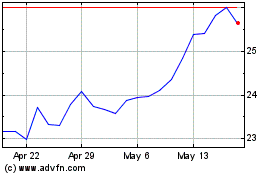

PLDT (NYSE:PHI)

Historical Stock Chart

From Mar 2024 to Mar 2025