New Research Finds Consumers Demand Payment Choice, Worry About Cash Access, and Remain Optimistic About Their Financial Future

August 14 2024 - 3:00AM

Business Wire

Paysafe’s annual Inside the Wallet report

polled the spending and saving habits of 14,500 people across age

groups from around the world

Over half of consumers worldwide (56%) have changed their

spending habits from a year ago, not only becoming more price

conscious but demanding payment choice, from debit cards and bank

transfers to digital wallets and cash, according to new research

from Paysafe (NYSE: PSFE), a global payment processor and digital

wallet provider.

According to Paysafe’s report, ‘Inside the Wallet: How consumers

are spending and saving in 2024’, 43% of consumers have abandoned

their online shopping cart if a business didn’t offer their payment

method of choice. With retailers increasingly adopting cashless

policies, an overwhelming number of consumers (63%) expressed

concern about losing cash as a payment option, with another 44% of

people indicating that they want to be able to buy goods or

services online and pay for them in cash at a local store.

Security in payments was also top of mind for respondents. More

than half of people (54%) said that security in a business’s

payment process is an important factor when deciding how to

purchase online. While two-thirds of consumers reported feeling

better buying from a business if they know there are security steps

in place to protect their data or if they see a payment option they

recognize.

Payment Options for Diverse Consumer Needs

Spending preferences are growing increasingly diverse. Debit

cards (53%) are the top payment method being used more frequently

this year vs last year, but bank transfers (39%), credit cards

(33%), and digital wallets (32%) have also increased in popularity,

with new payment methods and platforms beginning to emerge. Over

half (58%) of consumers have made an online purchase through social

media, with 38% doing so multiple times a year. Another one-third

(32%) of people are now using a wearable device, such as a

smartwatch, to pay.

Attitudes to developing technologies vary by generation, with

younger people more likely to embrace innovative payment options,

such as AI-powered payments. Over a third (36%) of 18-43-year-olds

are fully comfortable with AI being used to improve payments. This

compares to 33% of those aged 60 and over who are not comfortable

at all with the idea of AI in payments.

Bob Legters, Paysafe’s SVP Product, commented: “Consumers are

comparison shopping more than ever, not only to find the best deal

but the best payment experience that delivers choices, security,

and speed, and keeps them coming back. As consumers’ financial

situations and priorities shift, businesses need payment partners

that have a track record of offering innovative payment options

that attract a wide pool of consumers—from younger to older and

every age in between.”

Financial Health

Diving deeper into the data behind these changing payment

habits, the research reveals the financial challenges faced by many

global consumers. Over half (56%) of respondents say that they are

earning just enough to cover their monthly expenses and a quarter

(25%) say they are not earning enough money to cover their monthly

expenses, with the figure rising to 33% for Gen Z.

While most respondents anticipate an increase in their income

over the next 5 to 10 years – around half (49%) believe their

income will rise by 10% or less, and 12% say they don’t expect any

increase. Despite having limited disposable income early in their

careers, Gen Z and Millennials were hopeful about their future

earning potential, anticipating increases of 20% and 18%

respectively.

But with many consumers living pay cheque to pay cheque, the

opportunity to save has decreased, with 39% saving less than 6% of

their income each month and 14% not saving at all (down from 18% in

Paysafe’s 2023 research). The inability to save can be attributed

to an increase in the cost-of-living, with respondents reporting

that they’re spending more on everyday necessities like groceries

(66%), utilities (57%) and essential consumer goods (51%).

Optimistic Outlook

Paysafe’s data indicates a sense of optimism among consumers,

with 60% of respondents – and 78% of Gen Z – expressing confidence

about their financial future, and planning towards this.

Over a quarter (27%) of respondents are saving to buy their

first home. This rises to nearly half (48%) of Gen Z respondents,

who expect to purchase their first home before the age of 32. Gen

Z’s positive outlook extends to the belief that they can achieve

another major milestone early in life – nearly half (49%) expect to

retire before the age of 61.

For additional takeaways from the research, as well as further

guidance on how businesses should respond, download the full report

here: https://www.paysafe.com/en/inside-the-wallet/

About Paysafe

Paysafe Limited (“Paysafe”) (NYSE: PSFE) (PSFE.WS) is a leading

payments platform with an extensive track record of serving

merchants and consumers in the global entertainment sectors. Its

core purpose is to enable businesses and consumers to connect and

transact seamlessly through industry-leading capabilities in

payment processing, digital wallet, and online cash solutions. With

over 25 years of online payment experience, an annualized

transactional volume of $140 billion in 2023, and approximately

3,200 employees located in 12+ countries, Paysafe connects

businesses and consumers across 260 payment types in over 40

currencies around the world. Delivered through an integrated

platform, Paysafe solutions are geared toward mobile-initiated

transactions, real-time analytics and the convergence between

brick-and-mortar and online payments. Further information is

available at www.paysafe.com.

About the Research

The research was conducted on behalf of Paysafe by Sapio

Research between May and June 2024. It surveyed 14,500 respondents

over 18 years old from UK, USA, Canada, Mexico, Germany, Austria,

Bulgaria, Italy, Peru, Chile, Brazil, Colombia, Argentina and

Ecuador.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240813081262/en/

Paysafe Press Office pr@paysafe.com

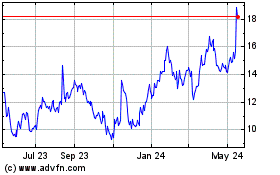

Paysafe (NYSE:PSFE)

Historical Stock Chart

From Dec 2024 to Jan 2025

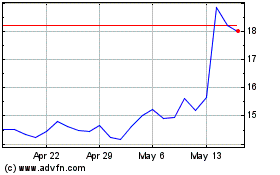

Paysafe (NYSE:PSFE)

Historical Stock Chart

From Jan 2024 to Jan 2025