Paysafe Limited (“Paysafe” or the “Company”) (NYSE: PSFE), a

leading payments platform, today announced its financial results

for the third quarter of 2024.

Third Quarter 2024 Financial Highlights (Metrics compared

to third quarter of 2023, unless otherwise noted)

- Revenue of $427.1 million, increased 8%; increased 7% on a

constant currency basis

- Total Payment Volume of $37.5 billion, increased 7%

- Net loss of $13.0 million, or ($0.21) per diluted share,

compared to net loss of $2.5 million, or ($0.04) per diluted

share

- Adjusted net income of $31.4 million, or $0.51 per diluted

share, compared to $35.3 million, or $0.57 per diluted share

- Adjusted EBITDA of $117.8 million, increased 1%; increased 1%

on a constant currency basis

- Net leverage1 decreased to 4.7x as of September 30, 2024,

compared to 5.0x as of December 31, 2023

Bruce Lowthers, CEO of Paysafe, commented: “I am happy to report

on behalf of our team another healthy quarter for Paysafe. Revenue

growth continues to be strong this year, reaching 8% for the third

quarter and year-to-date, demonstrating execution on our strategic

priorities and our focus on delivering higher quality, sustainable

revenue growth, while investing in the business and progressively

reducing net leverage. We are pleased to reaffirm our full year

financial outlook for 2024 and we remain confident that we are

taking the right actions to drive continued momentum in 2025 and

beyond.”

Full Year 2024 Financial Guidance

($ in millions) (unaudited)

Full Year 2024

Revenue

$1,713 - $1,729

Adjusted EBITDA

$471 - $484

Recent Strategic and Operational Highlights

- Welcomed John Crawford as our new Chief Financial Officer who

brings more than 25 years of financial leadership experience with a

strong background in the payments industry

- 2024 initiatives remain on track or ahead of schedule; welcomed

170 new hires to Paysafe's sales team year-to-date, expanding

Paysafe's go-to-market capabilities

- Paysafe's eCommerce channel continues to grow double-digits

driven by strong demand within our iGaming vertical in North

America

- Launched a partnership with Revolut to offer cash deposits for

Revolut's UK customers with plans to expand to other markets in

EEA

(1)

Paysafe defines net leverage as net debt

(total debt less cash and cash equivalents) divided by the sum of

the last twelve months (LTM) Adjusted EBITDA. For the period ended

September 30, 2024, total debt was $2,431.4 million and cash and

cash equivalents was $241.4 million, and LTM Adjusted EBITDA was

$470.5 million. For the period ended December 31, 2023, total debt

was $2,501.8 million and cash and cash equivalents was $202.3

million, and LTM Adjusted EBITDA was $458.7 million.

Third Quarter of 2024 Summary of Consolidated Results

Three Months Ended

Nine Months Ended

September 30,

September 30,

($ in thousands) (unaudited)

2024

2023

2024

2023

Revenue

$

427,103

$

396,410

$

1,284,765

$

1,186,597

Gross Profit (excluding depreciation and

amortization)

$

249,004

$

232,333

$

752,468

$

696,967

Net loss

$

(12,977

)

$

(2,549

)

$

(11,351

)

$

(8,122

)

Adjusted EBITDA

$

117,787

$

116,076

$

348,709

$

336,922

Adjusted net income

$

31,372

$

35,272

$

102,957

$

103,026

Total revenue for the third quarter of 2024 was $427.1 million,

an increase of 8%, compared to $396.4 million in the prior year

period, reflecting 7% growth in total payment volume. Excluding a

$1.4 million favorable impact from changes in foreign exchange

rates, total revenue increased 7%. Revenue from the Merchant

Solutions segment increased 11%, reflecting double-digit growth in

e-commerce as well as growth from small and medium-sized businesses

("SMBs") driven by initiatives to expand our sales capabilities and

optimize the portfolio. Revenue from the Digital Wallets segment

increased 4% both as reported and in constant currency, supported

by ongoing initiatives related to product and consumer engagement

as well as growth from merchants onboarded in 2023.

Net loss for the third quarter increased to $13.0 million,

compared to $2.5 million in the prior year period, largely

reflecting an increase in other expenses due to a loss on foreign

exchange.

Adjusted net income for the third quarter decreased 11% to $31.4

million, compared to $35.3 million in the prior year period,

reflecting an increase in depreciation and amortization expense as

well as an increase in the adjusted effective tax rate.

Adjusted EBITDA for the third quarter was $117.8 million, an

increase of 1%, compared to $116.1 million in the prior year

period, primarily reflecting revenue growth, partially offset by

incremental expenses related to previously announced initiatives to

expand the sales team and optimize the portfolio.

Third quarter operating cash flow was $81.9 million, compared to

$102.2 million in the prior year period, which was mainly driven by

movements in working capital. Unlevered free cash flow was $89.9

million, compared to $110.3 million in the prior year period.

Balance Sheet

As of September 30, 2024, total cash and cash equivalents were

$241.4 million, total debt was $2.4 billion and net debt was $2.2

billion. Compared to December 31, 2023, total debt decreased by

$70.4 million, reflecting net repayments of $72.5 million as well

as movement in foreign exchange rates.

Summary of Segment Results

Three Months Ended

Nine Months Ended

September 30,

YoY

September 30,

YoY

($ in thousands) (unaudited)

2024

2023

change

2024

2023

change

Revenue:

Merchant Solutions

$

241,142

$

216,847

11

%

$

727,518

$

651,066

12

%

Digital Wallets

$

190,930

$

182,855

4

%

$

571,060

$

543,382

5

%

Intersegment

$

(4,969

)

$

(3,292

)

51

%

$

(13,813

)

$

(7,851

)

76

%

Total Revenue

$

427,103

$

396,410

8

%

$

1,284,765

$

1,186,597

8

%

Adjusted EBITDA:

Merchant Solutions

$

52,646

$

57,467

-8

%

$

158,335

$

165,572

-4

%

Digital Wallets

$

84,119

$

79,930

5

%

$

249,806

$

236,350

6

%

Corporate

$

(18,978

)

$

(21,321

)

11

%

$

(59,432

)

$

(65,000

)

9

%

Total Adjusted EBITDA

$

117,787

$

116,076

1

%

$

348,709

$

336,922

3

%

Webcast and Conference Call

Paysafe will host a live webcast to discuss the results today at

8:30 a.m. (ET). The webcast and supplemental information can be

accessed on the investor relations section of the Paysafe website

at ir.paysafe.com. An archive will be available after the

conclusion of the live event and will remain available via the same

link for one year.

Time

Wednesday, November 13 2024, at 8:30 a.m.

ET

Webcast

Go to the Investor Relations section of

the Paysafe website to listen and view slides

Dial in

877-407-0752 (U.S. toll-free);

201-389-0912 (International)

About Paysafe

Paysafe Limited (“Paysafe”) (NYSE: PSFE) (PSFE.WS) is a leading

payments platform with an extensive track record of serving

merchants and consumers in the global entertainment sectors. Its

core purpose is to enable businesses and consumers to connect and

transact seamlessly through industry-leading capabilities in

payment processing, digital wallet, and online cash solutions. With

over 25 years of online payment experience, an annualized

transactional volume of $140 billion in 2023, and approximately

3,200 employees located in 12+ countries, Paysafe connects

businesses and consumers across 260 payment types in over 40

currencies around the world. Delivered through an integrated

platform, Paysafe solutions are geared toward mobile-initiated

transactions, real-time analytics and the convergence between

brick-and-mortar and online payments. Further information is

available at www.paysafe.com.

Forward-looking Statements

This press release includes “forward-looking statements” within

the meaning of U.S. federal securities laws. These forward-looking

statements are provided for illustrative purposes only and are not

intended to serve as, and must not be relied on by any investor as,

a guarantee, an assurance, a prediction or a definitive statement

of fact or probability. Paysafe Limited’s (“Paysafe,” “PSFE,” the

“Company,” “we,” “us,” or “our”) actual results may differ from

their expectations, estimates, and projections and, consequently,

you should not rely on these forward-looking statements as

predictions of future events. Words such as “anticipate,” “appear,”

“approximate,” “believe,” “budget,” “continue,” “could,”

“estimate,” “expect,” “forecast,” “foresee,” “guidance,” “intends,”

“likely,” “may,” “might,” “plan,” “possible,” “potential,”

“predict,” “project,” “seek,” “should,” "will," “would” and

variations of such words and similar expressions (or the negative

version of such words or expressions) may identify forward-looking

statements, but the absence of these words does not mean that a

statement is not forward-looking. These forward-looking statements

include, without limitation, Paysafe’s expectations with respect to

future performance.

These forward-looking statements involve significant risks,

uncertainties, and events that may cause the actual results to

differ materially, and potentially adversely, from those expressed

or implied in the forward-looking statements. While the Company

believes its assumptions concerning future events are reasonable, a

number of factors could cause actual results to differ materially

from those projected, including, but not limited to: cyberattacks

and security vulnerabilities; complying with and changes in money

laundering regulations, financial services regulations,

cryptocurrency regulations, consumer and business privacy and data

use regulations or other regulations in Bermuda, the UK, Ireland,

Switzerland, the United States, Canada and elsewhere; risks related

to our focus on specialized and high-risk verticals; geopolitical

events and the economic and other impacts of such geopolitical

events and the responses of governments around the world; acts of

war and terrorism; the effects of global economic uncertainties,

including inflationary pressure and rising interest rates, on

consumer and business spending; risks associated with foreign

currency exchange rate fluctuations; changes in our relationships

with banks, payment card networks, issuers and financial

institutions; risk related to processing online payments for

merchants and customers engaged in the online gambling and foreign

exchange trading sectors; risks related to becoming an unwitting

party to fraud or being deemed to be handling proceeds resulting

from the criminal activity by customers; the effects of

chargebacks, merchant insolvency and consumer deposit settlement

risk; changes to our continued financial institution sponsorships;

failure to hold, safeguard or account accurately for merchant or

customer funds; risks related to the availability, integrity and

security of internal and external IT transaction processing systems

and services; our ability to manage regulatory and litigation

risks, and the outcome of legal and regulatory proceedings; failure

of fourth parties to comply with contractual obligations; changes

and compliance with payment card network operating rules;

substantial and increasingly intense competition worldwide in the

global payments industry; risks related to developing and

maintaining effective internal controls over financial reporting;

managing our growth effectively, including growing our revenue

pipeline; any difficulties maintaining a strong and trusted brand;

keeping pace with rapid technological developments; risks

associated with the significant influence of our principal

shareholders; the effect of regional epidemics or a global pandemic

on our business; and other factors included in the “Risk Factors”

in our Form 20-F and in other filings we make with the SEC, which

are available at https://www.sec.gov. Readers are cautioned not to

place undue reliance upon any forward-looking statements, which

speak only as of the date made.

The Company expressly disclaims any obligations or undertaking

to release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in their

expectations with respect thereto or any change in events.

Paysafe Limited Condensed Consolidated

Statements of Operations (unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

($ in thousands)

2024

2023

2024

2023

Revenue

$

427,103

$

396,410

$

1,284,765

$

1,186,597

Cost of services (excluding depreciation

and amortization)

178,099

164,077

532,297

489,630

Selling, general and administrative

143,907

121,195

438,774

383,106

Depreciation and amortization

70,088

67,074

207,028

197,046

Impairment expense on goodwill and

intangible assets

119

—

795

275

Restructuring and other costs

340

835

1,520

4,165

Loss on disposal of subsidiary and other

assets, net

187

—

508

—

Operating income

34,363

43,229

103,843

112,375

Other (expense) / income, net

(14,742

)

9,661

2,010

19,584

Interest expense, net

(35,546

)

(38,421

)

(107,646

)

(112,639

)

(Loss) / income before taxes

(15,925

)

14,469

(1,793

)

19,320

Income tax (benefit) / expense

(2,948

)

17,018

9,558

27,442

Net loss

$

(12,977

)

$

(2,549

)

$

(11,351

)

$

(8,122

)

Net loss per share – basic

$

(0.21

)

$

(0.04

)

$

(0.19

)

$

(0.13

)

Net loss per share – diluted

$

(0.21

)

$

(0.04

)

$

(0.19

)

$

(0.13

)

Net loss

$

(12,977

)

$

(2,549

)

$

(11,351

)

$

(8,122

)

Other comprehensive (loss) / income, net

of tax of $0:

Gain / (loss) on foreign currency

translation

18,108

(8,853

)

4,441

1,525

Total comprehensive income /

(loss)

$

5,131

$

(11,402

)

$

(6,910

)

$

(6,597

)

Paysafe Limited Consolidated Net Loss per

share

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Numerator ($ in thousands)

Net loss - basic

$

(12,977

)

$

(2,549

)

$

(11,351

)

$

(8,122

)

Net loss - diluted

$

(12,977

)

$

(2,549

)

$

(11,351

)

$

(8,122

)

Denominator (in millions)

Weighted average shares – basic

60.7

61.6

61.0

61.3

Weighted average shares – diluted

60.7

61.6

61.0

61.3

Net loss per share

Basic

$

(0.21

)

$

(0.04

)

$

(0.19

)

$

(0.13

)

Diluted

$

(0.21

)

$

(0.04

)

$

(0.19

)

$

(0.13

)

Paysafe Limited Condensed Consolidated

Balance Sheets (unaudited)

($ in thousands)

September 30, 2024

December 31, 2023

Assets

Current assets

Cash and cash equivalents

$

241,381

$

202,322

Customer accounts and other restricted

cash

1,052,698

1,295,947

Accounts receivable, net of allowance for

credit losses of $6,673 and $5,240, respectively

180,298

162,081

Settlement receivables, net of allowance

for credit losses of $4,661 and $5,197, respectively

157,828

171,224

Prepaid expenses and other current

assets

65,971

74,919

Total current assets

1,698,176

1,906,493

Deferred tax assets

77,273

77,273

Property, plant and equipment, net

22,567

17,213

Operating lease right-of-use assets

38,251

22,120

Derivative financial assets

4,794

10,427

Intangible assets, net

1,038,937

1,163,935

Goodwill

2,029,948

2,023,402

Other assets – non-current

11,900

6,838

Total non-current assets

3,223,670

3,321,208

Total assets

$

4,921,846

$

5,227,701

Liabilities and equity

Current liabilities

Accounts payable and other liabilities

$

205,386

$

202,699

Short-term debt

10,190

10,190

Funds payable and amounts due to

customers

1,252,369

1,477,017

Operating lease liabilities – current

7,592

8,233

Contingent consideration payable –

current

9,884

11,828

Liability for share-based compensation –

current

6,494

2,701

Total current liabilities

1,491,915

1,712,668

Non-current debt

2,421,228

2,491,643

Operating lease liabilities –

non-current

34,725

16,963

Deferred tax liabilities

92,590

111,705

Warrant liabilities

1,342

1,423

Derivative financial liabilities –

non-current

377

—

Liability for share-based compensation –

non-current

2,320

3,108

Contingent consideration payable –

non-current

325

6,878

Total non-current liabilities

2,552,907

2,631,720

Total liabilities

4,044,822

4,344,388

Commitments and contingent liabilities

Total shareholders' equity

877,024

883,313

Total liabilities and shareholders'

equity

$

4,921,846

$

5,227,701

Paysafe Limited Condensed Consolidated

Statements of Cash Flow (unaudited)

Nine Months Ended

September 30,

($ in thousands)

2024

2023 (1)

Cash flows from operating

activities

Net loss

$

(11,351

)

$

(8,122

)

Adjustments for non-cash items:

Depreciation and amortization

208,006

197,046

Unrealized foreign exchange loss

7,139

4,907

Deferred tax (benefit) / expense

(17,751

)

17,453

Interest expense, net

(1,662

)

5,392

Share-based compensation

35,015

23,061

Other income, net

(6,939

)

(19,828

)

Impairment expense on goodwill and

intangible assets

795

275

Allowance for credit losses and other

28,841

13,857

Loss on disposal of subsidiary and other

assets, net

508

—

Non-cash lease expense

6,718

6,686

Movements in working capital:

Accounts receivable, net

(42,214

)

(15,857

)

Prepaid expenses and other current

assets

(7,635

)

(1,332

)

Accounts payable and other liabilities

(7,769

)

(26,623

)

Income tax receivable

3,208

(24,485

)

Net cash flows from operating

activities

194,909

172,430

Cash flows in investing

activities

Purchase of property, plant &

equipment

(11,434

)

(12,129

)

Purchase of merchant portfolios

(7,224

)

(26,749

)

Other intangible asset expenditures

(68,409

)

(69,393

)

Cash inflow / (outflow) from merchant

reserves

6,510

(24,400

)

Receipts under derivative financial

instruments

7,234

7,520

Other investing activities, net

1,958

(410

)

Net cash flows used in investing

activities

(71,365

)

(125,561

)

Cash flows from financing

activities

Cash settled equity awards

—

(484

)

Proceeds from exercise of warrants

—

5

Repurchases of shares withheld for

taxes

(6,641

)

(7,857

)

Proceeds from employee share purchase

plan

159

—

Purchase of treasury shares

(25,000

)

—

Settlement funds - merchants and

customers, net

(220,123

)

(527,798

)

Repurchase of borrowings

(80,253

)

(124,344

)

Proceeds from loans and borrowings

159,291

90,138

Repayments of loans and borrowings

(124,916

)

(68,592

)

Payment of debt issuance costs

(491

)

—

Proceeds under line of credit

650,000

675,000

Repayments under line of credit

(675,000

)

(675,000

)

Contingent consideration paid

(8,949

)

(9,210

)

Net cash flows used in financing

activities

(331,923

)

(648,142

)

Effect of foreign exchange rate

changes

4,189

(7,809

)

Decrease in cash and cash equivalents,

including customer accounts and other restricted cash during the

period

$

(204,190

)

$

(609,082

)

Cash and cash equivalents, including

customer accounts and other restricted cash at beginning of the

period

1,498,269

2,127,195

Cash and cash equivalents at end of the

period, including customer accounts and other restricted

cash

$

1,294,079

$

1,518,113

Nine Months Ended

September 30,

2024

2023

Cash and cash equivalents

$

241,381

$

226,451

Customer accounts and other restricted

cash

1,052,698

1,291,662

Total cash and cash equivalents,

including customer accounts and other restricted cash

$

1,294,079

$

1,518,113

(1)

During the fourth quarter of 2023, the

Company elected to change its presentation of the cash flows

associated with "Settlement receivables, net" and "Funds payable

and amounts due to customers" from operating activities, to present

them as financing activities within its Consolidated Statements of

Cash Flows. Comparative amounts have been recast to conform to

current period presentation. These recasts had no impact on the

Consolidated Statements of Comprehensive Loss, Consolidated

Statements of Financial Position or Consolidated Statements of

Shareholders' Equity.

Non-GAAP Financial Measures

To supplement the Company’s condensed consolidated financial

statements presented in accordance with generally accepted

accounting principles, or GAAP, the company uses non-GAAP measures

of certain components of financial performance. This includes Gross

Profit (excluding depreciation and amortization), Adjusted EBITDA,

Unlevered free cash flow, Adjusted net income, Adjusted net income

per share, and Net leverage which are supplemental measures that

are not required by, or presented in accordance with, accounting

principles generally accepted in the United States (“U.S.

GAAP”).

Gross Profit (excluding depreciation and amortization) is

defined as revenue less cost of services (excluding depreciation

and amortization). Management believes Gross Profit to be a useful

profitability measure to assess the performance of our businesses

and ability to manage cost.

Adjusted EBITDA is defined as net income/(loss) before the

impact of income tax (benefit)/expense, interest expense, net,

depreciation and amortization, share-based compensation, impairment

expense on goodwill and intangible assets, restructuring and other

costs, loss/(gain) on disposal of a subsidiaries and other assets,

net, and other income/(expense), net. These adjustments also

include certain costs and transaction items that are not reflective

of the underlying operating performance of the Company. Management

believes Adjusted EBITDA to be a useful profitability measure to

assess the performance of our businesses and improves the

comparability of operating results across reporting periods.

Adjusted net income excludes the impact of certain

non-operational and non-cash items. Adjusted net income is defined

as net income/(loss) attributable to the Company before the impact

of other non-operating income / (expense), net, impairment expense

on goodwill and intangible assets, restructuring and other costs,

accelerated amortization of debt fees, amortization of acquired

assets, loss/(gain) on disposal of subsidiaries and other assets,

share-based compensation, discrete tax items and the income tax

(benefit)/expense on these non-GAAP adjustments. Adjusted net

income per share is adjusted net income as defined above divided by

adjusted weighted average dilutive shares outstanding. Management

believes the removal of certain non-operational and non-cash items

from net income enhances shareholders' ability to evaluate the

Company’s business performance and profitability by improving

comparability of operating results across reporting periods.

Unlevered free cash flow is defined as net cash flows provided

by/used in operating activities, adjusted for the impact of capital

expenditure, payments relating to restructuring and other costs and

cash paid for interest. Capital expenditure includes purchases of

property plant & equipment and purchases of other intangible

assets, including software development costs. Capital expenditure

does not include purchases of merchant portfolios. Management

believes unlevered free cash flow to be a liquidity measure that

provides useful information about the amount of cash generated by

the business.

Net leverage is defined as net debt (gross debt less cash and

cash equivalents) divided by the last twelve months Adjusted

EBITDA. Management believes net leverage is a useful measure of the

Company's credit position and progress towards leverage

targets.

Management believes the presentation of these non-GAAP financial

measures, including Gross Profit, Adjusted EBITDA, Unlevered free

cash flow, Adjusted net income, Adjusted net income per share, and

Net leverage when considered together with the Company’s results

presented in accordance with GAAP, provide users with useful

supplemental information in comparing the operating results across

reporting periods by excluding items that are not considered

indicative of Paysafe’s core operating performance. In addition,

management believes the presentation of these non-GAAP financial

measures provides useful supplemental information in assessing the

Company’s results on a basis that fosters comparability across

periods by excluding the impact on the Company’s reported GAAP

results of acquisitions and dispositions that have occurred in such

periods. However, these non-GAAP measures exclude items that are

significant in understanding and assessing Paysafe’s financial

results or position. Therefore, these measures should not be

considered in isolation or as alternatives to revenue, net income,

cash flows from operations or other measures of profitability,

liquidity or performance under GAAP.

You should be aware that Paysafe’s presentation of these

measures may not be comparable to similarly titled measures used by

other companies. In addition, the forward-looking non-GAAP

financial measure of Adjusted EBITDA provided herein have not been

reconciled to the comparable GAAP measure due to the inherent

difficulty in forecasting and quantifying certain amounts that are

necessary for such reconciliations. We have reconciled the

historical non-GAAP financial measures presented herein to their

most directly comparable GAAP financial measures. A reconciliation

of our forward-looking non-GAAP financial measures to their most

directly comparable GAAP financial measures cannot be provided

without unreasonable effort because of the inherent difficulty of

accurately forecasting the occurrence and financial impact of the

adjusting items necessary for such reconciliations that have not

yet occurred, are out of our control, or cannot be reasonably

predicted. For the same reasons, we are unable to address the

probable significance of the unavailable information, which could

be material to future results.

Reconciliation of GAAP Net Loss to Adjusted EBITDA

Three Months Ended

Nine Months Ended

September 30,

September 30,

($ in thousands)

2024

2023

2024

2023

Net loss

$

(12,977

)

$

(2,549

)

$

(11,351

)

$

(8,122

)

Income tax (benefit) / expense

(2,948

)

17,018

9,558

27,442

Interest expense, net

35,546

38,421

107,646

112,639

Depreciation and amortization

70,088

67,074

207,028

197,046

Share-based compensation expense

12,690

4,938

35,015

23,061

Impairment expense on goodwill and

intangible assets

119

—

795

275

Restructuring and other costs

340

835

1,520

4,165

Loss on disposal of subsidiaries and other

assets, net

187

—

508

—

Other expense / (income), net

14,742

(9,661

)

(2,010

)

(19,584

)

Adjusted EBITDA

$

117,787

$

116,076

$

348,709

$

336,922

Reconciliation of Operating Cash Flow to Non-GAAP Unlevered

Free Cash Flow

Three Months Ended

Nine Months Ended

September 30,

September 30,

($ in thousands)

2024

2023 (1)

2024

2023 (1)

Net cash inflows from operating

activities

$

81,934

$

102,216

$

194,909

$

172,430

Capital expenditure

(24,950

)

(25,696

)

(79,843

)

(81,522

)

Cash paid for interest

32,246

32,363

109,308

107,247

Payments relating to Restructuring and

other costs

655

1,397

4,706

30,562

Unlevered Free Cash Flow

$

89,885

$

110,280

$

229,080

$

228,717

Adjusted EBITDA

117,787

116,076

348,709

336,922

(1)

During the fourth quarter of 2023, the

Company elected to change its presentation of "Settlement

receivables, net" and "Funds payable and amounts due to customers"

from operating activities to present them as financing activities

within its Consolidated Statements of Cash Flows. As a result, the

reconciling item related to "Movements in customer accounts and

other restricted cash" is no longer required in the unlevered free

cash flow reconciliation. Comparative amounts have been recast to

conform to current period presentation.

Reconciliation of GAAP Gross Profit to Non-GAAP Gross Profit

(excluding depreciation and amortization)

Three Months Ended

Nine Months Ended

September 30,

September 30,

($ in thousands)

2024

2023

2024

2023

Revenue

$

427,103

$

396,410

$

1,284,765

$

1,186,597

Cost of services (excluding depreciation

and amortization)

178,099

164,077

532,297

489,630

Depreciation and amortization

70,088

67,074

207,028

197,046

Gross Profit (1)

$

178,916

$

165,259

$

545,440

$

499,921

Depreciation and amortization

70,088

67,074

207,028

197,046

Gross Profit (excluding depreciation

and amortization)

$

249,004

$

232,333

$

752,468

$

696,967

(1)

Gross Profit has been calculated as

revenue, less cost of services and depreciation and amortization.

Gross profit is not presented within the Company's consolidated

financial statements.

Reconciliation of GAAP Net Loss to Adjusted Net

Income

Three Months Ended

Nine Months Ended

September 30,

September 30,

($ in thousands)

2024

2023

2024

2023

Net loss

$

(12,977

)

$

(2,549

)

$

(11,351

)

$

(8,122

)

Other non operating expense / (income),

net (1)

17,062

(7,274

)

5,424

(12,852

)

Impairment expense on goodwill and

intangible assets

119

—

795

275

Amortization of acquired assets (2)

33,721

34,094

100,851

101,862

Restructuring and other costs

340

835

1,520

4,165

Loss on disposal of subsidiaries and other

assets, net

187

—

508

—

Share-based compensation expense

12,690

4,938

35,015

23,061

Discrete tax items (3)

(2,046

)

14,313

8,027

25,198

Income tax expense on non-GAAP adjustments

(4)

(17,724

)

(9,085

)

(37,832

)

(30,561

)

Adjusted net income

$

31,372

$

35,272

$

102,957

$

103,026

(in millions)

Weighted average shares -

diluted

60.7

61.6

61.0

61.3

Adjusted diluted impact

1.3

0.1

0.8

0.3

Adjusted weighted average shares -

diluted

62.0

61.7

61.8

61.6

(1)

Other non-operating expense / (income),

net primarily consists of income and expenses outside of the

Company's operating activities, including, fair value gain / loss

on warrant liabilities and derivatives, gain / loss on repurchases

of debt, gain / loss on foreign exchange and the release of certain

provisions.

(2)

Amortization of acquired asset represents

amortization expense on the fair value of intangible assets

acquired through various Company acquisitions, including brands,

customer relationships, software and merchant portfolios.

(3)

Discrete tax items mainly represent (a)

valuation allowance benefit / (expense) recorded on deferred tax

assets representing a benefit of $(766) and an expense of $10,780

for the three months ended September 30, 2024 and 2023,

respectively, and expenses of $8,540 and $15,533 for the nine

months ended September 30, 2024 and 2023, respectively (b)

measurement period adjustments which were $0 and $3,117 for the

three months ended September 30, 2024 and 2023, respectively, and

($382) and $4,199 for the nine months ended September 30, 2024 and

2023, respectively, and (c) discrete tax expense on share-based

compensation, which would not have been incurred as share-based

compensation expense is removed from adjusted net income, of $55

and $236 for the three months ended September 30, 2024 and 2023,

respectively, and $2,527 and $3,977 for the nine months ended

September 30, 2024 and 2023, respectively. The remaining discrete

tax items mainly relate to the movement in uncertain tax provisions

relating to prior years.

(4)

Income tax expense on non-GAAP adjustments

reflects the tax expense on each taxable adjustment using the

current statutory tax rate of the applicable jurisdiction specific

to that adjustment.

Adjusted Net Income per Share

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Numerator ($ in thousands)

Adjusted net income - basic

$

31,372

$

35,272

$

102,957

$

103,026

Adjusted net income - diluted

$

31,372

$

35,272

$

102,957

$

103,026

Denominator (in millions)

Weighted average shares – basic

60.7

61.6

61.0

61.3

Adjusted weighted average shares – diluted

(1)

62.0

61.7

61.8

61.6

Adjusted net income per share

Basic

$

0.52

$

0.57

$

1.69

$

1.68

Diluted

$

0.51

$

0.57

$

1.67

$

1.67

(1)

The denominator used in the calculation of

diluted adjusted net income per share for the three and nine months

ended September 30, 2024 and 2023 includes the dilutive effect of

the Company's restricted stock units.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112141747/en/

Media Crystal Wright Paysafe +1 (904) 328-7740

crystal.wright@paysafe.com

Investors Kirsten Nielsen Paysafe +1 (646) 901-3140

kirsten.nielsen@paysafe.com

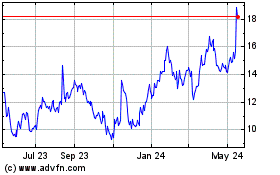

Paysafe (NYSE:PSFE)

Historical Stock Chart

From Dec 2024 to Jan 2025

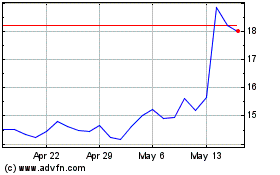

Paysafe (NYSE:PSFE)

Historical Stock Chart

From Jan 2024 to Jan 2025