PitchBook Recognizes RCP's Secondary and Co-investment Programs with Top Rankings

October 02 2024 - 11:13AM

RCP Advisors, a private equity investment firm that provides access

to North American small buyout fund managers through primary funds,

secondary funds, and co-investment funds, is pleased to announce

that its secondary family of funds (RCP SOF I-IV) was ranked among

the top ten secondary programs in PitchBook’s 2023 Global Manager

Performance Score League Tables. “Our top-performing strategy is a

result of our firm-wide commitment to the North American small

buyout market. Our laser focus gives us unique deal flow and

diligence opportunities. We’re extremely proud of what we’ve

achieved together at RCP,” said Jon Madorsky, Managing Partner and

Co-Portfolio Manager of Secondary Funds.

Additionally, RCP's co-investment program (RCPDirect I-IV) was

recognized with the highest performance score in PitchBook's

Manager Performance Scoring for the co-investments category. “We

are honored that our RCPDirect co-investment program has been

recognized by PitchBook with their top performance score. Our team

works hard to achieve these results, and I want to further thank

our GPs and their portfolio management teams, without which our

high-quality deal flow and operating performance would not be

possible,” said Dave McCoy, Managing Partner and Co-Portfolio

Manager of Co-investments.

ABOUT RCP ADVISORS

Founded in 2001, RCP Advisors, a subsidiary of P10, Inc. (NYSE:

PX), is a private equity investment firm that provides access to

North American small buyout fund managers through primary funds,

secondary funds, and co-investment funds, as well as customized

solutions and research services. RCP believes it is one of the

largest fund sponsors focused on this niche, with over $14.7

billion in committed capital* and 56 full-time professionals as of

September 30, 2024.

Past performance is not a guarantee of future

results. There can be no assurance that a fund will

achieve comparable results as any prior investments or prior

investment funds of RCP. Source: PitchBook. The PitchBook Manager

Performance Scores (the “Performance Scores”) are a third-party

rating published by PitchBook, an independent third-party, on

9/27/24 (data as of most current date). The PitchBook Global

Manager Performance Score League Tables (the "League Tables") are a

third-party rating published by PitchBook on July 30, 2024 (data as

of 12/31/2023). The Performance Scores are a quantitative framework

designed to assess the performance track record of a fund manager’s

closed-end private market strategies, also known as fund families.

The Performance Scores aggregate historical performance of each

manager’s family of funds across vintage years and reflect the

extent to which certain fund families outperformed or

underperformed a benchmark, which is based on IRR across all fund

vintages within the same fund strategy peer group (e.g.,

fund-of-funds, secondaries, co-investment, etc.). For the

“co-investment – general” fund strategy, a total of 768 fund

families across 1,479 funds were included in their evaluation.

To be included in the ranking, PitchBook required fund families

to have at least two funds with a Z-score to qualify. Comparisons

made by PitchBook are to fund sponsors with investment strategies,

structures and investment terms and conditions that are different

(in some cases, materially) than those of RCP. Additional

information regarding the criteria and methodology underlying the

Performance Scores are available

here: https://files.pitchbook.com/website/files/pdf/PitchBook_Manager_Performance_Scoring.pdf

RCP has not made any payment to PitchBook or any of its

affiliates to be considered for this ranking or in connection with

any other services. The Performance Scores should not be considered

an endorsement of RCP or its funds by the authors or distributors

of such rankings. The Performance Scores are developed on a

proprietary basis exclusively by PitchBook. RCP has not

independently verified the data used in PitchBook’s Performance

Scores and makes no representations about the accuracy or

completeness of such information or Performance Scores. This

ranking is not to be construed as indicative of RCP’s future

performance or the future performance of any investment vehicle

managed by RCP. The Performance Scores should not be relied upon

when making a decision to invest in any fund. *“Committed

capital” primarily reflects the capital commitments associated with

our SMAs, focused commingled funds, and advisory accounts advised

by RCP since the firm’s inception in 2001 (including funds that

have since been sold, dissolved, or wound down and certain

historical advisory accounts for which RCP’s advisory contracts

have expired). We include capital commitments in our calculation of

committed capital if (a) we have full discretion over the

investment decisions in an account or have responsibility or

custody of assets or (b) we do not have full discretion to make

investment decisions but play a role in advising the client on

asset allocation, performing investment manager due diligence and

recommending investments for the client’s portfolio and/or

monitoring and reporting on their investments. For our

discretionary SMAs and commingled funds, as well as for our

non-discretionary advisory accounts for which RCP is responsible

for advising on all investments within the client’s portfolio,

committed capital is calculated based on aggregate capital

commitments to such accounts. For non-discretionary accounts where

RCP is responsible for advising only a portion of the client

portfolio investments, committed capital is calculated as capital

commitments by the client to those underlying investments which

were made based on RCP’s recommendation or with respect to which

RCP advises the client. Committed capital does not include (i)

certain historical non-discretionary advisory accounts no longer

under advisement by RCP, (ii) assets managed or advised by the

Private Capital Unit or HB Units of RCP 2, (iii) capital

commitments to funds managed or sponsored by RCP’s affiliated (but

independently operated) management companies, and (iv) RCP’s

ancillary products or services.

rcpadvisors.com

rcp@rcpadvisors.com

312.266.7300

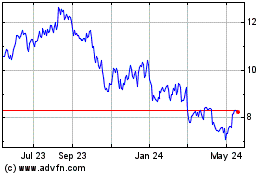

P10 (NYSE:PX)

Historical Stock Chart

From Dec 2024 to Jan 2025

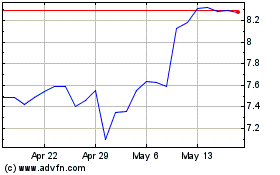

P10 (NYSE:PX)

Historical Stock Chart

From Jan 2024 to Jan 2025