Q2 Announces New Partnership with Alloy to Deliver Joint Fraud Monitoring Solution for Banks and Credit Unions

January 22 2025 - 9:00AM

Business Wire

Partnership empowers financial institutions to

manage their fraud posture by balancing proactive monitoring and

account holder experience

Q2 Holdings Inc. (NYSE: QTWO), a leading provider of digital

transformation solutions for financial services, today announced a

strategic partnership with Alloy, a leading identity and fraud

prevention platform provider, to deliver a joint ongoing fraud

monitoring solution for Q2 Digital Banking customers. Powered by

Alloy’s centralized identity decision engine for fraud detection

and prevention, this new solution addresses the growing need for

financial institutions to take control of their fraud monitoring

efforts while maintaining an engaging user experience and growing

their business.

Through this partnership, Q2 and Alloy will deliver a solution

that addresses ongoing fraud risks, such as account takeover and

peer-to-peer (P2P) payment fraud, that continuously threaten

financial institutions. According to Alloy’s upcoming 2025 State of

Fraud Benchmark Report one in three financial institutions lost

over $1 million to fraud last year. Additionally, account takeover

fraud was the most common fraud type by case volume identified by

mid-market banks and credit unions in 2024.

“The joint solution Q2 and Alloy are offering will go a long way

towards enabling financial institutions to prevent fraud without

hindering customer experiences, which is a very difficult thing to

do,” said Matt Quale, President of Digital Banking at Forbright

Bank. “I’m excited about this partnership’s ability to facilitate

business growth and mitigate fraud losses for banks and credit

unions.”

Alloy will serve as the centralized identity decision engine,

integrating Q2’s digital banking data, Q2 Innovation Studio, and

Alloy’s robust data partner network to help financial institutions

prevent more fraud. The ongoing fraud monitoring offering will be

the first solution to actively ingest user activity signals coupled

with fraud signals from multiple third-party data sources with the

ability to interdict in real time on risky activities that may

occur within the Q2 Digital Banking platform.

“We believe that successful fraud prevention starts with a

holistic approach to understanding identity,” said Parilee Wang,

Chief Product Officer at Alloy. “That means not just tracking the

suspicious movement of money, but also separating out the

identities of fraudsters from those of genuine customers. Our joint

solution with Q2 brings together the various data sources financial

institutions need to more clearly understand their customer so they

can better reduce criminal activity throughout the customer

lifecycle.”

By bringing together events in Q2 digital banking with

industry-leading third-party data vendors in Alloy's

identity-centric decisioning platform, the joint solution will

provide real-time digital banking user action risk assessments and

ongoing monitoring. The partnership will also help distinguish

genuine customers from the risky ones ensuring that genuine

customers benefit from a seamless digital banking experience while

strategically introducing healthy friction for riskier

customers.

Additionally, it will improve operational efficiency via

centralized decisioning and streamlined case management.

“This strategic partnership between Q2 and Alloy represents an

evolution in fraud prevention for financial institutions who

leverage Q2’s digital banking platform," said Jim Mortensen,

Strategic Advisor at Datos Insights. "By combining Q2's digital

banking platform with Alloy's identity-centric fraud prevention and

orchestration capabilities, Q2’s clients can leverage a more

dynamic approach to fraud detection. What makes this partnership

particularly compelling is the real-time risk assessment and

interdiction capabilities coupled with the ability for client FIs

to make timely modifications to their fraud detection processes

rapidly. This approach should help Q2 clients strike that crucial

balance between strong fraud prevention and maintaining the

seamless digital experience consumers expect."

“Banks and credit unions need scalable fraud solutions to combat

growing fraud threats while maintaining an engaging customer

experience,” said Jeff Scott, VP of fraudtech solutions at Q2. “Our

partnership with Alloy will enhance existing native fraud

monitoring capabilities within Q2 Digital Banking, providing a

scalable, flexible, and identity-centric approach to fraud

monitoring across digital channels. We are committed to

continuously empowering our customers to help them fight against

fraud and protect their account holders.”

To learn more about Alloy and Q2’s new solution, please visit

this link.

About Q2 Holdings, Inc.

Q2 is a leading provider of digital transformation solutions for

financial services, serving banks, credit unions, alternative

finance companies, and fintechs in the U.S. and internationally. Q2

enables its financial institution and fintech customers to provide

comprehensive, data-driven digital engagement solutions for

consumers, small businesses and corporate clients. Headquartered in

Austin, Texas, Q2 has offices worldwide and is publicly traded on

the NYSE under the stock symbol QTWO. To learn more, please visit

Q2.com. Follow us on LinkedIn and X to stay up to date.

About Alloy

Alloy provides an Identity and Fraud Prevention Platform that

enables global financial institutions and fintechs to manage

identity risk so they can grow with confidence. Over 600 of the

world’s largest financial institutions and fintechs turn to Alloy’s

end-to-end platform to access actionable intelligence and the

broadest network of data sources across the industry, as well as

stay ahead of fraud, credit, and compliance risks. Founded in 2015,

Alloy is powering the delivery of great financial products to more

customers around the world.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250122773860/en/

Media Contact Maria Gari Q2 Holdings, Inc.

Maria.gari@q2.com 315-657-0041

Alloy Larissa Padden 202-841-4419

Larissa.Padden@Cognitomedia.com

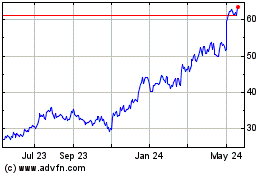

Q2 (NYSE:QTWO)

Historical Stock Chart

From Jan 2025 to Feb 2025

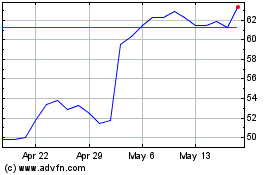

Q2 (NYSE:QTWO)

Historical Stock Chart

From Feb 2024 to Feb 2025