Q2 Helps 4Front Credit Union Boost Primacy and Member Satisfaction

January 14 2025 - 9:00AM

Business Wire

Q2’s industry-leading digital banking platform

strengthens member engagement for 4Front Credit Union, increasing

monthly logins to over one million

Q2 Holdings, Inc. (NYSE: QTWO), a leading provider of digital

transformation solutions for financial services, today announced it

has enabled 4Front Credit Union (“4Front”) to transform its digital

banking experience for its 100,000 members and successfully grow

its annual loan volume by $60 million.

4Front, a Michigan-based credit union with more than $1 billion

in assets, has successfully modernized its previous systems to

deliver a differentiated digital banking experience, operational

excellence and improved member engagement and loyalty. The credit

union also leverages Q2 Innovation Studio to provide members with

access to popular fintech solutions directly within the digital

banking app, eliminating the need for members to go to third-party

sources.

“Our partnership with Q2 not only helps us build credibility

with our members; it increases primacy,” said 4Front Credit Union

CEO Andy Kempf. “For us, deepening the end-user experience by

providing our members with the solutions they need is critical and

ultimately helps us foster stronger member engagement. Today, our

members know they don’t need to go elsewhere because we’re keeping

pace with their expectations.”

4Front leverages pre-built fintech solution integrations such as

SavvyMoney through Q2 Innovation Studio and also integrates

third-party fintech solutions, like QCash, into its digital banking

experience through Q2 Innovation Studio’s robust, award-winning

SDK. Doing so has enabled the credit union to offer valuable

financial wellness solutions directly to its members and generate

significant growth in loan volume without requiring additional

marketing or overhead investment. As a result, member engagement

and satisfaction has increased with more than a million monthly

logins.

“In today’s environment, speed to market is critical. By

providing members with access to the fintech solutions directly

through the digital banking platform, financial institutions can

quickly and more fully serve their account holders’ financial

needs,” said Anthony Ianniciello, vice president of Product

Management, Q2. “We are committed to empowering 4Front Credit

Union’s continued success as they strive to meet the growing

demands of their members.”

To learn more about 4Front’s partnership with Q2, read the case

study here.

To learn more about the Q2 Innovation Studio, click here.

About Q2 Holdings, Inc.

Q2 is a leading provider of digital transformation solutions for

financial services, serving banks, credit unions, alternative

finance companies, and fintechs in the U.S. and internationally. Q2

enables its financial institutions and fintech companies to provide

comprehensive, data-driven digital engagement solutions for

consumers, small businesses and corporate clients. Headquartered in

Austin, Texas, Q2 has offices worldwide and is publicly traded on

the NYSE under the stock symbol QTWO. To learn more, please visit

Q2.com. Follow us on LinkedIn and X to stay up to date.

About 4Front Credit Union

Celebrating over 70 years in Michigan, 4Front Credit Union

serves over 100,000 members, with assets of over $1 billion and 20

locations. As a not-for-profit cooperative, 4Front prides itself on

making banking smart and simple for its members, wherever they are

on their financial journey. Membership eligibility is open to

anyone who lives, works, attends school, or worships in Michigan.

Visit www.4frontcu.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250114911000/en/

MEDIA CONTACTS

Carly Baker Q2 Holdings, Inc. carly.baker@q2.com

210-391-1706

Rob Marsh 4Front Credit Union rmarsh@4frontcu.com

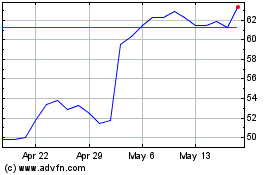

Q2 (NYSE:QTWO)

Historical Stock Chart

From Dec 2024 to Jan 2025

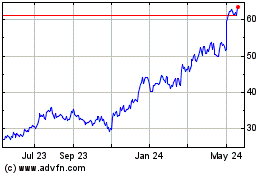

Q2 (NYSE:QTWO)

Historical Stock Chart

From Jan 2024 to Jan 2025