New report reveals combating payment fraud,

strengthening client relationships and enhancing commercial banking

experience are top trends for financial institutions

Q2 Holdings, Inc. (NYSE:QTWO), a leading provider of digital

transformation solutions for financial services, announced today it

has released its State of Commercial Banking January 2025 Market

Analysis report. Key findings from the annual report reveal major

trends in the commercial banking industry, in addition to the

challenges and opportunities banks and credit unions will face in

the coming year.

“The commercial banking industry demonstrated resilience and

adaptability in 2024, successfully rebuilding liquidity to near

pre-crisis levels,” said Q2’s Senior Strategic Business Advisor

Gita Thollesson. “2025 will present its own challenges and

opportunities, including combating payment fraud and strengthening

primacy in a competitive digital landscape. For banks and credit

unions to maintain their edge, they should strategically leverage

digital offerings to enhance profitability and meet customer

demands for efficiency and innovation.”

This report is based on findings from Q2 PrecisionLender’s

proprietary database of 2024 commercial lending deal flow, along

with economic data from several public sources, including the

Federal Deposit Insurance Corporation (FDIC) and Federal Reserve,

and industry research. Q2 PrecisionLender data reflects commercial

relationships from more than 140 geographically diverse banks and

credit unions in North America, ranging in size from small

community banks to top 10 U.S. institutions. This report also

references data from Q2’s Centrix Exact TMS positive pay solution

and live polling conducted during Q2 webinars in 2024.

Key Takeaways from the Report:

- Liquidity has improved but has become more costly, squeezing

net interest margins – Financial institutions have emerged from

the liquidity crisis with a solid foundation of deposits,

approaching pre-crisis levels.

- Federal Reserve rate cuts have reshaped the commercial loan

pricing landscape – The 100 basis points in Federal Reserve

rate cuts between September and December 2024 contributed to a

shallowing of the inverted yield curve, with short-term rates

declining while mid-term rates spiked.

- Pockets of credit stress reside in the commercial real

estate sector – Credit performance has exceeded expectations

across much of the market, with only a modest increase in

delinquencies and a decline in commercial and industrial (C&I)

downgrades.

- Fraud continues to concern bank and credit union executives

– By embracing collaboration, advanced technologies like AI,

and a centralized approach, banks and credit unions can be a strong

ally for business customers in the ongoing battle against

fraud.

- Data and digital technology drive the acquisition and growth

of small business relationships – The underserved small and

medium-sized business (SMB) market presents an opportunity for

banks and credit unions to grow deposits.

- Efficiency and user experience are becoming even more

pivotal for midsize and large companies – Commercial clients

are looking to their banks and credit unions to help them manage

their business more efficiently.

Click here to download the 2025 State of Commercial Banking

Market Analysis report.

For additional insights related to the report, listen to Q2

senior strategic business advisor and report co-author Anna-Fay

Lohn’s episode on The Purposeful Banker podcast, and watch the

recording of Q2’s annual State of Commercial Banking webinar.

To learn more about how Q2 delivers simple, smart, end-to-end

banking and lending solutions for commercial financial

institutions, visit https://www.q2.com/commercial.

About Q2 Holdings, Inc.

Q2 is a leading provider of digital transformation solutions for

financial services, serving banks, credit unions, alternative

finance companies, and fintechs in the U.S. and internationally. Q2

enables its financial institutions and fintech customers to provide

comprehensive, data-driven digital engagement solutions for

consumers, small businesses and corporate clients. Headquartered in

Austin, Texas, Q2 has offices worldwide and is publicly traded on

the NYSE under the stock symbol QTWO. To learn more, please visit

Q2.com. Follow us on LinkedIn and X to stay up to date.

Forward-looking Statements

This press release and the report referenced herein contains

forward-looking statements, including statements about: anticipated

challenges and opportunities in 2025, including combating payment

fraud and strengthening primacy in a competitive digital landscape;

requirements for financial institutions to remain competitive;

improved liquidity, with increased costs and tighter net interest

margins; the effects of interest rate cuts on commercial lending;

credit stress levels across the market; increased fraud and ways to

combat it; opportunities for data and digital technology within the

SMB market; and, the increased importance of efficiency and user

experience. The forward-looking statements contained in this press

release are based upon our historical performance and our current

plans, estimates, and expectations and are not a representation

that such plans, estimates or expectations will be achieved.

Factors that could cause actual results to differ materially from

those described herein include risks related to: (a) global

economic uncertainties and challenges or changes in the financial

services industry and credit markets, including as a result of

recent bank failures, mergers and acquisitions within the banking

sector, inflation, higher and shifting interest rates and any

potential financial regulations and their potential impacts on our

prospects' and customers' operations, the timing of prospect and

customer implementations and purchasing decisions, our business

sales cycles and on account holder or end user, or End User, usage

of our solutions; (b) the risk of increased or new competition in

our existing markets and as we enter new markets or new segments of

existing markets, or as we offer new solutions; (c) the risks

associated with the development of our solutions, including

artificial intelligence, or AI, based solutions, and changes to the

market for our solutions compared to our expectations; (d)

quarterly fluctuations in our operating results relative to our

expectations and guidance and the accuracy of our forecasts; (e)

the risks and increased costs associated with managing growth and

global operations, including hiring, training, retaining and

motivating employees to support such growth, particularly in light

of recent macroeconomic challenges, including increased competition

for talent, employee turnover, labor shortages and wage inflation;

(f) the risks associated with our transactional business which are

typically driven by End User behavior and can be influenced by

external drivers outside of our control; (g) the risks associated

with effectively managing our business and cost structure in an

uncertain economic environment, including as a result of challenges

in the financial services industry and the effects of seasonality

and unexpected trends; (h) the risks associated with geopolitical

uncertainties, including the heightened risk of state-sponsored

cyberattacks or cyber fraud on financial services and other

critical infrastructure, and political uncertainty or discord,

including related to the 2024 U.S. presidential election; (i) the

risks associated with accurately forecasting and managing the

impacts of any economic downturn or challenges in the financial

services industry on our customers and their End Users, including

in particular the impacts of any downturn on financial technology

companies, or FinTechs, or alternative finance companies, or

Alt-FIs, and our arrangements with them, which represent a newer

market opportunity for us, a more complex revenue model for us and

which may be more vulnerable to an economic downturn than our

financial institution customers; (j) the challenges and costs

associated with selling, implementing and supporting our solutions,

particularly for larger customers with more complex requirements

and longer implementation processes, including risks related to the

timing and predictability of sales of our solutions and the impact

that the timing of bookings may have on our revenue and financial

performance in a period; (k) the risk that errors, interruptions or

delays in our solutions or Web hosting negatively impacts our

business and sales; (l) the risks associated with cyberattacks,

financial transaction fraud, data and privacy breaches and breaches

of security measures within our products, systems and

infrastructure or the products, systems and infrastructure of third

parties upon which we rely and the resultant costs and liabilities

and harm to our business and reputation and our ability to sell our

solutions; (m) the difficulties and risks associated with

developing and selling complex new solutions and enhancements,

including those using AI with the technical and regulatory

specifications and functionality required by our customers and

relevant governmental authorities; (n) risks associated with

operating within and selling into a regulated industry, including

risks related to evolving regulation of AI and machine learning,

the receipt, collection, storage, processing and transfer of data

and increased regulatory scrutiny in financial technology and

related services, including specifically on banking-as-a-service,

or BaaS, services; (o) the risks associated with our sales and

marketing capabilities, including partner relationships and the

length, cost and unpredictability of our sales cycle; (p) the risks

inherent in third-party technology and implementation partnerships

that could cause harm to our business; (q) the risk that we will

not be able to maintain historical contract terms such as pricing

and duration; (r) the general risks associated with the complexity

of our customer arrangements and our solutions; (s) the risks

associated with integrating acquired companies and successfully

selling and maintaining their solutions; (t) litigation related to

intellectual property and other matters and any related claims,

negotiations and settlements; (u) the risks associated with further

consolidation in the financial services industry; (v) the risks

associated with selling our solutions internationally and with the

continued expansion of our international operations; and (w) the

risk that our debt repayment obligations may adversely affect our

financial condition and that we may not be able to obtain capital

when desired or needed on favorable terms.

Additional information relating to the uncertainty affecting the

Q2 business is contained in Q2's filings with the Securities and

Exchange Commission. These documents are available on the SEC

Filings section of the Investor Relations section of Q2's website

at http://investors.Q2.com/. These forward-looking statements

represent Q2's expectations as of the date of this press release.

Subsequent events may cause these expectations to change, and Q2

disclaims any obligations to update or alter these forward-looking

statements in the future, whether as a result of new information,

future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250130547921/en/

MEDIA CONTACT Carly Baker Q2 Holdings, Inc. +1

210-391-1706 Carly.baker@q2.com

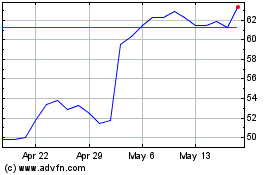

Q2 (NYSE:QTWO)

Historical Stock Chart

From Jan 2025 to Feb 2025

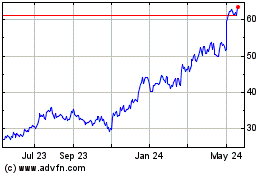

Q2 (NYSE:QTWO)

Historical Stock Chart

From Feb 2024 to Feb 2025