false000010182900001018292025-01-282025-01-280000101829us-gaap:CommonStockMember2025-01-282025-01-280000101829rtx:Notes2.150Due2030Member2025-01-282025-01-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________

FORM 8-K

____________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 28, 2025

____________________________________

RTX CORPORATION

(Exact name of registrant as specified in its charter)

____________________________________ | | | | | | | | |

| Delaware | 001-00812 | 06-0570975 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | |

| 1000 Wilson Boulevard, | Arlington, | Virginia | 22209 |

(Address of principal executive offices, including zip code)

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | |

| Title of each class | Trading Symbol(s) | | Name of each exchange on which registered |

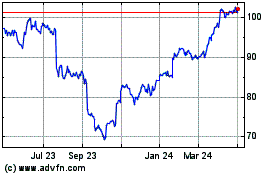

| Common Stock ($1 par value) | RTX | | New York Stock Exchange |

| (CUSIP 75513E 101) | | | |

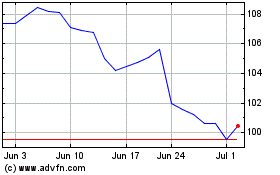

| 2.150% Notes due 2030 | RTX 30 | | New York Stock Exchange |

| (CUSIP 75513E AB7) | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Section 2—Financial Information

Item 2.02. Results of Operations and Financial Condition.

On January 28, 2025, RTX Corporation (the “Company”) issued a press release announcing its fourth quarter 2024 results.

The press release issued January 28, 2025 is furnished herewith as Exhibit No. 99 to this Report, and shall not be deemed filed for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section and shall not be deemed to be incorporated by reference into any filing by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Section 9—Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. | | | | | |

Exhibit Number | Exhibit Description |

| |

| |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | |

| RTX CORPORATION |

| (Registrant) |

| | |

Date: January 28, 2025 | By: | /s/ NEIL G. MITCHILL JR. |

| | Neil G. Mitchill Jr. |

| | Executive Vice President and Chief Financial Officer |

| | | | | | | | |

| | |

| Media Contact |

| 202.384.2474 |

| |

| Investor Contact |

| | 781.522.5123 |

RTX Reports 2024 Results and Announces 2025 Outlook

RTX exceeds 2024 sales and EPS expectations*;

Expects continued sales, earnings, and cash flow growth in 2025

ARLINGTON, Va., January 28, 2025 – RTX (NYSE: RTX) reports fourth quarter 2024 results and announces 2025 outlook.

Fourth quarter 2024

•Sales of $21.6 billion, up 9 percent versus prior year, and up 11 percent organically* excluding divestitures

•GAAP EPS was $1.10 and included $0.30 of acquisition accounting adjustments and $0.14 of restructuring and other net significant and/or non-recurring charges

•Adjusted EPS* of $1.54, up 19 percent versus prior year

•Operating cash flow of $1.6 billion; free cash flow* of $0.5 billion

•Company backlog of $218 billion; including $125 billion of commercial and $93 billion of defense

•Returned $852 million of capital to shareowners

Full year 2024

•Reported sales of $80.7 billion

•Adjusted sales* of $80.8 billion, up 9 percent versus prior year, and up 11 percent organically* excluding divestitures

•GAAP EPS was $3.55 and included $1.20 of acquisition accounting adjustments and $0.98 of restructuring and other net significant and/or non-recurring charges

•Adjusted EPS* of $5.73, up 13 percent versus prior year

•Operating cash flow of $7.2 billion; free cash flow* of $4.5 billion

•Returned $3.7 billion of capital to shareowners, returning over $33 billion since the merger

Outlook for full year 2025

•Adjusted sales* of $83.0 - $84.0 billion, including 4 to 6 percent organic growth*

•Adjusted EPS* of $6.00 - $6.15

•Free cash flow* of $7.0 - $7.5 billion

“RTX delivered a very strong year of performance in 2024 with 11 percent organic sales growth* and 13 percent adjusted EPS growth*, including segment margin expansion* in all three businesses,” said RTX President and CEO Chris Calio.

1

*Adjusted net sales (also referred to as adjusted sales), organic sales, adjusted operating profit (loss) and margin, adjusted segment operating profit (loss) and margin, adjusted net income, adjusted earnings per share (“EPS”), adjusted effective tax rate and free cash flow are non-GAAP financial measures. When we provide our expectation for adjusted net sales (also referred to as adjusted sales), adjusted EPS and free cash flow on a forward-looking basis, a reconciliation of these non-GAAP financial measures to the corresponding GAAP measures (expected diluted EPS and expected cash flow from operations) is not available without unreasonable effort due to potentially high variability, complexity, and low visibility as to the items that would be excluded from the GAAP measure in the relevant future period, such as unusual gains and losses, the ultimate outcome of pending litigation, fluctuations in foreign currency exchange rates, the impact and timing of potential acquisitions and divestitures, and other structural changes or their probable significance. The variability of the excluded items may have a significant, and potentially unpredictable, impact on our future GAAP results. See “Use and Definitions of Non-GAAP Financial Measures” below for information regarding non-GAAP financial measures.

.

“We have strong momentum heading into 2025 with a $218 billion backlog and unprecedented demand for our products and solutions. We remain focused on advancing our strategic priorities of executing on our commitments, innovating for growth and harnessing the breadth and scale of RTX, giving us confidence in our 2025 financial outlook.”

Fourth quarter 2024

RTX reported fourth quarter sales of $21.6 billion, up 9 percent over the prior year. GAAP EPS of $1.10 included $0.30 of acquisition accounting adjustments, $0.05 of restructuring, and $0.09 of other net significant and/or non-recurring charges. Adjusted EPS* of $1.54 was up 19 percent versus the prior year.

The company reported net income attributable to common shareowners in the fourth quarter of $1.5 billion which included $408 million of acquisition accounting adjustments, $61 million of restructuring, and $120 million of other net significant and/or non-recurring charges. Adjusted net income* of $2.1 billion was up 18 percent versus the prior year driven by growth in adjusted segment operating profit*, partially offset by higher taxes and lower pension income. Operating cash flow in the fourth quarter was $1.6 billion. Capital expenditures were $1.1 billion, resulting in free cash flow* of $0.5 billion.

Summary Financial Results – Operations Attributable to Common Shareowners | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 4th Quarter | | Twelve Months |

| ($ in millions, except EPS) | 2024 | | 2023 | % Change | | 2024 | | 2023 | % Change |

| Reported | | | | | | | | | | |

| Sales | $ | 21,623 | | | $ | 19,927 | | 9 | % | | $ | 80,738 | | | $ | 68,920 | | 17 | % |

| Net Income | $ | 1,482 | | | $ | 1,426 | | 4 | % | | $ | 4,774 | | | $ | 3,195 | | 49 | % |

| EPS | $ | 1.10 | | | $ | 1.05 | | 5 | % | | $ | 3.55 | | | $ | 2.23 | | 59 | % |

| | | | | | | | | | |

| Adjusted* | | | | | | | | | | |

| Sales | $ | 21,623 | | | $ | 19,824 | | 9 | % | | $ | 80,808 | | | $ | 74,305 | | 9 | % |

| Net Income | $ | 2,071 | | | $ | 1,753 | | 18 | % | | $ | 7,705 | | | $ | 7,263 | | 6 | % |

| EPS | $ | 1.54 | | | $ | 1.29 | | 19 | % | | $ | 5.73 | | | $ | 5.06 | | 13 | % |

| | | | | | | | | | |

| Operating Cash Flow | | $ | 1,561 | | | $ | 4,711 | | (67) | % | | $ | 7,159 | | | $ | 7,883 | | (9) | % |

| Free Cash Flow* | | $ | 492 | | | $ | 3,906 | | (87) | % | | $ | 4,534 | | | $ | 5,468 | | (17) | % |

| | | | | | | | | | |

Segment Results

Collins Aerospace | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 4th Quarter | | Twelve Months |

| ($ in millions) | 2024 | | 2023 | % Change | | 2024 | | 2023 | % Change |

| Reported | | | | | | | | | | | |

| Sales | $ | 7,537 | | | $ | 7,120 | | 6 | % | | | $ | 28,284 | | | $ | 26,253 | | 8 | % | |

| Operating Profit | $ | 1,106 | | | $ | 1,126 | | (2) | % | | | $ | 4,135 | | | $ | 3,825 | | 8 | % | |

| ROS | 14.7 | % | | 15.8 | % | (110) | | bps | | 14.6 | % | | 14.6 | % | — | | bps |

| | | | | | | | | | | |

| Adjusted* | | | | | | | | | | | |

| Sales | $ | 7,537 | | | $ | 7,008 | | 8 | % | | | $ | 28,284 | | | $ | 26,198 | | 8 | % | |

| Operating Profit | $ | 1,207 | | | $ | 1,035 | | 17 | % | | | $ | 4,496 | | | $ | 3,896 | | 15 | % | |

| ROS | 16.0 | % | | 14.8 | % | 120 | | bps | | 15.9 | % | | 14.9 | % | 100 | | bps |

| |

Collins Aerospace had fourth quarter 2024 reported sales of $7,537 million, up 6 percent versus the prior year. The increase in sales was driven by a 13 percent increase in defense and a 12 percent increase in commercial aftermarket, partially offset by a 6 percent decrease in commercial OE. The increase in defense sales was driven by higher volume across multiple programs and platforms, including new programs awarded in 2024. The increase in commercial aftermarket sales was driven by continued growth in commercial air traffic, and the decrease in commercial OE sales was driven by lower narrow-body volume. Adjusted sales* of $7,537 million, were up 8 percent versus the prior year.

Collins Aerospace reported operating profit of $1,106 million, down 2 percent versus the prior year. This included a $155 million charge related to the impairment of contract fulfillment costs which was partially offset by a $99 million gain on the sale of the Hoist & Winch business. Q4 2023 included a benefit of $112 million from a customer settlement. On an adjusted basis, operating profit* of $1,207 million was up 17 percent versus the prior year. Operationally, the increase was driven by drop through on higher commercial aftermarket and defense volume, which was partially offset by lower commercial OE volume and unfavorable commercial OE mix.

Pratt & Whitney | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 4th Quarter | | Twelve Months |

| ($ in millions) | 2024 | | 2023 | % Change | | 2024 | | 2023 | % Change |

| Reported | | | | | | | | | | | |

| Sales | $ | 7,569 | | | $ | 6,439 | | 18 | % | | | $ | 28,066 | | | $ | 18,296 | | NM | |

| Operating Profit (loss) | $ | 504 | | | $ | 382 | | 32 | % | | | $ | 2,015 | | | $ | (1,455) | | NM | |

| ROS | 6.7 | % | | 5.9 | % | 80 | | bps | | 7.2 | % | | (8.0) | % | NM | |

| | | | | | | | | | | |

| Adjusted* | | | | | | | | | | | |

| Sales | $ | 7,569 | | | $ | 6,439 | | 18 | % | | | $ | 28,066 | | | $ | 23,697 | | 18 | % | |

| Operating Profit | $ | 717 | | | $ | 405 | | 77 | % | | | $ | 2,281 | | | $ | 1,688 | | 35 | % | |

| ROS | 9.5 | % | | 6.3 | % | 320 | | bps | | 8.1 | % | | 7.1 | % | 100 | | bps |

| |

NM = Not Meaningful

Pratt & Whitney had fourth quarter 2024 reported and adjusted sales of $7,569 million, up 18 percent versus the prior year. The increase was driven by a 31 percent increase in commercial OE, a 17 percent increase in

commercial aftermarket, and an 8 percent increase in military. The increase in commercial sales was driven by increased deliveries and favorable OE mix in Large Commercial Engines, and higher commercial aftermarket volume. The increase in military sales was driven by higher volume on F135 production, the F135 Engine Core Upgrade program, and F135 sustainment, which was partially offset by lower sustainment volume across legacy platforms, including the F100 and F117.

Pratt & Whitney reported operating profit of $504 million, up 32 percent versus the prior year. The increase was driven by favorable volume and mix in Large Commercial Engines OE, favorable mix in Pratt Canada aftermarket, and drop through on higher commercial aftermarket and military volume. Pratt & Whitney also benefited from an approximately $70 million insurance recovery. Reported operating profit included a $157 million charge related to a customer bankruptcy. On an adjusted basis, operating profit* of $717 million, was up 77 percent versus the prior year.

Raytheon | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 4th Quarter | | Twelve Months |

| ($ in millions) | 2024 | | 2023 | % Change | | 2024 | | 2023 | % Change |

| Reported | | | | | | | | | | | |

| Sales | $ | 7,157 | | | $ | 6,886 | | 4 | % | | | $ | 26,713 | | | $ | 26,350 | | 1 | % | |

| Operating Profit | $ | 824 | | | $ | 604 | | 36 | % | | | $ | 2,594 | | | $ | 2,379 | | 9 | % | |

| ROS | 11.5 | % | | 8.8 | % | 270 | | bps | | 9.7 | % | | 9.0 | % | 70 | | bps |

| | | | | | | | | | | |

| Adjusted* | | | | | | | | | | | |

| Sales | $ | 7,157 | | | $ | 6,886 | | 4 | % | | | $ | 26,783 | | | $ | 26,350 | | 2 | % | |

| Operating Profit | $ | 728 | | | $ | 618 | | 18 | % | | | $ | 2,728 | | | $ | 2,434 | | 12 | % | |

| ROS | 10.2 | % | | 9.0 | % | 120 | | bps | | 10.2 | % | | 9.2 | % | 100 | | bps |

Raytheon had fourth quarter 2024 reported and adjusted sales of $7,157 million, up 4 percent versus the prior year. The increase in sales was driven by higher volume on land and air defense systems, including Global Patriot, NASAMS and counter-UAS programs, as well as higher volume from the restart of contracts with a Middle East customer. This was partially offset by the impact from the divestiture of the Cybersecurity, Intelligence and Services business completed in the first quarter of 2024 and lower volume on air and space defense systems. Excluding the impact of the divestiture, sales were up 10 percent versus the prior year*.

Raytheon reported operating profit of $824 million, up 36 percent versus the prior year. The increase was driven by drop through on higher volume, improved net productivity, and favorable mix which was partially offset by the impact from the divestiture of the Cybersecurity, Intelligence and Services business. Reported operating profit included a $102 million benefit related to reserve adjustments associated with the restart of contracts with a Middle East customer. On an adjusted basis, operating profit* of $728 million was up 18 percent versus the prior year.

About RTX

RTX is the world's largest aerospace and defense company. With more than 185,000 global employees, we push the limits of technology and science to redefine how we connect and protect our world. Through industry-leading businesses – Collins Aerospace, Pratt & Whitney, and Raytheon – we are advancing aviation, engineering

integrated defense systems for operational success, and developing next-generation technology solutions and manufacturing to help global customers address their most critical challenges. The company, with 2024 sales of more than $80 billion, is headquartered in Arlington, Virginia.

Conference Call on the Fourth Quarter 2024 Financial Results

RTX’s financial results conference call will be held on Tuesday, January 28, 2025 at 8:30 a.m. ET. The conference call will be webcast live on the company's website at www.rtx.com and will be available for replay following the call. The corresponding presentation slides will be available for downloading prior to the call.

Use and Definitions of Non-GAAP Financial Measures

RTX Corporation (“RTX” or “the Company”) reports its financial results in accordance with accounting principles generally accepted in the United States (“GAAP”). We supplement the reporting of our financial information determined under GAAP with certain non-GAAP financial information. The non-GAAP information presented provides investors with additional useful information but should not be considered in isolation or as substitutes for the related GAAP measures. We believe that these non-GAAP measures provide investors with additional insight into the Company’s ongoing business performance. Other companies may define non-GAAP measures differently, which limits the usefulness of these measures for comparisons with such other companies. We encourage investors to review our financial statements and publicly-filed reports in their entirety and not to rely on any single financial measure. A reconciliation of the non-GAAP measures to the corresponding amounts prepared in accordance with GAAP appears in the tables in this Appendix. Certain non-GAAP financial adjustments are also described in this Appendix. Below are our non-GAAP financial measures:

| | | | | |

Non-GAAP measure | Definition |

Adjusted net sales / Adjusted sales | Represents consolidated net sales (a GAAP measure), excluding net significant and/or non-recurring items1 (hereinafter referred to as “net significant and/or non-recurring items”). |

Organic sales | Organic sales represents the change in consolidated net sales (a GAAP measure), excluding the impact of foreign currency translation, acquisitions and divestitures completed in the preceding twelve months and net significant and/or non-recurring items. |

Adjusted operating profit (loss) and margin

| Adjusted operating profit (loss) represents operating profit (loss) (a GAAP measure), excluding restructuring costs, acquisition accounting adjustments and net significant and/or non-recurring items. Adjusted operating profit margin represents adjusted operating profit (loss) as a percentage of adjusted net sales. |

Segment operating profit (loss) and margin

| Segment operating profit (loss) represents operating profit (loss) (a GAAP measure) excluding Acquisition Accounting Adjustments2, the FAS/CAS operating adjustment3, Corporate expenses and other unallocated items, and Eliminations and other. Segment operating profit margin represents segment operating profit (loss) as a percentage of segment sales (net sales, excluding Eliminations and other). |

Adjusted segment sales | Represents consolidated net sales (a GAAP measure) excluding eliminations and other and net significant and/or non-recurring items. |

Adjusted segment operating profit (loss) and margin

| Adjusted segment operating profit (loss) represents segment operating profit (loss) excluding restructuring costs, and net significant and/or non-recurring items. Adjusted segment operating profit margin represents adjusted segment operating profit (loss) as a percentage of adjusted segment sales (adjusted net sales excluding Eliminations and other). |

Adjusted net income | Adjusted net income represents net income (a GAAP measure), excluding restructuring costs, acquisition accounting adjustments and net significant and/or non-recurring items. |

| | | | | |

Adjusted earnings per share (EPS) | Adjusted EPS represents diluted earnings per share (a GAAP measure), excluding restructuring costs, acquisition accounting adjustments and net significant and/or non-recurring items. |

| Adjusted effective tax rate | Adjusted effective tax rate represents the effective tax rate (a GAAP measure), excluding the tax impact of restructuring costs, acquisition accounting adjustments and net significant and/or non-recurring items. |

Free cash flow

| Free cash flow represents cash flow from operations (a GAAP measure) less capital expenditures. Management believes free cash flow is a useful measure of liquidity and an additional basis for assessing RTX’s ability to fund its activities, including the financing of acquisitions, debt service, repurchases of RTX’s common stock and distribution of earnings to shareowners. |

1 Net significant and/or non-recurring items represent significant nonoperational items and/or significant operational items that may occur at irregular intervals.

2 Acquisition Accounting Adjustments include the amortization of acquired intangible assets related to acquisitions, the amortization of the property, plant and equipment fair value adjustment acquired through acquisitions, the amortization of customer contractual obligations related to loss making or below market contracts acquired, and goodwill impairment, if applicable.

3 The FAS/CAS operating adjustment represents the difference between the service cost component of our pension and postretirement benefit (PRB) expense under the Financial Accounting Standards (FAS) requirements of GAAP and our pension and PRB expense under U.S. government Cost Accounting Standards (CAS) primarily related to our Raytheon segment.

When we provide our expectation for adjusted net sales (also referred to as adjusted sales), organic sales, adjusted operating profit (loss) and margin, adjusted segment operating profit (loss) and margin, adjusted EPS, adjusted effective tax rate, and free cash flow, on a forward-looking basis, a reconciliation of the differences between the non-GAAP expectations and the corresponding GAAP measures, as described above, generally are not available without unreasonable effort due to potentially high variability, complexity, and low visibility as to the items that would be excluded from the GAAP measure in the relevant future period, such as unusual gains and losses, the ultimate outcome of pending litigation, fluctuations in foreign currency exchange rates, the impact and timing of potential acquisitions and divestitures, and other structural changes or their probable significance. The variability of the excluded items may have a significant, and potentially unpredictable, impact on our future GAAP results.

Cautionary Statement Regarding Forward-Looking Statements This press release contains statements which, to the extent they are not statements of historical or present fact, constitute “forward-looking statements” under the securities laws. From time to time, oral or written forward-looking statements may also be included in other information released to the public. These forward-looking statements are intended to provide RTX Corporation (“RTX”) management’s current expectations or plans for our future operating and financial performance, based on assumptions currently believed to be valid and are not statements of historical fact. Forward-looking statements can be identified by the use of words such as “believe,” “expect,” “expectations,” “plans,” “strategy,” “prospects,” “estimate,” “project,” “target,” “anticipate,” “will,” “should,” “see,” “guidance,” “outlook,” “goals,” “objectives,” “confident,” “on track,” “designed to, ” “commit,” “commitment” and other words of similar meaning. Forward-looking statements may include, among other things, statements relating to future sales, earnings, cash flow, results of operations, uses of cash, share repurchases, tax payments and rates, research and development spending, cost savings, other measures of financial performance, potential future plans, strategies or transactions, credit ratings and net indebtedness, the Pratt powder metal matter and related matters and activities, including without limitation other engine models that may be impacted, the merger (the “merger”) between United Technologies Corporation (“UTC”) and Raytheon Company (“Raytheon”) or the spin-offs by UTC of Otis Worldwide Corporation and Carrier Global Corporation into separate independent companies (the “separation transactions”) in 2020, the pending disposition of Collins’ actuation and flight control business, targets and commitments (including for share repurchases or otherwise), and other statements that are not solely historical facts. All forward-looking statements involve risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied in the forward-looking statements. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the U.S. Private Securities Litigation Reform Act of 1995. Such risks, uncertainties and other factors include, without limitation: (1) the effect of changes in economic, capital market and political conditions in the U.S. and globally, such as from the global sanctions and export controls with respect to Russia, and any changes therein, and including changes related to

financial market conditions, banking industry disruptions, fluctuations in commodity prices or supply (including energy supply), inflation, interest rates and foreign currency exchange rates, disruptions in global supply chain and labor markets, levels of consumer and business confidence, the imposition of tariffs, and geopolitical risks, including, without limitation, in the Middle East and Ukraine; (2) risks associated with U.S. government sales, including changes or shifts in defense spending due to budgetary constraints, spending cuts resulting from sequestration, a continuing resolution, a government shutdown, the debt ceiling or measures taken to avoid default, or otherwise, and uncertain funding of programs; (3) risks relating to our performance on our contracts and programs, including our ability to control costs, the mix of our contracts and programs, and our inability to pass some or all of our costs on fixed price contracts to the customer, and risks related to our dependence on U.S. government approvals for international contracts; (4) challenges in the development, certification, production, delivery, support and performance of RTX advanced technologies and new products and services and the realization of the anticipated benefits (including our expected returns under customer contracts), as well as the challenges of operating in RTX’s highly-competitive industries both domestically and abroad; (5) risks relating to RTX’s reliance on U.S. and non-U.S. suppliers and commodity markets, including the effect of sanctions, tariffs, delays and disruptions in the delivery of materials and services to RTX or its suppliers and cost increases; (6) risks relating to RTX international operations from, among other things, changes in trade policies and implementation of sanctions, foreign currency fluctuations, economic conditions, political factors, sales methods, U.S. or local government regulations, and our dependence on U.S. government approvals for international contracts; (7) the condition of the aerospace industry; (8) potential changes in policy positions or priorities that emerge from the incoming U.S. presidential administration, including changes in DoD policies or priorities; (9) the ability of RTX to attract, train qualify, and retain qualified personnel and maintain its culture and high ethical standards, and the ability of our personnel to continue to operate our facilities and businesses around the world; (10) the scope, nature, timing and challenges of managing acquisitions, investments, divestitures (including the pending disposition of Collins' actuation and flight control business) and other transactions, including the realization of synergies and opportunities for growth and innovation, the assumption of liabilities and other risks and incurrence of related costs and expenses, and risks related to completion of announced divestitures; (11) compliance with legal, environmental, regulatory and other requirements, including, among other things, obtaining regulatory approvals for new technologies and products and export and import requirements such as the International Traffic in Arms Regulations and the Export Administration Regulations, anti-bribery and anticorruption requirements, such as the Foreign Corrupt Practices Act, industrial cooperation agreement obligations, and procurement and other regulations in the U.S. and other countries in which RTX and its businesses operate; (12) the outcome of pending, threatened and future legal proceedings, investigations, and other contingencies, including those related to U.S. government audits and disputes and the potential for suspension or debarment of U.S. government contracting or export privileges as a result thereof; (13) risks related to the previously-disclosed deferred prosecution agreements entered into between the Company and the Department of Justice (DOJ), the Securities and Exchange Commission (SEC) administrative order imposed on the Company, and the related investigations by the SEC and DOJ, and the consent agreement between the Company and the Department of State; (14) factors that could impact RTX’s ability to engage in desirable capital-raising or strategic transactions, including its credit rating, capital structure, levels of indebtedness, and related obligations, capital expenditures and research and development spending, and capital deployment strategy including with respect to share repurchases, and the availability of credit, borrowing costs, credit market conditions, and other factors; (15) uncertainties associated with the timing and scope of future repurchases by RTX of its common stock or declarations of cash dividends, which may be discontinued, accelerated, suspended or delayed at any time due to various factors, including market conditions and the level of other investing activities and uses of cash; (16) risks relating to realizing expected benefits from, incurring costs for, and successfully managing, strategic initiatives such as cost reduction, restructuring, digital transformation and other operational initiatives; (17) risks of additional tax exposures due to new tax legislation or other developments in the U.S. and other countries in which RTX and its businesses operate; (18) risks relating to addressing the identified rare condition in powder metal used to manufacture certain Pratt & Whitney engine parts requiring accelerated removals and inspections of a significant portion of the PW1100G-JM Geared Turbofan (GTF) fleet, including, without limitation, the number and expected timing of shop visits, inspection results and scope of work to be performed, turnaround time, availability of new parts, available capacity at overhaul facilities, outcomes of negotiations with impacted customers, and risks related to other engine models that may be impacted by the powder metal matter, and in each case the timing and costs relating thereto, as well as other issues that could impact RTX product performance, including quality, reliability or durability; (19) changes in production volumes of one or more of our significant customers as a result of business, labor, or other challenges, and the resulting effect on its or their demand for our products and services; (20) risks relating to an RTX product safety failure, quality issue or other failure affecting RTX’s or its customers’ or suppliers’ products or systems; (21) risks relating to cybersecurity, including cyber-attacks on RTX’s information technology infrastructure, products, suppliers, customers and partners, and cybersecurity-related regulations; (22) risks related to insufficient indemnity or insurance coverage; (23) risks related to artificial intelligence; (24) risks relating to our intellectual property and certain third-party intellectual property; (25) threats to RTX facilities and personnel, as well as other events outside of RTX’s control such as public health crises,

damaging weather or other acts of nature; (26) the effect of changes in accounting estimates for our programs on our financial results; (27) the effect of changes in pension and other postretirement plan estimates and assumptions and contributions; (28) risks relating to an impairment of goodwill and other intangible assets; (29) the effects of climate change and changing climate-related regulations, customer and market demands, products and technologies; and (30) the intended qualification of (i) the merger as a tax-free reorganization and (ii) the separation transactions and other internal restructurings as tax-free to UTC and former UTC shareowners, in each case, for U.S. federal income tax purposes. For additional information on identifying factors that may cause actual results to vary materially from those stated in forward-looking statements, see the reports of RTX, UTC and Raytheon on Forms S-4, 10-K, 10-Q and 8-K filed with or furnished to the Securities and Exchange Commission from time to time. Any forward-looking statement speaks only as of the date on which it is made, and RTX assumes no obligation to update or revise such statement, whether as a result of new information, future events or otherwise, except as required by applicable law.

RTX Corporation

Consolidated Statement of Operations | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended December 31, | | Twelve Months Ended December 31, |

| | (Unaudited) | | (Unaudited) |

| (dollars in millions, except per share amounts; shares in millions) | 2024 | | 2023 | | 2024 | | 2023 |

| Net Sales | $ | 21,623 | | | $ | 19,927 | | | $ | 80,738 | | | $ | 68,920 | |

| Costs and expenses: | | | | | | | |

| Cost of sales | 17,388 | | | 15,918 | | | 65,328 | | | 56,831 | |

| Research and development | 808 | | | 757 | | | 2,934 | | | 2,805 | |

| Selling, general, and administrative | 1,574 | | | 1,445 | | | 5,806 | | | 5,809 | |

| Total costs and expenses | 19,770 | | | 18,120 | | | 74,068 | | | 65,445 | |

| | | | | | | |

| Other income (expense), net | 258 | | | (30) | | | (132) | | | 86 | |

| Operating profit | 2,111 | | | 1,777 | | | 6,538 | | | 3,561 | |

| Non-service pension income | (384) | | | (446) | | | (1,518) | | | (1,780) | |

| | | | | | | | |

| Interest expense, net | 486 | | | 488 | | | 1,862 | | | 1,505 | |

| Income before income taxes | 2,009 | | | 1,735 | | | 6,194 | | | 3,836 | |

| Income tax expense | 449 | | | 262 | | | 1,181 | | | 456 | |

| Net income | 1,560 | | | 1,473 | | | 5,013 | | | 3,380 | |

| Less: Noncontrolling interest in subsidiaries’ earnings | 78 | | | 47 | | | 239 | | | 185 | |

| | | | | | | |

| | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | |

| Net income attributable to common shareowners | $ | 1,482 | | | $ | 1,426 | | | $ | 4,774 | | | $ | 3,195 | |

| | | | | | | | |

| Earnings Per Share attributable to common shareowners: | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Basic | $ | 1.11 | | | $ | 1.05 | | | $ | 3.58 | | | $ | 2.24 | |

| | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Diluted | $ | 1.10 | | | $ | 1.05 | | | $ | 3.55 | | | $ | 2.23 | |

| | | | | | | | |

| Weighted Average Shares Outstanding: | | | | | | | |

| Basic shares | 1,334.4 | | | 1,354.9 | | | 1,332.1 | | | 1,426.0 | |

| Diluted shares | 1,348.9 | | | 1,361.7 | | | 1,343.6 | | | 1,435.4 | |

RTX Corporation

Segment Net Sales and Operating Profit (Loss) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Twelve Months Ended |

| (Unaudited) | | (Unaudited) |

| December 31, 2024 | | December 31, 2023 | | December 31, 2024 | | December 31, 2023 |

| (dollars in millions) | Reported | Adjusted | | Reported | Adjusted | | Reported | Adjusted | | Reported | Adjusted |

| Net Sales | | | | | | | | | | | |

| Collins Aerospace | $ | 7,537 | | $ | 7,537 | | | $ | 7,120 | | $ | 7,008 | | | $ | 28,284 | | $ | 28,284 | | | $ | 26,253 | | $ | 26,198 | |

| Pratt & Whitney | 7,569 | | 7,569 | | | 6,439 | | 6,439 | | | 28,066 | | 28,066 | | | 18,296 | | 23,697 | |

| Raytheon | 7,157 | | 7,157 | | | 6,886 | | 6,886 | | | 26,713 | | 26,783 | | | 26,350 | | 26,350 | |

| Total segments | 22,263 | | 22,263 | | | 20,445 | | 20,333 | | | 83,063 | | 83,133 | | | 70,899 | | 76,245 | |

| Eliminations and other | (640) | | (640) | | | (518) | | (509) | | | (2,325) | | (2,325) | | | (1,979) | | (1,940) | |

| Consolidated | $ | 21,623 | | $ | 21,623 | | | $ | 19,927 | | $ | 19,824 | | | $ | 80,738 | | $ | 80,808 | | | $ | 68,920 | | $ | 74,305 | |

| | | | | | | | | | | |

| Operating Profit (Loss) | | | | | | | | | | | |

| Collins Aerospace | $ | 1,106 | | $ | 1,207 | | | $ | 1,126 | | $ | 1,035 | | | $ | 4,135 | | $ | 4,496 | | | $ | 3,825 | | $ | 3,896 | |

| Pratt & Whitney | 504 | | 717 | | | 382 | | 405 | | | 2,015 | | 2,281 | | | (1,455) | | 1,688 | |

| Raytheon | 824 | | 728 | | | 604 | | 618 | | | 2,594 | | 2,728 | | | 2,379 | | 2,434 | |

| Total segments | 2,434 | | 2,652 | | | 2,112 | | 2,058 | | | 8,744 | | 9,505 | | | 4,749 | | 8,018 | |

| Eliminations and other | 7 | | 7 | | | (8) | | 1 | | | (48) | | (48) | | | (42) | | (81) | |

| Corporate expenses and other unallocated items | (7) | | (4) | | | (110) | | (70) | | | (933) | | (107) | | | (275) | | (169) | |

| FAS/CAS operating adjustment | 197 | | 197 | | | 282 | | 282 | | | 833 | | 833 | | | 1,127 | | 1,127 | |

| Acquisition accounting adjustments | (520) | | — | | | (499) | | — | | | (2,058) | | — | | | (1,998) | | — | |

| Consolidated | $ | 2,111 | | $ | 2,852 | | | $ | 1,777 | | $ | 2,271 | | | $ | 6,538 | | $ | 10,183 | | | $ | 3,561 | | $ | 8,895 | |

| | | | | | | | | | | |

| Segment Operating Profit (Loss) Margin | | | | | | | | | |

| Collins Aerospace | 14.7 | % | 16.0 | % | | 15.8 | % | 14.8 | % | | 14.6 | % | 15.9 | % | | 14.6 | % | 14.9 | % |

| Pratt & Whitney | 6.7 | % | 9.5 | % | | 5.9 | % | 6.3 | % | | 7.2 | % | 8.1 | % | | (8.0) | % | 7.1 | % |

| Raytheon | 11.5 | % | 10.2 | % | | 8.8 | % | 9.0 | % | | 9.7 | % | 10.2 | % | | 9.0 | % | 9.2 | % |

| Total segment | 10.9 | % | 11.9 | % | | 10.3 | % | 10.1 | % | | 10.5 | % | 11.4 | % | | 6.7 | % | 10.5 | % |

RTX Corporation

Consolidated Balance Sheet | | | | | | | | | | | |

| December 31, 2024 | | December 31, 2023 |

| (dollars in millions) | (Unaudited) | | (Unaudited) |

| Assets | | | |

| Cash and cash equivalents | $ | 5,578 | | | $ | 6,587 | |

| Accounts receivable, net | 10,976 | | | 10,838 | |

| Contract assets | 14,570 | | | 12,139 | |

| Inventory, net | 12,768 | | | 11,777 | |

| | | |

| Other assets, current | 7,241 | | | 7,076 | |

| Total current assets | 51,133 | | | 48,417 | |

| Customer financing assets | 2,246 | | | 2,392 | |

| | | |

| Fixed assets, net | 16,089 | | | 15,748 | |

| Operating lease right-of-use assets | 1,864 | | | 1,638 | |

| Goodwill | 52,789 | | | 53,699 | |

| Intangible assets, net | 33,443 | | | 35,399 | |

| Other assets | 5,297 | | | 4,576 | |

| Total assets | $ | 162,861 | | | $ | 161,869 | |

| | | |

| Liabilities, Redeemable Noncontrolling Interest, and Equity | | | |

| Short-term borrowings | $ | 183 | | | $ | 189 | |

| Accounts payable | 12,897 | | | 10,698 | |

| Accrued employee compensation | 2,620 | | | 2,491 | |

| Other accrued liabilities | 14,831 | | | 14,917 | |

| Contract liabilities | 18,616 | | | 17,183 | |

| | | |

| Long-term debt currently due | 2,352 | | | 1,283 | |

| Total current liabilities | 51,499 | | | 46,761 | |

| Long-term debt | 38,726 | | | 42,355 | |

| Operating lease liabilities, non-current | 1,632 | | | 1,412 | |

| Future pension and postretirement benefit obligations | 2,104 | | | 2,385 | |

| Other long-term liabilities | 6,942 | | | 7,511 | |

| Total liabilities | 100,903 | | | 100,424 | |

| Redeemable noncontrolling interest | 35 | | | 35 | |

| Shareowners’ Equity: | | | |

| Common stock | 37,434 | | | 37,040 | |

| Treasury stock | (27,112) | | | (26,977) | |

| Retained earnings | 53,589 | | | 52,154 | |

| Accumulated other comprehensive loss | (3,755) | | | (2,419) | |

| Total shareowners’ equity | 60,156 | | | 59,798 | |

| Noncontrolling interest | 1,767 | | | 1,612 | |

| Total equity | 61,923 | | | 61,410 | |

| Total liabilities, redeemable noncontrolling interest, and equity | $ | 162,861 | | | $ | 161,869 | |

RTX Corporation

Consolidated Statement of Cash Flows | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended December 31, | | Twelve Months Ended December 31, |

| (Unaudited) | | (Unaudited) |

| (dollars in millions) | 2024 | | 2023 | | 2024 | | 2023 |

| Operating Activities: | | | | | | | |

| Net income | $ | 1,560 | | | $ | 1,473 | | | $ | 5,013 | | | $ | 3,380 | |

| Adjustments to reconcile net income to net cash flows provided by operating activities from: | | | | | | | |

| Depreciation and amortization | 1,139 | | | 1,059 | | | 4,364 | | | 4,211 | |

| Deferred income tax (benefit) provision | 72 | | | 326 | | | (47) | | | (402) | |

| Stock compensation cost | 109 | | | 106 | | | 437 | | | 425 | |

| Net periodic pension and other postretirement income | (334) | | | (391) | | | (1,326) | | | (1,555) | |

| Gain on sale of Cybersecurity, Intelligence and Services business, net of transaction costs | — | | | — | | | (415) | | | — | |

| Change in: | | | | | | | |

| Accounts receivable | (1,111) | | | (892) | | | (175) | | | (1,805) | |

| Contract assets | 39 | | | 410 | | | (2,414) | | | (753) | |

| Inventory | 231 | | | 326 | | | (1,474) | | | (1,104) | |

| Other current assets | (160) | | | (283) | | | (402) | | | (1,161) | |

| Accounts payable and accrued liabilities | (819) | | | 594 | | | 1,508 | | | 4,016 | |

| Contract liabilities | 676 | | | 1,893 | | | 1,872 | | | 2,322 | |

| Other operating activities, net | 159 | | | 90 | | | 218 | | | 309 | |

| Net cash flows provided by operating activities | 1,561 | | | 4,711 | | | 7,159 | | | 7,883 | |

| Investing Activities: | | | | | | | |

| Capital expenditures | (1,069) | | | (805) | | | (2,625) | | | (2,415) | |

| Dispositions of businesses, net of cash transferred | 512 | | | — | | | 1,795 | | | 6 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Increase in other intangible assets | (164) | | | (215) | | | (611) | | | (751) | |

| (Payments) receipts from settlements of derivative contracts, net | (145) | | | 32 | | | (142) | | | 14 | |

| Other investing activities, net | 87 | | | 10 | | 49 | | | 107 | |

| Net cash flows used in investing activities | (779) | | | (978) | | | (1,534) | | | (3,039) | |

| Financing Activities: | | | | | | | |

| Proceeds from long-term debt | — | | | 9,940 | | | — | | | 12,914 | |

| Repayment of long-term debt | (800) | | | (403) | | | (2,500) | | | (578) | |

| Proceeds from bridge loan | — | | | 10,000 | | | — | | | 10,000 | |

| Repayment of bridge loan | — | | | (10,000) | | | — | | | (10,000) | |

| | | | | | | |

| Change in commercial paper, net | — | | | (997) | | | — | | | (524) | |

| Change in other short-term borrowings, net | (35) | | | 19 | | | (4) | | | 87 | |

| Dividends paid on common stock | (802) | | | (767) | | | (3,217) | | | (3,239) | |

| Repurchase of common stock | (50) | | | (10,283) | | | (444) | | | (12,870) | |

| | | | | | | |

| Other financing activities, net | (181) | | | (127) | | | (452) | | | (317) | |

| Net cash flows used in financing activities | (1,868) | | | (2,618) | | | (6,617) | | | (4,527) | |

| Effect of foreign exchange rate changes on cash and cash equivalents | (39) | | | 14 | | | (28) | | | 18 | |

| | | | | | | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | (1,125) | | | 1,129 | | | (1,020) | | | 335 | |

| Cash, cash equivalents and restricted cash, beginning of period | 6,731 | | | 5,497 | | | 6,626 | | | 6,291 | |

| | | | | | | |

| Cash, cash equivalents and restricted cash, end of period | 5,606 | | | 6,626 | | | 5,606 | | | 6,626 | |

| Less: Restricted cash, included in Other assets, current and Other assets | 28 | | | 39 | | | 28 | | | 39 | |

| | | | | | | |

| Cash and cash equivalents, end of period | $ | 5,578 | | | $ | 6,587 | | | $ | 5,578 | | | $ | 6,587 | |

RTX Corporation

Reconciliation of Adjusted (Non-GAAP) Results

Adjusted Sales, Adjusted Operating Profit & Operating Profit Margin | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended December 31, | | Twelve Months Ended December 31, | |

| (Unaudited) | | (Unaudited) | |

| (dollars in millions - Income (Expense)) | 2024 | | 2023 | | 2024 | | 2023 | |

| Collins Aerospace | | | | | | | | |

| Net sales | $ | 7,537 | | | $ | 7,120 | | | $ | 28,284 | | | $ | 26,253 | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Benefits related to litigation matters (1) | — | | | 112 | | | — | | | 55 | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Adjusted net sales | $ | 7,537 | | | $ | 7,008 | | | $ | 28,284 | | | $ | 26,198 | | |

| Operating profit | $ | 1,106 | | | $ | 1,126 | | | $ | 4,135 | | | $ | 3,825 | | |

| Restructuring | (17) | | | 1 | | | (47) | | | (71) | | |

Gain on sale of business, net of transaction and other related costs (1) | 99 | | | — | | | 99 | | | — | | |

Charge associated with initiating alternative titanium sources (1) | — | | | — | | | (175) | | | — | | |

| | | | | | | | |

Segment and portfolio transformation and divestiture costs (1) | (28) | | | (29) | | | (83) | | | (62) | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Benefits related to litigation matters (1) | — | | | 119 | | | — | | | 62 | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Impairment of contract fulfillment costs (1) | (155) | | | — | | | (155) | | | — | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Adjusted operating profit | $ | 1,207 | | | $ | 1,035 | | | $ | 4,496 | | | $ | 3,896 | | |

| Adjusted operating profit margin | 16.0 | % | | 14.8 | % | | 15.9 | % | | 14.9 | % | |

| Pratt & Whitney | | | | | | | | |

| Net sales | $ | 7,569 | | | $ | 6,439 | | | $ | 28,066 | | | $ | 18,296 | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Powder Metal charge (1) | — | | | — | | | — | | | (5,401) | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Adjusted net sales | $ | 7,569 | | | $ | 6,439 | | | $ | 28,066 | | | $ | 23,697 | | |

| Operating profit (loss) | $ | 504 | | | $ | 382 | | | $ | 2,015 | | | $ | (1,455) | | |

| Restructuring | (56) | | | (23) | | | (102) | | | (74) | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Insurance settlement | — | | | — | | | 27 | | | — | | |

| | | | | | | | |

| | | | | | | | |

Powder Metal charge (1) | — | | | — | | | — | | | (2,888) | | |

| | | | | | | | |

| | | | | | | | |

Charges related to a customer insolvency (1) | — | | | — | | | — | | | (181) | | |

| | | | | | | | |

| | | | | | | | |

Expected settlement of a litigation matter (1) | — | | | — | | | (34) | | | — | | |

| | | | | | | | |

Customer bankruptcy (1) | (157) | | | — | | | (157) | | | — | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Adjusted operating profit | $ | 717 | | | $ | 405 | | | $ | 2,281 | | | $ | 1,688 | | |

| Adjusted operating profit margin | 9.5 | % | | 6.3 | % | | 8.1 | % | | 7.1 | % | |

| Raytheon | | | | | | | | |

| Net sales | $ | 7,157 | | | $ | 6,886 | | | $ | 26,713 | | | $ | 26,350 | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Contract termination (1) | — | | | — | | | (70) | | | — | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Adjusted net sales | $ | 7,157 | | | $ | 6,886 | | | $ | 26,783 | | | $ | 26,350 | | |

| Operating profit | $ | 824 | | | $ | 604 | | | $ | 2,594 | | | $ | 2,379 | | |

| Restructuring | (6) | | | (9) | | | (36) | | | (42) | | |

Gain on sale of business, net of transaction and other related costs (1) | — | | | — | | | 375 | | | — | | |

| | | | | | | | |

| | | | | | | | |

Segment and portfolio transformation and divestiture costs (1) | — | | | (5) | | | — | | | (13) | | |

| | | | | | | | |

Contract termination (1) | — | | | — | | | (575) | | | — | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Middle East contracts restart adjustments (1) | 102 | | | — | | | 102 | | | — | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Adjusted operating profit | $ | 728 | | | $ | 618 | | | $ | 2,728 | | | $ | 2,434 | | |

| Adjusted operating profit margin | 10.2 | % | | 9.0 | % | | 10.2 | % | | 9.2 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Eliminations and Other | | | | | | | | |

| Net sales | $ | (640) | | | $ | (518) | | | $ | (2,325) | | | $ | (1,979) | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Prior year impact from R&D capitalization IRS notice (1) | — | | | (9) | | — | | | (39) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Adjusted net sales | $ | (640) | | | $ | (509) | | | $ | (2,325) | | | $ | (1,940) | | |

| Operating profit (loss) | $ | 7 | | | $ | (8) | | | $ | (48) | | | $ | (42) | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Prior year impact from R&D capitalization IRS notice (1) | — | | | (9) | | | — | | | (39) | | |

| Gain on sale of land | — | | | — | | | — | | | 68 | | |

Charges related to a customer insolvency (1) | — | | | — | | | — | | | 10 | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Adjusted operating profit (loss) | $ | 7 | | | $ | 1 | | | $ | (48) | | | $ | (81) | | |

| Corporate expenses and other unallocated items | | | | | | | | |

| Operating loss | $ | (7) | | | $ | (110) | | | $ | (933) | | | $ | (275) | | |

| Restructuring | — | | | (13) | | | (9) | | | (59) | | |

| | | | | | | | |

| | | | | | | | |

Tax audit settlements (1) | — | | | — | | | (68) | | | — | | |

Segment and portfolio transformation and divestiture costs (1) | (3) | | | (11) | | | (11) | | | (31) | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Legal matters (1) | — | | | — | | | (918) | | | — | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Expiration of tax statute of limitations | — | | | (16) | | | — | | | (16) | | |

| | | | | | | | |

| | | | | | | | |

Tax matters and related indemnification (1) | — | | | — | | | 180 | | | — | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Adjusted operating loss | $ | (4) | | | $ | (70) | | | $ | (107) | | | $ | (169) | | |

| FAS/CAS Operating Adjustment | | | | | | | | |

| Operating profit | $ | 197 | | | $ | 282 | | | $ | 833 | | | $ | 1,127 | | |

| | | | | | | | |

| Acquisition Accounting Adjustments | | | | | | | | |

| Operating loss | $ | (520) | | | $ | (499) | | | $ | (2,058) | | | $ | (1,998) | | |

| Acquisition accounting adjustments | (520) | | | (499) | | | (2,058) | | | (1,998) | | |

| Adjusted operating profit | $ | — | | | $ | — | | | $ | — | | | $ | — | | |

| RTX Consolidated | | | | | | | | |

| Net sales | $ | 21,623 | | | $ | 19,927 | | | $ | 80,738 | | | $ | 68,920 | | |

Total net significant and/or non-recurring items included in Net sales above (1) | — | | | 103 | | | (70) | | | (5,385) | | |

| Adjusted net sales | $ | 21,623 | | | $ | 19,824 | | | $ | 80,808 | | | $ | 74,305 | | |

| Operating profit | $ | 2,111 | | | $ | 1,777 | | | $ | 6,538 | | | $ | 3,561 | | |

| Restructuring | (79) | | | (44) | | | (194) | | | (246) | | |

| Acquisition accounting adjustments | (520) | | | (499) | | | (2,058) | | | (1,998) | | |

Total net significant and/or non-recurring items included in Operating profit above (1) | (142) | | | 49 | | | (1,393) | | | (3,090) | | |

| Adjusted operating profit | $ | 2,852 | | | $ | 2,271 | | | $ | 10,183 | | | $ | 8,895 | | |

(1) Refer to “Non-GAAP Financial Adjustments” below for a description of these adjustments.

RTX Corporation

Reconciliation of Adjusted (Non-GAAP) Results

Adjusted Income, Earnings Per Share, and Effective Tax Rate

| | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended December 31, | | Twelve Months Ended December 31, | |

| (Unaudited) | | (Unaudited) | |

| (dollars in millions - Income (Expense)) | 2024 | | 2023 | | 2024 | | 2023 | |

| Net income attributable to common shareowners | $ | 1,482 | | $ | 1,426 | | $ | 4,774 | | $ | 3,195 | |

| Total Restructuring | (79) | | (44) | | (194) | | (246) | |

| Total Acquisition accounting adjustments | (520) | | (499) | | (2,058) | | (1,998) | |

Total net significant and/or non-recurring items included in Operating profit (1) | (142) | | 49 | | (1,393) | | (3,090) | |

Significant and/or non-recurring items included in Non-service Pension Income | | | | | | | | |

| Non-service pension restructuring | — | | (2) | | (9) | | (4) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Pension curtailment related to sale of business (1) | — | | — | | 9 | | — | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Significant non-recurring and non-operational items included in Interest Expense, Net | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Tax audit settlements (1) | — | | — | | 78 | | — | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Benefits related to litigation matters | — | | 1 | | — | | 1 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Expiration of tax statute of limitations | — | | 10 | | — | | 10 | |

| | | | | | | | |

| | | | | | | | |

Tax matters and related indemnification (1) | — | | — | | (11) | | — | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Tax effect of restructuring and net significant and/or non-recurring items above | 152 | | 99 | | 516 | | 1,191 | |

Significant and/or non-recurring items included in Income Tax Expense | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Tax audit settlements (1) | — | | — | | 296 | | — | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Expiration of tax statute of limitations | — | | 61 | | — | | 61 | |

Prior year impact from R&D capitalization IRS notice (1) | — | | (5) | | — | | (13) | |

| | | | | | | | |

Tax matters and related indemnification (1) | — | | — | | (156) | | — | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Significant and/or non-recurring items included in Noncontrolling Interest | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Noncontrolling interest share of charges related to an insurance settlement | — | | — | | (9) | | — | |

| | | | | | | | |

Noncontrolling interest share of benefits related to litigation matters (1) | — | | 3 | | — | | 3 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Noncontrolling interest share of customer insolvency charges (1) | — | | — | | — | | 17 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Less: Impact on net income (loss) attributable to common shareowners | (589) | | (327) | | (2,931) | | (4,068) | |

| Adjusted net income attributable to common shareowners | $ | 2,071 | | $ | 1,753 | | $ | 7,705 | | $ | 7,263 | |

| | | | | | | | |

| Diluted Earnings Per Share | $ | 1.10 | | $ | 1.05 | | $ | 3.55 | | $ | 2.23 | |

| Impact on Diluted Earnings Per Share | (0.44) | | (0.24) | | (2.18) | | (2.83) | |

| Adjusted Diluted Earnings Per Share | $ | 1.54 | | $ | 1.29 | | $ | 5.73 | | $ | 5.06 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Effective Tax Rate | 22.3% | | 15.1% | | 19.1% | | 11.9% | |

| Impact on Effective Tax Rate | 0.4% | | (3.7)% | | 0.3% | | (6.6)% | |

| Adjusted Effective Tax Rate | 21.9% | | 18.8% | | 18.8% | | 18.5% | |

(1) Refer to “Non-GAAP Financial Adjustments” below for a description of these adjustments.

RTX Corporation

Reconciliation of Adjusted (Non-GAAP) Results

Segment Operating Profit Margin and Adjusted Segment Operating Profit Margin | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended December 31, | | Twelve Months Ended December 31, |

| (Unaudited) | | (Unaudited) |

| (dollars in millions) | 2024 | | 2023 | | 2024 | | 2023 |

| Net Sales | $ | 21,623 | | | $ | 19,927 | | | $ | 80,738 | | | $ | 68,920 | |

| Reconciliation to segment net sales: | | | | | | | |

| Eliminations and other | 640 | | | 518 | | | 2,325 | | | 1,979 | |

| Segment Net Sales | $ | 22,263 | | | $ | 20,445 | | | $ | 83,063 | | | $ | 70,899 | |

| Reconciliation to adjusted segment net sales: | | | | | | | |

Net significant and/or non-recurring items (1) | — | | | 112 | | | (70) | | | (5,346) | |

| Adjusted Segment Net Sales | $ | 22,263 | | | $ | 20,333 | | | $ | 83,133 | | | $ | 76,245 | |

| | | | | | | |

| Operating Profit | $ | 2,111 | | | $ | 1,777 | | | $ | 6,538 | | | $ | 3,561 | |

| Operating Profit Margin | 9.8 | % | | 8.9 | % | | 8.1 | % | | 5.2 | % |

| Reconciliation to segment operating profit: | | | | | | | |

| Eliminations and other | (7) | | | 8 | | | 48 | | | 42 | |

| Corporate expenses and other unallocated items | 7 | | | 110 | | | 933 | | | 275 | |

| FAS/CAS operating adjustment | (197) | | | (282) | | | (833) | | | (1,127) | |

| Acquisition accounting adjustments | 520 | | | 499 | | | 2,058 | | | 1,998 | |

| Segment Operating Profit | $ | 2,434 | | | $ | 2,112 | | | $ | 8,744 | | | $ | 4,749 | |

| Segment Operating Profit Margin | 10.9 | % | | 10.3 | % | | 10.5 | % | | 6.7 | % |

| Reconciliation to adjusted segment operating profit: | | | | | | | |

| Restructuring | (79) | | | (31) | | | (185) | | | (187) | |

Net significant and/or non-recurring items (1) | (139) | | | 85 | | | (576) | | | (3,082) | |

| Adjusted Segment Operating Profit | $ | 2,652 | | | $ | 2,058 | | | $ | 9,505 | | | $ | 8,018 | |

| Adjusted Segment Operating Profit Margin | 11.9 | % | | 10.1 | % | | 11.4 | % | | 10.5 | % |

(1) Refer to “Non-GAAP Financial Adjustments” below for a description of these adjustments.

RTX Corporation

Free Cash Flow Reconciliation | | | | | | | | | | | | |

| Quarter Ended December 31, |

| (Unaudited) |

(dollars in millions) | 2024 | | 2023 |

| Net cash flows provided by operating activities | $ | 1,561 | | | | $ | 4,711 | |

| Capital expenditures | (1,069) | | | | (805) | |

| Free cash flow | $ | 492 | | | | $ | 3,906 | |

| | | | |

| Twelve Months Ended December 31, |

| (Unaudited) |

| (dollars in millions) | 2024 | | 2023 |

| Net cash flows provided by operating activities | $ | 7,159 | | | | $ | 7,883 | |

| Capital expenditures | (2,625) | | | | (2,415) | |

| Free cash flow | $ | 4,534 | | | | $ | 5,468 | |

RTX Corporation

Reconciliation of Adjusted (Non-GAAP) Results

Organic Sales Reconciliation | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended December 31, 2024 compared to the Quarter Ended December 31, 2023 |

| (Unaudited) |

(dollars in millions) | Total Reported Change | Acquisitions & Divestitures Change | FX / Other Change (2) | Organic Change | | Prior Year Adjusted Sales (1) | Organic Change as a % of Adjusted Sales |

| Collins Aerospace | $ | 417 | | $ | (18) | | $ | (107) | | $ | 542 | | | $ | 7,008 | | 8 | % |

| Pratt & Whitney | 1,130 | | — | | (25) | | 1,155 | | | 6,439 | | 18 | % |

| Raytheon | 271 | | (412) | | 8 | | 675 | | | 6,886 | | 10 | % |

Eliminations and Other (3) | (122) | | 1 | | 22 | | (145) | | | (509) | | 28 | % |

| Consolidated | $ | 1,696 | | $ | (429) | | $ | (102) | | $ | 2,227 | | | $ | 19,824 | | 11 | % |

(1) For the full Non-GAAP reconciliation of adjusted sales refer to “Reconciliation of Adjusted (Non-GAAP) Results - Adjusted Sales, Adjusted Operating Profit & Operating Profit Margin.”

(2) Includes other significant non-operational items and/or significant operational items that may occur at irregular intervals.

(3) FX/Other Change includes the transactional impact of foreign exchange hedging at Pratt & Whitney Canada, which is included in Pratt & Whitney’s FX/Other Change, but excluded for Consolidated RTX.

| | | | | | | | | | | | | | | | | | | | | | | |

| Twelve Months Ended December 31, 2024 compared to the Twelve Months Ended December 31, 2023 |

| (Unaudited) |

(dollars in millions) | Total Reported Change | Acquisitions & Divestitures Change | FX / Other Change (2) | Organic Change | | Prior Year Adjusted Sales (1) | Organic Change as a % of Adjusted Sales |

| Collins Aerospace | $ | 2,031 | | $ | (18) | | $ | (47) | | $ | 2,096 | | | $ | 26,198 | | 8 | % |

| Pratt & Whitney | 9,770 | | — | | 5,384 | | 4,386 | | | 23,697 | | 19 | % |

| Raytheon | 363 | | (1,274) | | (54) | | 1,691 | | | 26,350 | | 6 | % |

Eliminations and Other (3) | (346) | | 1 | | 10 | | (357) | | | (1,940) | | 18 | % |

| Consolidated | $ | 11,818 | | $ | (1,291) | | $ | 5,293 | | $ | 7,816 | | | $ | 74,305 | | 11 | % |

(1) For the full Non-GAAP reconciliation of adjusted sales refer to “Reconciliation of Adjusted (Non-GAAP) Results - Adjusted Sales, Adjusted Operating Profit & Operating Profit Margin.”

(2) Includes other significant non-operational items and/or significant operational items that may occur at irregular intervals.

(3) FX/Other Change includes the transactional impact of foreign exchange hedging at Pratt & Whitney Canada, which is included in Pratt & Whitney’s FX/Other Change, but excluded for Consolidated RTX.

Non-GAAP Financial Adjustments

| | | | | |

| Non-GAAP Adjustments | Description |

| Benefits related to litigation matters | The quarter and twelve months ended December 31, 2023 includes a net sales benefit of $112 million and $55 million, respectively and a corresponding net operating profit benefit of $119 million and $62 million, respectively related to the settlement of two customer litigation matters at Collins. Management has determined that the nature and significance of these settlements are considered unusual and therefore, not indicative of the Company’s ongoing operational performance. |

| Segment and portfolio transformation and divestiture costs | The quarters and twelve months ended December 31, 2024 and 2023 include certain segment and portfolio transformation costs incurred in connection with the 2023 completed segment realignment as well as separation costs incurred in advance of the completion of certain divestitures. |

| Charge associated with initiating alternative titanium sources | The twelve months ended December 31, 2024 includes a net pre-tax charge of $0.2 billion related to the recognition of unfavorable purchase commitments and an impairment of contract fulfillment costs associated with initiating alternative titanium sources at Collins. These charges were recorded as a result of the Canadian government’s imposition of new sanctions in February 2024, which included U.S.- and German-based Russian-owned entities from which we source titanium for use in our Canadian operations. Management has determined that these impacts are directly attributable to the sanctions, incremental to similar costs incurred for reasons other than those related to the sanctions and has determined that the nature of the charge is considered significant and unusual, and therefore, not indicative of the Company’s ongoing operational performance. |

| Impairment of contract fulfillment costs | The quarter and twelve months ended December 31, 2024 include a net pre-tax charge of $0.2 billion related to an impairment of contract fulfillment costs as a result of a contract cancellation during the fourth quarter of 2024 at Collins. Management has determined that the nature and significance of the charge is considered unusual and, therefore not indicative of the Company’s ongoing operational performance. |

| Powder Metal charge | The twelve months ended December 31, 2023 includes a net pre-tax charge of $2.9 billion related to the Pratt powder metal matter during the third quarter of 2023. The charge is reflected in the Consolidated Statement of Operations as a reduction of sales of $5.4 billion which was partially offset by a net reduction of cost of sales of $2.5 billion primarily representing our partners’ 49% share of this charge. The charge includes the Company’s current best estimate of expected customer compensation for the estimated duration of the disruption as well as the third quarter Estimate-at-Completion (EAC) adjustment impact of this matter to Pratt & Whitney’s long-term maintenance contracts. Management has determined that these items are directly attributable to the powder metal matter, incremental to similar costs (or income) incurred for reasons other than those related to the powder metal matter and not expected to recur, and therefore, not indicative of the Company’s ongoing operational performance. |

| Charge related to a customer insolvency | The twelve months ended December 31, 2023 includes a net pre-tax charge of $0.2 billion related to a customer insolvency during the second quarter of 2023. The charge primarily relates to Contract assets and Customer financing assets exposures with the customer. Management has determined that the nature and significance of the charge is considered unusual and, therefore not indicative of the Company’s ongoing operational performance. |

| Expected settlement of a litigation matter | The twelve months ended December 31, 2024 includes a pre-tax charge of $34 million reflecting the expected settlement value relating to a litigation matter at Pratt & Whitney. Management has determined that the impact is directly attributable to the expected legal settlement and that the nature of the charge is considered non-operational and therefore, not indicative of the Company’s ongoing operational performance. |

| Customer bankruptcy | The quarter and twelve months ended December 31, 2024 include a net pre-tax charge of approximately $0.2 billion related to a customer bankruptcy during the fourth quarter of 2024 at Pratt & Whitney. The charge primarily relates to contract asset exposures with the customer. Management has determined that the nature and significance of the charge is considered unusual and, therefore not indicative of the Company’s ongoing operational performance. |

| Contract termination | The twelve months ended December 31, 2024 includes a pre-tax charge of $0.6 billion related to the termination of a fixed price development contract with a foreign customer at Raytheon. The charge includes the write-off of remaining contract assets and settlement with the customer. Management has determined that these impacts are directly attributable to the termination, incremental to similar costs incurred for reasons other than those attributable to the termination and has determined that the nature of the pre-tax charge is considered significant and unusual and therefore, not indicative of the Company’s ongoing operational performance. |

| | | | | |

| Gain on sale of business, net of transaction and other related costs | The quarter and twelve months ended December 31, 2024 includes a pre-tax gain, net of transaction and other related costs, of $0.1 billion associated with the completed sale of the Hoist & Winch business at Collins. The twelve months ended December 31, 2024 also includes a pre-tax gain, net of transaction and other related costs, of $0.4 billion associated with the completed sale of the Cybersecurity, Intelligence and Services (CIS) business at Raytheon. Management has determined that the nature of these net gains on the divestitures is considered significant and non-operational and therefore, not indicative of the Company’s ongoing operational performance. |

| Middle East contracts restart adjustments | The quarter and twelve months ended December 31, 2024 includes a net operating profit benefit of $0.1 billion primarily related to reserve and contract loss provision adjustments as a result of restarting work under certain contracts with a Middle East customer. Management has determined that the nature and significance of the benefit is considered unusual, therefore not indicative of the Company's ongoing operational performance. |

| Prior year impact from R&D capitalization IRS notice | The quarter and twelve months ended December 31, 2023 includes a net pre-tax charge of $9 million and $39 million, respectively and a tax expense increase of $5 million and $13 million, respectively related to the 2022 impact of an IRS notice issued in September 2023 related to the capitalization of research and experimental expenditures for tax purposes. Management has determined that these items are directly attributable to the IRS notice and represents the impact to 2022, incremental to similar costs (or income) incurred for reasons other than the tax law change and not expected to recur, and therefore, not indicative of the Company’s ongoing operational performance. |

| Tax audit settlements | The twelve months ended December 31, 2024 includes a tax benefit of $0.3 billion recognized as a result of the closure of the examination phase of multiple federal tax audits. In addition, there was a pre-tax charge of $68 million for the write-off of certain tax related indemnity receivables and a pre-tax gain on the reversal of $78 million of interest accruals, both directly associated with these tax audit settlements. Management has determined that the nature of these impacts related to the tax audit settlements is considered significant and non-operational and therefore, not indicative of the Company’s ongoing operational performance. |

| Legal matters | The twelve months ended December 31, 2024 includes charges of $0.9 billion related to the expected resolution of several outstanding legal matters. The charge includes an additional accrual of $0.3 billion to resolve the previously disclosed criminal and civil government investigations of defective pricing claims for certain legacy Raytheon Company contracts entered into between 2011 and 2013 and in 2017; an additional accrual of $0.4 billion to resolve the previously disclosed criminal and civil government investigations of improper payments made by Raytheon Company and its joint venture, Thales-Raytheon Systems, in connection with certain Middle East contracts since 2012; and an accrual of $0.3 billion related to certain voluntarily disclosed export controls violations, primarily identified in connection with the integration of Rockwell Collins and, to a lesser extent, Raytheon Company, including certain violations expected to be resolved pursuant to a consent agreement with the Department of State. Management has determined that these impacts are directly attributable to these legacy legal matters and that the nature of the charges are considered significant and unusual and therefore, not indicative of the Company’s ongoing operational performance. |