Shell to Sell Nigeria Onshore Oil Business for Up to $2.4 Billion -- Update

January 16 2024 - 5:11AM

Dow Jones News

By Christian Moess Laursen

Shell has agreed to sell its Nigerian onshore oil subsidiary for

up to $2.4 billion, making good on a promise to exit what was for

decades one of its most dependable cash cows but in recent years

has become a big drag on its reputation.

The London-based energy major said Tuesday that it will receive

$1.3 billion initially for Shell Petroleum Development Company of

Nigeria, with the buyer--a consortium of five companies--paying up

to an additional $1.1 billion, mainly relating to prior receivables

and cash balances. The majority is expected to be paid at

completion of the deal.

The divestment aligns with Shell's previously announced intent

to exit onshore oil production in the Niger Delta and to focus

future investment in Nigeria on its deepwater and integrated gas

positions, it said.

"Shell sees a bright future in Nigeria with a positive

investment outlook for its energy sector," Integrated Gas and

Upstream Director Zoe Yujnovich said.

The oil-and-gas company's relationship with the West African

country dates back to 1936, when the group established a venture

together with the precursor company of British rival BP. First

shipment of oil from Nigeria was in 1958.

At the beginning of this century, Shell's Nigerian operations

faced controversy, increasing militant attacks and lawsuits in

relation to claims of pollution.

In 2011, a United Nations report alleged that Shell and the

Nigerian government contributed to 50 years of pollution in

Ogoniland, and required the world's largest oil clean-up, costing

an initial $1 billion and taking up to 30 years.

Two years later, a Dutch court ruled Shell could be held

partially responsible for pollution in the Niger Delta.

"We will continue to support the country's growing energy needs

and export ambitions in areas aligned with our strategy," Yujnovich

said.

Shell will continue to play a role in supporting SPDC in the

development and production of natural gas, it said.

The consortium, called Renaissance, comprises four

exploration-and-production companies based in Nigeria and an

international energy group.

By purchasing all the shares in SPDC, Renaissance will at

completion control SPDC's 30% stake in the SPDC joint venture,

which consists of 15 oil mining leases for petroleum operations

onshore and three leases for petroleum operations in shallow waters

in Nigeria.

The net book value of SPDC was around $2.8 billion as of Dec.

31.

Completion of the transaction is subject to approvals by the

government of Nigeria and other conditions.

At 1014 GMT, shares were down 1.3% at 2,449.00 pence.

Write to Christian Moess Laursen at christian.moess@wsj.com

(END) Dow Jones Newswires

January 16, 2024 05:56 ET (10:56 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

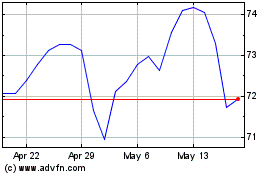

Shell (NYSE:SHEL)

Historical Stock Chart

From Nov 2024 to Dec 2024

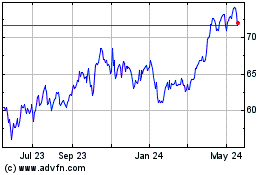

Shell (NYSE:SHEL)

Historical Stock Chart

From Dec 2023 to Dec 2024