false2025Q1000083298802/01http://fasb.org/us-gaap/2023#AccountsPayableCurrent364353330258365263263340365xbrli:sharesiso4217:USDiso4217:USDxbrli:sharessig:Reportable_segmentxbrli:puresig:location00008329882024-02-042024-05-0400008329882024-06-0700008329882023-01-292023-04-2900008329882024-05-0400008329882024-02-0300008329882023-04-290000832988us-gaap:RedeemableConvertiblePreferredStockMember2024-05-040000832988us-gaap:RedeemableConvertiblePreferredStockMember2023-04-290000832988us-gaap:RedeemableConvertiblePreferredStockMember2024-02-0300008329882023-01-280000832988us-gaap:CommonStockMember2024-02-030000832988us-gaap:AdditionalPaidInCapitalMember2024-02-030000832988us-gaap:OtherAdditionalCapitalMember2024-02-030000832988us-gaap:TreasuryStockCommonMember2024-02-030000832988us-gaap:RetainedEarningsMember2024-02-030000832988us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-02-030000832988us-gaap:RetainedEarningsMember2024-02-042024-05-040000832988us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-02-042024-05-040000832988us-gaap:TreasuryStockCommonMember2024-02-042024-05-040000832988us-gaap:AdditionalPaidInCapitalMember2024-02-042024-05-040000832988us-gaap:CommonStockMember2024-05-040000832988us-gaap:AdditionalPaidInCapitalMember2024-05-040000832988us-gaap:OtherAdditionalCapitalMember2024-05-040000832988us-gaap:TreasuryStockCommonMember2024-05-040000832988us-gaap:RetainedEarningsMember2024-05-040000832988us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-05-040000832988us-gaap:CommonStockMember2023-01-280000832988us-gaap:AdditionalPaidInCapitalMember2023-01-280000832988us-gaap:OtherAdditionalCapitalMember2023-01-280000832988us-gaap:TreasuryStockCommonMember2023-01-280000832988us-gaap:RetainedEarningsMember2023-01-280000832988us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-280000832988us-gaap:RetainedEarningsMember2023-01-292023-04-290000832988us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-292023-04-290000832988us-gaap:AdditionalPaidInCapitalMember2023-01-292023-04-290000832988us-gaap:TreasuryStockCommonMember2023-01-292023-04-290000832988us-gaap:CommonStockMember2023-04-290000832988us-gaap:AdditionalPaidInCapitalMember2023-04-290000832988us-gaap:OtherAdditionalCapitalMember2023-04-290000832988us-gaap:TreasuryStockCommonMember2023-04-290000832988us-gaap:RetainedEarningsMember2023-04-290000832988us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-290000832988srt:MinimumMember2024-02-042024-05-040000832988srt:MaximumMember2024-02-042024-05-040000832988sig:NorthAmericaSegmentMembersig:KayMember2024-02-042024-05-040000832988sig:InternationalMembersig:KayMember2024-02-042024-05-040000832988us-gaap:AllOtherSegmentsMembersig:KayMember2024-02-042024-05-040000832988sig:KayMember2024-02-042024-05-040000832988sig:NorthAmericaSegmentMembersig:KayMember2023-01-292023-04-290000832988sig:InternationalMembersig:KayMember2023-01-292023-04-290000832988us-gaap:AllOtherSegmentsMembersig:KayMember2023-01-292023-04-290000832988sig:KayMember2023-01-292023-04-290000832988sig:NorthAmericaSegmentMembersig:ZaleJewelryMember2024-02-042024-05-040000832988sig:InternationalMembersig:ZaleJewelryMember2024-02-042024-05-040000832988us-gaap:AllOtherSegmentsMembersig:ZaleJewelryMember2024-02-042024-05-040000832988sig:ZaleJewelryMember2024-02-042024-05-040000832988sig:NorthAmericaSegmentMembersig:ZaleJewelryMember2023-01-292023-04-290000832988sig:InternationalMembersig:ZaleJewelryMember2023-01-292023-04-290000832988us-gaap:AllOtherSegmentsMembersig:ZaleJewelryMember2023-01-292023-04-290000832988sig:ZaleJewelryMember2023-01-292023-04-290000832988sig:JaredMembersig:NorthAmericaSegmentMember2024-02-042024-05-040000832988sig:InternationalMembersig:JaredMember2024-02-042024-05-040000832988us-gaap:AllOtherSegmentsMembersig:JaredMember2024-02-042024-05-040000832988sig:JaredMember2024-02-042024-05-040000832988sig:JaredMembersig:NorthAmericaSegmentMember2023-01-292023-04-290000832988sig:InternationalMembersig:JaredMember2023-01-292023-04-290000832988us-gaap:AllOtherSegmentsMembersig:JaredMember2023-01-292023-04-290000832988sig:JaredMember2023-01-292023-04-290000832988sig:NorthAmericaSegmentMembersig:DigitalBannersMember2024-02-042024-05-040000832988sig:InternationalMembersig:DigitalBannersMember2024-02-042024-05-040000832988us-gaap:AllOtherSegmentsMembersig:DigitalBannersMember2024-02-042024-05-040000832988sig:DigitalBannersMember2024-02-042024-05-040000832988sig:NorthAmericaSegmentMembersig:DigitalBannersMember2023-01-292023-04-290000832988sig:InternationalMembersig:DigitalBannersMember2023-01-292023-04-290000832988us-gaap:AllOtherSegmentsMembersig:DigitalBannersMember2023-01-292023-04-290000832988sig:DigitalBannersMember2023-01-292023-04-290000832988sig:DiamondsDirectMembersig:NorthAmericaSegmentMember2024-02-042024-05-040000832988sig:InternationalMembersig:DiamondsDirectMember2024-02-042024-05-040000832988sig:DiamondsDirectMemberus-gaap:AllOtherSegmentsMember2024-02-042024-05-040000832988sig:DiamondsDirectMember2024-02-042024-05-040000832988sig:DiamondsDirectMembersig:NorthAmericaSegmentMember2023-01-292023-04-290000832988sig:InternationalMembersig:DiamondsDirectMember2023-01-292023-04-290000832988sig:DiamondsDirectMemberus-gaap:AllOtherSegmentsMember2023-01-292023-04-290000832988sig:DiamondsDirectMember2023-01-292023-04-290000832988sig:BanterByPiercingPagodaMembersig:NorthAmericaSegmentMember2024-02-042024-05-040000832988sig:BanterByPiercingPagodaMembersig:InternationalMember2024-02-042024-05-040000832988sig:BanterByPiercingPagodaMemberus-gaap:AllOtherSegmentsMember2024-02-042024-05-040000832988sig:BanterByPiercingPagodaMember2024-02-042024-05-040000832988sig:BanterByPiercingPagodaMembersig:NorthAmericaSegmentMember2023-01-292023-04-290000832988sig:BanterByPiercingPagodaMembersig:InternationalMember2023-01-292023-04-290000832988sig:BanterByPiercingPagodaMemberus-gaap:AllOtherSegmentsMember2023-01-292023-04-290000832988sig:BanterByPiercingPagodaMember2023-01-292023-04-290000832988sig:NorthAmericaSegmentMembersig:PeoplesMember2024-02-042024-05-040000832988sig:InternationalMembersig:PeoplesMember2024-02-042024-05-040000832988us-gaap:AllOtherSegmentsMembersig:PeoplesMember2024-02-042024-05-040000832988sig:PeoplesMember2024-02-042024-05-040000832988sig:NorthAmericaSegmentMembersig:PeoplesMember2023-01-292023-04-290000832988sig:InternationalMembersig:PeoplesMember2023-01-292023-04-290000832988us-gaap:AllOtherSegmentsMembersig:PeoplesMember2023-01-292023-04-290000832988sig:PeoplesMember2023-01-292023-04-290000832988sig:InternationalMembersig:NorthAmericaSegmentMember2024-02-042024-05-040000832988sig:InternationalMembersig:InternationalMember2024-02-042024-05-040000832988sig:InternationalMemberus-gaap:AllOtherSegmentsMember2024-02-042024-05-040000832988sig:InternationalMember2024-02-042024-05-040000832988sig:InternationalMembersig:NorthAmericaSegmentMember2023-01-292023-04-290000832988sig:InternationalMembersig:InternationalMember2023-01-292023-04-290000832988sig:InternationalMemberus-gaap:AllOtherSegmentsMember2023-01-292023-04-290000832988sig:InternationalMember2023-01-292023-04-290000832988sig:NorthAmericaSegmentMembersig:OtherBannerMember2024-02-042024-05-040000832988sig:InternationalMembersig:OtherBannerMember2024-02-042024-05-040000832988us-gaap:AllOtherSegmentsMembersig:OtherBannerMember2024-02-042024-05-040000832988sig:OtherBannerMember2024-02-042024-05-040000832988sig:NorthAmericaSegmentMembersig:OtherBannerMember2023-01-292023-04-290000832988sig:InternationalMembersig:OtherBannerMember2023-01-292023-04-290000832988us-gaap:AllOtherSegmentsMembersig:OtherBannerMember2023-01-292023-04-290000832988sig:OtherBannerMember2023-01-292023-04-290000832988sig:NorthAmericaSegmentMember2024-02-042024-05-040000832988sig:InternationalMember2024-02-042024-05-040000832988us-gaap:AllOtherSegmentsMember2024-02-042024-05-040000832988sig:NorthAmericaSegmentMember2023-01-292023-04-290000832988sig:InternationalMember2023-01-292023-04-290000832988us-gaap:AllOtherSegmentsMember2023-01-292023-04-290000832988sig:NorthAmericaSegmentMembersig:BridalMember2024-02-042024-05-040000832988sig:InternationalMembersig:BridalMember2024-02-042024-05-040000832988us-gaap:AllOtherSegmentsMembersig:BridalMember2024-02-042024-05-040000832988sig:BridalMember2024-02-042024-05-040000832988sig:NorthAmericaSegmentMembersig:BridalMember2023-01-292023-04-290000832988sig:InternationalMembersig:BridalMember2023-01-292023-04-290000832988us-gaap:AllOtherSegmentsMembersig:BridalMember2023-01-292023-04-290000832988sig:BridalMember2023-01-292023-04-290000832988sig:NorthAmericaSegmentMembersig:FashionMember2024-02-042024-05-040000832988sig:InternationalMembersig:FashionMember2024-02-042024-05-040000832988us-gaap:AllOtherSegmentsMembersig:FashionMember2024-02-042024-05-040000832988sig:FashionMember2024-02-042024-05-040000832988sig:NorthAmericaSegmentMembersig:FashionMember2023-01-292023-04-290000832988sig:InternationalMembersig:FashionMember2023-01-292023-04-290000832988us-gaap:AllOtherSegmentsMembersig:FashionMember2023-01-292023-04-290000832988sig:FashionMember2023-01-292023-04-290000832988sig:NorthAmericaSegmentMembersig:WatchesMember2024-02-042024-05-040000832988sig:InternationalMembersig:WatchesMember2024-02-042024-05-040000832988us-gaap:AllOtherSegmentsMembersig:WatchesMember2024-02-042024-05-040000832988sig:WatchesMember2024-02-042024-05-040000832988sig:NorthAmericaSegmentMembersig:WatchesMember2023-01-292023-04-290000832988sig:InternationalMembersig:WatchesMember2023-01-292023-04-290000832988us-gaap:AllOtherSegmentsMembersig:WatchesMember2023-01-292023-04-290000832988sig:WatchesMember2023-01-292023-04-290000832988us-gaap:ServiceMembersig:NorthAmericaSegmentMember2024-02-042024-05-040000832988us-gaap:ServiceMembersig:InternationalMember2024-02-042024-05-040000832988us-gaap:ServiceMemberus-gaap:AllOtherSegmentsMember2024-02-042024-05-040000832988us-gaap:ServiceMember2024-02-042024-05-040000832988us-gaap:ServiceMembersig:NorthAmericaSegmentMember2023-01-292023-04-290000832988us-gaap:ServiceMembersig:InternationalMember2023-01-292023-04-290000832988us-gaap:ServiceMemberus-gaap:AllOtherSegmentsMember2023-01-292023-04-290000832988us-gaap:ServiceMember2023-01-292023-04-290000832988sig:OtherProductMembersig:NorthAmericaSegmentMember2024-02-042024-05-040000832988sig:InternationalMembersig:OtherProductMember2024-02-042024-05-040000832988us-gaap:AllOtherSegmentsMembersig:OtherProductMember2024-02-042024-05-040000832988sig:OtherProductMember2024-02-042024-05-040000832988sig:OtherProductMembersig:NorthAmericaSegmentMember2023-01-292023-04-290000832988sig:InternationalMembersig:OtherProductMember2023-01-292023-04-290000832988us-gaap:AllOtherSegmentsMembersig:OtherProductMember2023-01-292023-04-290000832988sig:OtherProductMember2023-01-292023-04-290000832988sig:NorthAmericaSegmentMemberus-gaap:SalesChannelDirectlyToConsumerMember2024-02-042024-05-040000832988sig:InternationalMemberus-gaap:SalesChannelDirectlyToConsumerMember2024-02-042024-05-040000832988us-gaap:AllOtherSegmentsMemberus-gaap:SalesChannelDirectlyToConsumerMember2024-02-042024-05-040000832988us-gaap:SalesChannelDirectlyToConsumerMember2024-02-042024-05-040000832988sig:NorthAmericaSegmentMemberus-gaap:SalesChannelDirectlyToConsumerMember2023-01-292023-04-290000832988sig:InternationalMemberus-gaap:SalesChannelDirectlyToConsumerMember2023-01-292023-04-290000832988us-gaap:AllOtherSegmentsMemberus-gaap:SalesChannelDirectlyToConsumerMember2023-01-292023-04-290000832988us-gaap:SalesChannelDirectlyToConsumerMember2023-01-292023-04-290000832988us-gaap:SalesChannelThroughIntermediaryMembersig:NorthAmericaSegmentMember2024-02-042024-05-040000832988us-gaap:SalesChannelThroughIntermediaryMembersig:InternationalMember2024-02-042024-05-040000832988us-gaap:SalesChannelThroughIntermediaryMemberus-gaap:AllOtherSegmentsMember2024-02-042024-05-040000832988us-gaap:SalesChannelThroughIntermediaryMember2024-02-042024-05-040000832988us-gaap:SalesChannelThroughIntermediaryMembersig:NorthAmericaSegmentMember2023-01-292023-04-290000832988us-gaap:SalesChannelThroughIntermediaryMembersig:InternationalMember2023-01-292023-04-290000832988us-gaap:SalesChannelThroughIntermediaryMemberus-gaap:AllOtherSegmentsMember2023-01-292023-04-290000832988us-gaap:SalesChannelThroughIntermediaryMember2023-01-292023-04-290000832988sig:SalesChannelThroughOtherMembersig:NorthAmericaSegmentMember2024-02-042024-05-040000832988sig:InternationalMembersig:SalesChannelThroughOtherMember2024-02-042024-05-040000832988us-gaap:AllOtherSegmentsMembersig:SalesChannelThroughOtherMember2024-02-042024-05-040000832988sig:SalesChannelThroughOtherMember2024-02-042024-05-040000832988sig:SalesChannelThroughOtherMembersig:NorthAmericaSegmentMember2023-01-292023-04-290000832988sig:InternationalMembersig:SalesChannelThroughOtherMember2023-01-292023-04-290000832988us-gaap:AllOtherSegmentsMembersig:SalesChannelThroughOtherMember2023-01-292023-04-290000832988sig:SalesChannelThroughOtherMember2023-01-292023-04-290000832988sig:ExtendedServicePlansandLifetimeWarrantyAgreementsMember2024-02-042024-05-040000832988sig:ExtendedServicePlansandLifetimeWarrantyAgreementsMember2023-01-292023-04-290000832988sig:ExtendedServicePlanMember2024-05-040000832988sig:ExtendedServicePlanMember2024-02-030000832988sig:ExtendedServicePlanMember2023-04-290000832988sig:OtherDeferredRevenueMember2024-05-040000832988sig:OtherDeferredRevenueMember2024-02-030000832988sig:OtherDeferredRevenueMember2023-04-290000832988sig:ExtendedServicePlanMember2023-01-280000832988sig:ExtendedServicePlanMember2024-02-042024-05-040000832988sig:ExtendedServicePlanMember2023-01-292023-04-290000832988sig:ExtendedServicePlanAndOtherDeferredRevenueMember2024-02-042024-05-040000832988sig:ExtendedServicePlanAndOtherDeferredRevenueMember2023-01-292023-04-290000832988us-gaap:OperatingSegmentsMembersig:NorthAmericaSegmentMember2024-02-042024-05-040000832988us-gaap:OperatingSegmentsMembersig:NorthAmericaSegmentMember2023-01-292023-04-290000832988sig:InternationalMemberus-gaap:OperatingSegmentsMember2024-02-042024-05-040000832988sig:InternationalMemberus-gaap:OperatingSegmentsMember2023-01-292023-04-290000832988us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2024-02-042024-05-040000832988us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2023-01-292023-04-290000832988us-gaap:CorporateNonSegmentMember2024-02-042024-05-040000832988us-gaap:CorporateNonSegmentMember2023-01-292023-04-290000832988us-gaap:OperatingSegmentsMembersig:BlueNileMembersig:NorthAmericaSegmentMember2023-01-292023-04-290000832988us-gaap:RedeemableConvertiblePreferredStockMember2016-10-050000832988us-gaap:RedeemableConvertiblePreferredStockMember2016-10-052016-10-050000832988us-gaap:RedeemableConvertiblePreferredStockMember2024-04-012024-05-040000832988us-gaap:RedeemableConvertiblePreferredStockMember2024-04-012024-04-010000832988us-gaap:RedeemableConvertiblePreferredStockMember2024-04-152024-04-150000832988us-gaap:RedeemableConvertiblePreferredStockMember2024-02-042024-05-040000832988us-gaap:SubsequentEventMemberus-gaap:RedeemableConvertiblePreferredStockMember2024-05-062024-05-060000832988us-gaap:SubsequentEventMemberus-gaap:RedeemableConvertiblePreferredStockMember2024-05-202024-05-200000832988us-gaap:RedeemableConvertiblePreferredStockMember2023-01-292024-02-030000832988us-gaap:RedeemableConvertiblePreferredStockMember2023-01-292023-04-290000832988us-gaap:CommonStockMemberus-gaap:OtherCurrentLiabilitiesMember2024-05-040000832988us-gaap:CommonStockMemberus-gaap:OtherCurrentLiabilitiesMember2023-04-290000832988us-gaap:OtherCurrentLiabilitiesMemberus-gaap:RedeemableConvertiblePreferredStockMember2024-05-040000832988us-gaap:OtherCurrentLiabilitiesMemberus-gaap:RedeemableConvertiblePreferredStockMember2023-04-290000832988sig:ShareRepurchaseProgramTwentySeventeenMember2024-02-030000832988sig:ShareRepurchaseProgramTwentySeventeenMember2024-03-200000832988sig:ShareRepurchaseProgramTwentySeventeenMember2018-02-042024-05-040000832988sig:ShareRepurchaseProgramTwentySeventeenMember2024-05-040000832988sig:ShareRepurchaseProgramTwentySeventeenMember2024-02-042024-05-040000832988sig:ShareRepurchaseProgramTwentySeventeenMember2023-01-292023-04-290000832988us-gaap:StockCompensationPlanMember2024-02-042024-05-040000832988us-gaap:StockCompensationPlanMember2023-01-292023-04-290000832988us-gaap:RedeemableConvertiblePreferredStockMember2024-02-042024-05-040000832988us-gaap:RedeemableConvertiblePreferredStockMember2023-01-292023-04-290000832988us-gaap:AccumulatedTranslationAdjustmentMember2024-02-030000832988us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-02-030000832988us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-02-030000832988us-gaap:AccumulatedTranslationAdjustmentMember2024-02-042024-05-040000832988us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-02-042024-05-040000832988us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-02-042024-05-040000832988us-gaap:AccumulatedTranslationAdjustmentMember2024-05-040000832988us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-05-040000832988us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-05-040000832988us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:ForeignExchangeContractMember2024-02-042024-05-040000832988us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:ForeignExchangeContractMember2023-01-292023-04-290000832988us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-02-042024-05-040000832988us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-292023-04-290000832988sig:AccumulatedDefinedBenefitPlansAdjustmentSettlementLossAttributableToParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-02-042024-05-040000832988sig:AccumulatedDefinedBenefitPlansAdjustmentSettlementLossAttributableToParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-292023-04-290000832988us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-02-042024-05-040000832988us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-292023-04-290000832988us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-02-042024-05-040000832988us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-292023-04-290000832988sig:NorthAmericaSegmentMember2024-02-030000832988sig:NorthAmericaSegmentMember2024-05-040000832988us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMember2024-05-040000832988us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMember2024-02-030000832988us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMember2023-04-290000832988us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2024-05-040000832988us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2024-02-030000832988us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2023-04-290000832988us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2024-02-042024-05-040000832988us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2023-01-292023-04-290000832988us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:USTreasurySecuritiesMember2024-05-040000832988us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2024-05-040000832988us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-05-040000832988us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:USTreasurySecuritiesMember2024-02-030000832988us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2024-02-030000832988us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-02-030000832988us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:USTreasurySecuritiesMember2023-04-290000832988us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2023-04-290000832988us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-04-290000832988us-gaap:ForeignExchangeContractMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-05-040000832988us-gaap:ForeignExchangeContractMemberus-gaap:FairValueInputsLevel1Member2024-05-040000832988us-gaap:ForeignExchangeContractMemberus-gaap:FairValueInputsLevel2Member2024-05-040000832988us-gaap:ForeignExchangeContractMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-02-030000832988us-gaap:ForeignExchangeContractMemberus-gaap:FairValueInputsLevel1Member2024-02-030000832988us-gaap:ForeignExchangeContractMemberus-gaap:FairValueInputsLevel2Member2024-02-030000832988us-gaap:ForeignExchangeContractMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-04-290000832988us-gaap:ForeignExchangeContractMemberus-gaap:FairValueInputsLevel1Member2023-04-290000832988us-gaap:ForeignExchangeContractMemberus-gaap:FairValueInputsLevel2Member2023-04-290000832988us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-05-040000832988us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2024-05-040000832988us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-05-040000832988us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-02-030000832988us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2024-02-030000832988us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-02-030000832988us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-04-290000832988us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-04-290000832988us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-04-290000832988us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:CorporateDebtSecuritiesMember2024-05-040000832988us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2024-05-040000832988us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-05-040000832988us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:CorporateDebtSecuritiesMember2024-02-030000832988us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2024-02-030000832988us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-02-030000832988us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:CorporateDebtSecuritiesMember2023-04-290000832988us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2023-04-290000832988us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-04-290000832988us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-05-040000832988us-gaap:FairValueInputsLevel1Member2024-05-040000832988us-gaap:FairValueInputsLevel2Member2024-05-040000832988us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-02-030000832988us-gaap:FairValueInputsLevel1Member2024-02-030000832988us-gaap:FairValueInputsLevel2Member2024-02-030000832988us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-04-290000832988us-gaap:FairValueInputsLevel1Member2023-04-290000832988us-gaap:FairValueInputsLevel2Member2023-04-290000832988us-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2024-05-040000832988us-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2024-05-040000832988us-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2024-02-030000832988us-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2024-02-030000832988us-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2023-04-290000832988us-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2023-04-290000832988us-gaap:SeniorNotesMember2024-05-040000832988us-gaap:SeniorNotesMember2024-02-030000832988us-gaap:SeniorNotesMember2023-04-290000832988us-gaap:SeniorNotesMember2014-05-190000832988us-gaap:SeniorNotesMember2019-09-052019-09-050000832988us-gaap:SeniorNotesMember2019-09-050000832988us-gaap:SeniorNotesMember2019-09-060000832988us-gaap:RevolvingCreditFacilityMember2019-09-270000832988sig:TermLoanFacilityMember2019-09-270000832988us-gaap:RevolvingCreditFacilityMember2021-07-280000832988us-gaap:RevolvingCreditFacilityMember2024-05-040000832988us-gaap:RevolvingCreditFacilityMember2023-04-290000832988us-gaap:RevolvingCreditFacilityMember2024-02-030000832988sig:Fiscal2024RestructuringPlanMember2024-02-030000832988sig:Fiscal2024RestructuringPlanMember2024-02-042024-05-040000832988sig:Fiscal2024RestructuringPlanMemberus-gaap:EmployeeSeveranceMember2024-02-042024-05-040000832988sig:Fiscal2024RestructuringPlanMemberus-gaap:FacilityClosingMember2024-02-042024-05-040000832988sig:AssetImpairmentsMembersig:Fiscal2024RestructuringPlanMember2024-02-042024-05-040000832988sig:Fiscal2024RestructuringPlanMember2023-05-072024-05-040000832988sig:Fiscal2024RestructuringPlanMemberus-gaap:EmployeeSeveranceMember2023-05-072024-05-040000832988sig:Fiscal2024RestructuringPlanMemberus-gaap:FacilityClosingMember2023-05-072024-05-040000832988sig:AssetImpairmentsMembersig:Fiscal2024RestructuringPlanMember2023-05-072024-05-040000832988sig:Fiscal2024RestructuringPlanMembersrt:MinimumMember2024-05-040000832988sig:Fiscal2024RestructuringPlanMembersrt:MaximumMember2024-05-040000832988sig:AssetImpairmentsMembersig:Fiscal2024RestructuringPlanMembersrt:MinimumMember2024-05-040000832988sig:AssetImpairmentsMembersig:Fiscal2024RestructuringPlanMembersrt:MaximumMember2024-05-040000832988sig:EmploymentPracticesCollectiveActionMember2022-01-302022-04-300000832988sig:EmploymentPracticesCollectiveActionMember2022-06-082022-06-080000832988sig:EmploymentPracticesCollectiveActionMember2023-01-292023-04-290000832988sig:OtherMattersMember2022-10-302023-01-280000832988sig:OtherMattersMember2023-01-292023-04-290000832988sig:EugeniaUlasewiczMember2024-02-042024-05-040000832988sig:MaryElizabethFinnMember2024-02-042024-05-040000832988sig:StashPtakMember2024-02-042024-05-040000832988sig:HowardMelnickMember2024-02-042024-05-040000832988sig:SteveLovejoyMember2024-02-042024-05-040000832988sig:RebeccaWootersMember2024-02-042024-05-040000832988sig:OdedEdelmanMember2024-02-042024-05-040000832988sig:WilliamRBraceMember2024-02-042024-05-040000832988sig:JamieL.SingletonMember2024-02-042024-05-040000832988sig:HowardMelnickMember2024-05-040000832988sig:RebeccaWootersMember2024-05-040000832988sig:EugeniaUlasewiczMember2024-05-040000832988sig:OdedEdelmanMember2024-05-040000832988sig:SteveLovejoyMember2024-05-040000832988sig:MaryElizabethFinnMember2024-05-040000832988sig:JamieL.SingletonMember2024-05-040000832988sig:StashPtakMember2024-05-040000832988sig:WilliamRBraceMember2024-05-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| ☒ | Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

for the quarterly period ended May 4, 2024 or

| | | | | |

| ☐ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

for the transition period from to

Commission file number 1-32349

SIGNET JEWELERS LIMITED

| | |

| (Exact name of Registrant as specified in its charter) |

| | | | | | | | |

| Bermuda | | Not Applicable |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

Clarendon House

2 Church Street

Hamilton HM11

Bermuda

(441) 296 5872

(Address and telephone number including area code of principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on which Registered |

| Common Shares of $0.18 each | | SIG | | The New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer o Non-accelerated filer o Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Common Shares, $0.18 par value, 44,606,286 shares as of June 7, 2024

SIGNET JEWELERS LIMITED

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

SIGNET JEWELERS LIMITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| 13 weeks ended | | | | |

| (in millions, except per share amounts) | May 4, 2024 | | April 29, 2023 | | | | | | Notes |

Sales | $ | 1,510.8 | | | $ | 1,668.0 | | | | | | | 3 |

Cost of sales | (938.4) | | | (1,036.0) | | | | | | | |

Gross margin | 572.4 | | | 632.0 | | | | | | | |

Selling, general and administrative expenses | (515.4) | | | (530.4) | | | | | | | |

Other operating (expense) income, net | (7.2) | | | 0.1 | | | | | | | 17 |

| Operating income | 49.8 | | | 101.7 | | | | | | | 4 |

Interest income, net | 8.6 | | | 5.6 | | | | | | | |

Other non-operating income (expense), net | 0.2 | | | (0.4) | | | | | | | |

| Income before income taxes | 58.6 | | | 106.9 | | | | | | | |

Income taxes | (6.5) | | | (9.5) | | | | | | | 9 |

| Net income | $ | 52.1 | | | $ | 97.4 | | | | | | | |

Dividends on redeemable convertible preferred shares | (92.2) | | | (8.6) | | | | | | | 5, 6 |

| Net (loss) income attributable to common shareholders | $ | (40.1) | | | $ | 88.8 | | | | | | | |

| | | | | | | | | |

| Earnings (loss) per common share: | | | | | | | | | |

Basic | $ | (0.90) | | | $ | 1.96 | | | | | | | 7 |

Diluted | $ | (0.90) | | | $ | 1.79 | | | | | | | 7 |

Weighted average common shares outstanding: | | | | | | | | | |

Basic | 44.6 | | | 45.3 | | | | | | | 7 |

Diluted | 44.6 | | | 54.5 | | | | | | | 7 |

The accompanying notes are an integral part of these condensed consolidated financial statements.

SIGNET JEWELERS LIMITED

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 13 weeks ended |

| May 4, 2024 | | April 29, 2023 |

| (in millions) | Pre-tax

amount | | Tax

(expense)

benefit | | After-tax

amount | | Pre-tax

amount | | Tax

(expense)

benefit | | After-tax

amount |

| Net income | | | | | $ | 52.1 | | | | | | | $ | 97.4 | |

Other comprehensive loss: | | | | | | | | | | | |

Foreign currency translation adjustments | (4.1) | | | — | | | (4.1) | | | 1.2 | | | — | | | 1.2 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Cash flow hedges: | | | | | | | | | | | |

| Unrealized loss | — | | | — | | | — | | | (0.2) | | | — | | | (0.2) | |

Reclassification adjustment for gains to earnings | (0.2) | | | — | | | (0.2) | | | (0.5) | | | 0.1 | | | (0.4) | |

Pension plan: | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Reclassification adjustment for pension settlement loss to earnings | — | | | — | | | — | | | 0.2 | | | (4.1) | | | (3.9) | |

| Total other comprehensive loss | $ | (4.3) | | | $ | — | | | $ | (4.3) | | | $ | 0.7 | | | $ | (4.0) | | | $ | (3.3) | |

| Total comprehensive income | | | | | $ | 47.8 | | | | | | | $ | 94.1 | |

| | | | | | | | | | | | | | |

| |

| | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

SIGNET JEWELERS LIMITED

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except par value per share amount) | May 4, 2024 | | February 3, 2024 | | April 29, 2023 | | Notes |

Assets | | | | | | | |

Current assets: | | | | | | | |

Cash and cash equivalents | $ | 729.3 | | | $ | 1,378.7 | | | $ | 655.9 | | | |

| | | | | | | |

Inventories | 1,983.6 | | | 1,936.6 | | | 2,183.5 | | | 10 |

Income taxes | 9.3 | | | 9.4 | | | 45.4 | | | |

Other current assets | 202.4 | | | 211.9 | | | 198.3 | | | |

Total current assets | 2,924.6 | | | 3,536.6 | | | 3,083.1 | | | |

Non-current assets: | | | | | | | |

Property, plant and equipment, net of accumulated depreciation and amortization of $1,469.5 (February 3, 2024 and April 29, 2023: $1,441.2 and $1,372.8, respectively) | 475.1 | | | 497.7 | | | 568.2 | | | |

Operating lease right-of-use assets | 979.4 | | | 1,001.8 | | | 1,072.7 | | | 11 |

Goodwill | 754.5 | | | 754.5 | | | 751.4 | | | 12 |

Intangible assets, net | 402.2 | | | 402.8 | | | 406.8 | | | 12 |

Other assets | 315.2 | | | 319.3 | | | 286.2 | | | |

Deferred tax assets | 300.2 | | | 300.5 | | | 37.0 | | | |

Total assets | $ | 6,151.2 | | | $ | 6,813.2 | | | $ | 6,205.4 | | | |

Liabilities, Redeemable convertible preferred shares, and Shareholders’ equity | | | | | | | |

Current liabilities: | | | | | | | |

Current portion of long-term debt | $ | 147.8 | | | $ | 147.7 | | | $ | — | | | 15 |

Accounts payable | 599.3 | | | 735.1 | | | 701.5 | | | |

Accrued expenses and other current liabilities | 356.0 | | | 400.2 | | | 378.1 | | | |

Deferred revenue | 360.6 | | | 362.9 | | | 368.7 | | | 3 |

Operating lease liabilities | 253.0 | | | 260.3 | | | 273.9 | | | 11 |

Income taxes | 31.4 | | | 69.8 | | | 53.3 | | | |

Total current liabilities | 1,748.1 | | | 1,976.0 | | | 1,775.5 | | | |

Non-current liabilities: | | | | | | | |

Long-term debt | — | | | — | | | 147.5 | | | 15 |

Operating lease liabilities | 818.5 | | | 835.7 | | | 902.0 | | | 11 |

Other liabilities | 93.9 | | | 96.0 | | | 96.8 | | | |

Deferred revenue | 878.9 | | | 881.8 | | | 874.9 | | | 3 |

Deferred tax liabilities | 202.0 | | | 201.7 | | | 172.9 | | | |

Total liabilities | 3,741.4 | | | 3,991.2 | | | 3,969.6 | | | |

Commitments and contingencies | | | | | | | 20 |

Redeemable Series A Convertible Preference Shares $0.01 par value: authorized 500 shares, 0.313 shares outstanding (February 3, 2024 and April 29, 2023: 0.625 shares outstanding, respectively) | 328.0 | | | 655.5 | | | 654.3 | | | 5 |

Shareholders’ equity: | | | | | | | |

Common shares of $0.18 par value: authorized 500 shares, 44.7 shares outstanding (February 3, 2024 and April 29, 2023: 44.2 and 45.4 outstanding, respectively) | 12.6 | | | 12.6 | | | 12.6 | | | |

Additional paid-in capital | 181.6 | | | 230.7 | | | 210.5 | | | |

Other reserves | 0.4 | | | 0.4 | | | 0.4 | | | |

Treasury shares at cost: 25.3 shares (February 3, 2024 and April 29, 2023: 25.8 and 24.6 shares, respectively) | (1,622.9) | | | (1,646.9) | | | (1,556.5) | | | |

Retained earnings | 3,779.7 | | | 3,835.0 | | | 3,182.0 | | | |

Accumulated other comprehensive loss | (269.6) | | | (265.3) | | | (267.5) | | | 8 |

Total shareholders’ equity | 2,081.8 | | | 2,166.5 | | | 1,581.5 | | | |

Total liabilities, redeemable convertible preferred shares and shareholders’ equity | $ | 6,151.2 | | | $ | 6,813.2 | | | $ | 6,205.4 | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

SIGNET JEWELERS LIMITED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | | | | |

| | 13 weeks ended |

| (in millions) | | May 4, 2024 | | April 29, 2023 |

Operating activities | | | | |

| Net income | | $ | 52.1 | | | $ | 97.4 | |

| Adjustments to reconcile net income to net cash used in operating activities: | | | | |

Depreciation and amortization | | 36.6 | | | 43.1 | |

Amortization of unfavorable contracts | | (0.5) | | | (0.5) | |

Share-based compensation | | 7.6 | | | 11.3 | |

Deferred taxation | | 0.5 | | | 51.5 | |

| | | | |

| | | | |

| | | | |

| | | | |

Other non-cash movements | | 5.7 | | | 2.5 | |

Changes in operating assets and liabilities: | | | | |

| | | | |

| Inventories | | (48.9) | | | (29.8) | |

| Other assets | | 12.3 | | | (27.6) | |

| Accounts payable | | (136.7) | | | (170.3) | |

| Accrued expenses and other liabilities | | (40.8) | | | (264.9) | |

Change in operating lease assets and liabilities | | (2.8) | | | (31.3) | |

| Deferred revenue | | (4.7) | | | (7.8) | |

| Income tax receivable and payable | | (38.6) | | | (55.4) | |

| | | | |

| Net cash used in operating activities | | (158.2) | | | (381.8) | |

Investing activities | | | | |

Purchase of property, plant and equipment | | (23.3) | | | (27.1) | |

| | | | |

| | | | |

| | | | |

| | | | |

| Other investing activities, net | | 1.8 | | | — | |

| Net cash used in investing activities | | (21.5) | | | (27.1) | |

Financing activities | | | | |

Dividends paid on common shares | | (10.2) | | | (9.0) | |

Dividends paid on redeemable convertible preferred shares | | (10.3) | | | (8.2) | |

Repurchase of common shares | | (7.4) | | | (39.1) | |

| | | | |

| Repurchase of redeemable convertible preferred shares | | (412.0) | | | — | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Other financing activities, net | | (27.6) | | | (44.4) | |

| Net cash used in financing activities | | (467.5) | | | (100.7) | |

Cash and cash equivalents at beginning of period | | 1,378.7 | | | 1,166.8 | |

| Decrease in cash and cash equivalents | | (647.2) | | | (509.6) | |

Effect of exchange rate changes on cash and cash equivalents | | (2.2) | | | (1.3) | |

Cash and cash equivalents at end of period | | $ | 729.3 | | | $ | 655.9 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

SIGNET JEWELERS LIMITED

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | Common

shares at

par value | | Additional

paid-in

capital | | Other

reserves | | Treasury

shares | | Retained

earnings | | Accumulated other

comprehensive

loss | | Total

shareholders’

equity |

| Balance at February 3, 2024 | $ | 12.6 | | | $ | 230.7 | | | $ | 0.4 | | | $ | (1,646.9) | | | $ | 3,835.0 | | | $ | (265.3) | | | $ | 2,166.5 | |

| | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | — | | | 52.1 | | | — | | | 52.1 | |

Other comprehensive loss | — | | | — | | | — | | | — | | | — | | | (4.3) | | | (4.3) | |

Dividends declared: | | | | | | | | | | | | | |

Common shares, $0.29/share | — | | | — | | | — | | | — | | | (12.9) | | | — | | | (12.9) | |

Preferred shares, $13.14/share | — | | | — | | | — | | | — | | | (5.0) | | | — | | | (5.0) | |

| Redemption of preferred shares | — | | | — | | | — | | | — | | | (87.2) | | | — | | | (87.2) | |

Repurchase of common shares | — | | | — | | | — | | | (7.4) | | | — | | | — | | | (7.4) | |

Net settlement of equity-based awards | — | | | (56.7) | | | — | | | 31.4 | | | (2.3) | | | — | | | (27.6) | |

Share-based compensation expense | — | | | 7.6 | | | — | | | — | | | — | | | — | | | 7.6 | |

| Balance at May 4, 2024 | $ | 12.6 | | | $ | 181.6 | | | $ | 0.4 | | | $ | (1,622.9) | | | $ | 3,779.7 | | | $ | (269.6) | | | $ | 2,081.8 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | Common

shares at

par value | | Additional

paid-in

capital | | Other

reserves | | Treasury

shares | | Retained

earnings | | Accumulated other

comprehensive

loss | | Total

shareholders’

equity |

| Balance at January 28, 2023 | $ | 12.6 | | | $ | 259.7 | | | $ | 0.4 | | | $ | (1,574.7) | | | $ | 3,144.8 | | | $ | (264.2) | | | $ | 1,578.6 | |

| | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | — | | | 97.4 | | | — | | | 97.4 | |

Other comprehensive loss | — | | | — | | | — | | | — | | | — | | | (3.3) | | | (3.3) | |

Dividends declared: | | | | | | | | | | | | | |

Common shares, $0.23/share | — | | | — | | | — | | | — | | | (10.4) | | | — | | | (10.4) | |

Preferred shares, $13.14/share | — | | | — | | | — | | | — | | | (8.6) | | | — | | | (8.6) | |

Repurchase of common shares | — | | | — | | | — | | | (39.1) | | | — | | | — | | | (39.1) | |

Net settlement of equity-based awards | — | | | (60.5) | | | — | | | 57.3 | | | (41.2) | | | — | | | (44.4) | |

| | | | | | | | | | | | | |

Share-based compensation expense | — | | | 11.3 | | | — | | | — | | | — | | | — | | | 11.3 | |

| Balance at April 29, 2023 | $ | 12.6 | | | $ | 210.5 | | | $ | 0.4 | | | $ | (1,556.5) | | | $ | 3,182.0 | | | $ | (267.5) | | | $ | 1,581.5 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

SIGNET JEWELERS LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Organization and principal accounting policies

Signet Jewelers Limited (“Signet” or the “Company”), a holding company incorporated in Bermuda, is the world’s largest retailer of diamond jewelry. The Company operates through its 100% owned subsidiaries with sales primarily in the United States (“US”), United Kingdom (“UK”) and Canada. Signet manages its business as three reportable segments: North America, International, and Other. The “Other” reportable segment consists of subsidiaries involved in the purchasing and conversion of rough diamonds to polished stones. See Note 4 for information regarding the Company’s reportable segments.

Signet’s business is seasonal, with the fourth quarter historically accounting for approximately 35-40% of annual sales as well as for a substantial portion of the annual operating profit.

Basis of preparation

The condensed consolidated financial statements of the Company are prepared, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”). Certain information and footnote disclosures normally included in financial statements prepared in accordance with US generally accepted accounting principles (“US GAAP” or “GAAP”) have been condensed or omitted from this report, as is permitted by such rules and regulations. Intercompany transactions and balances have been eliminated in consolidation. The Company has reclassified certain prior year amounts to conform to the current year presentation. In the opinion of management, the accompanying condensed consolidated financial statements reflect all adjustments, which are of a normal recurring nature, necessary for a fair presentation of the results for the interim periods. The results for interim periods are not necessarily indicative of the results to be expected for the full fiscal year or for any other interim period. These condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes included in Signet’s Annual Report on Form 10-K for the fiscal year ended February 3, 2024 filed with the SEC on March 21, 2024.

Use of estimates

The preparation of these condensed consolidated financial statements, in conformity with US GAAP and SEC regulations for interim reporting, requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements and reported amounts of revenues and expenses during the reported periods. Actual results could differ from those estimates. Estimates and assumptions are primarily made in relation to the valuation of inventories, deferred revenue, employee compensation, income taxes, contingencies, leases, asset impairments for goodwill, indefinite-lived intangible and long-lived assets and the depreciation and amortization of long-lived assets.

Fiscal year

The Company’s fiscal year ends on the Saturday nearest to January 31st. Fiscal 2025 and Fiscal 2024 refer to the 52-week period ending February 1, 2025 and the 53-week period ended February 3, 2024, respectively. Within these condensed consolidated financial statements, the first quarter of the relevant fiscal years 2025 and 2024 refer to the 13 weeks ended May 4, 2024 and April 29, 2023, respectively.

Foreign currency translation

The financial position and operating results of certain foreign operations, including certain subsidiaries operating in the UK as part of the International reportable segment and Canada as part of the North America reportable segment, are consolidated using the local currency as the functional currency. Assets and liabilities are translated at the rates of exchange on the condensed consolidated balance sheet dates, and revenues and expenses are translated at the monthly average rates of exchange during the period. Resulting translation gains or losses are included in the accompanying condensed consolidated statements of shareholders’ equity as a component of accumulated other comprehensive income (loss) (“AOCI”). Gains or losses resulting from foreign currency transactions are included within other operating (expense) income, net within the condensed consolidated statements of operations.

See Note 8 for additional information regarding the Company’s foreign currency translation.

2. New accounting pronouncements

The following section provides a description of new accounting pronouncements ("Accounting Standard Update" or "ASU") issued by the Financial Accounting Standards Board ("FASB") that are applicable to the Company.

New accounting pronouncements recently adopted

There were no new accounting pronouncements adopted during Fiscal 2025 that have a material impact on the Company’s financial position or results of operations.

New accounting pronouncements issued but not yet adopted

Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures (“ASU 2023-07”)

In November 2023, the FASB issued ASU 2023-07. This ASU requires the following disclosures on an annual and interim basis:

•Significant segment expenses that are regularly provided to the chief operating decision maker (“CODM”) and included with each reported measure of segment profit/loss.

•Other segment items by reportable segment, consisting of differences between segment revenue and segment profit/loss not already disclosed above.

•Other information by reportable segment, including total assets, depreciation and amortization, and capital expenditures.

•The title of the CODM and an explanation of how the CODM uses the reported measures of segment profit/loss in assessing segment performance and deciding how to allocate resources.

The amendments in this ASU are effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024, with early adoption permitted, and should be applied on a retrospective basis. This ASU will have no impact on the Company’s financial condition or results of operations. The Company is evaluating the impact of this ASU on its segment reporting disclosures.

Income Taxes (Topic 740): Improvements to Income Tax Disclosures (“ASU 2023-09”)

In December 2023, the FASB issued ASU 2023-09. This ASU modifies the annual disclosure requirements for income taxes in the following ways:

•The effective tax rate reconciliation must be disclosed using both percentages and dollars (currently only one is required). The reconciliation must contain several prescriptive categories, including disaggregating material impacts from foreign, state, and local taxes by jurisdiction. Qualitative information regarding material reconciling items is also required to be disclosed.

•The amount of income taxes paid must be disclosed and disaggregated by jurisdiction.

The amendments in this ASU are effective for fiscal years beginning after December 15, 2024, with early adoption permitted, and may be applied on a prospective or retrospective basis. This ASU will have no impact on the Company’s financial condition or results of operations. The Company is evaluating the impact of this ASU on its income tax disclosures.

3. Revenue recognition

The following table provides the Company’s total sales, disaggregated by banner, for the 13 weeks ended May 4, 2024 and April 29, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 13 weeks ended May 4, 2024 | | 13 weeks ended April 29, 2023 |

| (in millions) | North America | | International | | Other | | Consolidated | | North America | | International | | Other | | Consolidated |

Sales by banner: | | | | | | | | | | | | | | | |

Kay | $ | 567.5 | | | $ | — | | | $ | — | | | $ | 567.5 | | | $ | 602.2 | | | $ | — | | | $ | — | | | $ | 602.2 | |

Zales | 256.7 | | | — | | | — | | | 256.7 | | | 295.4 | | | — | | | — | | | 295.4 | |

Jared | 249.5 | | | — | | | — | | | 249.5 | | | 274.0 | | | — | | | — | | | 274.0 | |

Digital banners (1) | 133.7 | | | — | | | — | | | 133.7 | | | 168.2 | | | | | | | 168.2 | |

| Diamonds Direct | 82.6 | | | — | | | — | | | 82.6 | | | 88.2 | | | — | | | — | | | 88.2 | |

Banter by Piercing Pagoda | 83.6 | | | — | | | — | | | 83.6 | | | 85.5 | | | — | | | — | | | 85.5 | |

Peoples | 39.2 | | | — | | | — | | | 39.2 | | | 38.2 | | | — | | | — | | | 38.2 | |

International segment banners | — | | | 77.2 | | | — | | | 77.2 | | | — | | | 93.0 | | | — | | | 93.0 | |

Other (2) | 7.2 | | | — | | | 13.6 | | | 20.8 | | | 9.5 | | | — | | | 13.8 | | | 23.3 | |

Total sales | $ | 1,420.0 | | | $ | 77.2 | | | $ | 13.6 | | | $ | 1,510.8 | | | $ | 1,561.2 | | | $ | 93.0 | | | $ | 13.8 | | | $ | 1,668.0 | |

| | | | | | | | | | | | | | | |

| | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

(1) Includes sales from the Company’s digital banners, James Allen and Blue Nile.

(2) Other primarily includes sales from the Company’s diamond sourcing operation, loose diamonds and Rocksbox.

The following table provides the Company’s total sales, disaggregated by major product, for the 13 weeks ended May 4, 2024 and April 29, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 13 weeks ended May 4, 2024 | | 13 weeks ended April 29, 2023 |

| (in millions) | North America | | International | | Other | | Consolidated | | North America | | International | | Other | | Consolidated |

Sales by product: | | | | | | | | | | | | | | | |

Bridal | $ | 639.3 | | | $ | 35.3 | | | $ | — | | | $ | 674.6 | | | $ | 727.7 | | | $ | 41.0 | | | $ | — | | | $ | 768.7 | |

Fashion | 536.8 | | | 15.2 | | | — | | | 552.0 | | | 571.4 | | | 15.6 | | | — | | | 587.0 | |

Watches | 42.7 | | | 20.8 | | | — | | | 63.5 | | | 44.8 | | | 30.1 | | | — | | | 74.9 | |

Services (1) | 178.6 | | | 5.9 | | | — | | | 184.5 | | | 175.8 | | | 6.3 | | | — | | | 182.1 | |

Other (2) | 22.6 | | | — | | | 13.6 | | | 36.2 | | | 41.5 | | | — | | | 13.8 | | | 55.3 | |

Total sales | $ | 1,420.0 | | | $ | 77.2 | | | $ | 13.6 | | | $ | 1,510.8 | | | $ | 1,561.2 | | | $ | 93.0 | | | $ | 13.8 | | | $ | 1,668.0 | |

| | | | | | | | | | | | | | | |

| | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

(1) Services primarily includes sales from service plans, repairs and subscriptions.

(2) Other primarily includes sales from the Company’s diamond sourcing operation and other miscellaneous non-jewelry sales.

The following table provides the Company’s total sales, disaggregated by channel, for the 13 weeks ended May 4, 2024 and April 29, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 13 weeks ended May 4, 2024 | | 13 weeks ended April 29, 2023 |

| (in millions) | North America | | International | | Other | | Consolidated | | North America | | International | | Other | | Consolidated |

Sales by channel: | | | | | | | | | | | | | | | |

Store | $ | 1,094.3 | | | $ | 60.8 | | | $ | — | | | $ | 1,155.1 | | | $ | 1,191.0 | | | $ | 76.8 | | | $ | — | | | $ | 1,267.8 | |

eCommerce | 321.5 | | | 16.4 | | | — | | | 337.9 | | | 364.4 | | | 16.2 | | | — | | | 380.6 | |

Other (1) | 4.2 | | | — | | | 13.6 | | | 17.8 | | | 5.8 | | | — | | | 13.8 | | | 19.6 | |

Total sales | $ | 1,420.0 | | | $ | 77.2 | | | $ | 13.6 | | | $ | 1,510.8 | | | $ | 1,561.2 | | | $ | 93.0 | | | $ | 13.8 | | | $ | 1,668.0 | |

| | | | | | | | | | | | | | | |

| | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

(1) Other primarily includes sales from the Company’s diamond sourcing operation and loose diamonds.

Extended service plans (“ESP”)

The Company recognizes revenue related to ESP sales in proportion to when the expected costs will be incurred. The deferral periods for ESP sales are determined from patterns of claims costs, including estimates of future claims costs expected to be incurred. Management reviews the trends in historical claims to assess whether changes are required to the revenue and cost recognition rates utilized. A significant change in either the overall claims pattern or the life over which the Company is expected to fulfill its obligations under the warranty, could result in material change to revenues. All direct costs associated with the sale of the ESP are deferred and amortized in proportion to the revenue recognized and disclosed as either other current assets or other assets in the condensed consolidated balance sheets. These direct costs primarily include sales commissions and credit card fees.

Deferred ESP selling costs

Unamortized deferred ESP selling costs as of May 4, 2024, February 3, 2024 and April 29, 2023 were as follows:

| | | | | | | | | | | | | | | | | |

| (in millions) | May 4, 2024 | | February 3, 2024 | | April 29, 2023 |

| Other current assets | $ | 27.8 | | | $ | 28.2 | | | $ | 28.4 | |

| Other assets | 82.2 | | | 83.0 | | | 84.1 | |

| Total deferred ESP selling costs | $ | 110.0 | | | $ | 111.2 | | | $ | 112.5 | |

Amortization of deferred ESP selling costs is included within selling, general and administrative expenses in the condensed consolidated statements of operations. Amortization of deferred ESP selling costs was $11.2 million and $10.9 million during the 13 weeks ended May 4, 2024 and April 29, 2023, respectively.

Deferred revenue

Deferred revenue as of May 4, 2024, February 3, 2024 and April 29, 2023 was as follows:

| | | | | | | | | | | | | | | | | |

| (in millions) | May 4, 2024 | | February 3, 2024 | | April 29, 2023 |

| ESP deferred revenue | $ | 1,153.7 | | | $ | 1,158.7 | | | $ | 1,149.4 | |

Other deferred revenue (1) | 85.8 | | | 86.0 | | | 94.2 | |

Total deferred revenue | $ | 1,239.5 | | | $ | 1,244.7 | | | $ | 1,243.6 | |

| | | | | |

| Disclosed as: | | | | | |

| Current liabilities | $ | 360.6 | | | $ | 362.9 | | | $ | 368.7 | |

| Non-current liabilities | 878.9 | | | 881.8 | | | 874.9 | |

| Total deferred revenue | $ | 1,239.5 | | | $ | 1,244.7 | | | $ | 1,243.6 | |

(1) Other deferred revenue primarily includes revenue collected from customers for custom orders and eCommerce orders, for which control has not yet transferred to the customer.

| | | | | | | | | | | | | | | |

| 13 weeks ended | | |

| (in millions) | May 4, 2024 | | April 29, 2023 | | | | |

| ESP deferred revenue, beginning of period | $ | 1,158.7 | | | $ | 1,159.5 | | | | | |

Plans sold (1) | 121.9 | | | 113.4 | | | | | |

Revenue recognized (2) | (126.9) | | | (123.5) | | | | | |

| ESP deferred revenue, end of period | $ | 1,153.7 | | | $ | 1,149.4 | | | | | |

(1) Includes impact of foreign exchange translation.

(2) The Company recognized sales of $85.2 million and $86.7 million during the 13 weeks ended May 4, 2024 and April 29, 2023, respectively, related to deferred revenue that existed at the beginning of the period in respect to ESP.

4. Segment information

Financial information for each of Signet’s reportable segments is presented in the tables below. Signet’s CODM utilizes segment sales and operating income, after the elimination of any inter-segment transactions, to determine resource allocations and performance assessment measures. Signet aggregates operating segments with similar economic and operating characteristics. Signet manages its business as three reportable segments: North America, International, and Other. Signet’s sales are derived from the retailing of jewelry, watches, other products and services as generated through the management of its reportable segments. The Company allocates certain support center costs between operating segments, and the remainder of the unallocated costs are included with the corporate and unallocated expenses presented.

The North America reportable segment operates across the US and Canada. Its US stores operate nationally in malls and off-mall locations, as well as online, principally as Kay (Kay Jewelers and Kay Outlet), Zales (Zales Jewelers and Zales Outlet), Jared (Jared The Galleria Of Jewelry and Jared Vault), Diamonds Direct, Banter by Piercing Pagoda, Rocksbox, and digital banners, James Allen and Blue Nile. Its Canadian stores operate as Peoples Jewellers.

The International reportable segment operates stores in the UK, Republic of Ireland and Channel Islands, as well as online. Its stores operate in malls and off-mall locations (i.e. high street) principally under the H. Samuel and Ernest Jones banners.

The Other reportable segment primarily consists of subsidiaries involved in the purchasing and conversion of rough diamonds to polished stones.

| | | | | | | | | | | | | | | |

| 13 weeks ended | | |

| (in millions) | May 4, 2024 | | April 29, 2023 | | | | |

Sales: | | | | | | | |

North America segment | $ | 1,420.0 | | | $ | 1,561.2 | | | | | |

International segment | 77.2 | | | 93.0 | | | | | |

Other segment | 13.6 | | | 13.8 | | | | | |

Total sales | $ | 1,510.8 | | | $ | 1,668.0 | | | | | |

| | | | | | | |

Operating income (loss): | | | | | | | |

North America segment (1) | $ | 83.2 | | | $ | 124.7 | | | | | |

International segment (2) | (13.0) | | | (6.9) | | | | | |

Other segment | (3.1) | | | (0.7) | | | | | |

| Corporate and unallocated expenses | (17.3) | | | (15.4) | | | | | |

Total operating income | 49.8 | | | 101.7 | | | | | |

| Interest income, net | 8.6 | | | 5.6 | | | | | |

| Other non-operating income (expense), net | 0.2 | | | (0.4) | | | | | |

| Income before income taxes | $ | 58.6 | | | $ | 106.9 | | | | | |

(1) Operating income during the 13 weeks ended May 4, 2024 includes $0.6 million of restructuring charges and $2.0 million of asset impairment charges primarily related to planned store closures.

Operating income during the 13 weeks ended April 29, 2023 includes $7.8 million of integration-related expenses, primarily severance and retention, and exit and disposal costs incurred for the integration of Blue Nile and a $3.0 million credit to income related to the adjustment of a prior litigation accrual.

See Note 18 and Note 20 for additional information.

(2) Operating loss during the 13 weeks ended May 4, 2024 includes $4.0 million of restructuring charges; $0.4 million of net asset impairment charges primarily related to planned store closures; and $1.3 million of net losses from the previously announced divestiture of the UK prestige watch business.

See Note 18 for additional information.

5. Redeemable preferred shares

On October 5, 2016, the Company issued 625,000 redeemable Series A Convertible Preference Shares (“Preferred Shares”) to Green Equity Investors VI, L.P., Green Equity Investors Side VI, L.P., LGP Associates VI-A LLC and LGP Associates VI-B LLC, all affiliates of Leonard Green & Partners, L.P. (together, the “Preferred Holders”), for an aggregate purchase price of $625.0 million, or $1,000 per share (the “Stated Value”) pursuant to the investment agreement dated August 24, 2016. The Preferred Shares are classified as temporary equity within the condensed consolidated balance sheets.

On March 30, 2024, Signet’s Board of Directors (the “Board”) approved amendments to the Certificate of Designation to be effective as of April 1, 2024, including to provide for net share settlement upon conversion of the Preferred Shares. Under the terms of the net share settlement, in the event of a mandatory conversion by the Company or a conversion at the option of a Preferred Holder, in exchange for each Preferred Share, Signet will deliver cash for the stated value of the Preferred Share, and may elect to deliver any net settlement amount in excess of stated value in cash, shares or a combination of cash and shares. The current stated value of the Preferred Shares is $1,050.94 per share. The amended Certificate of Designation also includes certain restrictions on the Preferred Holders’ rights to convert the Preferred Shares, including: (a) prior to May 1, 2024, the Preferred Holders may not convert more than 50% of the Preferred Shares in the aggregate; and (b) after May 1, 2024, the Preferred Holders may not convert more than $110.0 million of stated value of the Preferred Shares (in aggregate) in any 30-day period prior to November 15, 2024. No other modifications to the terms of the Certificate of Designation were made.

On April 1, 2024, following the effectiveness of the amended Certificate of Designation, the Preferred Holders delivered notice to the Company of a conversion of 312,500 Preferred Shares (in the aggregate). In accordance with the terms of the amended Certificate of Designation, the conversion was settled in cash by the Company for $414.1 million on April 15, 2024, which included $2.1 million of accrued and unpaid dividends as of the date of conversion. The excess of the settlement amount (excluding dividends) over the stated value of the Preferred Shares was $83.6 million, which was recorded as a deemed dividend and a charge to net (loss) income attributable to common shareholders in the condensed consolidated statement of operations. The Company also incurred $1.5 million of expenses directly related to the redemption and recorded this as an additional deemed dividend charged to net income (loss) attributable to common shareholders, which was included in accrued expenses and other current liabilities in the condensed consolidated balance sheet as of May 4, 2024.

On May 6, 2024, the Preferred Holders elected to convert an additional 100,000 Preferred Shares. Upon notice of conversion, the Company elected to settle the full conversion amount totaling $129.0 million in cash, which was paid on May 20, 2024.

The following table presents certain conversion measures as of May 4, 2024, February 3, 2024 and April 29, 2023:

| | | | | | | | | | | | | | | | | |

| (in millions, except conversion rate and conversion price) | May 4, 2024 | | February 3, 2024 | | April 29, 2023 |

Conversion rate | 12.5406 | | | 12.5406 | | | 12.3939 | |

Conversion price | $ | 79.7410 | | | $ | 79.7410 | | | $ | 80.6849 | |

Potential impact of Preferred Shares if-converted to common shares (2) | 0.7 | | | 8.2 | | | 8.1 | |

Liquidation preference (1) | $ | 332.5 | | | $ | 665.1 | | | $ | 665.1 | |

(1) Includes the Stated Value of the Preferred Shares plus any declared but unpaid dividends

(2) The potential impact of conversion of the outstanding Preferred Shares as of May 4, 2024 reflects the modified net share settlement provisions described above, based on the volume weighted average price per share as of the last trading date of the first quarter.

In connection with the issuance of the Preferred Shares, the Company incurred direct and incremental expenses of $13.7 million, including financial advisory fees, closing costs, legal expenses and other offering-related expenses. These direct and incremental expenses originally reduced the carrying value of the Preferred Shares and are accreted through retained earnings as a deemed dividend from the date of issuance through the then first known redemption date in November 2024. Accumulated accretion recorded in the condensed consolidated balance sheets was $13.3 million as of May 4, 2024 (February 3, 2024 and April 29, 2023: $12.4 million and $11.1 million, respectively).

Accretion of $0.9 million was recorded to Preferred Shares in the condensed consolidated balance sheets during the 13 weeks ended May 4, 2024 and $0.4 million for the 13 weeks ended April 29, 2023.

6. Shareholders’ equity

Dividends on Common Shares

Dividends declared on common shares during the 13 weeks ended May 4, 2024 and April 29, 2023 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal 2025 | | Fiscal 2024 |

| (in millions, except per share amounts) | Dividends

per share | | Total dividends | | Dividends

per share | | Total dividends |

First quarter (1) | $ | 0.29 | | | $ | 12.9 | | | $ | 0.23 | | | $ | 10.4 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

(1) Signet’s dividend policy results in the dividend payment date being a quarter in arrears from the declaration date. As of May 4, 2024 and April 29, 2023, there was $12.9 million and $10.4 million recorded in accrued expenses and other current liabilities in the condensed consolidated balance sheets reflecting the cash dividends declared for the first quarter of Fiscal 2025 and Fiscal 2024, respectively.

Dividends on Preferred Shares

Dividends declared on the Preferred Shares during the 13 weeks ended May 4, 2024 and April 29, 2023 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal 2025 | | Fiscal 2024 |

| (in millions, except per share amounts) | Dividends

per share | | Total dividends(2) | | Dividends

per share | | Total dividends |

First quarter (1) | $ | 13.14 | | | $ | 6.2 | | | $ | 13.14 | | | $ | 8.2 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

(1) Signet’s dividend policy results in the dividend payment date being a quarter in arrears from the declaration date. As of May 4, 2024 and April 29, 2023, there was $4.1 million and $8.2 million recorded in accrued expenses and other current liabilities in the condensed consolidated balance sheets reflecting the cash dividends on the Preferred Shares declared for the first quarter of Fiscal 2025 and Fiscal 2024, respectively.

(2) Dividends on the Preferred Shares during the first quarter of Fiscal 2025 includes $2.1 million of dividends paid in April 2024 in connection with the redemption further described in Note 5.

There were no cumulative undeclared dividends on the Preferred Shares that reduced net (loss) income attributable to common shareholders during the 13 weeks ended May 4, 2024 or April 29, 2023. See Note 5 for additional discussion of the Company’s Preferred Shares.

Share repurchases

Signet may from time to time repurchase common shares under various share repurchase programs authorized by Signet’s Board. Repurchases may be made in the open market, through block trades, through accelerated share repurchase agreements or otherwise. The timing, manner, price and amount of any repurchases will be determined by the Company at its discretion and will be subject to economic and market conditions, stock prices, applicable legal requirements and other factors. The repurchase programs are funded through Signet’s existing cash reserves and liquidity sources. Repurchased shares are held as treasury shares and used by Signet primarily for issuance of share-based compensation awards, or for general corporate purposes.

The Board authorized repurchases to be made under the 2017 Share Repurchase Program (the “2017 Program”). Through the end of Fiscal 2024, the total authorization under the 2017 Program had been increased to approximately $1.9 billion, with $661.0 million remaining as of February 3, 2024. In March 2024, the Board approved a further $200.0 million increase to the multi-year authorization under the 2017 Program. Since inception of the 2017 Program, the Company has repurchased approximately $1.2 billion of shares, with $853.6 million of shares authorized for repurchase remaining as of May 4, 2024.

The share repurchase activity during the 13 weeks ended May 4, 2024 and April 29, 2023 was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 13 weeks ended May 4, 2024 | | 13 weeks ended April 29, 2023 |

| (in millions, except per share amounts) | | | Shares repurchased | | Amount repurchased (1) | | Average repurchase price per share (1) | | Shares repurchased | | Amount repurchased (1) | | Average repurchase price per share (1) |

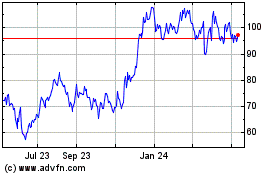

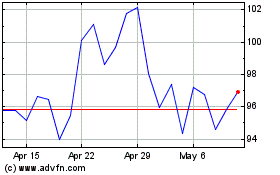

| 2017 Program | | | 0.1 | | $ | 7.4 | | | $ | 101.10 | | | 0.5 | | $ | 39.1 | | | $ | 74.95 | |

(1) Includes amounts paid for commissions.

7. Earnings (loss) per common share (“EPS”)

Basic EPS is computed by dividing net (loss) income attributable to common shareholders by the weighted average number of common shares outstanding for the period. The computation of basic EPS is outlined in the table below:

| | | | | | | | | | | | | | | |

| 13 weeks ended | | |

| (in millions, except per share amounts) | May 4, 2024 | | April 29, 2023 | | | | |

| Numerator: | | | | | | | |

| Net (loss) income attributable to common shareholders | $ | (40.1) | | | $ | 88.8 | | | | | |

| Denominator: | | | | | | | |

Weighted average common shares outstanding | 44.6 | | | 45.3 | | | | | |

EPS – basic | $ | (0.90) | | | $ | 1.96 | | | | | |

The dilutive effect of share awards represents the potential impact of outstanding awards issued under the Company’s share-based compensation plans, including time-based restricted shares, time-based restricted stock units, performance-based stock units, and stock options issued under the Omnibus Plan and stock options issued under the Share Saving Plans. The dilutive effect of performance share units represents the number of contingently issuable shares that would be issuable if the end of the period was the end of the contingency period and is based on the actual achievement of performance metrics through the end of the current interim periods. The dilutive effect of Preferred Shares represents the potential impact for common shares that would be issued upon conversion. Potential common share dilution related to share awards and Preferred Shares is determined using the treasury stock and if-converted methods, respectively. Prior to modification under the if-converted method, the Preferred Shares were assumed to be converted at the beginning of the period, and the resulting common shares are included in the denominator of the diluted EPS calculation for the entire period being presented, only in the periods in which such effect is dilutive. Additionally, in periods in which Preferred Shares are dilutive, cumulative dividends and accretion for issuance costs associated with the Preferred Shares are added back to net income (loss) attributable to common shareholders. Following the modification and conversion of the Preferred Shares described in Note 5, a modified if-converted method is used to determine potential common share dilution related to the remaining outstanding Preferred Shares. Under this method, dividends and accretion of issuance costs are no longer added back to net income (loss) attributable to common shareholders. See Note 5 for additional discussion of the Company’s Preferred Shares.

The computation of diluted EPS is outlined in the table below:

| | | | | | | | | | | | | | | |

| 13 weeks ended | | |

| (in millions, except per share amounts) | May 4, 2024 | | April 29, 2023 | | | | |

| Numerator: | | | | | | | |

| Net (loss) income attributable to common shareholders | $ | (40.1) | | $ | 88.8 | | | | |

Add: Dividends on Preferred Shares | — | | 8.6 | | | | |

| Numerator for diluted EPS | $ | (40.1) | | $ | 97.4 | | | | |

| Denominator: | | | | | | | |

Basic weighted average common shares outstanding | 44.6 | | 45.3 | | | | |

Plus: Dilutive effect of share awards | — | | 1.1 | | | | |

Plus: Dilutive effect of Preferred Shares | — | | 8.1 | | | | |

Diluted weighted average common shares outstanding | 44.6 | | 54.5 | | | | |

EPS – diluted | $ | (0.90) | | $ | 1.79 | | | | |

The calculation of diluted EPS excludes the following items for each respective period on the basis that their effect would be antidilutive:

| | | | | | | | | | | | | | | |

| 13 weeks ended | | |

| (in millions) | May 4, 2024 | | April 29, 2023 | | | | |

| Share awards | 0.5 | | | — | | | | | |

| Potential impact of Preferred Shares | 2.9 | | | — | | | | | |

Total antidilutive shares | 3.4 | | | — | | | | | |

8. Accumulated other comprehensive income (loss)

The following tables present the changes in AOCI by component and the reclassifications out of AOCI, net of tax:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| (in millions) | Foreign

currency

translation | | Losses on available-for-sale securities, net | | Gains (losses)

on cash flow

hedges | | | | | | Accumulated

other