false000154934600015493462023-12-212023-12-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

FORM 8-K

|

|

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

|

|

Date of Report (Date of earliest event reported):

|

December 21, 2023

|

| |

|

|

Shutterstock, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

|

001-35669

|

|

80-0812659

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

350 Fifth Avenue, 20th Floor

New York,

NY 10118

(Address of principal executive offices, including zip code)

(646)

710-3417

(Registrant’s telephone number, including area code)

Not applicable

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Class

|

Trading symbol

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value per share

|

SSTK

|

New York Stock Exchange

|

| |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

| |

|

☐

|

Emerging growth company

|

| |

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

As previously reported in the Current Report on Form 8-K filed with the U.S. Securities and Exchange

Commission (the “SEC”) by Shutterstock, Inc. (the “Company”) on June 23, 2023 (the “Initial Form 8-K”), the Company entered into a Stock Purchase Agreement with Meta Platforms, Inc. (“Meta”) dated May 22, 2023 (the “Purchase Agreement”) to purchase

Giphy, Inc. (“Giphy”). On June 23, 2023, the Company completed its purchase of Giphy. The consideration payable by the Company pursuant to the Purchase Agreement was $53 million in net cash, in addition to cash acquired, assumed debt and other

working capital adjustments.

On August 31, 2023, the Company amended the Initial Form 8-K to include the financial statements required by Item

9.01(a) and the pro forma financial information required by Item 9.01(b) (the “Amended Form 8-K/A”).

In connection with the filing of a Registration Statement on Form S-3 by the Company on the date hereof, this Current

Report on Form 8-K is being filed to provide updated unaudited pro forma condensed combined financial information for the nine months ended September 30, 2023 related to the Company’s acquisition of Giphy (the “Updated Pro Forma Financial

Information”). The Updated Pro Forma Financial Information updates and supplements the unaudited pro forma condensed combined financial information of the Company and related disclosures contained in Exhibit 99.3 to the Amended Form 8-K/A. To the

extent that information in this Current Report on Form 8-K differs from or updates information contained in the Amended Form 8-K/A , the information in this Current Report on Form 8-K shall supersede or supplement the information in the Amended Form

8-K/A.

The Updated Pro Forma Financial Information included in this Current Report on Form 8-K has been presented for

informational purposes only, as required by Form S-3. It does not purport to represent the actual results or project future operating results of the Company following the acquisition of Giphy.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(a) Unaudited Pro Forma

Condensed Combined Financial Information.

The unaudited pro forma condensed combined financial information for the nine-months ended September 30, 2023 related to the Company’s

acquisition of Giphy are attached as Exhibit 99.1 to this Form 8-K and incorporated herein by reference.

(b) Exhibits.

|

Exhibit Number

|

Description

|

|

99.1

|

Unaudited pro forma condensed combined financial information for the nine months ended September 30, 2023

|

|

104

|

Cover Page for Interactive Data File

|

FORWARD-LOOKING STATEMENTS

This Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All

statements other than statements of historical fact are forward-looking. Examples of forward-looking statements include, but are not limited to, statements regarding guidance, industry prospects, future business, future results of operations or

financial condition, new or planned features, products or services, management strategies and our competitive position. You can identify forward-looking statements by words such as “may,” “will,” “would,” “should,” “could,” “expect,” “aim,”

“anticipate,” “believe,” “estimate,” “intend,” “plan,” “predict,” “project,” “seek,” “potential,” “opportunities” and other similar expressions and the negatives of such expressions. However, not all forward-looking statements contain these words.

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that could cause our actual results to differ materially from those expressed or implied by the forward-looking statements contained herein. Such risks

and uncertainties include, among others, those discussed under the caption “Risk Factors” in our most recent Annual Report on Form 10-K, as well as in other documents that the Company may file from time to time with the SEC. Factors related to the

transactions discussed in this document that could cause actual results to differ materially from those contemplated by the forward-looking statements include: potential litigation relating to the transaction that could be instituted; the effects of

disruption to our or the target’s respective businesses; our ability to achieve the benefits from the transaction, including monetization; our ability to effectively integrate the acquired operations into our operations; our ability to retain key

target personnel; and the effects of any unknown liabilities. As a result of such risks, uncertainties and factors, the Company’s actual results may differ materially from any future results, performance or achievements discussed in or implied by the

forward-looking statements contained in this Form 8-K. The forward-looking statements contained in this Form 8-K are made only as of this date and the Company assumes no obligation to update the information included in this press release or revise

any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by law.

EXHIBIT INDEX

|

Exhibit No.

|

|

Exhibit Description

|

|

|

|

|

|

99.1

|

|

|

| |

|

|

|

104

|

|

Cover Page Interactive Data File - The cover page XBRL tags are embedded within the Inline XBRL document.

|

SIGNATURE

Pursuant to

the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

SHUTTERSTOCK, INC.

|

|

|

|

|

|

|

|

|

Dated: December 21, 2023

|

By:

|

/s/ Jarrod Yahes

|

|

|

|

Jarrod Yahes

|

|

|

|

Chief Financial Officer

|

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

On May 22, 2023, Shutterstock, Inc. (“Shutterstock” or the “Company”) entered into a Stock Purchase Agreement with Meta Platforms, Inc.

(“Meta”) (the “Purchase Agreement”). On June 23, 2023, the Company completed its acquisition (the “Acquisition”) of all of the outstanding shares of Giphy, Inc. (“Giphy”) from Meta. The consideration payable by the Company pursuant to the Purchase

Agreement was $53 million in net cash, in addition to cash acquired, assumed debt and other working capital adjustments.

The unaudited pro forma condensed combined statements of operations for the nine months ended

September 30, 2023 were prepared as if the Acquisition had occurred on January 1, 2022, and is derived from the historical financial statements of Shutterstock and Giphy, and should be read in conjunction with Shutterstock’s consolidated financial

statements included in its Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (the “SEC”) on October 31, 2023, Giphy’s unaudited condensed consolidated statement of operations for the period from January 1, 2023 through

June 23, 2023 and Giphy’s unaudited condensed consolidated financial statements for the quarterly periods ended March 31, 2023 and 2022, which are included in the Company’s Current Report on Form 8-K/A filed with the SEC on August 31, 2023. For all

periods after June 23, 2023 Giphy’s results were included in the Shutterstock consolidated financial statements. No unaudited pro forma condensed combined balance sheet is presented herein since the Acquisition is already reflected in the Company’s

most recent consolidated balance sheet filed with the SEC.

The unaudited pro forma condensed combined financial information has been prepared for illustrative

purposes only and are not necessarily indicative of the financial condition or results of operations of future periods or the financial condition or results of operations that would have been realized had the entities been a single entity as of or for

the periods presented.

Assumptions underlying the pro forma adjustments are described in the accompanying notes, which

should be read in conjunction with the unaudited pro forma condensed combined financial information. The transaction accounting adjustments are based on available information and assumptions that the Company’s management believes are reasonable. Such

adjustments are estimates and actual experience may differ from expectations.

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2023

(In thousands, except per share data)

| |

|

|

|

|

Transaction

|

|

|

|

|

| |

Historical

|

|

Accounting

|

|

|

|

Pro Forma

|

| |

Shutterstock

|

|

Giphy

|

|

Adjustments

|

|

Note

|

|

Combined

|

| |

|

|

|

|

|

|

|

|

|

|

Revenue

|

$ 657,368

|

|

$ —

|

|

$ 7,151

|

|

4A

|

|

$ 664,519

|

| |

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue

|

256,798

|

|

—

|

|

2,538

|

|

4B

|

|

259,336

|

|

Sales and marketing

|

152,084

|

|

11,148

|

|

(829)

|

|

4C

|

|

162,403

|

|

Product development

|

72,722

|

|

27,108

|

|

(20,293)

|

|

4C

|

|

79,537

|

|

General and administrative

|

109,488

|

|

11,874

|

|

(6,559)

|

|

4B, 4C, 4D

|

|

114,803

|

|

Total operating expenses

|

591,092

|

|

50,130

|

|

(25,143)

|

|

|

|

616,079

|

|

Income / (loss) from operations

|

66,276

|

|

(50,130)

|

|

32,294

|

|

|

|

48,440

|

|

Bargain purchase gain

|

51,804

|

|

—

|

|

(51,804)

|

|

4E

|

|

—

|

|

Other income, net

|

2,328

|

|

78

|

|

—

|

|

|

|

2,406

|

|

Income / (loss) before income taxes

|

120,408

|

|

(50,052)

|

|

(19,510)

|

|

|

|

50,846

|

|

Provision for income taxes

|

9,133

|

|

—

|

|

7,104

|

|

4F

|

|

16,237

|

|

Net income / (loss)

|

$ 111,275

|

|

$ (50,052)

|

|

$ (26,614)

|

|

|

|

$ 34,609

|

| |

|

|

|

|

|

|

|

|

|

|

Earnings per share:

|

|

|

|

|

|

|

|

|

|

|

Basic

|

$ 3.10

|

|

|

|

|

|

|

|

$ 0.96

|

|

Diluted

|

$ 3.06

|

|

|

|

|

|

|

|

$ 0.95

|

| |

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

Basic

|

35,938

|

|

|

|

|

|

|

|

35,938

|

|

Diluted

|

36,352

|

|

|

|

|

|

|

|

36,352

|

Notes to Unaudited Pro Forma Condensed Combined Financial Information

Note 1 – Basis of Pro Forma Presentation

On May 22, 2023, Shutterstock, Inc. (“Shutterstock” or the “Company”) entered into a Stock Purchase Agreement with Meta Platforms, Inc.

(“Meta”) (the “Purchase Agreement”)to purchase all of the outstanding shares of Giphy, Inc. (“Giphy”) from Meta (the “Acquisition”). On June 23, 2023, the Company completed the Acquisition. The consideration payable by the Company pursuant to the

Purchase Agreement was $53 million in net cash, in addition to cash acquired, assumed debt and other working capital adjustments. Giphy is a New York-based company that operates a collection of GIFs and stickers that supplies casual conversational

content.

The unaudited pro forma condensed combined financial information has been prepared for illustrative

and informational purposes only and were prepared from the respective historical information of Shutterstock and Giphy and reflect adjustments to the historical information using the acquisition method of accounting.

The unaudited pro forma condensed combined statement of operations for the nine months ended

September 30, 2023 was prepared as if the Acquisition had occurred on January 1, 2022, and is derived from Shutterstock’s consolidated financial statements included in its Quarterly Report on Form 10-Q filed with the SEC on October 31, 2023, Giphy’s

unaudited condensed consolidated statement of operations for the period from January 1, 2023 through June 23, 2023 and Giphy’s unaudited condensed consolidated financial statements for the quarterly periods ended March 31, 2023 and 2022, which are

included in the Company’s Current Report on Form 8-K/A filed with the SEC on August 31, 2023. For all periods after June 23, 2023 Giphy’s results were included in the Shutterstock consolidated financial statements.

The unaudited pro forma condensed combined financial information is not necessarily indicative of

what Shutterstock’s results of operations would have been had the transaction occurred January 1, 2022, nor is it necessarily indicative of what the results of operations of the combined company will be in future periods. The historical financial

information has been adjusted to reflect transaction related adjustments that management believes are necessary to present fairly Shutterstock’s pro forma results of operations following the closing of the transaction for the period indicated.

Additionally, the unaudited pro forma condensed combined statement of operations does not reflect any benefits that may result from potential revenue enhancements, anticipated cost savings and expense efficiencies or other synergies that may be

achieved from the Acquisition.

The pro forma adjustments are based on certain estimates and assumptions. The actual adjustments

and the allocation of the final purchase price will depend on several factors, including additional financial information and completion of the determination of fair value of assets and liabilities of Giphy as of the purchase date. Therefore, the

actual adjustments will differ from the pro forma adjustments, and it is possible that the differences may be material.

Note 2 – Giphy Acquisition Consideration

In January 2023, the United Kingdom Competition and Markets Authority (the “CMA”) issued its final order requiring Meta to divest its

ownership of Giphy, which Meta acquired in 2020. In connection with the closing of the Acquisition, whose terms were preapproved by the CMA, the Company and Meta

entered into a transitional services agreement (the “TSA”) pursuant to which Meta is responsible for certain costs related to retention of Giphy employees, including (i) recurring salary, bonus, and benefits through August 2024, which would be $35.6 million if all employees are retained through August 2024, and (ii) nonrecurring items, totaling $87.9 million, comprised of one-time employment inducement bonuses and the cash value of unvested Meta equity awards (the “Giphy Retention Compensation”).

The Giphy Retention Compensation will be paid to the individuals for being employees of the Company

after the completion of the Acquisition. Accordingly, it was determined that the payments by the Company are for future service requirements and will be reflected as operating expenses, less any amounts earned by the employees prior to the Acquisition

as pre-combination service, in the Company’s Statements of Operations as incurred. The pro-forma adjustments reflect the change in the historical compensation costs expected to be incurred from the Acquisition date, as if it had occurred on January 1,

2022. If the Giphy employees are no longer employed by the Company, the full amount of the Giphy Retention Compensation may not be paid or recognized as expense.

In addition, upon closing of the Acquisition, the Company also entered into an agreement with Meta

whereby the Company will provide Meta with Giphy content through API services for a period of two years. To reflect this customer arrangement at fair value, the Company allocated and deferred $30 million of the Acquisition proceeds to the API services

agreement.

The Giphy purchase price, which will result in net cash to be received by the Company, is as

follows (in thousands):

| |

Purchase Price

|

|

Purchase price

|

$ 53,000

|

|

Cash acquired and other working capital adjustments

|

4,750

|

|

Cash paid on closing

|

$ 57,750

|

| |

|

|

Fair value of Giphy Retention Compensation contingent consideration1

|

(98,723)

|

|

Fair value of consideration attributable to pre-combination service2

|

34,972

|

| |

|

|

Net purchase price

|

$ (6,001)

|

1 — This amount consists of $123.5 million of Giphy

Retention Compensation, adjusted for $18.9 million of income tax obligations associated with the receipt of the Giphy Retention Compensation and $5.9 million for the time value of money.

2 — Relates to the cash value of replaced unvested Meta equity awards attributable to pre-combination services.

Note 3 – Preliminary Fair Value Allocation of Assets Acquired and Liabilities Assumed

The preliminary fair value of consideration transferred in the Acquisition has been allocated to

the intangible and tangible assets acquired and liabilities assumed at the Acquisition date, with the excess of the fair value of the net assets acquired over the net consideration received recorded as a bargain purchase gain. The identifiable

intangible assets of these acquisitions are being amortized on a straight-line basis.

|

Assets acquired and liabilities assumed:

|

|

As of September 30, 2023

|

|

Cash and cash equivalents

|

|

$ 4,030

|

|

Prepaid expenses and other current assets

|

|

1,416

|

|

Right of use assets

|

|

1,243

|

|

Intangible assets:

|

|

|

|

Trade name

|

|

21,000

|

|

Developed technology

|

|

21,500

|

|

Intangible assets

|

|

42,500

|

|

Deferred tax asset

|

|

1,006

|

|

Other assets

|

|

1,647

|

|

Total assets acquired

|

|

$ 51,842

|

| |

|

|

|

Accounts payable, accrued expenses and other liabilities

|

|

(4,949)

|

|

Lease liability

|

|

(1,090)

|

|

Total liabilities assumed

|

|

(6,039)

|

|

Net assets acquired

|

|

$ 45,803

|

|

Net purchase price

|

|

(6,001)

|

|

Bargain purchase gain

|

|

$ 51,804

|

The fair value adjustments are preliminary and based on estimates of the fair value and useful

lives of the assets and liabilities assumed as of September 30, 2023 and have been prepared to illustrate the effect of the Acquisition. Accordingly, the pro forma purchase price allocation may be subject to further adjustments as additional

information becomes available and as additional analyses and final valuations are completed. The final adjustments could be materially different from those reflected herein. The identifiable intangible assets, which include developed technology and

the trade name have weighted average useful lives of approximately 4.0 years and 15.0

years, respectively. The fair value of the developed technology was determined using the cost to recreate method, and the fair value of the trade name was determined using the relief-from-royalty method.

Note 4 – Summary Accumulation of Other Pro Forma Adjustments

The following pro forma adjustments result from the Acquisition assuming it

occurred on January 1, 2022, and adjusted operating results for the period from January 1, 2023, through June 23, 2023. Operating activity for the period from June 24, 2023, through September 30, 2023 have been reflected in the Company’s condensed consolidated financial statements filed with the SEC on October 31, 2023.

|

A.

|

To record $7.1 million for the period from January 1, 2023 through June 23, 2023 representing the allocation of the $30 million of Acquisition consideration to the API services agreement, which was

deferred on the date of acquisition and will be recorded as revenue. See Note 2. |

|

B.

|

Amortization of intangible assets recorded in connection with purchase accounting adjustments.

|

| |

|

Period from January 1, 2023 through June 23, 2023

|

|

Cost of revenue

|

|

2,538

|

|

General and administrative

|

|

692

|

C.

|

Adjustments to compensation

expense resulting from the Giphy Retention Compensation arrangements executed at the closing of the Acquisition. See Note 2.

|

|

|

Period from January 1, 2023 through June 23, 2023

|

|

Sales and marketing

|

|

(829)

|

|

Product development

|

|

(20,293)

|

|

General and administrative

|

|

(4,251)

|

|

D.

|

Adjustment to remove $3.0 million of transaction costs (e.g. attorneys, bankers, etc.) related to the Giphy

Acquisition recorded in 2023.

|

|

E.

|

Represents removal of bargain purchase gain of $51.8 million, which was calculated as of the Acquisition date.

|

F.

|

Estimated income tax impact of the Transaction

Accounting Adjustments, using the statutory tax rate.

|

v3.23.4

Document and Entity Information

|

Dec. 21, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 21, 2023

|

| Entity File Number |

001-35669

|

| Entity Registrant Name |

Shutterstock, Inc.

|

| Entity Central Index Key |

0001549346

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

80-0812659

|

| Entity Address, Address Line One |

350 Fifth Avenue

|

| Entity Address, Address Line Two |

20th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10118

|

| City Area Code |

646

|

| Local Phone Number |

710-3417

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

SSTK

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

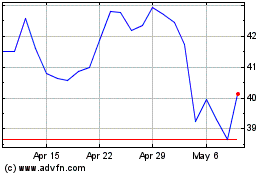

Shutterstock (NYSE:SSTK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Shutterstock (NYSE:SSTK)

Historical Stock Chart

From Feb 2024 to Feb 2025