UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month

of November, 2024

Commission

File Number: 1-13546

STMicroelectronics N.V.

(Name

of Registrant)

WTC Schiphol Airport

Schiphol Boulevard 265

1118 BH Schiphol Airport

The Netherlands

(Address

of Principal Executive Offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F

o

Enclosure: A press release dated November

20, 2024, announcing STMicroelectronics' financial model for 2027-2028 and path towards achieving its 2030 ambition.

PR No: C3296C

STMicroelectronics Outlines 2027-2028 Financial Model

and Path Towards 2030 Ambition

| · | Setting an intermediate financial model: ~$18B

revenues and 22-24% operating margin in 2027-2028 |

| · | Reiterating $20B+ revenue ambition and associated

financial model, now expected to be reached by 2030 |

Geneva, November 20, 2024 -

STMicroelectronics (NYSE:STM), a global semiconductor leader serving customers across the spectrum of electronics applications,

is hosting today its Capital Markets Day in Paris, France. Within the framework of an unchanged strategy, ST is reiterating its $20 billion

plus revenue ambition and associated financial model, that it now expects to be reached by 2030. ST is also setting an intermediate financial

model with revenues expected around $18 billion with an operating margin within a 22% to 24% range in 2027-2028.

With the execution of its manufacturing reshaping program

and cost base resizing initiative, ST expects to exit 2027 with high triple-digit million-dollar savings compared to the current cost

base. This will enable the company to reach an operating margin between 22 and 24% in 2027-2028.

ST’s value proposition remains focused on sustainable

and profitable growth, providing differentiating enablers to customers with a strong commitment to sustainability. With its customers

and partners, ST will continue to be a key actor of the transformation of all industries towards a smarter, safer and more sustainable

future.

Summary table

| |

Intermediate model

(2027-2028) |

$20B Ambition

(By 2030) |

| Revenues |

~$18B |

$20B+ |

| Gross Margin |

~44-46% |

~50% |

| Operating Margin |

~22-24%2 |

>30% |

| Free Cash Flow[1] Margin |

~20%[2] |

>25% |

Financials assume a currency exchange rate of approximately $1.09 = €1.00.

Full Capital Markets Days list of presenters and agenda:

The event will cover ST’s strategy, key market

trends and growth opportunities, developments in manufacturing, technology and products, and value creation:

| · | Welcome – Jerome Ramel, Executive Vice President,

Corporate Development & Integrated External Communication |

| · | Opening remarks – Jean-Marc Chery, President

& CEO |

1

Non-U.S. GAAP measure. See Appendix for additional information

explaining why the Company believes these measures are important.

2

Excluding one-offs

| · | Analog, Power & Discrete, MEMS and Sensors

Group – Marco Cassis, President, Analog, Power & Discrete, MEMS and Sensors Group, Head of Strategy, System Research and Applications,

Innovation Office |

| · | Microcontrollers, Digital ICs and RF Products

Group – Remi El-Ouazzane, President,

Microcontrollers, Digital ICs and RF products Group |

| · | Technology

& Manufacturing – Fabio

Gualandris, President, Quality, Manufacturing, & Technology |

| · | Financial overview – Lorenzo Grandi, President

and Chief Financial Officer |

| · | The presentations will be followed by a Q&A

session. |

ST’s Capital Markets Day will be webcast live

from Paris, France, on Wednesday, November 20 from 9.00am to 1.15pm Central European Times (CET) / 3.00am to 7.17am US Eastern Time (ET).

The live webcast featuring video, audio and presentation slides will be accessible on ST’s website cmd.st.com. All presentation

materials can also be downloaded from the website immediately prior to the start of the webcast. After the conclusion of the event, a

recording will be made available on the website.

Forward-looking Information

Some of the statements contained in this release

that are not historical facts are statements of future expectations and other forward-looking statements (within the meaning of Section

27A of the Securities Act of 1933 or Section 21E of the Securities Exchange Act of 1934, each as amended) that are based on management’s

current views and assumptions, and are conditioned upon and also involve known and unknown risks and uncertainties that could cause actual

results, performance or events to differ materially from those anticipated by such statements due to, among other factors:

| · | changes in global trade policies, including

the adoption and expansion of tariffs and trade barriers, that could affect the macro-economic environment and adversely impact the demand

for our products; |

| · | uncertain macro-economic and industry trends

(such as inflation and fluctuations in supply chains), which may impact production capacity and end-market demand for our products; |

| · | customer demand that differs from projections

which may require us to undertake transformation measures that may not be successful in realizing the expected benefits in full or at

all; |

| · | the ability to design, manufacture and sell

innovative products in a rapidly changing technological environment; |

| · | changes in economic, social, public health,

labor, political, or infrastructure conditions in the locations where we, our customers, or our suppliers operate, including as a result

of macroeconomic or regional events, geopolitical and military conflicts, social unrest, labor actions, or terrorist activities; |

| · | unanticipated events or circumstances, which

may impact our ability to execute our plans and/or meet the objectives of our R&D and manufacturing programs, which benefit from public

funding; |

| · | financial difficulties with any of our major

distributors or significant curtailment of purchases by key customers; |

| · | the loading, product mix, and manufacturing

performance of our production facilities and/or our required volume to fulfill capacity reserved with suppliers or third-party manufacturing

providers; |

| · | availability and costs of equipment, raw materials,

utilities, third-party manufacturing services and technology, or other supplies required by our operations (including increasing costs

resulting from inflation); |

| · | the functionalities and performance of our

IT systems, which are subject to cybersecurity threats and which support our critical operational activities including manufacturing,

finance and sales, and any breaches of our IT systems or those of our customers, suppliers, partners and providers of third-party licensed

technology; |

| · | theft, loss, or misuse of personal data about

our employees, customers, or other third parties, and breaches of data privacy legislation; |

| · | the impact of intellectual property (“IP”)

claims by our competitors or other third parties, and our ability to obtain required licenses on reasonable terms and conditions; |

| · | changes in our overall tax position as a result

of changes in tax rules, new or revised legislation, the outcome of tax audits or changes in international tax treaties which may impact

our results of operations as well as our ability to accurately estimate tax credits, benefits, deductions and provisions and to realize

deferred tax assets; |

| · | variations in the foreign exchange markets

and, more particularly, the U.S. dollar exchange rate as compared to the Euro and the other major currencies we use for our operations; |

| · | the outcome of ongoing litigation as well as

the impact of any new litigation to which we may become a defendant; |

| · | product liability or warranty claims, claims

based on epidemic or delivery failure, or other claims relating to our products, or recalls by our customers for products containing our

parts; |

| · | natural events such as severe weather, earthquakes,

tsunamis, volcano eruptions or other acts of nature, the effects of climate change, health risks and epidemics or pandemics in locations

where we, our customers or our suppliers operate; |

| · | increased regulation and initiatives in our

industry, including those concerning climate change and sustainability matters and our goal to become carbon neutral by 2027 on scope

1 and 2 and partially scope 3; |

| · | epidemics or pandemics, which may negatively

impact the global economy in a significant manner for an extended period of time, and could also materially adversely affect our business

and operating results; |

| · | industry changes resulting from vertical and

horizontal consolidation among our suppliers, competitors, and customers; and |

| · | the ability to successfully ramp up new programs

that could be impacted by factors beyond our control, including the availability of critical third-party components and performance of

subcontractors in line with our expectations. |

Such forward-looking statements are subject to various

risks and uncertainties, which may cause actual results and performance of our business to differ materially and adversely from the forward-looking

statements. Certain forward-looking statements can be identified by the use of forward-looking terminology, such as “believes”,

“expects”, “may”, “are expected to”, “should”, “would be”, “seeks”

or “anticipates” or similar expressions or the negative thereof or other variations thereof or comparable terminology, or

by discussions of strategy, plans or intentions.

Some of these risk factors are set forth and are

discussed in more detail in “Item 3. Key Information — Risk Factors” included in our Annual Report on Form 20-F for

the year ended December 31, 2023 as filed with the Securities and Exchange Commission (“SEC”) on February 22, 2024. Should

one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially

from those described in this press release as anticipated, believed or expected. We do not intend, and do not assume any obligation, to

update any industry information or forward-looking statements set forth in this release to reflect subsequent events or circumstances.

Unfavorable changes in the above or other factors

listed under “Item 3. Key Information — Risk Factors” from time to time in our Securities and Exchange Commission (“SEC”)

filings, could have a material adverse effect on our business and/or financial condition.

About STMicroelectronics

At ST, we are over 50,000 creators and makers of semiconductor

technologies mastering the semiconductor supply chain with state-of-the-art manufacturing facilities. An integrated device manufacturer,

we work with more than 200,000 customers and thousands of partners to design and build products, solutions, and ecosystems that address

their challenges and opportunities, and the need to support a more sustainable world. Our technologies enable smarter mobility, more

efficient power and energy management, and the wide-scale deployment of cloud-connected autonomous things. We are committed to achieving

our goal to become carbon neutral on scope 1 and 2 and partially scope 3 by 2027. Further information can be found at www.st.com.

For further information, please contact:

INVESTOR RELATIONS:

Jérôme Ramel

EVP Corporate Development & Integrated External Communication

Tel: +41 22 929 59 20

jerome.ramel@st.com

MEDIA RELATIONS:

Alexis Breton

Group VP Corporate External Communications

Tel: + 33 6 59 16 79 08

alexis.breton@st.com

Appendix

ST

Supplemental Non-U.S. GAAP Financial Information

U.S. GAAP – Non-U.S. GAAP Reconciliation

The supplemental non-U.S. GAAP information presented

in this press release is unaudited and subject to inherent limitations. Such non-U.S. GAAP information is not based on any comprehensive

set of accounting rules or principles and should not be considered as a substitute for U.S. GAAP measurements. Also, our supplemental

non-U.S. GAAP financial information may not be comparable to similarly titled non-U.S. GAAP measures used by other companies. Further,

specific limitations for individual non-U.S. GAAP measures, and the reasons for presenting non-U.S. GAAP financial information, are set

forth in the paragraphs below. To compensate for these limitations, the supplemental non-U.S. GAAP financial information should not be

read in isolation, but only in conjunction with our consolidated financial statements prepared in accordance with U.S. GAAP.

ST believes that these non-U.S. GAAP financial measures

provide useful information for investors and management because they offer, when read in conjunction with ST’s U.S. GAAP financials,

(i) the ability to make more meaningful period-to-period comparisons of ST’s on-going operating results, (ii) the ability

to better identify trends in ST’s business and perform related trend analysis, and (iii) to facilitate a comparison of ST’s

results of operations against investor and analyst financial models and valuations, which may exclude these items.

Net Capex and Free Cash Flow (non-U.S. GAAP measures)

ST presents Net Capex as a non-U.S. GAAP measure, which

is reported as part of our Free Cash Flow (non-US GAAP measure), to take into consideration the effect of advances from capital grants

received on prior periods allocated to property, plant and equipment in the reporting period.

Net Capex, a non-U.S. GAAP measure, is defined as (i)

Payment for purchase of tangible assets, as reported plus (ii) Proceeds from sale of tangible assets, as reported plus (iii) Proceeds

from capital grants and other contributions, as reported plus (iv) Advances from capital grants allocated to property, plant and equipment

in the reporting period.

ST believes Net Capex provides useful information for

investors and management because annual capital expenditures budget includes the effect of capital grants. Our definition of Net Capex

may differ from definitions used by other companies.

Free Cash Flow, which is a non-U.S. GAAP measure, is

defined as (i) net cash from operating activities plus (ii) Net Capex plus (iii) payment for purchase (and proceeds from sale) of intangible

and financial assets and (iv) net cash paid for business acquisitions, if any.

ST believes Free Cash Flow provides useful information

for investors and management because it measures our capacity to generate cash from our operating and investing activities to sustain

our operations.

Free Cash Flow reconciles with the total cash flow

and the net cash increase (decrease) by including the payment for purchases of (and proceeds from matured) marketable securities and net

investment in (and proceeds from) short-term deposits, the net cash from (used in) financing activities and the effect of changes in exchange

rates, and by excluding the advances from capital grants received on prior periods allocated to property, plant and equipment in the reporting

period. Our definition of Free Cash Flow may differ from definitions used by other companies.

5

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

|

|

STMicroelectronics N.V. |

| |

|

|

|

| Date: |

November 20, 2024 |

By: |

/s/ Lorenzo Grandi |

| |

|

|

|

| |

|

Name: |

Lorenzo Grandi |

| |

|

Title: |

Chief Financial Officer

President, Finance, Purchasing, ERM and Resilience |

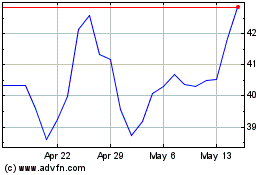

STMicroelectronics NV (NYSE:STM)

Historical Stock Chart

From Nov 2024 to Dec 2024

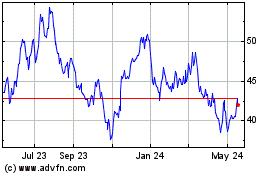

STMicroelectronics NV (NYSE:STM)

Historical Stock Chart

From Dec 2023 to Dec 2024