Amended Statement of Beneficial Ownership (sc 13d/a)

January 03 2023 - 3:56PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

| SITIO ROYALTIES CORP. |

|

|

| (Name of Issuer) |

| |

| Class A Common Stock, par value $0.0001 per share |

|

|

| (Title of Class of Securities) |

| |

| 82982V101 |

|

|

| (CUSIP Number) |

| |

| Todd E. Molz |

| General Counsel, Chief Administrative Officer & Managing Director |

| Oaktree Capital Group Holdings GP, LLC |

| 333 South Grand Avenue, 28th Floor |

| Los Angeles, California 90071 |

| (213) 830-6300 |

|

|

| (Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications) |

| |

| December 29, 2022 |

|

|

| (Date of Event Which Requires Filing of This Statement) |

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed original

and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

|

CUSIP No. 82982V101 |

SCHEDULE 13D |

Page 2 of 15 |

| 1 |

NAME OF REPORTING PERSON

Source Energy Partners, LLC |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☒ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

OO (See Item 3) |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.0% |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

|

CUSIP No. 82982V101 |

SCHEDULE 13D |

Page 3 of 15 |

| 1 |

NAME OF REPORTING PERSON

OCM Source Holdings, L.P. |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☒ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

Not applicable |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.0% |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

|

CUSIP No. 82982V101 |

SCHEDULE 13D |

Page 4 of 15 |

| 1 |

NAME OF REPORTING PERSON

Oaktree Fund GP, LLC |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☒ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

Not applicable |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.0% |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

|

CUSIP No. 82982V101 |

SCHEDULE 13D |

Page 5 of 15 |

| 1 |

NAME OF REPORTING PERSON

Oaktree Fund GP I, L.P. |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☒ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

Not applicable |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.0% |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

|

CUSIP No. 82982V101 |

SCHEDULE 13D |

Page 6 of 15 |

| 1 |

NAME OF REPORTING PERSON

Oaktree Capital I, L.P. |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☒ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

Not applicable |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.0% |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

|

CUSIP No. 82982V101 |

SCHEDULE 13D |

Page 7 of 15 |

| 1 |

NAME OF REPORTING PERSON

OCM Holdings I, LLC |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☒ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

Not applicable |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.0% |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

|

CUSIP No. 82982V101 |

SCHEDULE 13D |

Page 8 of 15 |

| 1 |

NAME OF REPORTING PERSON

Oaktree Holdings, LLC |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☒ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

Not applicable |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.0% |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

|

CUSIP No. 82982V101 |

SCHEDULE 13D |

Page 9 of 15 |

| 1 |

NAME OF REPORTING PERSON

Oaktree Capital Group, LLC |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☒ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

Not applicable |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.0% |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

|

CUSIP No. 82982V101 |

SCHEDULE 13D |

Page 10 of 15 |

| 1 |

NAME OF REPORTING PERSON

Oaktree Capital Group Holdings GP, LLC |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☒ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

Not applicable |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware | |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.0% |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

|

CUSIP No. 82982V101 |

SCHEDULE 13D |

Page 11 of 15 |

| 1 |

NAME OF REPORTING PERSON

Brookfield Corporation |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☒ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

Not applicable |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Ontario, Canada |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.0% |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

|

CUSIP No. 82982V101 |

SCHEDULE 13D |

Page 12 of 15 |

| 1 |

NAME OF REPORTING PERSON

BAM Partners Trust |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☒ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

Not applicable |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Ontario, Canada |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.0% |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

|

CUSIP No. 82982V101 |

SCHEDULE 13D |

Page 13 of 15 |

Explanatory Note

This Amendment No. 2 (the “Amendment”) amends and supplements

the statement on Schedule 13D originally filed with the United States Securities and Exchange Commission on June 16, 2022 (the “Original

Schedule 13D”), as amended by Amendment No. 1 to the Schedule 13D filed on September 8, 2022 (the Original Schedule 13D as so amended,

the “Schedule 13D”), relating to the Class A Common Stock of Sitio Royalties Corp. (f/k/a Falcon Mineral Corporation) (the

"Issuer"). As set forth below, as a result of the transactions described herein, on December 29, 2022 the Reporting Persons

ceased to be the beneficial owners of more than five percent of the Issuer’s securities. The filing of this Amendment represents

the final amendment to the Schedule 13D and constitutes an exit filing for the Reporting Persons. Capitalized terms used but not otherwise

defined in this Amendment shall have the meanings ascribed to such terms in the Schedule 13D.

Item 4. Purpose of Transaction.

Item 4 of this Amendment is hereby amended and supplemented to add

the following:

On December 29, 2022, pursuant to the terms of the Merger Agreement,

the Merger was consummated, pursuant to which, among other things (i) the Issuer’s Class C shareholders received shares of Class

C common stock in Snapper Merger Sub I, Inc. which was renamed “Sitio Royalties Corp.” (“New Sitio”), as merger

consideration, with the Issuer’s Class C shareholders receiving 12,935,120 shares of Class C common stock in New Sitio, corresponding

on a one-for-one basis with the number of shares of Class C common stock held by each such Reporting Person immediately prior to the consummation

of the Merger, (ii) the 12,935,120 OpCo Units owned in aggregate by the Reporting Persons are now exchangeable for shares of Class A common

stock of New Sitio and (iii) the Voting and Support Agreement was terminated. As a result, the Reporting Persons no longer beneficially

own any Class C common stock and the OpCo Units owned by the Reporting Persons are no longer exchangeable for shares of Class A common

stock, and with respect to the Allocation Rights, to the extent Restricted Shares are forfeited by the original holders thereof, such

rights will be settled in Class C common stock in New Sitio.

Item 5. Interest in Securities of the Issuer.

Item 5 of the Schedule 13D is hereby amended and restated

in its entirety as follows:

(a) and (b) As a result of the consummation of the Merger, the Reporting

Persons no longer beneficially own any securities of the Issuer nor have sole or shared power to vote, direct the vote, dispose or direct

the disposition with respect to any securities of the Issuer, and the filing of this Amendment No. 2 represents the final amendment to

the Schedule 13D and constitutes an “exit” filing for each Reporting Person.

(c) Except as set forth in this Amendment No. 2, none of the Reporting

Persons has effected any transaction in Class A common stock in the past 60 days.

(d) Not applicable.

(e) As of December 29, 2022, the Reporting Persons ceased to beneficially

own more than 5% of the Issuer’s outstanding Class A common stock.

|

CUSIP No. 82982V101 |

SCHEDULE 13D |

Page 14 of 15 |

SIGNATURES

After reasonable inquiry and to the best of

our knowledge and belief, we certify that the information set forth in this statement is true, complete and correct.

DATED: January 3, 2023

| |

SOURCE ENERGY PARTNERS, LLC |

| |

|

|

|

| |

By: |

Oaktree Fund GP I, L.P. |

|

| |

Its: |

Managing Member |

|

| |

|

|

|

| |

By: |

/s/ Henry Orren |

|

| |

|

Name: Henry Orren |

|

| |

|

Title: Senior Vice President |

|

| |

OCM SOURCE HOLDINGS, L.P. |

| |

|

|

|

| |

By: |

Oaktree Fund GP, L.P. |

|

| |

Its: |

General Partner |

|

| |

|

|

|

| |

By: |

Oaktree Fund GP I, L.P. |

|

| |

Its: |

Managing Member |

|

| |

|

|

|

| |

By: |

/s/ Henry Orren |

|

| |

|

Name: Henry Orren |

|

| |

|

Title: Senior Vice President |

|

| |

OAKTREE FUND GP, LLC |

| |

|

|

|

| |

By: |

Oaktree Fund GP I, L.P. |

|

| |

Its: |

Managing Member |

|

| |

|

|

|

| |

By: |

/s/ Henry Orren |

|

| |

|

Name: Henry Orren |

|

| |

|

Title: Authorized Signatory |

|

| |

OAKTREE FUND GP I, L.P. |

| |

|

|

|

| |

By: |

/s/ Henry Orren |

|

| |

|

Name: Henry Orren |

|

| |

|

Title: Authorized Signatory |

|

|

CUSIP No. 82982V101 |

SCHEDULE 13D |

Page 15 of 15 |

| |

OAKTREE CAPITAL I, L.P. |

| |

|

|

|

| |

By: |

/s/ Henry Orren |

|

| |

|

Name: Henry Orren |

|

| |

|

Title: Senior Vice President |

|

| |

OCM HOLDINGS I, LLC |

| |

|

|

|

| |

By: |

/s/ Henry Orren |

|

| |

|

Name: Henry Orren |

|

| |

|

Title: Senior Vice President |

|

| |

OAKTREE HOLDINGS, LLC |

| |

|

|

|

| |

By: |

/s/ Henry Orren |

|

| |

|

Name: Henry Orren |

|

| |

|

Title: Senior Vice President |

|

| |

OAKTREE CAPITAL GROUP, LLC |

| |

|

|

|

| |

By: |

/s/ Henry Orren |

|

| |

|

Name: Henry Orren |

|

| |

|

Title: Senior Vice President |

|

| |

OAKTREE CAPITAL GROUP HOLDINGS GP, LLC |

| |

|

|

|

| |

By: |

/s/ Henry Orren |

|

| |

|

Name: Henry Orren |

|

| |

|

Title: Senior Vice President |

|

| |

BROOKFIELD CORPORATION |

| |

|

|

|

| |

By: |

/s/ Kathy Sarpash |

|

| |

|

Name: Kathy Sarpash |

|

| |

|

Title: Senior Vice President, Legal & Regulatory |

|

| |

BAM PARTNERS TRUST |

| |

|

|

|

| |

By: |

BAM Class B Partners Inc. |

|

| |

Its: |

Trustee |

|

| |

|

|

|

| |

By: |

/s/ Kathy Sarpash |

|

| |

|

Name: Kathy Sarpash |

|

| |

|

Title: Secretary |

|

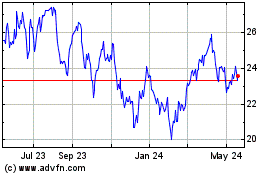

Sitio Royalties (NYSE:STR)

Historical Stock Chart

From Dec 2024 to Jan 2025

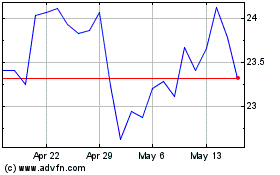

Sitio Royalties (NYSE:STR)

Historical Stock Chart

From Jan 2024 to Jan 2025