Company reports production above guidance range

with strong operator activity in Permian and DJ Basins

2024 outlook enhanced through legacy asset

outperformance and impact of five acquisitions closed in third

quarter

Line of sight wells increased 11% Q-o-Q with

higher operator activity and permitting in the Midland and DJ

Basins

Long-term debt reduced by approximately $56.5

million during the quarter

Third quarter total return of capital of $0.47

per share, includes $29.0 million in common stock repurchases and

planned payment of $0.28 per share dividend

Sitio Royalties Corp. (NYSE: STR) (“Sitio”, “STR” or the

“Company”) today announced third quarter 2024 operational and

financial results. Robust production, coupled with strong

year-to-date performance and the positive impact from five recent

acquisitions, allowed the Company to enhance its 2024 outlook.

Supplemental slides have been posted to Sitio’s website,

www.sitio.com. A conference call and webcast is planned for 7:30

a.m. CT / 8:30 a.m. ET on Thursday, November 7, 2024. Participation

details can be found within this release.

HIGHLIGHTS

- Posted third quarter net income of $27.9 million and Adjusted

EBITDA of $135.4 million. Financial results reflected strong

production volumes from legacy assets and recent acquisitions

- Recorded third quarter production above full year guidance

range, 38,585 barrels of oil equivalent per day (“Boe/d”) (50%

oil)

- Reduced long-term debt by approximately $56.5 million during

the period with the Company’s quarter-end credit facility balance

at $403.0 million and liquidity of $455.5 million

- Ongoing benefit of diversified asset base, exposure to quality

operators across top domestic basins and track record of value-add

acquisitions. Line of sight (“LOS”) wells increased 11%

quarter-over-quarter and there were 7.7 net wells turned-in-line,

providing high confidence in sustainable business model

- Continued to return cash to shareholders and enhance value on a

per share basis; Sitio to return $0.47 per share of Class A Common

Stock, comprised of a $0.28 per share cash dividend (payable

November 27, 2024), and $0.19 per share of stock repurchases;

Year-to-date, the buyback program has reduced outstanding shares by

3% and total return of capital (including dividends and stock

repurchases) is $1.67 per share

- Repurchased 1.4 million shares of Class A Common Stock during

the quarter ($21.47 per share avg. price); Repurchases year-to-date

total $105.2 million with $94.8 million authorization remaining as

of September 30, 2024

“We continued our streak of sound results, beating expectations

for the third consecutive quarter. This allowed us to strengthen

our full-year 2024 outlook with higher volumes and cash costs that

are down by approximately 4% year-over-year,” said Sitio CEO Chris

Conoscenti. “We are proving the resiliency of our business model

and offer investors an attractive option to own quality and high

margin oil and gas assets across several of the best basins in the

U.S. Through disciplined acquisitions and effective management of

our resources, we are differentiating Sitio from its peers. The

recent expansion of our line-of-sight wells and healthy operating

activity levels today provide us with high-confidence in our

ability to deliver value for our shareholders.”

THIRD QUARTER 2024 FINANCIAL AND OPERATING RESULTS

Net income in the quarter was $27.9 million and Adjusted EBITDA

was $135.4 million. Financial performance benefited from robust

production from legacy assets and the impact of recent

acquisitions.

Third quarter production exceeded full year 2024 guidance,

averaging 38,585 Boe/d (50% oil and 72% liquids). Oil production

for the period was 19,134 Bbl/d and was positively impacted by

strong revenues from the Delaware, Midland and DJ Basins.

Average realized commodity prices during the third quarter were

$74.67 per Bbl for oil (98% of NYMEX WTI and Midland Oil), $17.11

per Bbl for natural gas liquids, and $0.45 per Mcf for natural gas

(21% of NYMEX Henry Hub; $0.90 per Mcf above Waha). Total average

realized price for the period was $41.65 per barrel of oil

equivalent ("Boe") on an unhedged basis. Realized prices benefited

from approximately $4.3 million in net cash settlements for

commodity derivative contracts and total average realized price for

the period was $42.85 per Boe on a hedged basis.

General and administrative expenses was $14.4 million and Cash

G&A in the period was in-line with expectations at $7.8

million, or $2.20 per Boe. With Sitio’s diverse asset base and

exposure to multiple operators, the Company benefits from

industry’s continued innovation and operational efficiency gains.

Sitio believes that many of these gains are sustainable and will

positively impact future margins.

3Q 2024 AND YTD PRO FORMA RESULTS VS. PRIOR 2024 FY

GUIDANCE

The table below shows third quarter 2024 and pro forma 2024

results for the three months ended September 30, 2024 relative to

the prior full year guidance previously issued on August 7, 2024.

Primarily as a result of our legacy asset outperformance and the

impact of recent acquisitions, we are providing updated full year

guidance later in this press release under "Updated 2024 Full Year

Financial and Operational Guidance."

Metric

3Q 2024

Reported Results

YTD24

Pro Forma Results(1)

Prior 2024 FY

Guidance(1)

Average daily production (Boe/d)

38,585

38,595

36,000 – 38,000

Oil %

50

%

50

%

49% – 51%

Cash G&A ($ in millions)

$

7.8

$

22.6

$31.5 – $33.5 (annual)

Production taxes (% of royalty

revenue)

6.9

%

7.7

%

7.5% – 9.5%

Estimated cash taxes ($ in

millions)(2)

$

4.6

$

13.9

$9.0 – $15.0 (annual)

(1)

Includes production from the DJ Basin

Acquisition as if it was owned on January 1, 2024; The DJ Basin

Acquisition is defined as the all-cash acquisition of approximately

13,000 NRAs in the DJ Basin from an undisclosed third party that

closed on April 4, 2024

(2)

Cash tax guidance is based on strip

pricing when guidance was issued; Estimated cash taxes for YTD24

Pro Forma Results represents the estimated cash taxes used in the

calculation of Discretionary Cash Flow and is not pro forma for the

DJ Basin Acquisition

UPDATED 2024 FULL YEAR FINANCIAL AND OPERATIONAL

GUIDANCE

The table below includes Sitio's updated guidance for full year

2024 and includes impacts from the DJ Basin Acquisition as if the

transaction had closed on January 1, 2024 for pro forma average

daily production. Sitio today enhanced its full-year 2024 outlook

and raised the midpoint of its pro forma average daily production

range by 1,000 Boe/d due to robust legacy production year-to-date

and expected impacts from five recent acquisitions. The midpoint of

2024 guidance for cash taxes increased by $7.0 million based on

latest estimates.

Full Year 2024 Guidance

August 7, 2024

November 6, 2024

Change at Midpoint

Pro Forma Average Daily

Production(1)

Pro forma average daily production

(Boe/d)(1)

36,000 - 38,000

37,000 - 39,000

1,000

Pro forma average daily production (%

oil)(1)

49% - 51%

49% - 51%

-

Expenses and Taxes

Cash G&A ($ in millions)

$31.5 - $33.5

$30.0 - $32.0

$

(1.5

)

Production taxes (% of royalty

revenue)

7.5% - 9.5%

7.5% - 9.5%

-

Cash taxes ($ in millions)(2)

$9.0 - $15.0

$17.0 - $21.0

$

7.0

(1)

Includes production from the DJ Basin

Acquisition as if it was owned on January 1, 2024

(2)

Cash tax guidance range is based on

expectations at strip pricing when guidance was issued

OPERATOR ACTIVITY

The following table summarizes Sitio's net average daily

production and net line-of-sight ("LOS") wells by area.

Delaware

Midland

DJ

Eagle

Ford

Williston/Other

Total

Average Daily

Production (Boe/d)

for the three

months ended

September 30,

2024

As reported

20,167

8,446

5,648

3,386

938

38,585

% Oil

50

%

57

%

37

%

54

%

45

%

50

%

Net LOS

Wells

as of

September 30, 2024

Net spuds

11.1

8.9

5.8

1.4

0.3

27.5

Net permits

11.4

5.1

2.8

1.9

0.2

21.4

Net LOS

wells

as of September

30, 2024

22.5

14.0

8.6

3.3

0.5

48.9

FINANCIAL UPDATE

Sitio's third quarter 2024 average unhedged realized prices

including all expected quality, transportation and demand

adjustments were $74.67 per barrel of oil, $0.45 per Mcf of natural

gas and $17.11 per barrel of natural gas liquids, for a total price

of $41.65 per Boe. During the third quarter of 2024, the Company

received $4.3 million in net cash settlements for commodity

derivative contracts and as a result, average hedged realized

prices were $75.96 per barrel of oil, $0.78 per Mcf of natural gas

and $17.11 per barrel of natural gas liquids, for a total price of

$42.85 per Boe.

Consolidated net income for the third quarter of 2024 was $27.9

million, which is $1.2 million, or 4.0% lower than consolidated net

income in the second quarter of 2024. This decrease was primarily

driven by $17.7 million lower oil, natural gas and natural gas

liquids revenues and $1.5 million lower lease bonus and other

income, partially offset by $8.4 million higher commodity

derivative gains, $7.4 million of decreased depreciation, depletion

and amortization, and $2.2 million of decreased severance and ad

valorem taxes. For the three months ended September 30, 2024,

Adjusted EBITDA was $135.4 million, down 10.7% compared to the

second quarter 2024 Adjusted EBITDA of $151.7 million, largely due

to lower unhedged realized oil prices.

As of September 30, 2024, the Company had $1,003.0 million

principal value of total debt outstanding (comprised of $403.0

million drawn on Sitio's revolving credit facility and $600.0

million of senior unsecured notes) and liquidity of $455.5 million,

including $8.5 million of cash and $447.0 million of remaining

availability under its $850.0 million credit facility.

Sitio did not add to or extinguish any of its commodity swaps or

collars during the third quarter of 2024. A summary of the

Company's existing commodity derivative contracts as of September

30, 2024 is included in the table below.

Oil (NYMEX WTI)

2024

1H25

Swaps

Bbl per day

3,300

1,100

Average price ($/Bbl)

$

82.66

$

74.65

Collars

Bbl per day

—

2,000

Average call ($/Bbl)

—

$

93.20

Average put ($/Bbl)

—

$

60.00

Gas (NYMEX Henry Hub)

2024

1H25

Swaps

MMBtu per day

500

—

Average price ($/MMBtu)

$

3.41

—

Collars

MMBtu per day

11,400

11,600

Average call ($/MMBtu)

$

7.24

$

10.34

Average put ($/MMBtu)

$

4.00

$

3.31

RETURN OF CAPITAL FRAMEWORK

Sitio is committed to returning capital to shareholders while

maintaining a balanced and durable capital structure. Since

becoming public in 2022, Sitio has returned more than $765 million

to owners, including year-to-date returns of $245 million.

Sitio’s Board of Directors declared a cash dividend of $0.28 per

share of Class A Common Stock with respect to the third quarter of

2024. The dividend is payable on November 27, 2024 to the

stockholders of record at the close of business on November 19,

2024. During the third quarter of 2024, the Company repurchased an

aggregate 1.4 million shares of Class A Common Stock at an average

price of $21.47 per share, representing 26% of third quarter 2024

Discretionary Cash Flow, or $0.19 per share. As of September 30,

2024, the Company had repurchased a total of 4.5 million in Class A

Common Stock and Sitio OpCo Partnership Units, representing

approximately 3% of shares outstanding prior to the Board's

authorization of Sitio's $200 million share repurchase program. In

total, Sitio's return of capital for the third quarter of 2024 is

$0.47 per share.

CONFERENCE CALL INFORMATION

Sitio will host a conference call at 7:30 a.m. CT / 8:30 a.m. ET

on Thursday, November 7, 2024. Participants can access the call by

dialing 1-833-470-1428 in the United States, or 1-404-975-4839 in

other locations, with access code 296060, or by webcast at

https://events.q4inc.com/attendee/861493711. Participants may also

pre-register for the event via the following link:

https://www.netroadshow.com/events/login?show=3a129c74&confId=71395.

The conference call, live webcast, and replay can also be accessed

through the Investor Relations section of Sitio’s website at

www.sitio.com.

FINANCIAL RESULTS

Production Data

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Production Data:

Crude oil (MBbls)

1,760

1,617

5,219

4,786

Natural gas (MMcf)

5,900

6,203

16,808

17,214

NGLs (MBbls)

806

744

2,316

1,996

Total (MBOE)(6:1)

3,549

3,395

10,336

9,651

Average daily production (BOE/d)(6:1)

38,585

36,900

37,725

35,349

Average Realized Prices:

Crude oil (per Bbl)

$

74.67

$

80.21

$

77.07

$

75.11

Natural gas (per Mcf)

$

0.45

$

1.54

$

0.85

$

1.90

NGLs (per Bbl)

$

17.11

$

18.14

$

19.32

$

19.39

Combined (per BOE)

$

41.65

$

45.00

$

44.63

$

44.65

Average Realized Prices After Effects

of Derivative Settlements:

Crude oil (per Bbl)

$

75.96

$

82.21

$

77.95

$

77.95

Natural gas (per Mcf)

$

0.78

$

1.84

$

1.21

$

2.20

NGLs (per Bbl)

$

17.11

$

18.14

$

19.32

$

19.39

Combined (per BOE)

$

42.85

$

46.49

$

45.66

$

46.59

Selected Expense Metrics

Three Months Ended September

30,

2024

2023

Severance and ad valorem taxes

6.9

%

7.9

%

Depletion ($/Boe)

$

21.97

$

23.74

General and administrative ($/Boe)

$

4.05

$

3.55

Cash G&A ($/Boe)

$

2.20

$

2.18

Interest expense, net ($/Boe)

$

6.34

$

7.77

Condensed Consolidated Balance

Sheets

(In thousands except par and share

amounts)

September 30,

2024

December 31,

2023

(Unaudited)

ASSETS

Current assets

Cash and cash equivalents

$

8,507

$

15,195

Accrued revenue and accounts

receivable

118,635

107,347

Prepaid assets

8,023

12,362

Derivative asset

9,066

19,080

Total current assets

144,231

153,984

Property and equipment

Oil and natural gas properties, successful

efforts method:

Unproved properties

2,514,348

2,698,991

Proved properties

2,752,715

2,377,196

Other property and equipment

3,688

3,711

Accumulated depreciation, depletion,

amortization, and impairment

(738,232

)

(498,531

)

Total property and equipment, net

4,532,519

4,581,367

Long-term assets

Long-term derivative asset

—

3,440

Deferred financing costs

8,887

11,205

Operating lease right-of-use asset

4,949

5,970

Other long-term assets

2,778

2,835

Total long-term assets

16,614

23,450

TOTAL ASSETS

$

4,693,364

$

4,758,801

LIABILITIES AND EQUITY

Current liabilities

Accounts payable and accrued expenses

$

56,364

$

30,050

Operating lease liability

1,605

1,725

Total current liabilities

57,969

31,775

Long-term liabilities

Long-term debt

992,854

865,338

Deferred tax liability

248,005

259,870

Non-current operating lease liability

4,511

5,394

Other long-term liabilities

1,150

1,150

Total long-term liabilities

1,246,520

1,131,752

Total liabilities

1,304,489

1,163,527

Equity

Class A Common Stock, par value $0.0001

per share; 240,000,000 shares authorized; 82,871,009 and 82,451,397

shares issued and 79,288,976 and 82,451,397 outstanding at

September 30, 2024 and December 31, 2023, respectively

8

8

Class C Common Stock, par value $0.0001

per share; 120,000,000 shares authorized; 73,730,215 and 74,965,217

shares issued and 73,677,467 and 74,939,080 outstanding at

September 30, 2024 and December 31, 2023, respectively

7

8

Additional paid-in capital

1,720,293

1,796,147

Accumulated deficit

(153,853

)

(187,738

)

Class A Treasury Shares, 3,582,033 and 0

shares at September 30, 2024 and December 31, 2023,

respectively

(83,896

)

—

Class C Treasury Shares, 52,748 and 26,137

shares at September 30, 2024 and December 31, 2023,

respectively

(1,265

)

(677

)

Noncontrolling interest

1,907,581

1,987,526

Total equity

3,388,875

3,595,274

TOTAL LIABILITIES AND EQUITY

$

4,693,364

$

4,758,801

Unaudited Condensed Consolidated

Statements of Operations

(In thousands, except per share

amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenues:

Oil, natural gas and natural gas liquids

revenues

$

147,858

$

152,766

$

461,345

$

430,887

Lease bonus and other income

1,517

3,944

7,969

13,115

Total revenues

149,375

156,710

469,314

444,002

Operating expenses:

Depreciation, depletion and

amortization

78,093

80,716

239,896

222,718

General and administrative

14,382

12,044

40,849

37,786

Severance and ad valorem taxes

10,196

12,124

34,655

32,927

Impairment of oil and gas properties

—

—

—

25,617

Total operating expenses

102,671

104,884

315,400

319,048

Net income from operations

46,704

51,826

153,914

124,954

Other income (expense):

Interest expense, net

(22,511

)

(26,373

)

(63,709

)

(71,735

)

Change in fair value of warrant

liability

—

8

—

2,950

Loss on extinguishment of debt

—

(687

)

—

(1,470

)

Commodity derivatives gains (losses)

7,785

(24,125

)

(2,872

)

(3,250

)

Interest rate derivative gains

—

9

—

456

Net income before taxes

31,978

658

87,333

51,905

Income tax expense

(4,111

)

(383

)

(11,733

)

(6,884

)

Net income

27,867

275

75,600

45,021

Net (income) loss attributable to

noncontrolling interest

(15,304

)

12

(41,715

)

(22,877

)

Net income attributable to Class A

stockholders

$

12,563

$

287

$

33,885

$

22,144

Net income (loss) per share of Class A

Common Stock

Basic

$

0.15

$

—

$

0.41

$

0.26

Diluted

$

0.15

$

—

$

0.41

$

0.26

Weighted average Class A Common Stock

outstanding

Basic

80,142

81,712

81,095

80,984

Diluted

80,278

157,260

81,263

80,984

Unaudited Condensed Consolidated

Statements of Cash Flows

(In thousands)

Nine Months Ended September

30,

2024

2023

Cash flows from operating

activities:

Net income

$

75,600

$

45,021

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation, depletion and

amortization

239,896

222,718

Amortization of deferred financing costs

and long-term debt discount

3,925

4,275

Share-based compensation

17,558

14,474

Change in fair value of warrant

liability

—

(2,950

)

Loss on extinguishment of debt

—

1,470

Impairment of oil and gas properties

—

25,617

Commodity derivatives losses

2,872

3,250

Net cash received for commodity

derivatives settlements

10,582

18,730

Interest rate derivative gains

—

(456

)

Net cash paid for interest rate derivative

settlements

—

403

Deferred tax benefit

(11,984

)

(15,107

)

Change in operating assets and

liabilities:

Accrued revenue and accounts

receivable

(11,288

)

26,188

Prepaid assets

4,402

13,187

Other long-term assets

961

1,866

Accounts payable and accrued expenses

24,984

(3,131

)

Operating lease liabilities and other

long-term liabilities

(777

)

(737

)

Net cash provided by operating

activities

356,731

354,818

Cash flows from investing

activities:

Purchases of oil and gas properties, net

of post-close adjustments

(190,834

)

(172,070

)

Purchases of other property and

equipment

—

(19

)

Other, net

(319

)

—

Net cash used in investing

activities

(191,153

)

(172,089

)

Cash flows from financing

activities:

Borrowings on credit facilities

329,000

588,500

Repayments on credit facilities

(203,000

)

(497,500

)

Repayments on 2026 Senior Notes

—

(33,750

)

2026 Senior Notes issuance costs

—

(351

)

Debt issuance costs

(144

)

—

Distributions to noncontrolling

interest

(91,512

)

(121,924

)

Dividends paid to Class A stockholders

(99,087

)

(121,555

)

Dividend equivalent rights paid

(943

)

(982

)

Repurchases of Class A Common Stock

(82,619

)

—

Repurchases of Sitio OpCo Partnership

Units (including associated Class C Common Shares)

(22,142

)

—

Cash paid for taxes related to net

settlement of share-based compensation awards

(1,819

)

(3,432

)

Payments of deferred financing costs

—

(9,214

)

Net cash used in financing

activities

(172,266

)

(200,208

)

Net change in cash and cash

equivalents

(6,688

)

(17,479

)

Cash and cash equivalents, beginning of

period

15,195

18,818

Cash and cash equivalents, end of

period

$

8,507

$

1,339

Supplemental disclosure of non-cash

transactions:

Increase in current liabilities for

additions to property and equipment:

$

42

$

224

Oil and gas properties acquired through

issuance of Class C Common Stock and Sitio OpCo Partnership

Units:

—

66,256

Supplemental disclosure of cash flow

information:

Cash paid for income taxes:

$

3,080

$

9,268

Cash paid for interest expense:

51,144

68,249

Non-GAAP financial measures

Adjusted EBITDA, Pro Forma Adjusted EBITDA, Discretionary Cash

Flow, Pro Forma Discretionary Cash Flow and Cash G&A are

non-GAAP supplemental financial measures used by our management and

by external users of our financial statements such as investors,

research analysts and others to assess the financial performance of

our assets and their ability to sustain dividends and/or share

repurchases over the long term without regard to financing methods,

capital structure or historical cost basis. Sitio believes that

these non-GAAP financial measures provide useful information to

Sitio's management and external users because they allow for a

comparison of operating performance on a consistent basis across

periods.

We define Adjusted EBITDA as net income plus (a) interest

expense, (b) provisions for taxes, (c) depreciation, depletion and

amortization, (d) non-cash share-based compensation expense, (e)

impairment of oil and natural gas properties, (f) gains or losses

on unsettled derivative instruments, (g) change in fair value of

the warrant liability, (h) loss on debt extinguishment, (i)

merger-related transaction costs and (j) write off of financing

costs.

We define Pro Forma Adjusted EBITDA as Adjusted EBITDA plus Cash

Acquisitions EBITDA from July 1, 2023 to September 30, 2023 that is

not included in Adjusted EBITDA for the three months ended

September 30, 2023. Cash Acquisitions is defined as the four

acquisitions that closed in July and August 2023 for approximately

$181 million.

We define Discretionary Cash Flow and Pro Forma Discretionary

Cash Flow for the three months ended September 30, 2024 as Adjusted

EBITDA, less cash and accrued interest expense and estimated cash

taxes.

We define Discretionary Cash Flow for the three months ended

September 30, 2023 as Adjusted EBITDA, less cash interest expense

and cash taxes.

We define Pro Forma Discretionary Cash Flow for the three months

ended September 30, 2023 as Discretionary Cash Flow for the three

months ended September 30, 2023 plus Cash Acquisitions

Discretionary Cash Flow from July 1, 2023 to September 30, 2023

that is not included in Discretionary Cash Flow for the three

months ended September 30, 2023.

We define Cash G&A as general and administrative expense

less (a) non-cash share-based compensation expense, (b)

merger-related transaction costs and (c) rental income.

Merger-related transaction costs for the three months ended

September 30, 2023 have been recast to conform to the current

period presentation.

These non-GAAP financial measures do not represent and should

not be considered an alternative to, or more meaningful than, their

most directly comparable GAAP financial measures or any other

measure of financial performance presented in accordance with GAAP

as measures of our financial performance. Non-GAAP financial

measures have important limitations as analytical tools because

they exclude some but not all items that affect the most directly

comparable GAAP financial measure. Our computations of Adjusted

EBITDA, Pro Forma Adjusted EBITDA, Discretionary Cash Flow, Pro

Forma Discretionary Cash Flow and Cash G&A may differ from

computations of similarly titled measures of other companies.

The pro forma financial data is presented for illustrative

purposes only and should not be relied upon as an indication of the

financial condition that would have been achieved if the

acquisitions had taken place on the specified dates. In addition,

future results may vary significantly from the results reflected in

such pro forma data and should not be relied on as an indication of

future results.

The following tables present a reconciliation of Adjusted EBITDA

and Pro Forma Adjusted EBITDA to the most directly comparable GAAP

financial measure for the period indicated (in thousands).

Three Months Ended

September 30,

2024

2023

Net income

$

27,867

$

275

Interest expense, net

22,511

26,373

Income tax expense

4,111

383

Depreciation, depletion and

amortization

78,093

80,716

EBITDA

$

132,582

$

107,747

Non-cash share-based compensation

expense

6,251

4,368

Losses (gains) on unsettled derivative

instruments

(3,518

)

29,497

Change in fair value of warrant

liability

—

(8

)

Loss on debt extinguishment

—

687

Merger-related transaction costs

126

251

Adjusted EBITDA

$

135,441

$

142,542

Cash Acquisitions EBITDA1

—

1,144

Pro Forma Adjusted EBITDA1

$

135,441

$

143,686

(1)

Cash Acquisitions closed in 2023 and are

reflected in the full results for the three months ended September

30, 2024

Three Months Ended June

30,

2024

Net income

$

29,041

Interest expense, net

22,688

Income tax expense

4,838

Depreciation, depletion and

amortization

85,485

EBITDA

$

142,052

Non-cash share-based compensation

expense

6,203

Losses on unsettled derivative

instruments

3,329

Merger-related transaction costs

149

Adjusted EBITDA

$

151,733

The following table presents a reconciliation of Discretionary

Cash Flow and Pro Forma Discretionary Cash Flow to the most

directly comparable GAAP financial measure for the period indicated

(in thousands).

Three Months Ended

September 30,

2024

2023

Cash flow from operations

$

138,679

$

122,141

Interest expense, net

22,511

26,373

Income tax expense

4,111

383

Deferred tax benefit

4,490

7,686

Changes in operating assets and

liabilities

(33,154

)

(12,810

)

Amortization of deferred financing costs

and long-term debt discount

(1,322

)

(1,482

)

Merger-related transaction costs

126

251

Adjusted EBITDA

$

135,441

$

142,542

Less:

Cash and accrued interest expense

21,189

24,694

Estimated cash taxes

4,625

457

Discretionary Cash Flow

$

109,627

$

117,391

Cash Acquisitions Discretionary Cash

Flow1

$

—

$

1,144

Pro Forma Discretionary Cash

Flow1

$

109,627

$

118,535

(1)

Cash Acquisitions closed in 2023 and are

reflected in the full results for the three months ended September

30, 2024

The following table presents a reconciliation of Cash G&A to

the most directly comparable GAAP financial measure for the period

indicated (in thousands).

Three Months Ended

September 30,

2024

2023

General and administrative expense

$

14,382

$

12,044

Less:

Non-cash share-based compensation

expense

6,251

4,368

Merger-related transaction costs

126

251

Rental income

183

136

Cash G&A

$

7,822

$

7,289

About Sitio Royalties Corp.

Sitio is a shareholder returns-driven company focused on

large-scale consolidation of high-quality oil & gas mineral and

royalty interests across premium basins, with a diversified set of

top-tier operators. With a clear objective of generating cash flow

from operations that can be returned to stockholders and

reinvested, Sitio has accumulated over 265,000 NRAs through the

consummation of over 200 acquisitions to date. More information

about Sitio is available at www.sitio.com.

Forward-Looking Statements

This news release contains statements that may constitute

“forward-looking statements” for purposes of federal securities

laws. Forward-looking statements include, but are not limited to,

statements that refer to projections, forecasts, or other

characterizations of future events or circumstances, including any

underlying assumptions. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intends,” “may,”

“might,” “plan,” “seeks,” “possible,” “potential,” “predict,”

“project,” “prospects,” “guidance,” “outlook,” “should,” “would,”

“will,” and similar expressions may identify forward-looking

statements, but the absence of these words does not mean that a

statement is not forward-looking. These statements include, but are

not limited to, statements about the Company's expected results of

operations, cash flows, financial position and future dividends; as

well as certain future plans, expectations and objectives for the

Company’s operations, including statements about our return of

capital framework, our share repurchase program and its intended

benefits, financial and operational guidance, strategy, synergies,

certain levels of production, future operations, financial

position, prospects, and plans. While forward-looking statements

are based on assumptions and analyses made by us that we believe to

be reasonable under the circumstances, whether actual results and

developments will meet our expectations and predictions depend on a

number of risks and uncertainties that could cause our actual

results, performance, and financial condition to differ materially

from our expectations and predictions. Factors that could

materially impact such forward-looking statements include, but are

not limited to: commodity price volatility, the global economic

uncertainty and market volatility related to slowing growth and

demand, especially from China, the conflict in Ukraine and

associated economic sanctions on Russia, the conflict in the

Israel-Gaza region and continued hostilities in the Middle East

including heightened tensions and conflict with Iran, Lebanon and

Yemen, voluntary production cuts by OPEC+ and others, including any

additional extensions of such voluntary production cuts or the

duration thereof, increased global oil, natural gas and natural gas

liquids supply and those other factors discussed or referenced in

the "Risk Factors" section of Sitio’s Annual Report on Form 10-K

for the year ended December 31, 2023 and other publicly filed

documents with the SEC. Any forward-looking statement made in this

news release speaks only as of the date on which it is made.

Factors or events that could cause actual results to differ may

emerge from time to time, and it is not possible to predict all of

them. Sitio undertakes no obligation to publicly update any

forward-looking statement, whether as a result of new information,

future development, or otherwise, except as may be required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106907897/en/

IR contact: Ross Wong (720) 640–7647 IR@sitio.com

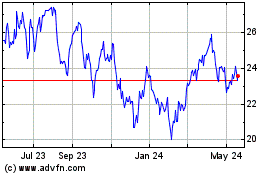

Sitio Royalties (NYSE:STR)

Historical Stock Chart

From Nov 2024 to Dec 2024

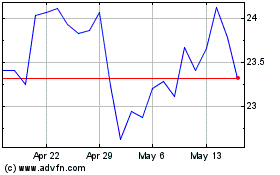

Sitio Royalties (NYSE:STR)

Historical Stock Chart

From Dec 2023 to Dec 2024