Announces Definitive Agreement to Acquire

13,062 NRAS in the DJ Basin for $150 Million(1)

Announces $200 Million Share Repurchase

Program and Updated Return of Capital Framework

Closed on Previously Announced Sale of

Anadarko and Appalachia Assets for $114 Million

Declared $0.51 Dividend Per Share of Class A

Common Stock for Fourth Quarter 2023

Issues Full Year 2024 Financial and

Operational Guidance, With Pro Forma Production Range of 35,000 –

38,000 Boe/d (49% – 51% Oil)(2)

Sitio Royalties Corp. (NYSE: STR) (“Sitio”, “STR” or the

“Company”) today announced operational and financial results for

the quarter and year ended December 31, 2023. Unless the context

clearly indicates otherwise, references to “we,” “our,” “us” or

similar terms refer to Sitio and its subsidiaries.

FOURTH QUARTER 2023 OPERATIONAL AND FINANCIAL

HIGHLIGHTS

- 4Q 2023 average daily production volume of 35,776 barrels of

oil equivalent per day ("Boe/d") (47% oil); Pro forma 4Q 2023

average daily production volume of 36,623 Boe/d (49% oil)(3)

- Declared 4Q 2023 dividend of $0.51 per share of Class A Common

Stock, an increase of $0.02 per share, or approximately 4% higher

compared to the 3Q 2023 dividend

- Record high pro forma net line-of-sight (“LOS”) wells of 53.4

as of December 31, 2023, comprised of 34.4 net spuds and 19.0 net

permits; Approximately 78% of pro forma net LOS wells are in the

Permian Basin and 14% in the DJ Basin(4)

- 4Q 2023 net loss of $91.7 million, compared to 3Q 2023 net

income of $0.3 million; decrease primarily driven by a $144.5

million non-cash loss on sale of assets in the Appalachian and

Anadarko Basins, decreased average daily production volumes of

1,124 Boe/d and a $1.06 per Boe decrease in realized hedged

commodity prices

- 4Q 2023 Adjusted EBITDA(5) of $134.9 million, down by 5.3%

sequentially from 3Q 2023 Adjusted EBITDA, primarily due to

decreased average daily production volumes of 3.0% and a 2.3%

decrease in realized hedged prices per Boe

- 4Q 2023 Pro Forma Adjusted EBITDA(6) of $143.6 million,

including contribution from the DJ Basin Acquisition(1) and 4Q23

Stock Acquisition(7) assets for the entire quarter

- During 4Q 2023, reduced long-term debt by $131.1 million,

resulting in liquidity of $588.2 million as of December 31,

2023

RECENT DEVELOPMENTS – DJ BASIN ACQUISITION HIGHLIGHTS

- In January 2024, signed definitive agreement with an

undisclosed third party to acquire 13,062 NRAs in the DJ Basin (the

"DJ Basin Acquisition"), of which approximately 77% are in the

Wattenberg Field in Weld County, for $150 million, subject to

customary closing adjustments; Effective date of October 1, 2023

and expected to close in early 2Q 2024

- Expected to fund acquisition with cash on hand, cash generated

from operations and revolving credit facility borrowings

- Represents a 4.0x purchase multiple of asset level cash flow

for the twelve months ending September 30, 2024

- Resulted in $0.04 per share increase to 4Q 2023 return of

capital and is expected to be 6% accretive to Sitio's standalone

2024 return of capital per share

- 4Q 2023 average daily production volume of 2,609 Boe/d (41%

oil) and asset level cash flow of $8.6 million

- Top operators by production volumes are Chevron Corporation,

Civitas Resources and Occidental Petroleum Corporation

- As of February 19, 2024, approximately 75% of rigs in the

entire DJ Basin were on the DJ Basin acquisition acreage, an

increase of 3x relative to rigs on Sitio's legacy DJ Basin

acreage

- Net LOS wells of 5.1 as of December 31, 2023, comprised of 3.4

net spuds and 1.7 net permits; Strong visibility of activity

through 1Q 2030 because approximately 21% of NRAs have exposure to

multi-year Comprehensive Area Plans ("CAP") or Oil and Gas

Development Plans ("OGDP")

- Estimated remaining inventory of 9.6 net locations, with 73% in

the Wattenberg Field and approximately 26% in CAPs or OGDPs as of

December 31, 2023

UPDATED RETURN OF CAPITAL FRAMEWORK

- On February 28, 2024, Sitio’s Board of Directors authorized a

$200 million share repurchase program, which has no expiration date

and is expected to commence in early March 2024

- New return of capital framework creates additional flexibility

for the Company to maximize long-term value for shareholders

- The Company is revising its return of capital framework to

include both cash dividends and share repurchases effective 1Q

2024, with no impact on 4Q 2023 distributions:

- Minimum of 65% of Discretionary Cash Flow (“DCF”): Allocated to

total return of capital (minimum cash dividend and mix of

additional cash dividends and/or share repurchases)

- Minimum of 35% of DCF: Allocated to cash dividends; Represents

an approximate 5% yield based on 4Q 2023 Pro Forma DCF

- Minimum of 30% of DCF: Allocated to additional cash dividends,

share repurchases or a mix of both

- Up to 35% of DCF: Allocated to balance sheet management and

opportunistic cash acquisitions; no changes from previous return of

capital framework

4Q 2023 and 2H 2023 RESULTS RELATIVE TO 2H 2023

GUIDANCE

The table below shows fourth quarter 2023 and second half 2023

results relative to financial and operational guidance for the

second half of 2023 that was issued on November 8, 2023.

2H 2023 Guidance Metric

4Q 2023 Results

2H 2023 Results

4Q 2023 Pro Forma(3)

2H 2023 Guidance (November 8,

2023)

Average daily production (Boe/d)

35,776

36,338

36,623

35,000 – 37,000

Oil %

47

%

47

%

49

%

49% – 51%

Gathering and transportation ($/Boe)

$

1.58

$

1.47

$

1.52

$1.25 – $1.50

Cash G&A ($ in millions)

$

6.6

$

14.0

$

6.6

$27.0–$28.0(annual)

Production taxes (% of royalty

revenue)

9.8

%

8.8

%

9.6

%

6% – 8%

Reported cash tax rate (% of pre-tax

income/loss)(8)

NM

NM

NA

2% – 4%

Chris Conoscenti, Chief Executive Officer of Sitio commented,

“In the fourth quarter, we continued to advance our strategic

efforts through active portfolio management and returns-focused

capital allocation. We are already off to a great start in 2024 as

we entered into an agreement to acquire over 13,000 NRAs in the DJ

Basin for a compelling price that is accretive for our

shareholders. As we reallocate capital from the recently closed

divestiture of assets in the Appalachia and Anadarko Basins into

these higher returning assets, we will have transformed our current

DJ Basin position into a leading position with enhanced exposure to

the Greater Wattenberg Field. Additionally, I'm excited to announce

that the Board of Directors has authorized a $200 million share

repurchase program as part of our new return of capital framework,

which provides us with another method to enhance long-term

shareholder value. This repurchase program is a reflection of the

confidence we have in the fundamentals of our business. We still

plan to allocate at least 65% of DCF to return of capital and

utilize the remainder of DCF to pay down debt and make

opportunistic cash acquisitions. Under our updated return of

capital framework, we intend to allocate a minimum of 35% of DCF to

cash dividends and at least 30% of DCF to additional cash

dividends, share repurchases or a mix of both.”

(1) Definitive agreement to acquire DJ Basin assets from an

undisclosed third party signed in January 2024 and is expected to

close in early 2Q 2024; $150 million purchase price and final NRAs

subject to customary closing adjustments

(2) Includes production from the DJ Basin Acquisition for full

year 2024 as if the transaction had closed on January 1, 2024

(3) Represents 4Q 2023 metrics plus 4Q 2023 metrics from the DJ

Basin Acquisition and 4Q23 Stock Acquisition (collectively the

“Oct’23 Effective Date Acquisitions”) as if they were owned on

October 1, 2023 and excludes 4Q 2023 metrics from the Appalachian

and Anadarko Basin assets that were divested on December 22, 2023;

Metrics include production volumes, gathering and transportation

costs, and production taxes, as appropriate

(4) Includes net wells from the DJ Basin Acquisition as of

December 31, 2023

(5) For definitions of non-GAAP financial measures and

reconciliations to their most directly comparable GAAP financial

measures, please see “Non-GAAP financial measures”

(6) 4Q 2023 Pro Forma Adjusted EBITDA represents 4Q 2023

Adjusted EBITDA plus Oct’23 Effective Date Acquisitions(2) EBITDA,

which reflects as if Sitio had owned the Oct’23 Effective Date

Acquisitions since October 1, 2023

(7) The 4Q23 Stock Acquisition is defined as the acquisition of

522 NRAs in the Permian Basin for shares of Sitio’s Class C Common

Stock and a corresponding number of common units representing

limited partner interests in Sitio Royalties Operating Partnership,

LP, a controlled subsidiary of the Company ("OpCo" and such units,

"OpCo Units") that closed on December 8, 2023

(8) Calculated as cash taxes paid of $8 thousand divided by net

loss before taxes of $112.9 million for the three months ended

December 31, 2023. Calculated as cash taxes paid of $465 thousand

divided by net loss before taxes of $112.2 million for the six

months ended December 31, 2023. Shown as "NM", or "not meaningful"

because the implied reported 4Q 2023 and 2H 2023 cash tax rates are

negative

OPERATOR ACTIVITY

The following table summarizes Sitio's net average daily

production, pro forma net average daily production, as reported net

wells online, pro forma net wells online, as reported net LOS

wells, pro forma net LOS wells, as reported net royalty acres by

area, and pro forma net royalty acres by area as of December 31,

2023.

Delaware

Midland

DJ

Eagle Ford

Williston

Appalachia

Anadarko

Total

Average Daily

Production (Boe/d) for the three months ended December 31,

2023

As reported

18,566

8,242

3,737

2,789

646

986

810

35,776

% Oil

48

%

59

%

30

%

53

%

62

%

3

%

28

%

47

%

Pro forma(9)

18,600

8,242

6,346

2,789

646

-

-

36,623

% Oil(9)

48

%

59

%

35

%

53

%

62

%

NA

NA

49

%

Net Well Activity

(normalized to 5,000' laterals)

Net wells online as of September 30,

2023

127.1

62.2

37.1

35.7

9.4

3.8

9.9

285.2

As reported net wells online as of

December 31, 2023

131.8

65.4

38.9

36.0

9.5

-

-

281.6

Pro forma net wells online as of December

31, 2023(10)

131.8

65.4

57.4

36.0

9.5

-

-

300.1

Pro forma net wells online increase

(decrease) since September 30, 2023(10)

4.7

3.2

20.3

0.3

0.1

(3.8

)

(9.9

)

14.9

Net LOS Wells as

of December 31, 2023

As reported net LOS wells

27.4

14.2

2.5

3.4

0.8

-

-

48.3

Pro forma net spuds(4)

17.6

9.0

4.7

2.6

0.5

-

-

34.4

Pro forma net permits(4)

9.8

5.2

2.9

0.8

0.3

-

-

19.0

Pro forma net LOS wells(4)

27.4

14.2

7.6

3.4

0.8

-

-

53.4

Net Royalty Acres

(normalized to 1/8th royalty equivalent)

September 30, 2023

152,268

45,366

24,973

21,783

8,202

12,676

9,872

275,140

As reported December 31, 2023

152,664

45,380

24,973

21,077

8,203

-

-

252,297

Pro forma December 31, 2023(11)

152,664

45,380

38,035

21,077

8,203

-

-

265,359

Pro forma NRA increase (decrease) since

September 30, 2023(11)

396

14

13,062

(706

)

1

(12,676

)

(9,872

)

(9,781

)

(9) Includes 4Q 2023 reported production volumes plus 4Q 2023

production volumes from the Oct’23 Effective Date Acquisitions as

if they were owned on October 1, 2023 and excludes 4Q 2023

production volumes from the Appalachian and Anadarko Basin assets

that were divested on December 22, 2023

(10) Wells currently online and producing, based on well

designations in public data as of December 31, 2023. Pro forma for

net wells from the DJ Basin Acquisition as of December 31, 2023 and

excludes wells from the Appalachian and Anadarko Basin assets that

were divested on December 22, 2023

(11) Includes NRAs from the DJ Basin Acquisition, subject to

closing adjustments

MERGERS AND ACQUISITIONS

On December 8, 2023, Sitio closed on the acquisition of 522 NRAs

in the Permian Basin (the "4Q23 Stock Acquisition") in exchange for

shares of its Class C Common Stock and OpCo Units. The acquired

assets produced an average of approximately 46 Boe/d (62% oil) and

generated approximately $0.2 million of asset level cash flow for

the three months ended December 31, 2023 as if they were owned on

October 1, 2023. The 4Q23 Stock Acquisition has an effective date

of October 1, 2023 and 4Q 2023 cash flow attributable to the NRAs

acquired is included in Sitio's 4Q 2023 Pro Forma DCF.

On December 22, 2023, Sitio closed on the divestiture of all of

its mineral and royalty interests in the Anadarko Basin in Oklahoma

and the Appalachian Basin in Pennsylvania, Ohio and West Virginia

to an undisclosed third party for $114.0 million (the “Appalachian

and Anadarko Basins Divestiture”).

In January of 2024, Sitio signed a definitive agreement to

acquire 13,062 NRAs primarily in the core of the DJ Basin for

$150.0 million, subject to customary closing adjustments. The

transaction enhances the Company's DJ Basin footprint, adding

high-quality acreage in the Greater Wattenberg Field at a

compelling price with visible growth through the first half of 2025

from spuds, permits and acreage in several multi-year CAPs and

OGDPs with leading operators such as Chevron Corporation,

Occidental Petroleum, and Civitas Resources. Monthly net production

on the DJ Basin Acquisition acreage has grown by 89% from December

2022 through December 2023, versus a 7% decline on the divested

assets over the same time period. As of December 31, 2023, the DJ

Basin Acquisition assets had approximately 18.4 net wells online

and 5.1 net LOS wells, comprised of 3.4 net spuds and 1.7 net

permits. The transaction is expected to close in early 2Q 2024 with

an effective date of October 1, 2023; therefore, DJ Basin

Acquisition 4Q 2023 asset level cash flow is included in Sitio's 4Q

2023 Pro Forma DCF. Sitio plans to fund the DJ Basin Acquisition

with cash on hand, cash generated from operations and revolving

credit facility borrowings.

FINANCIAL UPDATE

Sitio's fourth quarter 2023 average unhedged realized prices

including all expected quality, transportation and demand

adjustments were $77.91 per barrel of oil, $1.40 per Mcf of natural

gas and $18.72 per barrel of natural gas liquids, for a total

equivalent price of $43.65 per barrel of oil equivalent. During the

fourth quarter of 2023, the Company received $5.9 million in net

cash settlements for commodity derivative contracts and as a

result, average hedged realized prices were $80.68 per barrel of

oil, $1.66 per Mcf of natural gas and $18.72 per barrel of natural

gas liquids, for a total equivalent price of $45.43 per barrel of

oil equivalent. This represents a $1.06 per barrel of oil

equivalent, or a 2.3% decrease relative to hedged realized prices

for the three months ended September 30, 2023.

Consolidated net loss for the fourth quarter of 2023 was $91.7

million, compared to consolidated net income of $0.3 million in the

third quarter of 2023. This decrease was driven primarily by a

$144.5 million non-cash loss on sale from the divestiture of assets

in the Appalachian and Anadarko Basins, and lower revenues from

decreased average daily production volumes of 1,124 Boe/d, or 3.0%

and a $1.06 per Boe decrease in realized hedged commodity prices,

offset partially by a non-cash unrealized gain in derivatives of

$12.2 million. For the three months ended December 31, 2023,

Adjusted EBITDA was $134.9 million, down 5.3% sequentially from

third quarter 2023 Adjusted EBITDA, primarily due to decreased

average production volumes of 3.0% and a 2.3% decrease in realized

hedged prices per Boe.

As of December 31, 2023, the Company had $877.0 million

principal value of total debt outstanding (comprised of $277.0

million of borrowings outstanding under Sitio's revolving credit

facility and $600.0 million aggregate principal amount of senior

unsecured notes) and liquidity of $588.2 million, including $15.2

million of cash and $573.0 million of remaining availability under

its $850.0 million credit facility.

Sitio had approximately $0.4 million of realized gains during 4Q

2023 from its interest rate swap, which had a $202.5 million

notional amount during the quarter and expired on December 31,

2023. Sitio did not add to or extinguish any of its commodity swaps

or collars during the fourth quarter of 2023. A summary of the

Company's existing commodity derivative contracts as of December

31, 2023 is included in the table below.

Oil (NYMEX WTI)

2024

1H25

Swaps

Bbl per day

3,300

1,100

Average price ($/Bbl)

$

82.66

$

74.65

Collars

Bbl per day

—

2,000

Average call ($/Bbl)

—

$

93.20

Average put ($/Bbl)

—

$

60.00

Gas (NYMEX Henry Hub)

2024

1H25

Swaps

MMBtu per day

500

—

Average price ($/MMBtu)

$

3.41

—

Collars

MMBtu per day

11,400

11,600

Average call ($/MMBtu)

$

7.24

$

10.34

Average put ($/MMBtu)

$

4.00

$

3.31

2023 YEAR END PROVED RESERVES

Estimated 2023 year end proved reserves of 85,293 MBOE

attributable to Sitio's interests in its underlying acreage are

based on a reserve report prepared by the independent petroleum

engineering firm of Cawley, Gillespie & Associates, Inc. in

accordance with Standards Pertaining to the Estimating and Auditing

of Oil and Gas Reserves Information promulgated by the Society of

Petroleum Evaluation Engineers and definitions and guidelines

established by the SEC. Of these reserves, approximately 82% were

classified as proved developed reserves and 18% were classified as

proved undeveloped (“PUD”) reserves. PUD reserves for Sitio

included in these estimates relate solely to wells that were spud

but not yet producing as of December 31, 2023. The largest driver

of year-over-year changes to reserves was extensions of 9,257 MBbls

of oil, 26,710 MMcf of natural gas, and 3,723 MBbls of NGLs.

Acquisitions increased 2023 year end reserves by 5,803 Mboe;

however, the Appalachian and Anadarko Basins Divestiture decreased

2023 year end reserves by 5,340 Mboe, resulting in an overall net

increase in 2023 year end reserves from acquisitions and

divestitures of 463 Mboe. The following table sets forth

information regarding the Company’s net ownership interest in

estimated quantities of proved developed and undeveloped oil and

natural gas quantities and the changes therein for each of the

periods presented.

Oil (MBbls)

Natural Gas (MMcf)

Natural Gas Liquids

(MBbls)

Total (MBOE)

Balance as of December 31, 2022

35,057

159,442

18,359

79,989

Revisions

(994

)

(289

)

1,394

352

Extensions

9,257

26,710

3,723

17,431

Acquisition of reserves

2,682

9,572

1,525

5,803

Divestiture of reserves

(826

)

(22,029

)

(843

)

(5,340

)

Production

(6,344

)

(23,136

)

(2,742

)

(12,942

)

Balance as of December 31, 2023

38,832

150,270

21,416

85,293

Proved developed and undeveloped

reserves:

Oil (MBbls)

Natural Gas (MMcf)

Natural Gas Liquids

(MBbls)

Total (MBOE)

Developed as of December 31, 2022

27,407

133,489

15,169

64,824

Undeveloped as of December 31, 2022

7,650

25,953

3,190

15,165

Balance at December 31, 2022

35,057

159,442

18,359

79,989

Developed as of December 31, 2023

30,537

127,170

18,167

69,899

Undeveloped as of December 31, 2023

8,295

23,100

3,249

15,394

Balance at December 31, 2023

38,832

150,270

21,416

85,293

2024 FULL YEAR FINANCIAL AND OPERATIONAL GUIDANCE

The table below includes Sitio's guidance for full year 2024 and

includes impacts from the DJ Basin Acquisition as if the

transaction had closed on January 1, 2024. The 36,500 Boe/d

midpoint of the pro forma average daily production range is in-line

with pro forma average daily production of 36,623 Boe/d for 4Q 2023

and reflects the Company's current expectations for operator

activity on its acreage. Full year 2024 Cash G&A guidance is

inclusive of a 25%+ increase in headcount since the end of 2022 and

technology development and enhancement projects that are expected

to further streamline the Company's large-scale minerals

acquisitions and management.

Full Year 2024 Guidance

Low

High

Pro Forma Average Daily

Production(2)

Pro forma average daily production

(Boe/d)(2)

35,000

38,000

Pro forma average daily production (%

oil)(2)

49

%

51

%

Expenses and Taxes

Cash G&A ($ in millions)

$

31.5

$

33.5

Production taxes (% of royalty

revenue)

7.5

%

9.5

%

Cash taxes ($ in millions)(12)

$

30.0

$

37.0

(2) Includes production from the DJ Basin Acquisition for full

year 2024 as if the transaction had closed on January 1, 2024

(12) Cash tax guidance range is based on expectations at current

strip pricing

RETURN OF CAPITAL

The Company's Board of Directors declared a cash dividend of

$0.51 per share of Class A Common Stock with respect to the fourth

quarter of 2023. The dividend is payable on March 28, 2024 to the

stockholders of record at the close of business on March 15, 2024.

Based on a 65% payout ratio of fourth quarter 2023 DCF and not

including the pro forma impacts from the Oct’23 Effective Date

Acquisitions, Sitio's quarterly dividend would have been

approximately $0.47 per Class A common share; however, the

Company's Board of Directors approved a fourth quarter 2023

dividend of $0.51 per Class A common share, which equates to a 65%

payout ratio including pro forma DCF for the full three months

ended December 31, 2023.

On February 28, 2024, the Company's Board of Directors also

authorized a share repurchase program up to $200 million, and

updated its return of capital framework to include share

repurchases. The Company has revised its return of capital

framework to allow more flexibility to maximize shareholder returns

based on market conditions, business outlook, and stock price. The

Company plans to continue to allocate a minimum of 65% of DCF to

return of capital, comprised of a minimum of 35% of DCF in cash

dividends and at least 30% of DCF comprised of additional cash

dividends, share repurchases, or a mix of both.

Repurchases may be made from time to time through various

methods, including but not limited to open market transactions,

privately negotiated transactions, and by other means in accordance

with applicable state and federal securities laws, certain of which

may be made pursuant to trading plans meeting the requirements of

Rule 10b5-1 and 10b-18 under the Securities Exchange Act of 1934,

as amended. The timing of repurchases under the repurchase program,

as well as the number and value of shares repurchased under the

program, will be determined by the Company at its discretion and

will depend on a variety of factors, including the market price of

the Company's Common Stock, oil and gas commodity prices, general

market and economic conditions, available liquidity, compliance

with the Company's debt and other agreements, applicable legal

requirements and other considerations. The exact number of shares

to be repurchased by the Company is not guaranteed, and the program

may be modified, suspended, or discontinued at any time without

prior notice. The Company is not obligated to purchase any dollar

amount or number of shares under the repurchase program.

FOURTH QUARTER 2023 EARNINGS CONFERENCE CALL

Sitio will host a conference call at 8:30 a.m. Eastern on

Thursday, February 29, 2024 to discuss its fourth quarter and full

year 2023 operating and financial results. Participants can access

the call by dialing 1-833-470-1428 in the United States, or

1-404-975-4839 in other locations, with access code 911248 or by

webcast at https://events.q4inc.com/attendee/149886582.

Participants may also pre-register for the event via the following

link:

https://www.netroadshow.com/events/login?show=8838c4a3&confId=59569.

The conference call, live webcast, and replay can also be accessed

through the Investor Relations section of Sitio’s website at

www.sitio.com.

UPCOMING INVESTOR CONFERENCES

Members of Sitio's management team will be attending Piper

Sandler's 24th Annual Energy Conference from March 18 - 20, 2024

and KeyBanc Capital Markets' Minerals Spotlight virtual event on

March 26, 2024. Presentation materials associated with these events

will be accessible through the Investor Relations section of

Sitio's website at www.sitio.com.

FINANCIAL RESULTS

Production Data

Three Months Ended December

31,

Year Ended December

31,

2023

2022

2023

2022

Production Data:

Crude oil (MBbls)

1,558

892

6,344

2,861

Natural gas (MMcf)

5,923

3,049

23,136

9,531

NGLs (MBbls)

746

341

2,742

1,100

Total (MBoe)(6:1)

3,291

1,741

12,942

5,550

Average daily production (Boe/d)(6:1)

35,776

18,925

35,457

15,204

Average Realized Prices:

Crude oil (per Bbl)

$

77.91

$

81.84

$

75.80

$

93.05

Natural gas (per Mcf)

$

1.40

$

4.33

$

1.77

$

5.50

NGLs (per Bbl)

$

18.72

$

26.44

$

19.21

$

33.51

Combined (per Boe)

$

43.65

$

54.68

$

44.39

$

64.05

Average Realized Prices After Effects

of Derivative Settlements:

Crude oil (per Bbl)

$

80.68

$

87.21

$

78.62

$

95.65

Natural gas (per Mcf)

$

1.66

$

4.35

$

2.06

$

5.46

NGLs (per Bbl)

$

18.72

$

26.44

$

19.21

$

33.51

Combined (per Boe)

$

45.43

$

57.48

$

46.30

$

65.33

Selected Expense Metrics

Three Months Ended December

31,

2023

2022

Severance and ad valorem taxes

9.8

%

7.9

%

Depreciation, depletion and amortization

($/Boe)

$

20.85

$

21.37

General and administrative ($/Boe)

$

3.60

$

10.44

Cash G&A ($/Boe)

$

1.99

$

2.27

Interest expense, net ($/Boe)

$

6.59

$

10.00

Consolidated Balance Sheets

(In thousands except par and share

amounts)

December 31,

December 31,

2023

2022

ASSETS

Current assets

Cash and cash equivalents

$

15,195

$

18,818

Accrued revenue and accounts

receivable

107,347

142,010

Prepaid assets

12,362

12,489

Derivative asset

19,080

18,874

Total current assets

153,984

192,191

Property and equipment

Oil and natural gas properties, successful

efforts method:

Unproved properties

2,698,991

3,244,436

Proved properties

2,377,196

1,926,214

Other property and equipment

3,711

3,421

Accumulated depreciation, depletion,

amortization, and impairment

(498,531

)

(223,214

)

Total property and equipment, net

4,581,367

4,950,857

Long-term assets

Long-term derivative asset

3,440

13,379

Deferred financing costs

11,205

7,082

Operating lease right-of-use asset

5,970

5,679

Other long-term assets

2,835

1,714

Total long-term assets

23,450

27,854

TOTAL ASSETS

$

4,758,801

$

5,170,902

LIABILITIES AND EQUITY

Current liabilities

Accounts payable and accrued expenses

$

30,050

$

21,899

Warrant liability

—

2,950

Operating lease liability

1,725

1,563

Total current liabilities

31,775

26,412

Long-term liabilities

Long-term debt

865,338

938,896

Deferred tax liability

259,870

313,607

Non-current operating lease liability

5,394

5,303

Other long-term liabilities

1,150

89

Total long-term liabilities

1,131,752

1,257,895

Total liabilities

1,163,527

1,284,307

Commitments and contingencies (see Note

16)

Equity

Class A Common Stock, par value $0.0001

per share; 240,000,000 shares authorized; 82,451,397 and 80,804,956

shares issued and 82,451,397 and 80,171,951 outstanding at December

31, 2023 and December 31, 2022, respectively

8

8

Class C Common Stock, par value $0.0001

per share; 120,000,000 shares authorized; 74,965,217 and 74,347,005

shares issued and 74,939,080 and 74,347,005 outstanding at December

31, 2023 and December 31, 2022, respectively

8

7

Additional paid-in capital

1,796,147

1,750,640

Accumulated deficit

(187,738

)

(9,203

)

Class A Treasury Shares, 0 and 633,005

shares at December 31, 2023 and December 31, 2022, respectively

—

(19,085

)

Class C Treasury Shares, 26,137 and 0

shares at December 31, 2023 and December 31, 2022, respectively

(677

)

—

Noncontrolling interest

1,987,526

2,164,228

Total equity

3,595,274

3,886,595

TOTAL LIABILITIES AND EQUITY

$

4,758,801

$

5,170,902

Consolidated Statements of

Operations

(In thousands, except per share

amounts)

Years Ended December

31,

2023

2022

2021

Revenues:

Oil, natural gas and natural gas liquids

revenues

$

574,542

$

355,430

$

118,548

Lease bonus and other income

18,814

14,182

2,040

Total revenues

593,356

369,612

120,588

Operating expenses:

Management fees to affiliates

—

3,241

7,480

Depreciation, depletion and

amortization

291,320

104,511

40,906

General and administrative

49,620

42,299

12,998

Severance and ad valorem taxes

46,939

25,572

6,934

Impairment of oil and gas properties

25,617

—

—

Deferred offering costs write off

—

—

2,396

Loss on sale of oil and gas properties

144,471

—

—

Total operating expenses

557,967

175,623

70,714

Net income from operations

35,389

193,989

49,874

Other income (expense):

Interest expense, net

(93,413

)

(35,499

)

(1,893

)

Change in fair value of warrant

liability

2,950

3,662

—

Loss on extinguishment of debt

(21,566

)

(11,487

)

—

Commodity derivatives gains

15,199

39,037

—

Interest rate derivatives gains

462

110

—

Net income (loss) before taxes

(60,979

)

189,812

47,981

Income tax benefit (expense)

14,284

(5,681

)

(486

)

Net income (loss)

(46,695

)

184,131

47,495

Net income attributable to Predecessor

—

(78,104

)

(47,495

)

Net income attributable to temporary

equity

—

(90,377

)

—

Net (income) loss attributable to

noncontrolling interest

31,159

51

—

Net income (loss) attributable to Class

A stockholders

$

(15,536

)

$

15,701

$

—

Net income (loss) per Class A common

share

Basic

$

(0.20

)

$

1.10

—

Diluted

$

(0.20

)

$

1.10

—

Weighted average Class A common shares

outstanding

Basic

81,269

13,723

—

Diluted

81,269

13,723

—

Consolidated Statements of Cash

Flows

(In thousands)

Years Ended December

31,

2023

2022

2021

Cash flows from operating

activities:

Net income (loss)

$

(46,695

)

$

184,131

$

47,495

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation, depletion and

amortization

291,320

104,511

40,906

Amortization of deferred financing costs

and long-term debt discount

5,534

6,546

440

Share-based compensation

18,867

9,250

—

Change in fair value of warrant

liability

(2,950

)

(3,662

)

—

Loss on extinguishment of debt

21,566

11,487

—

Impairment of oil and gas properties

25,617

—

—

Commodity derivative gains

(15,199

)

(39,037

)

—

Net cash received for commodity derivative

settlements

24,613

7,104

—

Interest rate derivative gains

(462

)

(110

)

—

Net cash received (paid) for interest rate

derivative settlements

781

(209

)

—

Loss on sale of oil and gas properties

144,471

—

—

Deferred tax (benefit) expense

(42,946

)

1,631

—

Deferred offering cost write off

—

—

2,396

Change in operating assets and

liabilities:

Accrued revenue and accounts

receivable

33,564

(25,313

)

(27,697

)

Prepaid assets

19,550

(616

)

(97

)

Other long-term assets

2,089

(3,652

)

—

Accounts payable and accrued expenses

8,810

(88,558

)

1,673

Due to affiliates

—

(380

)

325

Operating lease liabilities and other

long-term liabilities

(1,030

)

1,837

488

Net cash provided by operating

activities

487,500

164,960

65,929

Cash flows from investing

activities:

Acquisition of Falcon, net of cash

—

4,484

—

Acquisition of Brigham, net of cash

—

11,054

—

Predecessor cash not contributed in the

Falcon Merger

—

(15,228

)

—

Purchases of oil and gas properties, net

of post-close adjustments

(170,545

)

(557,569

)

(38,470

)

Proceeds from sale of oil and gas

properties

113,298

—

(137

)

Other, net

(2,479

)

(840

)

(136

)

Net cash used in investing

activities

(59,726

)

(558,099

)

(38,743

)

Cash flows from financing

activities:

Borrowings on credit facilities

644,500

348,895

147,000

Repayments on credit facilities

(877,500

)

(209,000

)

(46,500

)

Issuance of 2026 Senior Notes

—

444,500

—

Repayments on 2026 Senior Notes

(438,750

)

(11,250

)

—

Issuance of 2028 Senior Notes

600,000

—

—

Borrowings on Bridge Loan Facility

—

425,000

—

Repayments on Bridge Loan Facility

—

(425,000

)

—

Debt issuance costs

(22,060

)

(24,889

)

(1,588

)

Debt extinguishment costs

(12,176

)

—

—

Distributions paid to Temporary Equity

—

(115,375

)

—

Distributions to noncontrolling

interest

(158,968

)

(13,318

)

(60,882

)

Dividends paid to Class A stockholders

(161,951

)

(18,165

)

—

Dividend equivalent rights paid

(1,048

)

(579

)

—

Issuance of equity in consolidated

subsidiary

—

—

1,467

Capital contributions

—

—

8,000

Distributions to partners

—

—

(67,500

)

Cash paid for taxes related to net

settlement of share-based compensation awards

(3,444

)

—

—

Deferred initial public offering costs

—

(61

)

(2,335

)

Other

—

(1,180

)

—

Net cash (used in) provided by

financing activities

(431,397

)

399,578

(22,338

)

Net change in cash and cash

equivalents

(3,623

)

6,439

4,848

Cash and cash equivalents, beginning of

period

18,818

12,379

7,531

Cash and cash equivalents, end of

period

$

15,195

$

18,818

$

12,379

Supplemental disclosure of non-cash

transactions:

Increase (decrease) in current liabilities

for additions to property and equipment:

$

(12

)

$

(379

)

446

Oil and gas properties acquired through

issuance of Class C Common Stock and common units in consolidated

subsidiary:

70,740

3,348,216

—

Oil and gas properties acquired through

issuance of equity in consolidated subsidiary:

—

—

572,166

Oil and gas properties acquired through

deemed distribution in connection with common control

transaction:

—

—

37,459

Temporary equity cumulative adjustment to

redemption value:

—

706,940

—

Supplemental disclosure of cash flow

information:

Cash paid for income taxes:

$

9,276

$

1,866

$

25

Cash paid for interest expense:

77,310

29,030

1,268

Non-GAAP financial measures

Adjusted EBITDA, Pro Forma Adjusted EBITDA, Discretionary Cash

Flow, Pro Forma Discretionary Cash Flow and Cash G&A are

non-GAAP supplemental financial measures used by our management and

by external users of our financial statements such as investors,

research analysts and others to assess the financial performance of

our assets and their ability to sustain dividends over the long

term without regard to financing methods, capital structure or

historical cost basis. Sitio believes that these non-GAAP financial

measures provide useful information to Sitio's management and

external users because they allow for a comparison of operating

performance on a consistent basis across periods.

We define Adjusted EBITDA as net income (loss) plus (a) interest

expense, (b) provisions for income taxes, (c) depreciation,

depletion and amortization, (d) non-cash share-based compensation

expense, (e) impairment of oil and gas properties, (f) gains or

losses on unsettled derivative instruments, (g) change in fair

value of warrant liability, (h) management fee to affiliates, (i)

loss on extinguishment of debt (j) merger-related transaction

costs, (k) write off of financing costs, and (l) loss on sale of

oil and gas properties.

We define Pro Forma Adjusted EBITDA as Adjusted EBITDA plus (a)

Oct’23 Effective Date Acquisitions EBITDA from October 1, 2023 to

December 31, 2023 that is not included in Adjusted EBITDA for the

three months ended December 31, 2023 and (b) Brigham Minerals

EBITDA October 1 to December 28, 2022.

We define Brigham Minerals EBITDA October 1 to December 28, 2022

as the EBITDA from October 1, 2022 through December 28, 2022 of the

assets acquired from Brigham Minerals on December 29, 2022.

We define Discretionary Cash Flow for time periods prior to 2024

as Adjusted EBITDA, less cash and accrued interest expense and cash

taxes.

We define Discretionary Cash Flow in 2024 as Adjusted EBITDA,

less cash and accrued interest and estimated cash taxes.

We define Pro Forma Discretionary Cash Flow as Discretionary

Cash Flow plus (a) Oct’23 Effective Date Acquisitions Discretionary

Cash Flow from October 1, 2023 to December 31, 2023 that is not

included in Discretionary Cash Flow for the three months ended

December 31, 2023 and (b) Brigham Minerals Discretionary Cash Flow

October 1 to December 28, 2022.

We define Brigham Minerals Discretionary Cash Flow October 1 to

December 28, 2022 as the DCF from October 1, 2022 through December

28, 2022 of the assets acquired from Brigham Minerals on December

29, 2022.

We define Cash G&A as general and administrative expense

less (a) non-cash share-based compensation expense, (b)

merger-related transaction costs and (c) rental income.

We define Loss on sale of oil and natural gas properties as the

non-cash losses incurred from the Appalachian and Anadarko Basins

Divestiture in December 2023.

These non-GAAP financial measures do not represent and should

not be considered an alternative to, or more meaningful than, their

most directly comparable GAAP financial measures or any other

measure of financial performance presented in accordance with GAAP

as measures of our financial performance. Non-GAAP financial

measures have important limitations as analytical tools because

they exclude some but not all items that affect the most directly

comparable GAAP financial measure. Our computations of Adjusted

EBITDA, Pro Forma Adjusted EBITDA, Discretionary Cash Flow, Pro

Forma Discretionary Cash Flow and Cash G&A may differ from

computations of similarly titled measures of other companies.

The following table presents a reconciliation of Adjusted EBITDA

and Pro Forma Adjusted EBITDA to the most directly comparable GAAP

financial measure for the periods indicated (in thousands).

Three Months Ended December

31,

2023

2022

Net income (loss)

$

(91,716

)

$

4,585

Interest expense, net

21,678

17,403

Income tax (benefit) expense

(21,168

)

475

Depreciation, depletion and

amortization

68,602

37,209

Impairment of oil and natural gas

properties

—

—

Loss on sale of oil and natural gas

properties

144,471

—

EBITDA

$

121,867

$

59,672

Non-cash share-based compensation

expense

4,393

4,303

Losses (gains) on unsettled derivative

instruments

(12,194

)

19,017

Change in fair value of warrant

liability

—

180

Loss on debt extinguishment

20,096

—

Merger-related transaction costs

745

9,922

Write off of financing costs

—

—

Adjusted EBITDA

$

134,907

$

93,094

Brigham Minerals EBITDA October 1 to

December 28, 2022

—

76,367

Oct'23 Effective Date Acquisitions

EBITDA

8,705

—

Pro Forma Adjusted EBITDA

$

143,612

$

169,461

The following table presents a reconciliation of Discretionary

Cash Flow and Pro Forma Discretionary Cash Flow to the most

directly comparable GAAP financial measure for the periods

indicated (in thousands).

Three Months Ended December

31,

2023

2022

Cash flow from operations

$

132,682

$

(6,115

)

Interest expense, net

21,678

17,403

Income tax (benefit) expense

(21,168

)

475

Deferred tax benefit (expense)

27,839

1,014

Changes in operating assets and

liabilities

(25,610

)

71,522

Amortization of deferred financing costs

and long-term debt discount

(1,259

)

(1,127

)

Merger-related transaction costs

745

9,922

Adjusted EBITDA

$

134,907

$

93,094

Less:

Cash and accrued interest expense

19,628

15,641

Cash taxes

8

—

Discretionary Cash Flow

$

115,271

$

77,453

Brigham Minerals Discretionary Cash Flow

October 1 to December 28, 2022

—

66,799

Oct'23 Effective Date Acquisitions

Discretionary Cash Flow

8,705

—

Pro Forma Discretionary Cash

Flow

$

123,976

$

144,252

The following table presents a reconciliation of Cash G&A to

the most directly comparable GAAP financial measure for the periods

indicated (in thousands).

Three Months Ended December

31,

2023

2022

General and administrative expense

$

11,834

$

18,182

Less:

Non-cash share-based compensation

expense

4,393

4,303

Merger-related transaction costs

745

9,922

Rental income

135

—

Cash G&A

$

6,561

$

3,957

About Sitio Royalties Corp.

Sitio is a shareholder returns-driven company focused on

large-scale consolidation of high-quality oil & gas mineral and

royalty interests across premium basins, with a diversified set of

top-tier operators. With a clear objective of generating cash flow

from operations that can be returned to stockholders and

reinvested, Sitio has accumulated over 250,000 NRAs through the

consummation of over 190 acquisitions and portfolio management to

date. More information about Sitio is available at

www.sitio.com.

Forward-Looking Statements

This news release contains statements that may constitute

“forward-looking statements” for purposes of federal securities

laws. Forward-looking statements include, but are not limited to,

statements that refer to projections, forecasts, or other

characterizations of future events or circumstances, including any

underlying assumptions. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intends,” “may,”

“might,” “plan,” “seeks,” “possible,” “potential,” “predict,”

“project,” “prospects,” “guidance,” “outlook,” “should,” “would,”

“will,” and similar expressions may identify forward-looking

statements, but the absence of these words does not mean that a

statement is not forward-looking. These statements include, but are

not limited to, statements about the Company's expected results of

operations, cash flows, financial position and future dividends; as

well as future plans, expectations and objectives for the Company’s

operations, including statements about our return of capital

framework, our share repurchase program, the implementation thereof

and the intended benefits, financial and operational guidance,

strategy, synergies, certain levels of production, future

operations, financial position, prospects, and plans. While

forward-looking statements are based on assumptions and analyses

made by us that we believe to be reasonable under the

circumstances, whether actual results and developments will meet

our expectations and predictions depend on a number of risks and

uncertainties that could cause our actual results, performance, and

financial condition to differ materially from our expectations and

predictions. Factors that could materially impact such

forward-looking statements include, but are not limited to:

commodity price volatility, the global economic uncertainty related

to the large-scale invasion of Ukraine by Russia, the conflict in

the Israel-Gaza region and continued hostilities in the Middle

East, the collapse of certain financial institutions and associated

liquidity risks, announcements of voluntary production cuts by

OPEC+ and others, and those other factors discussed or referenced

in the "Risk Factors" section of Sitio’s Annual Report on Form

10-K, for the year ended December 31, 2023 and other publicly filed

documents with the SEC. Any forward-looking statement made in this

news release speaks only as of the date on which it is made.

Factors or events that could cause actual results to differ may

emerge from time to time, and it is not possible to predict all of

them. Sitio undertakes no obligation to publicly update any

forward-looking statement, whether as a result of new information,

future development, or otherwise, except as may be required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240227439081/en/

IR contact: Ross Wong (720) 640–7647 IR@sitio.com

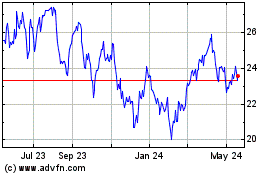

Sitio Royalties (NYSE:STR)

Historical Stock Chart

From Nov 2024 to Dec 2024

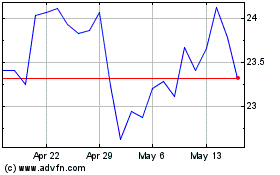

Sitio Royalties (NYSE:STR)

Historical Stock Chart

From Dec 2023 to Dec 2024